By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we describe the market segment that our Global Opportunities Fund invests into and explain the forces that have been driving recent underperformance. We also outline some modest changes we have made to portfolio positioning given a slowing global growth landscape.

Dear Fellow Investors,

Welcome to the April Ophir Letter to Investors – thank you for investing alongside us for the long term.

This too shall pass

If you can keep your head when all about you

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

…..

If you can meet with triumph and disaster

And treat those two impostors just the same;

These are some of our favourite lines from Rudyard Kipling’s famous poem ‘If’. They provide some great life lessons but also lessons for us as investors. They remind us that investing is as much about controlling your own emotions as it is about the more ‘nerdy’ technical aspects.

It is sometimes said that personal finance is 80% personal and 20% finance. Whether that split is right, who knows, but we’d agree investors often dramatically underestimate the value of ‘keeping your head when all about you are losing theirs’.

The urge for investors to bail out after the market falls, or when a stock or manager underperforms in the short term, can be overwhelming.

But equities tend to outperform over the long term, so if the underlying investment thesis remains intact, and the stock’s fundamentals have not deteriorated, or the manager’s process is working but their style is simply out of favour, selling at the bottom and buying at the top will rarely be profitable.

At the end of the day for shares, virtually all that matters in the long term is the ability of the companies to grow earnings through time. Here it’s all about things like unique products or services, customers’ willingness to pay, addressable markets, and intensity of competition. Inflation, interest rates, geopolitics, supply chain blockages etc. are all not without meaning, but pale into insignificance over the medium to long term on a company’s success.

That is why having an investment process that is time tested and sticking to it, but regularly reviewing it for improvements, is so important in investing. It will help you “keep your head” and “trust yourself” through difficult times. But also “make allowance for doubting” so that there is constant reflection.

In this month’s Letter to Investors, we review the month’s performance in markets and our funds and highlight some modest changes to portfolio positions we’ve made over the last few weeks as the outlook has shifted recently for some industry sectors.

April 2022 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during April. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -3.9% net of fees in April, underperforming its benchmark which returned -1.5%, and has delivered investors +23.0% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -3.3% net of fees in April, underperforming its benchmark which returned -1.5%, and has delivered investors +14.9% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -9.7% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -13.1% net of fees in April, underperforming its benchmark which returned -2.5%, and has delivered investors +16.3% p.a. post fees since inception. (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Markets took the elevator down in April

It is often said markets take the stairs up but the elevator down and that was definitely the case in April, particular for the US share market. For US shares in April there was shades of January in terms of the aggressiveness of the falls, with many indices down more than -10%.

What was the cause? It’s always tough pinpointing one thing but worries over Chinese growth and its ongoing COVID lockdowns, a negative take on Q1 corporate earnings, tighter financial conditions through a higher US dollar and higher interest rates all likely played into the risk-off attitude. It wasn’t all doom and gloom though, with the Australian and European share markets only seeing very light falls in comparison.

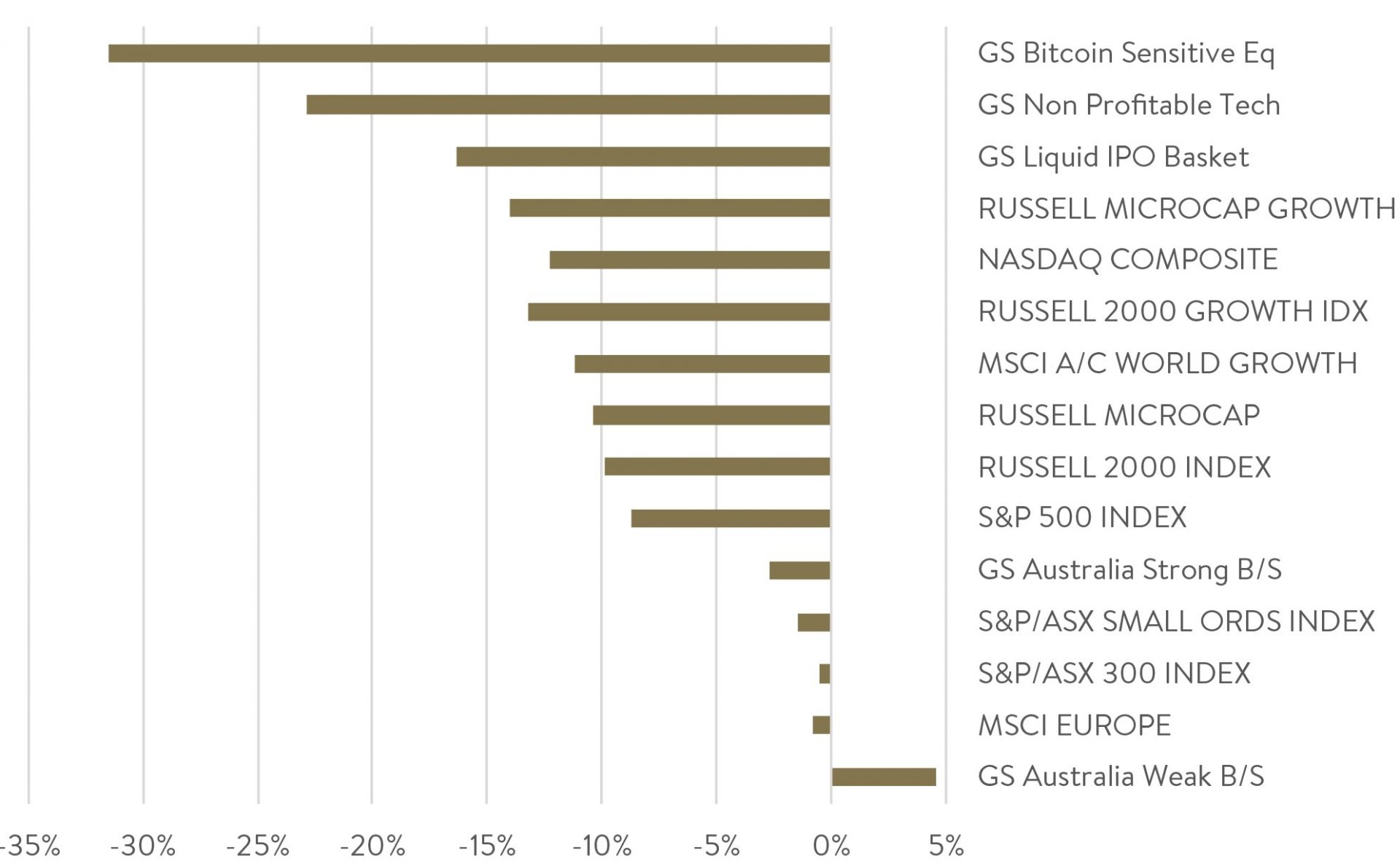

April saw continued significant growth sell off

Source: Factset. Data as of 30 April 2022

The toughest time to be a growth investor in decades

In the US, the market continued to savage growth businesses. The Goldman Sachs Non-Profitable Tech Index and GS Liquid IPO Index fell around -23% and -17% each. Small-cap growth orientated businesses in general were down -13%, as measured by the Russell 2000 Growth Index.

These headwinds meant our Global Opportunities Fund posted more significant falls than our Australian equity funds during April.

This has been the most punishing time to be a growth investor, particularly in the small cap part of the market, for at least a couple of decades.

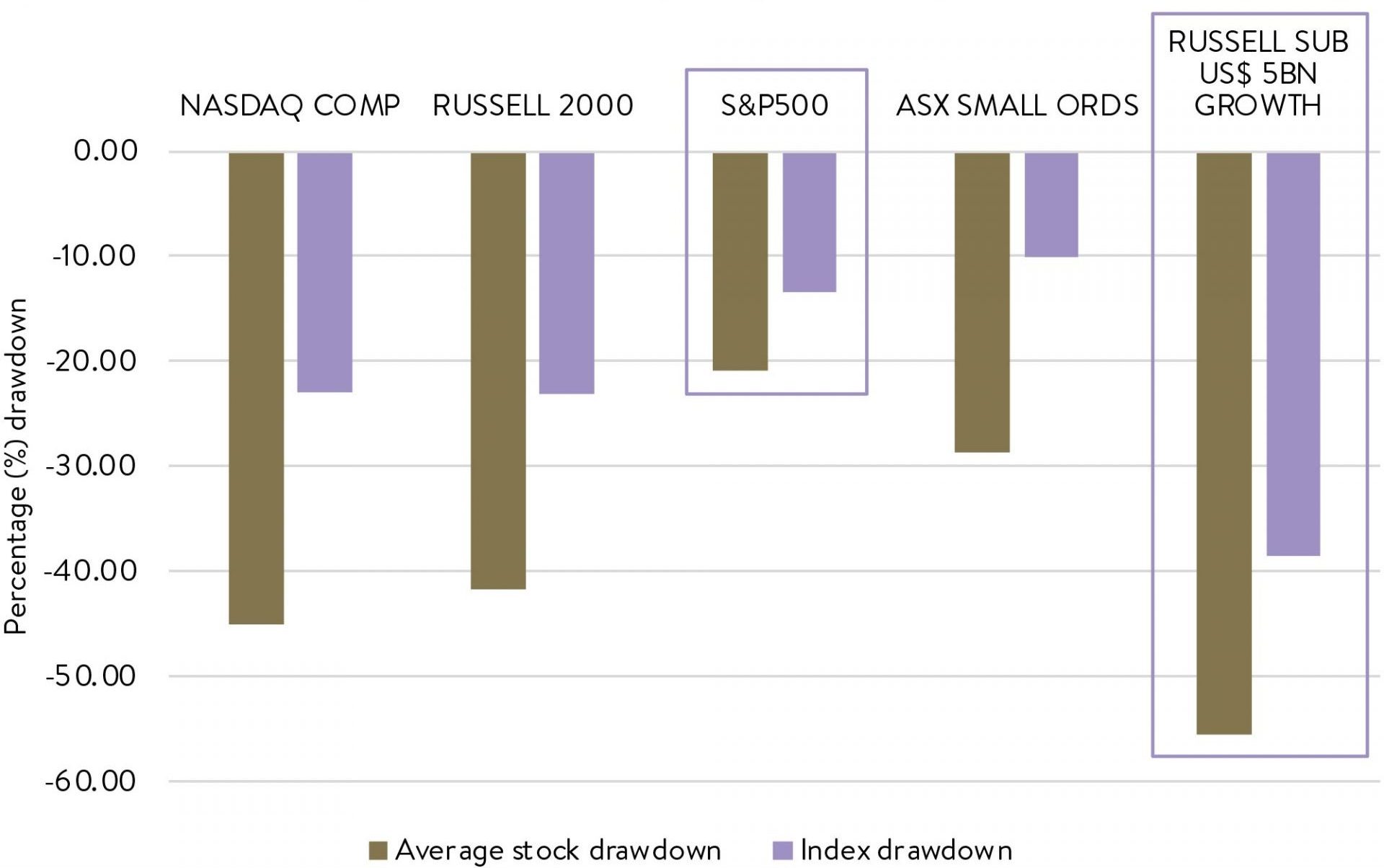

This can be easily seen in the chart below that illustrates how much an index has fallen and how much the average stock in that index has fallen. US small caps (Russell 2000) have had much deeper falls at both an index and stock level than US large caps (S&P500).

The sell off has impacted small caps significantly more than large caps

Source: Factset. Drawdown equals % off 52 week high. Data as of 27 April 2022.

You can also see that falls for growth-orientated US small caps below US$5 billion market cap (purple bordered area on far right) have been even more severe. The index is down almost -40% but the average stock is down around -55% from its highs over the last year!

But as we highlight in our Investment Strategy note this month, no one investing style wins in all market environments. Many go in and out of favour through time.

Matching our market segment

The recent performance in the Ophir funds has, unfortunately, been driven by the market segment we invest in (small cap growth).

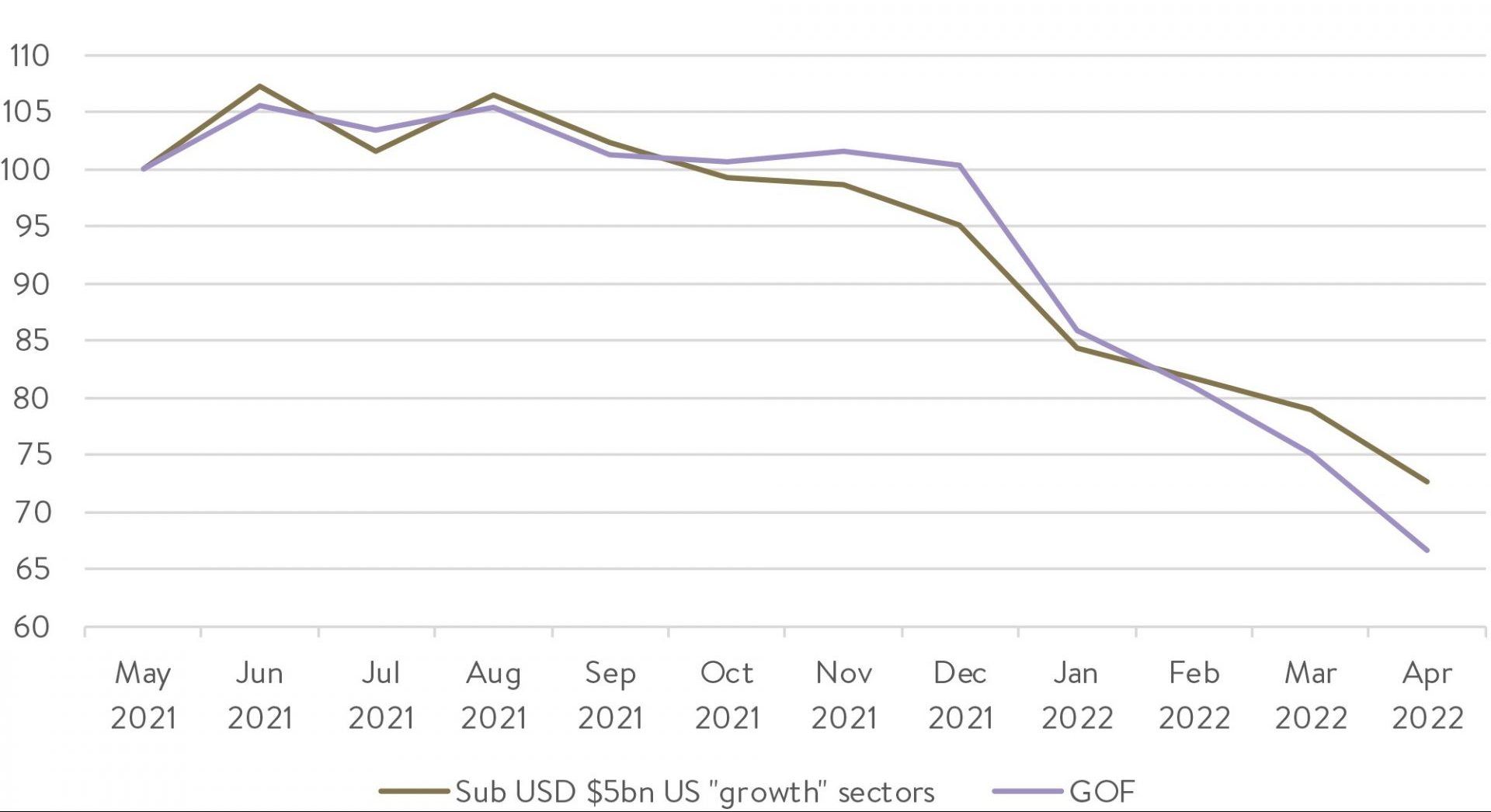

Global Funds have fallen in line with market segment Ophir invests in over the short term

Source: FactSet. Data as of 30 April 2022. “Growth” sectors include information technology, consumer discretionary, consumer staples, health care and industrials.

The above chart shows the performance of the Global Opportunities Fund (purple line) compared to sub-US$5 billion US small caps in the sectors we invest more in. These sectors generally tend to be more growth-orientated– IT, Consumer Discretionary, Consumer Staples, Health Care and Industrials (gold line).

As you can see the Fund has basically fallen in line with that market segment we invest in over recent months. Are we happy with this? No absolutely not. We always seek to outperform, although of course this is easier over longer periods of time where the impact of market noise tends to wash out and earnings growth wins the day.

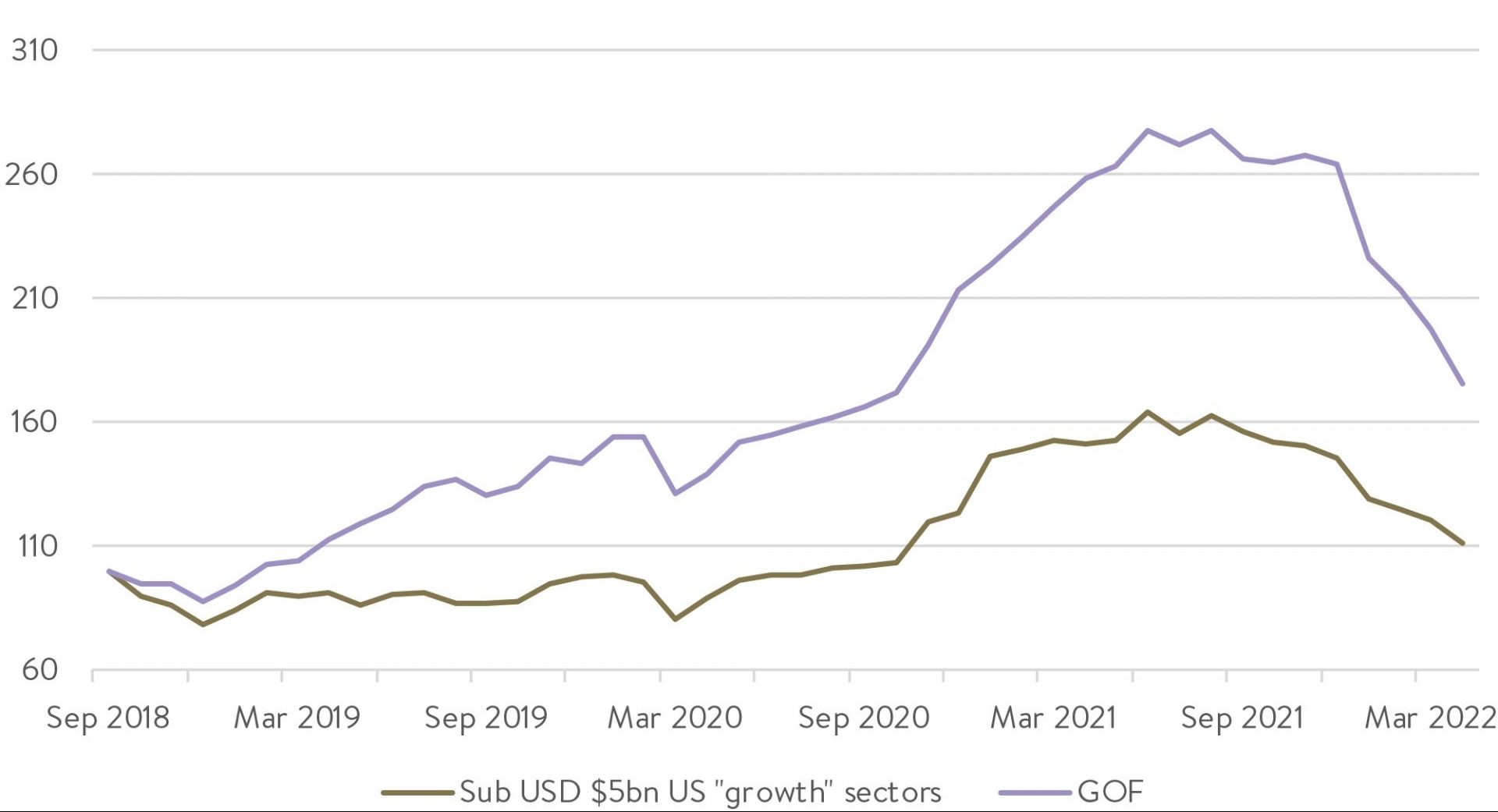

Pleasingly, as seen below, the Global Opportunities Fund is still well ahead of this market segment (and its formal benchmark) since inception in September 2018. Of course, we are very aware that not all investors will have been in the Fund since its inception and some may have only experienced the recent falls.

Global Funds are still ahead of the market segment Ophir invests in over the long term

Source: FactSet. Data as of 30 April 2022. “Growth” sectors include information technology, consumer discretionary, consumer staples, health care and industrials.

Macro headwinds dominating earnings of companies like Solo Brands

Solo Brands, a company we have held over the last six months in our Global Opportunities Fund, and a stock we have spoken about recently, illustrates how macro factors are overwhelming fundamentals and earnings.

US-based Solo Brands sells direct-to-consumer products with its biggest revenue earner being smokeless fire pits for backyards and camping. They are the largest seller of fire pits in the US, having sold more than 1 million units.

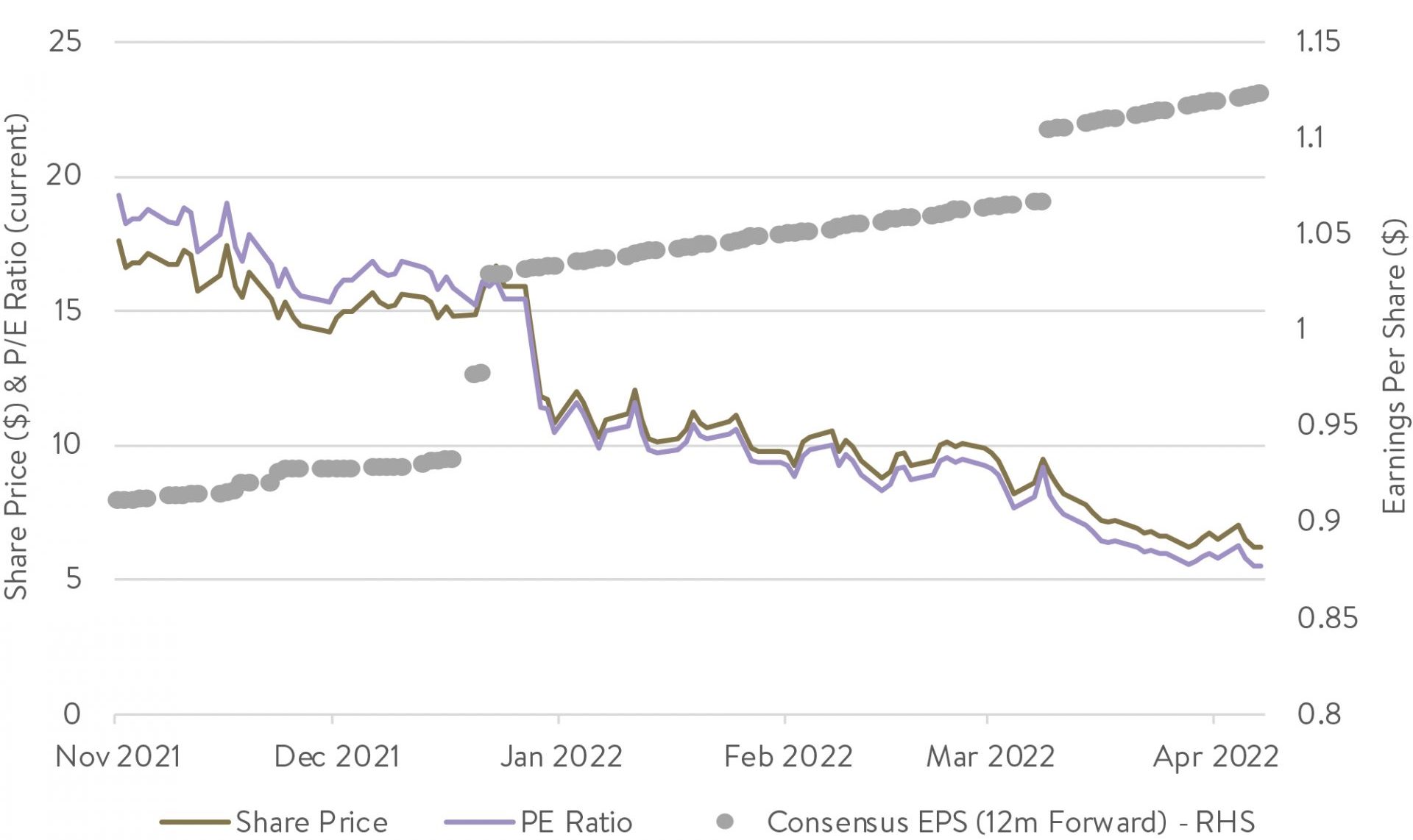

Solo Brands’ (DTC) valuation multiple has continued to derate despite raising earnings expectations

Source: FactSet. Data as at 27 April 2022.

Solo Brand’s share price is down around 60% since we purchased it at IPO in late October last year (see gold line for share price).

But the company’s earnings have gone from strength to strength. Analysts have consistently upgraded earnings (see grey dots).We have high confidence that in coming years Solo Brands will return to trading on the 15-20x price-to-earnings ratio that it would normally deserve given its underlying earnings are growing 20%+ per annum.

For the last few months, though, markets have cared little about these improving fundamentals and are lumping it in with all the other small-cap growth-orientated businesses that have been out of favour.

Changing times calls for changing positioning

But there is one area where we are “making allowance for their doubting too”. And that is our overall exposure to Consumer Discretionary-related companies across the Ophir funds. We are reviewing our allocations to Consumer Discretionary in light of a slowing global growth landscape.

As highlighted in our last Letter to Investors, over the last couple of months the probability of recession in the next 12 to 24 months has increased in the United States (and also Europe).

That’s because key central banks are more likely to aggressively hike interest rates to stem prolonged inflation that has been exacerbated by the war in Ukraine and lockdowns in China which have impacted supply chains.

Most economists have recently revised up their probability of recession in the US in 2023 to around 30-40%, from a negligible 0-5% back in January to February.

We are starting to see very early signs and commentary from some consumer-facing retailers in the US that demand is softening for larger-ticket items.

It is still too early to be certain how significant the softening will be, but waiting to be certain can often be too late in small caps. Larger funds that own companies across the market cap spectrum often ‘shoot first, ask questions later’ and sell down their small cap consumer-facing stocks given the lower levels of liquidity in these businesses.

Modest changes

As a result, over the last few weeks, we have been implementing some modest portfolio positioning changes across the Ophir funds.

These include:

- Overall decreasing our Consumer Discretionary exposure.

- Increasing our weighting to more defensively positioned growth businesses that are trading at reasonable prices and are less reliant on growth in the macro economy.

- Moving up the market cap spectrum in terms of the weight of holdings in our funds. This provides more liquidity and provides some protection in case economic growth slows more meaningfully which often negatively impacts the smallest and least liquid businesses disproportionately.

The above adjustments are not about making wholesale changes to the portfolio companies in our funds, although there have been and will be new entrants as a result. It is more about reweighting existing positions within each fund to better reflect the heightened chance of a more meaningful slowdown in economic growth ahead.

While slowing growth could mean more volatile and muted market returns in the next year or two, history suggests good share market returns can still be had leading up to recessionary periods – if this is where we are headed.

The bright side of slower economic and earnings growth, if that eventuates, is that those businesses that can structurally grow their earnings will become a scarcer commodity again. What becomes scarce typically becomes valued by the market and gets bid up. That would suit us just fine as our speciality remains finding those structural growers before the masses do.

Keeping our heads

It is never pleasant to experience market falls or underperformance. We and the rest of the investment staff at Ophir have 100% of our investable wealth in the Ophir funds. To fellow investors we say: we feel your pain.

One thing is sure though. In the search of 15%+ pa returns over the long term (our internal target across our funds), we will, as night follows day, have other shorter term periods of negative returns and underperformance.

As we wrote recently, all long-term top-performing managers have shorter term periods of underperformance and material falls in value.

It is essentially the price of admission for seeking and achieving the attractive returns small caps can provide over the long term.

Yet at the danger of striking an optimistic tone in such an environment, the silver lining is that recent performance has been driven by valuations compressing, not fundamentals of the companies we own.

And we know that ultimately fundamentals will win out.

The macro factors that are currently driving markets have little impact on the success of our portfolio companies over time, but this does require investor patience.

Meanwhile, we will be “keeping our heads”, looking for great opportunities this market is throwing up, and focusing on the long-term.

As Kipling said, if we can keep our heads … “Yours is the Earth and everything that’s in it”. Or at the very least, great investment returns!

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.