By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we discuss the reasons we are so excited about the return prospects for our Global funds over the next 5 years.

Welcome to the January Ophir Letter to Investors – thank you for investing alongside us for the long term.

Raging Bull continues

Scorsese, DeNiro, Pesci … looking back now, bringing them together was always going to be a recipe for success.

But the first time these all-stars teamed up was in 1980 for Raging Bull, which went on to score Robert DeNiro a Best Actor Oscar for his portrayal of former middleweight champion, Jake LaMotta.

LaMotta was nicknamed ‘the Raging Bull’ for his brawling, bullying and stalking style.

An investment ‘bull market’ is also understood to have derived from another of the animal’s characteristics. Bulls thrust their horns up in attack, symbolising the upwards movement in share prices.

By contrast, ‘bear markets’ and their falling share prices are named after the downward swiping of a bear’s paws used to defeat its prey.

2024, after a slow start, has mostly continued the raging bull market that started in October last year, particularly for U.S. large-cap stocks.

At writing the S&P 500 has surged over 22% from its October lows. It has pierced through the 5000 barrier as it made its way to a new all-time high.

In fact, it has risen 14 of the last 15 weeks – a hot streak only last achieved way back in 1972!

But despite this bullish rampage, there is one part of the market that has missed the party and is still cruelly being swiped by the bear: small caps.

While that creates challenges in the short run, the good news is that, for patient investors like us at Ophir, it is throwing up the most attractive valuations seen in decades and has created fantastic long-term opportunities for our Funds.

Janary 2024 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during January. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +0.5% net of fees in January, underperforming its benchmark which returned +0.9%, and has delivered investors +21.0% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +0.9% net of fees in January, outperforming its benchmark which returned -0.6%, and has delivered investors +12.6% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +3.3% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +5.1% net of fees in January, outperforming its benchmark which returned +1.3%, and has delivered investors +13.6% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

U.S. exceptionalism continues in 2024

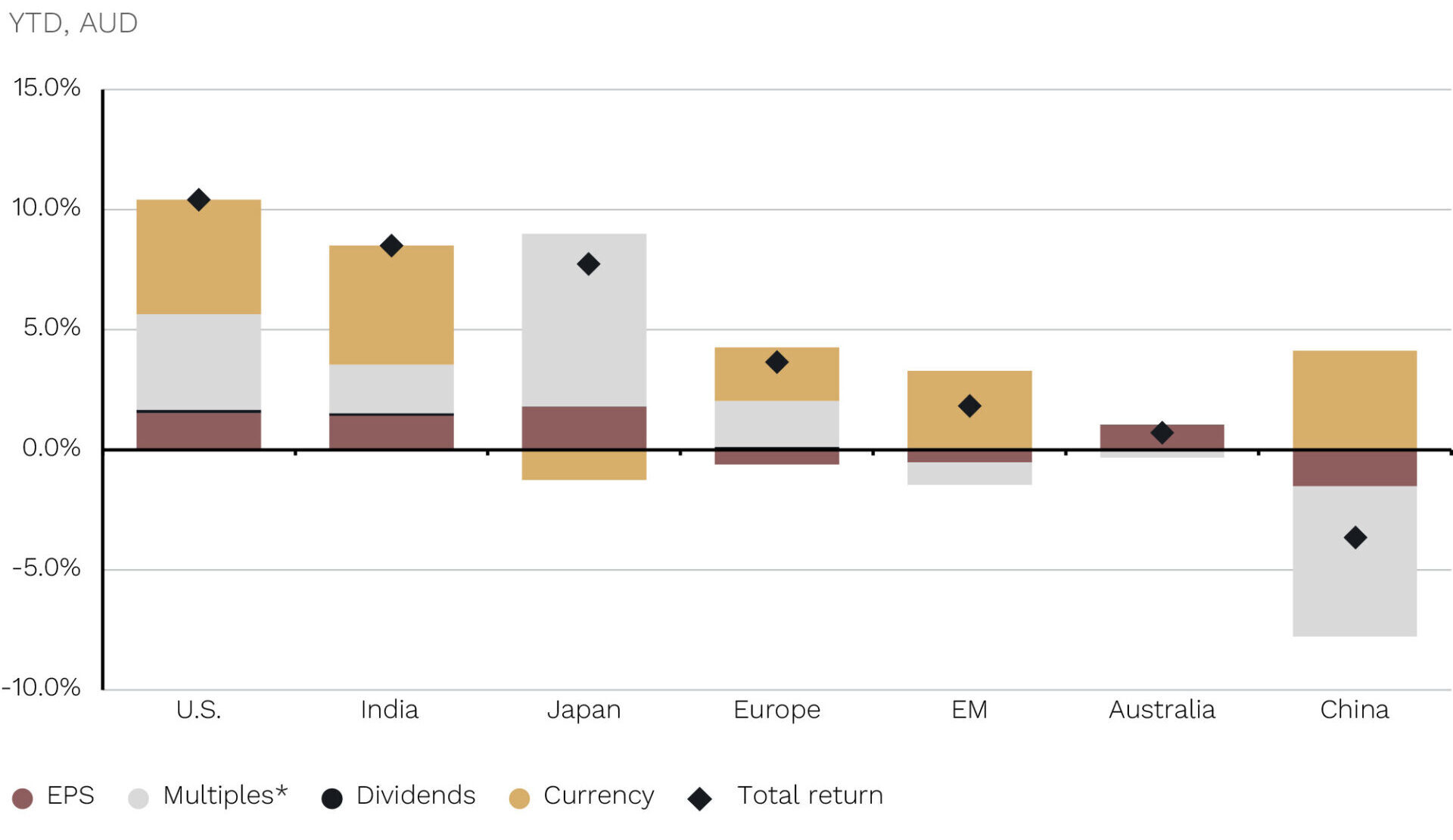

Below, we show the total returns (represented by diamonds) of the major global share markets, including Australia, so far in 2024, in Australia dollar terms.

Source of return

Source: JP Morgan Guide to Markets. Data as at 9 Feb 2024

The U.S. leads the way, with earnings per share (EPS), valuation multiples and currency (a falling AUD versus USD) all contributing to a total return over 10%.

Returns from the Australian share market this year have lagged, with no benefit – by definition – from currency. Valuations have gone slightly backwards.

Spare a thought, though, for investors in Chinese stocks where their market has been an outlier, falling over 7% (before a currency benefit). Valuation multiples have declined, with a collapsing property market, slowing growth and deflation all sapping investor confidence.

But, as mentioned, small caps also have been a laggard, with U.S. small caps (Russell 2000) down -0.8% in US dollar terms (but a better 4.1% in AUD terms), while Australian small caps are up just 1.1% (all to 9th February).

Why earnings matter most long term

New investors might look at the chart above and worry that there are so many components to manage in generating total investment returns:

- Earnings per share (EPS) growth;

- Expansion or contraction in valuation multiples, such as price-to-earnings ratios;

- Dividend growth; and

- Currency movements.

The reality, however, is that only one really matters in the long term: EPS growth.

Why?

Valuation multiples and currency movements, particularly if investors don’t buy when they are at extremes, tend to ‘wash out’ in the long term. And dividend growth is highly dependent on EPS because dividends cannot grow long term if earnings are not growing.

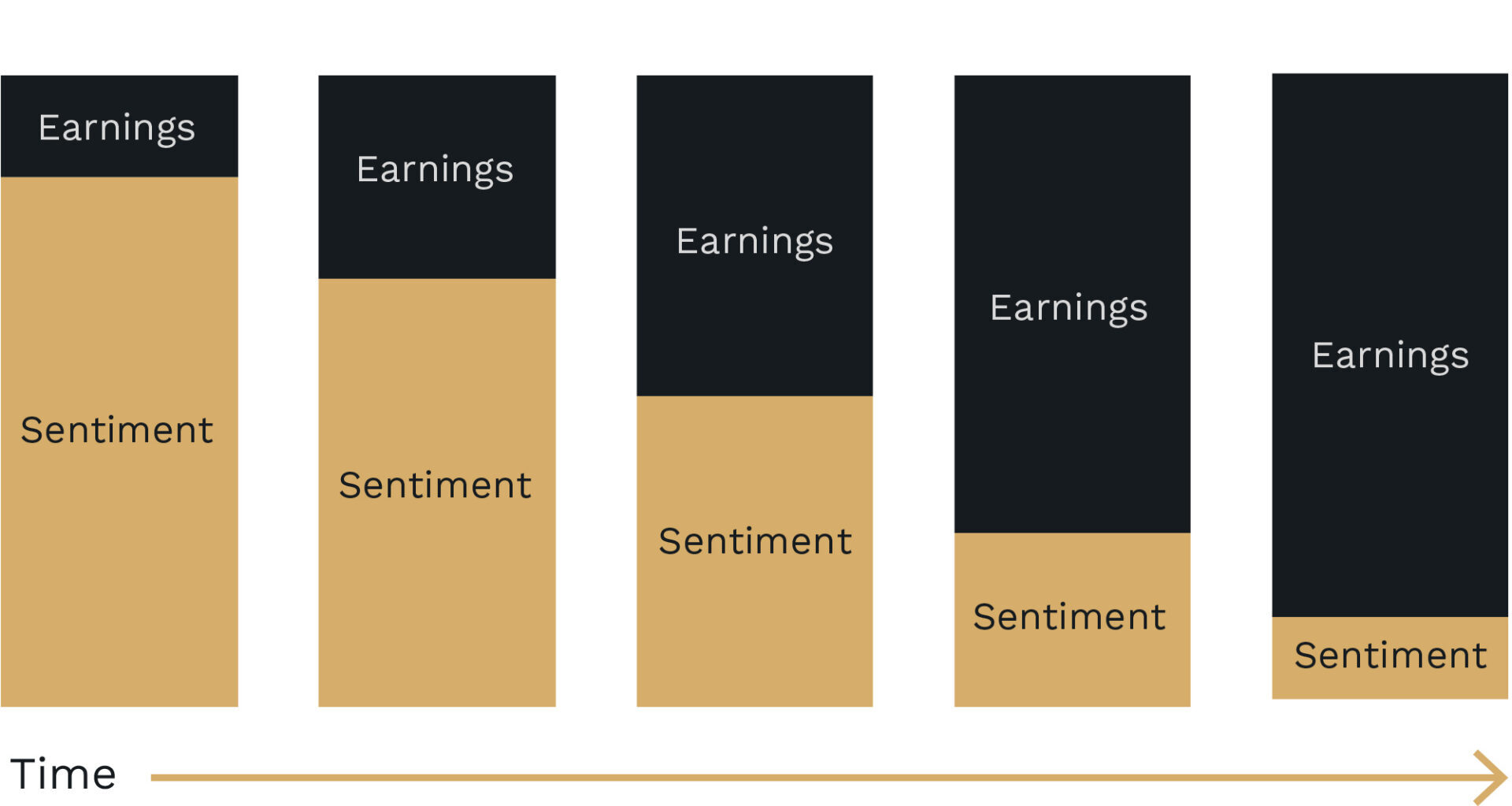

One simple but excellent way of picturing the impact of earnings on both the value of individual company share prices and the price of the share market as a whole, over time, is the chart below.

What moves the market

Source: Twitter/X.com, Brianferoldi

Over short periods, like a day or a few months, earnings do not move total returns much. You can see this in the red (EPS) bars in the top chart above. The red bars clearly had a smaller impact on total returns over the 5-6 week period covered in 2024.

What dominates the movement in share prices and the market in the short term, putting aside any currency movements, is investor sentiment, which is responsible for increasing or decreasing valuation multiples.

A cheery market typically sees multiples increase; a dour market sees multiples fall.

Unless you are possessed with an other-worldly ability to predict the future sentiment of the masses, the sentiment prediction game is a tough one to win and is more akin to gambling at the casino.

For the long-term investor, though, sentiment matters little.

Earnings win the day, long term.

As famed investor Peter Lynch, who ran the wonderfully successful Magellan Fund at Fidelity back in the 1970s and 80s once said:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.”

At Ophir, we spend probably 80-90% of our time studying the earnings power and trajectory of target companies.

If we can find businesses where the market is underestimating the earnings trajectory, ultimately, we will be rewarded. Maybe not today. Maybe not even at their next quarterly or sixth monthly financial results.

But should they string successive earnings ‘beats’ together, compared to market expectations, their share prices will inevitably rise along with profits.

This is why the earnings-based investor requires patience. For most managed funds that invest in shares using fundamental analysis (of revenues, profits), investors should have at least a five-year investment horizon.

Bull market yet to rage for small caps

Patience is certainly what is being required of investors in the small-cap space.

At Ophir, given our small-cap focus, we are acutely aware that volatile investor sentiment is impacting the asset class. It is part and parcel of investing here.

At points in the last two to three years, we have seen the valuations of higher-growth small-cap businesses hit hard after rises in long-term interest rates triggered a sell-off of ‘long duration’ assets.

Small caps have certainly been left in the shade by larger-capitalisation businesses, particularly the Magnificent 7 Mega Caps in the U.S. (Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla); and the so-called GRANOLAS – dubbed European ‘Mag 7’ (GlaxoSmithKline, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, Louis Vuitton, AstraZeneca, SAP and Sanofi).

While there are some wonderful large-cap businesses, a great business is not always a wonderful investment if the valuation is extreme.

Don’t just take our word for it, none other than Warren Buffett’s teacher Ben Graham once said: “A great company is not a great investment if you pay too much for the stock”.

While earnings matter most long term, you can have share price returns fail to live up to earnings growth if valuations get to extreme levels and “price in”, or assume too much growth than what is ultimately delivered.

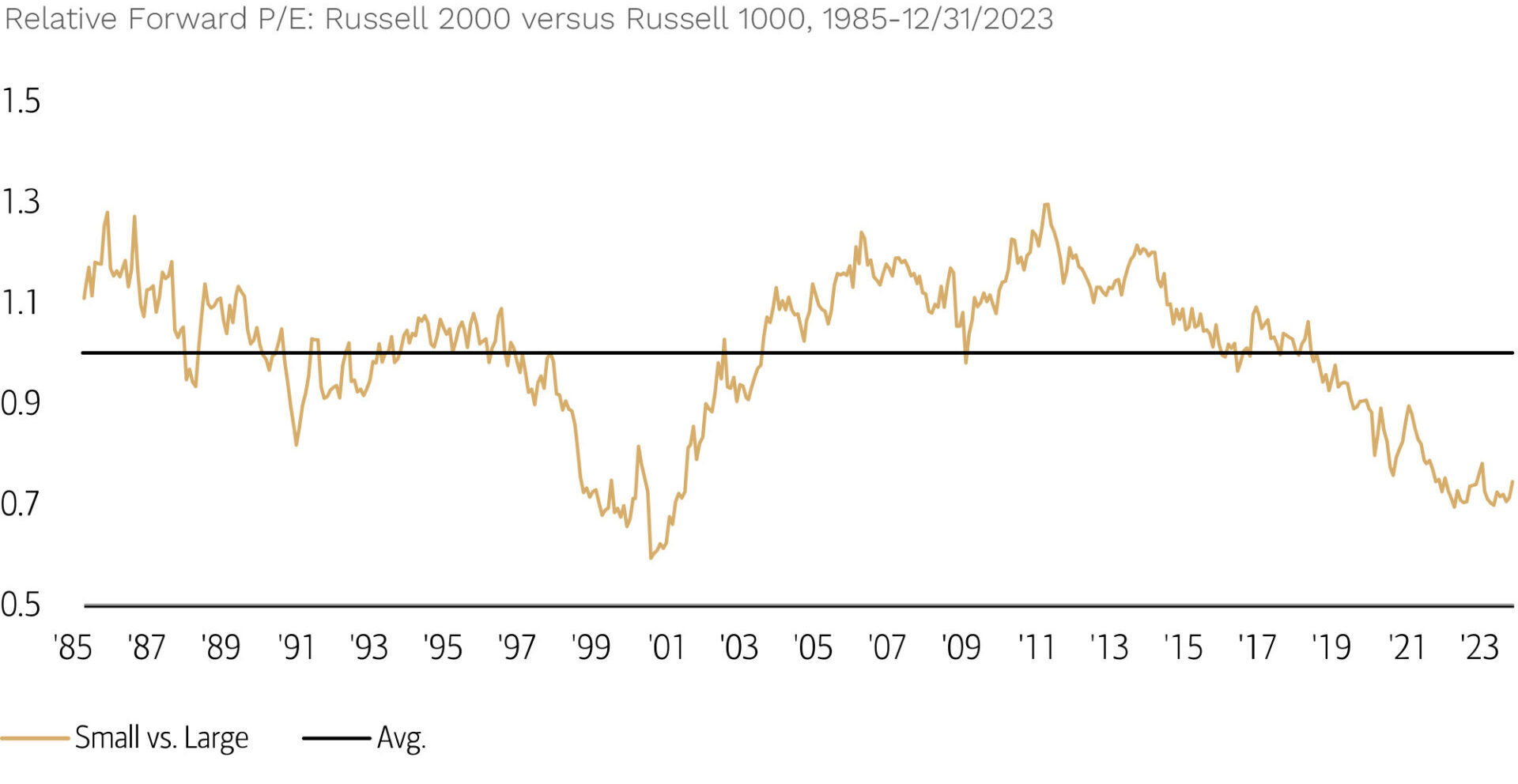

We would argue that the valuation differential in large versus small-cap businesses in the U.S. have become extreme.

Below, you can see that small caps have only been this cheap once before in the last 40 years – during the dot.com bubble.

Small caps then went on to outperform U.S. large caps by about 7% per annum over the next seven years after the S&P500 peaked in March 2000.

Small caps remain very historically cheap vs large caps

Source: BofA US Equity & Quant Strategy, Russell Investment Group. I/B/E/S, Compustat

Recession risk remnants

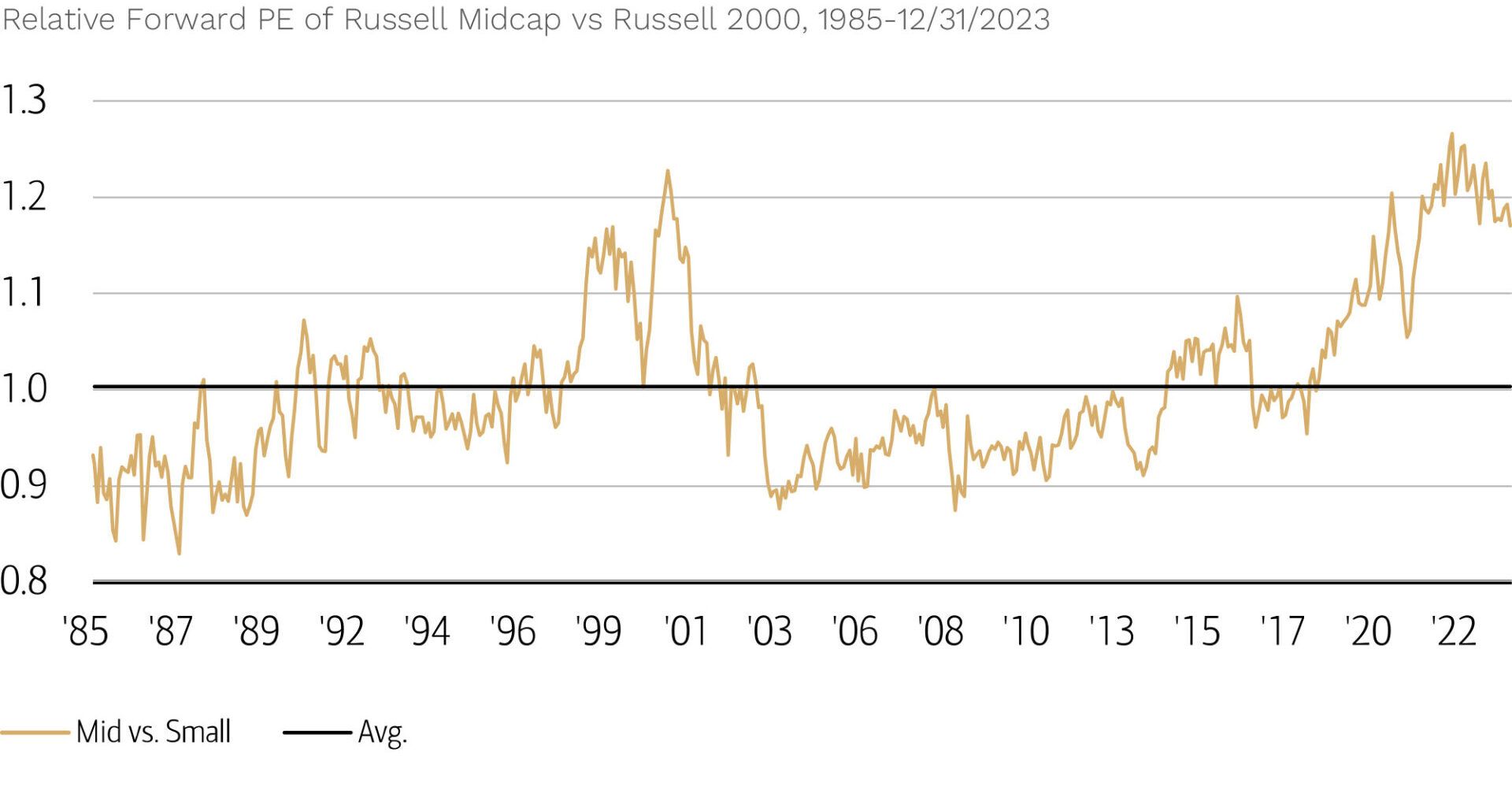

But it’s not just large caps that are looking expensive versus smalls.

Mid-cap valuations are also near a 40-year record premium versus small caps.

Mid caps trade at near record premium to small caps

Source:BofA US Equity & Quant Strategy, FactSet

What is the reason?

Our guess is that a lingering probability of recession in the world’s largest economy has seen market liquidity flow to the perceived safety of larger cap businesses, particularly the Magnificent 7. (Bloomberg’s survey of economic forecasters puts the median 12-month recession probability for the U.S. at 45%, down from 68% a year ago.)

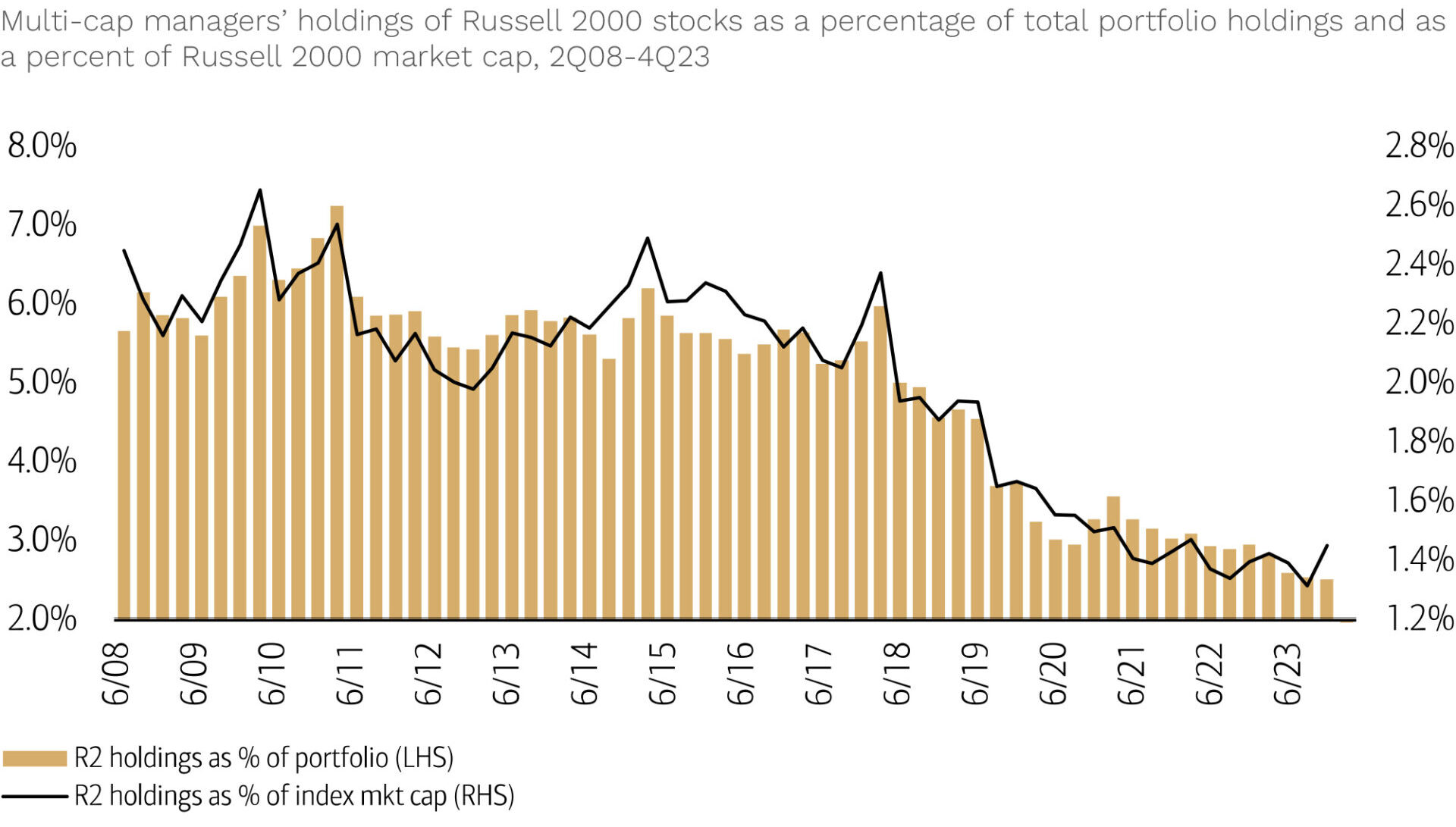

Multi-market cap fund positioning data in the U.S. shows that allocations to small caps (Russell 2000) from fund managers that can invest right across the market cap spectrum, are around record lows.

Multi-cap funds positioning in small caps is just off record lows

Source: FactSet, BofA US Equity & US Quant Strategy

We suspect that when the recession/no-recession question is resolved definitely, liquidity will flow back down to the small cap end of the market.

Such is the opportunity that, while the S&P 500 is back around all-time highs, the Russell 2000 at writing is still down around -20% from its highs and in a bear market.

This is the first time, ever, we’ve had U.S. large caps at all-time highs while US Small caps have been down over -20% in a bear market since the Russell index started in the 1970s!

Mean reversion is powerful force in investing, and we believe this won’t persist. This is a key reason why when we look out over the next 5 years we are very excited about the return prospects for our Global funds both in an absolute sense and relative to larger cap businesses.

Earnings season upon us

While markets continue to wait for the answer to the recession question, we, and the rest of the investment team here at Ophir, are deep in reporting season for both global and Australian companies.

It’s early days, but it’s been a pleasing start so far, particularly for our Global Funds where we have seen good stock-specific outperformance on result days through January and February.

We are less than halfway through reporting season, and we will provide a more comprehensive update in next month’s Letter to Investors.

Till then, back to trawling through our companies’ most recent financial results!

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.