A big FY25 but small cap rate cut benefit still ahead

Financial Year 2025 generated some great returns in the Ophir Funds and in this Letter to Investors we:

- Reveal what drove our Funds to achieve 20-40% returns – the punchline….it was stock picking!

- Cover what our returns look like in up and down markets

- Show how breadth of contributors is a good sign of performance repeatability

- Highlight how rate cuts ahead might help small caps outperform

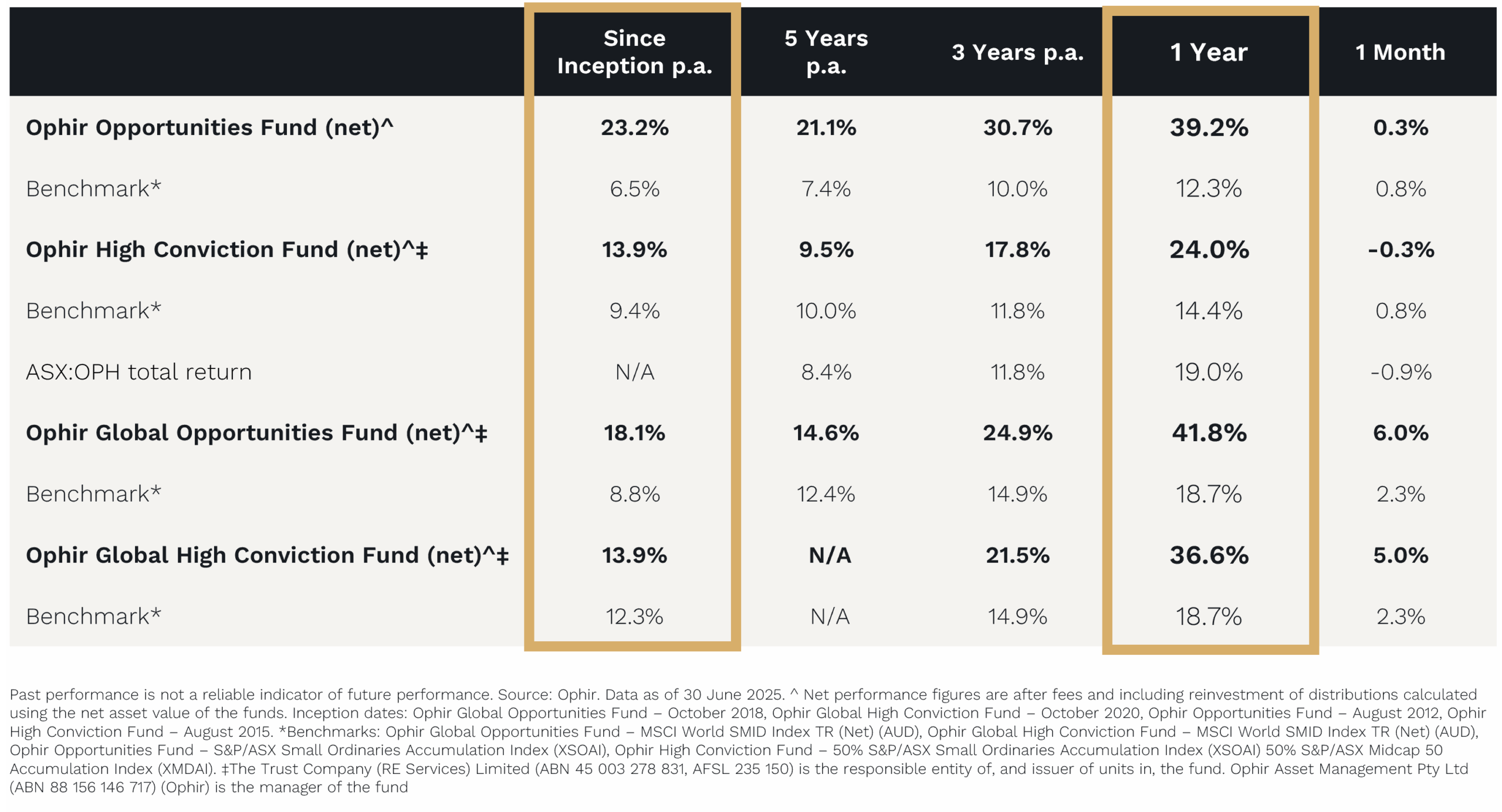

June 2025 Ophir Fund Performance

Before we jump into the Letter, we’ve provided a detailed monthly update for each of the Ophir Funds below.

The Ophir Opportunities Fund returned +0.3% net of fees in June, underperforming its benchmark which returned +0.8%, and has delivered investors +23.2% p.a. post fees since inception (August 2012).

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned -0.3% net of fees in June, underperforming its benchmark which returned +0.8%, and has delivered investors +13.9% p.a. post fees since inception (August 2015). ASX:OPH returned -0.9% for the month.

The Ophir Global Opportunities Fund (Class A) returned +6.0% net of fees in June, outperforming its benchmark which returned +2.3%, and has delivered investors +18.1% p.a. post fees since inception (October 2018).

The Ophir Global High Conviction Fund (Class A) returned +5.0% net of fees in June, outperforming its benchmark which returned +2.3%, and has delivered investors +13.9% p.a. post fees since inception (September 2020).

A Good Year

Despite four years on the trot now of global small cap underperformance versus large caps, it was a good FY25 (12 months to June 2025) for global and Australian small cap markets, producing total returns in the low to high teens.

But it was an even better year for the Ophir Funds, each of which was up between about 20-40% – see table below.

Longer term we assume the market, and our benchmarks, return about 10% per annum, which is what they have approximately done over the very long term. So, by this standard it was an above average 12 months for the small cap market.

We also target 5% outperformance, or 15% total returns, over the long term for all our funds. All four of our core funds below bested this mark in FY25, led by the Ophir Global Opportunities Fund up 41.8% after fees.

Of course, this is not a return investors should extrapolate out into the future as we are acutely aware virtually no one can achieve those types of returns on average over the long term, with the great Warren Buffett achieving more like 20% pa returns in the very long term.

We’d always caution investors that we seek to achieve 15% pa but that comes with risk. And the only thing we can guarantee is that the return in any one given year will not be exactly 15%!

Ophir Funds – Performance to 30 June 2025

While headline results of 1 year returns are great, its long-term returns that matter most for investors. Here our Australian and Global Opportunities Fund’s at 23.2% net p.a. and 18.1% net p.a. since their respective inceptions in 2012 and 2018 are the clear No.1 performers in their asset classes available in Australia (FE Fundinfo data).

The Ophir Opportunities Fund is hard closed, though the Global Opportunities Fund is still open (learn more here).

So if we can’t extrapolate 1 year returns, what can we learn from them? The answer is a lot!

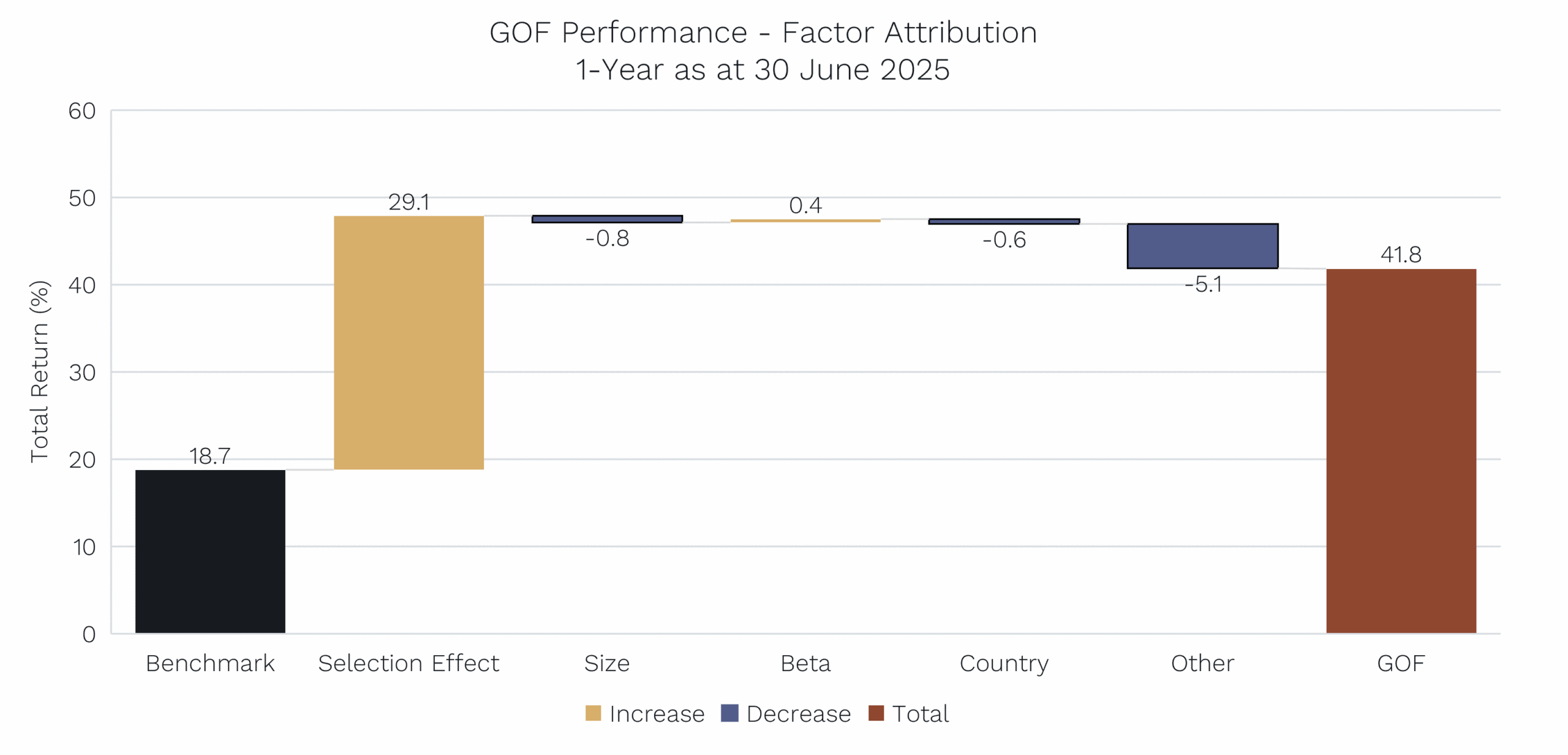

Stock picking rules the day

Below we “pop the hood” on the Global Opportunities Fund’s 41.8% after fee return in FY25. The Global small and mid cap market, as shown by its benchmark, returned 18.7% over the same period so we outperformed by 23.1%. The below chart shows multi-factor performance attribution from Bloomberg which is really just a fancy way of saying, you outperformed the market by 23.1%, what factors caused it?

We haven’t shown the long list of 35 odd factors that Bloomberg tracks, that’d be a really ugly chart, so many of them are just clumped under “Other”. It’s clear the outperformance wasn’t due to the “Size” of companies we invested in as Mid Caps outperformed Small Caps but we are more invested in Small Caps. It wasn’t due to us allocating more to certain countries over others compared to the benchmark – we broadly mirrored the benchmarks/markets allocations to different countries based on their size, with the U.S. being about 60%.

Anyone who tells you they can pick which country is likely to have a better performing share market over the short term is in our view likely lying to themselves, or worse, to you. Good luck to them. And it wasn’t due to taking on more market risk as Beta only contributed 0.4%, or virtually nothing, to the 23.1% outperformance.

Source: Bloomberg. Data as of 30 June 2025. Benchmark MSCI World SMID Index.

In fact, more than 100% of the outperformance was due to Selection Effect which, like we’ve covered previously, means it can’t be explained by standard investment characteristics or styles, but rather from stock picking by the team. That’s good and important because outperformance from stock picking, if you have a genuine edge versus the market, is more likely to be sustainable than outperformance due to some specific factor or style of company like “Size”, or “Growth” or “Industry”.

Those factors and styles might work for a while, but often mean revert (subsequently underperform) and there is not a lot of great evidence that one of them always outperforms in all markets or over the short and long term.

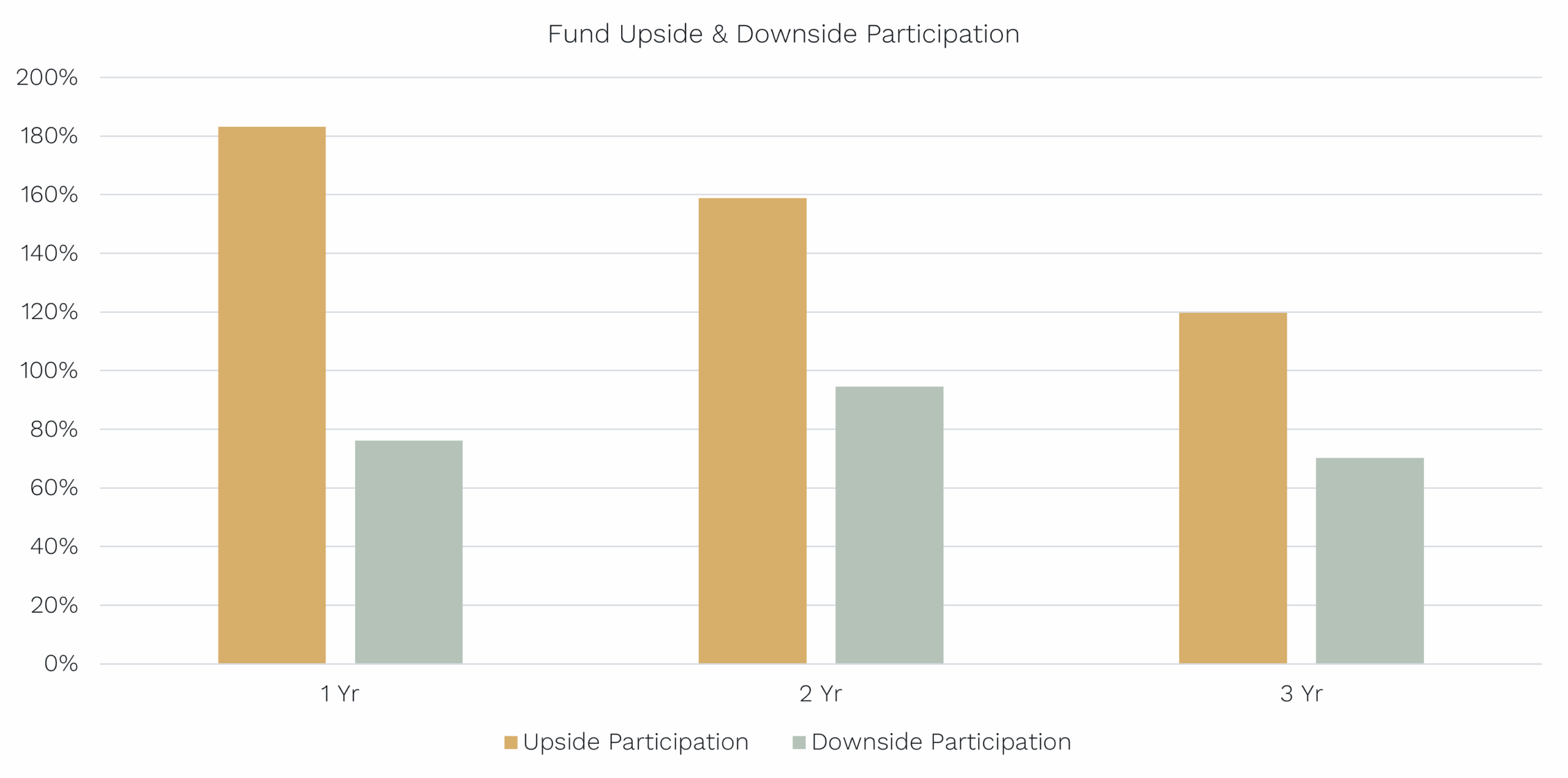

Protecting the downside and outperforming in up markets

Another attribute that investors often crave is to not fall as much as the share market when it inevitably does. The share market is volatile enough, if you can protect during the dips then that’s a trait virtually all investors would put their hand up for.

After a tough 2022 for our style of investing when smaller faster growing businesses saw their valuations get hit when interest rates rose rapidly, we are pleased to show that we’ve fallen less than the global small and mid cap market when there has been pull backs. Over the last year when our benchmark has been down, we have only been down on average 76% of that amount, meaning we fell only about three quarters the amount of the market, protecting value for investors (green bar in chart below). For example, if the market fell -4% in a month we tended to only fall about -3%.

Source: Ophir. Bloomberg. Data as of 30 June 2025.

On the flip side when the market has been up, we have been up 183% of the market’s return. So here if the market was up +4% in a month, we were up 7.3% on average.

As the chart shows this is not just a trait of the last year, but the last three years. That is we’ve both fallen less in down markets and outperformed more in up markets, but the size of the outperformance is more when the market is up.

This outperformance in both up and down markets is something we also notice in our Australian small and mid cap funds that have been running for even longer.

What do we put it down to?

At the end of the day we are looking for companies that can structurally grow and beat the market’s expectations on both revenues and profits. Sure, there might be shorter term periods where other styles of investing might be more in vogue (think Dot.com bubble where nobody cared about fundamentals if you had “.com” in your name!) but if you’re growing cash flows for owners more than the market expects, that’s going to be pretty attractive no matter if the market is in the red or black.

You don’t want to be a one trick pony or a lucky duck

One of our favourite ways to tell if a fund manager is more likely to be skilful or just lucky is to ask them this “How many different (uncorrelated) bets led to your outperformance?” The more there are, the more likely there is to be a repeatable skill in their investment process.

Why?

It’s pretty simple. Even a novice can beat a World Series of Poker Champion on one hand. You can get lucky once. Play enough times though and the novice will lose all their dough.

If you have only one or two stocks doing all the heavy lifting contributing to your outperformance then, though its still not certain, but you’re more likely to have just gotten lucky.

Put another way, the greater the spread of stocks contributing to your outperformance, the more comfortable you should be that outperformance is likely to continue in the future. And before you ask, yes they still need to be uncorrelated. Owning 40 gold stocks out of a supposed diversified 50-stock portfolio when the gold price does well, doesn’t mean you got 40 separate calls right, you got one!

In FY25, we had 19 stocks give over 1% contribution to the 41.8% return of the Global Opportunities Fund, with the biggest 3 contributors providing less than 10% of the fund’s return.

Source: Ophir. Bloomberg. Data as of 30 June 2025.

9 of the 10 industry sectors we invested in provided a positive return in FY25, with our industry allocation compared to our benchmark contributing virtually nothing to our outperformance (no big gold bet here!).

The key point being there was a wide spread of contributors to the return of our Global Opportunities Fund in FY25. While that doesn’t guarantee results in the future, we think it makes it more likely our investment process can sustainably produce outperformance in the long term, as it has in the past.

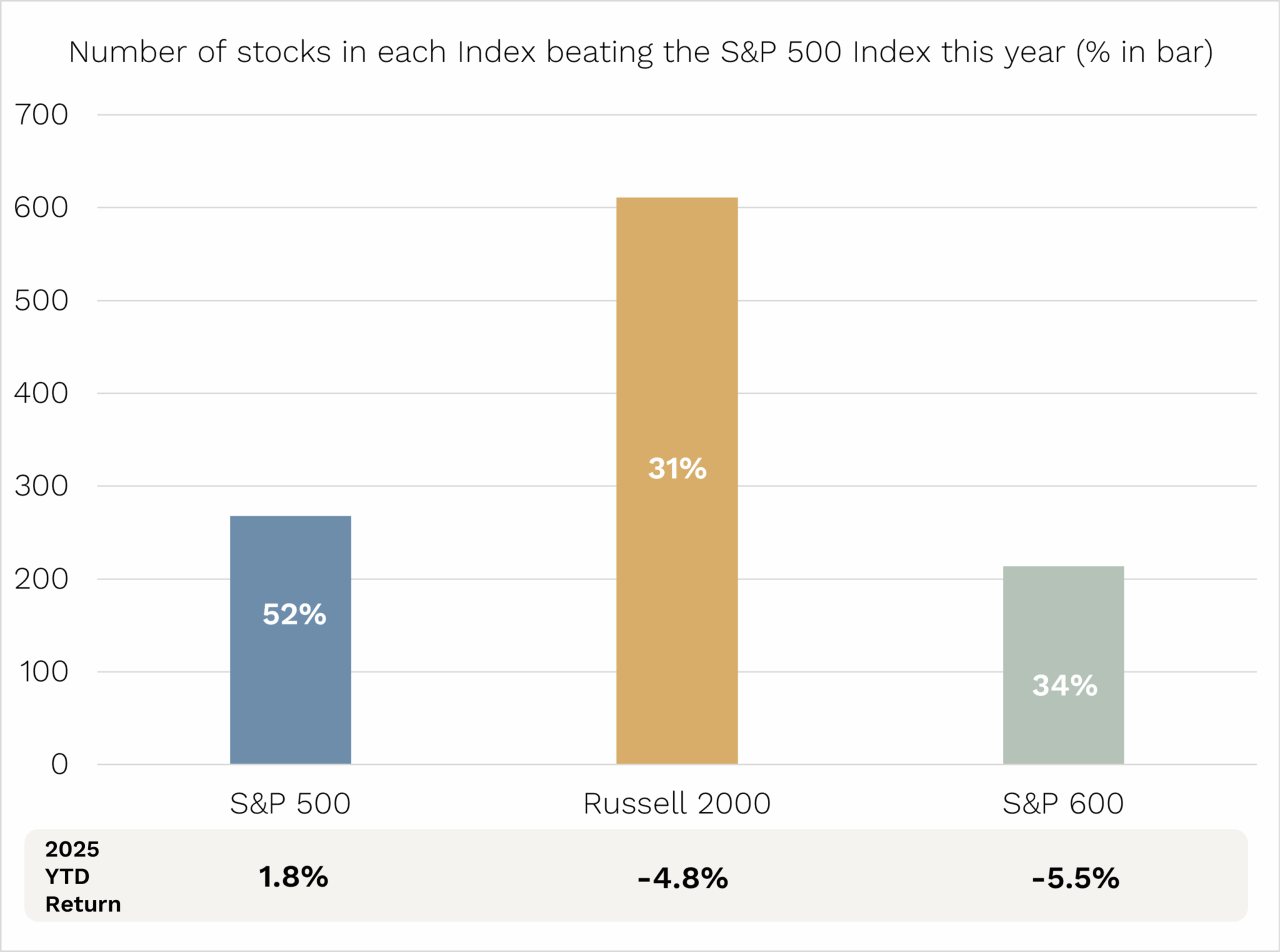

Cuts remain key

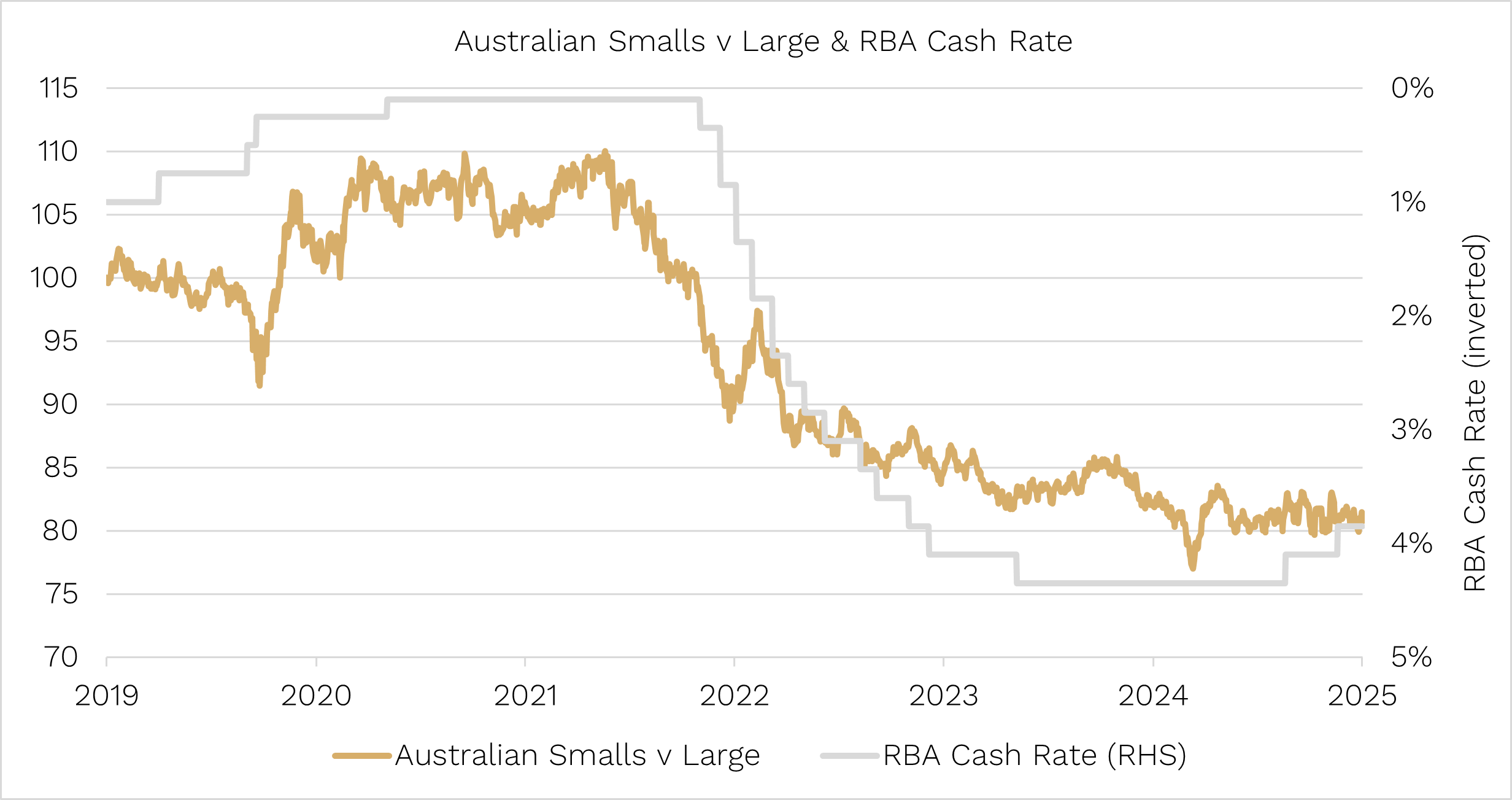

To close we thought we’d leave you with a chart that caught our eye this month. We don’t think we necessarily need small caps to be outperforming large caps to generate attractive returns for investors, and ourselves. FY25 is an example of that. But it sure would be nice if they did after 4 years of small cap market underperformance.

As we have argued for a while now (like in our May Letter to Investors), lower interest rates should certainly help.

Why? For one it reduces interest costs on smaller companies more (as they have more floating rate debt on average than large caps) and secondly it also spurs more risk taking by investors to venture further down the market cap spectrum.

The below chart shows Small Cap versus Large Cap performance in Australia (indexed to 100) in orange since 2019. A falling line means Small Caps are underperforming Large as has happened since late 2021. That coincided with interest rates rising in Australia (RBA Cash Rate inverted in grey). But now Small Caps have just more recently stopped their obvious underperformance as the RBA has begun their rate cutting cycle. A further 0.75%-1% of RBA rate cuts is priced by the market to occur over the next year.

Sometimes the investment world can get too technical in its analysis. Maybe it is just as simple this, as higher rates have hurt Small Caps relative to Large over the last few years. Perhaps more rate cuts are the antidote?

(The chart below looks very similar for U.S. Small versus Large Caps).

Source: Ophir. Bloomberg. Data as at 30 June 2025.

After strong returns in FY25 investors might be asking “is there more juice left in the stocks you hold in the funds, or has it all been squeezed out?” It’s the right question to ask.

The reality is the funds, and more so the global funds, which have a truly enormous investment pond to fish from, are fresh with several high conviction new ideas with big upside, replacing companies that did well and we sold in FY25, after hitting our valuation targets. This keeps us very excited for what lies ahead in FY26.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date of this information and video was prepared, and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.