By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we review Global and Australian reporting seasons and provide an update on Transmedics (NDQ:TMDX) and Glanbia (LSE:GLB), two key positions in our global portfolios.

Welcome to the February Ophir Letter to Investors – thank you for investing alongside us for the long term.

Reporting season scoreboard

Most people have their favourite sporting moment that lives forever in their memory. It might be Michael Jordan’s game-winning shot to clinch the 1998 NBA Finals, or perhaps Tiger Wood’s iconic shot on the 16th hole during the 2005 Masters Tournament. For us Aussies, it might be Cathy Freeman’s 400m track gold medal at the 2000 Sydney Olympics.

In sport, the time between the ‘act’ and the ‘result’ is usually measured in seconds, sometimes minutes, at most hours.

But with investing we must be a little more patient. There is a much larger gap between the act (buying into a stock) and the result.

The most frequent ‘result’ on how good our investing has been is measured in months: the months of reporting seasons. They typically come quarterly for companies in our global funds, and every six months for companies in our Australian funds.

February was one of the biggest reporting seasons of the year. Most companies in our global funds reported, not just December-quarter financial results, but full-year 2023 results. Companies in our Australian funds reported six-monthly results to December 2023.

We get to see whether all our hard work – meetings, road trips and phone calls – has enabled us to get the forecasts for the fundamentals of the companies we own, including their revenues and margins and profits, right.

Of course, as we spoke about last month that forecasting the fundamentals correctly in one reporting season doesn’t guarantee our funds will outperform in any given month. Non-fundamentals factors can impact share prices in the short term.

But if we string together many good reporting seasons, it virtually guarantees that we generate attractive long-term returns and outperformance.

In this Letter we will look at the US and domestic reporting seasons, then dive into how our funds performed. And we will then provide an update on Transmedics (NDQ:TMDX) and take a deeper look at one of the most exciting stocks in our global portfolio: Glanbia (LSE:GLB) .

February 2024 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during February. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +4.3% net of fees in February, outperforming its benchmark which returned +1.7%, and has delivered investors +21.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +2.6% net of fees in February, underperforming its benchmark which returned +3.5%, and has delivered investors +12.8% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -4.4% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +5.8% net of fees in February, outperforming its benchmark which returned +5.2%, and has delivered investors +14.5% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Solid reporting seasons in the US and Australia

Before we explore our funds’ results in more detail, it’s worth highlighting that this US reporting season was mostly a solid one. Earnings ‘beats’ versus ‘misses’ were in line with long-term averages.

Cracking results, though, from market heavyweights Nvidia and Meta (Facebook), and to a lesser extent Amazon, helped push share markets higher.

The so-called Magnificent 7 as a whole rose +12.1% in February. That helped push the S&P500 up +5.3%. There was some more breadth to the market in February, too, with the Russell 2000 index (US small caps) up an even stronger +5.7%.

The performance of mega-cap technology companies in the US flowed to the local market where the ASX 300 IT index posted a huge +19.7% during the month.

It was also a better-than-normal reporting season for corporate Australia, though our market didn’t rise as strongly as the US.

For Australian companies there were three earnings beats for every two misses. Analysts downgraded June 2024 financial-year earnings forecasts by -0.4%, or $600 million to $147 billion. The average historical reporting season downgrade, however, is -0.7%.

The main takeaways were:

- Cost growth is slowing. Higher costs had been crunching margins in recent reporting seasons, but there was better news here particularly with decreasing freight rates at companies like ResMed (ASX:RMD) (an Ophir holding) and Nick Scali (ASX:NCK).

- Weaker cash flow. For industrials this was due to rising capital expenditure (capex), though, which was a positive because companies are more confident in putting their capital to work to grow their business.

- Earnings momentum continued. High earnings momentum continued in many businesses, including AUB Group (ASX:AUB) and Life 360 (ASX:360) (both Ophir holdings), as well as Cochlear (ASX:COH) and Origin Energy ASX:ORG).

The ASX 300, however, was only up 1.0% in February. It significantly lagged the US share market. The materials and energy sectors weighed on the market, with key commodity prices falling. Iron ore was down around -12%.

The Australian business cycle still appears a touch behind the U.S., with higher inflation and later rate cuts expected domestically. Also U.S. corporate earnings look to have bottomed in early 2023, whilst it looks like Australian corporate earnings may only be bottoming now (absent a recession).

Clanger free: Ophir Global Funds – February reporting season

So how did we go during reporting season in our Global Funds?

Well, it was a pretty clean affair, with a distinct lack of any ‘clangers’.

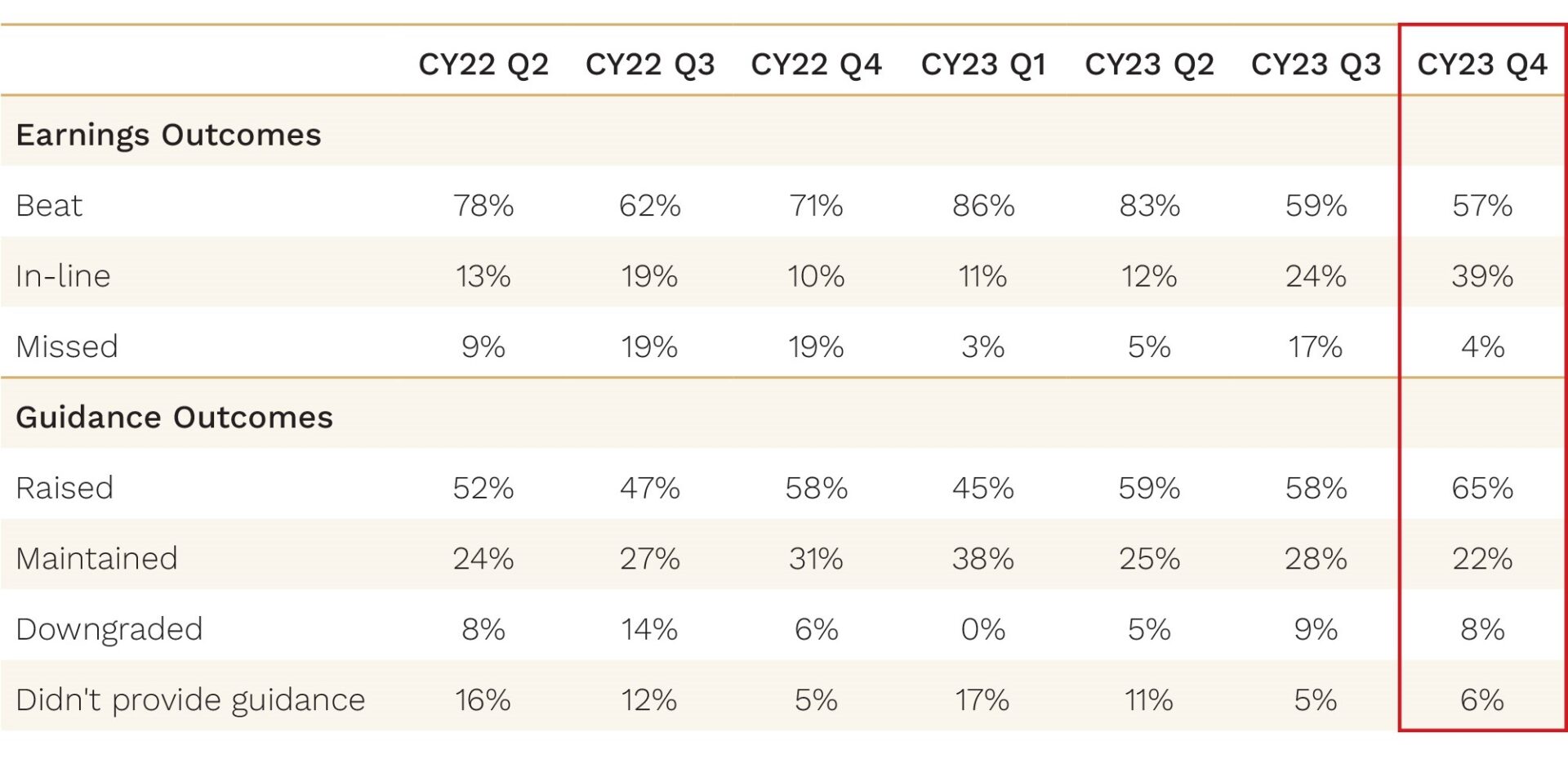

Below, we show how we performed, in aggregate, across our two global funds for two measures: ‘earnings outcomes’ and ‘earnings guidance’.

Both are relevant. Earnings outcomes looks at whether earnings came in ahead of (beat) the market consensus or below them (missed). Earnings guidance looks at whether the company itself increased (raised) or decreased (downgraded) its expectations for next quarter’s earnings.

If a company ‘beats’ and ‘raises’ it will typically outperform the market on the day. It will also likely have buying support from investors until its next reporting period in three months.

Global Funds – Reporting season outcomes

Source: Ophir. The results are weighted by the portfolio weights of the contituents that reported.

As you can see, the percentage of companies (by weight) in the global funds that beat expectations was a little lower than recent quarters. But the number of misses was very low. Only two companies out of the 30 that had reported at writing didn’t hit market expectations.

We have since exited one of those stocks. We continue to hold the other, a legal software provider for real estate transactions, because we believe its weak UK volumes will be offset as cyclical tailwinds pick up.

The standout was the number of companies that raised their revenue or earnings guidance: 65%. This was a noticeable lift from the last 12-18 months.

It is encouraging, particularly as economic soft-landing hopes build in the US. It is also likely a consequence of our decision to tilt the highest-weighted positions in our global funds towards businesses with the greatest clarity of earnings certainty for the year ahead.

Clean too: Ophir High Conviction Fund – February reporting season

Like our global funds, it was a very clean reporting season for the Ophir High Conviction Fund (ASX:OPH). Only one company missed its earnings expectations. Just three downgraded company guidance.

Ophir High Conviction Fund (ASX:OPH) – Reporting season outcomes

Source: Ophir. The results are weighted by the portfolio weights of the constituants that reported.

While the fund was up +2.6% during February, ahead of the +1.7% return on the ASX Small Ordinaries index, it was behind its benchmark return of +3.5%.

The ASX mid-cap index (50% of the benchmark) was up a very strong +5.4%. More than 40% of this return was attributed to strong share price returns from Wisetech (+29.4%) and Altium (+30.4%) neither of which we own.

We sold out of Altium because we correctly forecast that it would miss on earnings in February. The February miss would have sent the share price lower, but then it received a takeover offer during the month.

The top contributor was NextDC (ASX:NXT), one of Australia’s largest data centre operators. It continues to benefit from surging demand from cloud service providers and is one indirect way ASX investors can get exposure to the AI thematic.

The stock was up +25.9% on the month. It no doubt got a boost from Nvidia’s knockout result in the US that showed the AI thematic goes from strength to strength.

Transmedics beat and raises while aviation penetration grows

Below, we will touch on a “Stock in Focus” for a company we hold, Glanbia.

But before that, we thought we’d give a quick update on Transmedics, which we have held in our global funds since mid-2022, and which we spoke about recently, including at our Meet the Manager events last year.

Transmedics provides products and services for the removal, storage and transportation of liver, heart and lung transplants, primarily in the United States.

In late February it reported another great result.

Revenue for the December quarter came in around 20% ahead of the market’s expectation. It increased calendar year 2024 revenue guidance to USD$365 million – 11% above the market’s expectation of USD$330mil.

The company gave investors greater confidence in the growth of its aviation revenues (from organ transportation), a brand-new revenue stream from a recent acquisition.

Transmedics grew aviation penetration from 13% to 35% during the quarter and it plans to take the number of fleet planes from 11 to 15 in short order.

The aviation division is helping to release a key bottleneck in the end-to-end organ transplant process where, to date, lack of on-demand access to planes has resulted in significant wastage of organs across the industry.

Below is a picture of one of their aviation logistics hubs responsible for the coordination of organ transportation.

Source: Transmedics Investor Presentation January 2024.

Stock in focus – Glanbia

To finish, we thought we’d leave you with some insights into Glanbia, a key holding in our global funds that we are excited about.

We bought Glanbia in the second half of last year.

The business is an Irish company listed on the Dublin and London stock exchanges. It has an AUD$7.4 billion market cap.

The business operates in three key segments:

- Glanbia Performance Nutrition (GPN), which includes sports nutrition, active lifestyle and weight management products. Through its Optimum Nutrition line, it is the No.1 sports nutrition brand in the world, selling into over 90 countries.

- Glanbia Nutritionals (GN), which covers pre-mixed protein and micro-nutrient solutions. They are ingredient partner of choice to a wide range of businesses in the food, beverage and nutrition industry and the No.1 producer of whey protein isolate in the US.

- Joint Ventures, which covers the sales of cheese and whey protein ingredients. Here they are the No.1 provider of American-style cheddar cheese.

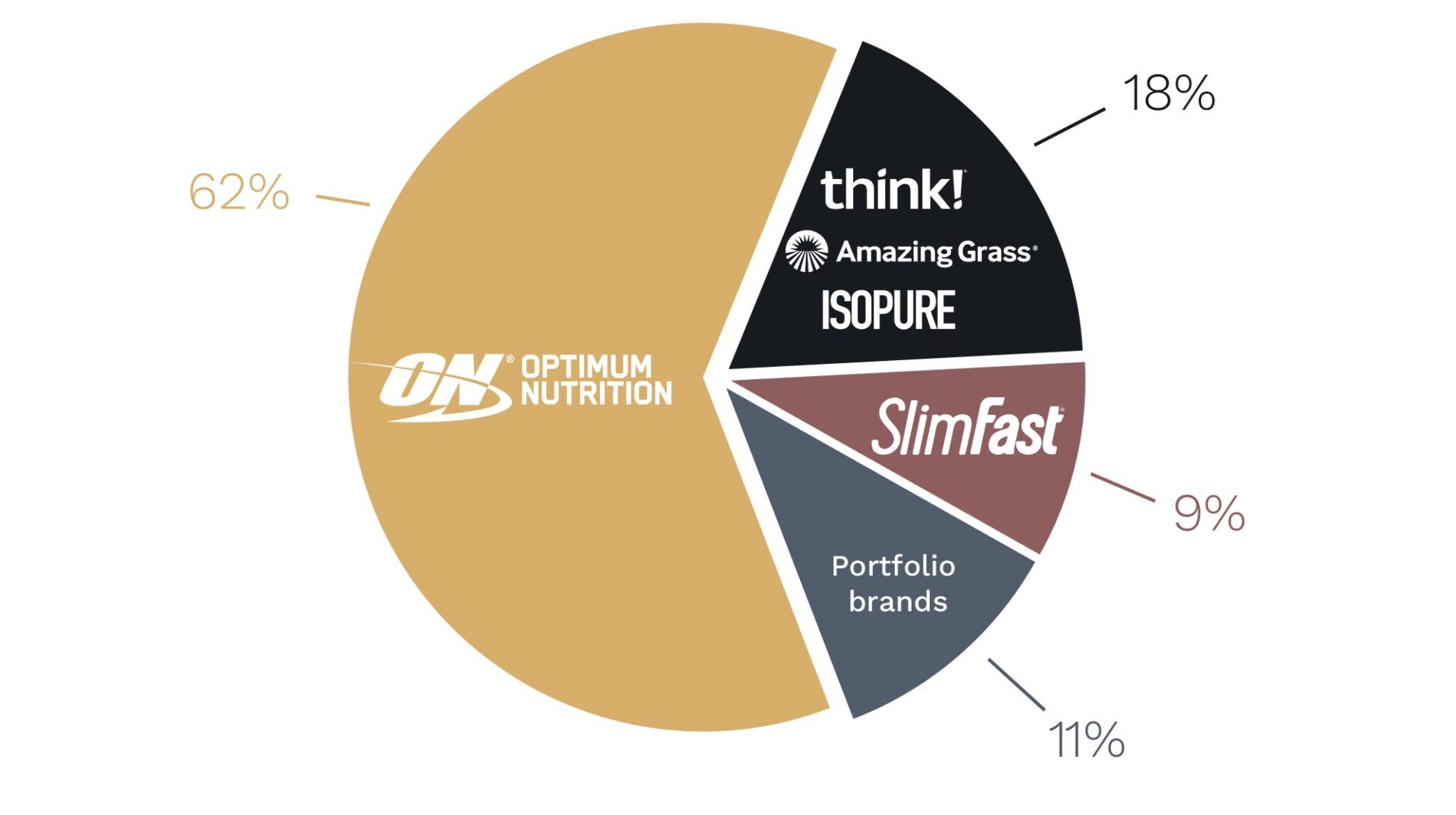

In its GPN business, which is its core growth engine, Glanbia has a suite of leading brands including Optimum Nutrition (“ON”) and Isopure (about 80% of revenue). They have been growing market share, underpinned by the GLP-1 thematic, but also more generally by increasing awareness of healthy living and lifestyle nutrition.

FY 2023 GPN Revenue Mix %

Source: Glanbia Investor Presentation.

GLP-1 weight loss drugs, such as Ozempic, have hit the news as stories of Hollywood celebrities such as Oprah Winfrey using them circulate. Use of GLP-1 has become more widespread in the US and looks likely to continue to accelerate worldwide.

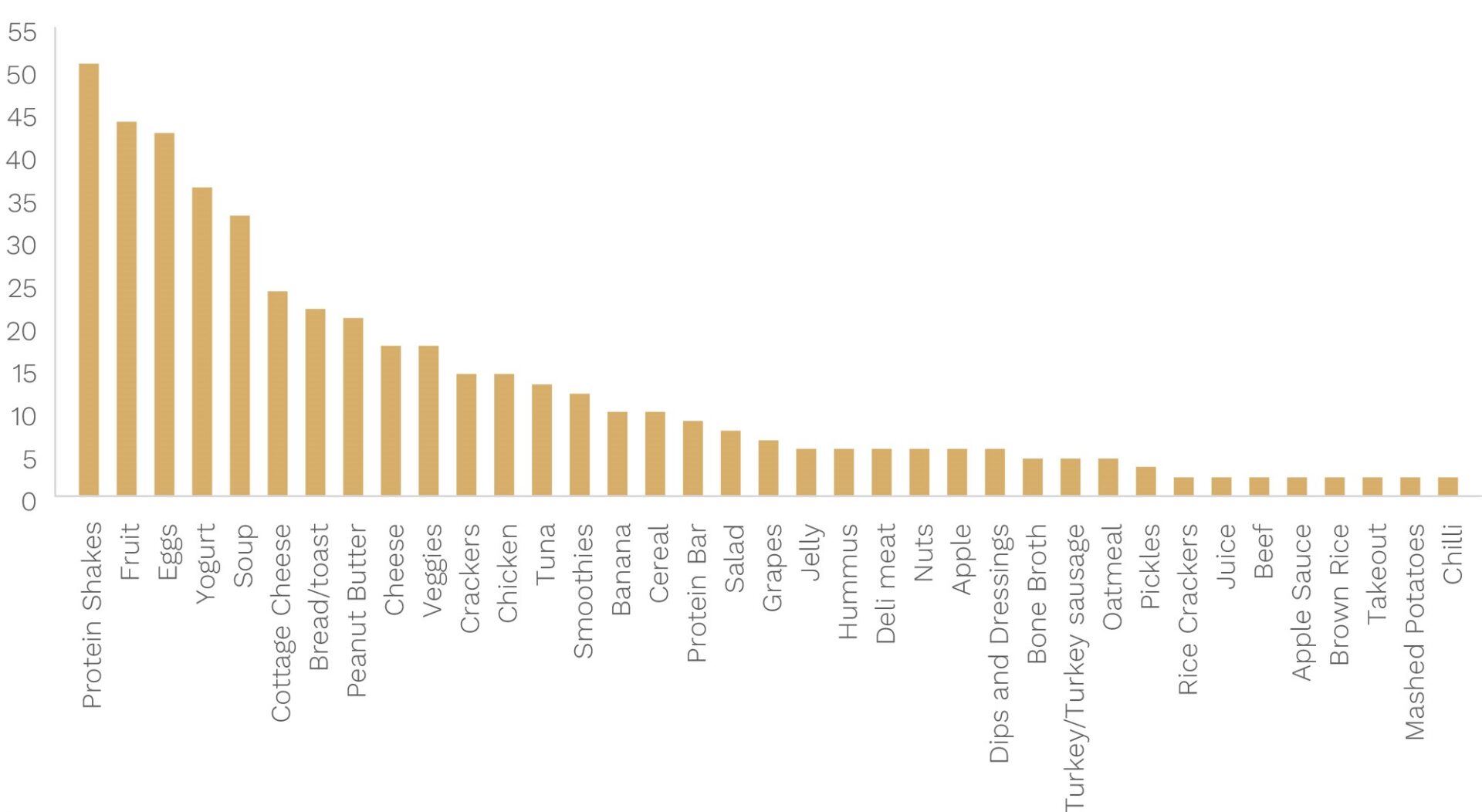

Interestingly, when GLP-1 users were surveyed on what they would be more likely to eat when not especially hungry (reduced hunger is a direct intended effect of the drug), protein shakes came out on top. That’s likely because one of the side effects is weight loss from muscle loss, not just fat loss. Heightened protein intake can potentially protect against this.

Count of GLP-1 users who mentioned each type of food as part of a meal they would eat if they weren’t especially hungry

Source: Facebook and Bernstein analysis

As the No.1 provider globally of sports nutrition products, a large portion of which is protein shakes, Glanbia looks set to benefit.

Earnings growth will also come from margin expansion given recent normalisation of whey protein pricing and stabilizing supply chains.

On top of earnings upside, its key product Optimum Nutrition, competes with Dymatize, a key product for company Bellbring Brands (NYSE:BRBR), which trades at a significant valuation premium. In our view the market is underappreciating Glanbia, so there is an opportunity for significant upside in its valuation (price-to-earnings ratio).

At a 13.5x forward price-to-earnings ratio, we think it is a cheap way to get exposure to a world class-provider of nutritional products that looks set to benefit from multiple structural tailwinds over the years ahead.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.