By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our September 2021 Letter to Investors we take a look at why the equity markets took a rare pull back recently during the month and what sectors and styles of investing are likely to do well if bond yields keep heading higher.

Dear Fellow Investors,

Welcome to the September Ophir Letter to Investors – thank you for investing alongside us for the long term.

The name is Bond … U.S. Bond: What the bond market signals for stocks

Sean Connery, after lighting a cigarette at the baccarat table in the 1963 Bond film Dr No, was the first to utter the now-famous words, “Bond, James Bond”.

Fast forward to today and the latest Bond movie, No Time to Die, the 25th and Daniel Craig’s last as the eponymous martini sipping British secret agent, had its world premiere during September. The film has garnered rave reviews from critics. (Though the pink velvet tuxedo jacket Craig wore to the UK premiere certainly earned more mixed opinions).

But it was a different kind of bond that was making the headlines in financial markets during September. Government bond prices decided in fact it was ‘time to die’ during the month falling steeply and sending bond interest rates, most importantly in the US, sharply higher.

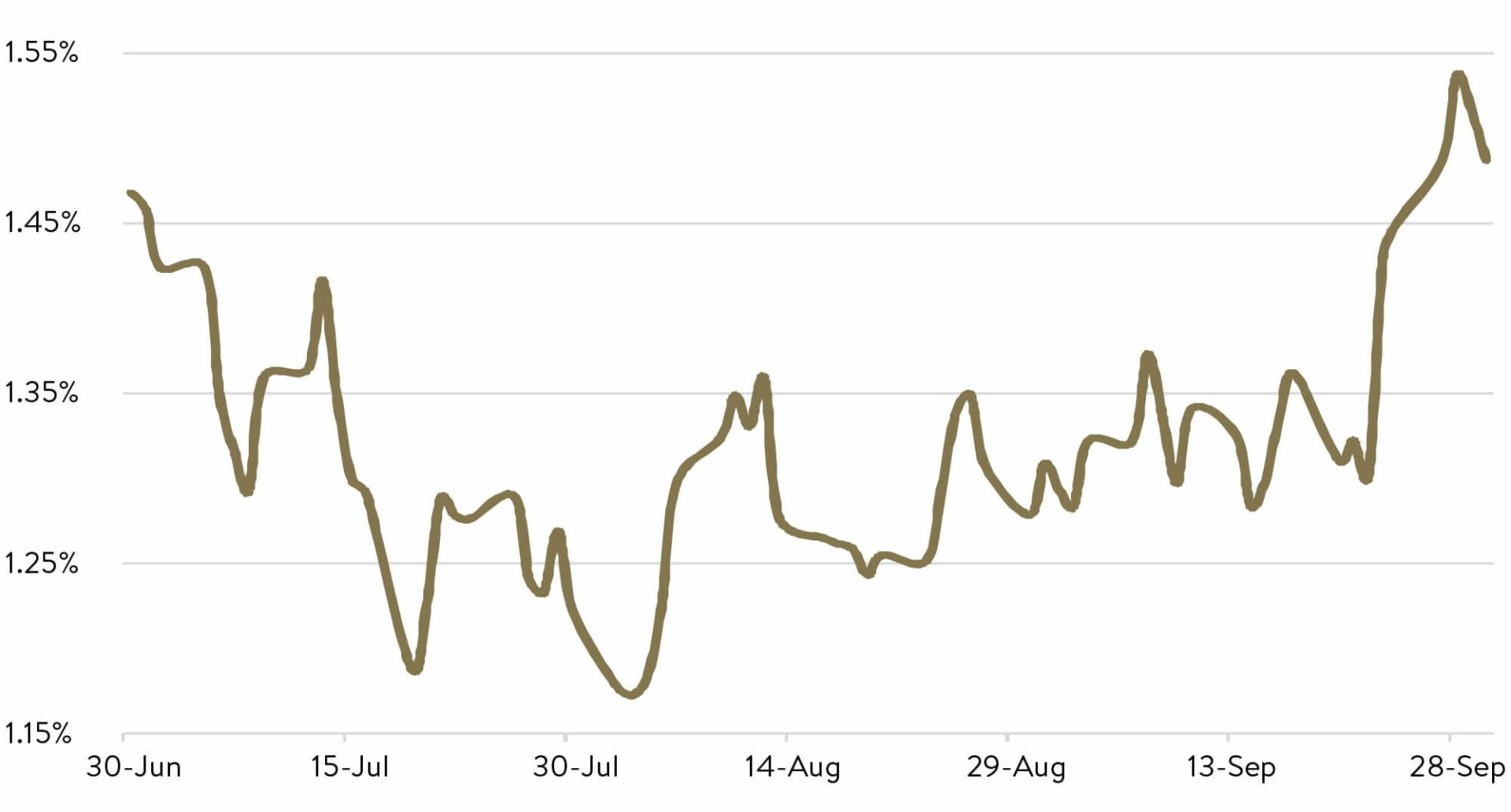

US 10-year yield

Source: J.P. Morgan calculations, Bloomberg Finance LP.

This happened after the US Federal Reserve at its September committee meeting took a more hawkish turn, which was echoed by similar comments from the Bank of England. Fed chairman, Jerome Powell, signalled the US central bank would start tapering their quantitative easing program this year with a good probability the Fed will start hiking rates later in 2022.

We think the rise in the 10-year government bond yield in late September and into early October (to 1.57% at time of writing) was more about monetary policy normalisation from central banks. That’s why, when compared with the ‘reflationary’ growth surprises of earlier in the year that led to temporary yield spikes, we believe the current rise in yields are more likely to be enduring. Most of the move higher has been in what experts call real yields, which is the interest rate you pay after stripping out the inflation component.

We were reminded again of the great quote from James Carville, Bill Clinton’s political adviser, who once proclaimed:

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

In this letter, we will review recent market trends, including the surge in energy stocks and the likelihood of the ‘opening up’ trade continuing. But we primarily look at what the bond market is signalling for equities. The good news is that history suggests rising real yields, especially early on, tends not to derail equity markets, which is a positive sign as we head towards 2022. But it also gives us some great information about which sectors, styles (value or growth?) and stocks are positioned for positive performance.

And we also ask the question: are we heading ‘back to the 70’s’ with a bout of Stagflation?

September 2021 Ophir Fund Performance

Before we jump into the letter, we have included below a summary of the performance of the Ophir Funds during August. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +0.4% net of fees in September outperforming its benchmark which returned -2.1% and has delivered investors +26.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -2.7% net of fees in September, underperforming its benchmark which returned -1.4% and has delivered investors +20.7% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +6.1% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned -4.0% net of fees in September, underperforming its benchmark which returned -2.4% and has delivered investors +38.6% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

September bogeyman: A win (or loss!) for history buffs

The sharp move higher in bond yields coincided with equity markets sell off in September. In fact, the MSCI World Index (which proxies global equities) fell 4.3%, its worst month since March 2020. It shocked many investors out of their slumber, particularly the retail traders who had only recently joined the investing brigade from home in their pyjamas.

Amazingly the month saw the first -5% pullback in the S&P500 in 330 days. Likewise, domestically, the Australian share market in September did not disappoint history buffs who know the month is historically the weakest of the year, with the local bourse falling, ending 11 consecutive months of gains, the longest since World War 2!

Admittedly the September market falls were likely not all the Fed or the bond markets doing. Investors also fretted about the Chinese real estate market (everyone has now heard of Evergrande right?), US debt ceiling issues, and rocketing energy prices, which all put a little more fear back into the market.

Australia’s great Energy-Iron Ore divide

The Australian share market was a relative outperformer, though, down a more modest -1.6% (ASX300), with the small cap end of the market we focus on down a slightly greater -2.0%. Under the bonnet, however, there was some truly extraordinary divergence amongst companies and sectors that echoed across overseas markets and reflected what was going on in Energy and Base Metals prices.

Australia’s Energy sector was up a whopping +16.4% in September, while the Materials sector was down in the doldrums, losing -12.1% for the month. Why such a huge difference? On the energy side, prices for thermal coal, natural gas and oil surged +25.1%, +28.0% and +7.6% respectively during September.

A witches’ brew of a strong recovery in demand, and long-standing underinvestment in supply (due to the prior low-price regime, environmental policies and geopolitical headwinds) appear to be boosting energy prices.

On the flip side, iron ore continued its crash back to earth, adding another 25.2% fall during the month with Chinese steel demand taking a back seat courtesy of government restrictions in the real estate sector and pollution concerns, particularly leading up to the Winter Olympics in early 2022.

These thematics dominated the performance bookends for the Aussie equity market. If you had ‘Energy’ in your name, there was a very good chance you were one of the best-performing stocks. For example, in the small and mid-cap part of the market we analyse, Beach Energy (+42.4%), Paladin Energy (+35.3%), Karoon Energy (+26.4%) and Cooper Energy (+20.0%) rode the energy price wave. At the same time, those exposed to iron ore took it on the chin with Champion Iron (-18.0%), Bluescope Steel (-17.1%) and Mineral Resources (-18.4%) all seeing big falls.

As long-time investors will know, we do not try to pick these price cycles because that’s devilishly difficult to do, and we are more than happy to ride the underperformance or outperformance that results from generally being underweight these sectors.

Can the ‘opening up trade’ trade up further?

The other key theme that came through in September returns on these shores was the outperformance of reopening-exposed stocks as investors looked forward to NSW and Victoria coming out of lockdown and learning to live with COVID-19 over the next few months.

We have seen this with travel-related businesses like Flight Centre (+30.8%), Webjet (+11.4%), Auckland Airport (+9.1%) and Corporate Travel Management (+7.9%) all strongly outperforming, whilst other reopeners like IDP Education (+18.4%) and Star Entertainment (+9.6%) also found investor backing.

This was typically at the expense of your COVID-19 beneficiaries (such as those that benefit from at-home spend) with Temple & Webster (-14.5%), Marley Spoon (-29.9%), Harvey Norman (-6.5%), Reece (-8.4%) and Reliance Worldwide (-10.4%) all seeing meaningful falls. This dynamic was evident overseas, with household name stocks such as travel-related company Expedia (+13.4) rallying, while parcel delivery giant Fedex (-17.2%) hit the skids.

This really goes to show investor psychology now. These stock moves, for local companies, all came on no company-specific news as we are in that air pocket period between annual financial results, which were released in August, and the upcoming AGM season in late October and November.

We think this trend of companies exposed to reopening outperforming in the share market has further to run but requires a little more selectivity given the moves already. And it pays for investors to be more exposed to the services sector, which should see the biggest benefit. As always, these positioning ‘bents’ in our portfolios are only ever at the margin, and the companies must still satisfy our usual criteria of structural growth, attractive valuations and additional growth ‘optionality’ that is underappreciated by the market.

The real story with bond yields

As alluded to earlier, and discussed at length in previous letters, we think longer-term bond yields are likely to continue heading higher, though perhaps in fits and starts, and not as sharply as they did at the end of September and start of October this year.

Yields will likely head higher because a big price-insensitive buyer (the US Fed which is tapering/ending QE and will buy fewer bonds) is stepping out of the market, and a big price-insensitive seller (the US Treasury which is low on cash and needs to sell more bonds to fund itself) is coming back into the market.

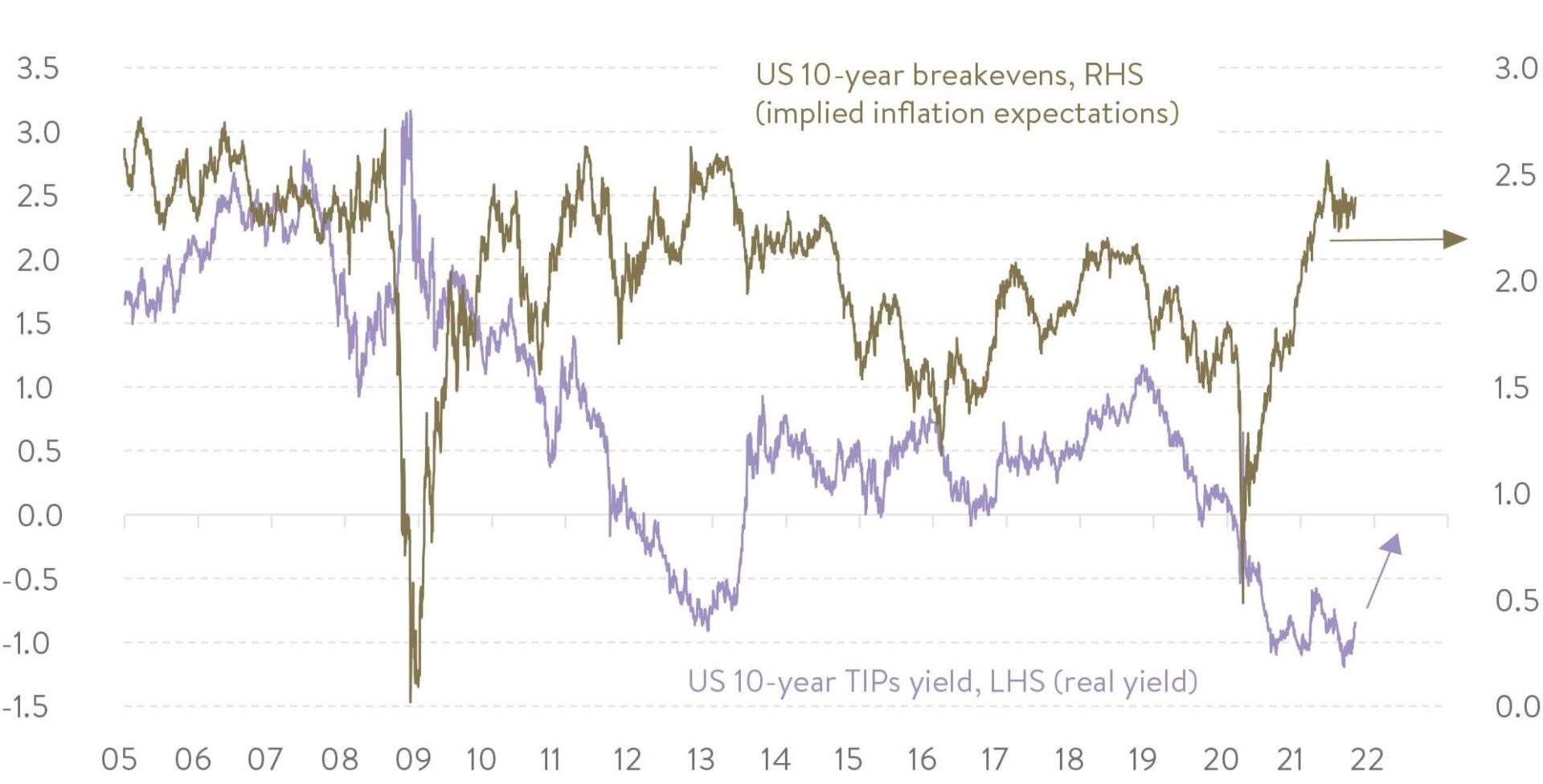

US 10-year TIPs yield and break even (inflation expectation), %

Source: Factset, MST Marquee

Most of the run-up in long-term US government yields early in the year was due to higher expected inflation. Now that has likely run its course, real yields, also called TIPS (Treasury Inflation Protected Securities) yields will likely be the component pushing headline US government bond yields higher to due the aforementioned factors (see chart).

Why the stock market can go higher in 2022

Why does it matter that it is real yields pushing US bond yields higher? Firstly, it impacts whether and how much share markets may rise. And secondly, it impacts which parts of the market are likely to fare well or poorly.

On the first, share market returns generally remain positive during interest rate tightening cycles by central banks, especially during the early stages of tightening, providing the process is orderly. The central banks are tightening in response to better economic growth and lower unemployment, both things which tend to go hand in hand with improved corporate earnings growth, which is good for share prices.

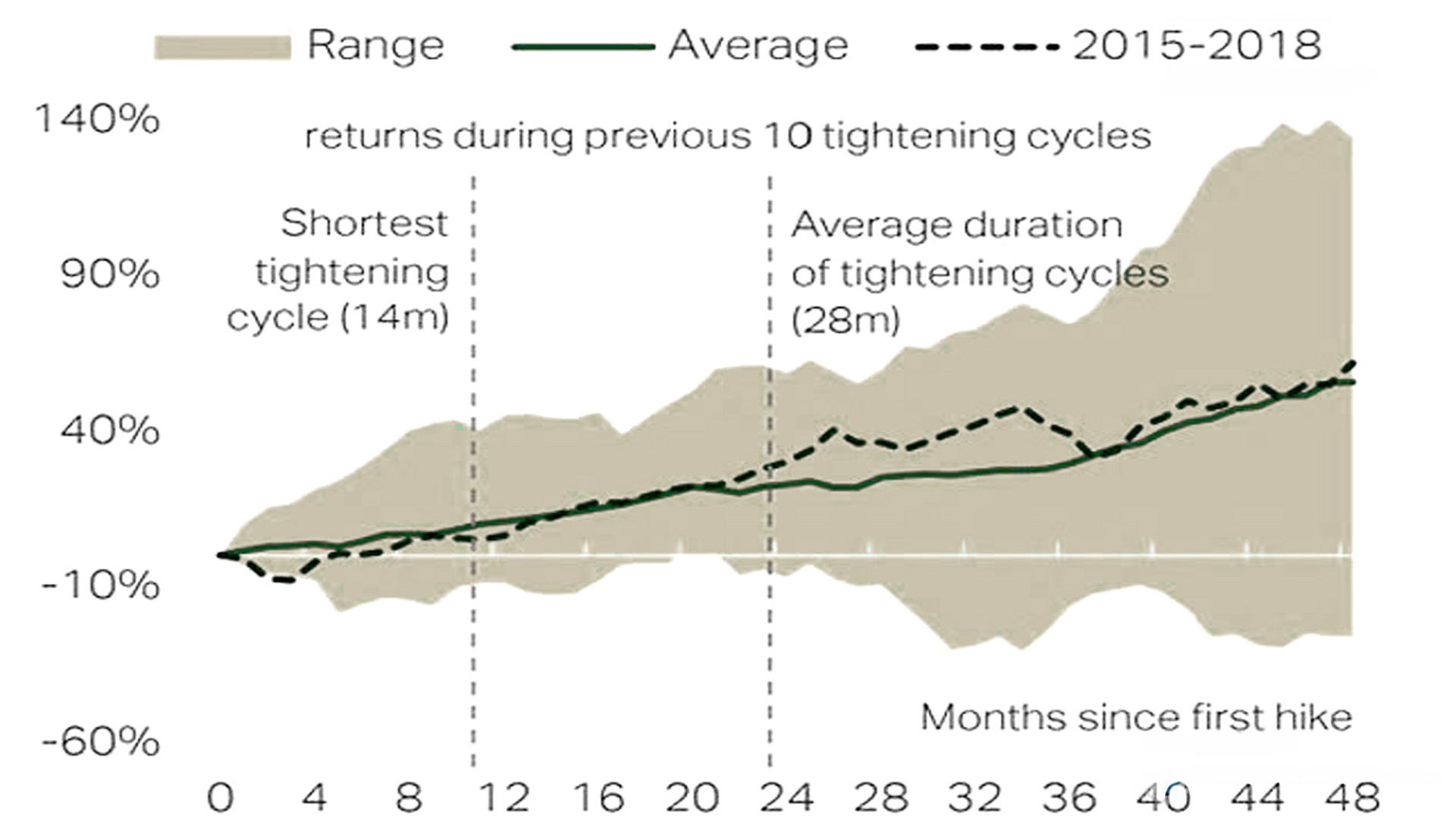

Equity returns positive in tightening cycles

Source: Bloomberg, TS Lombard

The chart above shows the range of overall US equity market returns during the first four years of the last ten interest rate tightening cycles by the Fed. As you can see returns tend to be positive, with a low incidence of negative returns, particularly in the first two years.

Later in tightening cycles we can sometimes see more cases of negative returns:

- When interest rates move into restrictive territory and put a handbrake on earnings through higher debt costs.

- Once interest rates get back to more normal levels, other risks become more relevant in their ability to derail equity markets.

Therefore, we believe share markets can continue to make gains into 2022, despite central banks starting to take away some of the punchbowl. It is also one of the reasons why cash levels are quite low in our funds at present, generally sub 5%. There are a lot of ideas competing to make it into our funds, and we are comfortable buying into new ideas at these prices and remaining largely fully invested.

Who wins when real yields rise?

On the second point, which parts of the market are likely to be the winners if bond yields (particularly real yields) keep rising from here is really one of the most important questions for investors right now.

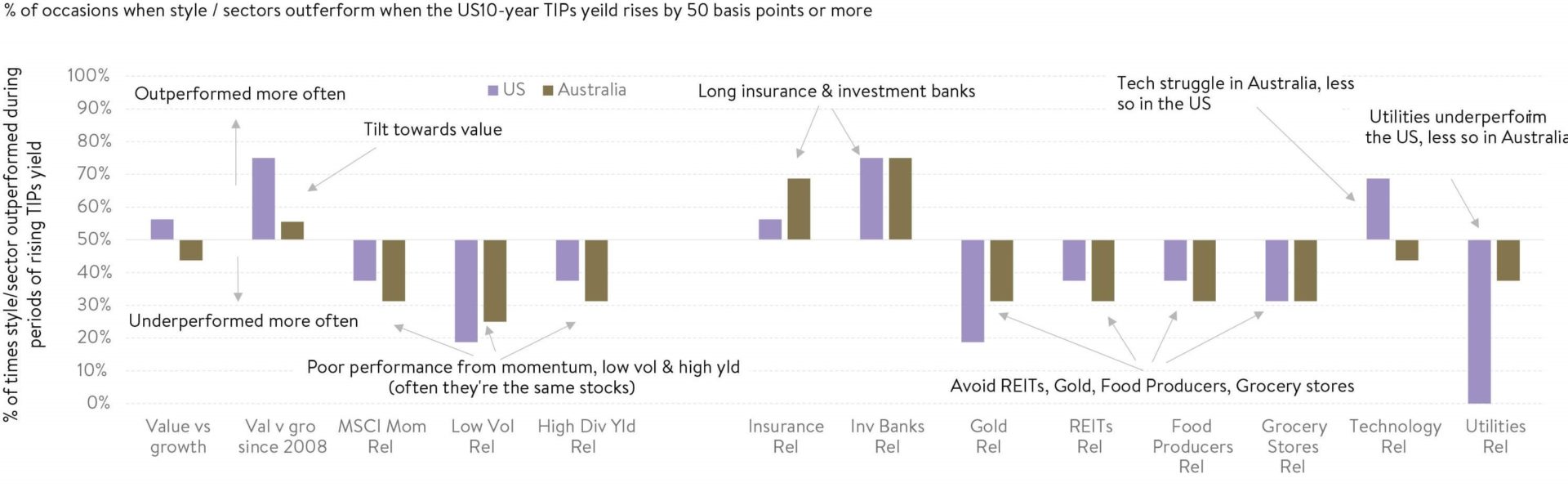

Since 2000, there have been 16 episodes where real yields in the US have risen significantly (by more than 0.5%). Courtesy or MST Marquee, below we show what happened in the Aussie and US share markets when they did.

Alpha and rising TIPs yield over the last 20 years

Source: Company Data, Factset, MST Marquee

As far as investing styles go, higher real yields have generally been a positive for ‘value’ style (cheap) companies and a headwind for ‘growth’ style (expensive) ones, particularly more recently, though perhaps by not as much as many believe.

Intuitively this makes sense. Growth businesses that are growing faster have more of their earnings forecast further out in the future. They are impacted more when discounting those cash flows back to today at higher interest rates.

The higher (lower) real yields and value out (under) performance relationship has sung particularly loudly over the last three years. That signals stock pickers have been acting like global macro traders more recently. Something we are acutely aware of when constructing our portfolios at present.

For us, this continues to mean avoiding the most expensive growers, both domestically and abroad.

Looking at what sectors to avoid, real estate investment trusts (REITS) and utilities are obvious ‘bond-proxy’ sectors by virtue of their long-term stable cash flows. They often underperform, just like bond prices do, when real yields rise.

This suits us just fine as we are typically structurally underweight these sectors given high levels of leverage, which we avoid like the plague, and relatively stable earnings which makes it harder for us to add value.

Gold and gold miners are another one to beware of because they face headwinds in a rising yield environment with the opportunity cost of holding gold increasing.

Whilst not dominating what we do, this analysis provides an overlay to the great stock ideas we are finding from a bottom-up perspective.

Stag-what?

Finally, we couldn’t let this letter pass without a word on that word which has recently reared its ugly head again – ‘stagflation’.

For those that have scratched their head every time they’ve heard it or for those who weren’t around in the 1970s when it became ‘a thing’ it means: “A period in which inflation is high, unemployment is high and economic growth is slow (stagnating)”.

It’s a portmanteau that creates the same allergic reaction in economists as does “chillax” in most normal human beings. The reason it has come back into the lexicon is:

- Inflation pressures have remained stubbornly high because some sectors are struggling to find workers, some supply chains remain backed up, and energy costs are sharply rising.

- The momentum of economic growth has slowed globally after the initial rebound from COVID-19 induced lockdowns.

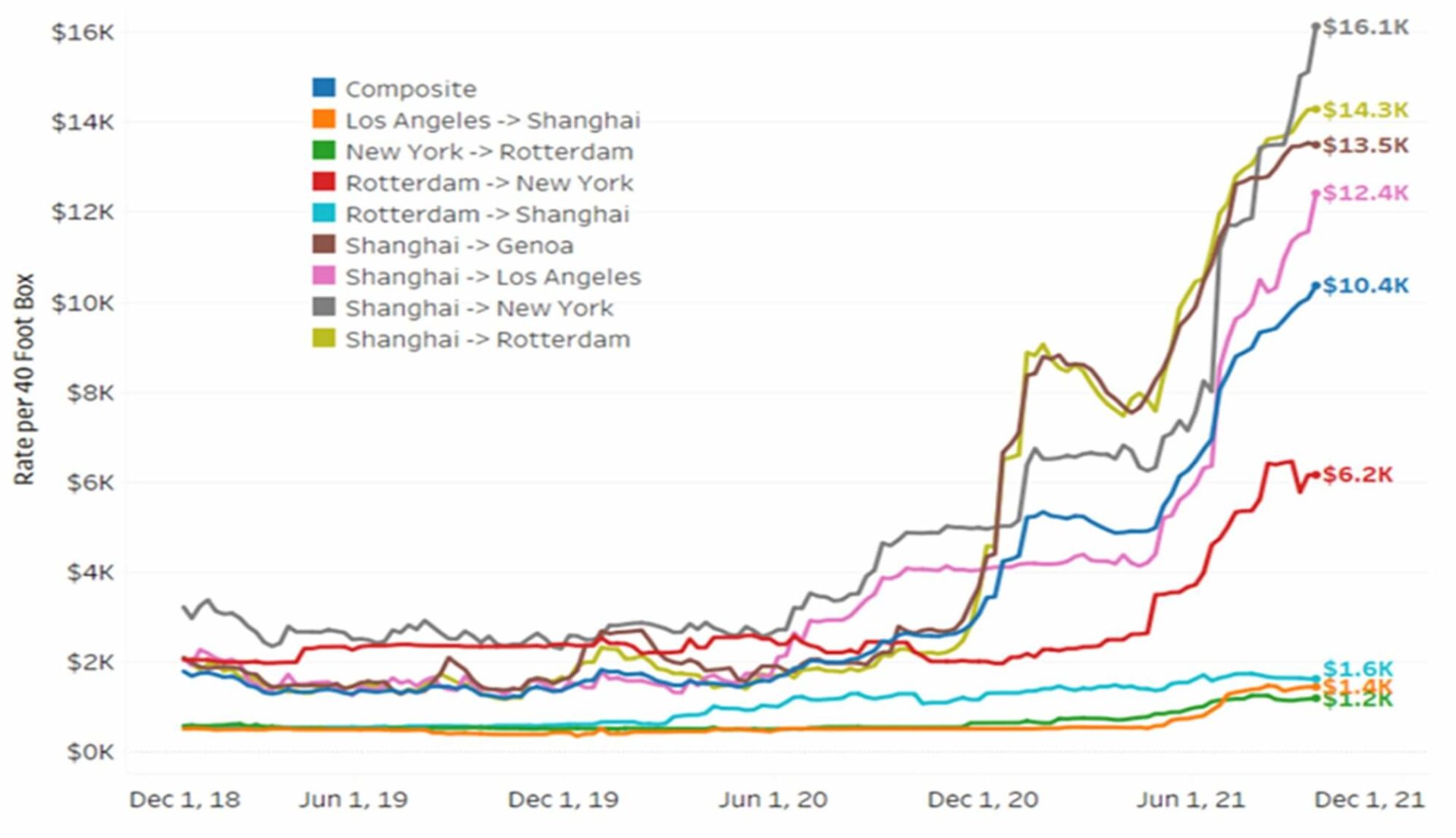

One easy way to visualise the supply chain issues that companies across the world are talking about is the markedly higher freight costs that many are paying (see below).

Freight costs continue to soar – Rivals baltic dry in resource boom 2008

Source: Arbor Research & Trading

This is clearly not an isolated issue.

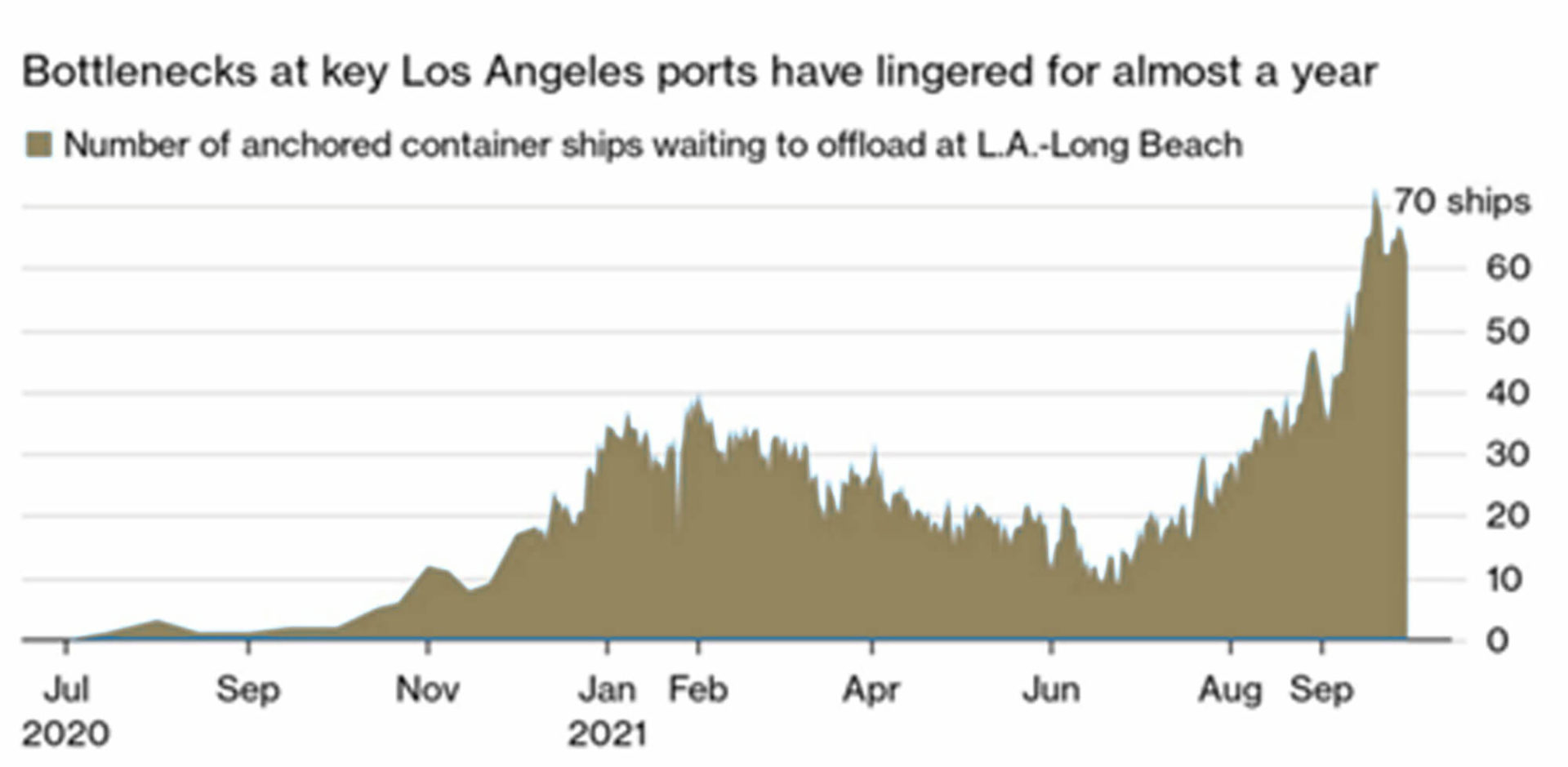

Some of the companies we analyse and hold globally have been recently talking about difficulties getting delivery of goods out of port in Los Angeles and Long Beach to their customers. These ports handle around 40% of cargo entering the US. You can see below the sharp increase in the number of ships in port. A surge in demand has seen retailers restocking from low inventory levels to try and get ahead of any supply issues before holiday season.

Tinseltown traffic jam

Source: Marine Exchange of Southern California & Vessel Traffic Service L.A./Long Beach

We expect this might create a messy September quarter reporting season for some US companies. Many businesses must get the goods unloaded off the ships to recognise revenue in their accounts and have been desperate to do so ahead of quarterly reporting deadlines. The issues have not been so much the physical capacity at port but finding the workers to unload and truck drivers for transport as well as the restricted operating hours. Incredibly President Biden himself has gotten involved to help solve this problem with expanded operating times just announced.

To be clear, we see global growth slowing but it is a far sight from stagnant. The IMF just released its global growth forecasts for 2021 and 2022 at 5.9% and 4.9% respectively, well above long-term trend levels, with US growth rates even higher at 6.0% and 5.2%.

Higher inflation might persist for a while yet into 2022, though there are signs that successive supply chain issues are steadily being dealt with. Lumber prices have rolled over and based on the latest available data there’s perhaps some early evidence that used car and freight prices may be peaking.

Ultimately, we think the stagflation talk will fall to the wayside over the next few months. Importantly for us, as we look into 2022, we believe a slower and more normalised growth environment as we all learn to live with COVID-19, is a positive backdrop for our investment process.

When growth is scarcer, or at least not outright bullish, investors are willing to pay up for growth. And that is our job: to be first to identify the companies whose better days and years are still ahead of them, but are as yet undiscovered by the market.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.