Investing in the share market: Go all-in or stage your entry?

In this Letter to Investors we look at

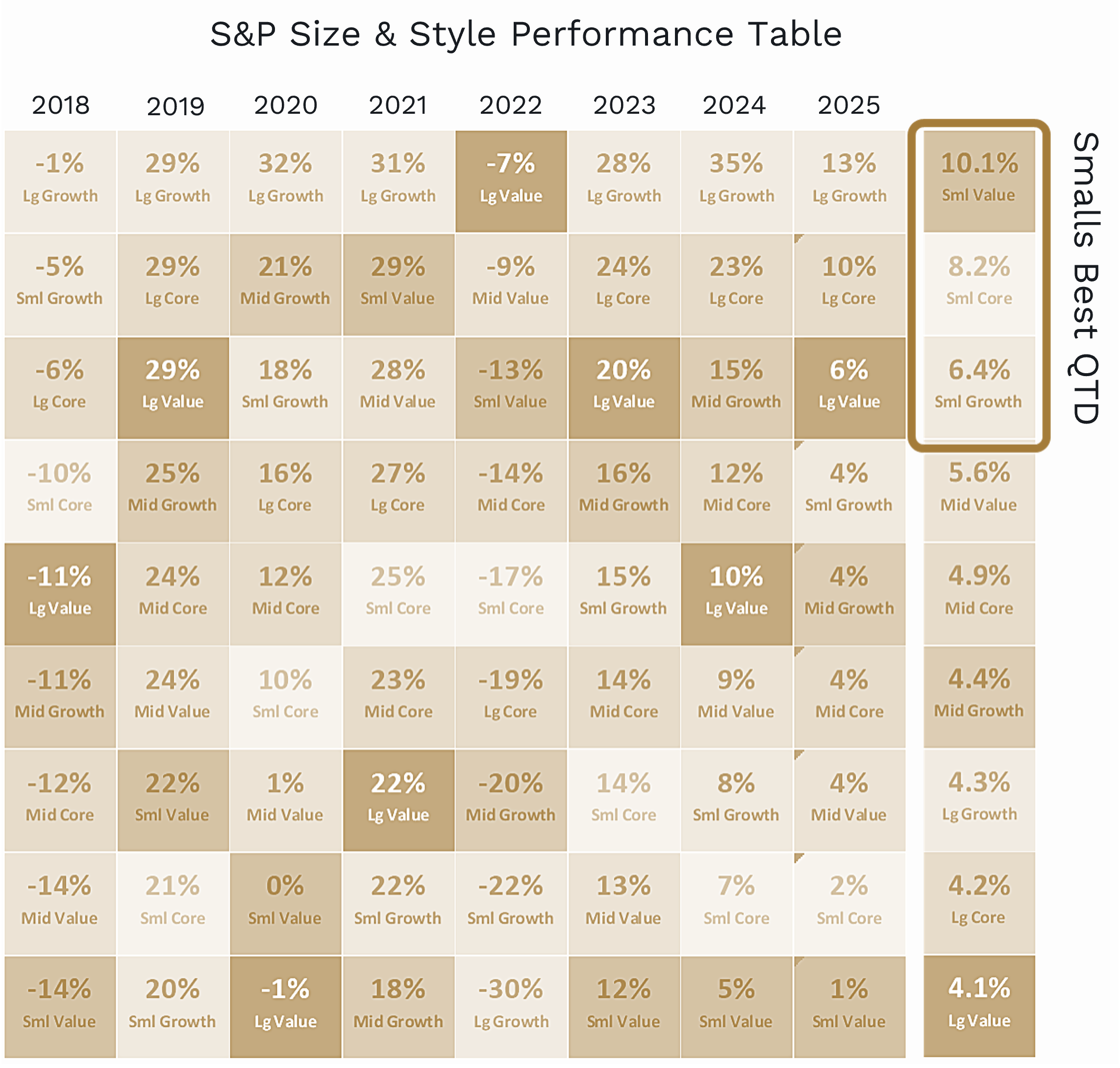

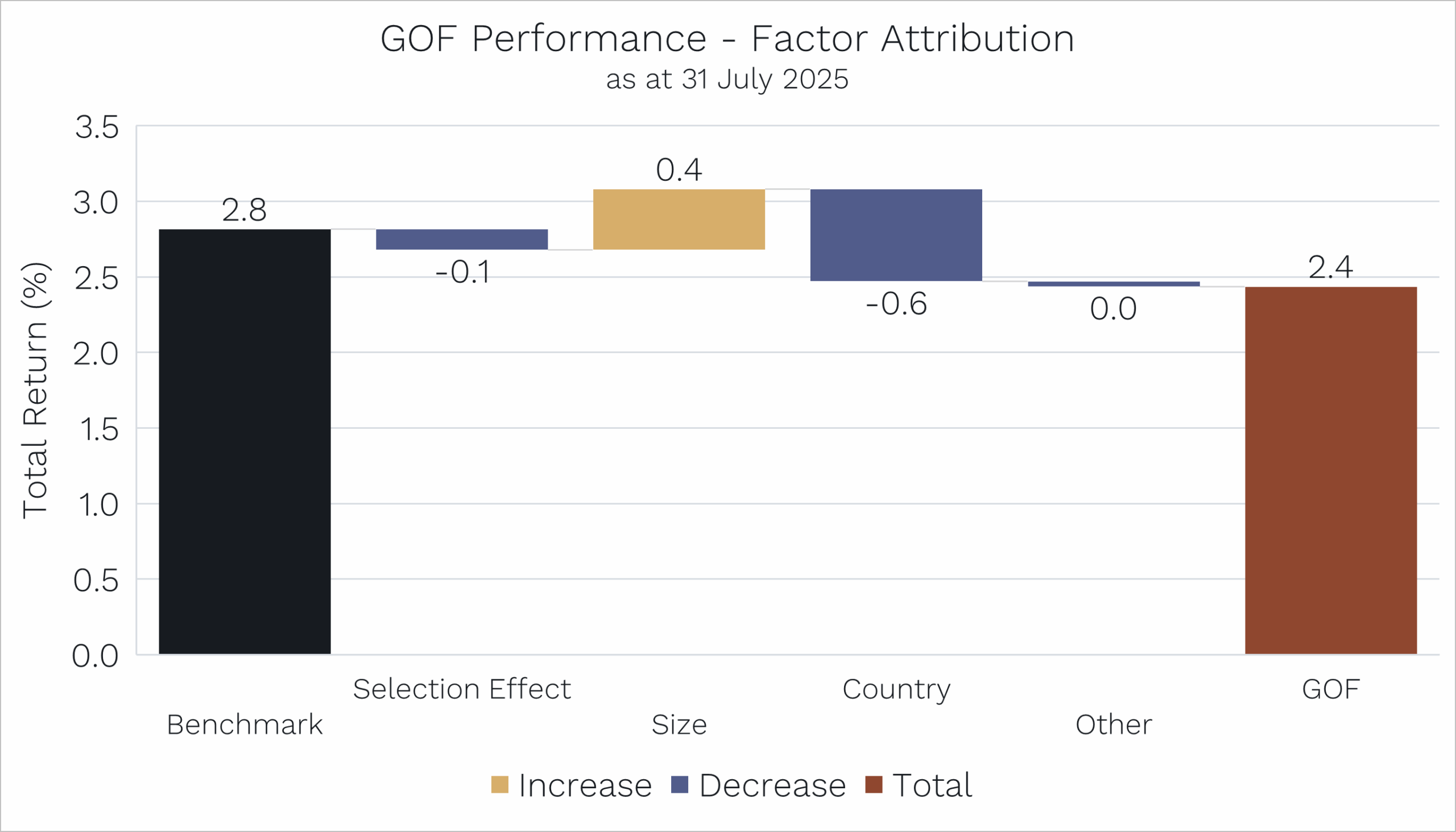

- The importance of ‘factors’ in driving short-term market moves.

- How a radical reshaping of interest rate cuts in November led certain factors, particularly growth, to underperform during the month.

- How these factor dynamics temporarily affected our Ophir Funds performance in November, and how they’re now unwinding … assisting with outperformance in our Global Funds at writing in December.

- We also look at the vital topic of whether to invest your money all at once in the market (lump sum) or in staged investments (staged market entry) over time.

- As part of our analysis, we look at which strategy – lump sum or staged – has outperformed over the last 50 years.

- And we then factor in risk/volatility and examine how staged investing is really like an insurance policy.

Last month, a very well-known Australian businessman said he wanted to invest in one of our share Funds.

But then he asked us: “Should I invest all at once, or stage it in over time?”

A great question – and one every investor faces.

And in this month’s Letter to Investors, we want to share our answer.

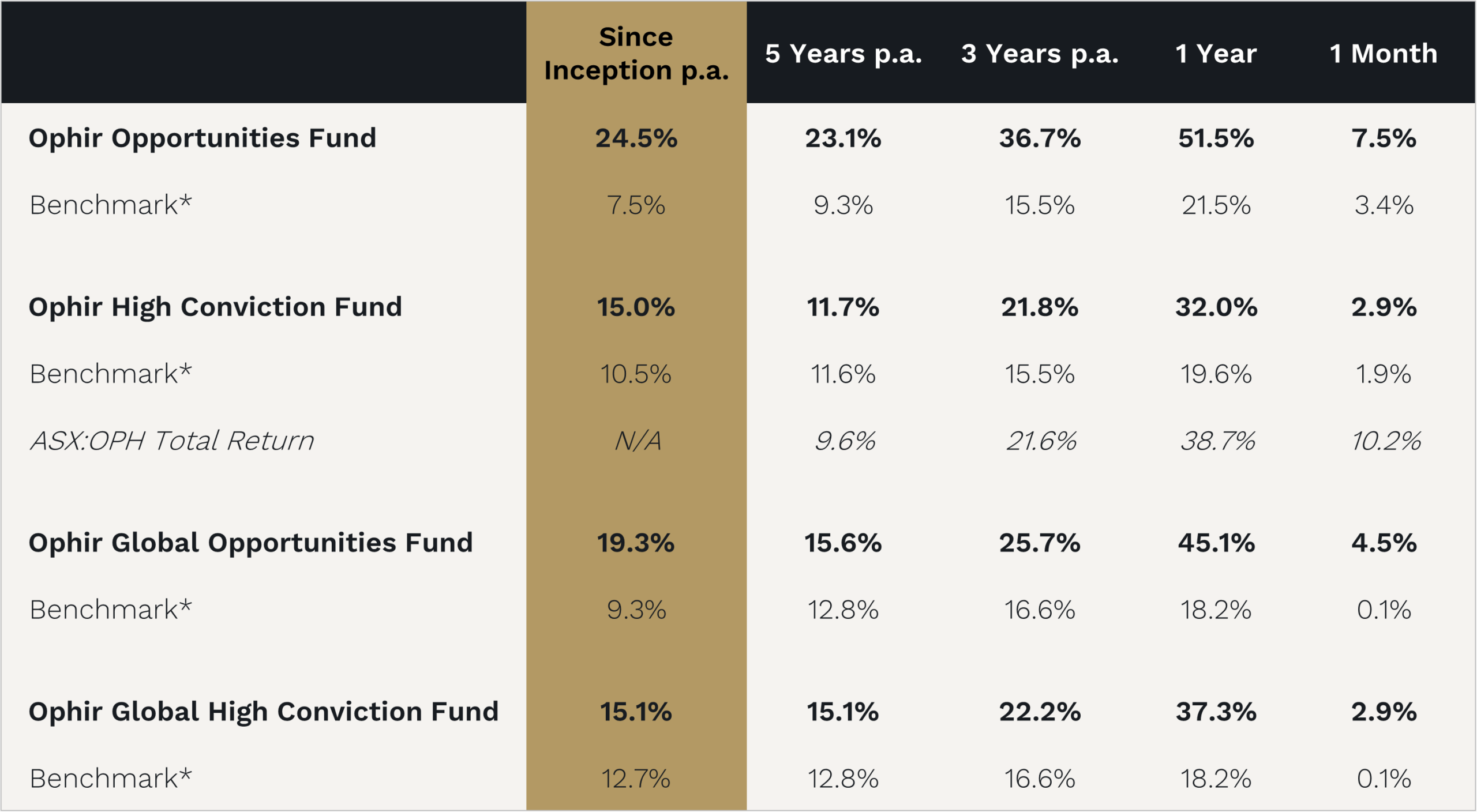

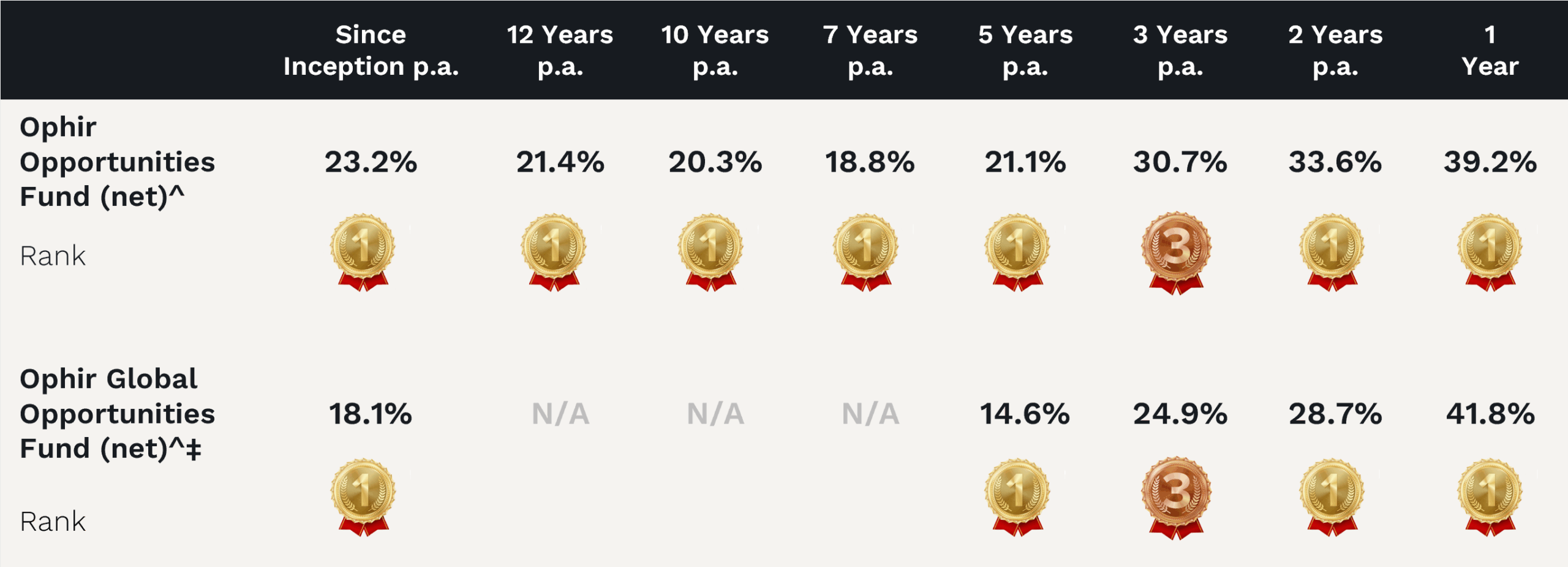

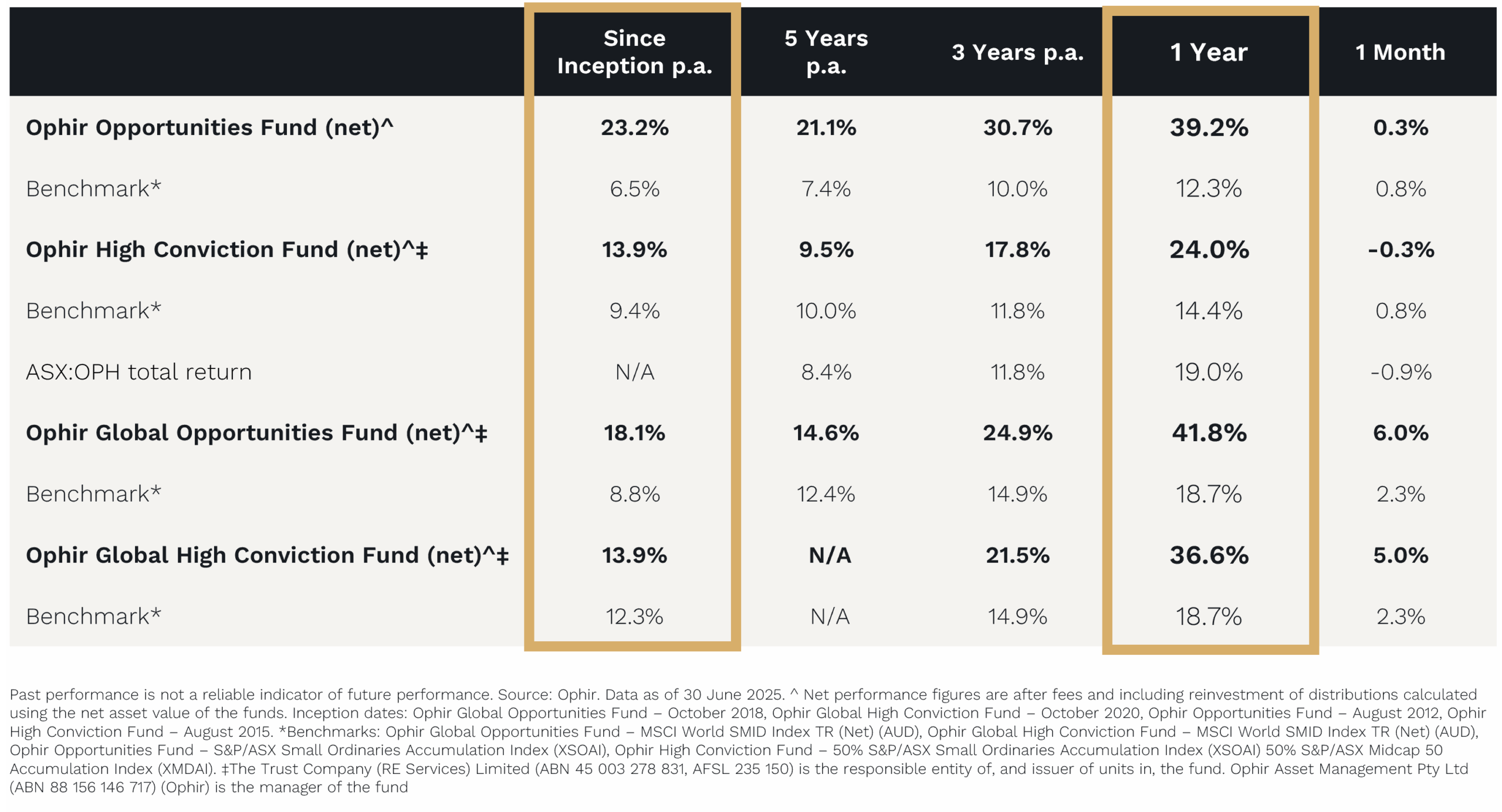

But first, we’d like to touch on November’s performance. All of our Funds underperformed during the month. But we are not concerned.

Why?

Factor facts

While earnings drive share prices over the long term, so-called factor headwinds or tailwinds can sway performance in the short term.

What are these factors?

There are an almost unlimited number of ‘factors’ professionals track these days. But essentially, they are various characteristics shared by certain groups of shares, including:

- The size of the company (small caps, mid-caps, etc)

- How liquid its shares are

- How fast their earnings are growing

- The stock’s valuation (cheap, etc.)

Professional investors often crowd in and out of these ‘factors’ at different times based on when they think the macroeconomic or market environment is going to suit a particular factor.

A radical move

November was one of these months where we saw big factor moves.

The precipitation factor? (pardon the pun).

The U.S. Federal Reserve.

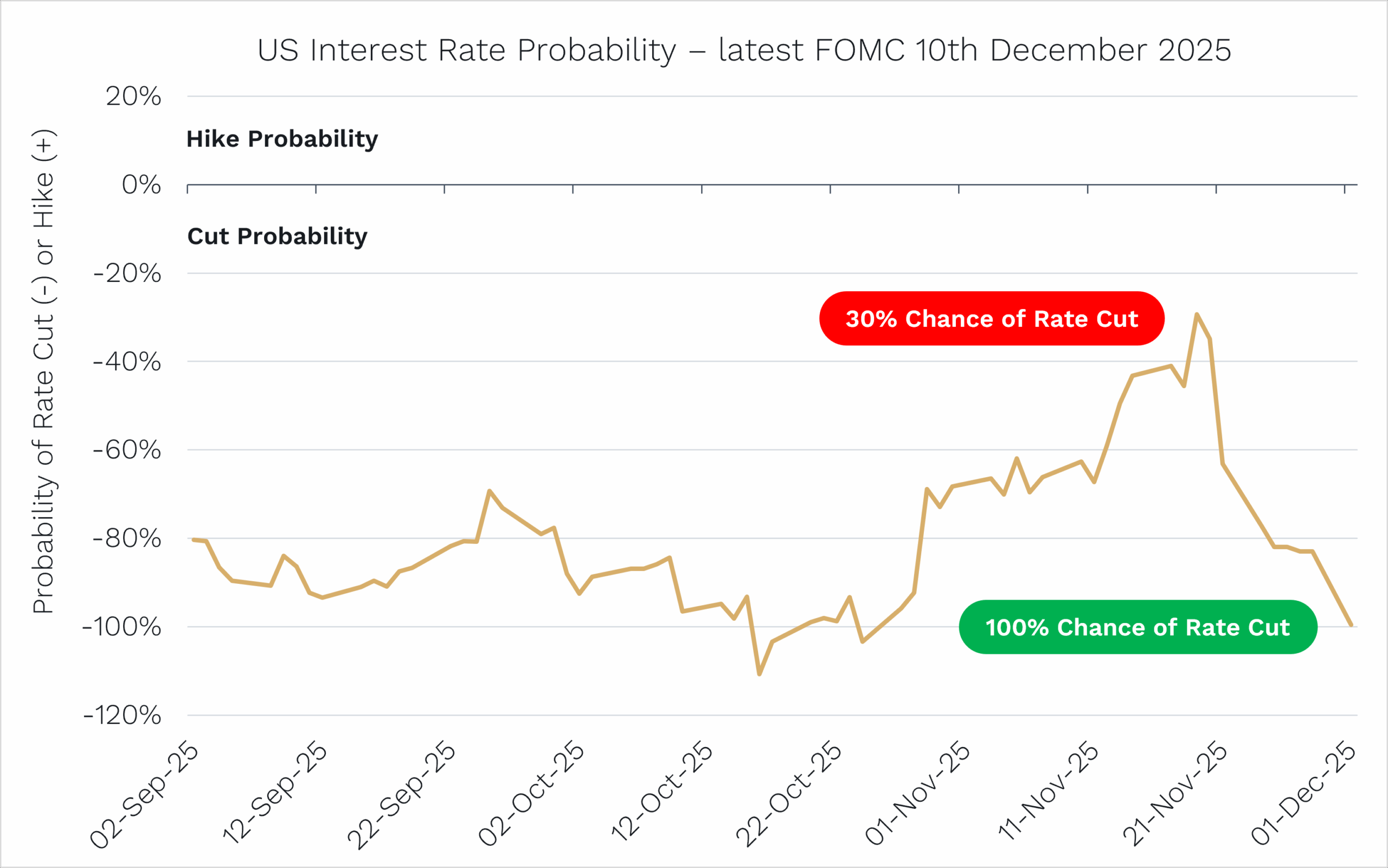

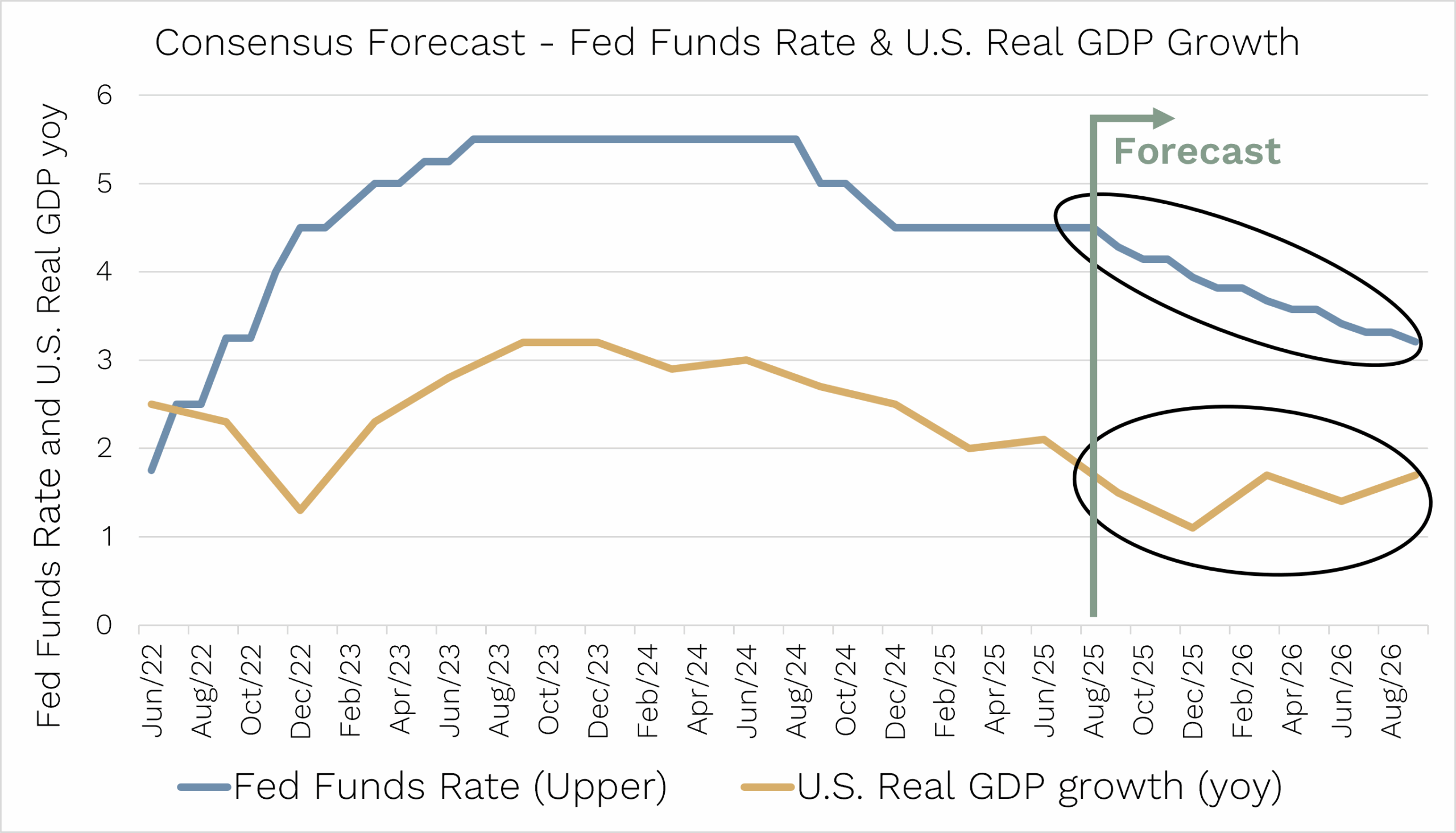

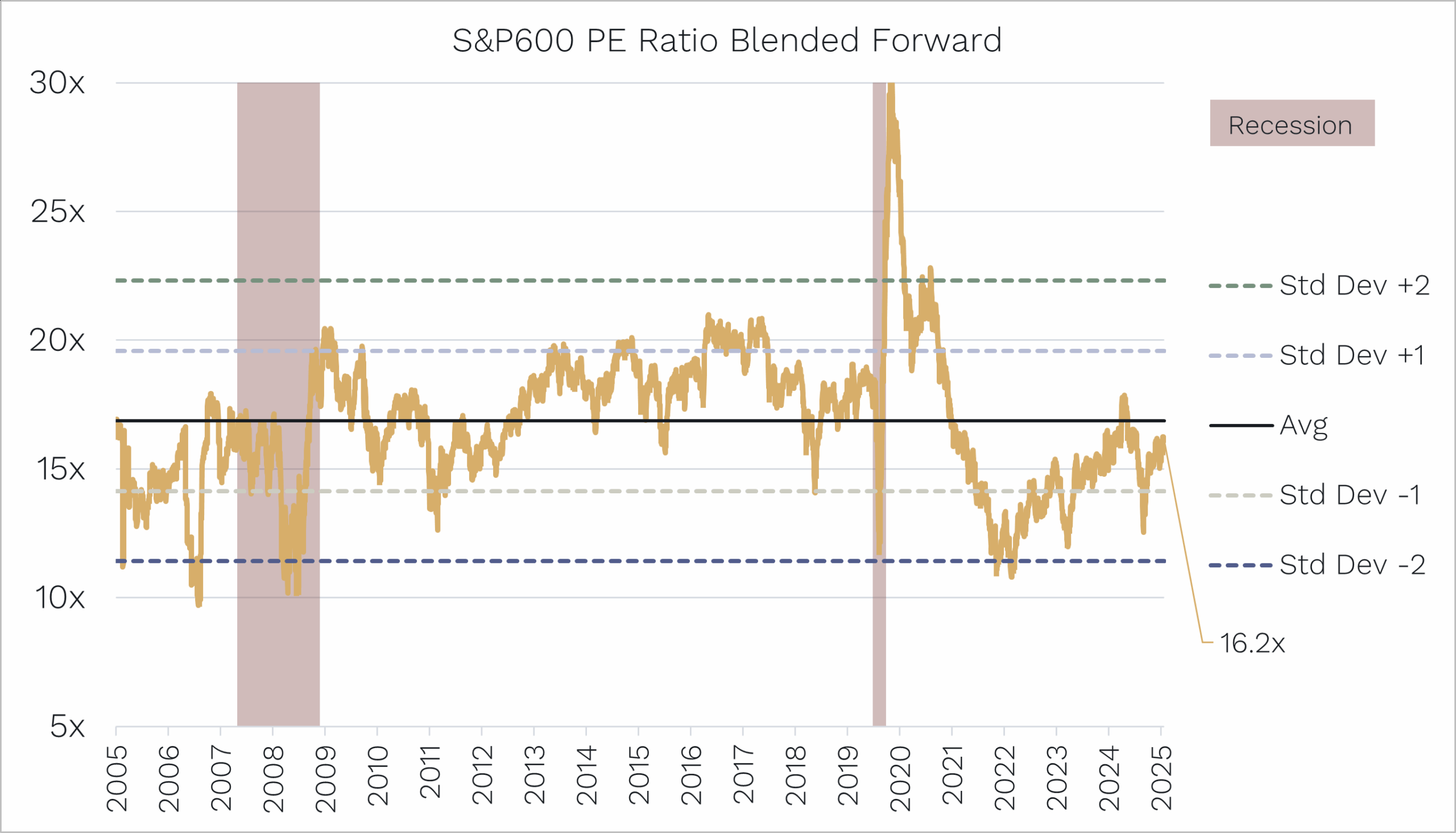

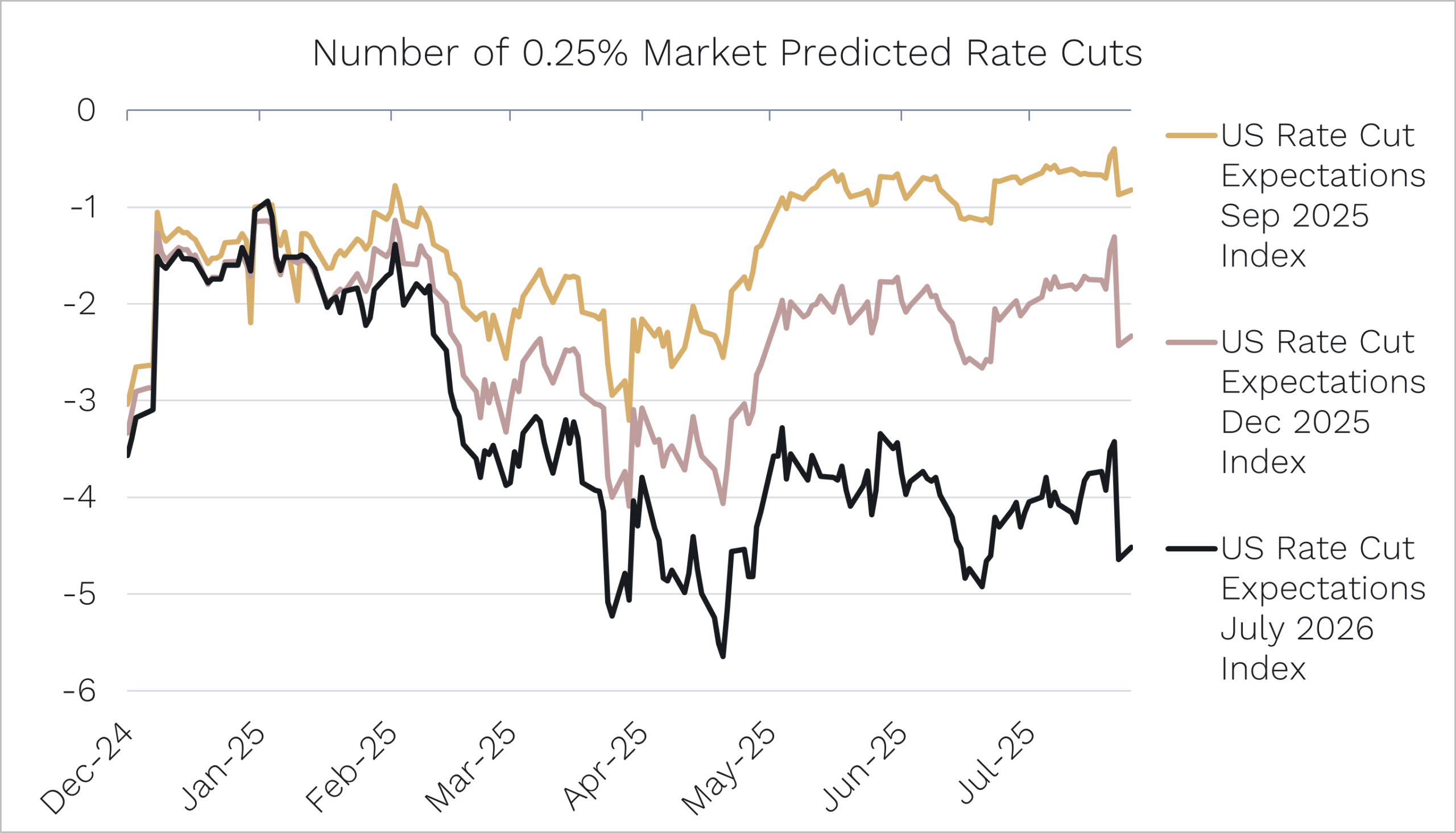

Heading into the end of October, markets thought the Fed was a sure thing to cut rates at its next meeting in December.

But then Chair Powell poured cold water on that idea at his post-meeting press conference on October 29.

As a result, over the first three weeks of November, the market switched to expecting a higher-for-longer interest rate environment.

The probability of a December rate cut crashed from 100% to about 30%.

For those who don’t track market pricing for these probabilities, for such a brief period, this is a radical move.

Probability of Rate Cuts

Source: Bloomberg for FOMC meeting at 10th December 2025. Data as of 30 November 2025.

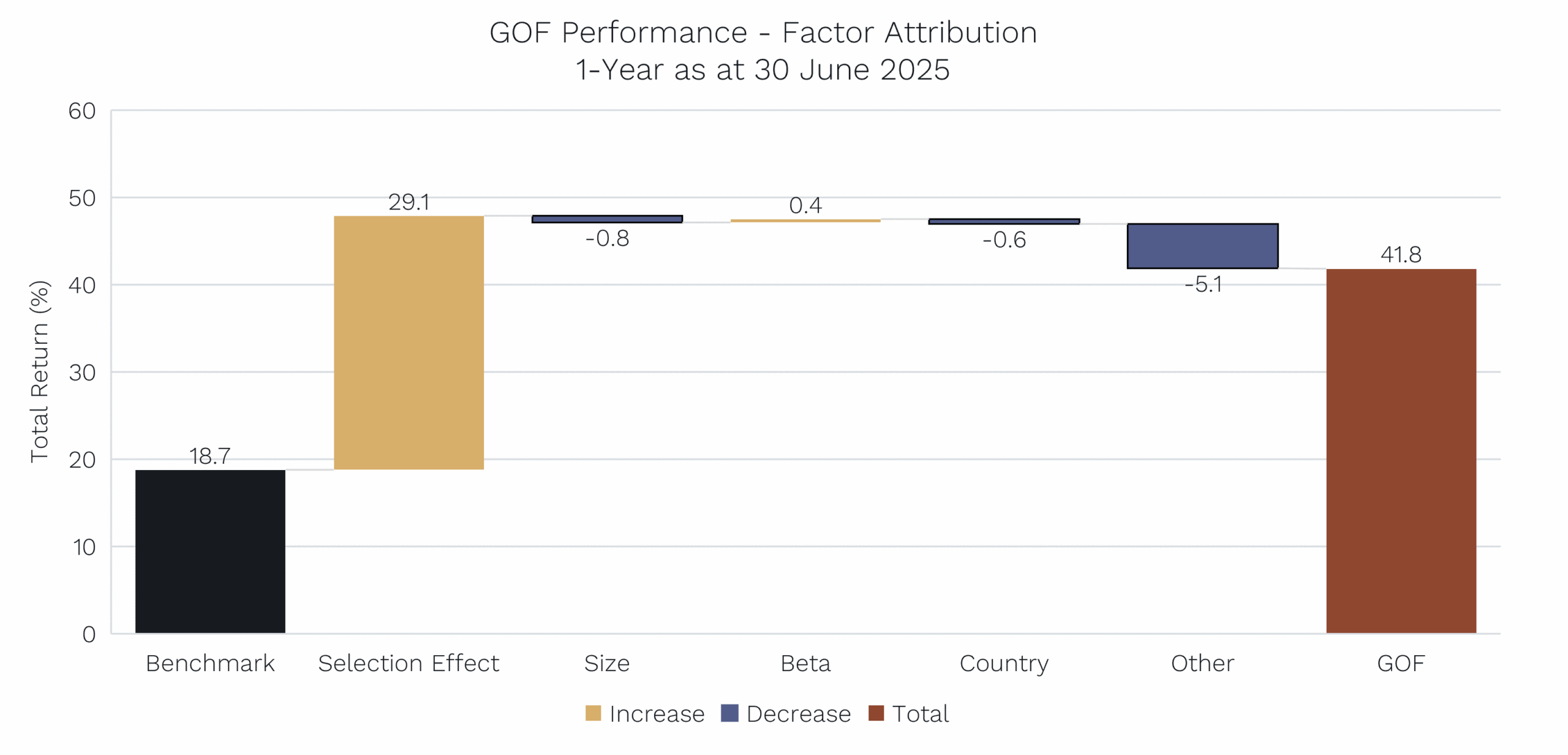

Growth hit

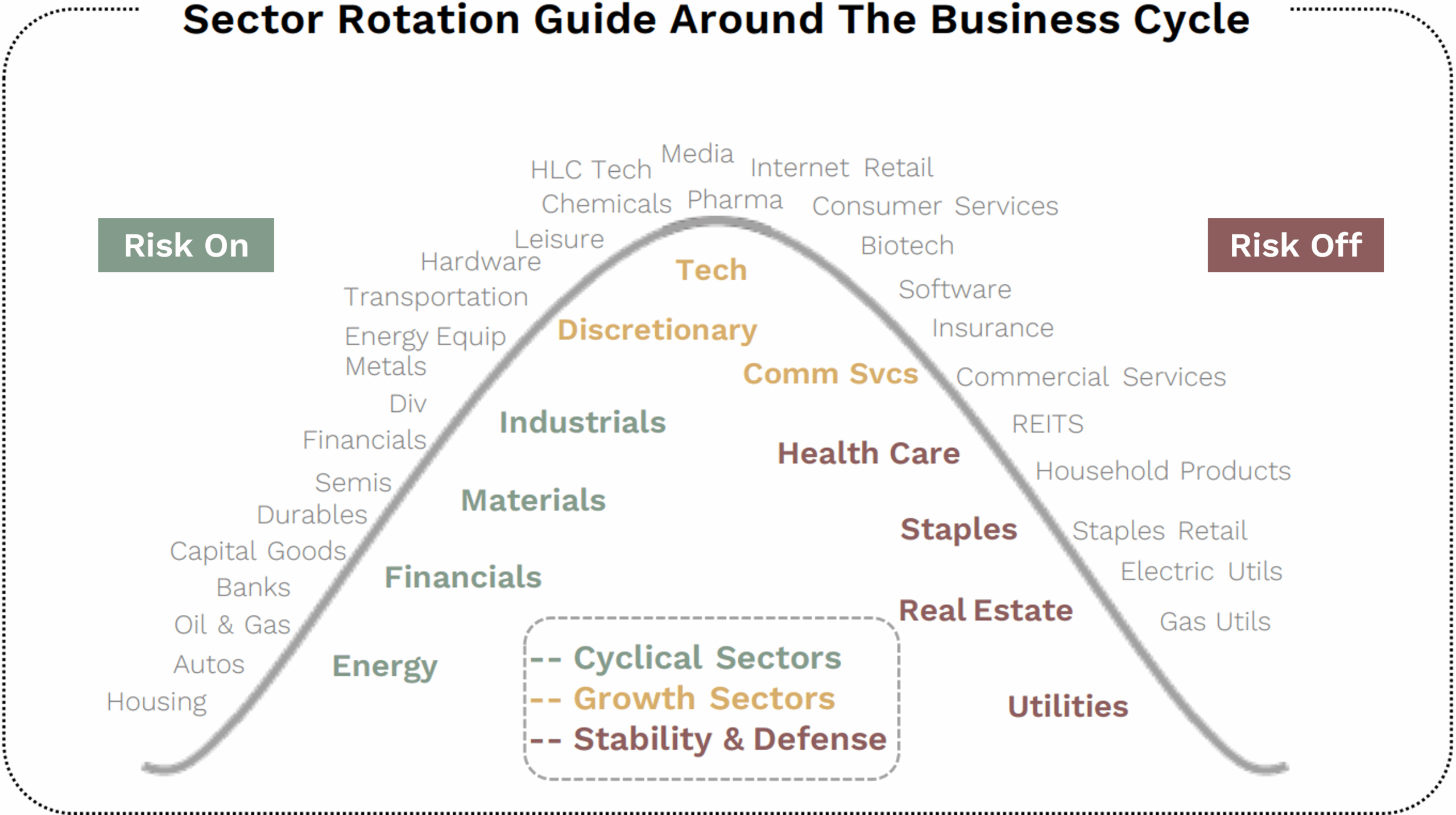

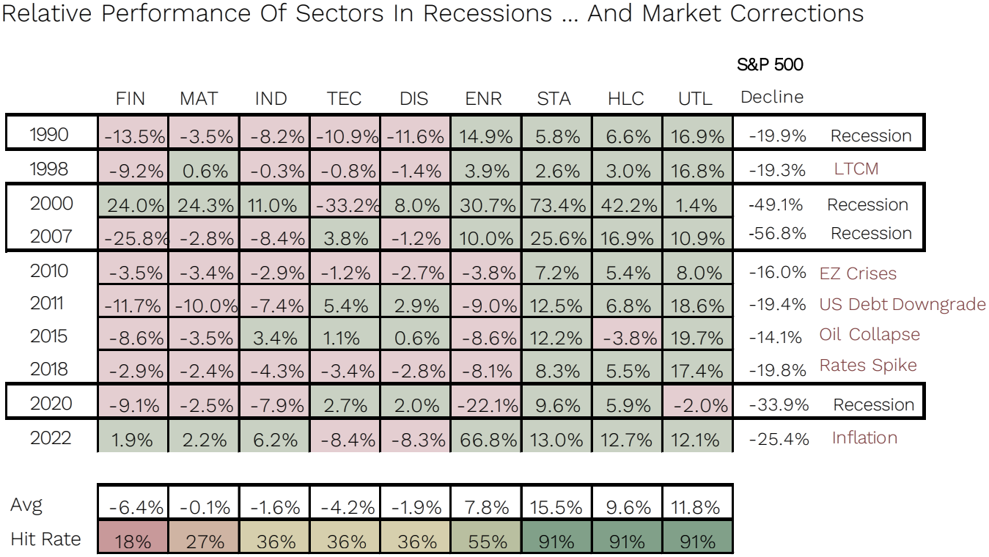

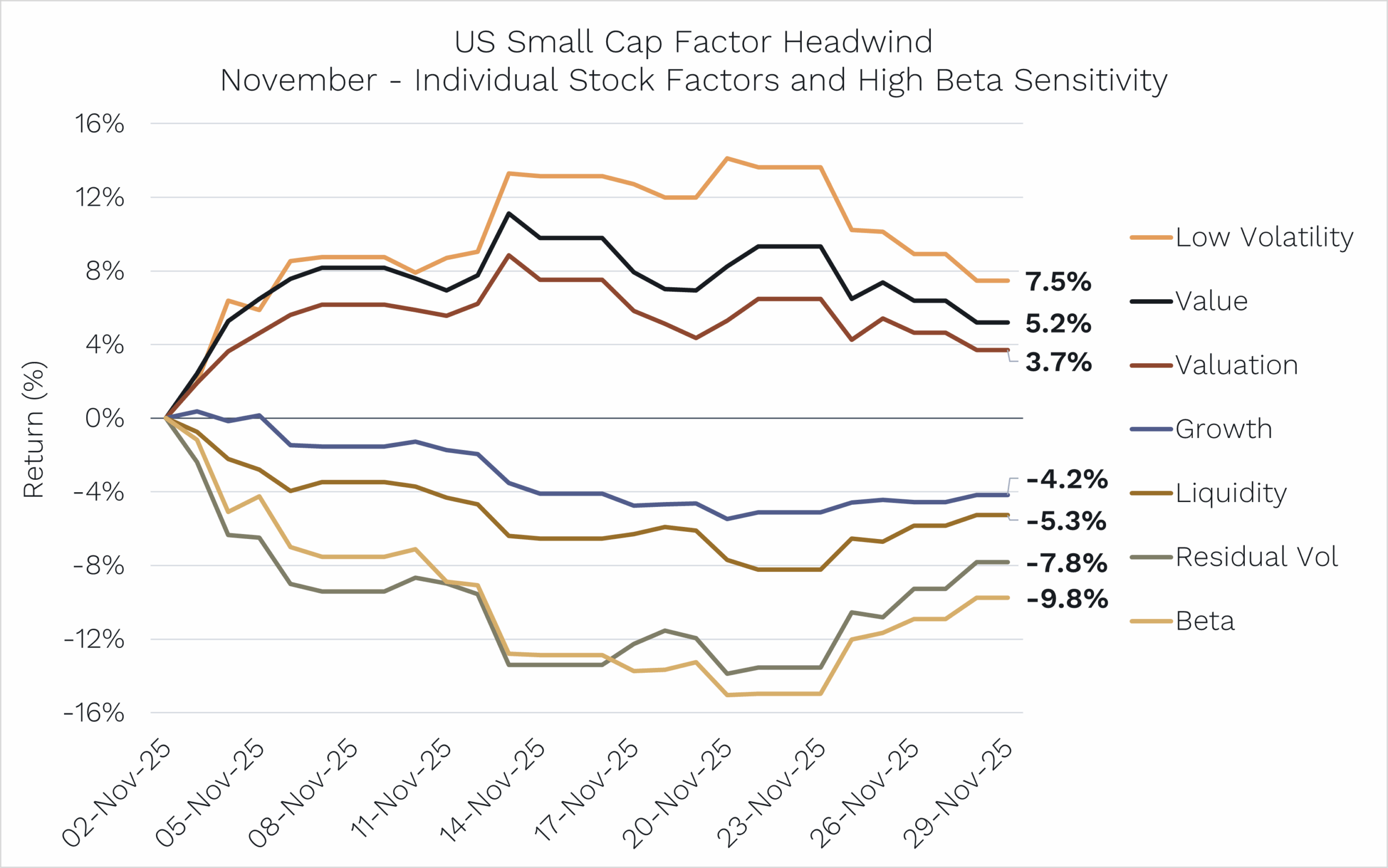

The new higher-for-longer expected rate environment triggered winners and losers amongst various factors:

- Growth, liquidity and beta underperformed.

- Low volatility and lower valuation stocks outperformed. (The chart below shows factor moves for U.S. small caps in November.)

Higher interest rates, particularly if unexpected, impact the valuations of growth-orientated stocks more as they have more of their lifetime cash flows further out in the future, and when you discount those future cash flows with a higher interest rate to determine their valuation today, that results in a bigger valuation drop.

U.S. factor headwinds in November

Source: Bloomberg for the Russell 2000 index long-short factors. Data as of 30 November 2025.

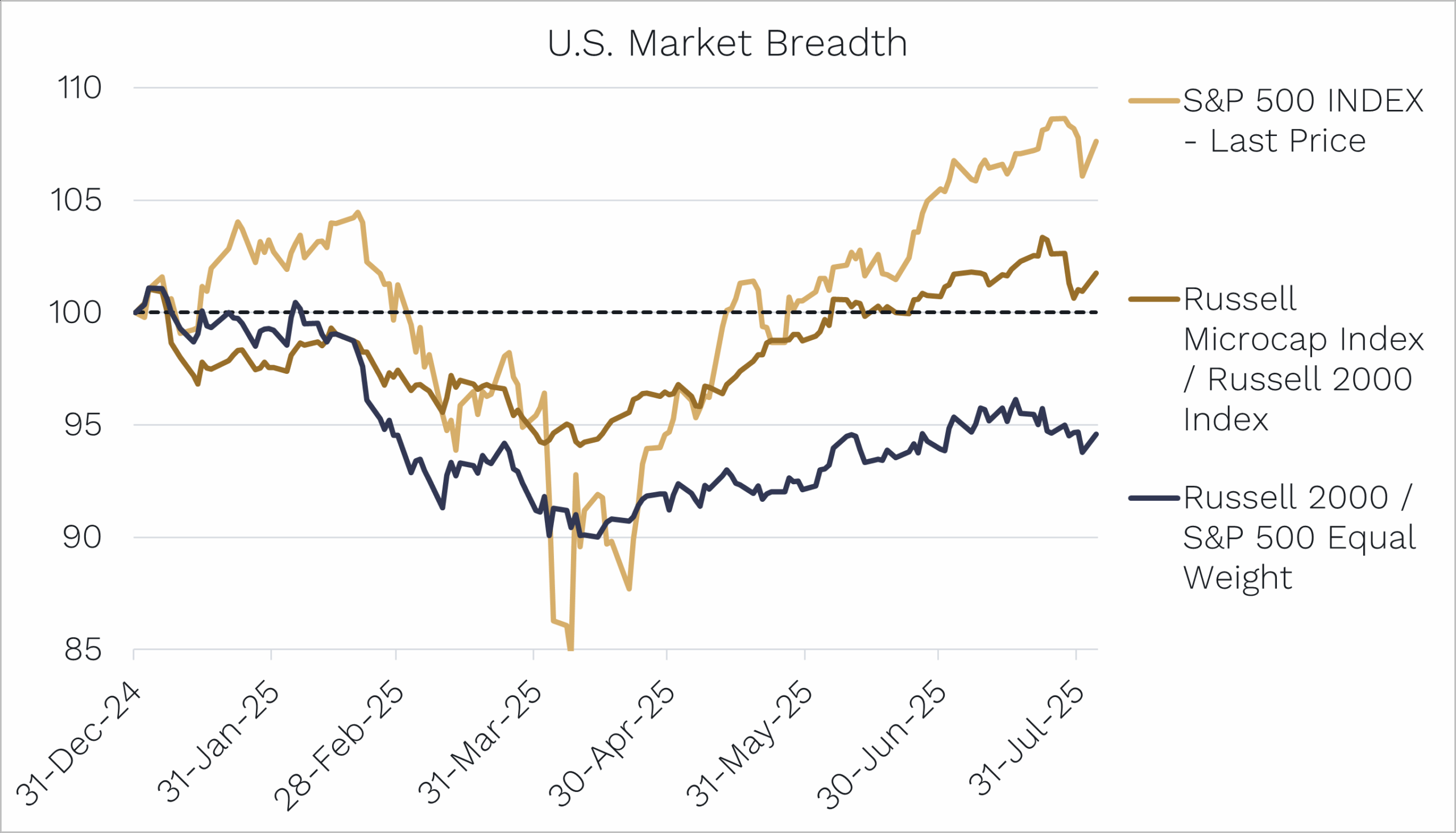

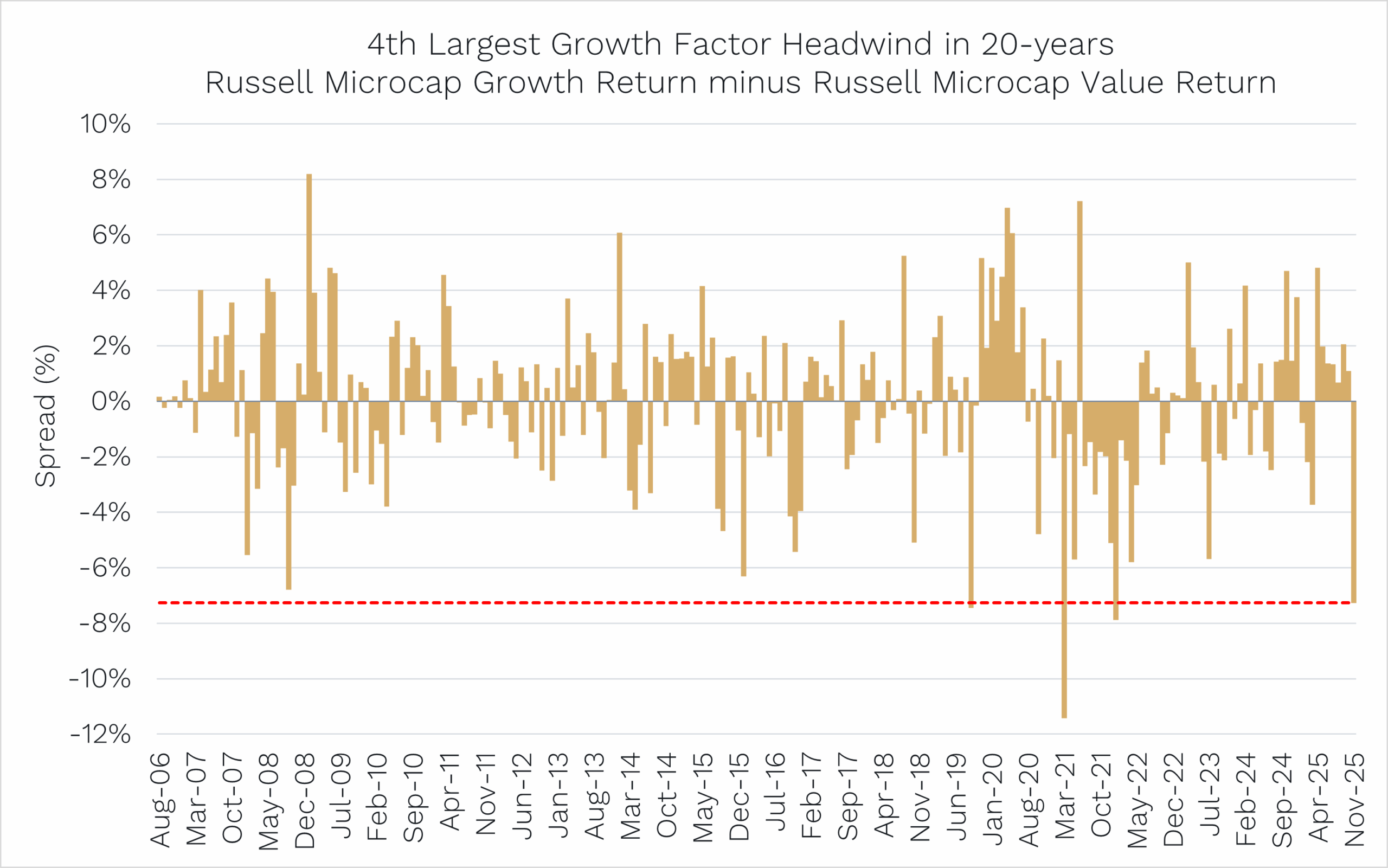

You will get some further idea of the relative factor performance of growth versus value-oriented companies in the U.S. in November in the microcaps chart below.

While we don’t really fish as low down the market capitalisation spectrum as microcaps, it shows that growth-oriented microcaps underperformed their value counterpart in November by the fourth most of any month in the last 20 years!

One of the largest factor headwinds – Growth vs Value

Source: Bloomberg. Data as of 30 November 2025.

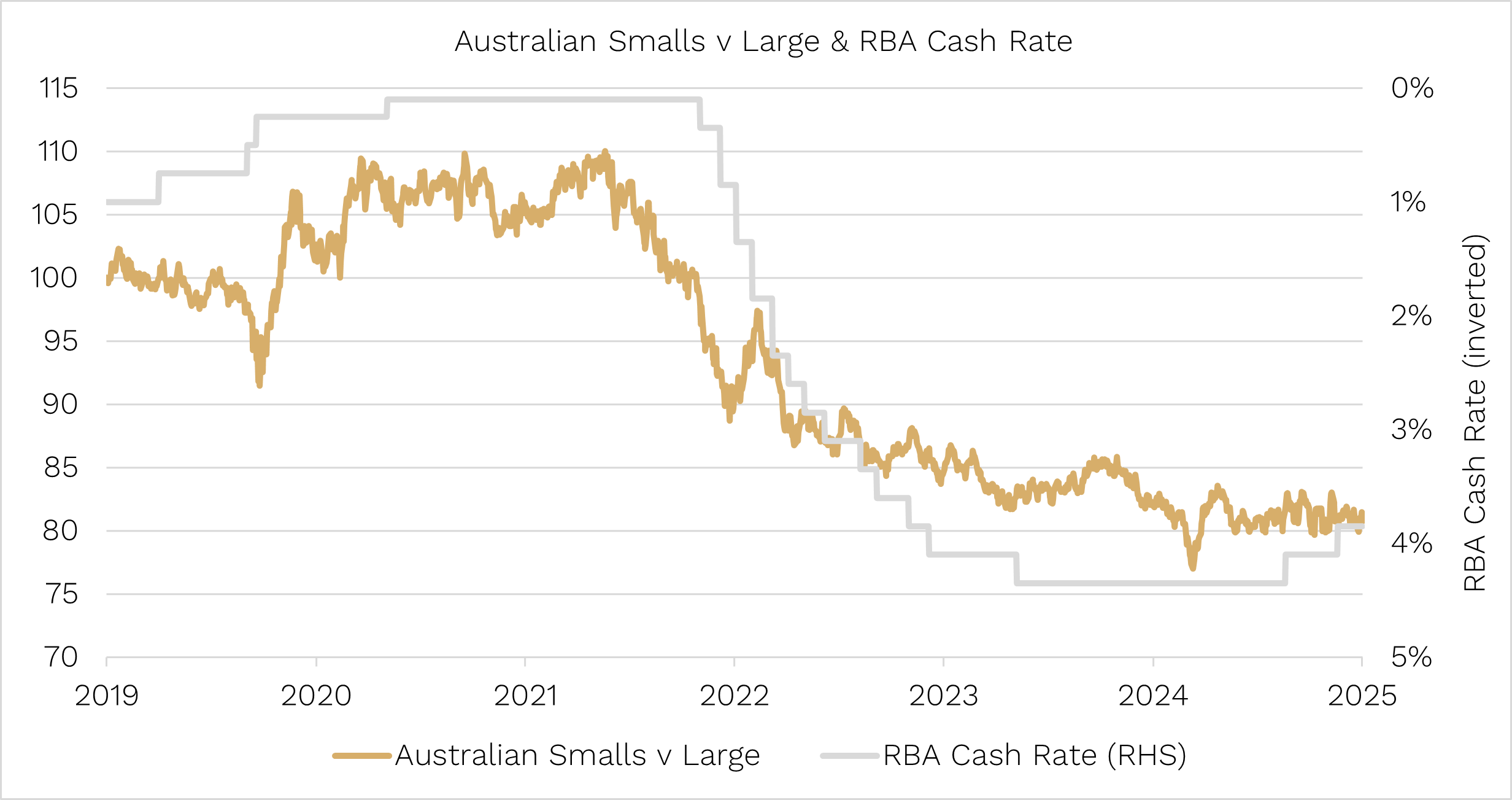

Given the importance of the U.S. Federal Reserve in driving the direction of interest rate policy globally, this growth underperformance compared to value was broad based in the U.S. in November and also impacted the Australian share market.

Sticking with our edge

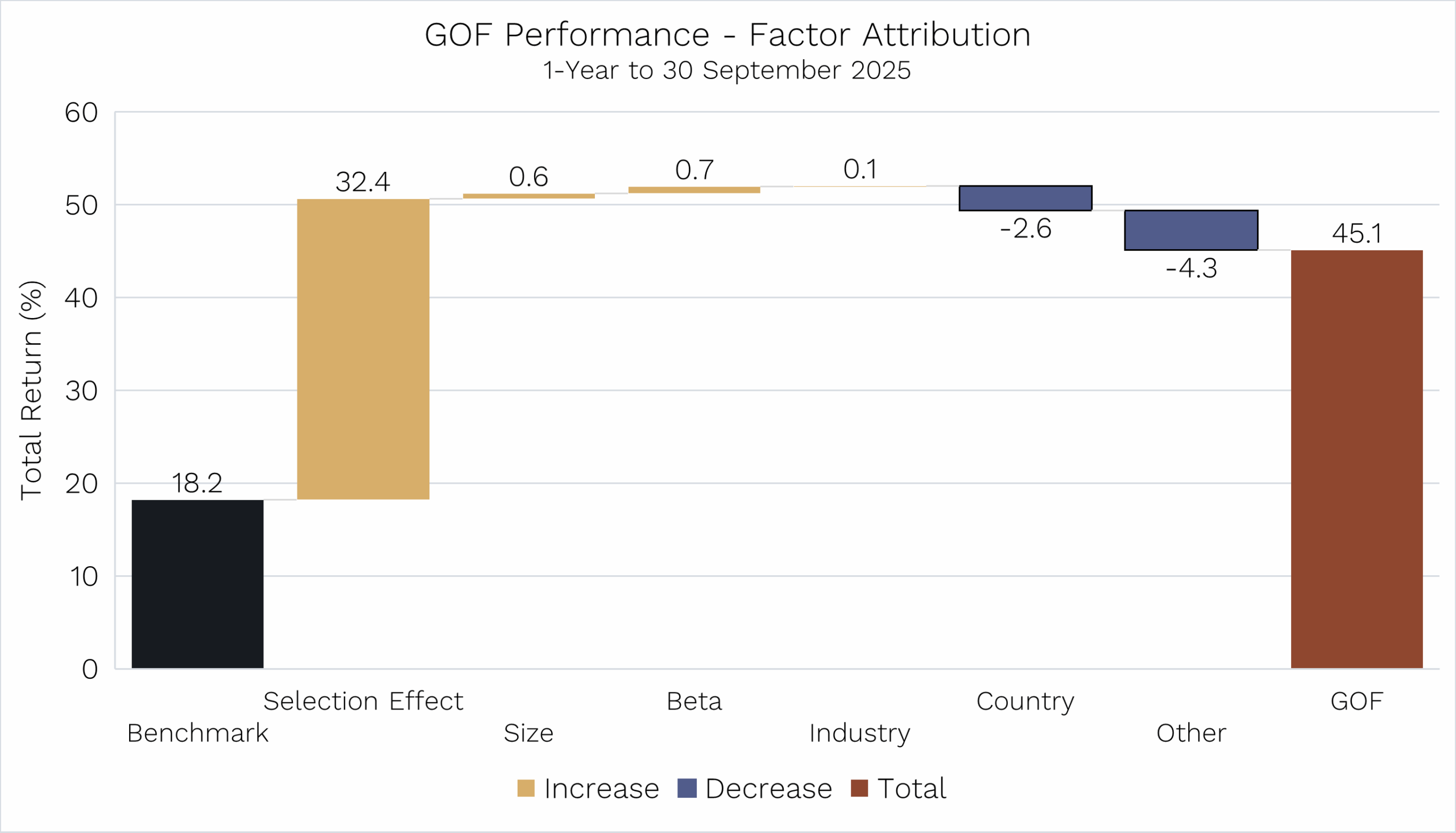

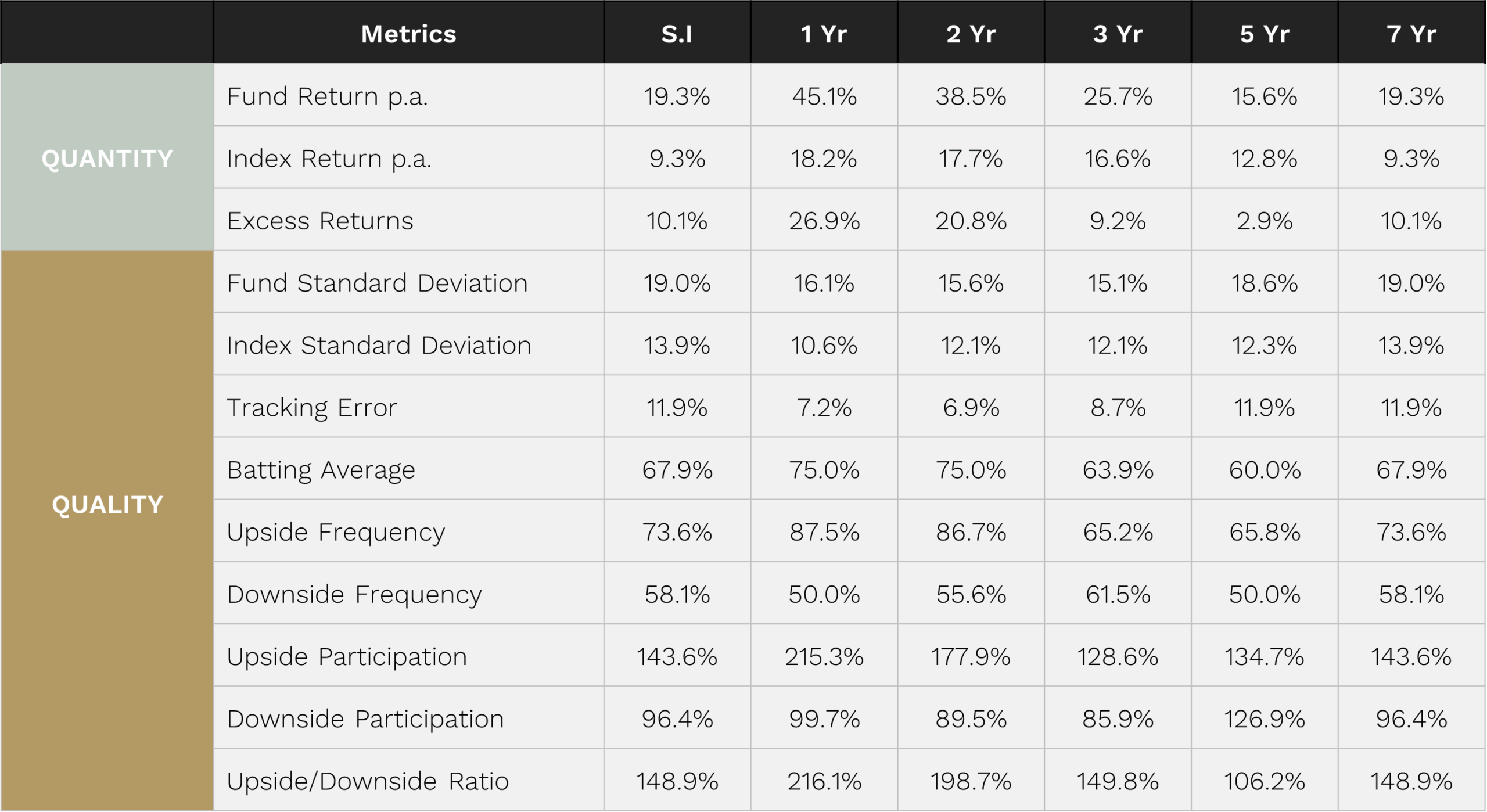

For Ophir, as a manager seeking to invest in higher-growth businesses (and why wouldn’t you in small caps, as that is where the next 10 or 20 bagger is found), this underperformance of growth naturally created a headwind for our performance in November.

In the last week or so of November, as further Fed Governors came out in support of an end-of-year cut, Fed rate cut probabilities for its December meeting headed back towards 100%. However, that led to only a partial recovery in the underperformance of smaller, less liquid growth businesses.

But now, at the time of writing in December, growth style companies in the U.S are continuing their recovery from the November factor underperformance, and as a result, our Ophir Global Funds have outperformed so far in December.

There will be times where having a growth factor bias will be like running into the wind; other times, it’s like running with a wind at your back.

But, ultimately, companies that consistently grow earnings faster than market expectations will be rewarded, and finding them is where we believe our edge is.

Market Entry – dip your toe or jump in all at once?

Back to this month’s key topic!

You’ve got a lump sum of cash, and you want to start investing in the stock market. You might consider ploughing it all in today. But then you worry: what if the share market then slumps?

Fortunately, there is a wealth of data available that can help investors make better-informed decisions.

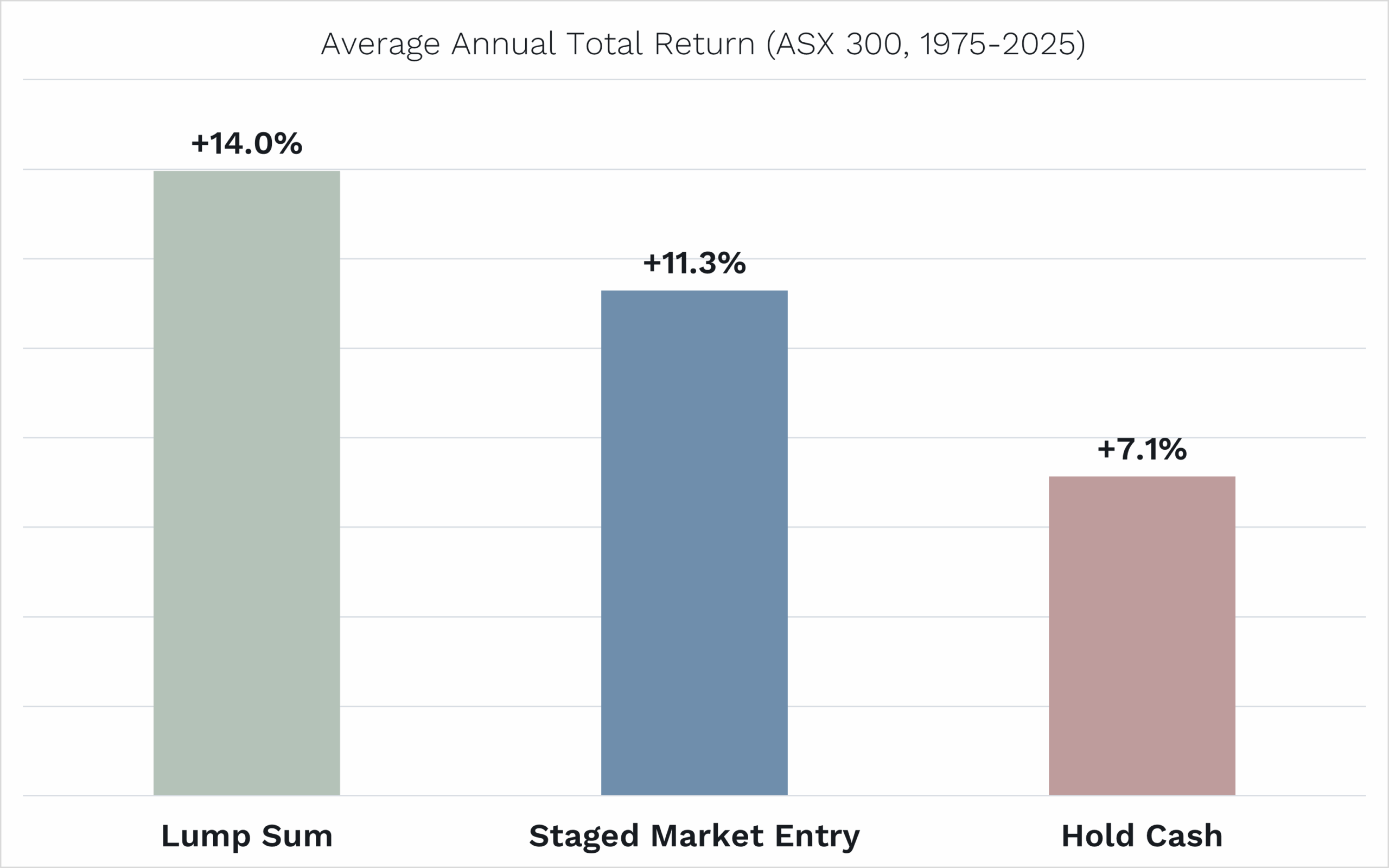

Below, for the last 50 years of Australian share market data (ASX 300 index), you can see the average 12-month results for

- ‘Lump sum’ investing (investing all at once).

- ‘Staged market entry’ (four equal investments at the start of each quarter over 12 months).

Source: Bloomberg. ASX 300 total return used for Lump Sum option. ASX 300 total return and Bloomberg Ausbond Bank Bill Index returns used for calculating Staged Market Entry return. Bloomberg Ausbond Bank Bill Index return used for Cash return.

On average, lump sum investing wins.

This makes sense because share markets tend to rise over a year. Delaying your investment through staged entry is, therefore, on average, going to hurt you.

And, of course, just sitting in cash earning interest has provided the worst result – though investors today would love to get a 7.1% return from their cash investment![1]

Lump sum risk

BUT, that is not the end of the story.

The world does not live in averages.

As famed investor Howard Marks said: “Never forget the six-foot-tall man who drowned crossing the river that was five feet deep on average”.

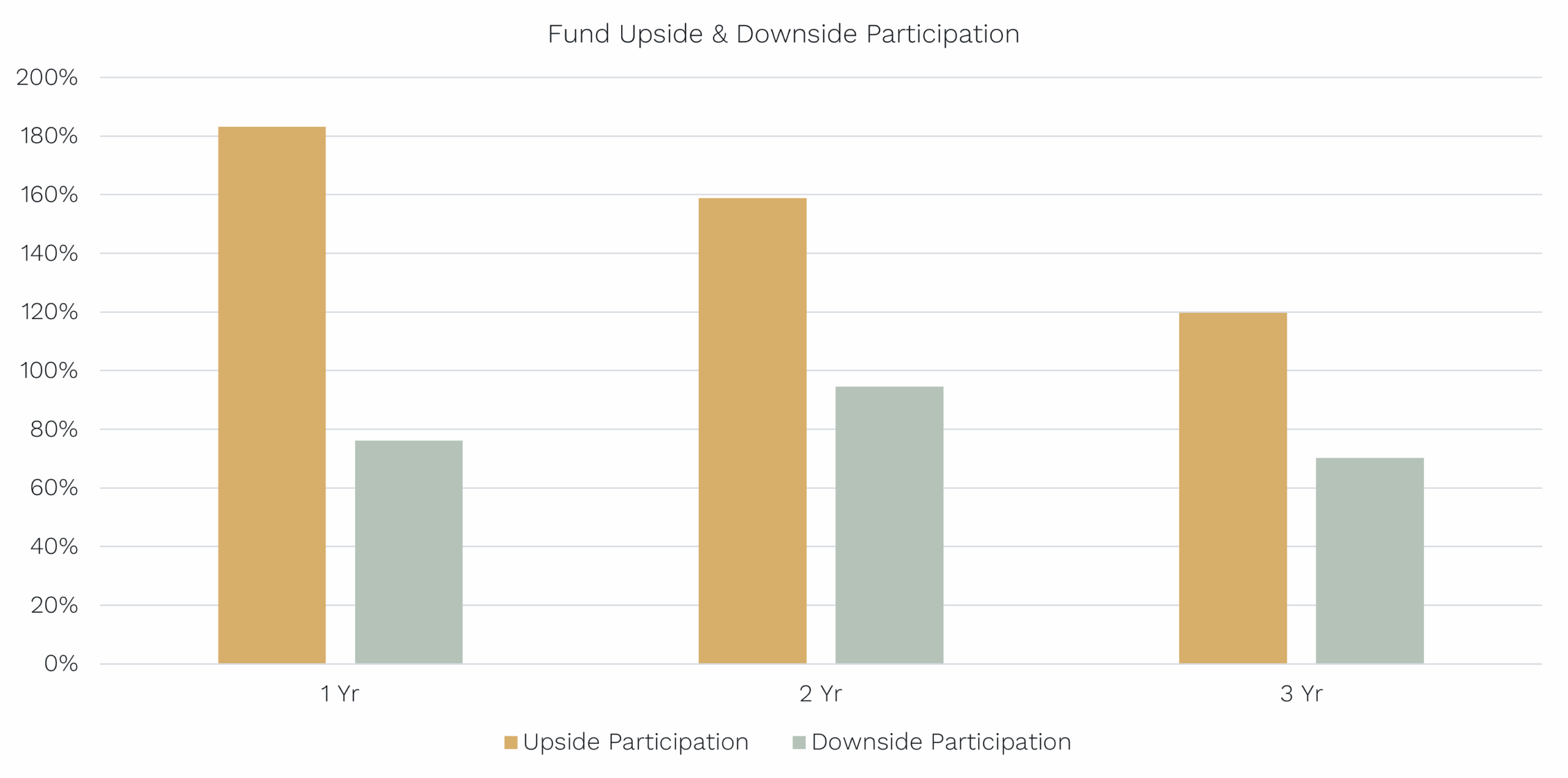

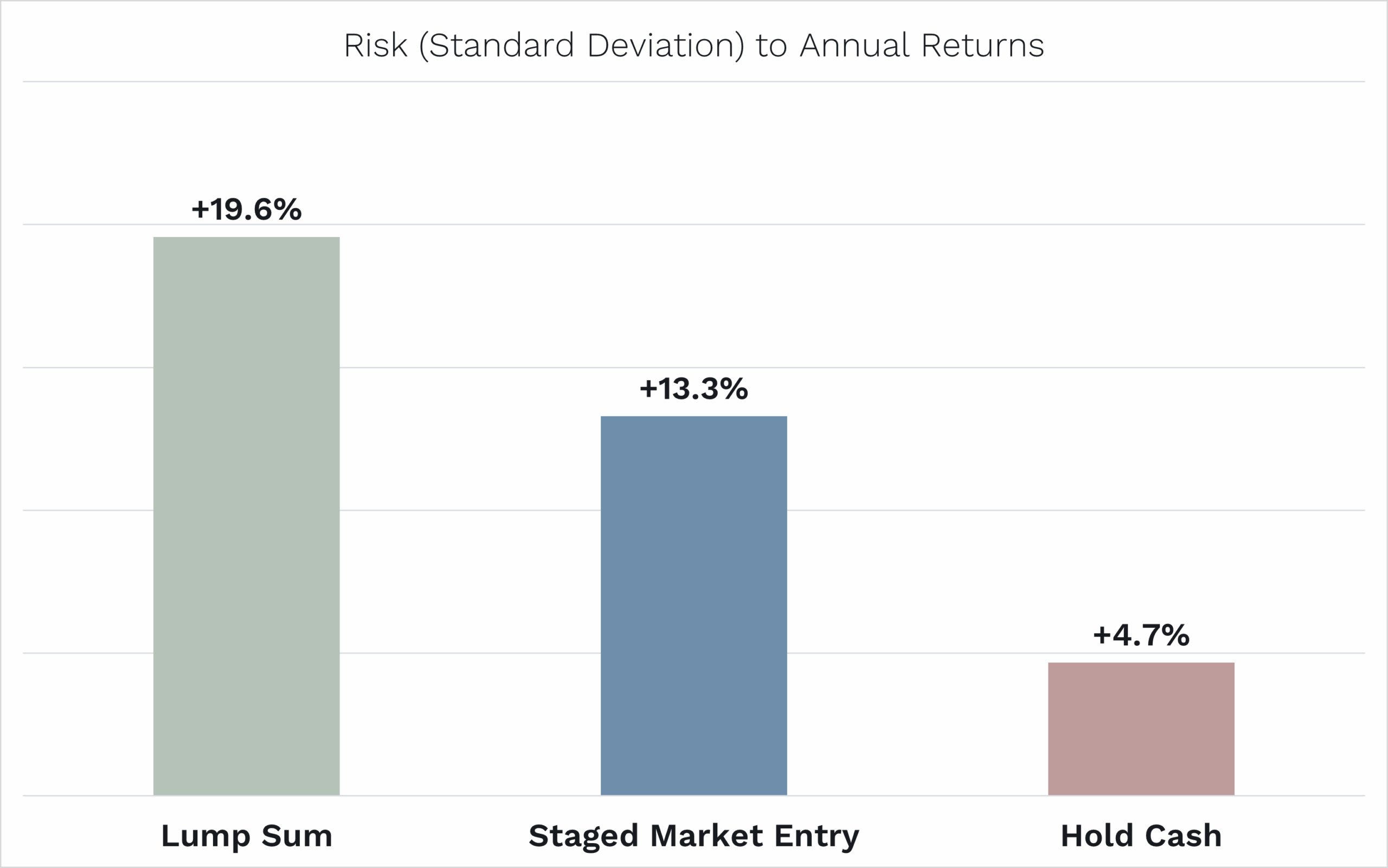

If we look at the ‘risk’ to those average annual returns we saw above – or the spread of outcomes around those averages – we see that lump sum investing was the riskiest.

Source: Bloomberg. Data from 1975 to 2025.

You don’t have to be a brainiac to understand why.

The share market return is more volatile than keeping all, or some, of your money earning interest from a cash investment. So going in all at once means you could do either a lot better than the 14% average … or a lot worse.

Naturally, by potentially staging their investment, it’s the ‘lot worse’ outcome investors are thinking of protecting against.

Like an insurance policy

So next up is the really insightful data to help you make your decision.

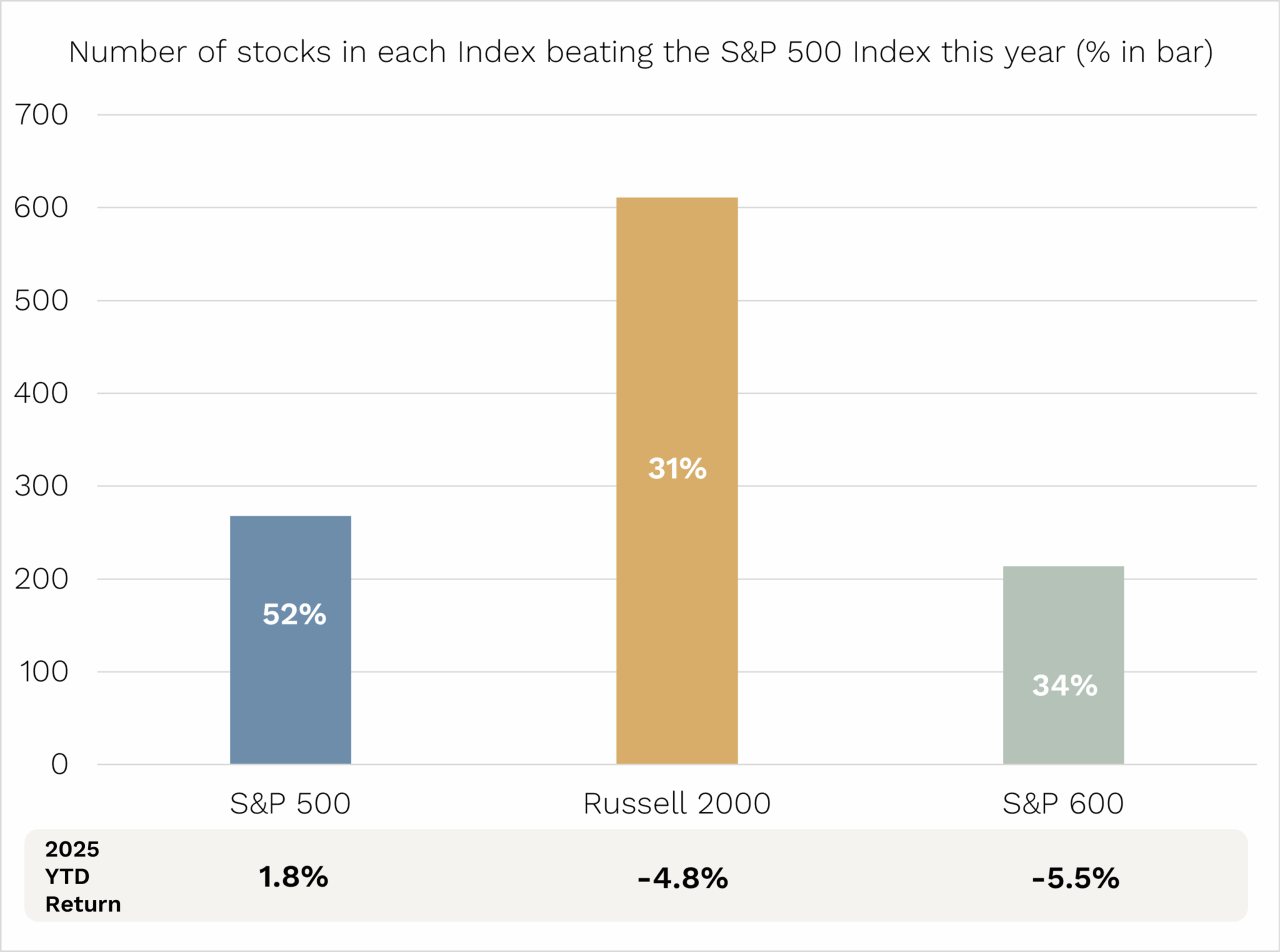

We have chopped share market returns over a year up into 10 deciles – or in other words, 10 equal baskets from the worst 10% of annual share market returns to the best 10%.

We have then looked at how much more, on average, you’d be better off from staging market entry compared to lump sum investing.

Source: Bloomberg. Data from 1975 to 2025.

What you can see is that:

- Staging makes you better off if share market returns are in the lowest return four deciles, or the worst 40% of returns.

- However, more often, staging makes you worse off because it underperforms in the best six deciles or best 60% of returns.

- There is also a ‘negative skew’ to staging. That is, staging makes you worse off to a greater extent in the best returning share market environments than it makes you better off in the worst returning share markets (i.e. -16.2% versus +10.2%).

The best way to think of staging market entry is like an insurance policy on your house burning down. Most of the time, you won’t need the policy, and it’s costing you money.

However, if your house burns down, or in this case, if you have unfortunate market timing and the share market falls after you’ve just started investing, then staging will have saved you money.

Why not just be a better market timer and only invest in a lump sum when you know the share market is going to go up over the next 12 months?

Sadly, that’s not possible.

Things like an expensive share market, or one that has gone up a lot over the past year, have virtually zero predictive power of what the share market is going to do over the next year.

And the longer you wait in cash for a ‘perfect’ share market opportunity, the likely longer you will have been sitting on the sidelines watching a rising share market go by.

A better-informed decision

So, as we see it, just like whether to purchase insurance for a house that might burn down, each individual needs to make up their own mind as to whether the insurance from staging your market entry – which will likely cost you money on average – is worth it for the peace of mind that it will have saved you money if share market returns turn out poor over the next year.

In our experience, for big, meaningful investments, many people choose to stage.

Ultimately, the choice is yours.

But hopefully, you are a little more informed now to make your decision.

[1] This seemingly high 7.1% average 12-month cash return is so high in large part due to the high interest rate/inflation years in the 80s and early 90s.

As always, if you’d like to chat to us about any of the Funds, please feel free to call us on (02) 8188 0397 or email us at ophir@ophiram.com.

Thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date of this was prepared, and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.