By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we discuss how the bond-driven bloodbath in share markets is throwing up some of the best valuation opportunities that we’ve seen in global small caps for years.

Welcome to the October Ophir Letter to Investors – thank you for investing alongside us for the long term.

Bond bogeyman hits again

It was billed as the ‘Battle of the Baddest’.

In a crossover boxing match in Riyadh at the end of October, current World Heavyweight Boxing Champ, Tyson ‘The Gypsy King’ Fury, standing at 6’9” tall and weighing 126kgs, faced the ex-UFC champion, Francis ‘The Predator’ Ngannou, standing at 6’4” and weighting 123kgs.

The heavy favourite, Fury, controversially won in a split decision, but not without a scare as Ngannou, widely billed as the hardest puncher in the world, floored Fury in the third round.

At the same time, over in the investing world, another heavyweight battle was raging in October. The bond market was fighting the share market. And it was the bond market hitting hardest.

But, as we’ll examine below, the good news is that this bond-driven bloodbath is throwing up some of the best valuation opportunities that we’ve seen in global small caps for years. (We will also look at some good news for two of our key investments, ResMed and Transmedics).

October 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during October. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -5.5% net of fees in October, in line with its benchmark which returned -5.5%, and has delivered investors +20.0% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned -6.0% net of fees in October, outperforming its benchmark which returned -6.2%, and has delivered investors +11.5% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -10.1% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -6.2% net of fees in October, underperforming its benchmark which returned -3.9%, and has delivered investors +10.8% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

The bond market intimidates

As we discuss in this month’s Investment Strategy Note – “Rates Higher = Shares Lower…is it that Simple?” – share markets have been much more sensitive to bond market moves over the last couple of years. That’s particularly been the case for younger, growth-orientated businesses (which is, of course, the area we focus on at Ophir).

We are reminded of that great quote from Democratic political adviser James Carville in the 1990s when he said:

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

And the bond market certainly intimidated in October.

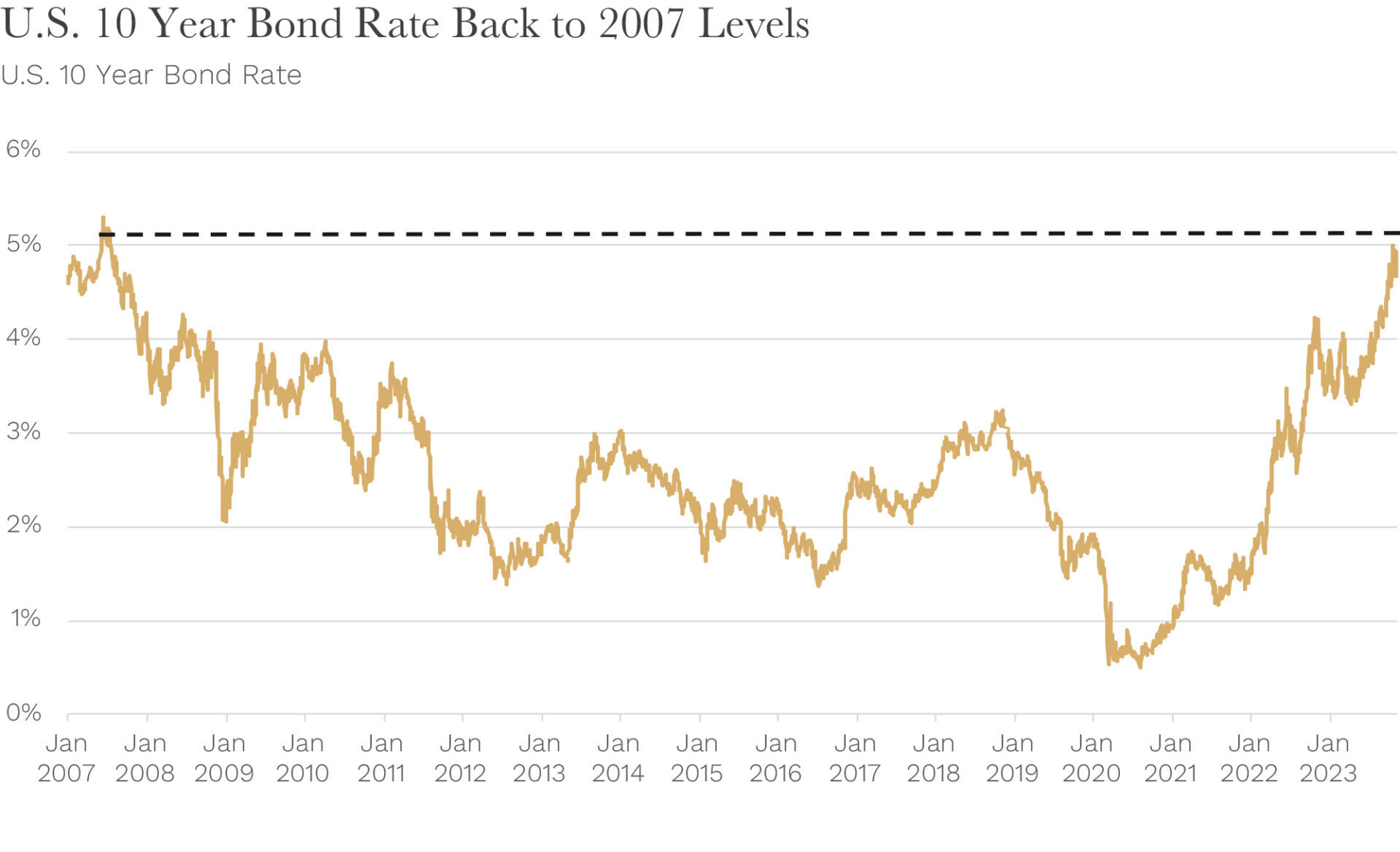

During the month, the U.S. 10-year government bond yield surged back to 2007 levels and momentarily cracked the 5% threshold.

Source: Factset. Data from January 2009 to 2 November 2023.

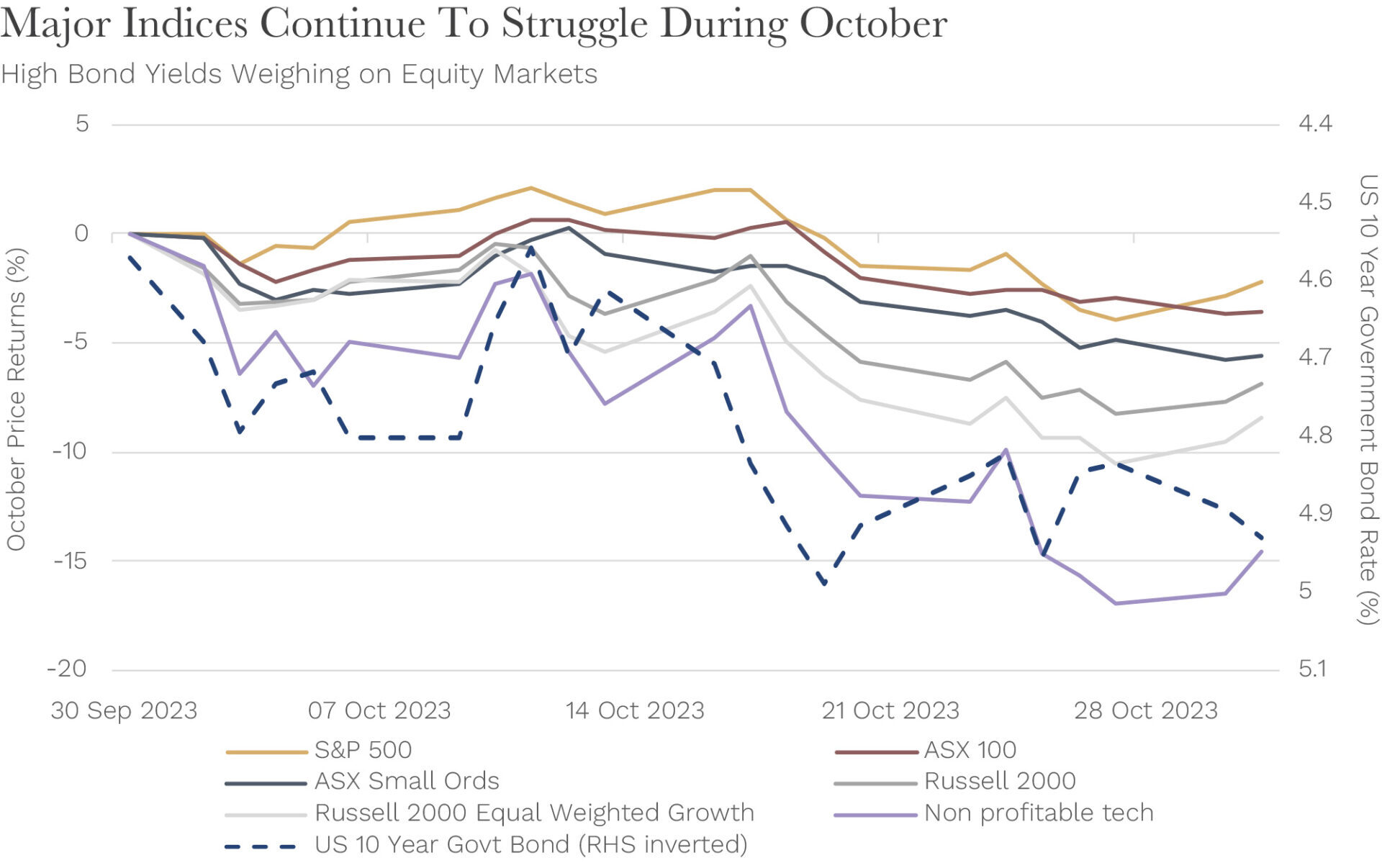

As shown in the chart below, as the US 10-year government bond yield rose from 4.57% to 4.93% over the month (right axis inverted), major share markets indices were down around -3% to -7%.

Again, younger companies were hit hardest. An extreme example was the U.S. non-profitable tech index, down almost -15%!

Source: Factset. Data from 30 September 2023 to 31 October 2023. Returns in local currency terms.

The Ophir Funds were not immune, though, during October, with all Funds performing in line or below benchmarks, primarily due to our skew to more growth-orientated businesses.

At the time of writing in early November, some of these share market losses have been reversed, with bond yields having dropped after softer economic and inflation data and more dovish central bank rhetoric.

Extreme valuation opportunity in Ophir global Funds

The flip side of this, though, is that valuations for our Funds, particularly in light of the growth we can buy, is now providing an opportunity to buy stocks at extremely low valuations.

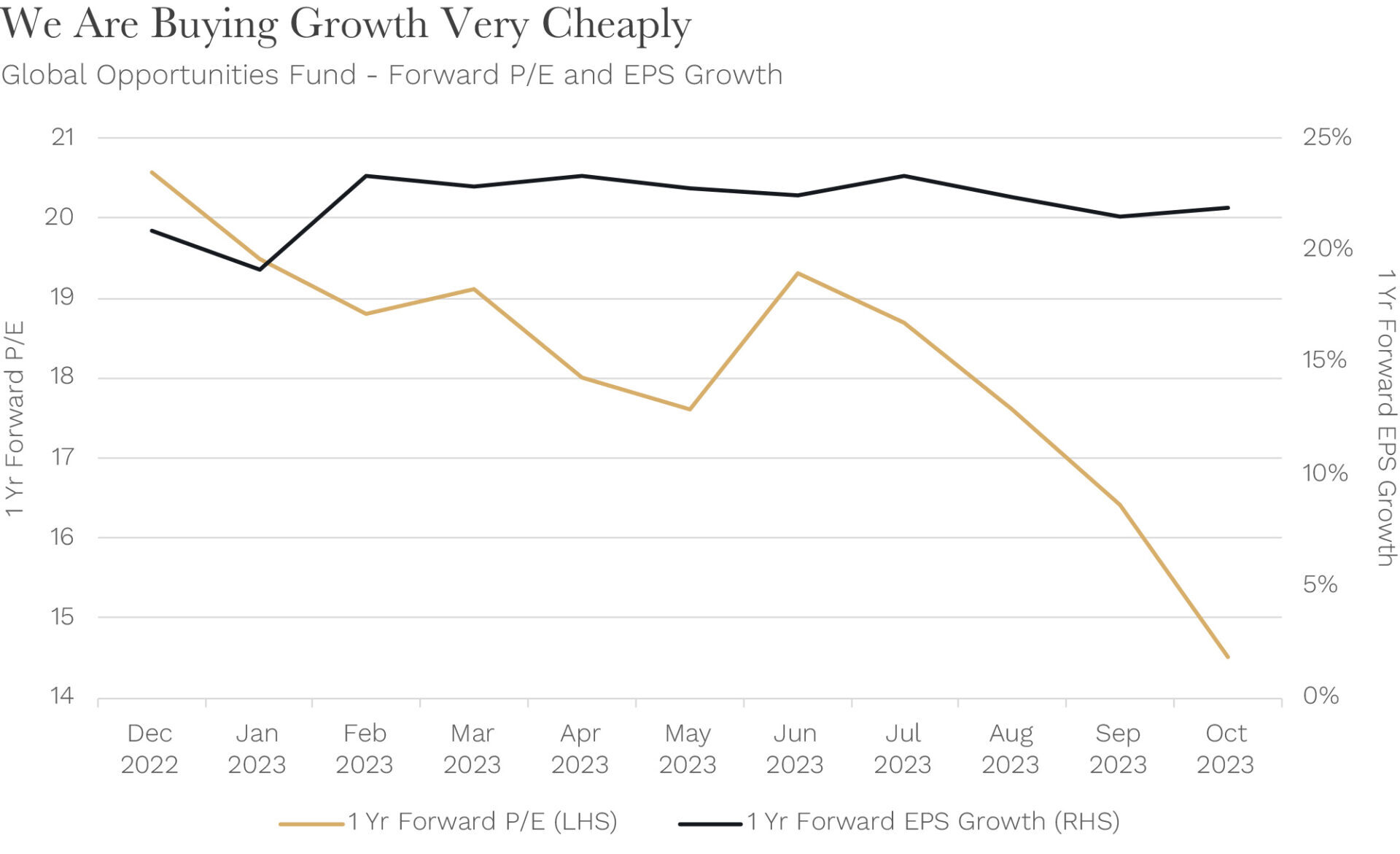

You can see this below for our Global Opportunities Fund.

Source: Factset. Data from 31 December 2022 to 31 October 2023. Returns in local currency terms.

Forecast earnings growth on average for companies in the Fund [1] over the next year is still around the 20% mark.

But the price-earnings (PE) ratio to buy that growth has dipped down to just 14.5 times.

As a general rule of thumb, any time you can buy earnings growth for a PE ratio less than the growth (here the PE is around 15x and earnings growth is 20%), it is an opportunity worth looking at very closely.

This means we can now buy earnings growth incredibly cheaply.

We can’t tell you with absolute certainty when these valuations will revert to ‘normal’ long-term levels, although history strongly suggests that they will eventually mean revert.

We suspect that for mean reversion to occur it will require two things:

- Some clarity on the recession/no-recession debate, which is probably a 2024 story; and

- Imminent prospects of interest rate cuts.

But what is certain is that these valuation levels are so cheap that we have been investing more of our personal capital into our Global Funds.

This is, without question, the most excited we have been about the forward-looking five-year returns since we have been investing in global small caps.

[1] Calculated using a weighted average, and conservatively using broker consensus estimates, which are lower than our expectations

ResMed – GLP-1 drugs are really a net benefit?

Last month in our Investment Strategy Note, ‘ResMed: Dealing with a ‘weighty issue’’, we covered our view on the headwinds ResMed has been facing recently, particularly from GLP-1 weight loss drugs.

For those unfamiliar with the background, we suggest going back and reading last month’s note.

During October, ResMed provided its Q1 result, which the market was eagerly awaiting given its recent share price sell off (it is also listed in the U.S. and reports quarterly).

Revenue, margins and earnings were all broadly in line with market expectations, with better-than-expected Mask growth offsetting weaker than expected Device growth for its CPAP machines.

With no current obvious impacts on the business’s financials from GLP-1 drugs, all the focus was on what management would say about how these drugs might disrupt their business in the future.

Glass half full

It was definitely ‘glass half full’ from ResMed (as you might expect). The company suggested “the work that’s being done in the pharmaceutical industry right now with obesity drugs will be a net positive for patient flow and patient growth in sleep apnea, COPD and for ResMed overall”.

How?

They believe, like cholesterol and blood pressure pharmaceuticals before it, that GLP-1 weight loss drugs may see a new population of patients, who may have never entered the healthcare system, engage with a doctor. After they go through this screening process, those with sleep apnea that otherwise would not have been in ResMed’s pipeline may be offered a ResMed device.

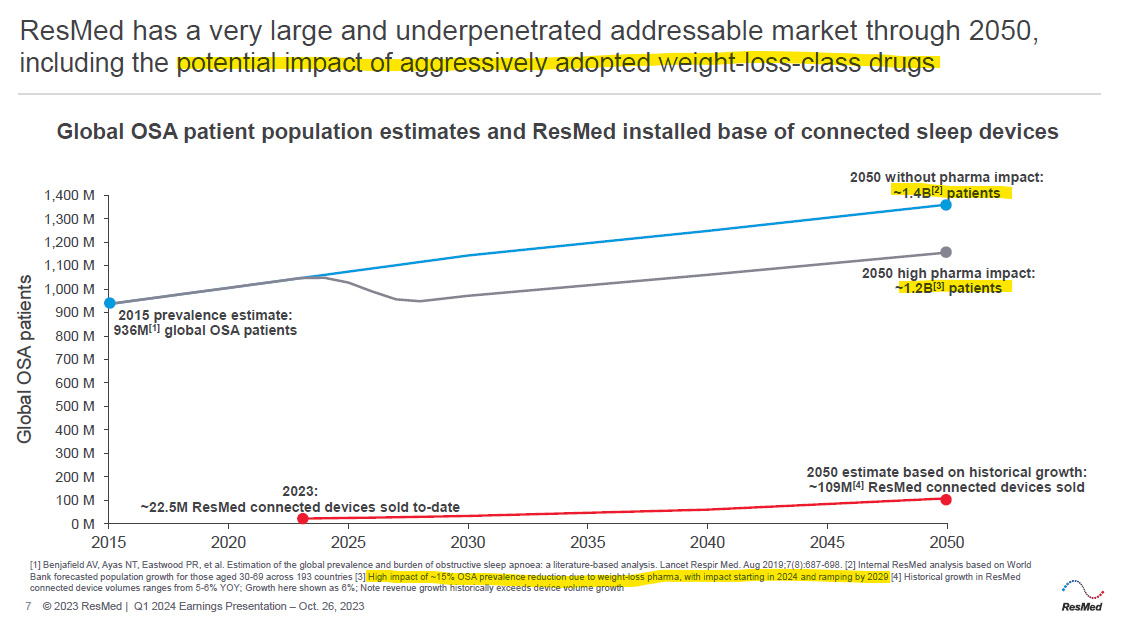

The chart below shows the key modelling from their update. It shows the addressable obstructive sleep apnea (OSA) market (blue line) and estimates of how much this would be decreased by high GLP-1 usage through to year 2050 (grey line).

Crucially, ResMed suggested this would likely have no negative impact on the sale of ResMed devices (red line) because the diagnoses and treatment of (OSA) is so underpenetrated.

Source: Factset. Data to 8th November 2023.

ResMed has also been tracking a cohort of “many thousands” of patients already on GLP-1 drugs and its CPAP (continuous positive airway pressure) therapy. ResMed is “not seeing any significant change in the PAP adherence rates nor any reduced participation in resupply programs versus control groups”.

Whilst early days, this in part addresses the risk that GLP-1 drugs won’t necessarily replace CPAP devices for many patients but may actually be complementary.

With other positive near-term drivers, such as a 5-10% cost reduction program, higher prices on machines, and a de-geared balance sheet, we are happy to continue holding ResMed for the time being.

The next big catalyst for the stock continues to be results of a key clinical trial in April next year. The trial examines a newer GLP-1 drug and its benefits to patients with OSA who are both on, and not on, CPAP therapy, such as ResMed’s.

Transmedics – Easing heart concerns get the share price pumping

Regular readers will know that we have held a business in our global Funds called Transmedics since mid-last year.

The business is involved in the removal, storage and transportation of livers, hearts and lungs for organ transplantation, primarily in the U.S.

While we have made money since our initial investment, it has been a volatile ride.

More recently, two key factors have been weighing on the share price:

- There were question marks over market share growth for heart transplants; and

- Investors were uncertain of the payoff for the business’s recent move to acquire planes to help transport its organs.

The market was eagerly awaiting Transmedics’s Q3 result, which it delivered in early November.

Put simply, it was very positive.

The share price rocketed 50%.

Revenue for the quarter came in at US$66.4 million, beating market expectations of $49.2million. And calendar year 2023 revenue guidance was raised from $180-190 million to $222-230 million.

A very big beat and raise.

There was positive news as well on the two key overhangs for the share price.

Heart transplant revenues in the U.S. came in at $15.1 million on the quarter, ahead of even the most bullish Wall Street analyst’s expectation.

And also, revenue for the aviation business, which was only launched towards the end of the quarter, was logged at $2.1 million, but is expected to ramp quickly.

Outside of acquisition-related expenses, during the quarter the business moved into operating profitability and is on track to more than double the number of organ cases it handles from less than 1,000 in 2022 to over 2,000 in 2023. It is still targeting 10,000 cases a year by 2028.

A full Q3 report card

With higher bond yields creating a challenging time for the share prices of smaller, faster-growing businesses, particularly ones that are currently unprofitable or just moving into profitability, it is good to see the market still rewarding companies that are delivering on fundamentals.

Shares may have taken more punches again in October, particularly smaller faster growing ones, but there is no question some absolute bargains now sit in our funds at prices we haven’t seen in a very long time. For us this means the value embedded in our funds is at a high level and has us more excited about future returns than we have been in many years.

We and the team are currently moving through the end of Q3 reporting season for our global Funds and look forward to providing a summary on how we have gone getting the fundamentals right in next month’s Letter to Investors.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.