In our Investment Strategy Note we discuss how retail traders took on some Wall Street hedge funds and won…for now.

Most investors by now would have heard of the now-infamous GameStop stock frenzy. The previously little-known US company is a loss-making mall retailer in a dying business. But over recent weeks, the US company experienced one of the most extreme and bizarre share price rallies we have ever seen, with the stock surging from $US19 a share to $US347 in just two weeks.

GameStop may seem distant and obscure, but all stock market investors need to consider the implications from this event. It particularly highlights that periodically markets can go mad in the short-term and detach from reality and value. Investors need to manage that risk, but they also need to remain committed to their investment process during times of heightened volatility if they are to harvest superior long-term returns.

Short selling explained

Stepping back, to understand last month’s volatility, one must first appreciate the mechanics of short-selling, and why investors choose to employ this strategy.

Short-selling or ‘shorting’, is when an investor tries to profit from a falling share price. The investor borrows shares in a company to sell on the market, hoping the price will drop. If it does, the investors buy shares back at the lower price and return them to the lender, pocketing the difference in price.

For example, you might borrow 200 shares of a $5 stock, with a view to short selling them. You sell the borrowed shares on the market at $5 each, receiving $1000.

Let’s say the price slumps to $2. You can buy 200 shares at $2 and return them. Your profit is $600. (You received $1000 for selling the borrowed shares, but it only cost you $400 to buy them back and return them, so you have $600 left in the bank.)

The goal of short-selling is to make a profit. So you would usually only enter a short-selling transaction when you believe a stock to be overvalued, and likely to drop in price.

The scary short squeeze

However, short selling does entail risk if the price goes up. At some point you would still need to close the transaction — that is, you’d have to buy that stock to repay the borrowing.

If, as in the example above, that $5 stock starts rising, and you buy it at $9 to ‘cover’ your short position (when you buy and return the shares), you’ve lost $4. If you’d borrowed 200 shares, that would deliver a hefty $800 loss.

Shorting stocks is riskier than buying. When you buy a stock outright, your losses are finite. If you buy at $5 and the price goes to zero, you lost $5. But if you short it and it goes to $10, $20, $50, etc, your losses are potentially unlimited.

The event short sellers dread most is a ‘short squeeze’ when the share prices of heavily shorted stock are rising. In a vicious cycle, the rising price forces short sellers to start buying the share to cover their short positions and minimise their losses. As the short sellers keep having to buy the stock, the share price is further pressured higher and higher.

A dying business

Last week’s GameStop short squeeze is one of the most dramatic in recent memory.

GameStop is a bricks and mortar retailer with a little over 5000 stores selling video games. Not surprisingly, selling video games in stores is no longer a great business given consumers have shifted towards downloading and the pandemic has slashed foot traffic in malls.

Those headwinds have been reflected in GameStop’s terrible earnings and share price performance.

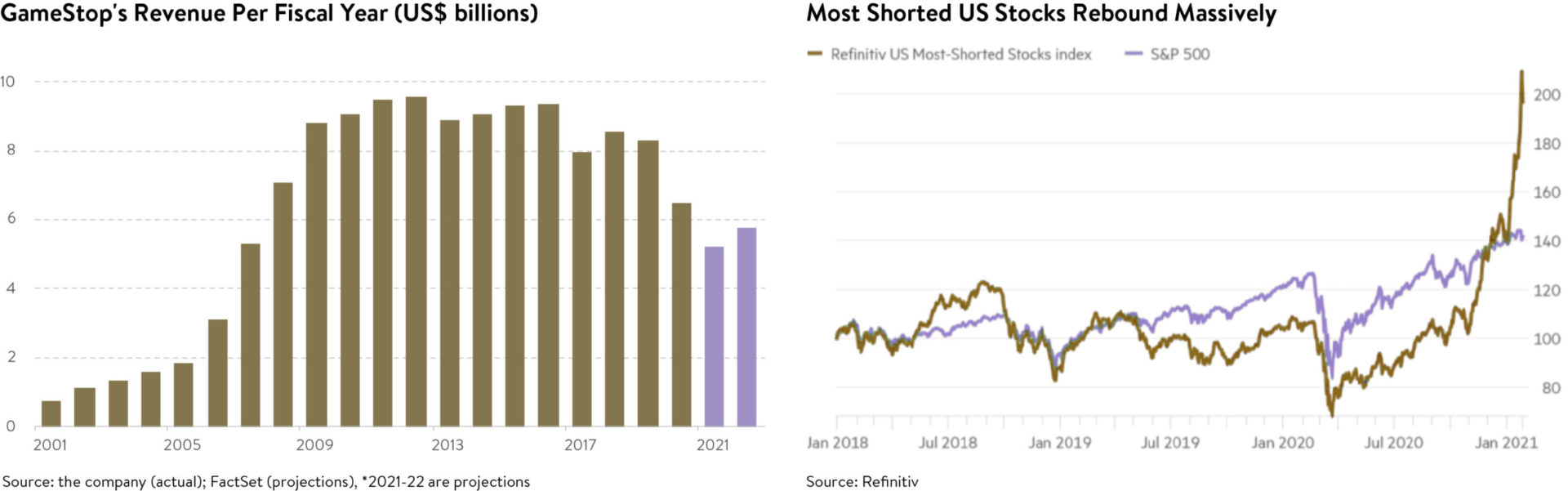

In 2011, GameStop reported net income of $408 million on revenue of $9.5 billion. But in the last 12 months, that had turned to a huge net loss of $275 million on revenue of $5.2 billion.

Given the grim outlook, with many investors concluding GameStop was a dying business, hedge funds have been short-selling the company over recent quarters. Until recently, that has been a profitable move. GameStop’s stock traded as high as $62.11 per share in 2007. It hit a low of $3.50 in March 2020, closing at $18.84 at the end of 2020, valuing the company at $1.3 billion.

Retail revenge on hedge funds

But then something dramatic happened. Retail investors, led by some in a Reddit chat room, WallStreetBets – where more than 3 million Reddit users discuss speculative stocks — piled into GameStop, and other stocks that hedge funds were heavily shorting.

This buying was not based on any new, or positive news about GameStop’s business. Instead, social media attracted people to the trade based on its volatility and the prospect of quick riches.

Speculating on smaller-sized companies is nothing new. But the coordinated and targeted approach the Reddit traders have taken to GameStop is unusual. Through a mix of awe, anger and envy, the retail traders have leveraged social media and combined their buying power to bring pain to the hedge funds who shorted GameStop.

The net result of this retail buying frenzy was an explosion in GameStop’s share price, with the stock rising by 1,625% over the month of January alone. (Other heavily shorted stocks have also seen strong retail buying.)

The hedge funds betting against GameStop were catastrophically wrongfooted. Year to date, hedge funds that had been shorting GameStop have lost at least US$5 billion.

Exposing Enron

So what are the lessons from the GameStop saga?

Some believe that GameStop once again highlights the malign impact of short selling on markets.

Yet, despite its risks, short selling plays an important role in capital markets. It enhances efficient price discovery, mitigates bubbles, increases market liquidity, and facilitates hedging and other risk management activities.

The biggest critics of short selling are often those companies that are shorted. During the GFC, companies such as Lehman Brothers blamed short-sellers for their troubles. However, years later it is clear these companies failed not because they were shorted, but because they had been mismanaged. The ability to short stocks gives investors the incentive to find out what is wrong with individual companies. Shorters were the first to expose Enron.

Ultimately, short selling is just a way of expressing a view that a particular stock is overvalued. This is no different to buying a stock you think is undervalued. And for markets to function effectively, these views of buyers and sellers must be matched accordingly.

Sticking to our guns

But GameStop has also raised concerns about the impact of retail traders and speculation.

Some established investors are uncomfortable about what happened. They believe that equity markets should be tied to fundamental value. But by attracting speculative retail traders who don’t have any philosophy about valuation, markets will increasingly experience periods where the flow of capital trumps fundamentals. This influx of trading based on hype and speculation is similar to what we have seen in Bitcoin.

As a fundamental and process-driven investor, at Ophir we believe these emerging trends need to be acknowledged and managed. We are always cognizant of shifting dynamics in markets, and this is reflected through our rigorous risk management regime.

Yet it doesn’t change our investment process: identifying small and mid cap stocks which we believe can grow to one day become household names.

We will experience periods where share prices become detached from reality. But despite that, we will stick to our guns, and over the long term believe we will generate the returns that compensate our investors for this volatility.