For our Global Opportunities Fund, November 2024 was its best single month of performance since its inception in October 2018, some 74 months ago. A pleasing result. Similarly, for our Global High Conviction Fund, November was its second-best performance month since inception in 2020.

When we have sizable out or underperformance relative to our benchmarks, we are really interested in understanding what caused that performance.

Is it because of some intended, or perhaps even unintended, ‘factor’ exposure? (A factor is a fairly obtuse term for a collection of stocks that share a common characteristic, such as size, value, geography or industry.)

Or is it because of good old-fashioned stock picking?

At Ophir, over the long term, we would obviously expect our stock picking skills to explain most of our outperformance, rather than factors, which investors can increasingly gain exposure to cheaply elsewhere.

Lifting the lid on November’s outperformance

Let’s firstly examine what drove November’s outperformance.

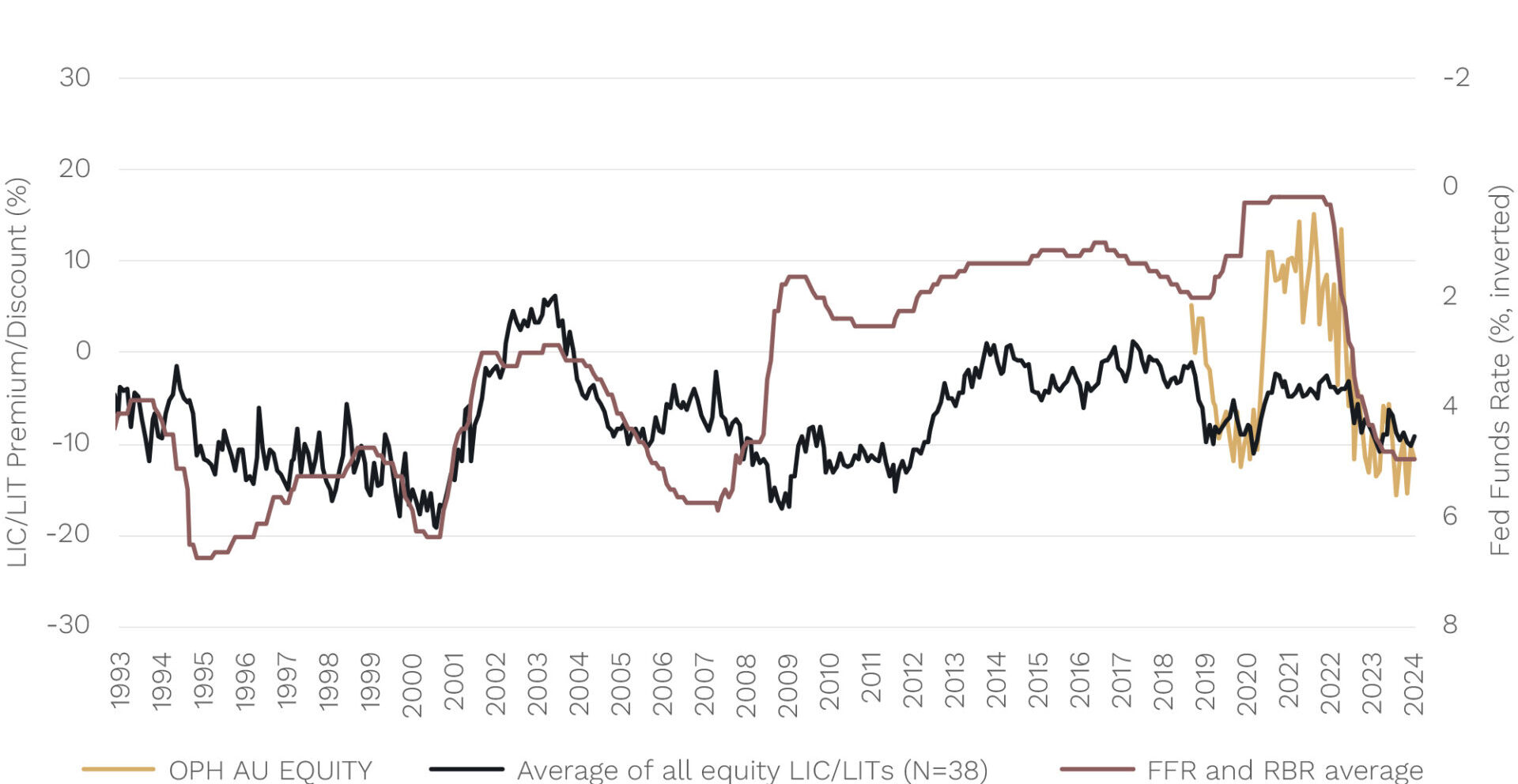

If we take the Global High Conviction Fund, below we show the Fund’s November performance versus its benchmark (left chart). And in the right chart we show the breakdown of its outperformance by various different factors, such as country, beta (a fancy finance term for companies whose share price tends to go up more when the share market goes up), style and size exposure … but also by ‘selection effect’.

GHCF November Performance Review

Source: Bloomberg & Ophir. Data as of 30 November 2024. Benchmark is the MSCI World SMID Cap Index NR (AUD). Factor analysis uses proxy of the Bloomberg Global Developed Mid Small Index.

Selection effect is the proportion of the outperformance versus the benchmark that you can attribute to specific companies Ophir has selected, after subtracting off any factor exposures/bets.

(At Ophir, our investment style gives us two primary factor exposures: ‘small cap’ and ‘growth’. We don’t overpay for that growth and investment consultants call our style Growth at a Reasonable Price, or GARP for short. But we don’t expect our style to deliver outperformance over the long run. It is the stocks we pick within that style that allow us to outperform.)

What the analysis shows is that selection effect, or stock picking, has contributed the lion’s share – in fact 81% of the outperformance for November.

This is a very similar number for our Global Opportunities Fund given the high overlap in stock holdings (75-80% overlap by weight).

This is crucially important because outperformance through stock picking is exactly what our investment process targets and what we spend all our time trying to achieve. It is also the most sustainable form of outperformance, in our view, given factor tailwinds can easily reverse and become headwinds (like we saw in 2022 when our small-cap growth style went against us).

The main Factor contributor to performance in November was country allocation, which made up 14% of the outperformance. This was mainly through us being overweight (versus the benchmark’s allocation) to U.S. companies whose performance tended to be better in the month, and underweight Japanese companies (we have zero allocation compared to the benchmark’s 10% allocation) which tended to have poorer performance.

What about the past year’s outperformance?

While it’s great that stocking picking has been the major driver of performance in November, it’s just one, albeit strong, month.

But if we zoom out a little, performance over the last year in the Ophir Global Funds has also been strong. The Global Opportunities Fund and Global High Conviction Fund are up +55.0% and +54.5% respectively, versus their common benchmark up +28.2%.

GHCF 1 Year Performance Review

Source: Bloomberg & Ophir. Data as of 30 November 2024. Benchmark is the MSCI World SMID Cap Index NR (AUD). Factor analysis uses proxy of the Bloomberg Global Developed Mid Small Index.

As shown above, if we perform the same analysis for the +26.3% outperformance over the last year in the Global High Conviction Fund, we see that 105% of the outperformance was driven by stock picking. An even better result than November.

How can stocking picking have driven more than 100% of the outperformance?

Easy. It’s because the ‘factor’ attribution to outperformance was actually negative -5%. That is, factor exposures of the Fund hurt relative performance.

What were the bigger factor headwinds to relative performance over the last year for the Global High Conviction Fund?

- This time Country exposure went against us. Being overweight French stocks hurt as the French share market underperformed.

- Also, size went against us. That is, larger companies tended to outperform smaller companies in the global share market over the last year.

It wasn’t all bad news, though, from a factor perspective.

Relative industry weights, and exposure to higher price momentum and higher beta stocks all added positively to returns.

It’s just on a net basis; factor exposures were a headwind.

Ophir’s hard work and stock picking skills paying off

The key takeaway remains though, just like November, the strong outperformance over the last year has been driven overwhelmingly by stock picking.

This is great news for investors.

It means the Ophir investment process is working. It means outperformance over the last year is not being primarily driven or being given any ‘free kicks’ from intended or unintended exposures to certain common characteristics of stocks – so-called ‘factor’ exposures that investors might be able to buy cheaply elsewhere.

Over the last year for our Global Funds, we did over 1,000+ company meetings to help us understand which companies we think will outperform. Not only did we meet with the company itself, but its customers, suppliers, competitors, industry experts, ex-employees … the list goes on. Many of these meetings are in person, traveling all over the world to gather our insights.

The hard work has been paying off both recently and over long term time periods, as shown by our Funds long-term track records.

Outperformance doesn’t necessarily happen in any given month or year. But it’s great to see that this year it has.

And, of course, the work continues.