In this month’s Investment Strategy Note we ‘weigh in’ with our view on the impact that GLP-1 drugs, such as Ozempic for diabetes and Wegovy for weight loss, could have on Resmed’s share price and why overall we are happy to maintain the company as a core position in the Ophir High Conviction Fund (ASX:OPH).

One of the most talked about stocks in the Aussie market this year, which has also been a long-term position in our Ophir High Conviction Fund, is Resmed.

Resmed (ASX:RMD) is a medical device company founded in Australia in 1989. Its continuous positive air pressure (CPAP) devices and masks treat sleep apnea.

CPAP has long been the gold standard for treating obstructive sleep apnea (OSA), and Resmed is the leading provider globally, with approximately 65% of its sales coming from the US.

But in August Resmed’s share price sold off -24.0% (and a further -7.4% in September) on the back of its latest full-year earnings result. As a long-term outperformer for us and the market, this came as a shock.

For this month’s Investment Strategy Note we thought we’d take a dive into what happened, what’s still unknown and what our position is as a long time investor in Resmed.

Resmed (ASX:RMD) – Share price

Source: Factset. Data as at 10th October 2023

3 triggers

While it was one of our top weights in our Ophir High Conviction Fund, after Resmed continued to outperform and got closer to our target price, we had fortuitously trimmed our position during May of this year. But the recent fall has clearly still had an impact on performance.

The sell-off was triggered by three things:

- Gross margins disappointed compared to expected improvement as supply chain issues dissipate.

- Investor concern grew around competition from a new wave of GLP-1 weight loss drugs.

- The looming re-entry of competitor Philips into the market after its June 2021 product recall.

While the supply chain issue highlighted above is temporary, and news in early October suggests the FDA will push back the timeline for competitor Philips to re-enter the market, it is the potential impact of GLP-1 weight loss drugs that is creating the most uncertainty.

CPAP killers?

GLP-1 drugs, such as Ozempic for diabetes and Wegovy for weight loss, have been making waves, with the number of prescriptions skyrocketing in the U.S.

They have been touted as ‘CPAP killers’ because they could potentially crush the pool of CPAP patients. Being overweight is a key risk factor for OSA (about 58-70% of sleep apnea cases are directly related to excess weight).

GLP-1 drugs have actually been around for about 20 years for diabetes and ten years for weight loss approved variants. More recent variants, such as Wegovy and Mounjaro, tout weight loss in trials of 15-25%, which are big numbers. (Mounjaro is currently in a Phase 3 trial to evaluate efficacy for sleep apnea, with results expected in March next year.)

GLP-1 drugs will likely impact the total addressable market (TAM) for Resmed because overweight patients will be prescribed GLP-1s and that will impact the ‘funnel’ of new patients for Resmed’s devices.

But the degree to which this will happen is highly uncertain. GLP-1s face several headwinds to take up, including supply constraints, lagging real-world efficacy, side effects, low drug compliance, high cost and lack of insurer coverage. (See the image below which highlights some case reports of people putting on more weight than they lost after stopping the drug!).

For some, the ‘After, After’ is worse than the ‘Before’

Source: CNBC Novo Nordisk has conceded some individuals may actually gain more weight after stopping an obesity drug than they initially lost.

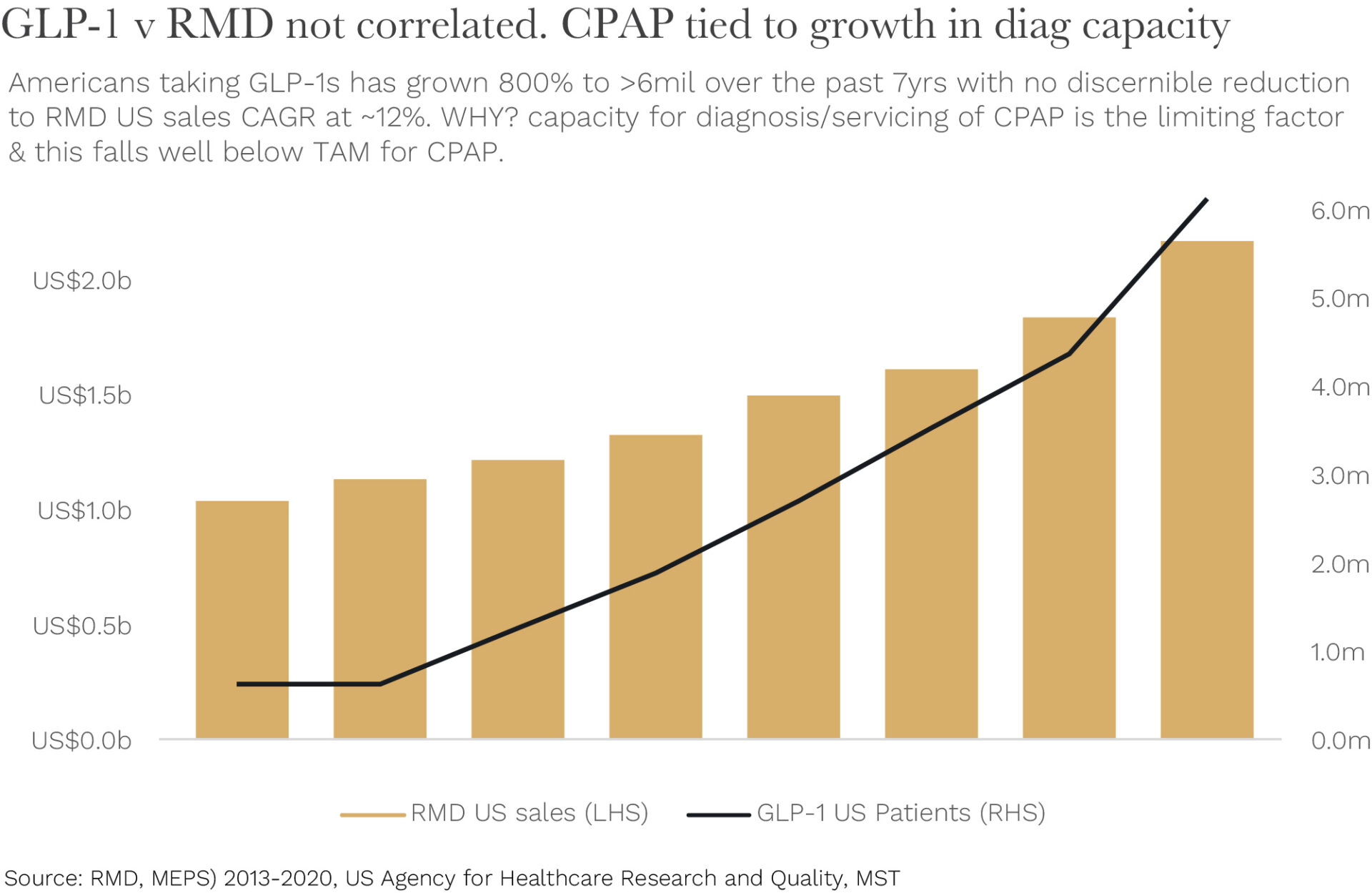

Regardless, treatment for OSA is still a large and underpenetrated market. Resmed’s revenue would have grown historically at the same rate even if its TAM was halved. This is because the limiting factor on Resmed growth to date has been the capacity to diagnose those with OSA and prescribe CPAP devices (see chart below). Further there is also still a significant population that suffer from OSA for non-weight related reasons (i.e. age and physical traits).

Skyrocketing GLP-1 use hasn’t slowed Resmed revenue

Source: MST Marquee

Maintaining a core position

We believe Resmed is currently at a pivotal point.

At current valuations, it is either:

- A great buying opportunity because it is trading at 5-year low valuations both in absolute terms and relative to competitors, or

- Overearning currently compared to what it may earn in the future, depending on the Philips recall and future impact of the new wave of weight loss drugs.

Overall, we are happy to maintain a core, but not highest conviction, position in Resmed. In our view, the attractive valuation it currently trades on outstrips the risks it faces.

However, we are keeping a very close eye on the company for further developments before purchasing any more.