We outline why we see the current discount in the Ophir High Conviction Fund’s (ASX:OPH) ASX price to its NAV as an opportunity and have been purchasing units personally.

Webster’s dictionary defines risk as “exposing to danger or hazard”.

However, the Chinese symbols for crisis below perhaps give a better description.

The first symbol translates to danger, whilst the second to “opportunity”.

In investing we think this gives a better description of risk. With danger comes opportunity. And so it is with the Listed Investment Company (LIC) and Listed Investment Trust (LIT) market in Australia.

As investors will know the Ophir High Conviction Fund, which invests in Australian & New Zealand listed small & mid cap companies, is offered as a LIT on the ASX under the ticker code “OPH”.

As of writing in late March this year, OPH was trading at its largest discount to Net Asset Value (NAV)[1] since March 2020, and close to its largest discount on record since listing in December 2018.

Is this big discount a risk or an opportunity? (Hint: we think it’s an opportunity!)

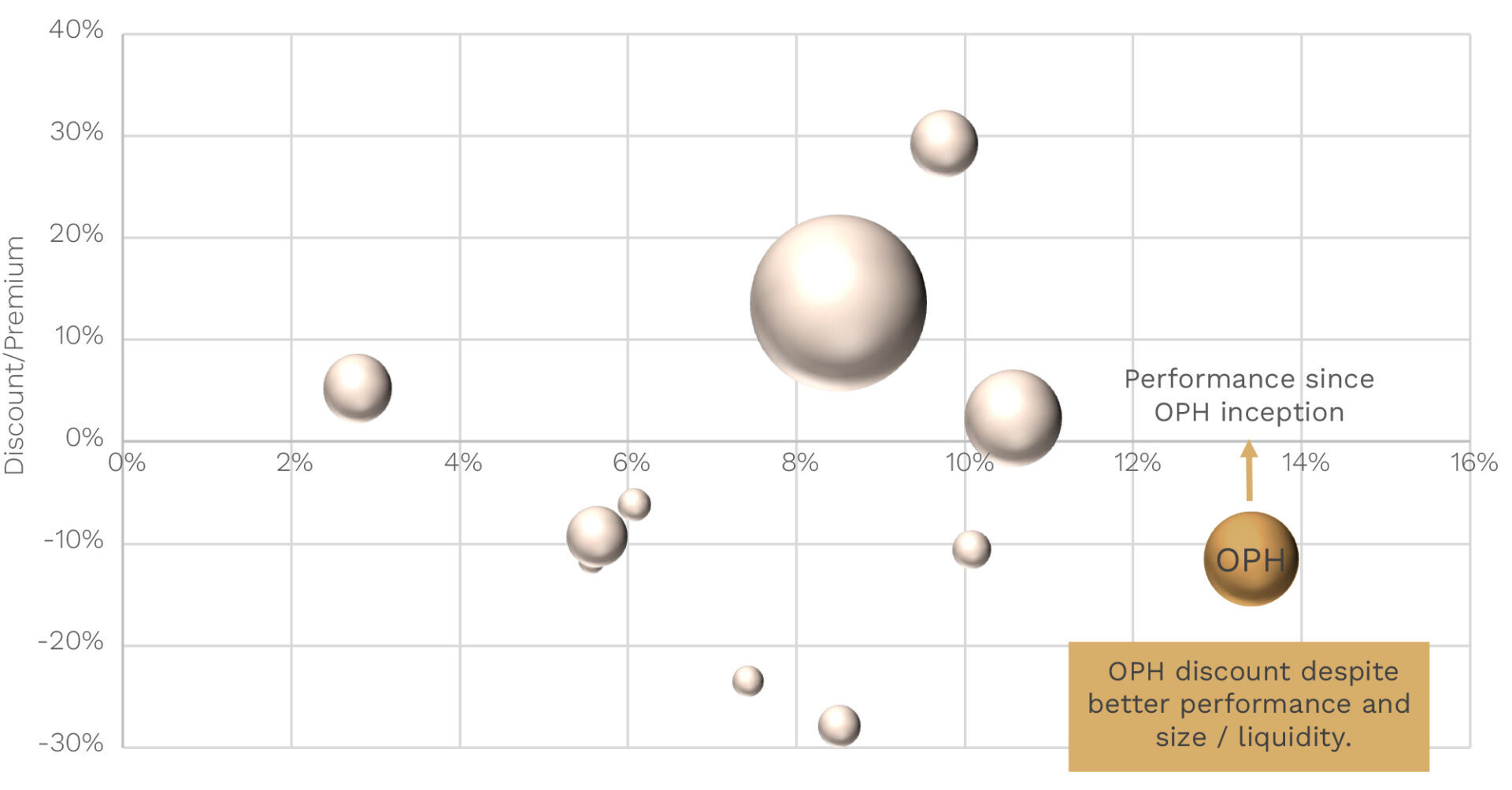

In the chart below, we show on the horizontal axis the total return per annum for all the Australian equity small and mid-cap LICs and LITs on the ASX that have an inception date on or before OPH (August 2015).

On the vertical axis we show the discount or premium for those same LICs and LITs on the ASX towards the end of March this year.

Discount/NAV Performance of OPH vs. Peers

Data from 1 August 2015 (OPH Inception date) to 28 February 2023. Past performance is not a reliable indicator of future performance. The size of bubbles represent the market capitilisation of the LIT/LIC. Discount/Premium as of 24 March 2023 according to Bell Potter data.

As you can see OPH is somewhat of an outlier in that it has the best performance since its inception but it is also currently trading at a significant discount and close to its largest discount since listing.

(The size of the ‘bubble’ represents the market cap of the fund and can be seen as a rough proxy for its liquidity.)

While some investors see the discount and premium to NAV as a risk, we and some other investors see it as an opportunity. On the 31st March, for example, according to Bell Potter data, you could buy $1 worth of assets in OPH for $0.88.

In fact, given the size of the opportunity, we (Andrew and Steven) have been putting our money where our mouth is and investing significant sums into OPH in late March and early April.

Why we listed OPH

Still, given the discount to NAV has only recently widened, which has lowered recent returns for OPH relative to the investment portfolio, it’s understandable that investors might be asking why we even listed OPH in the first place.

There are essentially four key reasons (though the first is the most important):

1. The benefits of the closed-end structure

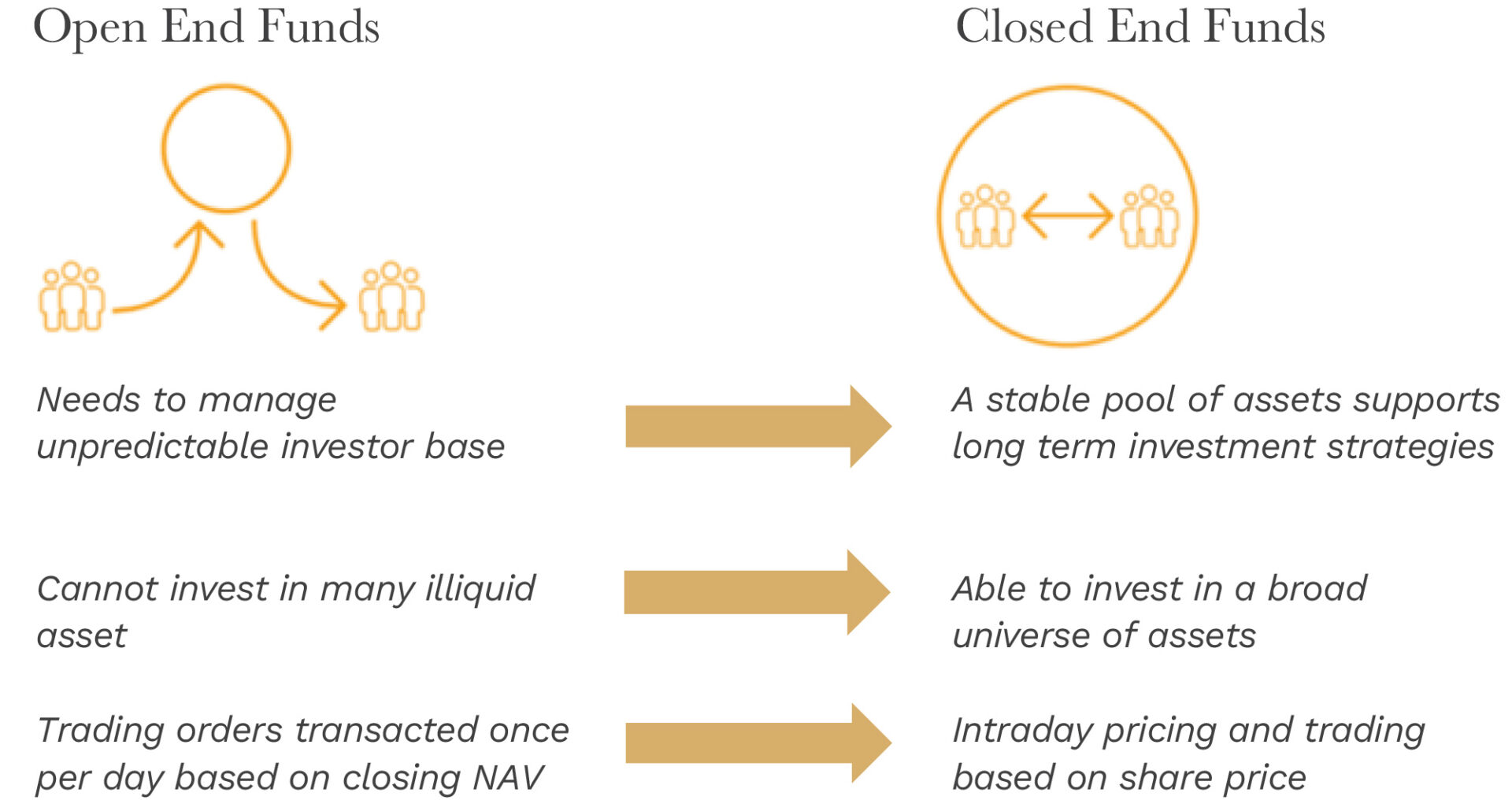

Firstly, we like the ‘closed-end’ structure of a LIC/LIT because it provides a stable capital base for investing.

Investors can buy or sell the fund on the ASX and supply and demand for OPH determines whether it trades at a premium or discount to NAV.

As the table below shows, a closed-end structure – which we achieved by listing the previously unlisted Ophir High Conviction Fund in December 2018 – means the fund’s pool of capital does not grow or shrink when it experiences applications or redemptions.

A stable pool of capital allows us to focus on generating the best long-term returns for investors without, for example, worrying about having to make fire sales of assets during market downturns to fund any redemptions.

Our experience (particularly during the GFC), along with academic evidence[2], suggests this can provide performance benefits to investors. We particularly think this is the case in our area of small caps where liquidity is lower and can be strained for portfolio holdings during market dislocations.

2. Investors can keep buying

Secondly, it allows investors – and us – to keep investing in the fund. We constrain capacity of our funds to assist performance. If you take in too much money, it can hurt investment returns. When the Ophir High Conviction Fund was unlisted, we closed it to new applications in early 2018 after it reached capacity. By listing the fund in late 2018 it allows us and investors to continue investing into the fund without increasing capacity and affecting performance.

3. The buyback mechanism

A LIT structure also allows, through its ‘buyback’ mechanism, a more efficient way to return capital to investors over time. Given our desire to constrain the capacity of our funds, if we continue to outperform our market benchmarks as we have done over the long term, then ultimately, we will have to hand back capital to investors to shrink the funds. We can do this by using the buyback mechanism for OPH to selectively buy back units at a discount to NAV, which shrinks the fund and is performance accretive to existing investors.

4. Buying at a discount to NAV can potentially enhance returns

Finally, a discounted NAV provides opportunities for investors to earn higher returns.

There are two ways this can enhance returns:

- All else being equal, returns are higher buying at a discount. For example, if the investment portfolio through the NAV generates a 15% return (in line with our internal long-term, per-annum target return) on a 15% discount (buy $1 of assets for $0.85), this would provide a 17.6% return ($0.15 return dividend by $0.85 purchase price).

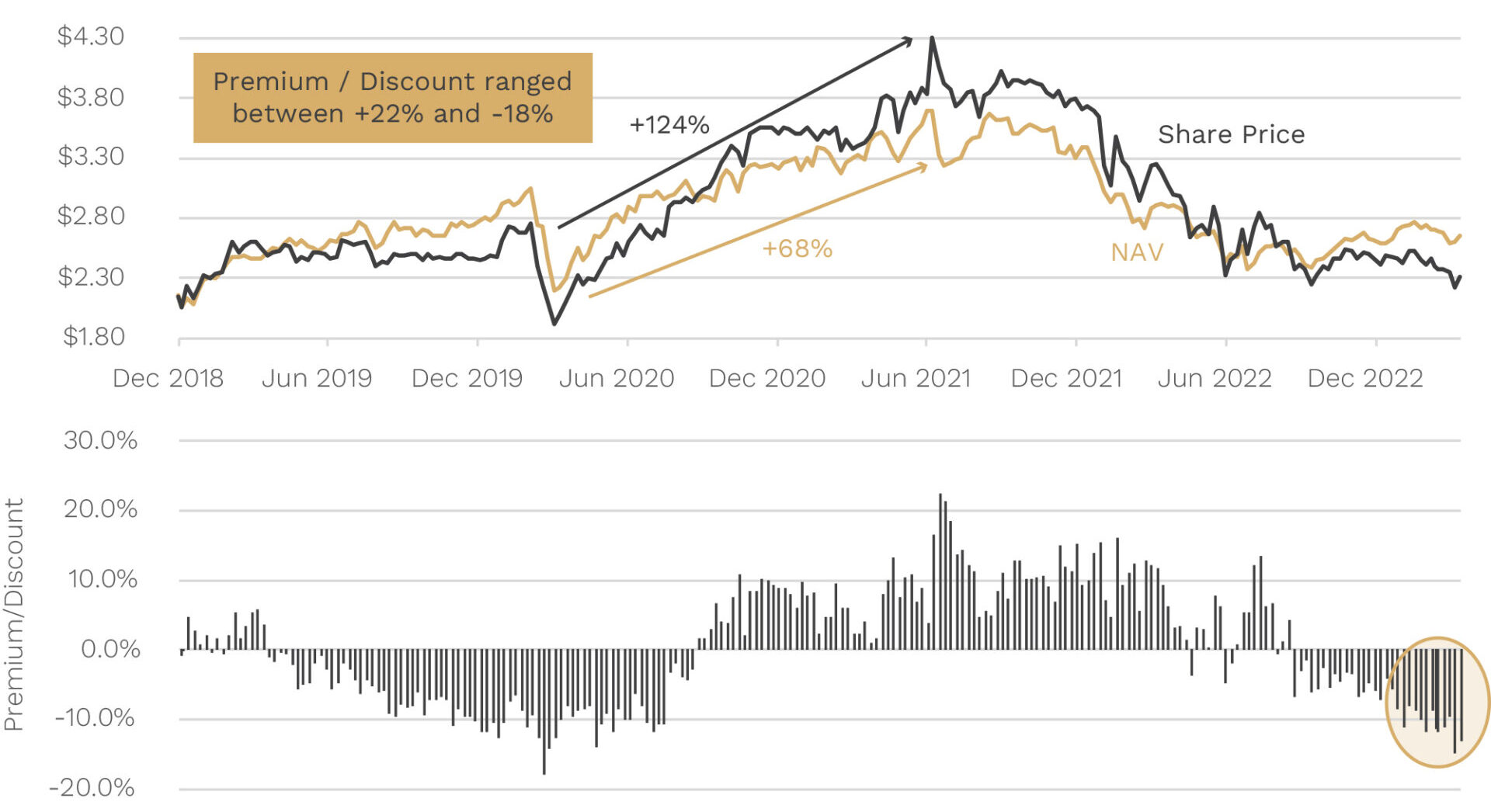

- The discount closes. A key example of this is from March 2020 when OPH was trading on a similar discount of -15% to NAV. By June 2021 the discount had closed and ultimately traded on a premium of over +20% (see bottom section of chart below). Over this period the investment portfolio through the NAV rose +68% but investor returns were significantly higher at +124% as the discount became a premium (see yellow and black lines).

(Note this can go against you if buying on a discount and the discount widens. We have the buyback mechanism in place which can be used to help protect against this, though it is still possible.)

ASX:OPH – Share Price vs NAV

Data as at 31 March 2023. Past performance is not a reliable indicator of future performance.

What are we doing to close the discount to NAV?

If investors see the current discount as an opportunity, as we do given our recent purchases, they may be wondering what we are doing to attempt to close the current material discount to NAV.

We have, of course, experience of dealing with this situation during 2020 when, as mentioned, OPH was trading at a similar discount.

Back in 2020, the discount was caused by three key factors. Firstly, in previous years we had an oversupply of LICs and LITs listing on the market. Secondly, the opposition Federal Labor Party’s proposed franking credit policy in 2019 was affecting sentiment because it would have curtailed the attractiveness of dividends from LICs if they were elected. The third factor was the market sell off during March 2020 related to the Covid epidemic (history suggests premiums shrink and discounts tend to widen during market falls).

Today, the discount is likely caused by the elongated period of this market sell off and low investor sentiment. And while shorter-term investment performance (NAV) of OPH is negative, down -3.9% over the last year to 31 March 2023, it is comfortably ahead of its benchmark which is down -8.6% (ASX Mid/Small Index).

To close the discount last time in 2020 we implemented a three-pronged approach:

- Firstly, we (Andrew and Steven) personally purchased units in OPH to take advantage of the value on offer.

- We also undertook a focussed marketing campaign to increase investor awareness of the opportunity to buy a top long-term performing Australian small/mid cap fund at a significant discount to the value of its underlying assets.

- And, finally, we used the buyback mechanism for OPH to buy units in OPH by the Fund itself.

We are currently undertaking the same approach to close the discount.

As noted, the first prong is being actioned and we will continue to buy personally when we see value on offer. A marketing campaign will also continue over the coming months.

As of writing we have not used the buyback mechanism in this current period to date. But we will not hesitate to do so when the opportunity presents itself.

The long-term view

Ultimately, we would ask our investors to judge us over the long term.

There will be times when the fund trades at a discount and others when it will trade at a premium.

But over the long-term horizon of the fund, we believe that the stable capital base of a listed structure provides a net benefit to investors, as we have found from previous experience.

Combined, the Ophir staff (including ourselves) are in the top 3 largest investors in the Fund, so we are all working hard to ensure it trades as close to the NAV as possible.

[1] Net Asset Value reflects the market value of the underlying investment portfolio.

[2] Edelen, R 1996, Investor flows and the assessed performance of open-ended mutual funds, Journal of Financial Economics.