By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we outline the key reasons for the biggest monthly fall in long term U.S. yields since the GFC, and importantly why this should be good news for small cap valuations.

Welcome to the November Ophir Letter to Investors – thank you for investing alongside us for the long term.

November rains returns

“Nothin’ lasts forever, and we both know hearts can change.” – Astute Investor, Axl Rose

At the time of its release in 1992, Guns and Roses’ ‘November Rain’, at over 9 minutes, was the longest song to ever have entered the U.S. Billboard Chart’s Top 10.

Investors could also have been wondering for how long the most recent share market sell off, which started in August, would last. The Russell 2000 (U.S. small caps) was down almost -20% near the end of October as 10-year bond yields ratcheted up from 4% to around 5%.

But as Guns and Roses lead Axl beautifully puts it in the song: “Nothin’ lasts forever, and we both know hearts can change”.

And they did in November. In a BIG way.

November literally ‘rained’ share market returns, with the S&P 500 finishing up +8.9% for the month. That’s its 7th best month of the last 30 years and its 6th best November in the last 100 years.

It was beaten again, though, by tech stocks. The Nasdaq was up an even better +10.7%. U.S. small caps (Russell 2000) followed closely behind, up +8.8%.

Japanese and European markets gained +8.5% and +7.9% respectively (Nikkei 225 and Euro Stoxx 50).

However, the Aussie share market lagged. Though it still put on a healthy +6.9% and +4.3% each for small and large caps (ASX Small Ords and ASX100).

November 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during November. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned 7.2% net of fees in November, outperforming its benchmark which returned 7.0%, and has delivered investors +20.6% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned 6.0% net of fees in November, underperforming its benchmark which returned 6.2%, and has delivered investors +12.2% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -0.9% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned 5.2% net of fees in November, outperforming its benchmark which returned 4.8%, and has delivered investors +11.7% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

What was the catalyst for this return deluge?

You guessed it. It was the bond market, again.

U.S. 10-year government bond yields collapsed, falling from 4.93% to 4.33%, giving back almost three quarters of their gains over August to October in the single month of November.

It was the biggest monthly fall in long-term U.S. yields since the GFC.

That led to some of the smaller and growth-orientated parts of the market playing a little catch up. The Russell Microcap Growth index and the Goldman Sachs Non-Profitable Tech index rose +11.0% and +20.3% respectively in November.

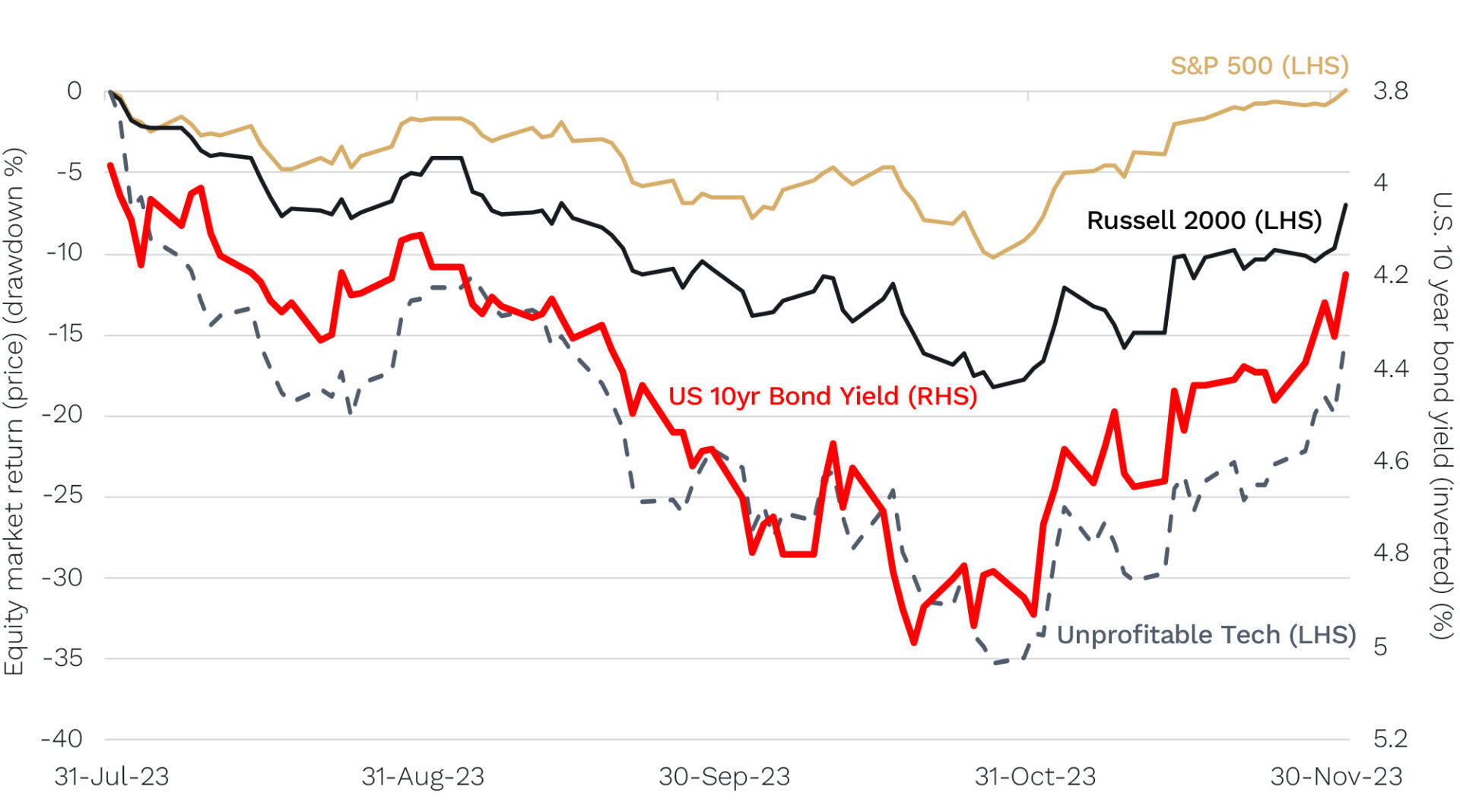

Equities rebound as bond yields fall

Source: Bloomberg. Data from 31 July to 1 December 2023.

So why did long-term bond yields fall (causing a corresponding rise in equity markets)?

Two key reasons stand out:

- Firstly, in early November, the U.S. Treasury announced that they would be issuing less debt at longer-term horizons, which helped push up long-term bond prices and therefore pushed down their yields.

- Secondly, in mid-November, a softer-than-expected October U.S. CPI print was released. The market now expects the Fed to start cutting rates sooner than previously thought, a change reflected in longer-term interest rates.

The crucial point for our investors is that it’s becoming increasingly clear that we are likely at – or very close to the end of – the interest-rate-hiking cycles in major economies.

Market pricing suggests central banks’ next move will be cutting rates in the U.S, Canada, Europe, the UK and Australia.

This, along with continuing disinflation across these economies, should limit the upside in longer-term bond yields.

The good news is that this should end the compression of company valuations in the small cap market in which we invest (from higher rates), which we have seen over the last couple of years.

Q3 reporting season – Guidance in our portfolios remains resilient despite broader bearishness

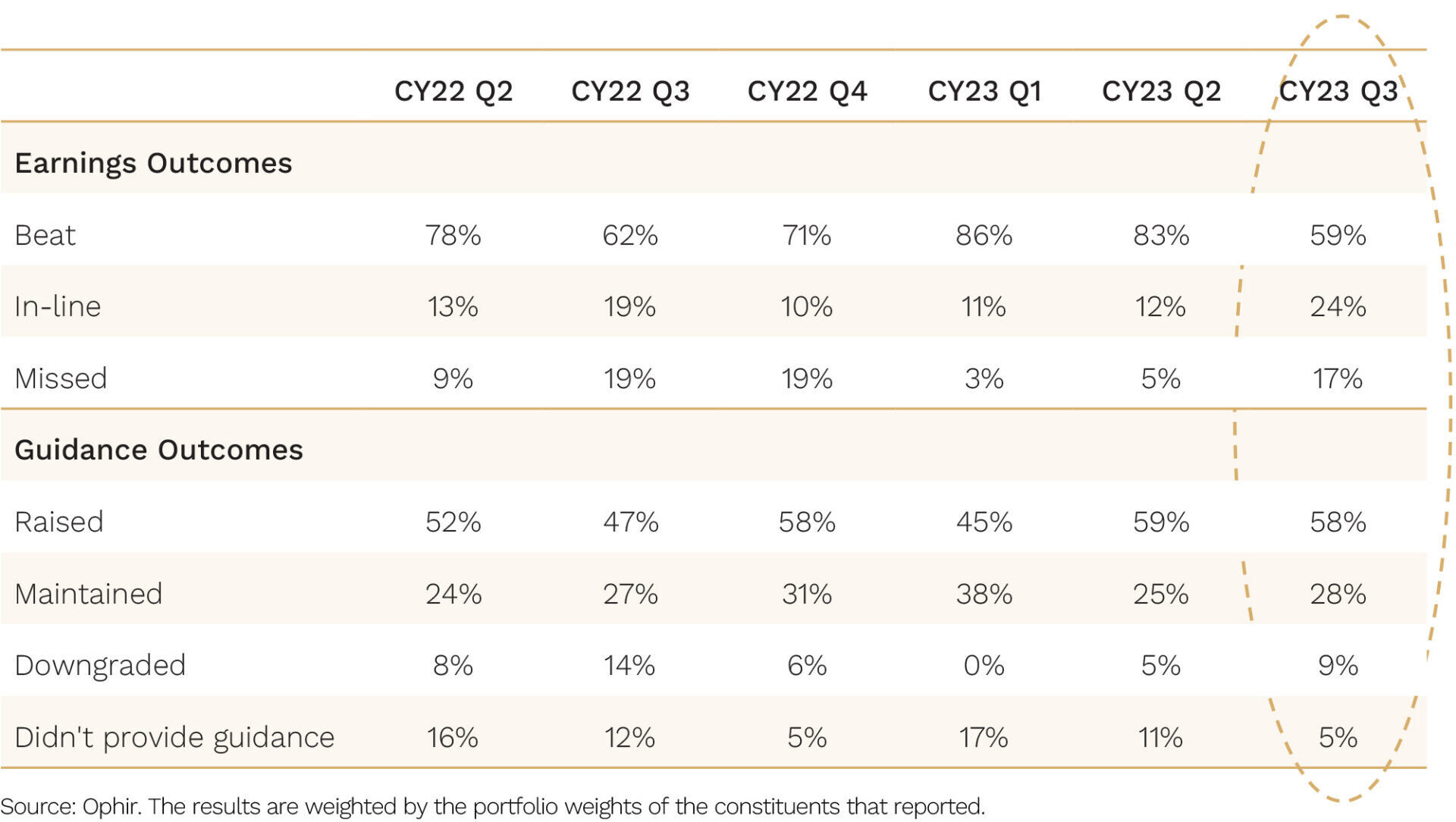

In November we wrapped up our Q3 company reporting season for our Global Funds.

In the table below, we show the percentage of the Global Funds that reported earnings beats versus misses (compared to market expectations) and earnings guidance raised or downgraded (again compared to market expectations).

Ophir Global Funds’ Reporting Season Outcomes

While there was a lower level of beats, and a higher level of in-line earnings results, we were pleased our funds were able to maintain their elevated level of earnings guidance raises.

In a market where there is heightened uncertainty about next year’s economic growth, it is also great that we have avoided a pickup in guidance downgrades. Our skew towards businesses with more resilient earnings has helped.

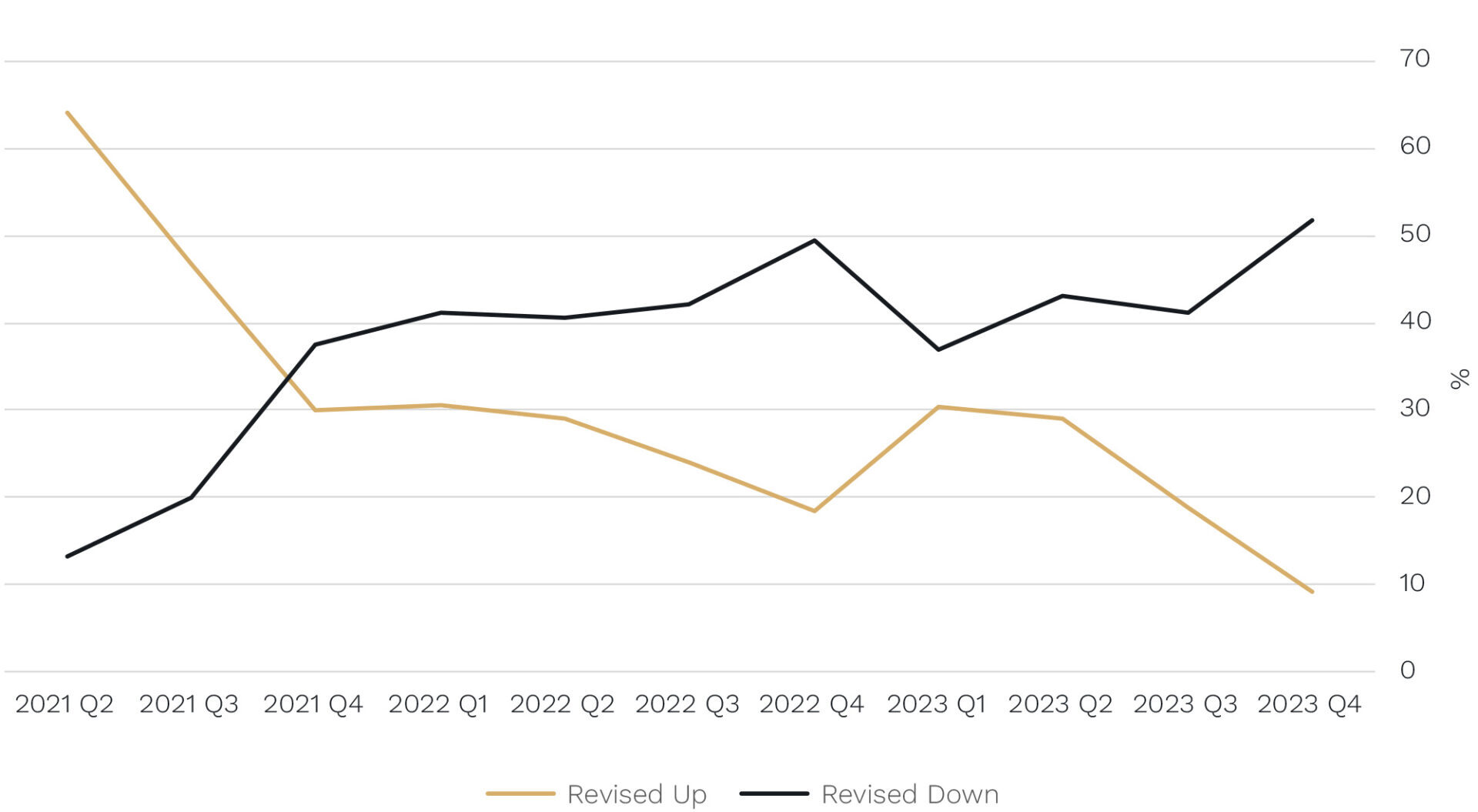

These achievements are particularly pleasing because there have been fewer upgrades of company fundamentals (revenues and profits) and more downgrades in the broader market.

As you can see below, companies in the S&P500, who are at the coalface, see slowing ahead. Only 9% of businesses upgraded their revenue guidance for Q4 – a cyclical low.

% of S&P500 companies seeing revenue upgrades versus downgrades for Q4

S&P500 Next Quarter Revenue Guidance

Source: Bloomberg

A distinct slowing

It really feels like a case of the ‘haves’ and ‘have nots’ at the moment.

Anything AI related is getting a valuation boost, and in some cases an early boost to earnings (e.g. Nvidia).

But for cyclical and retail-exposed businesses things are getting tougher.

It’s not a hard landing (yet at least). But there is a distinct slowing underway.

Take, for example, these recent comments from bellwether companies in the U.S:

- Dollar Tree (budget retailer and 19th largest U.S. retailer) CEO Rick Dreiling – “We experienced softening trends throughout the quarter, particularly in October, as lower-income consumers responded to the accumulated impact of inflation and reduced government benefits, we saw a notable pullback in spending, particularly in higher margin discretionary categories.”

- Dollar General (budget retailer and 17th largest U.S. retailer) CEO Todd Vasos – “Our customer continues to tell us they are feeling significant pressure on their spending which is supported by what we see in their behaviour. Based on these trends and what we see in the macroeconomic environment, we anticipate customer spending may continue to be constrained as we head into 2024, especially in discretionary categories.”

- Target (7th largest U.S. retailer) CEO Brian Cornell – “Overall, consumers are still spending, but pressures like higher interest rates, the resumption of student loan repayments, increased credit card debt and reduced savings rates have left them with less discretionary income, forcing them to make trade-offs in their family budgets. Guests who previously bought sweatshirts or denim in August or September are deciding to wait until the weather turns cold before making a purchase. This is a clear indication of the pressures they’re facing as they work to stretch their budgets until the next paycheck”.

Small Cap ‘catch up’ likely ahead

The economic outlook, of course, is a key factor in market direction.

As we discuss in this month’s Investment Strategy Note, short-term market direction (over the next 6-12 months) remains highly dependent on whether or not the U.S. goes into recession. It is definitely worth a read.

The good news for small-cap investors is that valuations, in general, remain cheap, particularly in the United States. That bodes well for future returns.

The extent to which small-caps have underperformed large caps has been stunning over the last couple of years, both globally and in Australia.

But mean reversion is a powerful force in investing. And recent trading in November and December suggests that, when it becomes clear we have started the next sustainable bull market, there is likely to be a period of small cap ‘catch up’.

A farewell to Charlie

The other big news of November was the passing of legendary investor, Charlie Munger, Warren Buffett’s business partner and right-hand man at Berkshire Hathaway.

Munger passed away last month at the ripe old age of 99, a month shy of his 100th birthday.

We thought we’d end with a Charlie quote. There are so many great ones, but we love these words on business success:

“You can be very deserving and very intelligent, very disciplined, but there’s also a factor of luck that comes into this thing. And the people who get the outcomes that seem extraordinary, they’re the people who have discipline and intelligence and good virtue plus a hell of a lot of luck.”

Great advice: Hard work, intelligence + luck.

We keep putting in the hard work, every day. And we have surrounded ourselves with intelligent people at Ophir.

As for luck, we feel incredibly lucky to have met many wonderful and loyal investors who have placed their trust and capital alongside ours in the Ophir Funds.

Thank you and Merry Christmas

There is no doubt that the last couple of years have been some of the most challenging here at Ophir in our investing lives. Whilst large caps have been spared somewhat, it has been a small cap “GFC” of sorts.

But valuations in small caps are now cheap, to screamingly cheap in some cases, and the headwinds of rising interest rates and inflation looks to be largely over, key milestones for an eventual recovery.

As we close out 2023, we thank you again for your support.

We could not do this without you.

We wish you a relaxing holiday period surrounded by family and friends.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.