By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

We discuss the grudge match currently playing out that could shape the direction of share markets over the next year. In the blue corner: AI and mega-cap tech. In the red corner: The Fed.

Welcome to the May Ophir Letter to Investors – thank you for investing alongside us for the long term.

Share market grudge match: AI hope versus recession fears

It’s been well covered, including by us (click here for last month’s Letter to Investors), that the market rally so far this year in the US has been driven by a handful of mega-cap tech companies.

Well, the market kept playing that same tune in May, but even louder, with AI-themed stocks, particularly the largest, riding that rocket even higher.

Nvidia, the semiconductor company[1] that makes the ‘picks and shovels’ (read advanced chips) for data-hungry generative AI businesses, came out during May and said it now expects to make $US11 billion of sales this quarter. That’s way above the $7 billion consensus estimate. Its stock shot up 25% the next day.

Nvidia’s market cap has breached US$1 trillion and the stock is now the fifth-largest company in the S&P500 index.

It is rare for such a large and highly covered company to surprise the market so much and it shows that US large caps are not always a highly efficient market.

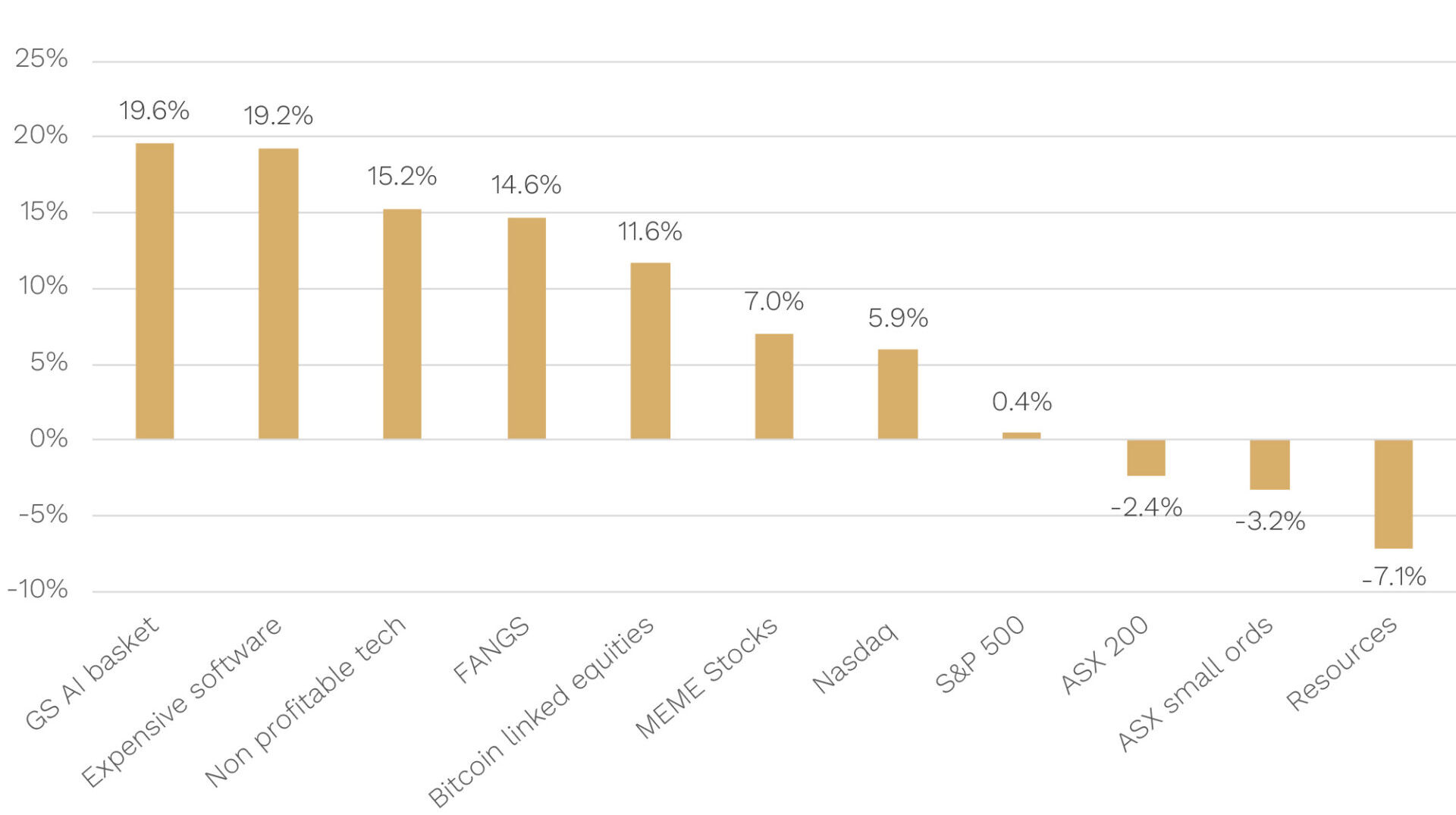

As seen below, Goldman Sach’s AI-themed basket of stocks led the share market winners in May, up +19.6%. This was in stark contrast to the S&P500, though, which barely moved (up just +0.4%) and the local Aussie share market which fell (ASX200 -2.4%).

Tech Leads Market in May

Source: FactSet. Data as at 31 May 2023.

This has set up an interesting boxing match for share market leadership.

Will the benefits of AI, and its broad application across industries, continue to push share markets higher? Or will the looming recession risks from central bank rate hikes win out, with markets eventually capitulating this year?

Below, we go through the pros and cons of each side, the prize they are fighting for, and who we suspect may win out.

May 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during May. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -0.6% net of fees in May, outperforming its benchmark which returned -3.3%, and has delivered investors +21.1% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +0.2% net of fees in May, outperforming its benchmark which returned -1.6%, and has delivered investors +13.0% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -6.0% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -0.9% net of fees in May, outperforming its benchmark which returned -1.0%, and has delivered investors +13.4% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

In the blue corner: AI and mega-cap tech

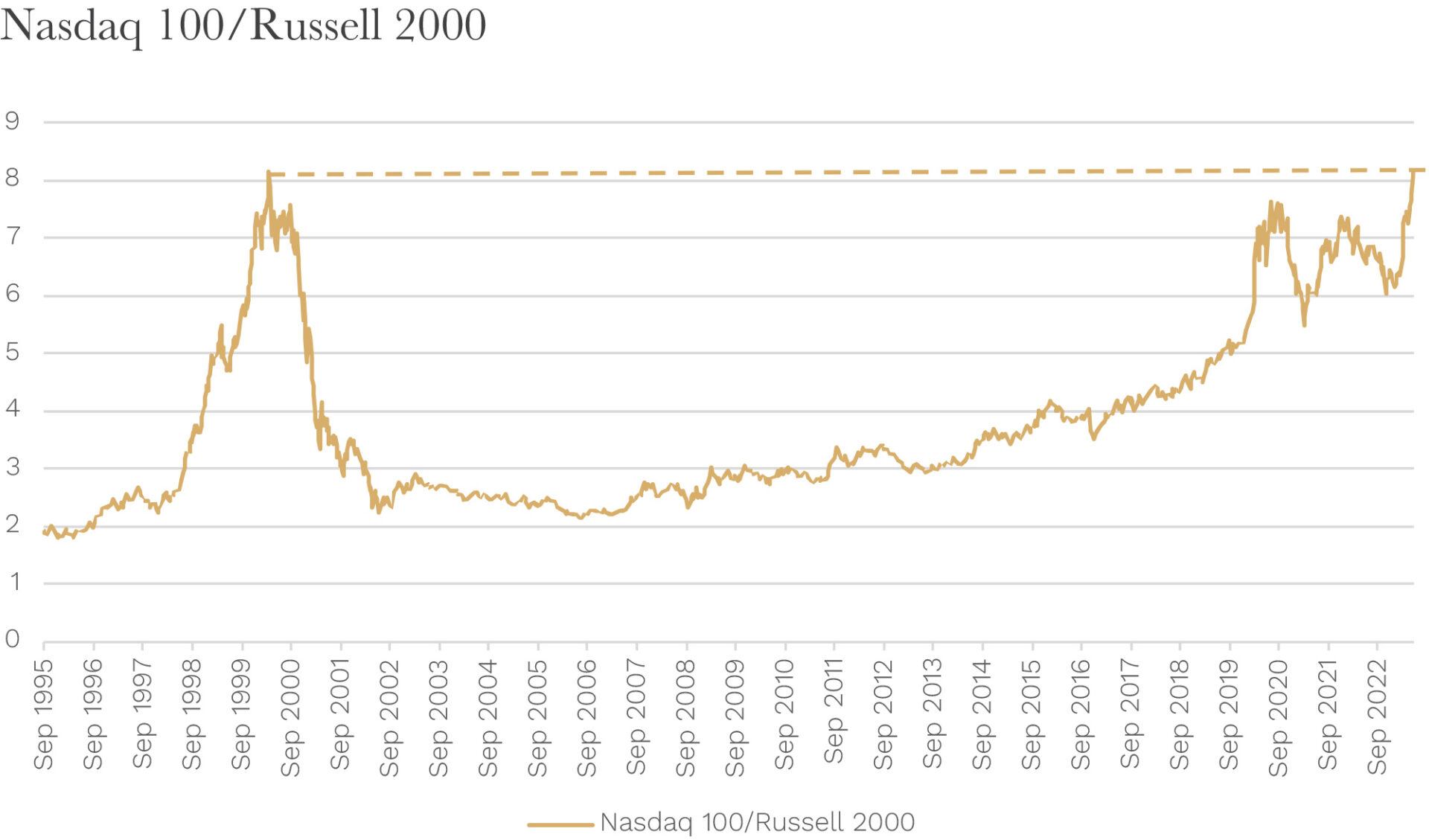

In early June, the chart below captured attention among professional investors.

It shows how the ratio of the Nasdaq 100 index (of the largest tech companies listed in the US) compared to the Russell 2000 index (of US small cap companies) is now back to its Dot Com bubble peak.

U.S. Tech v Small Caps Back to Dot Com Highs

Source: FactSet. Data as of 31 May 2023.

It got there due to share-price gains of tech stocks, such as Nvidia, Microsoft and Google, that are winning big, or predicted to win big, from the adoption of AI.

At face value, this chart may trigger worries that a ‘Dot Com Bubble 2.0’ may be on the cards. (As an aside, from their March 2000s bubble high, the Russell 2000 outperformed the Nasdaq 100 by a huge 90.3%, or 6.6% per annum, over the following 10 years.)

There are key differences this time, though:

- Firstly, the Nasdaq 100 trailing PE (price to earnings ratio) peaked at 115x in the Dot Com bubble, whilst today it is at a still-high but much more reasonable 34x.

- Secondly, last time during the Dot Com bubble, the high-priced large-cap leader, Cisco, saw its forward PE peak at 125x, while leader this time Nvidia is trading on a more modest 49x.

For us, the conclusion, at least so far, is that this time there is more substance, or earnings, behind the relative move higher in the leading technology-based stocks when compared to small caps.

The excitement behind AI is real. We believe AI can been applied across many industries which will meaningfully enhance productivity.

Goldman Sachs recently produced research which suggests that, under their baseline scenario, AI adoption would:

- Increase US productivity by 1.5% per annum over a 10-year period

- S&P500 earnings per share growth would rise by an additional 0.5% per annum over the next 20 years, and

- The fair value of the S&P500 today would rise by 9%.

Of course, it is early days and it’s still very uncertain how this will play out. Will, for example, there be any major policy response by governments, including direct regulation, or through labour market or tax policies?

In the red corner: The Fed

All the salivation over the long-term benefits of AI stands in stark contrast to the looming economic slowdown and recession risk potentially ahead in the next 6-12 months.

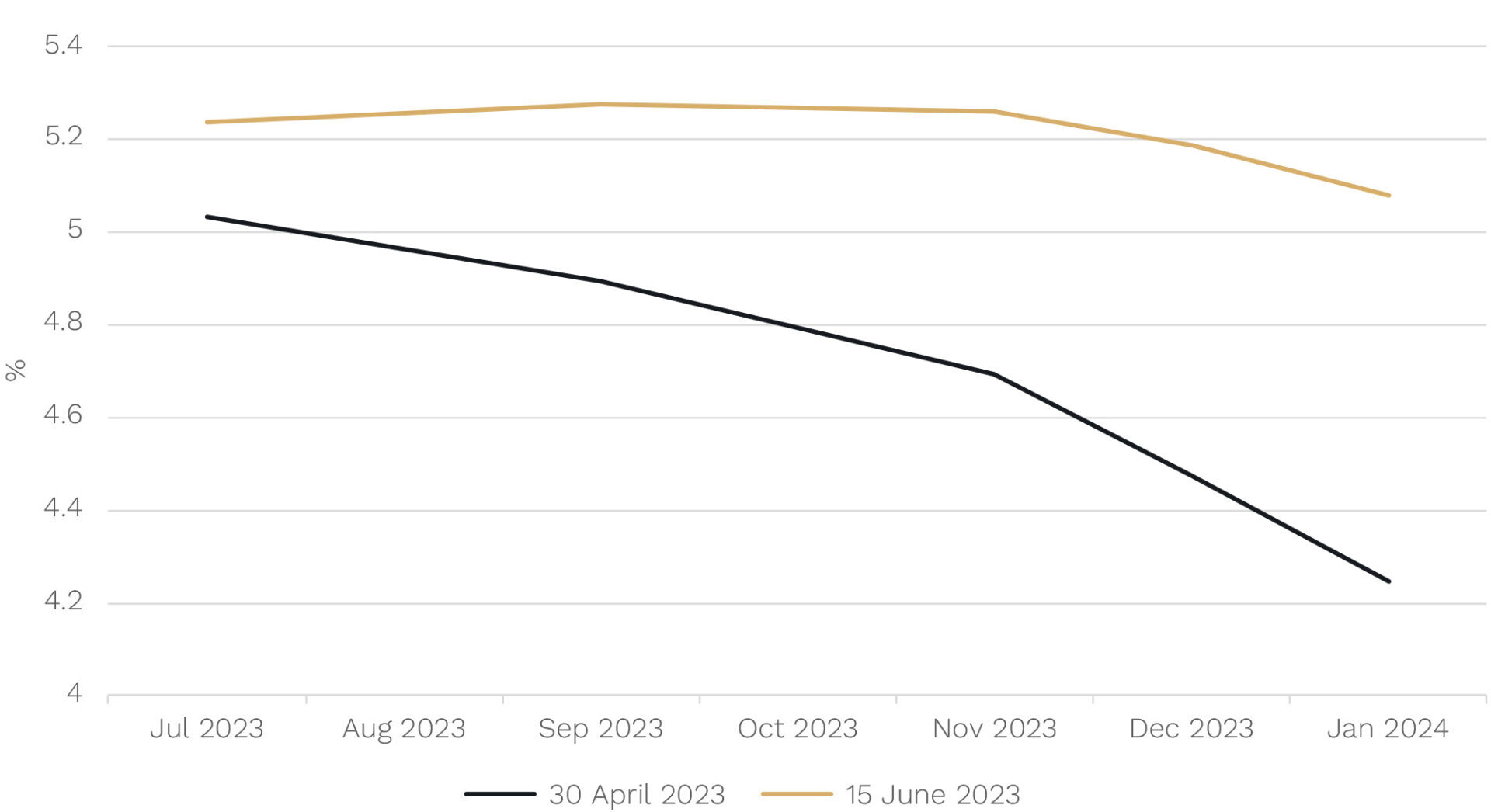

Many thought the key central banks’ interest rate hiking cycles were done (or nearly done) and that rate cuts might be around the corner. But it is clear investors may need to be more patient.

Stickier U.S. inflation, a stronger-than-expected labour market, and generally more hawkish Fed commentary, has seen markets change their tune over the last month. They now see one more rate hike coming. But, more importantly, the probability of rate cuts has now been pushed out further and into 2024.

Rate cuts move from a 2023 to 2024 story

Source. FactSet.

This is keeping the probability of a recession in the next year high in the U.S. (Bloomberg consensus is 65%), with consensus predicting the economic contraction to be in Q3 and Q4 this year.

As we highlight in our Investment Strategy Note this month, in all twelve U.S. recessions since World War 2, the US share market has not bottomed until after the recession start date.

This suggests there is still significant downside risks for the U.S. share market and, because of the U.S. market’s significance, for global share markets.

The “Share Market Prize”

The prize of this grudge match, the direction of share markets over the next year, is an interesting one given markets face a critical juncture.

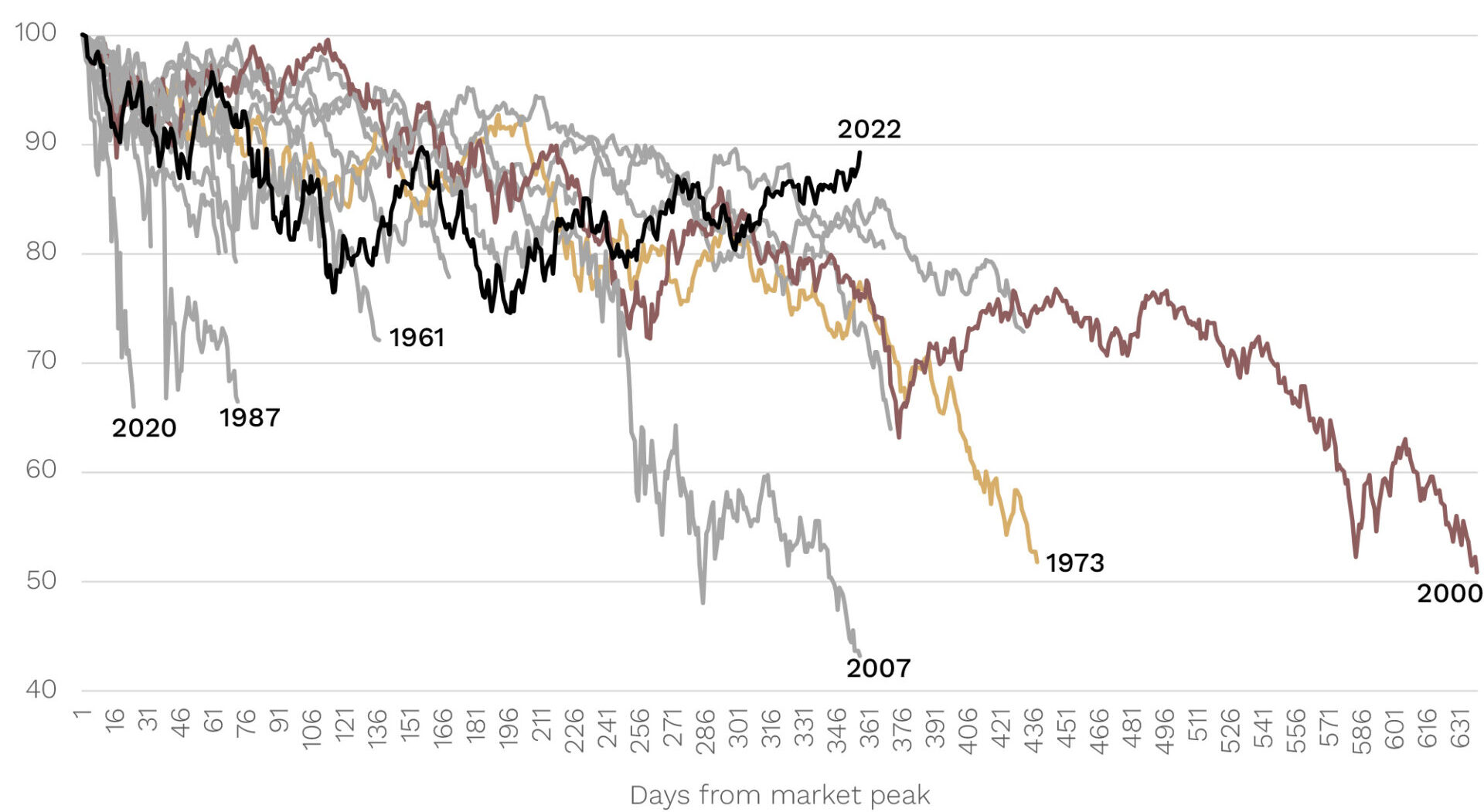

The S&P500 index fell into bear market territory last year (down more than -20%), reaching its maximum drawdown (at least so far) of -25% in October 2022.

Then in early June this year, it cracked a +20% gain from that October low.

Many define this +20% gain as the start of a new bull market.

So, is the bear dead? Or long live the bear?

As we show in the chart below, on the positive side, this has been one of the longer bear markets on record, suggesting a sustainable recovery may not be too far away. The longest bear market only went for a further nine months (i.e. 2000).

However, on the negative side, the 1973 and 2000 bear markets went for longer and fell further. The 1973 bear market economically shares some similarities as it was also a period of high inflation and oil prices. There was a U.S. recession courtesy of interest rate hikes in 1973/74 and the market fell a further 25-30% from the equivalent of where we are now.

Current v Prior Bear Markets – S&P 500

Source: FactSet. Data to 2 June 2023.

Ultimately, when and to what extent companies can realise the benefits from AI is very uncertain and as a result unlikely to be fully priced into companies at present.

The lesson of history is that if the U.S. was to go into recession, the S&P500 is much more likely to be swayed by the current economic data than the longer term, but highly uncertain, benefits of AI.

For us, the economic cycle is highly likely to win out in the short term in this match up.

Practically, this means we are not chasing the narrow and AI-dominated rally in markets. We have no doubt that there will be many long-term winners from AI.

It is also likely, though, that many stocks will be priced like the winners … but turn out not to be.

The dot com era showed investment success will be just as much about avoiding stocks whose valuations come back to earth when their earnings do not live up to the hype.

As long-term investors would be aware we are not thematic driven investors. That is, we don’t seek to identify themes driving investment markets in advance such as AI, telemedicine, cloud computing or electric vehicles. There is reams of this information produced by consulting firms such as McKinsey or Bain on these topics that is available to all investors.

It is not that we don’t think there will be big winners in each of these areas. Undoubtedly there will be. It’s just that many of the best investors already know about it.

We’d prefer to get our ideas directly from companies talking about their business or providing insights about their listed suppliers or customers (for B2B businesses). We believe these insights and the opportunities they reveal are more likely to be private and not priced by the market. It doesn’t mean we won’t hold businesses that are benefiting from AI (we hold some already where that is likely to be the case) just the path of finding them is different.

The bottom line for us though is this doesn’t change the fact that the economic cycle matters for markets.

With heightened recession risk in the U.S., and advanced economies more broadly, we continue to position our Funds in companies with more resilient earnings with less economic growth sensitivity.

The good news: history suggests U.S. recession or not, a sustainable and inclusive bull market in shares is likely not too far away.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.

[1] Semiconductor companies are some of the most direct beneficiaries of generative AI because of the massive computing power necessary for the large-language model algorithms to attempt to replicate human thought.