By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we discuss why we don’t believe there is enough evidence that the recent rally in U.S. large caps (S&P 500) is the start of a new bull market.

Welcome to the April Ophir Letter to Investors – thank you for investing alongside us for the long term.

It’s an iceberg market

What worries?

We all thought share markets had a list of worries as far as the eye can see, from inflation, interest rates and slowing growth.

But during April they casually shrugged off those fears and anxieties and generally headed higher.

The MSCI World index (in USD) was up a healthy 1.8% during the month.

It was boosted by Japan (Nikkei up +2.9%), Europe (MSCI Europe up +2.6%), the US (S&P500 up +1.6%) and Australia (S&P/ASX 200 up +1.9%) all rising.

Not all markets, though, finished in the green.

U.S. small caps (Russell 2000 down -1.8%) and Chinese equities (MSCI China down -5.1%) both lost ground.

It’s been a strong start to the year for equities in general.

The MSCI World index is now up over +8% and the S&P500 up +9.2% to the end of April.

Investors only gazing at the sunny headline results for those key indices we just mentioned might surmise that markets have packed up all their troubles in their ‘old kit bag’ and are smiling all the way to a new bull market.

But all is not what meets the eye.

Unfortunately, like an iceberg, there is way more going on below the surface. Despite major share market indices rising strongly this year, many stocks remain underwater (down on the year).

The current market could lure investors, unaware of the dangers lurking, into a false sense of safety and optimism.

In this month’s Letter, we’ll touch on bad market breadth (how much of the market is participating in a rally or a sell off), and what history has to tell us about what that means. Is this rally sustainable or merely a bear-market bounce?

And we’ll also touch on how U.S. Q1 reporting season has started and some key insights so far. That includes a look at how consumers in the U.S. are holding up and where rich Americans are choosing to dine.

In terms of portfolio positioning across our funds we still remain incrementally cautious without making any outsized macro bets as we head into what historically is usually a comparatively weaker period in the calendar for share markets.

April 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during April. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +3.7% net of fees in April, outperforming its benchmark which returned +2.8%, and has delivered investors +21.4% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +2.6% net of fees in April, underperforming its benchmark which returned +3.1%, and has delivered investors +13.2% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +8.7% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +1.9% net of fees in April, outperforming its benchmark which returned +1.5%, and has delivered investors +13.9% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

To the few go the spoils

Currently size is the big winner in the world’s largest share market, the U.S.

That is, the biggest companies have dramatically outperformed smaller companies. JP Morgan said by some measures this is the narrowest market leadership in a rising market since the 1990s, which has implications for the longevity of this rally.

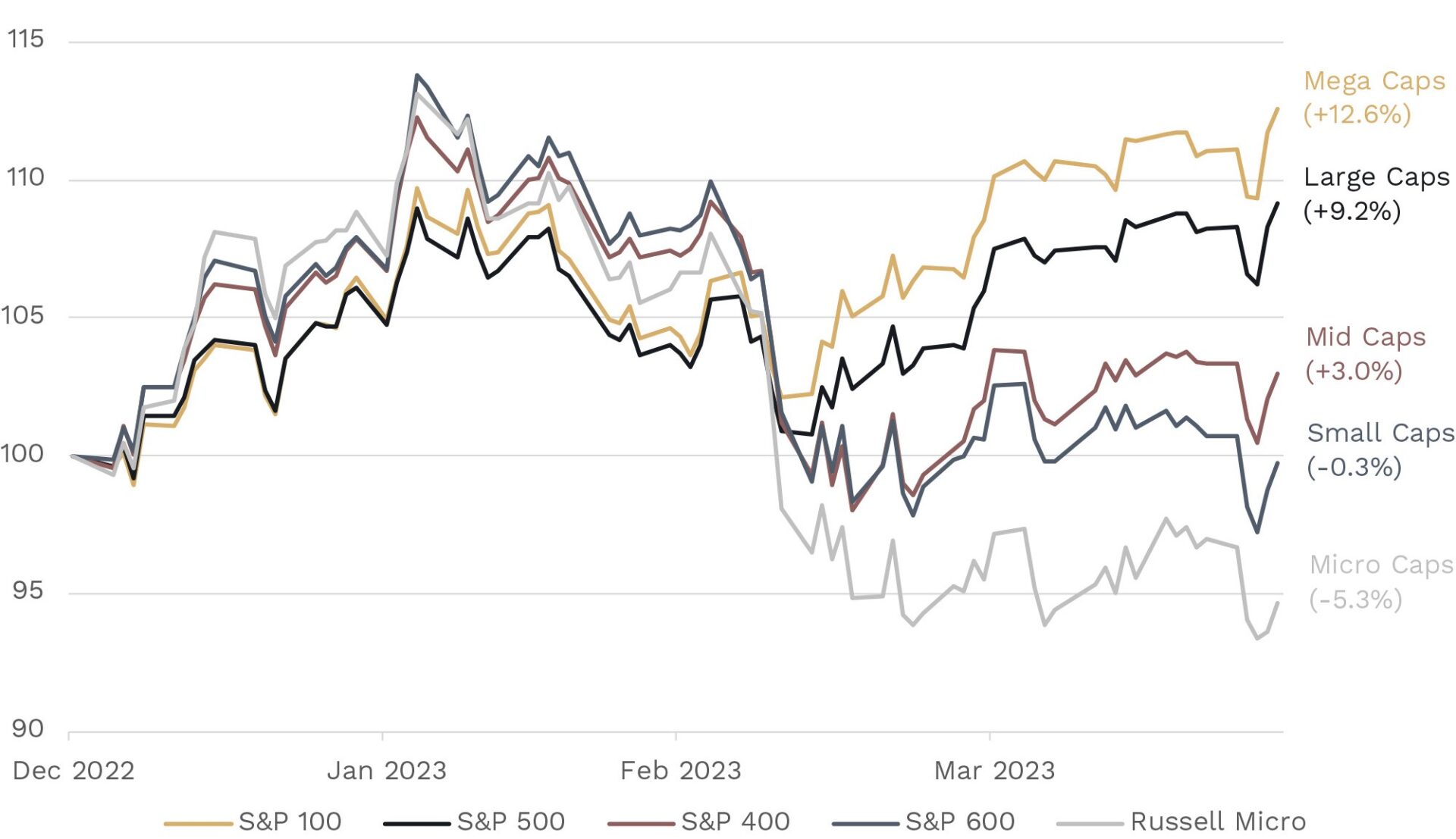

This divergence began in early March when Silicon Valley Bank collapsed. Markets dramatically repriced the number of interest rate hikes left this cycle by the Fed. Micro, small and mid-caps sat out the rebound over late March and April (see chart).

But the key indices that most investors follow are market-cap weighted and they are therefore influenced most heavily by the biggest businesses in the world.

So investors could be forgiven for missing that most stocks have actually not participated in this rally.

2023 YTD Price Returns By Index Size

Source: Factset. Data to 30 April 2023.

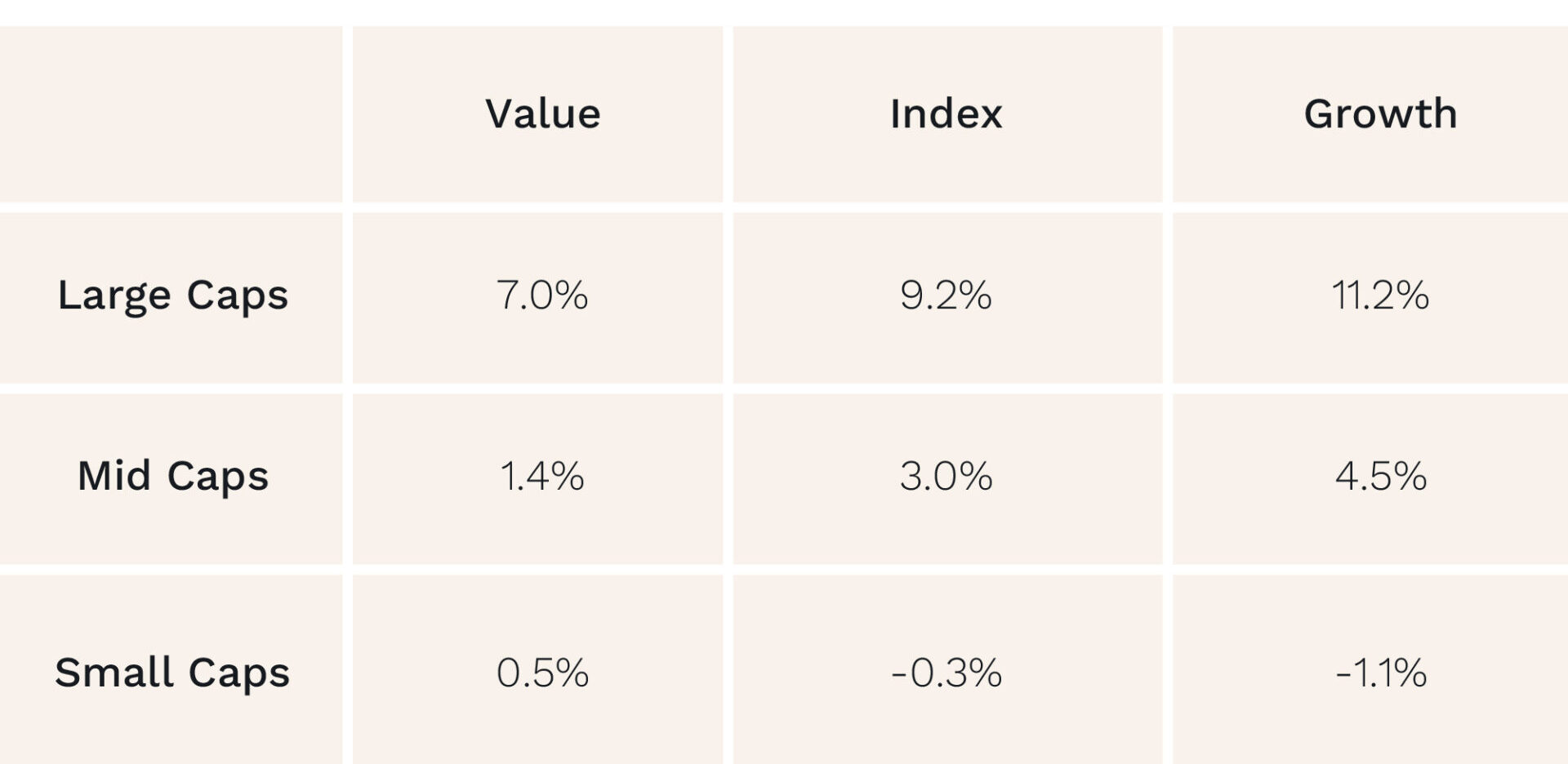

Looking under the surface further, below we break down US share market returns for the four months to the end of April by both size and style. Regular readers will recognise we’re updating the same table we provided last month.

What you can see is that:

- Large caps are the standout winner.

- Growth has been the best style for large caps, but the worst for small caps.

U.S Share Market YTD Returns – By Size and Style

Source: Factset. Data from 1 January 2023 to 30 April 2023.

Liquidity from investors has clearly gone to the biggest and most growth-orientated companies in the world for several reasons:

- A flight to safety on the back of the US regional banking issues.

- Lower long-term bond yields increasing valuations for mega-cap tech companies, reversing some of the valuation compression from the second half of 2022 as a result of higher rates.

- Increased optimism around generative artificial intelligence (AI) and Large Language Models (LLMs) that many investors expect a number of mega-cap tech companies to benefit from.

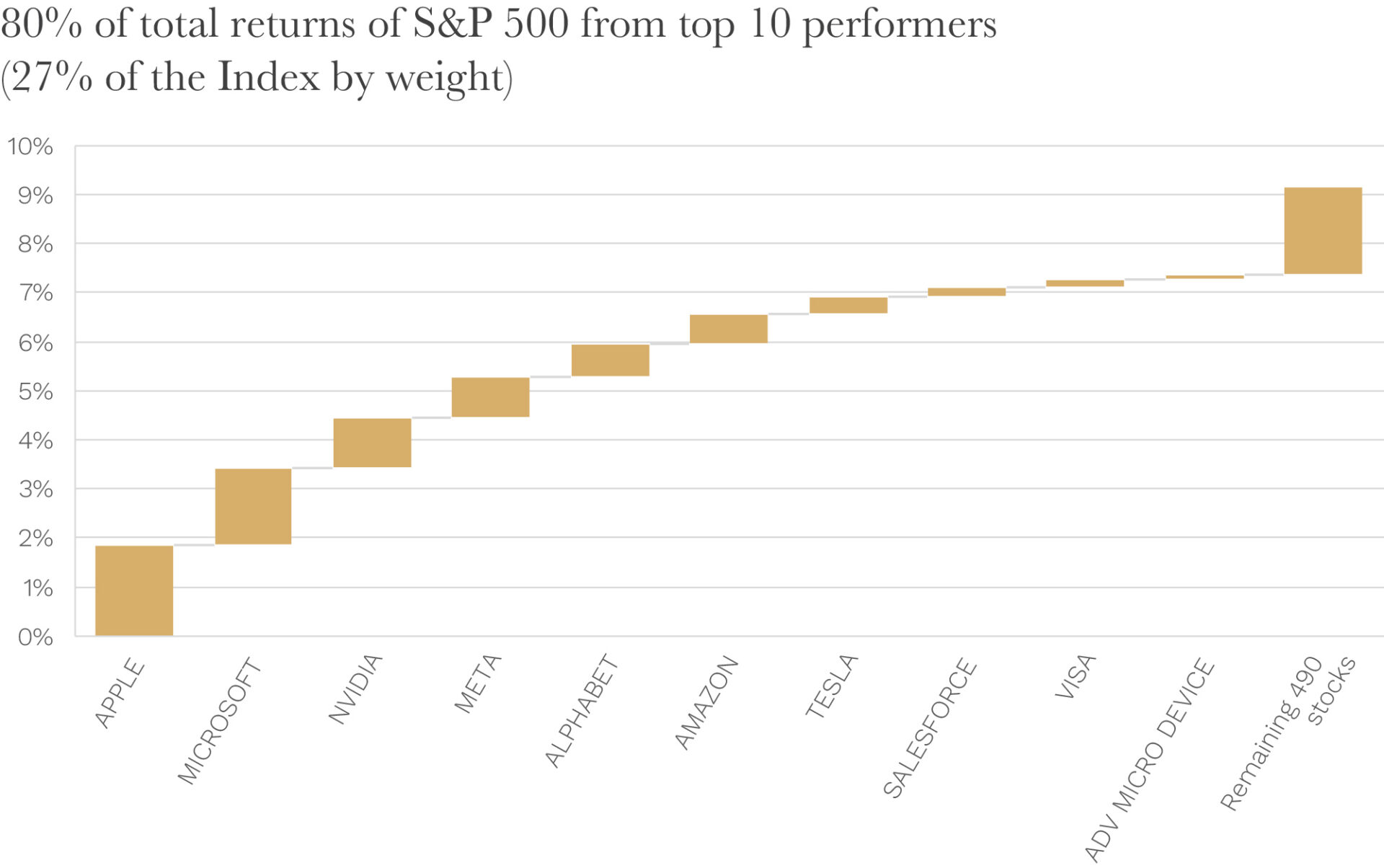

A small sliver of behemoths

But even within U.S. large caps (as measured by the S&P500 index), returns have been driven by a small sliver of gigantic-sized companies.

Below, we show the top 10 contributors to the S&P500’s 9.2% total return this year. The top 10 have driven 7.4% of that 9.2% return (80%), even though they make up only 27% of the index by weight. Those top 10, mostly household names, are up on average 41% this year, whilst the other 490 members of the S&P500 are up on average a paltry 2.5%.

Why does all this matter?

With share markets like the U.S., Europe and Australia having risen from their lows in the second half of 2022, many are asking: has a new bull market for shares started?

Small Number of Mega Cap Companies Driving Market Returns

Source: Factset

Maybe not a new bull market

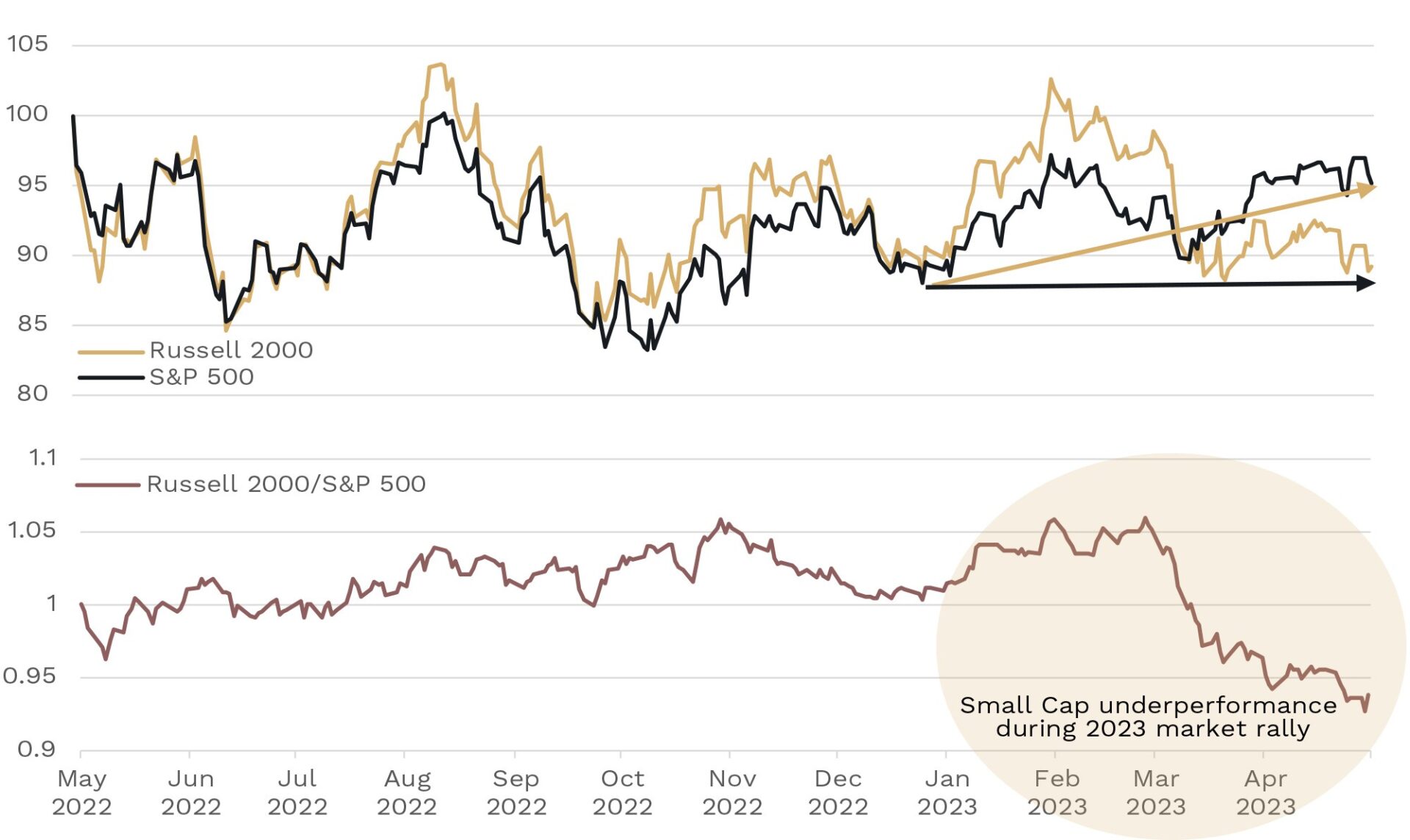

A major problem is that, based on history, this rally should be broader if we are to be confident this is the start of a new bull market.

As we’ve noted above, and as you can see below, this recent rally in U.S. large caps (S&P 500) has been accompanied by dramatic underperformance in U.S. small caps.

U.S. Small Caps Significantly Underperform U.S. Large Caps from Early March 2023

Source: Factset. S&P 500 and Russell 2000 indexed to 100 at start in top chart.

During bear markets (greater than 20% falls in the S&P500 index), whether accompanied by a recession or not, you tend to see small caps underperform going into the market fall … but then small caps outperform in the recovery, which kicks off the new bull market.

The strong share market returns we have seen so far in 2023 from global equities have been narrowly driven, which is not what tends to happen at the start of new bull markets.

We would expect a greater number of companies, including small caps, to have participated to be more confident that the recent market rally will continue.

That does not mean this still couldn’t occur, but the evidence is not there yet.

This is one of the reasons we haven’t been chasing the market rally this year.

Jumping a low bar

Turning to the March quarter reporting season in the U.S, the market wasn’t expecting much.

In fact, a 7% fall in S&P500 earnings was expected versus a year ago, the lowest since the COVID impacted Q3 in 2020.

It was a low bar for the market to step over, and so far it has.

Large caps report before small caps. We are just over halfway through, with some 267 of the 500 companies having reported at the time of writing.

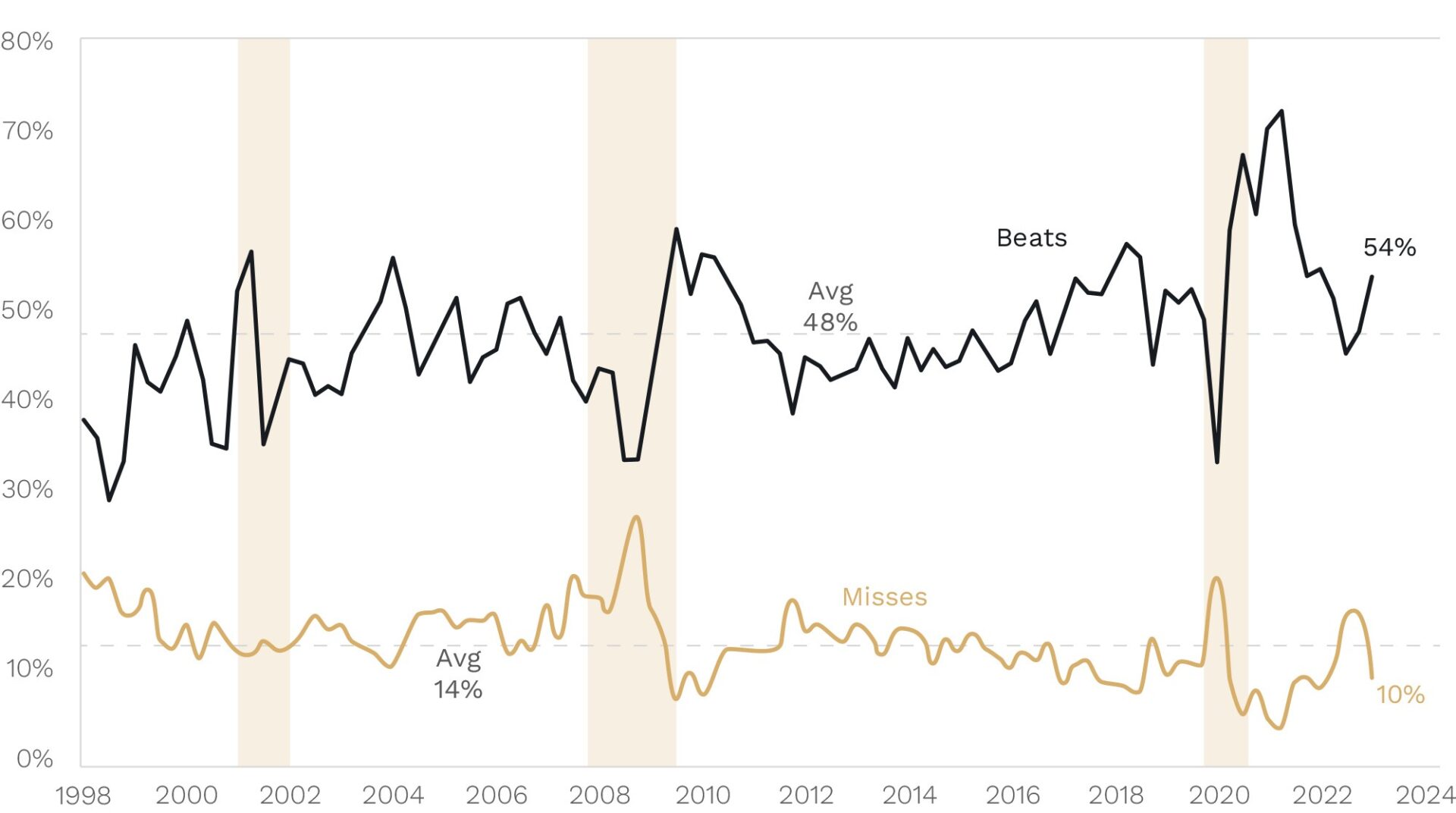

54% of companies have posted ‘beats’ on their Q1 results, which is above the long-term average of 48%. The misses, at just 10%, is below its average of 14%.

This is helping the U.S. share market hang tough.

But we are seeing a more-muted-than-normal reaction to the beats. (Beats have outperformed by just 0.4% on average on the day, well below the 1% historically).

And a more savage reaction to the misses (with misses underperforming by 2.9% on average on the day versus 2.1% historically).

This suggests low expectations are being beaten but the market remains wary given many large cap shares are fully priced and a tougher earnings environment still lays ahead.

Earnings Surprises – Higher Beats and Lower Misses but Compared to a Low Bar

Source: Goldman Sachs

Mixed messages

It’s clear consumers are more resilient than expected, which is backed by low unemployment and still-strong wage growth. That’s pushing expectations of a U.S. recession further out into 2023.

But the messages from bellwether names show a mixed picture at the coal face from companies. Take for example these comments on Q1 results:

- McDonald’s CEO Chris Kempczinski said around the world fewer people are adding fries to their order, people are also buying fewer items per order, and people are becoming more resistant to pricing. “So I think all of those things are reflective of, again, a more challenging macro environment.”

- UPS CFO Carol Tome said 2023 is proving to be an “interesting year”. Volume in the US relative to the company’s base plan was higher than expected in January and close to plan in February. But “it moved significantly lower in March, as retail sales contracted, and we saw a shift in consumer spending”.

- Yet Mastercard said its base-case scenario assumes consumer spending remains resilient and cross-border travel continues to recover. “And we feel like overall from a consumer health standpoint, our assumptions are relatively unchanged between what it was one quarter ago towards where we are right now”.

So what have we seen out of our global portfolio companies so far during reporting season?

Overall, whilst we see some of the resilience mentioned above, there are definitely some signs of weakness and trade down going on in some industries, such as restaurants and food service.

Take for example Chipotle Mexican Grill, (CMG US) the American fast-food restaurant that has been called the ‘budget restaurant for rich people’. It has benefited from high-income customers replacing more expensive dining with more frequent Chipotle trips. The stock is currently trading near all-time highs.

We have also seen a material deterioration in enterprise software and hardware spend towards the end of the quarter. This is even more so for those exposed to lumpy project expenditure by clients which is increasingly getting deferred as companies become more cautious.

As the year progresses we expect this may continue as the lagged effect of rates hikes and a credit pull back from banks slows growth and earnings. For us this reaffirms our somewhat cautious portfolio positioning. Cautious does not mean defensive though as we are excited by the growth outlook for our core positions and their idiosyncratic drivers which we believe can still deliver against a slowing macro backdrop.

Next month we will provide you with a more detailed update on the wash-up from the current reporting season for our global strategy. It’s been a solid start so far. But for now, it’s time to put down the pen and get back on the investing tools.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.