Idea Bonanza!

- In another good month for equity markets, January saw all of the Ophir funds outperform, with gains of at least +4% each, driven by good early Q4 earnings results for our Global Funds.

- The Mag-7 took a back seat in performance during the month, and many investors are asking whether DeepSeek’s AI has turned their once-powerful moats into mere puddles.

- Investors are focused on what could spark small-cap outperformance, but they should also be judging small caps on their superior reward-to-risk ratio relative to large caps which, in our opinion, should deliver outperformance over the next 5 years.

- While small-cap performance has been hampered by sluggish earnings growth, there are promising signs this could be about to change.

- In January we made the trek to the Needham Growth Conference in New York, leaving with a record number of fantastic ideas which should serve to significantly strengthen our portfolio.

At Ophir, we have notification alerts set up on our phones with many of the major news outlets including The Australian Financial Review, The Australian, The Wall Street Journal, The New York Times, Bloomberg News … the list goes on.

This year it has felt like almost every time a notification has popped up, in the headline has been the word ‘Trump’ or ‘Musk’. We don’t expect that to change much over the next four years. We just have to get used to it.

For investors, though, it helps to remember that, over the long run, almost the only thing that matters for a company’s share price is its earnings.

Not tariffs, interest rates, inflation, immigration policy, DOGE spending cuts, how many ‘illegal aliens’ are getting deported this week from the U.S., or whether a new ‘Riveria’ is being created in the Middle East.

Of course, some of these things will matter for some companies’ share prices, but mostly in the short term.

At a portfolio level, over the longer term, politics and government policy runs a distant second (or third or fourth) behind the idiosyncratic drivers of a company’s earnings.

Overwhelmingly, the things that have always mattered the most in investing will continue, such as:

- The size of a company’s addressable market

- The value the company offers its customers compared to its selling price

- Its ability to scale cost effectively

- The size of any moats that protect it from competition

- The strength of its balance sheet

- Its bargaining power with suppliers, and

- The gap between current and assessed value of the business

It’s easy to forget this when the volume of Trump or Musk articles goes stratospheric.

January 2025 Ophir Fund Performance

Before we dive further into the Letter, we’ve provided a detailed monthly update for each of the Ophir Funds below.

The Ophir Opportunities Fund returned +5.2% net of fees in January, outperforming its benchmark which returned +4.6%, and has delivered investors +23.0% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +6.6% net of fees in January, outperforming its benchmark which returned +5.1%, and has delivered investors +14.1% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +2.0% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +5.1% net of fees in January, outperforming its benchmark which returned +3.1%, and has delivered investors +18.0% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

The Ophir Global High Conviction Fund (Class A) returned +4.5% net of fees in January, outperforming its benchmark which returned +3.1%, and has delivered investors +13.9% p.a. post fees since inception (September 2020).

🡣 Ophir Global High Conviction (Class A) Fund Factsheet

The Ophir Global High Conviction Fund (Class B) returned +4.3% net of fees in January, outperforming its benchmark which returned +3.1%, and has delivered investors +28.1% p.a. post fees since inception (June 2023).

🡣 Ophir Global High Conviction (Class B) Fund Factsheet

The Mag-7 finally takes a backseat

Putting aside some of the noise, it was a good month for equity markets overall in January, and for the Ophir Funds.

Each of the Ophir Funds were up +4% or more, and all outperformed for the month. A pleasing result, particularly for the Ophir Global Funds where the performance was driven by good Q4 earnings results for some of our stocks.

After a muddle through the first half of January, major equity indices put on solid, to- in some cases great, returns in the second half of the month.

What was most interesting was that U.S. exceptionalism and Magnificent-7 led outperformance over the last couple of years, took a back seat.

While the S&P 500 was up +2.7%, the Mag-7 actually underperformed, rising just +2.5%. The equal weighted S&P 500 (where all 500 stocks get a 0.2% weight) rose +3.4%, which highlights that smaller large caps did better than the behemoths.

The perennially underperforming European equity market (Euro Stoxx 50) put on a whopping +8.0% – eclipsing that index’s all-time high from way back in the year 2000!

It also reverses, albeit for just a month, a little of the 25-year underperformance of the European versus the U.S. share market.

The question for investors is whether this the start of a rotation in leadership for this current bull market in shares that started back in October of 2022?

Space Race redux

Undoubtedly the big news in January that put a chink in the armour of some of the Mag-7, and particularly U.S. chipmaker Nvidia, was Chinese firm DeepSeek.

We won’t go into the details here because it’s been thoroughly covered by the press. But many were calling it a ‘Sputnik’ moment for the U.S. – that is, the U.S. might not be as far ahead in the AI ‘arms race’ as previously thought. This had echoes of the USSR’s 1957 launch of Sputnik, the first earth-orbiting satellite, a development which shocked Americans and helped trigger the space race between the U.S. and Russia.

This raises several questions:

- Is DeepSeek’s R1 – China’s new open sourced ‘reasoning’ AI large language model (LLM) – close in performance to the best U.S. models like Open AI’s ChatGPT? It appears so.

- Is it significantly cheaper to build and train than the best U.S. models? That’s what is being claimed, with some saying R1 was built for only 5% of the cost of U.S. models, though others argue that figure is understated.

- And has DeepSeek made some significant advances in software architecture that helped provide great performance at low cost? It seems the answer here too is yes, with U.S. competitors acknowledging the smarts behind DeepSeek’s code.

What is undeniable, though, is the meltdown that Nvidia’s share price suffered. After the DeepSeek announcement on the 27th January, Nvidia fell -17.0%, wiping out US$593 billion in market cap from the then-largest listed company in the world.

To put that in perspective, below are the 30 largest listed companies in the U.S. below $US500 billion in value at the time.

Source: Jefferies.

So, in other words, Nvidia’s market cap loss was the equivalent of McDonalds and Coca Cola being wiped from the face of the earth. (New Secretary of Health and Human Services RFK Jr has assured us he’s not taking away McDonald’s, one of Trump favourite foods!)

Source: X (Donald Trump Jr)

Moats or puddles?

All eyes during the recent U.S. reporting season were on the big capex plans of the hyperscalers, such as Meta, Google and Microsoft. Given DeepSeek’s seemingly cut-price AI LLM build job, investors wanted to know the hyperscalers weren’t wasting that big capex spend.

Investors have given them the benefit of the doubt for now.

As Microsoft CEO, Satya Nadella, said: “Jevons Paradox strikes again! As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can’t get enough of.”

The logic of the ‘Jevons Paradox’ is that a lower cost to produce = lower cost to consumers = higher demand from consumers as AI is built into all sorts of products.

But while the news from DeepSeek seems good for consumers and demand for AI applications more generally, the question now is whether the ‘moats’ for Meta, Google, Microsoft, and Co, are now more like shallow puddles in AI – that is, easier to be attacked by smaller upstarts?

What could spark small-cap outperformance?

Speaking of smaller upstarts, as small-cap investors, probably the most frequent question we get asked is: “We get small-cap valuations are very cheap versus large caps globally, but what might be the catalyst for small-cap outperformance?”

It’s an excellent question.

While small-cap valuations are very cheap globally versus large caps – and particularly in the U.S. where they really haven’t been this cheap in 25 years – small caps, in our opinion, will likely outperform large over the next 5-10 years.

It’s trickier to identify when that outperformance may start.

Firstly, we’d say don’t try pick the start. It’s better to focus on the fact that ultra-cheap relative valuations provide an asymmetric return payoff in small versus large caps. That is, should mean reversion in valuations occur like it has historically, small caps have more limited relative downside (it’s hard for them to get much cheaper in a relative sense) but much larger upside than large caps. This is why we are personally putting more money into our Ophir Global Funds now.

Earnings growth set to broaden out to small caps

One thing that’s likely been holding back small-cap outperformance is that for much of the last two years aggregate earnings of U.S. small caps (which make up almost 2/3’s of the global small cap market) have been stagnant. (Side Note: this is not the case for our Ophir Global Funds where through stock picking we have continued to be able to find companies growing earnings significantly).

This stagnant aggregate U.S. small cap earnings can be seen in the chart below with the yellow line of U.S. small cap earnings-per-share growth moving sideways, whilst mid, large and mega-cap earnings have grown.

Source: Bloomberg, Ophir

Why?

The Fed’s rate rise cycle has basically caused a bifurcated U.S. economy. Large caps earnings have been boosted by very strong Mag-7 earnings. But small caps, which hold disproportionately shorter-term floating-rate debt, have suffered under the weight of higher interest costs.

This may be about to change though.

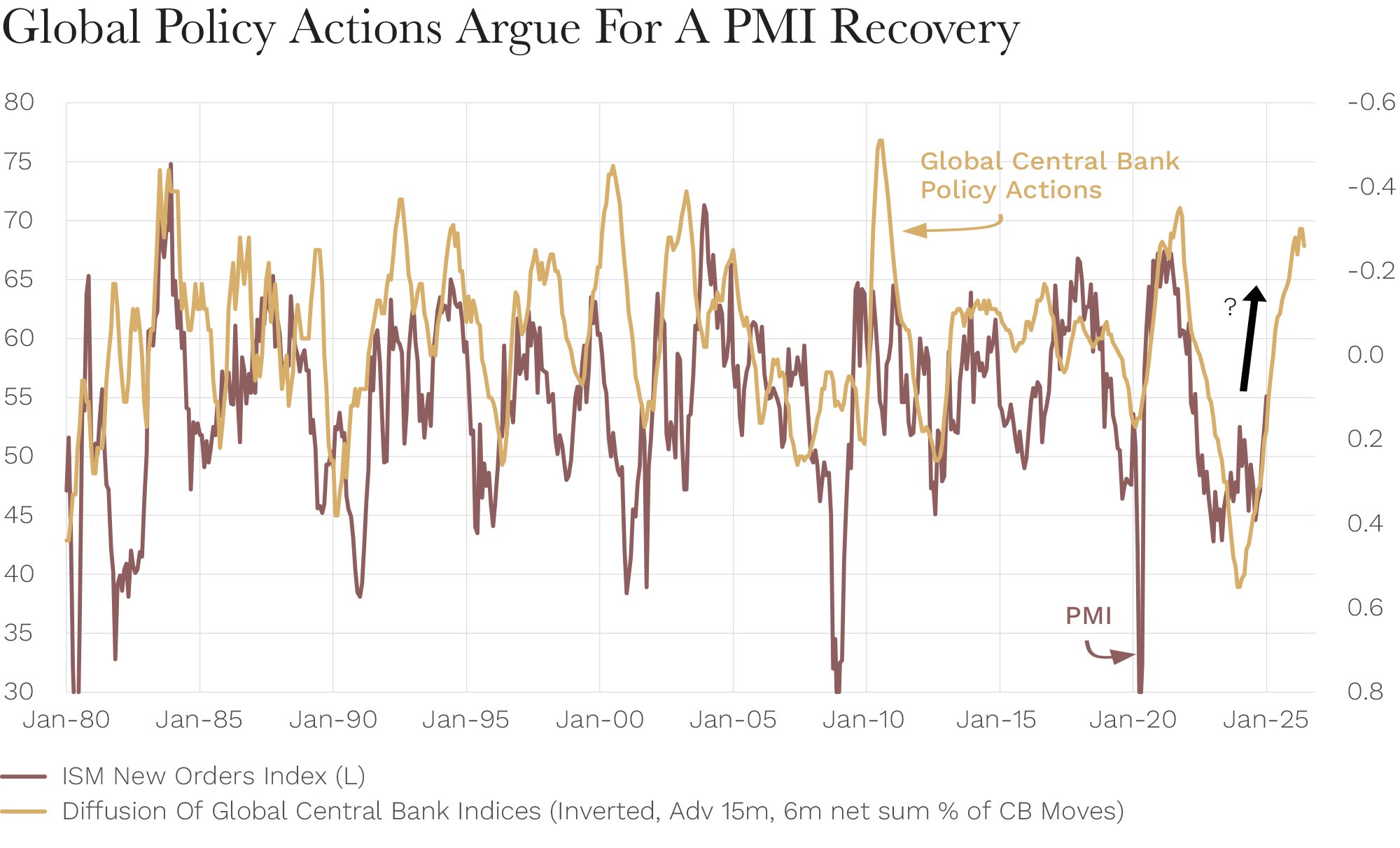

Interest rates, not just in the U.S., but globally, are now being cut (yellow line below). That should lead to a cyclical upswing in the U.S. economy – as measured by the Institute of Supply Management’s New Orders Index – a key leading index of manufacturing activity in the U.S. (red line below).

Source: Piper Sandler

Historically, as seen in the below chart, upswings in manufacturing activity have tended to see a broadening out of earnings growth in corporate America.

Never before have we seen more than two years in a row of flat or negative aggregate earnings growth across U.S. small caps. So there is some hope that 2025 represents a return to growth and leads to further liquidity flowing into and supporting the cheap small-cap valuations.

Source: Piper Sandler

Big conference conversion

In last month’s Letter to Investors (read here) we spoke about how the election of Donald Trump has given a shot in the arm to U.S. small business optimism.

Over November and December, the NFIB Small Business Optimism Index jumped the most in any two-month period in the Index’s 50-year history!

The percentage of small business owners expecting the U.S. economy to improve in the next year also recently reached near record levels.

With this background we were very excited to head one of our favourite small-cap conferences globally in January, the Needham Growth Conference in New York.

Over a few days, we had 28 one-on-one company meetings.

Normally at conferences like this we would have 2 or 3 high-quality ideas that result in 1 or 2 investments.

This year we had 9 ideas! And we think 4 or 5 investments might come from it.

High grading the portfolio

Small-cap businesses are definitely more bullish heading into the New Year, with a new market and US-economy-friendly administration in place, and major central banks cutting rates (ex the Bank of Japan who is doing its own thing!).

On one hand our cautious nature has the team asking: have we lowered our threshold for great ideas?

But for us (Andrew and Steven), who have seen this movie before, our muscle memory would tell us it’s more likely that, overall, the businesses we have seen are indeed more confident that they can grow earnings faster than last year and faster than the market expects.

This is great news for our Global Funds because it keeps pressure on the portfolios and increases the quality of ideas.

If we do have 5 new stocks come into the Global Funds, the threshold for getting in usually means they are at least an average weight stock of say 3-4%.

This in turn means the bottom 5 get pushed out, and the strength of the overall companies in the portfolios gets high graded.

That is exactly what we want. New year, new ideas and high pressure for only the best companies to remain in our Funds.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.