What small caps need to outperform – and does it even matter for us?

After a dramatic period for markets, in this month’s Letter to Investors, we examine:

- Why markets bounced back strongly from April’s shock sell-off

- The headwinds that have led to small caps underperforming large caps

- The key factors that will trigger a much-anticipated small-cap revival

- How Ophir’s Funds managed to outperform both small and large-cap indexes in 2024, including the S&P 500, despite smalls struggling

- Why the sheer number of opportunities in small-cap stocks means investors should stick with quality active small-cap managers during periods of small-cap index underperformance

- A historical perspective on why U.S. small caps have rarely been this cheap relative to large caps

April 2025 Ophir Fund Performance

Before we jump into the Letter, we’ve provided a detailed monthly update for each of the Ophir Funds below.

The Ophir Opportunities Fund returned +1.0% net of fees in April, underperforming its benchmark which returned +1.8%, and has delivered investors +22.4% p.a. post fees since inception (August 2012).

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +1.5% net of fees in April, underperforming its benchmark which returned +2.6%, and has delivered investors +13.0% p.a. post fees since inception (August 2015). ASX:OPH returned -0.7% for the month.

The Ophir Global Opportunities Fund (Class A) returned -0.9% net of fees in April, outperforming its benchmark which returned -1.7%, and has delivered investors +16.0% p.a. post fees since inception (October 2018).

The Ophir Global High Conviction Fund (Class A) returned -0.6% net of fees in April, outperforming its benchmark which returned -1.7%, and has delivered investors +11.4% p.a. post fees since inception (September 2020).

See latest performance for the Ophir Global Opportunities Fund (Class B) here and the Ophir Global High Conviction Fund (Class B) here.

“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it” – Ferris Bueller

If you only check the markets once a month, you’d have seen the S&P 500 fell just -0.8% in April. Ho-hum. Big deal.

But what you would have missed is one hell of a rollercoaster ride.

After U.S. President Donald Trump announced higher-than-expected tariffs on ‘Liberation Day’, the S&P 500 crashed -11.2% from the start of the month to its April 8th low.

Then, by month end, it had recovered almost all that fall.

Clearly, since we last spoke in our mid-April Letter to Investors a lot has happened – most of it investor friendly.

From its April 8th low – when Trump paused tariffs for 90 days – the Nasdaq, at writing in mid-May, has put on an incredible +25.4%.

That’s the third-largest rally in any 27-day period in the last two decades, behind only the April 2009 and April 2020 explosions coming out of the GFC and COVID bear markets.

The S&P 500 has also clawed back all its post-Liberation Day losses and is within a whisker of the all-time high reached in February of this year.

Fender bender fades

Is the rally because expectations for U.S. corporate earnings have suddenly improved?

No.

Corporate earnings expectations for the S&P 500 over the next 12 months are marginally lower now than when the market bottomed on April 8th.

But over the last month global trade uncertainty and recession risk in the U.S. and globally has receded. It’s become clearer that President Trump isn’t willing to drive the economic car off the cliff in pursuit of his tariff agenda.

That’s not to say a crash is totally off the cards; but a truly horrific fender bender looks less likely, particularly with airtime starting to increase for growth-positive U.S. tax cuts and deregulation.

The probability of a U.S. recession in 2025, according to Polymarket, has dropped from a high of 66% earlier in May to just 38% now.

And despite some deteriorating softer economic data (mostly survey data of households and businesses), hard economic data such as actual consumer spending and employment, for now at least, have remained rock solid.

While Trump continues to fill the headlines – and that’s not about to change – we thought we’d turn our attention this month to our No.1 question from investors:

“As a small caps manager, what do you think it’s going to take for small caps to start outperforming?”

The recent small cap ride

Given U.S. small caps make up about 60% of global small caps (with Japan in a distant second place at 13%), it makes sense to focus on the U.S. because it’s in the cockpit for launching small-cap outperformance.

Below, the orange line shows U.S. small-cap performance (S&P 600 index) divided by U.S. large-cap performance (S&P 500 index).

When the orange line moves up, small caps are outperforming large caps, and when it moves down small caps are underperforming.

Source: Bloomberg. Data to 16 May 2025

In March 2020, when COVID first hit and markets sank, small caps underperformed. Investors shunned the less liquid small end of the market in favour of less risky and more liquid large caps.

The Federal Reserve in the U.S., and most other central banks, cut interest rates in short order, and share markets recovered through the middle of the year. The rally was similar across U.S. small and large caps.

Then came November 2020, when first news of an effective COVID vaccine spread, and small caps shot ahead. We all knew we’d be able to go out again and the market looked forward to a recovering economy.

That small cap bullishness started to wane, though, around mid-2021 when inflation began shooting up as a result of the COVID lockdowns clogging supply chains, and – in hindsight – when the U.S. government and its handout cheques created overstimulus.

This would start the current four-years-and-counting underperformance of small caps through to today.

Why have small caps underperformed?

The inflation/rates headwind for smalls

Higher inflation is typically harder for smaller companies to pass on to consumers because they have less pricing power than large caps.

But, most importantly, higher inflation means higher interest rates.

Small caps in the U.S. typically have more short-term floating rate debt, making them more sensitive to higher interest rates.

At the same time, when war between Russia and Ukraine broke out in early 2022, pushing up oil prices and inflation again, it turned a gentle Fed interest-rate tightening cycle into the fastest hiking in 40 years.

Almost every economist you could find was predicting a U.S. recession in 2022 on the back of those rate hikes. That worry drove continued underperformance of small caps which historically have fallen more in recessions.

But by the third quarter of 2022 it had become clear inflation was peaking, and the U.S. share market finally reached a bottom after a brutal bear market.

This current bull market started in the U.S. (and globally) in October 2022, fuelled first by “the worst is over” for inflation hopes.

The bull market then received extra fuel after the release of ChatGPT in November that year, which boosted large cap tech performance amid optimism they would dominate the AI arms race.

All the while U.S. small caps continued to underperform.

Big clues

However, it’s important to note that this action historically is VERY unusual.

Every other bull market that we have small-cap data for going back to the late 1970s shows small caps outperform in the initial days, weeks and months of a new bull market.

Not this time.

There have been three periods during this bull market, however, when small caps have outperformed for two to four weeks.

That gives us a BIG clue of what the market is looking for to drive a more durable small-cap rally.

Those periods of small-cap outperformance occurred in December 2023, July 2024 and November 2024.

- The first two were driven by soft inflation data and hopes for imminent interest rate cuts by the Fed. No surprise here: High inflation/rates were the catalyst for small-cap underperformance, lower inflation/rates should be the antidote.

- The third was a big small-cap rally when Trump was elected late last year that had investors salivating for a cyclical upswing in economic and corporate earnings growth from the more business-friendly President.

The reality since then, however, is that the Fed has held off further rate cuts, preferring to wait and see how Trump’s tariffs impact inflation.

Though the Fed has taken rates down by 1%, they are still restrictive at 4.25% to 4.5%, and they remain above its estimates of a ‘neutral’ rate of 3.0%.

The good news is that markets are pricing in approximately almost 1% of rate cuts over the next year which will make rates much less restrictive and more small-cap friendly.

Earnings drive share markets – small caps need some!

Ultimately, lower interest rates are just a means to an end for small-cap outperformance. And that end is better earnings growth.

U.S. small-cap earnings growth in aggregate has been on the fast train to nowhere over the last two years or so.

And while mid caps have eked out some tiny growth, both mid caps and small caps have been well and truly bested by large-cap earnings growth driven, of course, by a Magnificent 7-induced earnings spree.

Source: Bloomberg. Data to 19 May 2025

Here’s some more good news: U.S. small-cap earnings have never flat lined or gone backwards before for more than about two years. So history says this earnings wilderness might be getting a little long in the tooth.

Rate cuts for more rates-sensitive small caps will help.

Greater tariff clarity would also help. The U.S. tariff situation is a mixed bag for U.S. small-cap revenues and earnings. Small caps are less likely than large caps to have supply chains weaving throughout the world which run afoul of tariffs.

But if they do source goods from overseas, they are less likely than large caps to have the bargaining power to rework those supply chains through lower tariffed countries (if it was even possible to identify who they are yet!).

The bottom line is that when tariff uncertainty is high, economic growth uncertainty is also high. And while that’s happening investors are likely to prefer larger and more liquid companies, which will keep the share prices of large caps comparatively higher than small caps until the tariff dust settles.

The good news is that tariff dust will likely clear at some point this year.

How the Ophir Funds can thrive even if small caps underperform

So should investors shun small caps, or the Ophir Funds, until lower rates, broader growth and more tariff certainty arrives?

Of course, the answer is no.

Exhibit A is the returns of the Ophir Funds in 2024.

The Aussie and Global small-cap benchmarks had average-ish years in 2024. The ASX Small Ords returned +8.4% and the MSCI World SMID index in AUD terms returned +20.7%, but was close to 10% in local currency terms as around half of that gain was due to a falling Aussie dollar.

Each small-cap index underperformed their large-cap index counterparts – in 2024 the ASX 200 rose +12.7% and the MSCI World index (AUD) rose +31.8%.

But, at Ophir, during 2024 we notched up some great results including:

- Our Aussie Ophir Opportunities Fund returned +42.8%, and

- Our Global Opportunities Fund returned +45.1%

Not only did our Aussie and global small-cap Funds comfortably beat our small-cap benchmarks, but they also beat the large-cap benchmarks.

How is that possible?

As we show by examining the two charts below, it’s because of a huge number of opportunities for savvy investors in the small-cap space.

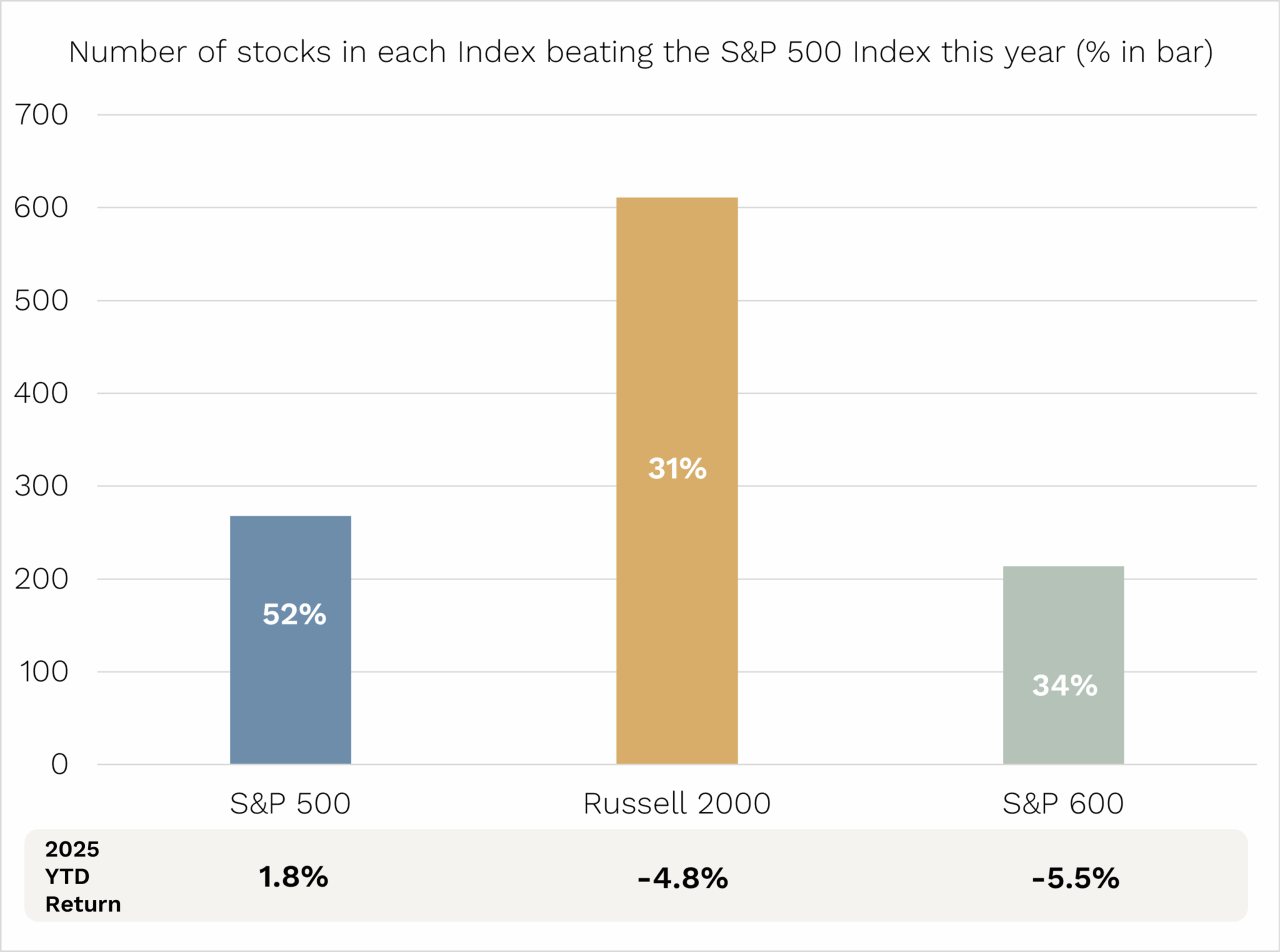

Yes U.S. large caps did outperform small caps in 2024 – the S&P 500 returned 25.1% while the Russell 2000 and S&P 600 small-cap indices returned 11.4% and 8.6% each.

Approximately 21% of U.S. large cap stocks outperformed the U.S. large-cap index. A similar percentage of U.S. small-cap stocks – 25% and 21% respectively for the Russell 2000 and S&P 600 Index – also outperformed the large-cap index.

Source: Bloomberg. Data for 2024.

But because there are more stocks in the U.S. small-cap indexes than large caps, there were actually MORE small-cap stocks, by number, that outperformed the U.S. large cap index.

That meant that if you’re a good active fund manager it’s possible to find lots of companies that outperform amid small caps, which in turn allows you to beat the large-cap indices. That’s exactly what we did in the Global Opportunities Fund in 2024. (Just don’t expect +40% returns every year! Our internal target is +15% p.a. returns in our funds over the long term.)

2024 isn’t just an anomaly though.

Source: Bloomberg. Data for 2025 to 16 May 2025.

As you can see above, year-to-date in 2025, despite U.S. small caps again underperforming the S&P 500 (-4.8% and -5.5% versus +1.8%) and a higher proportion of the large cap S&P 500 companies outperforming its index (52% versus 31% and 34% of small cap companies outperforming the large cap index) there are still heaps of small caps again beating the large cap index.

Bottom line: don’t shun all active managers in small caps because you think small caps will underperform.

There is still lots of small-cap stocks that are outperforming large cap indexes, providing opportunity for good small-cap managers.

Small caps are cheap

And despite a tough four years for small caps versus large caps, the tide will turn for the three reasons we mentioned above.

While we don’t feel we need small caps to outperform to necessarily generate attractive returns, it will be welcome when it arrives, nonetheless.

One final reason that small caps are highly attractive now; they are relatively cheap.

U.S. large caps are trading on a forward price-to-earnings (PE) valuation of 21.7x at writing. That’s in the 90th percentile for most expensive in its history – so very expensive.

But at a forward PE of 15.6x, U.S. small caps are only in the 37% percentile of its valuation history – so cheaper than its historical average.

When you combine the two U.S. small cap valuations versus U.S. large caps, only during 9% of the time through history have small caps been this cheap compared with their large cap counterparts.

And it’s not just an expensive Magnificent 7 story driving the relative cheapness of U.S. small caps.

If you equal-weight U.S. large caps (nullifying the Mag 7’s normal huge influence on large-cap index valuations) – though the data doesn’t go back as far – U.S. small caps are still in just the 12th percentile of expensiveness versus large caps.

As Buffett said, “price is what you pay, value is what you get”.

As relative valuations for U.S. small caps versus large caps are generationally cheap, we think you are getting a lot more value for your investment dollar.

And we expect that to play out in the years ahead.

So when we combine the fantastic opportunities on offer given the huge number of small-caps, lower rather than higher interest rates over the next couple of years, and their cheapness relative to large caps, I think we’ll look back in a few years as now being as good a time as any to be investing in the small-caps space.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date of this information and video was prepared, and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.