Investors who need a regular income can no longer rely on high dividend payments to see them through. We discuss why it’s time to shift your focus towards investing for ‘total return’.

The economic recession brought on by Covid-19 is creating challenges for all investors. But among the hardest hit are those in retirement who are relying on regular income from their investments. The generous dividend streams their portfolios once generated are about to come to an abrupt halt.

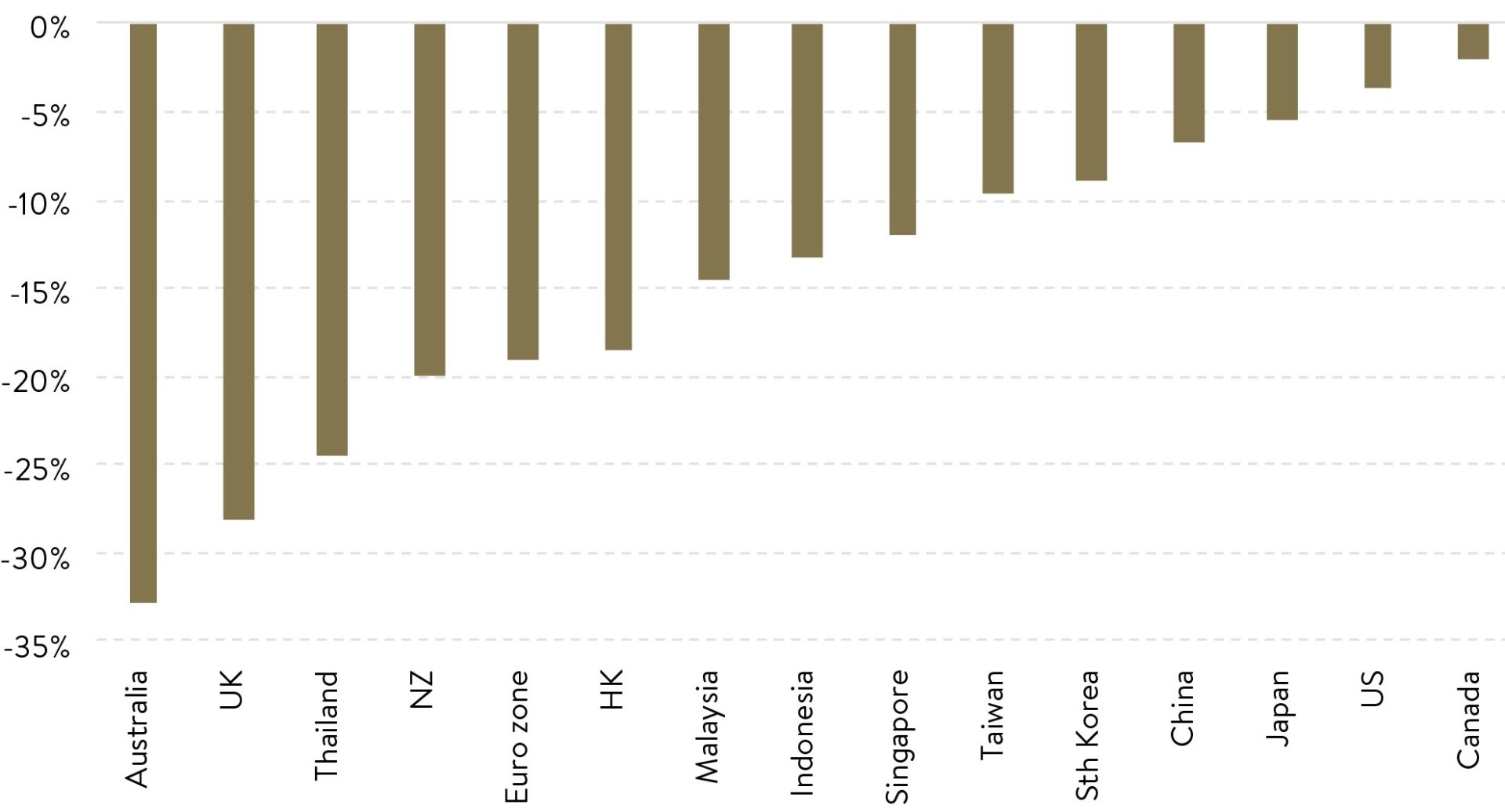

As the graph below illustrates, dividend payments by Australian companies are forecast to fall by over 30% in the next year from their peak. The severity of the cuts reflects the fact that dividends have been unsustainably high for some time. It’s also a response to the harsh operating environment that businesses now face.

In the eyes of many shareholders, companies must never cut dividends. This view is held not only by individual investors and retirees but also by many institutional funds. There’s a long-held culture of supporting the dividend at almost any cost, even if it means cutting workforces.

But in the current economic crisis, many companies are in a fight for survival. The cashflow that they relied on to support dividends has plummeted, as customers slowed their spending habits in response to coronavirus restrictions. At the same time, companies must invest in their business to make them more resilient to further disruptions.

In our view, it makes sense for firms to cut their dividends provided they have justified what they will use the cash for instead. In fact, don’t be surprised to see them also taking the opportunity to make lower, but more sustainable dividend payments the norm. Going forward, investors may have to understand and accept dividend cuts as an appropriate response to changing commercial realities.

Reductions in 12-month forward DPS by major market from 2019 peak

Source: MST Marquee

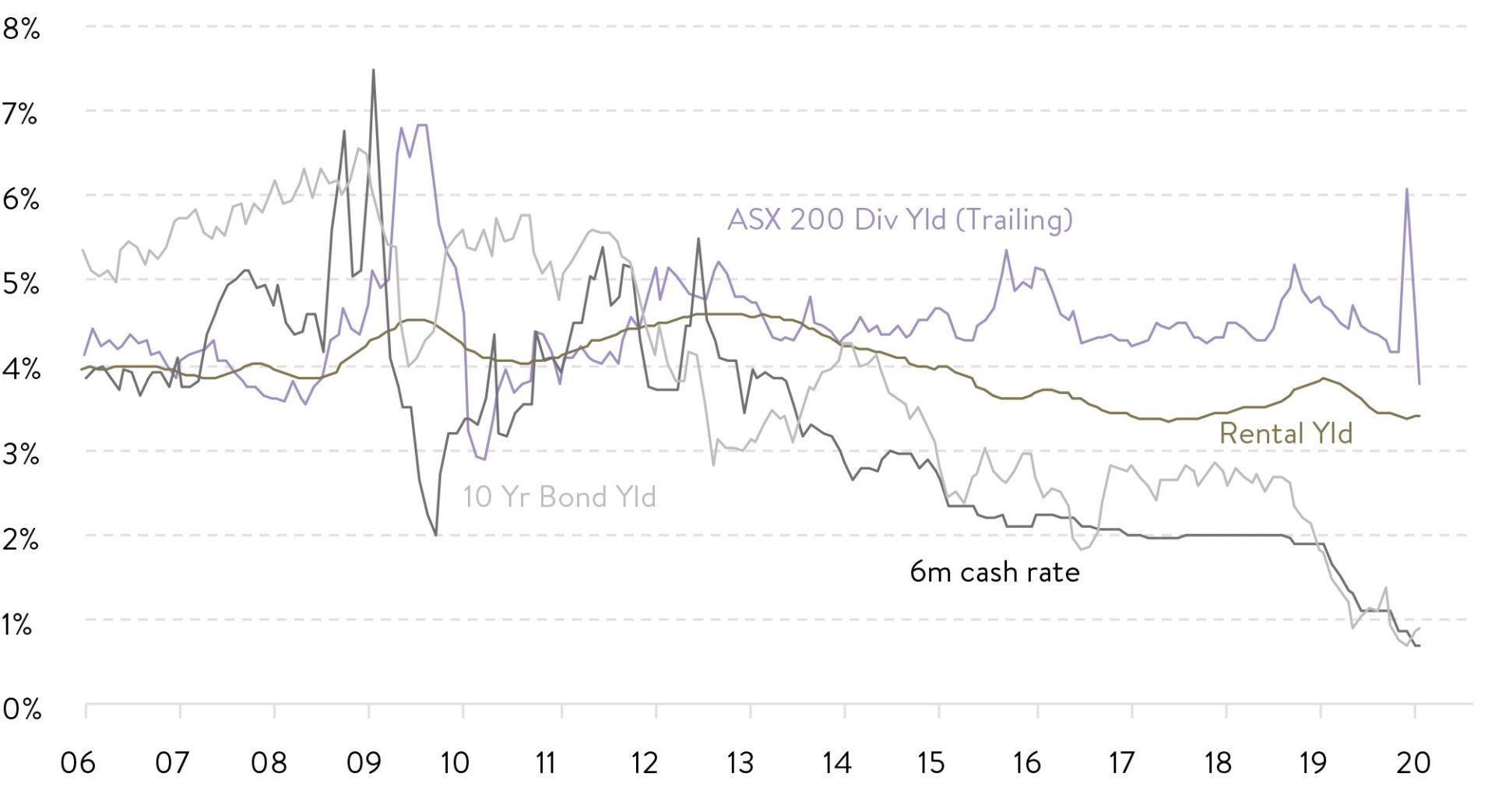

Trailing yield for Aussie equities, housing, bonds and cash

Source: MST Marquee

Pivot towards ‘total return investing’

So how concerned should we be about this trend towards lower dividend payments? And how can investors adjust their portfolios to provide sufficient income flow?

Currently, many Australian investors rely on an approach known as ‘income investing’. Income investing involves building a portfolio of securities that produce dependable cash payments. This is largely done through owning a basket of high-quality stocks with a history of healthy dividend payments.

But with dividends set to dry up, investors who seek income need to shift their focus towards ‘total return investing’.

Total return investing considers the two ways that equities generate returns: the dividend yield and the capital return that comes from a rising share price. Under this framework, dividends are viewed as a zero-sum game because a dividend of $1, for example, simply reduces the stock price by the same amount.

The key is to look for a total return, one that takes into account the combined gains in both stock price and dividend (including franking credits in Australia). It’s not so much where the return comes from, but the size of the total return that matters. We understand some investors in Australia, particularly retirees, may be attracted to the franking credit benefits of some high dividend paying companies. Often however being too focussed on these types of investments in your portfolio can bring in concentration risks and provide suboptimal total returns.

The lesson for investors is that high dividend yields don’t necessarily lead to higher dollar values of income over time. Instead investors should invest in stocks which are likely to achieve the strongest earnings growth over time, and providing a reasonable price is paid for those earnings, will typically lead to the best share price gains.

Under a total return investment strategy, if the natural income provided is insufficient, shareholders can create income by selling a portion of their shares. This is effectively the same as being paid a dividend by the company, the key difference being that you decide when to access your income. In Australia, for shares held longer than 12 months there is generally a capital gains tax discount available (up to 50%), which helps to offset any foregone franking credit benefit.

Good habits will pay off

At Ophir, our portfolios are biased towards growth equities and returns in the form of capital gains. We prioritise companies that have significant scope to grow their earnings over the coming decade. Given these companies generally require large capital investment for their businesses to reach their full potential, it makes more sense to reinvest any excess cash than it does to pay it out in dividends.

Over time the strong share price gains we expect these stocks to achieve should more than compensate investors for what they have missed out on in dividends. And investors can access income any time by selling some of their equities.

Finally, it’s worth remembering that companies are not the only ones having to adjust their expenditures in the face of the current pandemic. For most Australians eating out at restaurants has stopped and overseas holidays are a distant dream.

The silver lining of Covid-19 may be that we can trim bills and become more ruthless with how we spend and invest. We believe that well-managed companies should be doing the same.