In our Investment Strategy Note Andrew Mitchell takes a look back at our wild Afterpay ride from the very beginning and outline our six key lessons from our journey with this 50-bagger.

I met Nick Molnar for the first time in 2017. I had walked out of a meeting with a founder now considered one of Australia’s best-ever CEO entrepreneurs. But back at the office, I said to colleagues: “The CEO is too young. And isn’t layby dead?”.

Yet something had stood out. How, I asked, does a microcap layby business attract Cliff Rosenberg and David Hancock to the Board. I knew them both. I had met Cliff through another listed business (Nearmap) where he had an incredible track record. That was before he went to LinkedIn in Asia-Pac as managing director. I’d worked with David at CBA where he was the enormously respected Head of Equities.

Lesson 1: Sometimes you need a bit of luck.

I often wonder if we’d have invested in Afterpay — or been too late to the party — if we hadn’t known and respected Cliff and David. It goes to show it’s often not what you know, but who you know and listen to. Sometimes the best investments are the ones you make because you’ve built a fantastic network.

My initial mistake was to view Afterpay through the eyes of a late-30-something-male who thought this was too obvious to work. I wasn’t viewing it through the eyes of their original target market: a 20-year-old millennial female shopping in the fashion and beauty industries. I needed to throw off the shackles of my own experiences. As Warren Buffett has said, “if past history was all there was to the game, the richest people would be librarians”.

When I sat down with Cliff following Afterpay’s listing, he got me excited. He said the founders were dynamite. He hadn’t seen a visionary like Nick before. Nick, Cliff said, was 25 going on 40 years’ old. And Anthony Eisen’s business acumen was first rate. They made a dream team. Importantly, Cliff noted that while Nick and Anthony could have heated debates, they’d always reach an agreement.

With a fresh set of eyes, I went and spoke to some of Afterpay’s very first unlisted retailers, and it completely changed my mind. They loved it. Afterpay helped them convert more sales, it expanded the basket size, and it slashed returns. Many of these retailers were even taking stock in the IPO.

Ultimately, we invested following the IPO, and as time would tell, snag our first 50-bagger (assuming Square’s acquisition proceeds as expected).

Lesson 2: Have an open mind and be prepared to keep learning.

In this case, we really needed to understand Afterpay’s value proposition from the perspective of its target market. To do so there was no substitute to talking directly to Afterpay’s customers.

Afterpay’s addressable market exploded. It was broadening out of fashion and beauty into the likes of dentistry and airline tickets. More men used it. As, crucially, did older customers. This was vital for the share price. It meant ‘Customer Lifetime Value’ (how much a single customer is worth to the business), was expanding rapidly. As it swiftly increased its percentage of the checkout, we quickly started seeing the business as relevant for not just retail ‘some things’ but retail ‘almost everything’.

Then, in 2018, the stock halved. It was Afterpay’s first big test. ASIC was reviewing regulation of the Buy Now, Pay Later (BNPL) sector. Newspaper headlines blared doom and gloom about the company. Brokers sent through ‘short reports’ and many an Aussie fund manager bailed out. But rather than being caught in the headlights, we remembered the insights we got speaking to Afterpay’s first retailers in Australia. So we got on a plane to speak to their first retailers in the US. And wow! It was going so well for them, driving online sales, and changing customer behaviour. It was like hitting replay on a recording of what those first Australian retailers said. As more negative headlines filled papers, and sellers were out in force, we bought a huge amount of Afterpay stock at dirt cheap prices, and our timing couldn’t have been better.

Lesson 3: To perform as a fund manager, you can’t follow the herd.

It would have been easy to get worried out of our holding in Afterpay. But Australia was going to be a sideshow if Afterpay successfully launched in the US, a market 15 times its size. Don’t be lazy. You need to outwork your competitors.

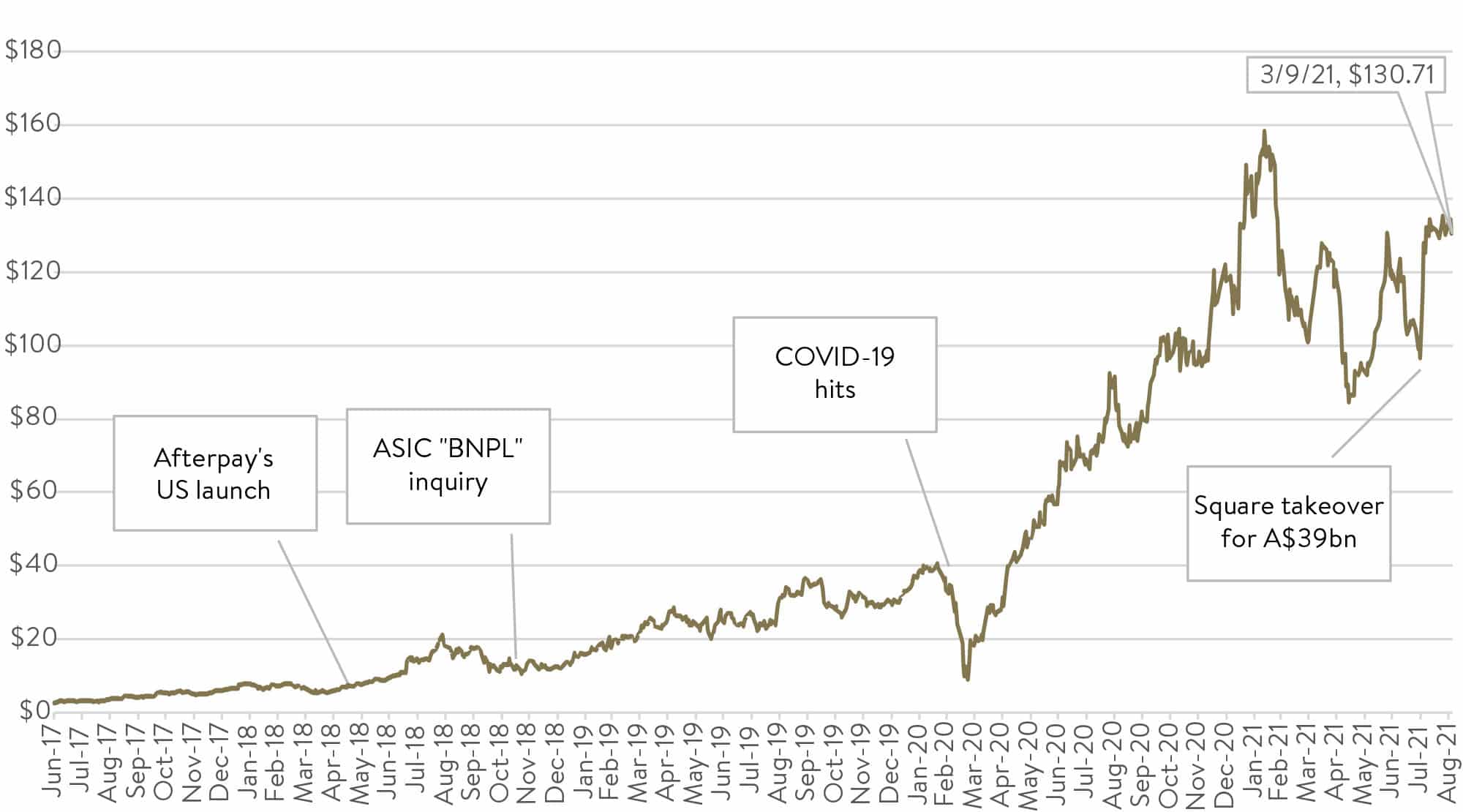

Afterpay share price

At this time, I bailed up David on Collins St, Melbourne, and walked with him. He was so excited. Afterpay had just hired a new Head of Risk from Uber, and for the US expansion, they were attracting amazing talent with lucrative options packages. This was one of the company’s most important acts because it allowed Afterpay to scale. It was no longer an Australian payments business, but on its way to becoming a global phenomenon.

Lesson 4: Pay up for amazing local talent when expanding globally.

This has been a hallmark of many of the great overseas success stories we have invested in. It now forms a part of our checklist for Aussie companies expanding internationally.

But then the company was tested again. COVID-19 hit. The stock price cratered. Nick, Anthony, and the board thought (as everyone did) they could be in big trouble. Brokers fired off reports telling investors to short the stock. The company pivoted quickly, though. It tightened its purchase approvals process. Then, spurred by lockdowns and massive government fiscal support, spending on ‘stay at home’ items took off. E-commerce got a shot of adrenaline and retail online adoption accelerated. Commentary from key customers confirmed the pick up in online sales. The company had just passed another big test.

We have often been asked over the years with Afterpay: “How can it be valued so high when it doesn’t make a profit?” Our answer is simple: Afterpay’s valuation, such as its price-to-earnings ratio (P/E), is so high because it is deliberately keeping the ‘E’ low to non-existent by reinvesting profits for future growth.

Its Australian business is highly profitable, but it is using that cash flow to grow and take market share in new geographies. This is crucially important when it is breaking into new markets with virgin soil. It can acquire customers dirt cheap where there is no incumbent. BNPL is a scale game – being slow or late can be deadly. Afterpay needed to win the land grab by expanding quickly and making big investments in marketing and technology. If they had stopped reinvesting for growth, and put today’s profits first, we would have headed for the exit given the opportunities that lay in front of the company.

Lesson 5: Profit, and the valuation metrics based on it, matter less when a business is rapidly scaling and reinvesting cash flow to grow.

When growing rapidly, other metrics matter more to investors, such as return on capital, customer lifetime value, customer acquisition cost, and merchant and customer growth numbers. It’s still important, though, not to overpay based on where you think the business will be at maturity.

Then, on August 2, Square announced it was going to buy Afterpay in a blockbuster deal that valued the company at $39 billion …

So where to now for Afterpay? I think it’s just the end of the beginning. Square seems a good match with lots of synergies. After the acquisition was announced, Square’s share price rose significantly, because investors could see that when it came to Square and Afterpay 1+1 = 3. Someone else may bid for the company. Apple and PayPal are two possibilities, although this becomes less likely as time goes by. We still own Afterpay in case a bidding war breaks out. We believe the BNPL industry will consolidate more, with perhaps 2-3 key players left when the market matures. I can see BNPL being just one, albeit very important, offering in a suite of products for the dominant payments providers.

But Nick and Anthony are rare. Leaders in the sector and the original entrepreneurs. They have made Afterpay a verb. I couldn’t be happier to have had my initial thoughts proven wrong.

A large early investor in Afterpay told me they saw Nick present at a TEDx in Sydney when the company was in its infancy and the woman next to him said: “Who is this guy? He has such a presence; he would be perfect for my daughter”. The investor replied: “I’m sorry to let you down, but he is very happily married”.

The Board once told me they had to encourage Nick to fly business class overseas because he was so frugal. If Nick can keep that kind of mindset and culture in the business, it’s got every chance of being one of the few established players at the end.

Lesson 6: Passionate, talented, visionary entrepreneurs are so scarce and valuable … to their shareholders, employees, customers, and the economy at large.

Finding the next Nick and Anthony is what gets us out of bed in the morning. When we are lucky enough to find these visionary entrepreneurs, we are reminded that there is no better part of the market in which to invest than small caps.