20/20 Vusion

When you’re at the supermarket and you see all those price tags that change every other day with deals, specials, or to reflect higher prices have you ever thought to yourself, ‘I’m glad I don’t have to change them.’ Well what if they changed themselves… This transformation is underway for global retail and behind those familiar pricing labels on store shelves there is a multi-billion-dollar company you’ve probably never heard of that is leading the charge.

VusionGroup, (VU-FP), is a French technology company specializing in Internet of Things (IoT) and data solutions for physical commerce. The company has established itself as a global market leader for electronic shelf labels (ESL) and cloud-based software solutions (VAS), supplying retailers with its innovative solutions to enhance store digitalisation.

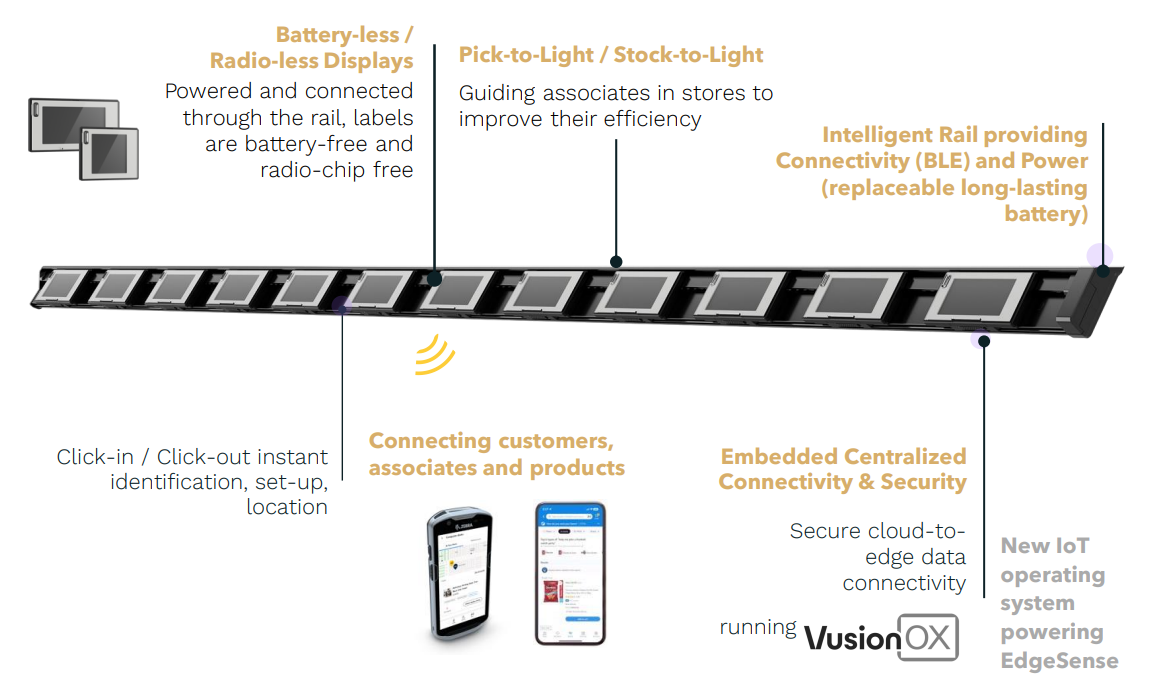

VusionGroup Product Features

Source: VusionGroup.

We first came across Vusion when spending a week on the ground in Paris to visit a long list of SMID-cap French companies around three years ago. What we discovered was one of the most compelling secular growth stories in global retail technology.

Shelf Control

After closely following the company for nearly a year, we took our position in June 2023. The catalyst? A short report that halved the stock price. At the heart of the bear case was the validity of its contract with Walmart – a major source of growth for Vusion in the U.S – and a large Chinese shareholder potentially selling down.

While definitely not our typical entry catalyst we were fortunately prepared and had done the following…

- Spent over a year engaging with the company and built trust in management’s delivery during that time.

- Spoke to multiple large U.S. and EU grocery chains about ESL and were already comfortable with the unit-level economics being generated.

- Ran channel checks on the company’s Chinese shareholder

- Conducted detailed discussions with management to address the other accounting concerns in the report

This allowed us to quickly conclude the short report was weak and the market had overreacted. We bought in on day two, once the dust had settled, at a time when the stock was trading at around €80.

A clear front-runner

Globally, there are four major providers of ESL’s: Vusion and Pricer in Europe, and Hanshow and Solum in Asia. We’ve conducted translated investor calls with Solum, met with Pricer management on multiple occasions, and held industry expert calls on Hanshow.

Through this work, one thing has become clear: Vusion has a material lead in the U.S. market.

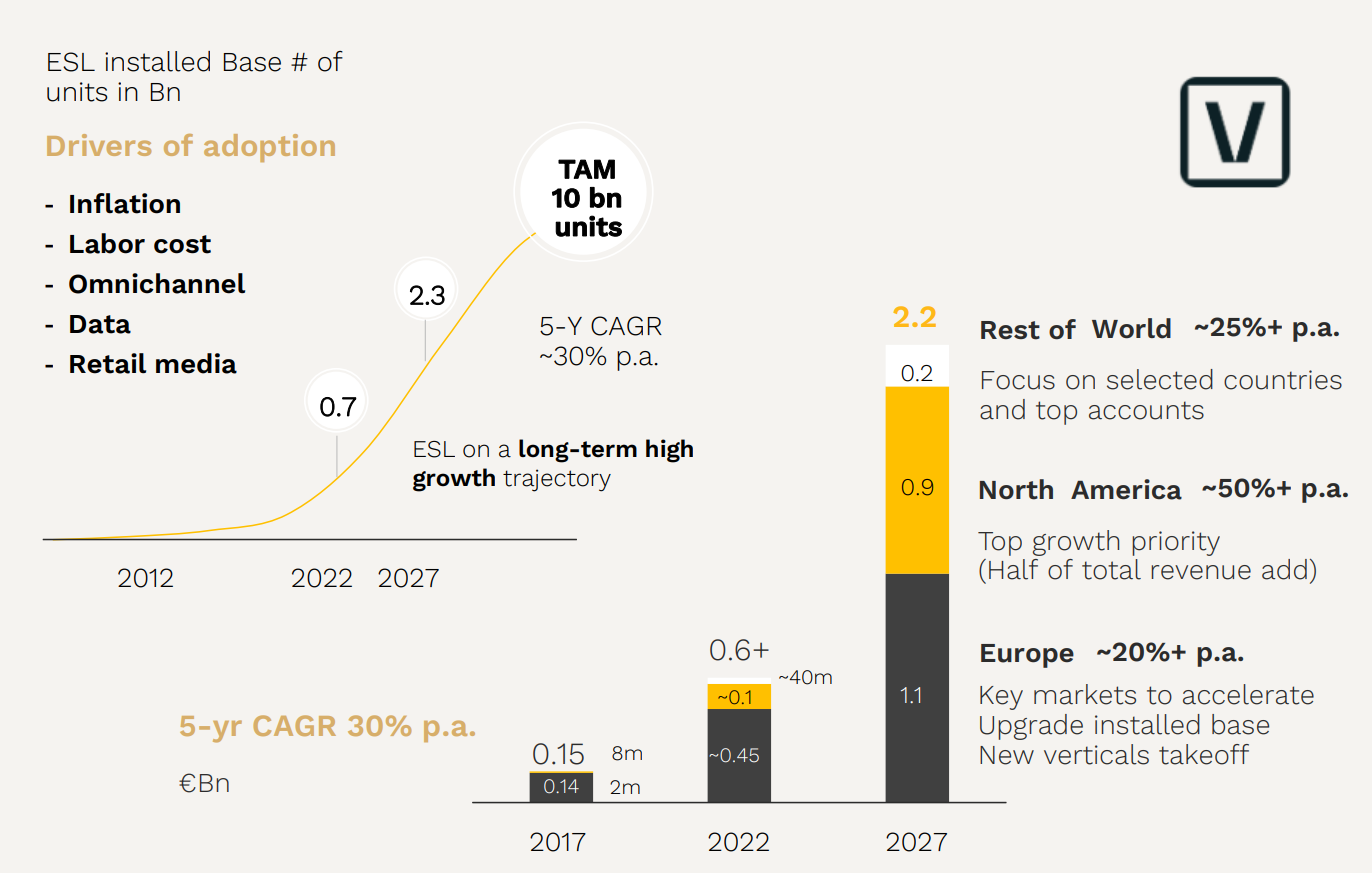

The U.S. currently represents only ~5% of the global ESL market compared to ~40–50% for Europe. But with Walmart as a marquee customer and ESL adoption still in its infancy stateside, the U.S. is on track to overtake Europe by 2029 as the largest market globally.

Source: VusionGroup, Ophir.

This market share head start, combined with Vusion’s differentiated software offering, gives the company a substantial runway for growth.

Growth remains in its infancy

Adoption of ESLs in the U.S. remains in the low single digits, with Walmart acting as a first-mover. But the macro backdrop is increasingly favourable: rising labour costs, supply chain volatility, and stockkeeping unit (SKU) proliferation are all improving the payback profile for ESL rollouts.

Importantly, the use case is expanding. ESLs are moving beyond grocery into pharmacy, hardware and other specialty retail, effectively doubling Vusion’s total addressable market.

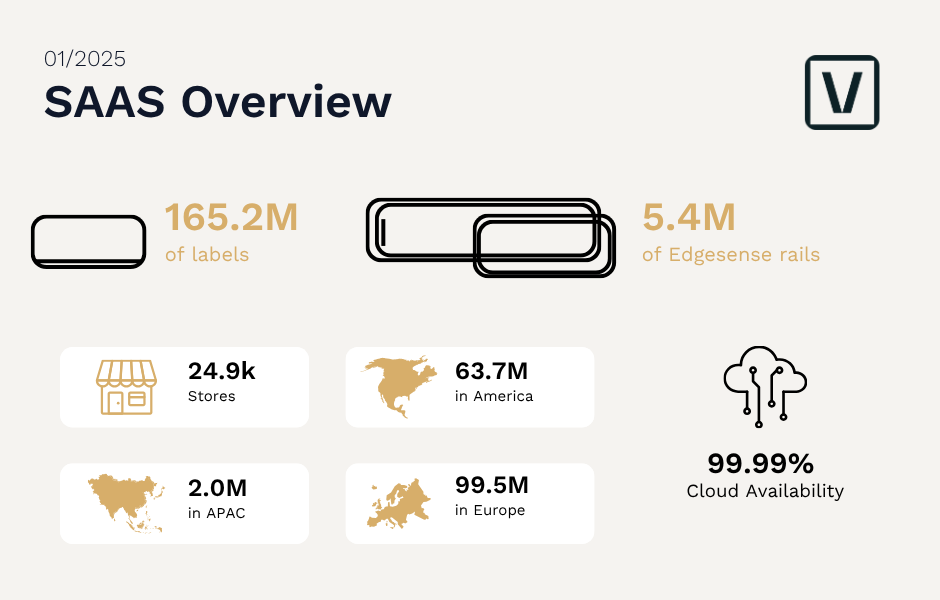

Source: VusionGroup, Ophir.

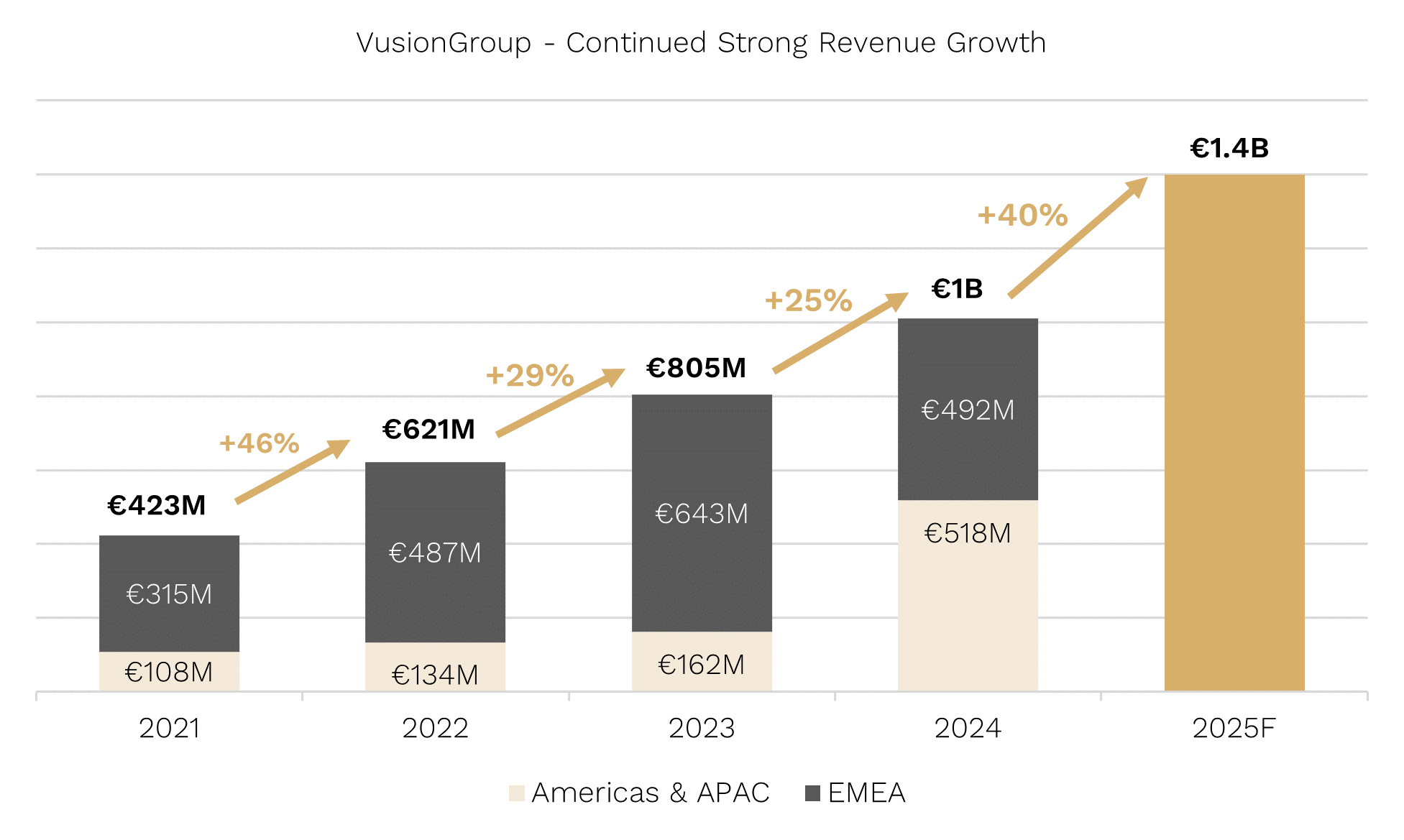

We model 25%+ revenue CAGR through 2027, supplemented by high-margin value-added services (VAS) products that Vusion bundles with its hardware. These software solutions, which include dynamic pricing, inventory automation, and theft prevention, are creating recurring revenue streams and best-in-class EBITDA margins that we believe increase Vusion’s competitive moat and customer stickiness.

Source: VusionGroup, Ophir.

Beyond the fundamentals, the technology itself is genuinely exciting. VAS features now enable:

- Optimised picking for online orders

- Time-of-day dynamic pricing

- Real-time inventory auto-replenishment

- Theft detection and loss prevention

These aren’t just bells and whistles, they’re solutions to real pain points for retailers, helping drive adoption and pricing power. And importantly, they deliver software-like margins on top of hardware deployments.

ESL penetration in the U.S. remains well below Europe despite a significantly larger store and SKU base, a recipe for catch-up growth.

- U.S. stores: Significantly more locations per chain; often with broader inventory complexity.

- Pharmacy and hardware: These verticals are still largely untouched and represent major future growth. Just picture an ESL replacement program on your next trip to Chemist Warehouse…

With ESLs moving from “nice to have” to operational necessity, we see a multi-year adoption curve ahead.

Why We Still Hold – The Price is Right!

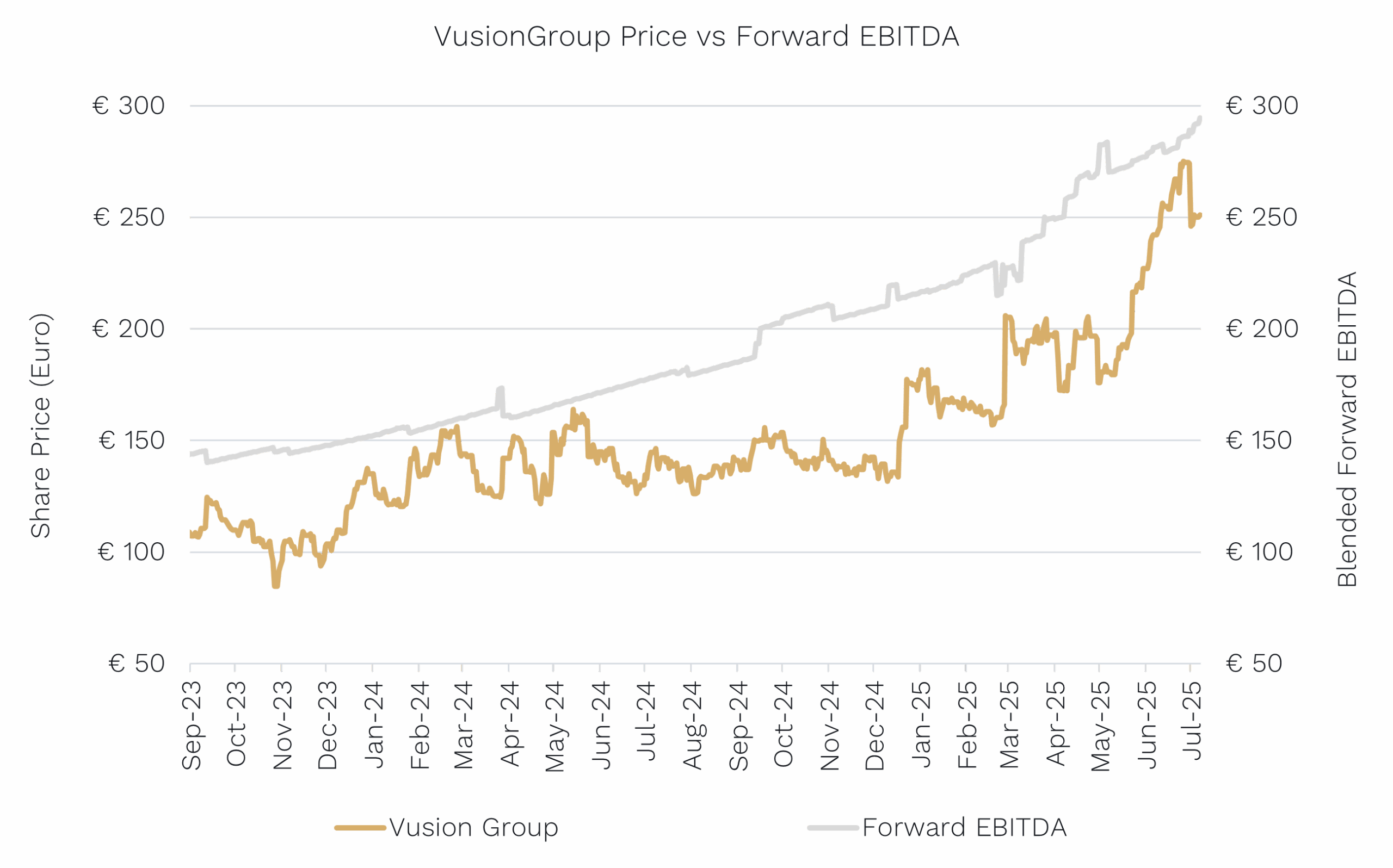

Despite recent strength in the share price, valuation remains attractive. Vusion trades on ~12x forward EBITDA with 35%+ EBITDA CAGR expected over the next few years. With increasing operating leverage from software and international expansion, we believe this multiple does not reflect the quality or visibility of future earnings.

Source: Bloomberg, Ophir.

We feel like we’ve been told to “Come on Down” and we’re on to a winner with structural tailwinds, an expanding TAM, and operational leverage still ahead. You don’t need 20/20 vision to see further upside from here.