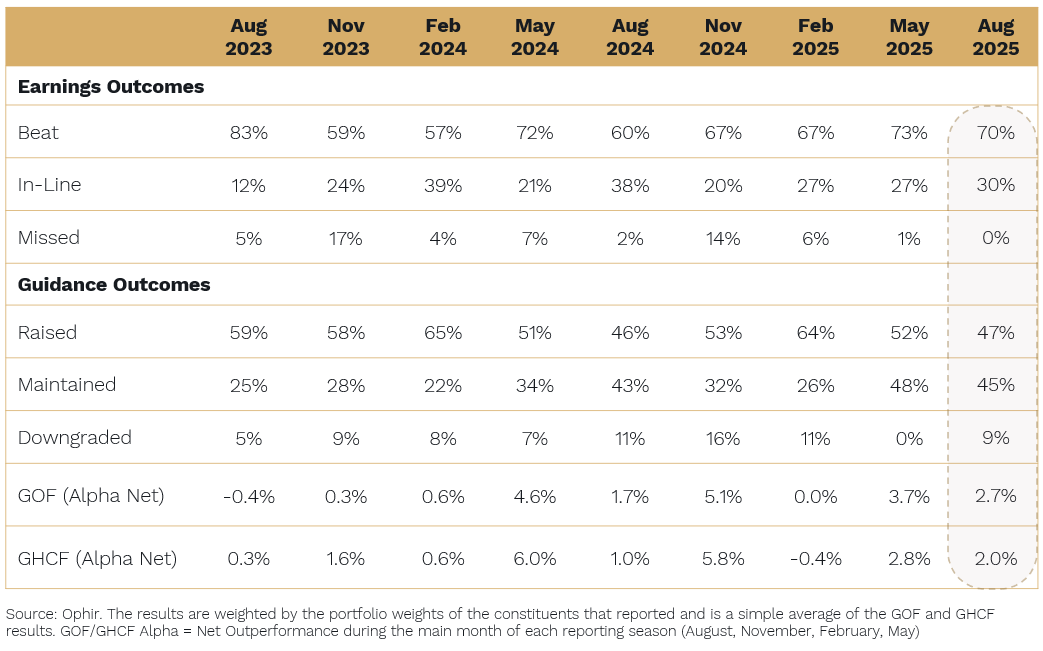

Most of the portfolio companies in our global funds reported their Q2 results in late July and early August.

Our performance during this period was solid with both of our global funds up 4-5%, compared with the benchmark return of 2.1%:

- We maintained our history of owning more ‘beats’ (companies reporting better-than-expected results) than ‘meets’ and ‘misses’;

- A similar number of our portfolio companies either upgraded or maintained guidance; and

- Pleasingly, very few of our holdings downgraded guidance.

At Ophir, we are always looking for companies doing better than the market expects because earnings beats typically translate to share price appreciation.

With no clear business cycle, we entered Q2 with a portfolio designed to work in either a strong or weak macro environment.

That positioning certainly helped our performance.

Two companies that we have recently added to our portfolios, which thrive in strong or weak macro, include Resideo (REZI) (see below for a deeper dive) and Descartes Systems (DSGX).

These sit alongside existing names like IES Holdings (IESC) and AAR Corp (AIR), a group that lets us participate in a recovery while providing downside protection.

We looked at both businesses in more detail previously (here and here).

Below, we look at a winner and loser from results season.

But first, stepping back, there were six key issues and themes that emerged during the period that particularly gained our attention:

-

Investors take profits

On balance, we saw profit-taking throughout reporting season, particularly for companies whose share prices had run strongly into their results.

Companies that delivered strong quarters, often saw their share prices fade a few days after earnings.

This was particularly the case for companies with a more cyclically dependent second half.

-

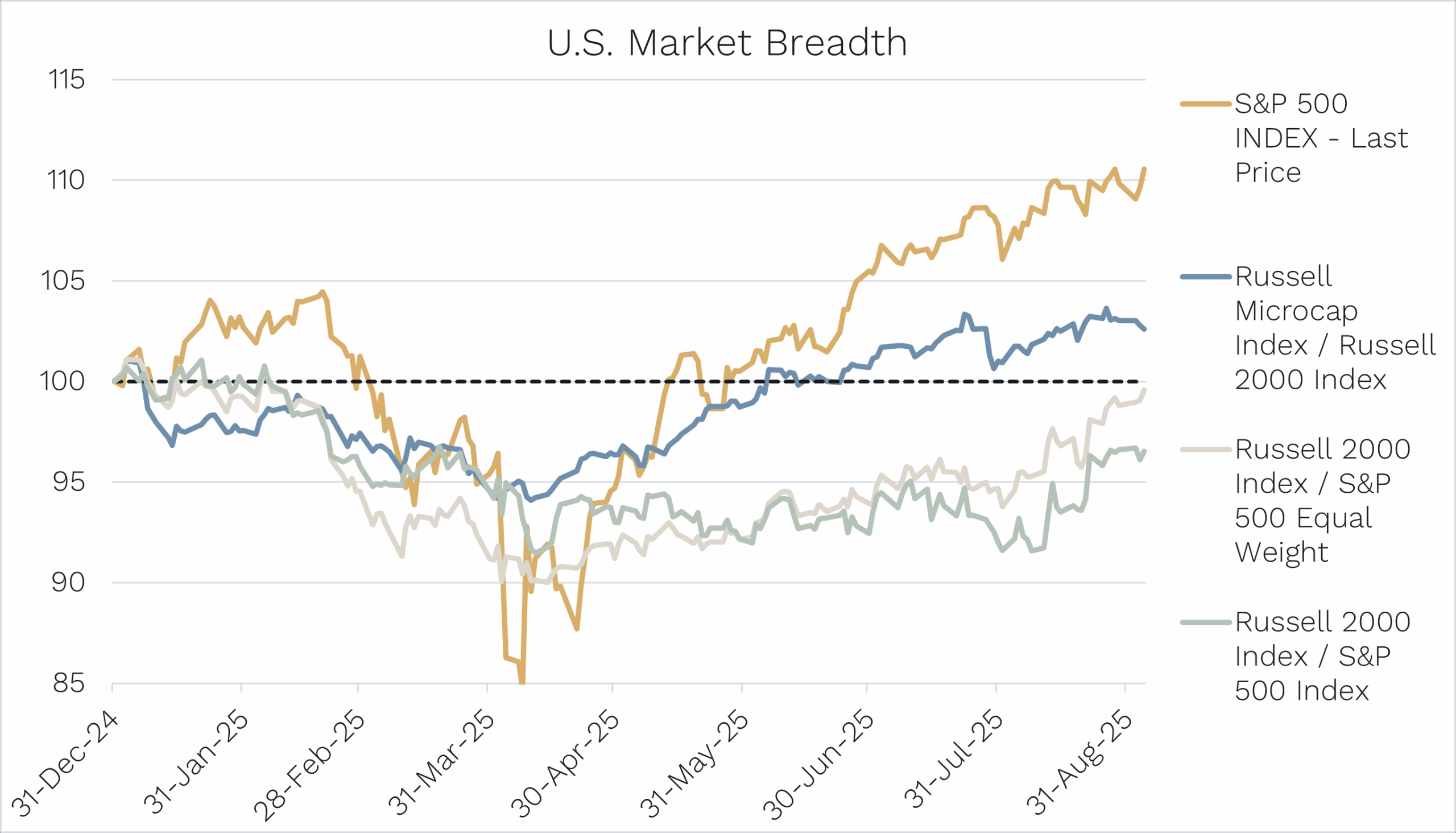

Market breadth widens

The share price fades were a sign that investors were rotating into less well-held names.

This apparent rotation is reflected in the continued widening of market breadth.

Within the Russell 2000 index, the micro-cap subset has been outperforming over the last few months.

Source: Ophir. Bloomberg.

-

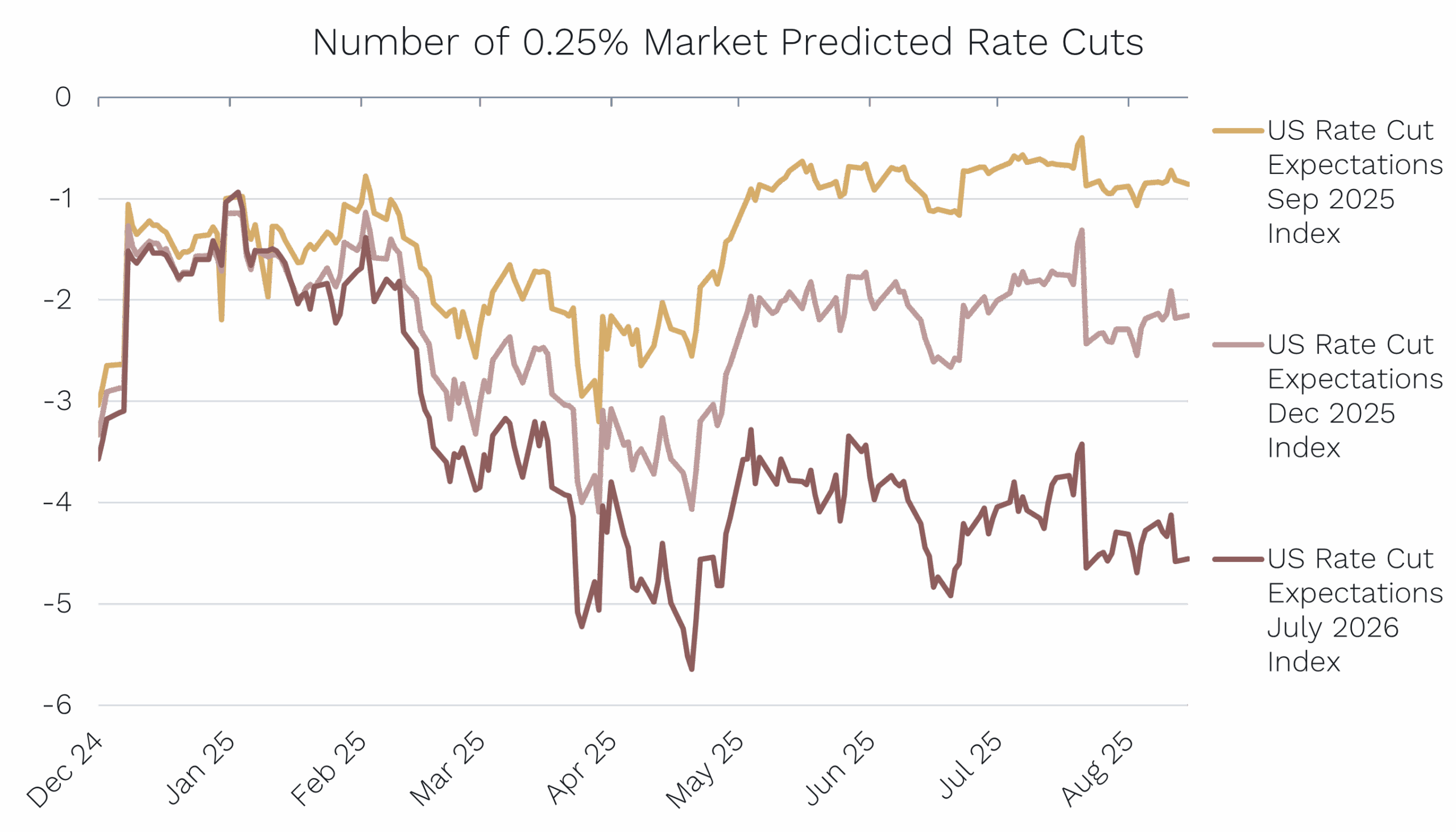

Rate cut prospects boost small caps

As the chance of a Fed rate cut in September increased, we saw this flow into small caps more broadly in August, with the Russell 2000 up 7% compared to the S&P 500’s 2% gain.

Source: Ophir. Bloomberg.

Direct beneficiaries of these lower rate expectations were home builders, building product suppliers and select REITs as the market anticipates housing transaction volumes to recover from their current historically low levels.

-

Tariff uncertainty continues

Investors questioned companies with tariff exposure that had strong quarterly results. They were concerned that pre-buying ahead of tariffs had pulled forward demand, giving the results a one-off boost.

-

Tech and healthcare struggle

The reporting season showed little patience for ‘good but not great’.

This was especially true in tech and software, where AI-fuelled names are facing growing fears of commoditisation.

Some examples (that we don’t hold) include The Trade Desk (TTD), HubSpot (HUBS) and Twilio (TWLO), which saw significant drawdowns in their share prices despite relatively solid results.

Healthcare was another tough spot. Investors were concerned about cost-cutting mandates (including RFK Jr. policy noise) and looming cuts to Medicare/Medicaid, and as a result, aggressively rotated out of the sector.

-

Positive outlooks tempered by caveats

However, when providing forward-looking statements, most companies sounded more constructive than last quarter. Though almost all added a caveat around tariffs and the consumer outlook.

Several also referenced concerns about “a left-field tweet” or regulatory surprise.

This is something investors must get used to under a Trump Administration.

Two results case studies (a winner and loser)

Below, we take a closer look at one winner and one loser from the recent results season.

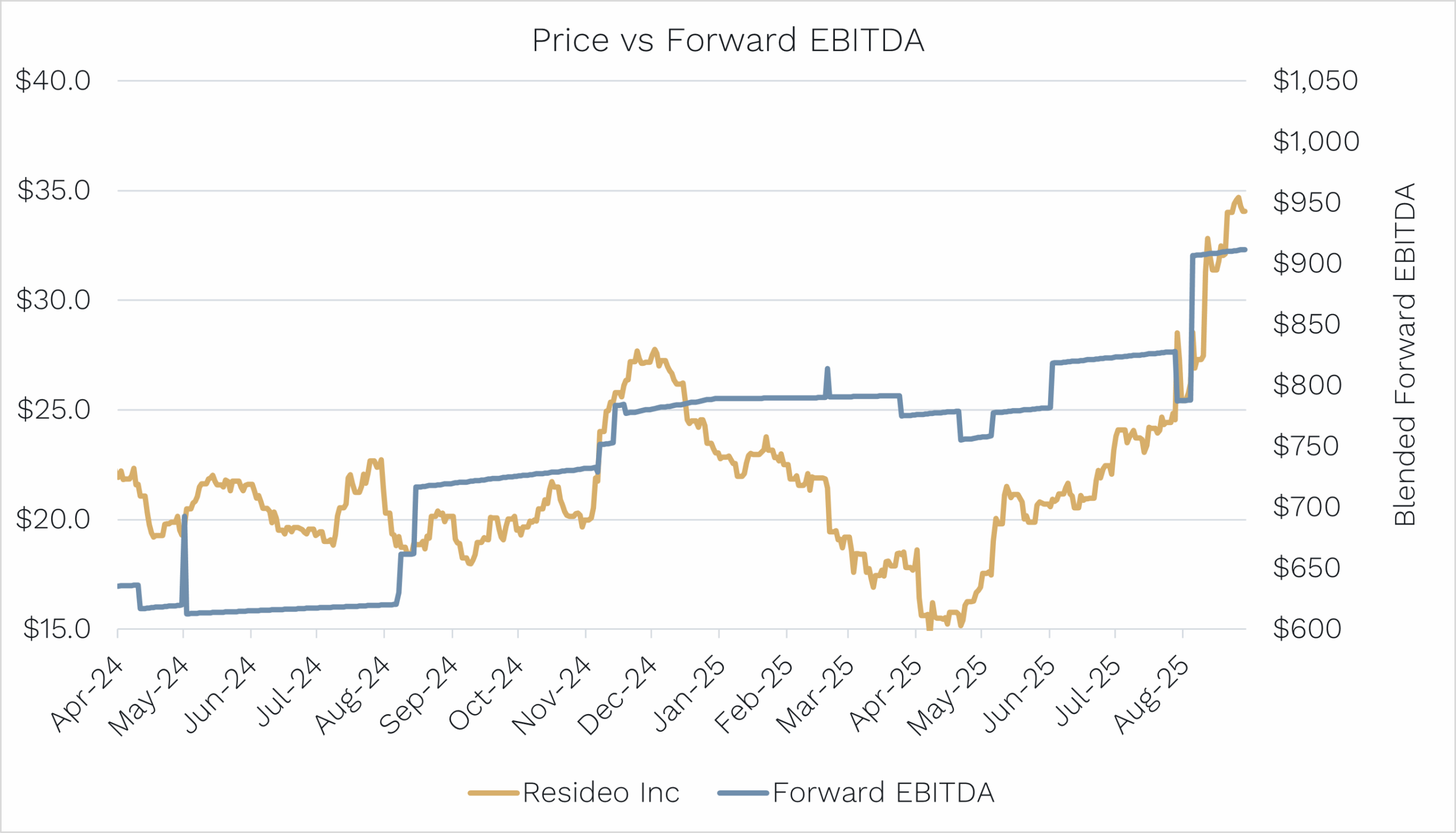

The Winner – Resideo Technologies (NYSE: REZI)

Spun out of Honeywell in 2018, Resideo operates two distinct business units:

- Products & Solutions (P&S): Smart thermostats, air quality monitors, fire/security systems, and

- ADI Distribution: Access control, fire protection, AV, and connected home product wholesaling

We’ve known Resideo for several years and re-initiated a large position ahead of the quarter. Our thesis was simple: The P&S division was quietly outperforming peers; gross margins were improving, and the company’s valuation was highly attractive at <10x earnings.

Source: Ophir. Bloomberg.

What Drove the Result

REZI’s Q2 result delivered on all fronts:

- Earnings guidance was upgraded due to stronger volumes and better margins

- A legacy environmental liability from the Honeywell spin was bought out

- Management announced plans to split the business into two standalone entities, unlocking appropriate multiples for each

Do We Still Own It?

Yes … and we’re still bullish.

The stock has rallied ~40% since our entry, but is still only trading on ~12x earnings.

With operational momentum accelerating, and a likely Investor Day in early 2026 to highlight the long-term earnings potential of each segment, we believe there is still meaningful upside ahead — especially if Fed rate cuts begin to support housing activity.

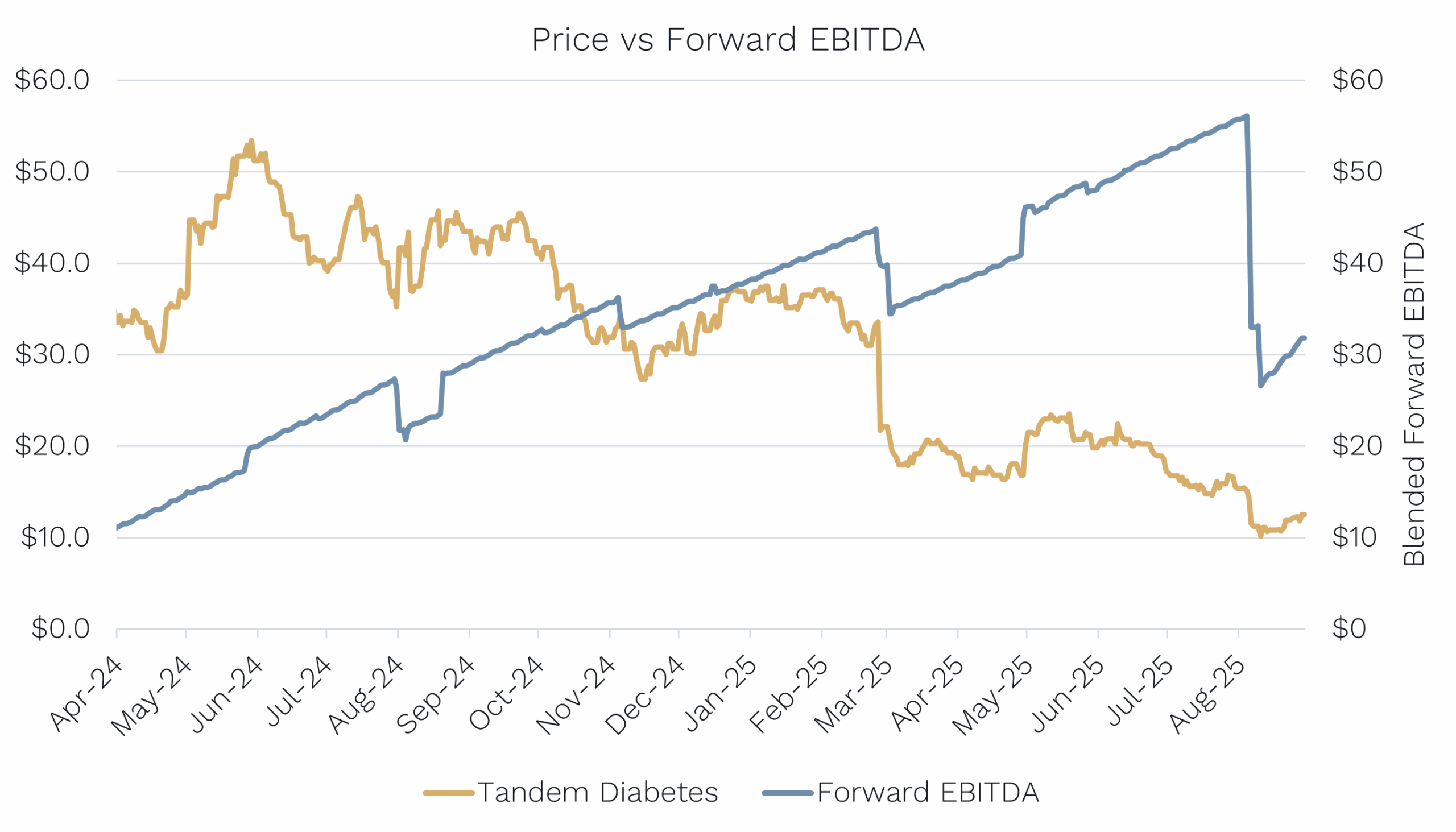

The Loser – Tandem Diabetes Care (NASDAQ: TNDM)

Tandem is the world’s #2 provider of insulin pumps, with its flagship t:slim X2 product integrating with CGMs (Continuous Glucose Monitors) to automate insulin delivery and improve glycaemic outcomes.

Why We Owned It

Heading into results, we believed the market was overly pessimistic and missing upside from three key drivers:

- The launch of the Mobi, which is a smaller, next-gen device;

- ASP (average selling price) uplift through pharmacy reimbursement; and

- Early traction in Type 2 diabetes, expanding the patient pool.

With the stock heavily sold off prior to the result, we believed downside was limited and that consumables and renewals would provide valuation support.

We did extensive work, including site visits, peer calls, distributor checks, and endocrinologist interviews.

What Went Wrong

The bear case on lower U.S. patient adds played out, and Tandem took a more cautious tone on second-half growth due to a competitor launch.

While Tandem maintained its full-year revenue guidance, the mix shifted toward Europe, and the company trimmed EBITDA guidance (driven by non-cash adjustments).

Source: Ophir. Bloomberg.

Do We Still Own It?

No.

We were frustrated by the magnitude of the sell-off, particularly given revenue was unchanged. But in the U.S. market, perceived share loss is lethal. We are also aware that cheap isn’t a catalyst.

With our channel checks and industry research not as accurate as needed, we decided to exit.

While our thesis may still play out in time, it’s more valuable to reallocate capital to higher-conviction names than try to chase lost ground on Tandem.

Continuing to deliver despite macro conditions

This reporting season reaffirmed our conviction that valuation alone isn’t enough. You need the setup, the positioning, and the execution to all line up.

But we’re encouraged that even in a tough tape, our balanced, fundamentals-driven approach continues to deliver.

Our focus remains on companies with multi-year growth drivers, improving business quality, and compelling valuations… with or without macro support.