Finding Alpha in Zeta

In a sea of marketing tech companies competing for attention, Zeta has quietly established itself as one of the most compelling players in the space. But it hasn’t all been smooth sailing, especially when it listed.

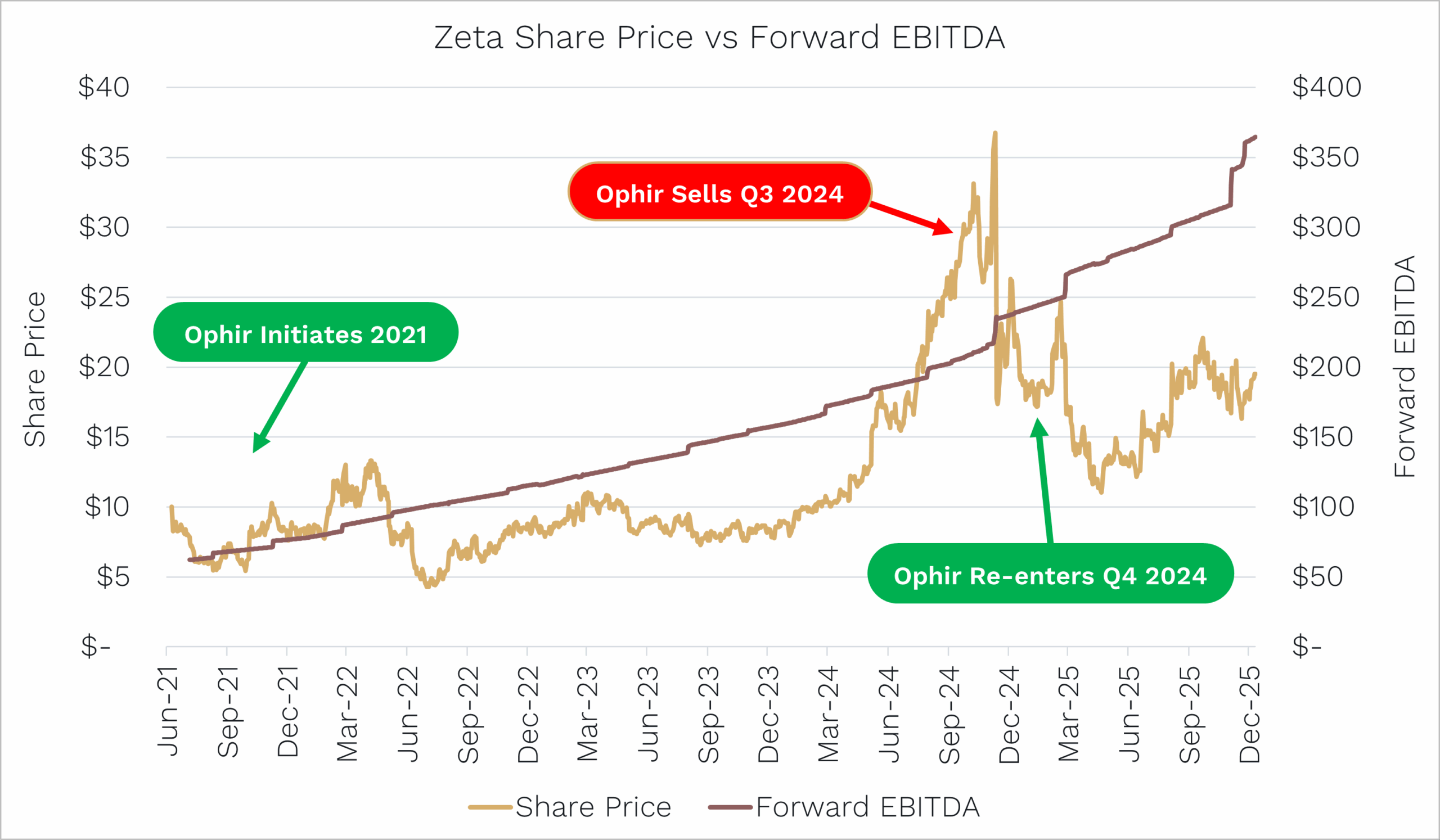

We first met Zeta in 2021 during a virtual roadshow shortly after what can only be described as a disastrous IPO. Just after listing, the analyst from the bank who listed the stock came out with a Neutral recommendation and a price target below the listing price. This contributed to the stock falling nearly 50% post IPO, and for a while, Zeta became a name most investors avoided.

So we took a meeting, did the work, and came away with a very different conclusion.

How We Gained Conviction

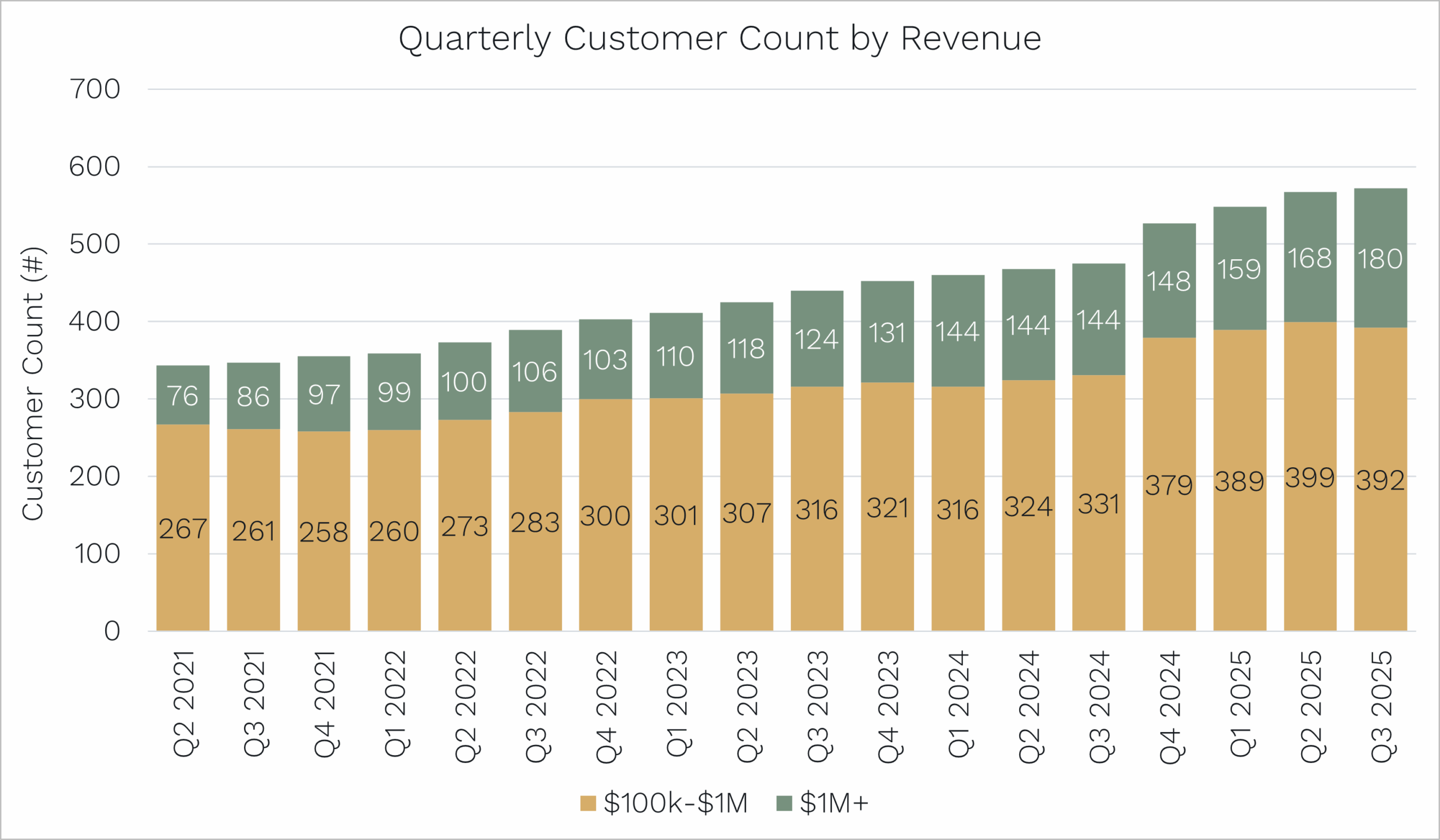

Major agency partners are the core customer base in Zeta’s market. After a series of diligence calls, we found repeated evidence of Zeta’s superior return on ad spend (ROAS) compared to the incumbents. We also sat through a two-hour technical demo with Zeta’s product engineers and walked away convinced the platform had the scalability, usability, and performance to support sustained growth with large enterprise clients.

In short, Zeta was misunderstood, but not broken.

Keeping Our Finger on the Pulse

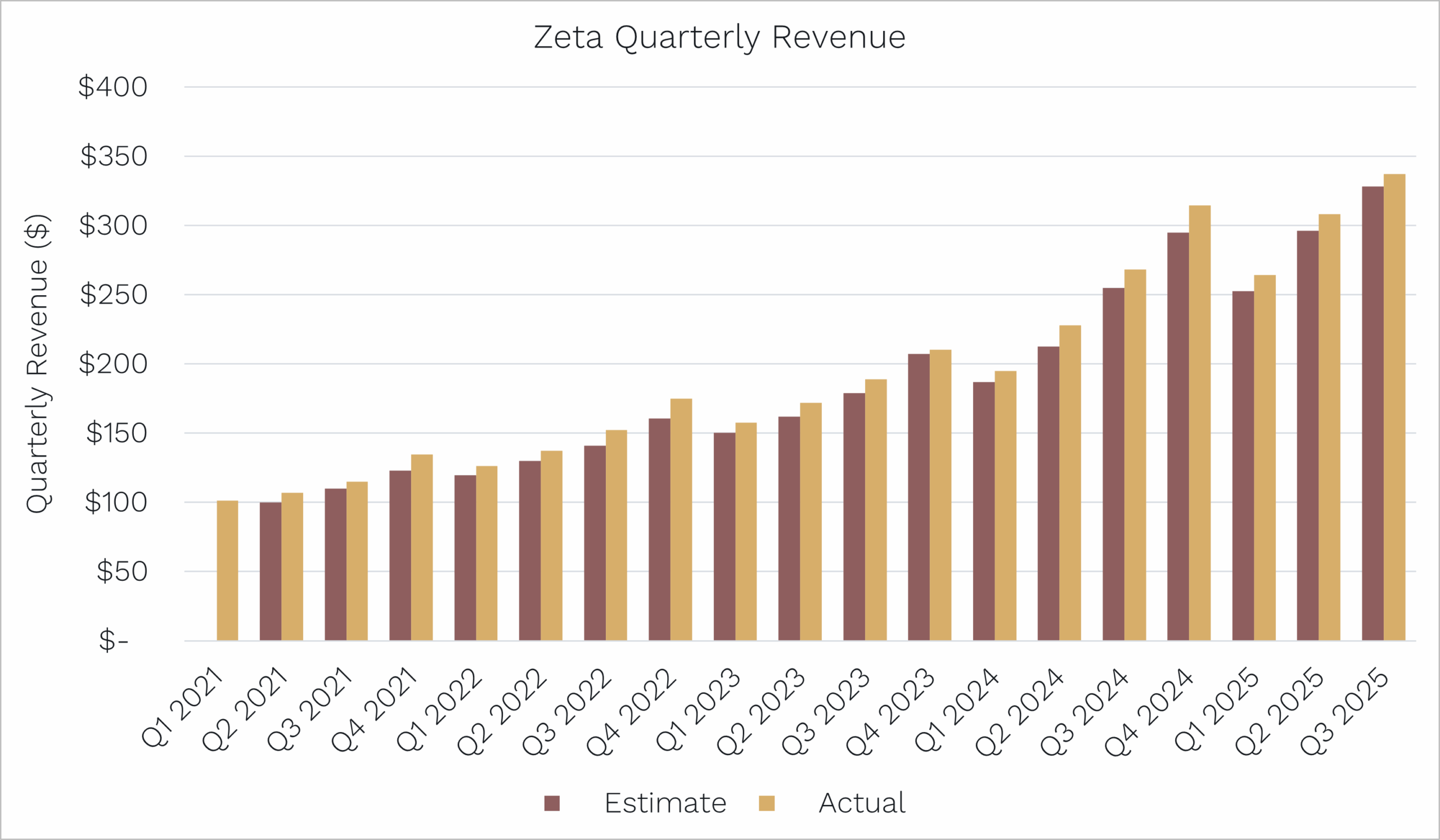

In Q3 2024, with the stock having exceeded our price target, we exited our position. After consistently beating and raising every quarter post IPO, we believed the stock was priced for perfection and the market was paying two years forward. We still liked the story, but felt the set-up required growth to accelerate further.

Source: Zeta Global Investor Day Presentation, October 2025.

As anticipated, guidance wasn’t enough to satisfy the markets’ elevated expectations.

Following the conservative 2025 guide, a short report attacking Zeta’s data integrity was released. This is a classic vulnerability for advertising technology (AdTech) businesses and the stock was sold off aggressively. We had already done deep diligence on Zeta’s data pipeline and knew from customer and partner conversations that the underlying data quality had been reviewed and validated by some of the most sophisticated agency buyers globally.

We believed the short report, while well-timed, was opportunistic. So we re-entered in Q4 2024 at a significant discount to intrinsic value.

Source: Ophir. Bloomberg Data as of 10 December 2025.

What They Do and Why It Works

Zeta is a leading U.S. marketing technology (MarTech) company. Their platform helps large enterprise customers identify, engage, and retain customers more effectively by using predictive AI, real-time signals, and a differentiated first-party data graph.

Unlike traditional software companies that sell you an “empty” database to fill with your own customer data, Zeta provides the software already filled with a massive proprietary dataset of consumer identities and behaviours.

This unique combination allows them to bridge the gap between AdTech (acquiring new customers via ads) and MarTech (retaining customers via email/SMS), a convergence that defines the current industry landscape.

Source: Zeta Global Investor Day Presentation, October 2025.

The Thesis in Focus

Zeta is a classic, Rule of 40 compounder, but isn’t currently trading like one.

- Organic revenue growth of 20%+

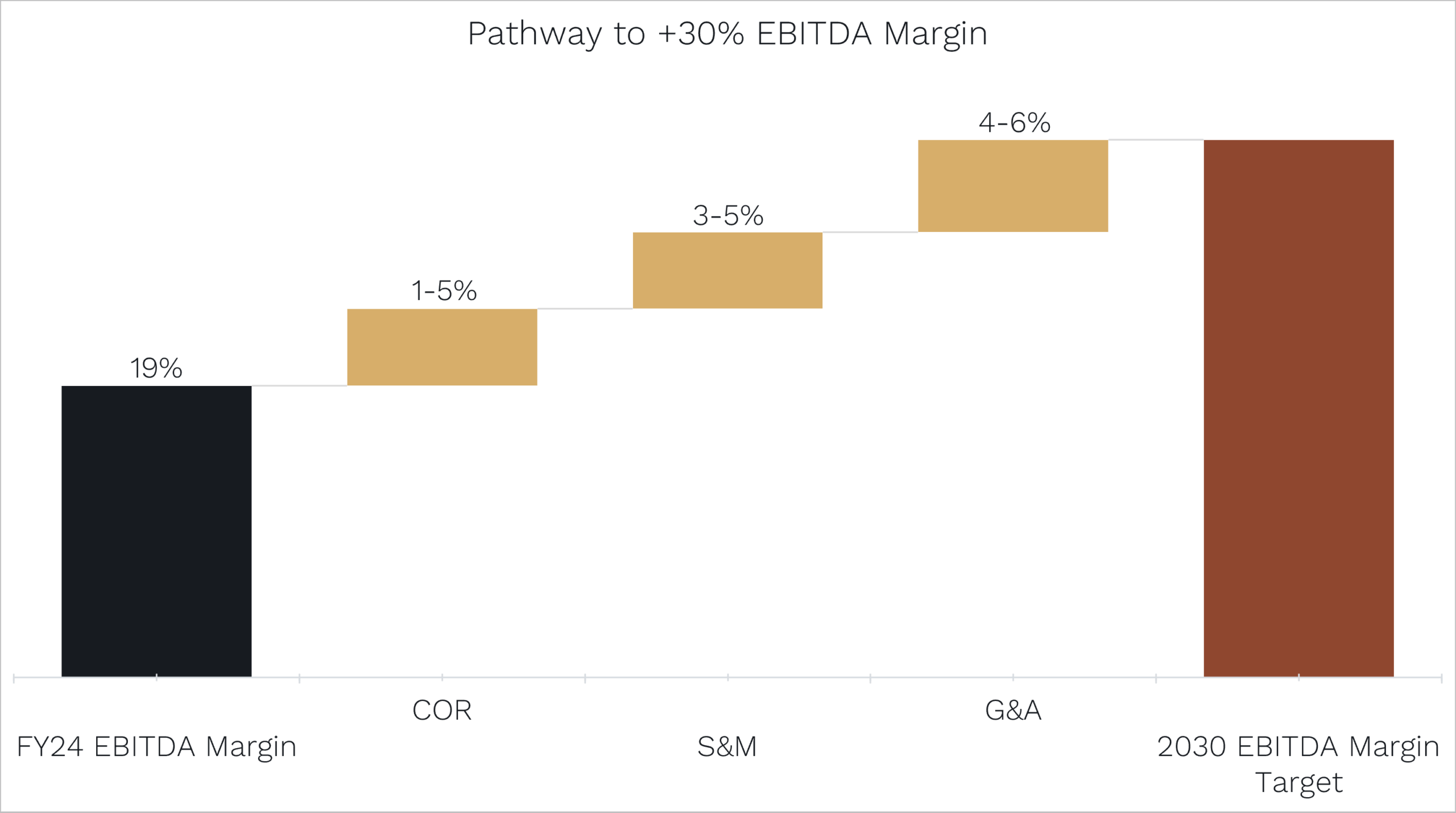

- EBITDA margins in the low 20s, growing toward 30%+ by 2030

- Multiple M&A levers to accelerate platform expansion

- Trades on just ~11x forward EBITDA

With margin expansion and top line momentum both in place, we believe Zeta deserves to re-rate back to the high-teens multiples it saw during prior periods of growth acceleration.

COR refers to Cost of Revenue, S&M to Sales and Marketing, and G&A to General and Administrative expenses.

Source: Zeta Global Investor Day Presentation, October 2025.

What Gives Us the Edge

- 20+ customer and agency diligence calls across several years

- Portfolio company usage validation from advertisers and data partners

- Three separate product walkthroughs with Zeta’s engineers to assess capability evolution

- Built conviction through multiple cycles — pre-IPO dislocation, post-rally exit, and re-entry after short attack

Why We Still Hold

We held a mid-sized weight going into the most recent result, halved it post-print due to macro uncertainty, and have since increased our position size as macro uncertainty has started to abated (relatively speaking).

- Q3 results beat EBITDA by ~10%, and consensus for 2026 was upgraded

- Yet the stock finished flat for the month

- Multiple is now at its lowest in years, despite ongoing earnings momentum

This isn’t about betting on the macro, but if risk sentiment improves, Zeta is well-positioned to slingshot out of this multiple compression phase.

Managing the Beta

It’s important to highlight: Zeta is a cyclical, higher-beta name. And that’s a feature, not a bug.

- It offers tremendous upside when confidence returns to the macro

- We believe the downside remains manageable, but it can be volatile during periods of macro uncertainty

For now, we’re happy owning a mid-sized position given the attractive multiple and as the macro backdrop shifts, we can flex the weight accordingly.

Final Word

Zeta may have started its public life under a cloud, but what’s emerged since is a category leader with a clear value proposition, an expanding product suite, and the kind of performance profile that earns loyalty from budget-conscious agency buyers.

With ongoing growth, rising margins, and a valuation that provides more reward than risk, we see Zeta as a name that can quietly compound, then quickly re-rate when sentiment catches up.