Seeing in the Dark

At Ophir, we’re always looking for exceptional businesses sitting just outside the spotlight. That’s how we came across Exosens, the European leader in night-vision components.

We first encountered Exosens – which is based in Merignac, France – through our investment in Theon International (THEON), a night-vision device manufacturer that IPO’d in February 2024. During diligence on THEON, it became clear that a key strategic supplier, Exosens, was a company we needed to know better.

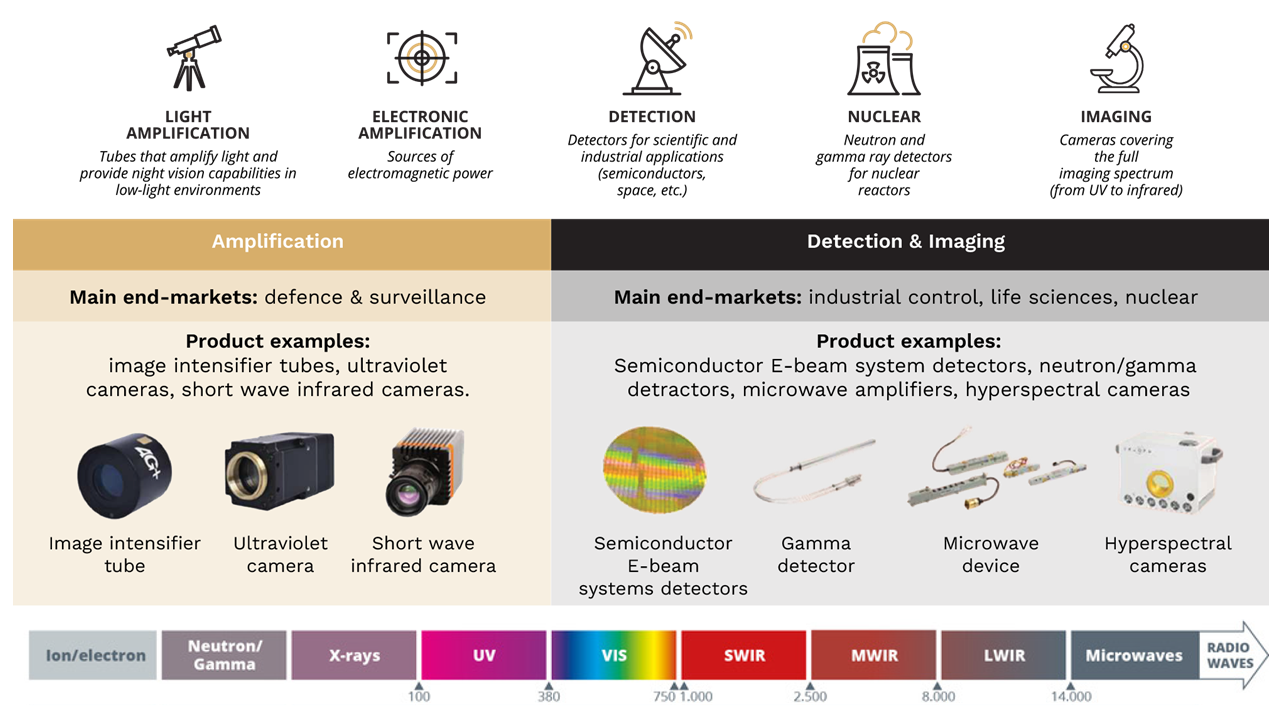

Exosens is the European leader in high-performance electro-optical technologies. It specialises in image intensifier tubes (IITs), the critical components used in night-vision goggles and weapon sights. (The tubes convert low-level light into bright images that humans can see.)

With more than 85 years of experience, Exosens has quietly built a strategic position as a mission-critical supplier to NATO forces, holding 42% global market share in IITs, and 72% market share ex-U.S.

Importantly, Exosens is “ITAR-free”, meaning it is not subject to U.S. arms export restrictions – a major advantage for European buyers seeking sovereign and secure supply chains.

Outside defence, Exosens also supplies radiation detection (24% global share), nuclear control components (38%), and imaging systems for high-end medical, scientific, and industrial use (~7% share overall, focused on niche segments). These non-defence operations provide valuable diversification and help create a steadier, less cyclical earnings base than defence alone.

Company Overview

Source: Exosens Company Report October 2025.

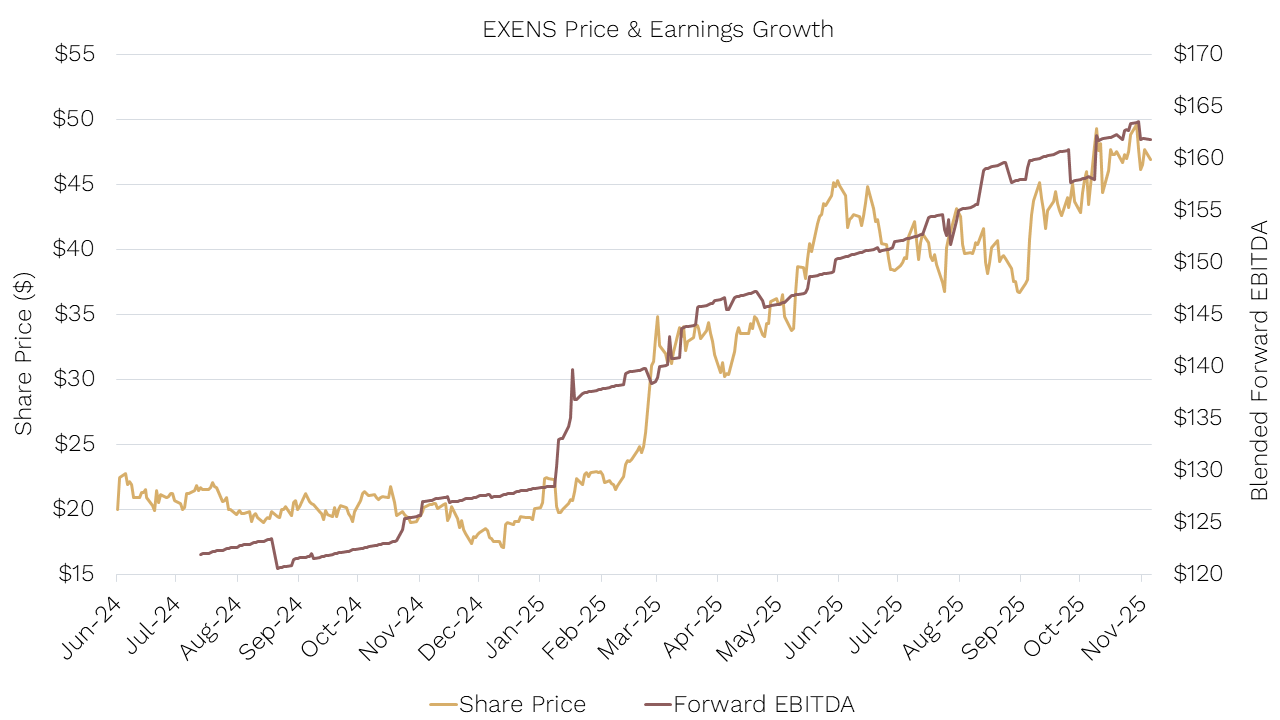

So when Exosens went public in June 2024, we were ready. With a front-row seat for the THEON process, and strong conviction in the electro-optical space, we became a top-five initial holder in Exosens. Since its IPO, Exosens shares have surged around ~130%, supported by growing investor enthusiasm for defence-related stocks.

After a three-day research trip to Europe in September 2025 – where Exosens stood out among 15 company meetings – we increased our position further.

Exosens is one of the most attractive under-the-radar growth stories in the whole defence and industrial imaging landscape. We are confident it will remain a fantastic investment for several key reasons.

1. A Secular Defence Tailwind

The first is that the company is well placed to benefit from surging defence spending in Europe.

The global market for night-vision IITs is highly concentrated. Alongside U.S.-based L3Harris and ElbitUSA, Exosens is the only other player of scale. Importantly, it is the only non-U.S. option with mass production capabilities and NATO credibility.

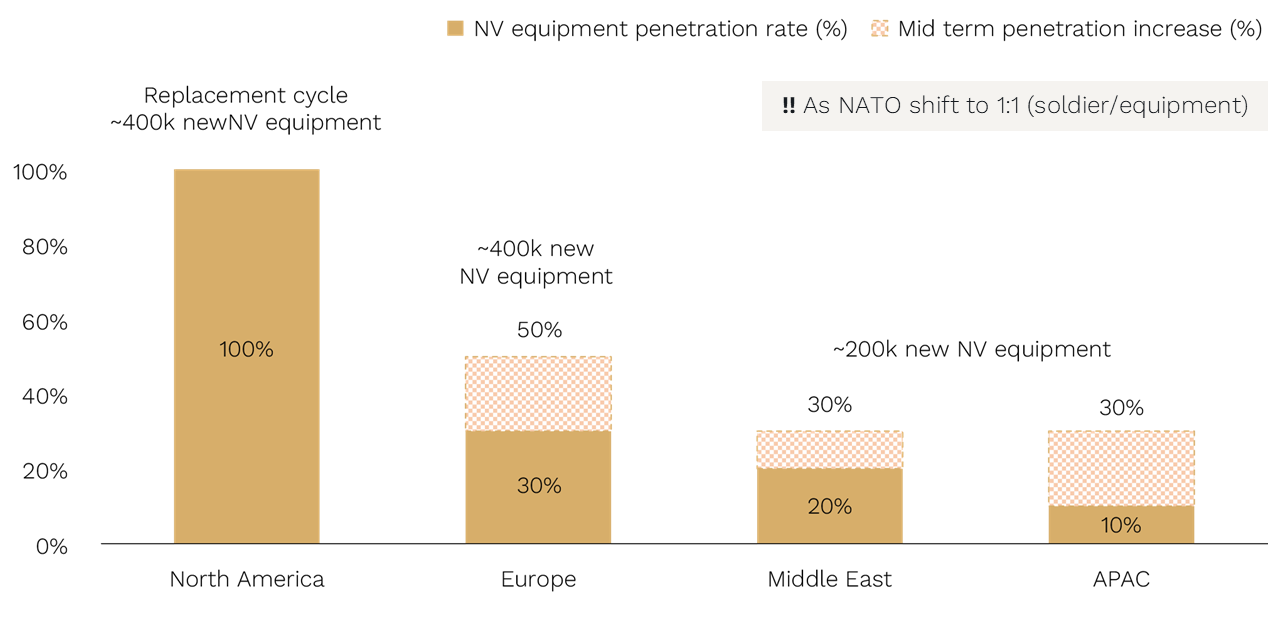

Europe’s penetration rate for night-vision remains low at ~30%, compared to ~100% in the U.S., offering Exosens significant room for growth.

If Europe’s penetration rate were to increase to 50%, it would imply roughly 400,000 additional devices – each requiring one or two IITs, depending on whether they are monocular or binocular.

Further supporting demand, Germany has announced plans to expand its armed forces by 40–45% by 2030, from approximately 180,000 to 260,000 troops.

Procurement ratio and penetration remain low outside of the U.S.

Source: Exosens Company Report October 2025.

As defence budgets across NATO continue to rise, electro-optics are growing even faster, driven by rising electronics use in warfare; night-fighting capability gaps across Europe; and shifting NATO procurement policies that favour ITAR-free, interoperable technologies.

We believe Exosens is uniquely positioned to capture this growth as the only European manufacturer producing mission-critical IITs at scale.

2. A Clear Vote of Confidence from THEON

Further supporting our thesis is that THEON recently entered into an agreement to purchase a 9.8% strategic stake in Exosens at a ~25% premium to the last close prior to the announcement (EUR54.00 per share).

The rationale for THEON’s deal with Exosens is two-fold:

- It strengthens THEON’s relationship with Exosens as its key supplier for image intensifier tubes, thereby mitigating supply risks in the near term; and

- It lays the ground for future collaboration on digital technologies which can provide further capabilities to night-vision products and other product segments.

We see this as a strong validation of both Exosens’ strategic importance and the robust demand outlook for THEON’s products.

3. Diversification and M&A

The third reason is Exosens’ track record of successfully diversifying through acquisitions.

Since 2022, Exosens has completed eight acquisitions, expanding its reach into nuclear, detection, and industrial control markets. These deals bring not only incremental revenue but also margin uplift and a more diversified customer base.

Exosens has also attracted suitors of its own. In 2020, U.S. electro-optical conglomerate Teledyne (TDY) made a bid for Exosens at roughly 11x EBITDA – before the surge in valuations following the Ukraine conflict. The bid was blocked by the French government due to the company’s strategic importance, and Teledyne went on to acquire FLIR Systems (FLIR) a year later for 17x EBITDA.

In calls with former Teledyne employees, we confirmed that the bid for Exosens was driven by its superior technology and market access – reinforcing our conviction in the quality and positioning of the business.

4. High Margin Optionality: Drone Imaging

The final reason for our confidence in Exosens’ ongoing success is the massive potential in drones.

Exosens also supplies imaging technology to the drone market, though it is not yet a material contributor to group earnings. Our research with a dozen global drone companies suggests this could evolve into a meaningful revenue stream, with incremental margins exceeding 60%. While it may not appear in near-term results, it provides substantial upside optionality for future years.

In our view, the market continues to underestimate the scale of this drone opportunity.

Just look below at the comparison to some Australian-listed companies – Droneshield and Electro Optic Systems – that saw significant share price appreciation on the global defence thematic.

(These two names have given back a lot of the recent gains, which demonstrates the volatility associated with investing in an undiversified business exposed to a ‘hot’ thematic.)

By the numbers, every US$50m of incremental drone revenue would be ~US$30m of EBITDA, adding ~15% to outer year EBITDA.

If even a portion of Exosens’ drone exposure materialises, its earnings base could expand materially and potentially warrant a significant multiple re-rating in line with other high-growth defence and imaging peers.

Gaining Our Edge Through the Fog of War

Exosens has carved out a rare position: a high-margin, IP-rich business with both defensive resilience and offensive growth.

We expect the company to deliver a top-line compound annual growth rate (CAGR) in the mid-teens over the next three to five years, underpinned by strong structural demand and disciplined execution.

We also anticipate continued EBITDA margin expansion driven by operating leverage, scale benefits, and an improving business mix.

Despite this growth potential – and the advantages outlined above – Exosens still trades on an attractive forward 12-month valuation of around ~15x EBITDA.

Source: Ophir. Bloomberg. Data as of November 2025.

Exosens sits at the crossroads of national security, advanced optics, and industrial innovation.

With a growing customer base, increasing optionality in high-growth verticals such as drones, and strong backing from sovereign governments, we believe Exosens stands out as one of the most compelling under-the-radar compounders in the European small-cap landscape today.