We’re pleased to confirm final distribution amounts for all Ophir Funds, along with payment timelines and next steps for investors.

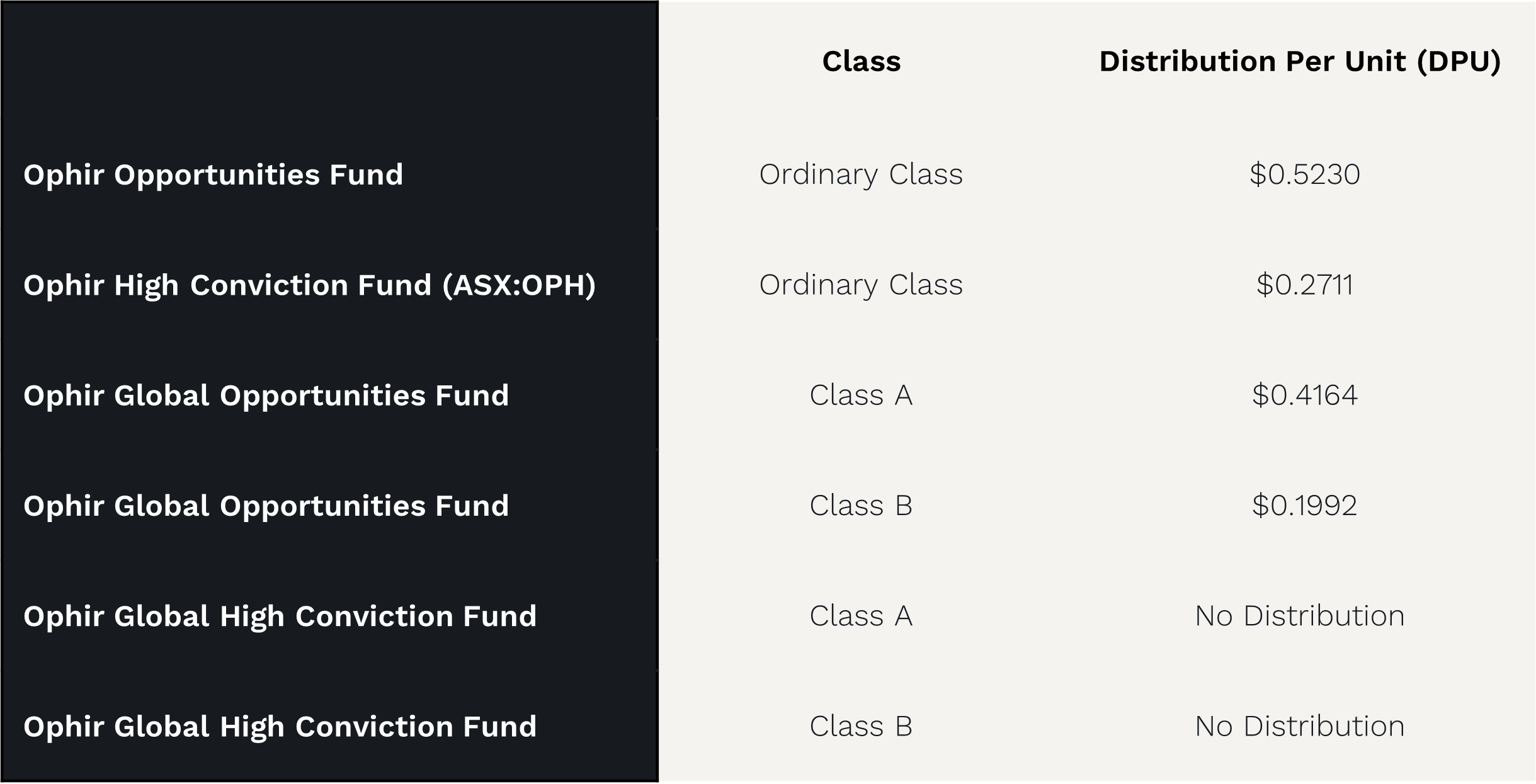

Final Distribution Per Unit (DPU)

Payment Dates

- Ophir Opportunities Fund – 23 July 2025

- Ophir Global Opportunities Fund – 23 July 2025

- Ophir High Conviction Fund (OPH) – 27 August 2025 (reflects the timing required to complete on-market purchasing of units to satisfy the DRP).

Distribution statements will be issued on the payment date and tax statements will be issued approximately one week later. Please note that during this payment and processing period the Automic Investor Portal may not accurately reflect your distribution payment or distribution reinvestment.

Understanding Fund Distributions

If you’ve recently received a distribution from your investment in an Ophir fund, or noticed your unit price fall on 1 July, you might be wondering what happened and what it means for your investment. Here’s a quick guide to help you understand how distributions work and why they’re a normal part of investing in managed funds like ours.

What Is a Fund Distribution?

A distribution is a payment made to investors from the income earned by a fund during the financial year. This can include interest, dividends, and realised capital gains from assets the fund has sold.

Even though Ophir’s funds are capital-growth focused (not income-focused), they may still pay distributions, because Australian tax rules require funds to pass on any net income to investors.

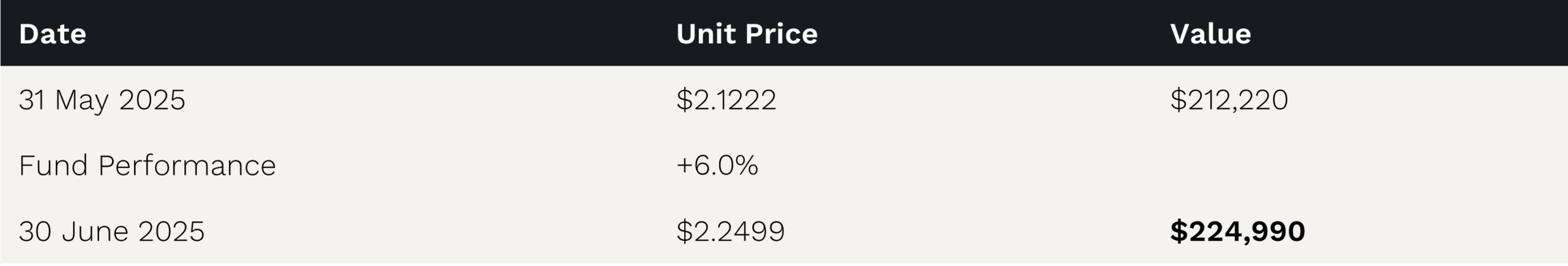

What Happens When a Distribution Is Paid?

When a distribution is paid, the fund’s unit price adjusts downward by the amount of the distribution. This is similar to how a company’s share price drops when it goes ex-dividend. Importantly, you are not losing money, the value is simply transferred from the unit price to either:

- A cash payment into your account, or

- Additional units in the fund (if you’re enrolled in the Distribution Reinvestment Plan, or DRP).

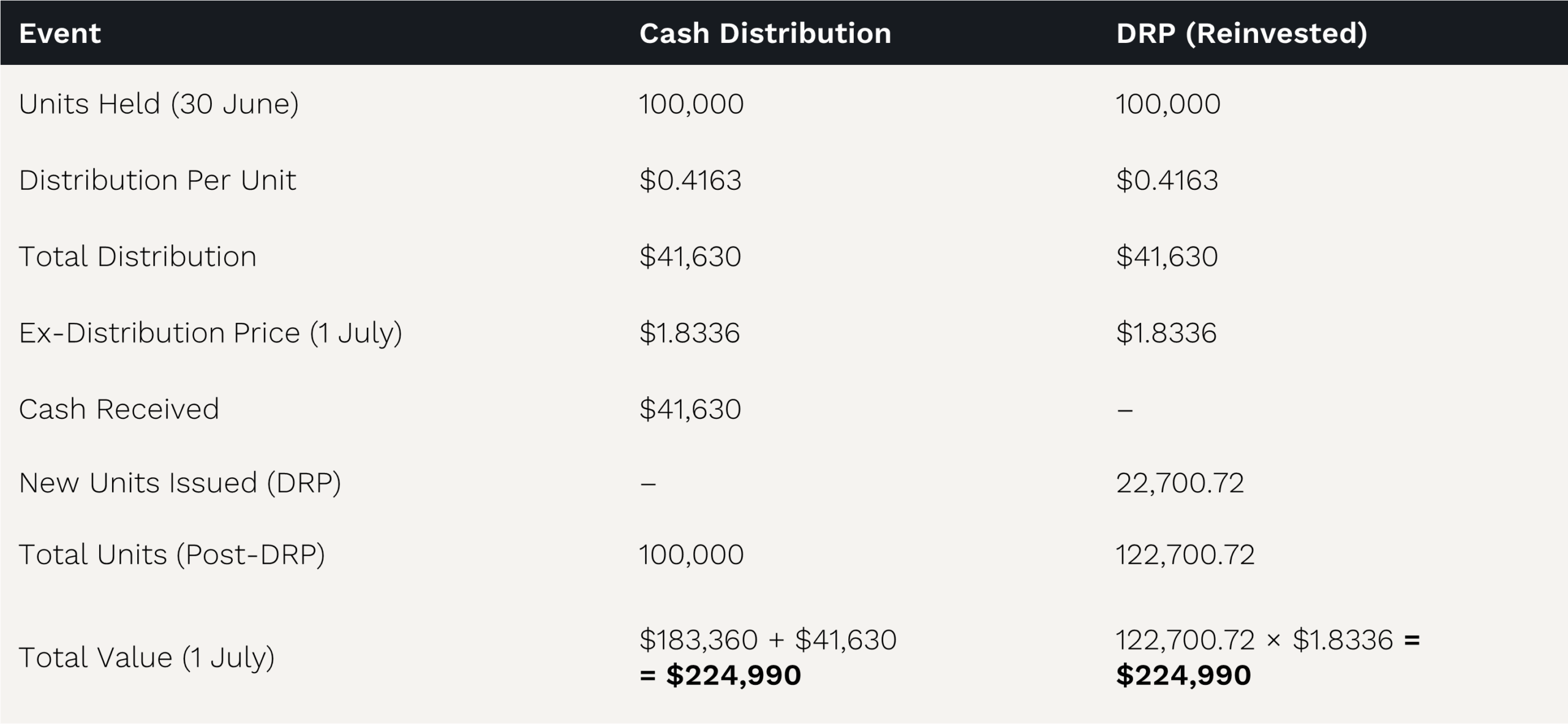

What Is the Distribution Reinvestment Plan (DRP)?

The DRP allows you to automatically reinvest your distribution to buy more units in the fund, instead of receiving the payment in cash. This helps compound your investment over time — with no transaction costs, (such as buy spreads) and requires no action from you once you’ve elected for “Full Participation”.

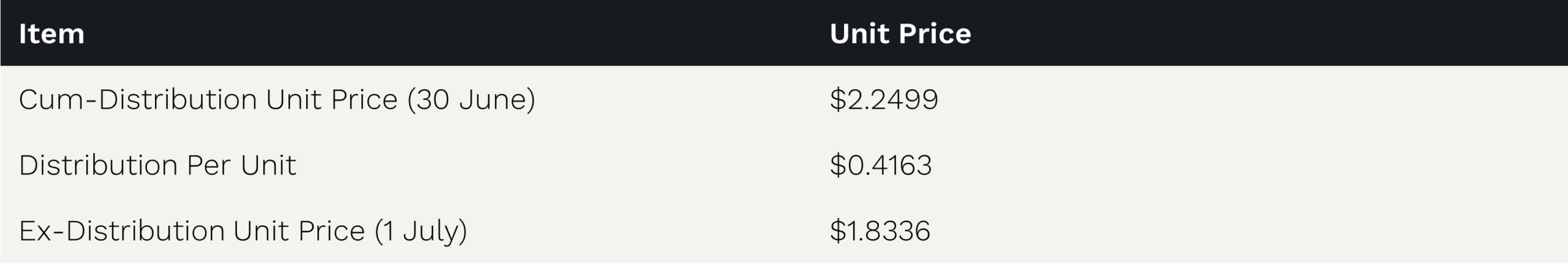

Example: Ophir Global Opportunities Fund – FY25

Let’s walk through a real example using the Ophir Global Opportunities Fund.

- On 31 May 2025, the unit price was $2.1222

- By 30 June 2025, the unit price had risen to $2.2499, an increase of approximately +6.0% for the month

- On 30 June, the fund paid a distribution of $0.4163 per unit

- On 1 July 2025, the unit price adjusted to $1.8336, reflecting the distribution

How Is the Ex-Distribution Unit Price Calculated?

Let’s assume you held 100,000 units in the Fund at 31 May 2025:

Didn’t Participate in the DRP?

If you did not register for the Distribution Reinvestment Plan (DRP) in our Global Funds but would like to make an additional investment, you can do so via either of the following methods:

1. Automic Investor Portal

Log in: Click here

Navigate to your holding

Select “Details” then “$ Top Up” to submit an additional application request

2. Paper Form

Complete a paper form:

Ophir Global Opportunities Fund – Click here

Ophir Global High Conviction Fund – Click here

Submit the form to ophir@automicgroup.com.au by 5pm AEST on Monday 28 July 2025 (3 business days before month-end) to be included in this month’s processing cycle

If you have any questions, please contact us via email (ophir@ophiram.com) or phone (+61 02 8188 0397). Thank you again for your continued support.

Team Ophir

This has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date of this information and video was prepared, and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.