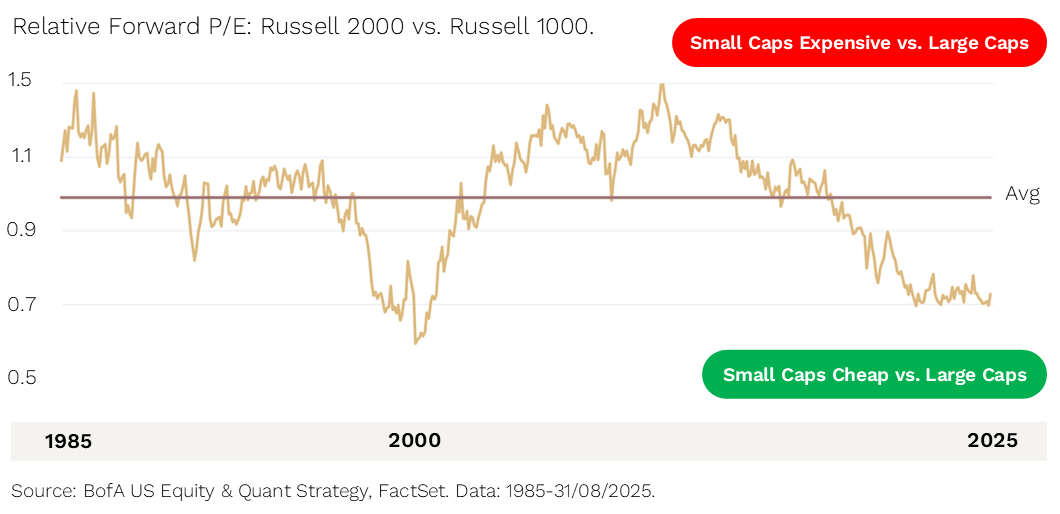

As the internet fuelled euphoria of the dot-com bubble burst in 2000, falling interest rates and a rotation out of large caps led to a period of significant outperformance for small companies.

Fast forward 25 years – large caps are trading at the largest premium to small caps (see chart further below) since then and the U.S. Federal Reserve has re-commenced its rate cutting cycle.

For over 13 years, Ophir has focused on discovering those hidden gems outside the large-cap universe – businesses that are doing better than the market expects.

Invest with Ophir: Invest

Join our Newsletter: Subscribe

Our Opportunities Funds

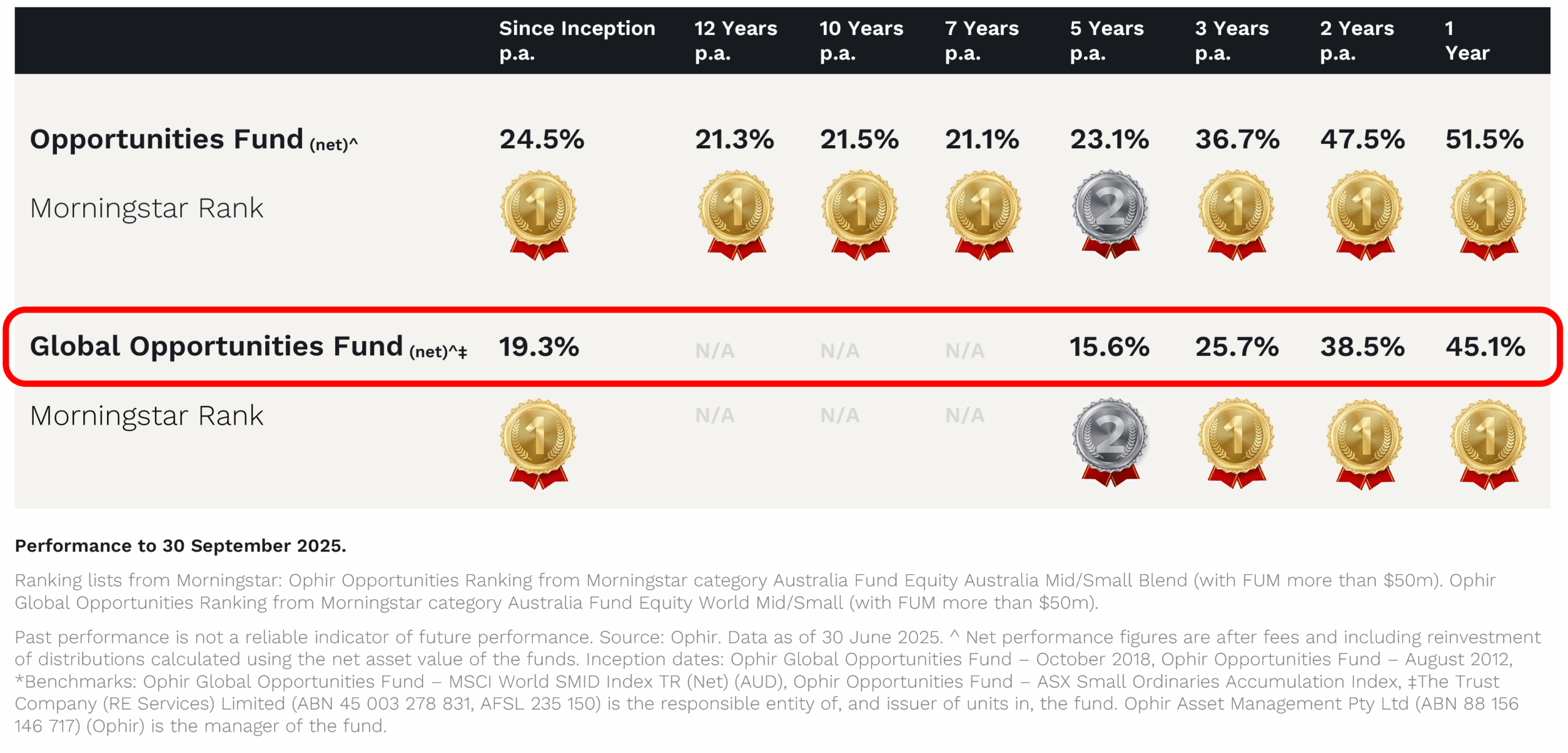

Our flagship small cap strategies, the Ophir Opportunities Fund and the Ophir Global Opportunities Fund, have delivered consistent, long-term outperformance by staying true to this process.

- The Ophir Opportunities Fund, our Australian small cap strategy, is the #1 performing Australian small cap fund since inception (1). It returned +51.5% over the last 12 months, and +24.5% p.a. net of fees since 2012, driven by uncovering future market leaders early. A recent example being family safety app, Life360. We backed it early, recognising the platform nature of the business, its future global growth prospects and the true value this presented.

- In 2018, we applied our investment process beyond Australia and launched the Ophir Global Opportunities Fund, targeting under-researched small and mid-cap companies across developed international markets. It is now the #1 performing global small cap fund available to Australian investors since inception (1), delivering +45.1% over the past year and +19.3% p.a. net of fees since 2018.

Importantly, the Global Opportunities Fund has recently reopened to new investors, and, like all Ophir strategies, is capacity constrained to protect long-term performance.

This presents an opportunity for those looking to gain exposure to global small caps through a proven manager.

While the two Funds invest across different geographies, they share the same DNA – and it shows.

The Global Opportunities Fund’s peer group rankings closely mirror the trajectory of its longer running Australian sibling, with both strategies delivering consistent top-ranked performance.

Performance & Rankings

Invest with Ophir: Invest

Join our Newsletter: Subscribe

Small Caps Are the Cheapest in a Generation

Today, U.S. small caps continue to trade at their steepest discount to large caps in 25 years.

So what does that mean for investors?

With further rate cuts on the horizon and the very real possibility of a “soft-landing”, the current valuation gap between large caps and small caps provides the backdrop for a period of sustained small cap outperformance.

Many small companies, overlooked during the large-cap rally, may now be poised to lead again. So maybe it’s time to think small… because bigger isn’t always better.

Invest with Ophir: Invest

Join our Newsletter: Subscribe

(1) Morningstar Peer Group Rankings Data as of 30 September 2025.

Prepared by Ophir Asset Management Pty Ltd ABN 88 156 146 717 AFSL 420082. Issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 as Responsible Entity for the Ophir Global Opportunities Fund.

The information in this article is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Before making any investment decision, you should consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMD) available at www.ophiram.com, and consult a licensed financial adviser.

Past performance is not a reliable indicator of future performance. Investment returns are not guaranteed, and the value of an investment may rise or fall.

© Ophir Asset Management Pty Ltd, 2025. All rights reserved.