By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

We remain cautious of businesses exposed to the Australian economy and continue to focus on those businesses that can grow irrespective of economic conditions.

Dear Fellow Investors,

Welcome to the June 2019 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Month in review

Global equity markets rallied strongly during June, reversing the declines experienced during May. Markets were buoyed by indications from both the US Federal Reserve and the European Central Bank that further monetary stimulus may be on its way to address weaker economic data, risks to the trade outlook and continued low inflation. Further supporting the rally was the diminished threat of further tariffs following the meeting of President Trump and President Xi Jinping at the G20 summit in Osaka.

On local shores the Reserve Bank of Australia cut official cash rates by 0.25% to a record low of 1.25%, the first move in official interest rates since August 2016. Further rate cuts are widely expected with economic growth slowing sharply and stubbornly low inflation persisting. We remain cautious of businesses exposed to the Australian economy and continue to focus on those businesses that can grow irrespective of economic conditions.

The MSCI All Countries World Index gained +6.4% during June, capping off a +14.9% gain during the first half of 2019, the strongest first half gain for the index since 1997. Whilst the ASX 200 lagged global indices in June rising +3.5%, it also experienced impressive first half gains rising +17.2%, its best first half gain since 1991. In contrast, Australian small caps were relative underperformers only gaining +0.9% during June.

The Ophir Opportunities Fund returned 4.2% after fees, outperforming the ASX Small Ordinaries Index by 3.2%. The Ophir High Conviction Fund returned 1.8% after fees, outperforming its benchmark by 0.1%.

Managing the expectations of our fellow investors

The month of June is always a time when we reflect on the financial year just passed and the performance of the Ophir funds.

We were a little disappointed when seeing investors earlier this month during our Meet the Manager presentations that several investors were not happy with the returns we generated in the last 12 months. Internally our view is we had a great 12 months and we are very proud of the returns we generated. However, we acknowledge where we did fail is setting realistic expectations for many of our investors.

The Ophir Opportunities Fund returned +14.1% after fees for the 2019 financial year beating the relevant index by +12.2% after fees. We believe this will rank the Opportunities Fund in the top 5 small cap funds in Australia when the Mercer fund manager survey is released later this month. The Ophir High Conviction Fund returned +7.1% after fees for the 2019 financial year beating its index by +4.2% after fees. We believe this will rank the High Conviction Fund in the first quartile of small and mid-cap funds in Australia when the Mercer fund manager survey is released later this month.

While the performance was well down from the +26.4% per annum returns since inception in August 2012 for the Ophir Opportunities Fund and the +20.8% per annum returns since inception in August 2015 for the Ophir High Conviction Fund, it was one of the most satisfying years for us for a few reasons:

1. The 2019 financial year will go down as the toughest to navigate for Australian share market investors in the last 10 years. In the December quarter the market fell sharply with the S&P/ASX Small Ordinaries Accumulation Index falling -13.4%. However, after the US Federal Reserve signalled that it would put further interest rate increases on hold to support growth, equities markets roared back to life catching many off guard with the S&P/ASX Small Ordinaries Accumulation Index posting a gain of +11.2%. From a personal stand point we have never seen so many funds management businesses shut their doors than the last 6 months. As at end May over one quarter of small and mid-cap funds had negative returns for the year according to the Mercer fund manager survey.

2. It is always difficult to back up an exceptionally strong year with another very strong year. In the 2018 financial year it is easy to forget that the Ophir Opportunities Fund delivered +35.3% after fees and the Ophir High Conviction Fund delivered +33.4% after fees. In fact Ophir received the 2018 Golden Calf Award at the Fund Manager Awards as the best performing small and mid-cap Fund in Australia.

We want to make sure in financial year 2020 our investors understand that while we have historically returned on average above 20% per annum after fees, there will be years we significantly underperform this depending how the market is behaving. All we can promise is we will continue to work as hard as we can to generate superior returns for our investors over the medium to long term. We ask investors to be patient and not mark any fund on one year’s performance, rather take a longer term view.

Three important principles of investing

In the spirit of managing expectations, we would like to recount a story we shared at our recent Meet the Manager presentations which draws on some of the investment principles.

A self-directed retired couple invested with Ophir during 2016 after a period of strong performance. Unfortunately, their timing wasn’t good because as soon as they invested markets suffered a significant correction and the Ophir High Conviction Fund fell in line with the market. As markets fell lower and lower, the couple’s emails and phone calls to our office grew in frequency. Four months after making their investment we received a nasty email and the couple took their money out, suffering approximately a 10% loss of their capital. If this couple had stayed invested, their initial investment would have increased in value by nearly 50%.

We are human and when someone loses a significant amount of money investing in Ophir it affects us. We didn’t enter this game to make money by others losing money. Our whole business model is built on alignment between the underlying investor and us the manager.

So what are the conclusions we can take from this example?

Firstly, to take advantage of the strong long term returns available in equities we must accept volatility. Over the last 10 years the S&P 500 has pulled back more than 5% on 17 occasions and every time ‘expert investors’ have predicted the end to this bull market. If volatility worries you then perhaps a term deposit or Treasury bonds is more your investment class. However, if you want significant capital growth you are going to have to deal with volatility.

Secondly, as investors we must resist the natural instinct to sell when markets are falling. Famously star portfolio manager Peter Lynch delivered a 29% annualised return during his tenure at the helm of Fidelity’s Magellan fund, however, he calculated that the average investor in his fund made only 7% over the same period. When performance fell away money would flow out of his fund through redemptions and when performance picked up money would flow back having missed the recovery.

Thirdly, we must accept that timing the market is notoriously difficult, if not impossible. Not trying to time markets but being patient and fully realising the benefits of compounding is the key to successful long term investing. It is time in the market, rather than timing the market which is most important. In 2008 Warren Buffett famously quoted:

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

Seeing through the investment noise

At Ophir we spend a considerable amount of time understanding the quality of a business and the environment in which it operates before we invest our own and our fellow investors’ capital. Doing this invariably involves spending some time in front of computer screens modelling financial statements and assessing balance sheets, but it is underpinned by what we call ‘doing the work’. This means getting away from our desks and regularly meeting with suppliers, competitors, customers and any other interest group that provide us with a deep level of insight into the business and importantly the strength and capability of management.

‘Doing the work’ requires us to spend significant time away from loved ones travelling both domestically and internationally to meet contacts face to face. The countless meetings are crucial to build the high conviction required to hold a stock in our portfolios. As our conviction in a company increases, typically we will increase its weighting. More importantly though, it allows us to see through much of the investment noise that we are subjected to on a daily basis via the financial press and broker reports.

A great example of this took place in early June when one of our significant and long term portfolio holdings A2Milk (ASX:A2M) was the subject of considerable press speculation. Followers of A2M will know that Chinese regulatory updates can create quite the share trading frenzy. June saw a number of regulatory announcements from China concerning the infant formula category. The one that grabbed the most air time and pressure on A2M’s share price (~-10%) was an action plan detailing ways the Chinese government intends to promote the local industry in an effort to boost self-sufficiency. Currently domestic brands have ~45% share of the local market with imported brands including A2 having taken share over the last decade. The report announced that the Chinese Government wants to get domestic market share above 60%, however, it did not specify a time frame.

Whilst the headline might appear a shot across the bow for a company like A2M, we actually don’t see this impacting the company significantly for a number of reasons. Firstly, barriers to entry have now just got higher, so for a company like A2M that has all the necessary licensing its position within the import category is stronger as it will become more difficult for companies without licenses to enter the market.

Secondly, this is not a new imperative. The Chinese Government has in the past tried to promote self-sufficiency in the broader dairy space without much success. None of the articles in the plan impose restrictions on foreign brands (outside of obtaining licenses) per se. Rather, they are about lifting standards and quality in the local industry with an attempt to win back consumer confidence. We have always been of the view that given the numerous contamination issues in China, there is a fundamental distrust of local food production that will be extremely difficult to win back and if Chinese parents have the financial means they will always opt for imported infant formula.

In the example above it was relatively easy for us to very quickly engage our list of contacts on the ground in China to determine what impact the report would likely have. While others were panic selling after the announcement, we have remained calm and confident because of the work we had done. At the time of writing the A2 share price had made up all of the losses it had experienced following this announcement.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Portfolio Managers

Ophir Asset Management

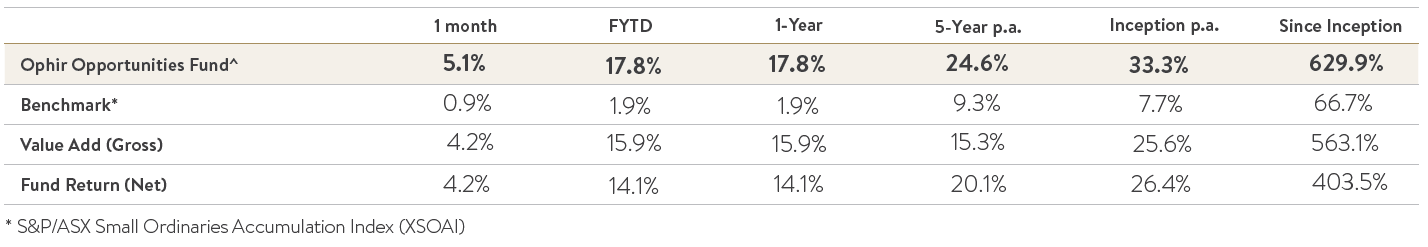

The Ophir Opportunities Fund

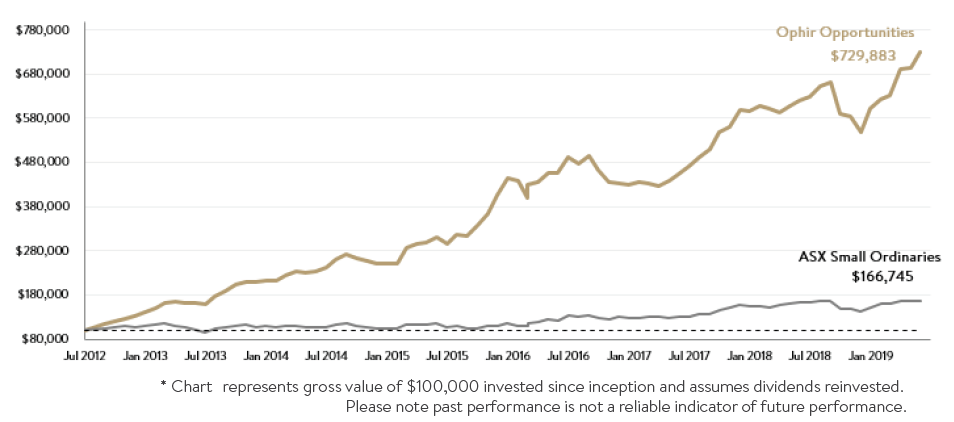

Growth of A$100,000 (pre all fees) since Inception

The Ophir Opportunities Fund returned +4.2% for the month after fees, outperforming the benchmark by 3.2%. Since inception, the Fund has returned +26.4% per annum after fees, outperforming the benchmark by 18.7%.

| 1 Month | 1 Year | 5 Year (p.a.) | Inception (p.a.) | Since Inception | |

| Ophir Opportunities Fund (Gross) | 5.1% | 17.8% | 24.6%p.a. | 33.3%p.a. | 629.9% |

| Benchmark* | 0.9% | 1.9% | 9.3%p.a. | 7.7%p.a. | 66.7% |

| Gross Value Add | 4.2% | 15.9% | 15.3%p.a. | 25.6%p.a. | 563.1% |

| Net Fund Return | 4.2% | 14.1% | 20.1%p.a. | 26.4%p.a. | 403.5% |

* S&P/ASX Small Ordinaries Accumulation Index (XSOAI)

| Buy Price | Mid Price | Exit Price | |

| June 2019 Cum Unit Price – Opportunities Fund | 2.8040 | 2.7942 | 2.7844 |

Key contributors to the Opportunities Fund performance this month included Silver Lake Resources Limited (SLR), Austal Limited (ASB) and Service Stream Limited (SSM). Key detractors included Kogan.com Ltd (KGN), Sundance Energy Australia Limited (SEA) and Capitol Health Limited (CAJ).

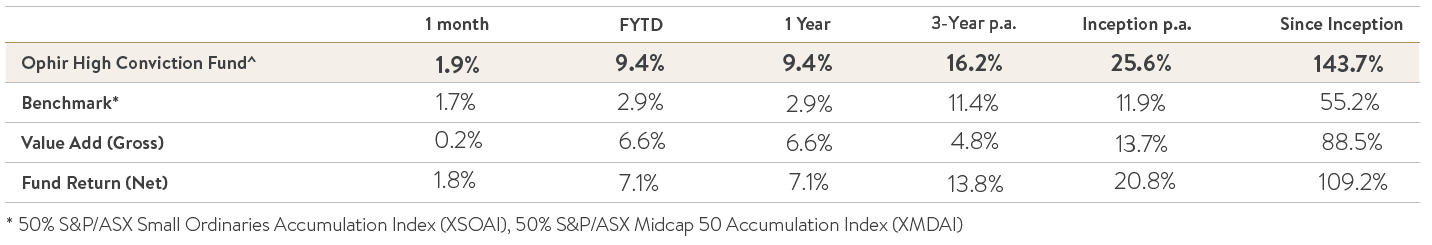

The Ophir High Conviction Fund

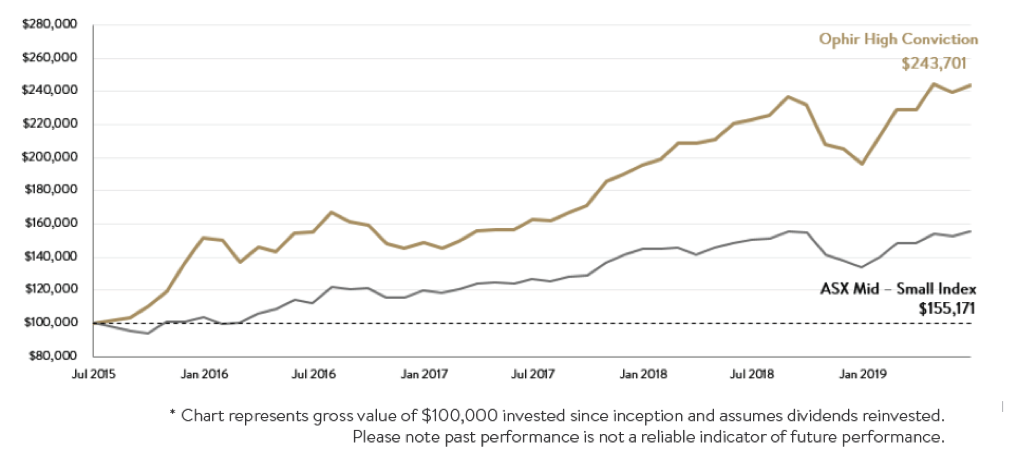

Growth of A$100,000 (pre all fees) since Inception

The Ophir High Conviction Fund returned +1.8% for the month after fees, outperforming the benchmark by 0.1%. Since inception, the Fund has returned +20.8% per annum, outperforming the benchmark by 8.9% per annum.

| 1 Month | 1 Year | 3 Year(p.a.) | Inception (p.a.) | Since Inception | |

| Ophir High Conviction Fund (Gross) | 1.9% | 9.4% | 16.2%p.a. | 25.6%p.a. | 143.7% |

| Benchmark* | 1.7% | 2.9% | 11.4%p.a. | 11.9%p.a. | 55.2% |

| Gross Value Add | 0.2% | 6.6% | 4.8%p.a. | 13.7%p.a. | 88.5% |

| Net Fund Return | 1.8% | 7.1% | 13.8%p.a. | 20.8%p.a. | 109.2% |

* 50% S&P/ASX Small Ordinaries Accumulation Index (XSOAI), 50% S&P/ASX Midcap 50 Accumulation Index (XMDAI)

| 30 June 2019 NAV – ASX:OPH | $2.61 |

Key contributors to the High Conviction Fund performance this month included Northern Star Resources (NST), Austal Limited (ASB) and Evolution Mining Ltd (EVN). Key detractors included A2 Milk Company Ltd (A2M), Webjet Limited (WEB) and AUB Group Limited (AUB).

This document is issued by Ophir Asset Management (AFSL 420 082) in relation to the Ophir Opportunities Fund & the Ophir High Conviction Fund (the Funds) and is intended for wholesale investors only. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir Asset Management accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. Any investment decision in connection with the Funds should only be made based on the information contained in the Information Memorandum and/or Product Disclosure Statements.