By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our September 2020 Letter to Investors we review how not overpaying for earnings growth in our Funds provides protection no matter which style of investing is in vogue.

Dear Fellow Investors,

Welcome to the September 2020 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Ophir Fund Performance

The Ophir Opportunities Fund returned -2.8% net of fees in September, performing in line with its benchmark and has delivered investors +25.4% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -4.7% net of fees in September, underperforming its benchmark by 1.8% and has delivered investors +18.3% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +2.7% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +2.7% net of fees in September, outperforming its benchmark by 1.6% and has delivered investors +29.0% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Finding growth, but not at any price

One step backwards

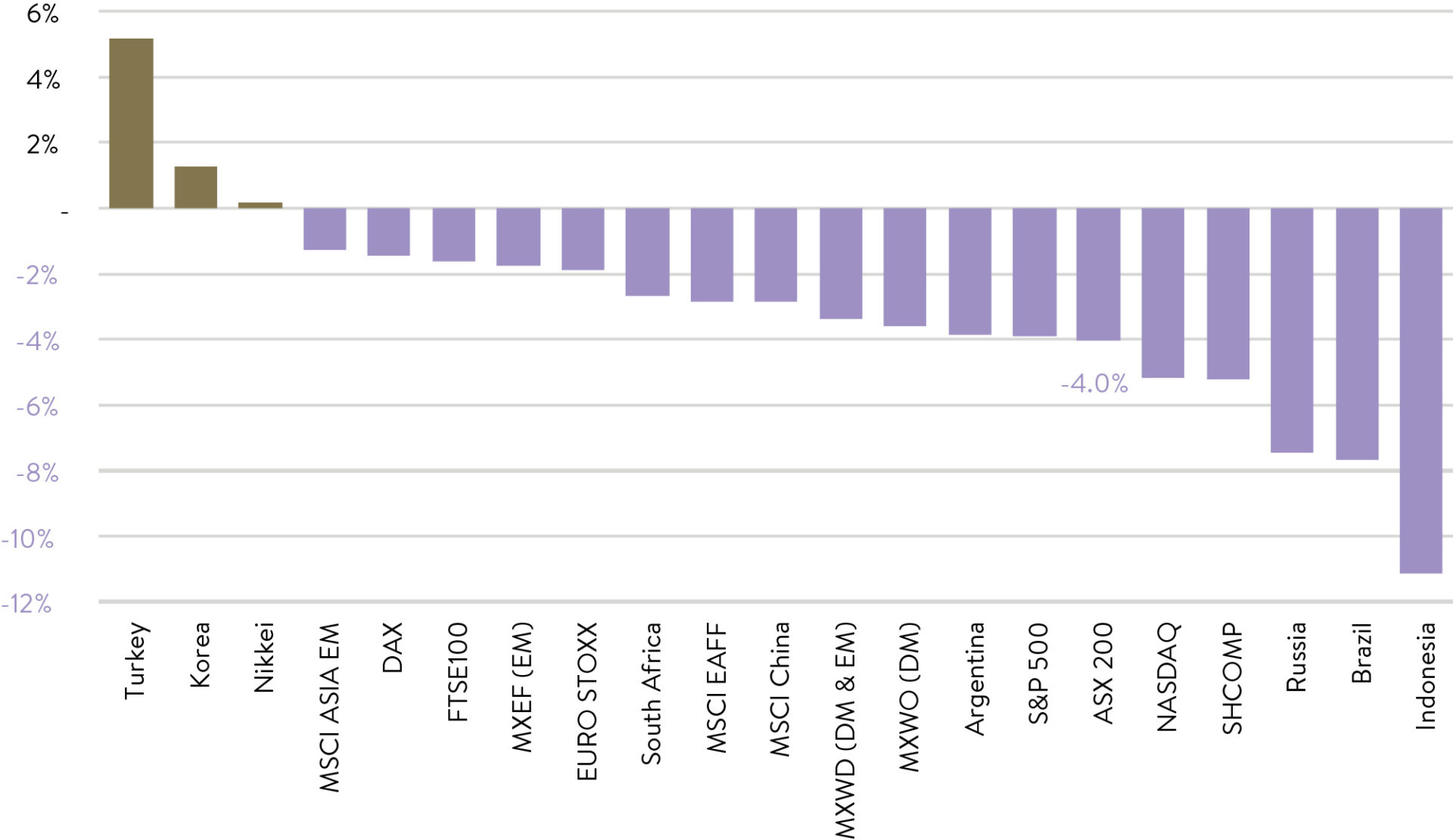

After five months of gains following the COVID-19-induced rout in March this year, major sharemarkets finally gave back some ground and fell in September. The major equity markets fell between -1% to -4% during the month with the Australian and US sharemarket falls at the top end (see charts). So, it has been a case of five steps forward and one step back for equity markets.

But investors also felt the return of volatility during the month, with daily moves of more than 1% up and down common.

There were several reasons for the September slide. Investors were firstly concerned about renewed lockdowns in Europe as countries there suffered second waves of COVID-19. The markets also factored in a reduced probability of further fiscal stimulus in the US this year. And tech also dragged – the NASDAQ suffered a 5% fall – as investors reassessed whether the sector has risen too hard, too fast.

But one of the major factors affecting markets is the timing of a vaccine for Covid-19. Indeed, a vaccine is emerging as a key factor in the outlook for markets, but also the investment styles that will outperform into the future. The good news is that we believe our portfolios are very well positioned to benefit from any vaccine scenario.

Global share markets performance – September 2020

Source: Bloomberg, JP Morgan

Vaccine oscillation

One of the major reasons markets have rebounded strongly from their March lows has been the building confidence that a COVID-19 vaccine will come to market in record time.

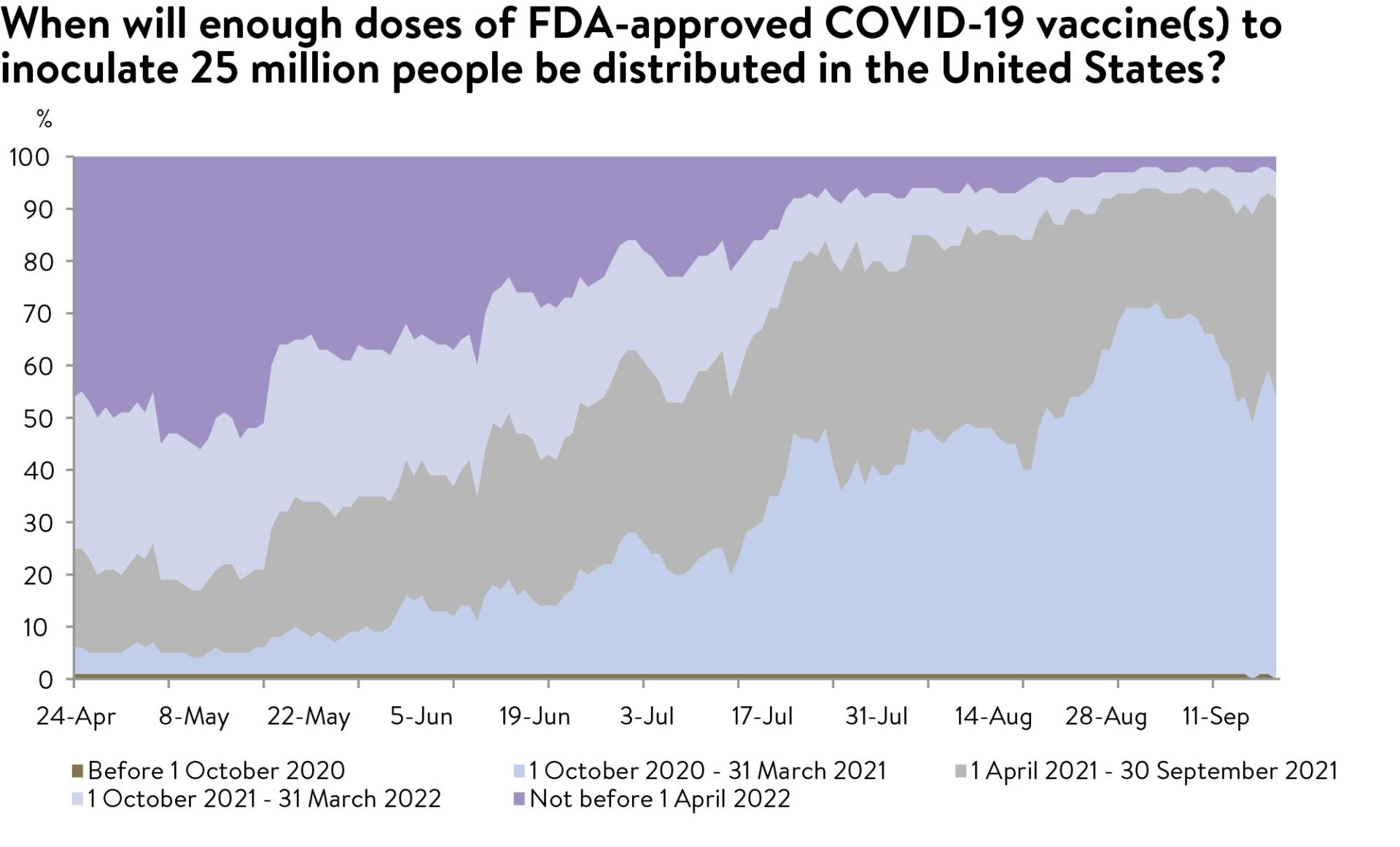

Earlier this year, The Good Judgement Project — which forecasts world events using crowd wisdom from “super forecasters” – forecast that a widely available vaccine would not be likely until after April 2022 (see chart below).

But then optimism increased when the forecast changed dramatically in the past few months with vaccine availability forecasts moved forward to the end of March 2021.

Unfortunately, that optimism has reversed a little recently. The timeframe has been pushed out again because of delays and some side effects in trials. The probability of a vaccine arriving in the US later in 2021 has increased.

The more delayed outlook for a vaccine seems to have played a part in the equity market pullback in September with investors searching for a catalyst to move the market higher, but were found wanting.

Forecasted vaccine approval date pushed out

Source: Good Judgment Project, Goldman Sachs Global Investment Research

A value vaccine renaissance?

But what is clear is that when/if a Covid-19 vaccine is available is becoming a key risk for investors and a key factor in how they position their portfolios.

After sustained underperformance over recent years, many so-called ‘value’ investing stalwarts are now wondering whether a vaccine will be the much-awaited catalyst for their investment style to return to favour.

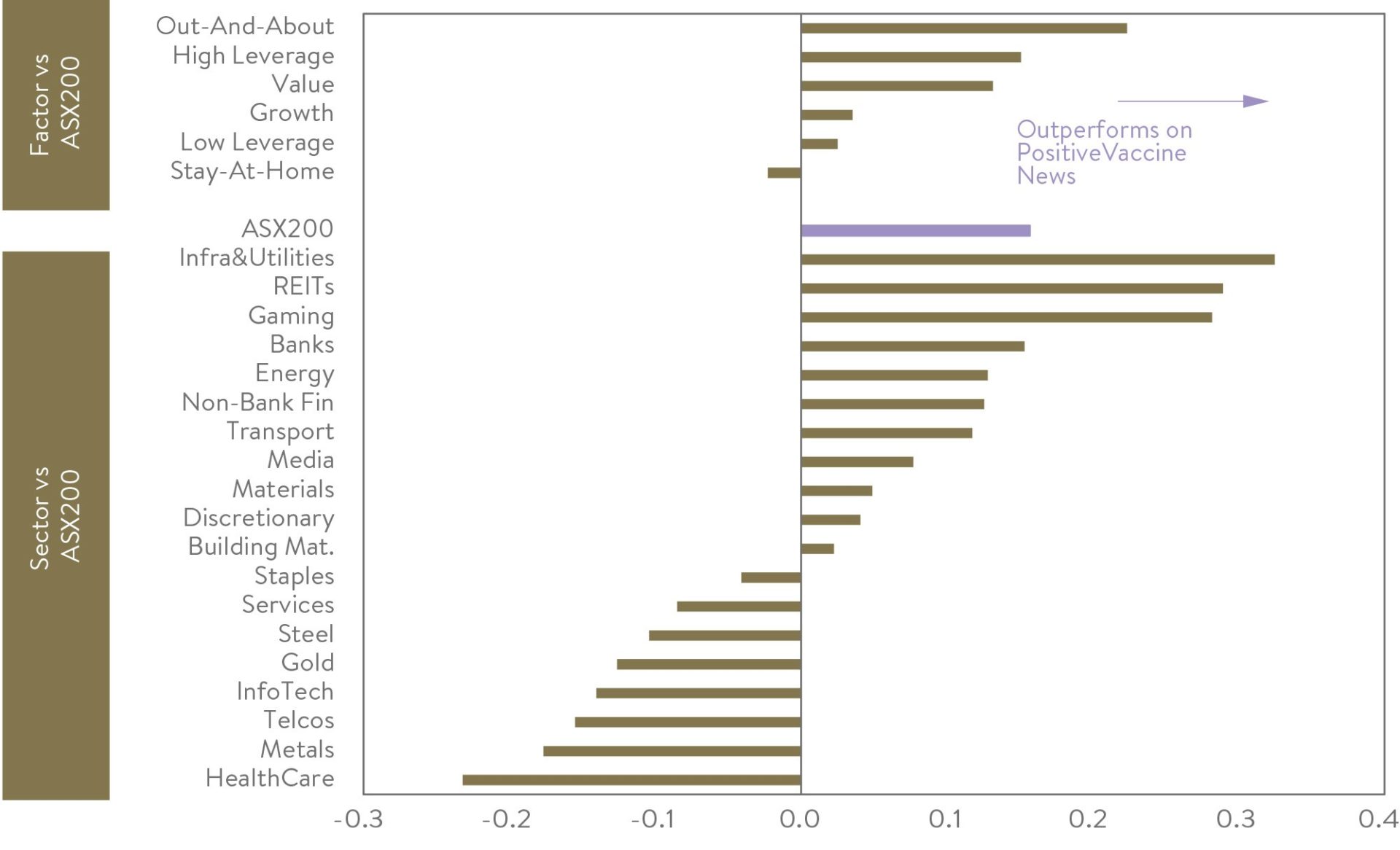

There are grounds for their optimism. When vaccine optimism has increased you can see that value, high leverage and ‘out-and-about’ stocks (such as those in the travel and entertainment industries) have tended to perform better in Australia (this is also generally true globally). This is not surprising given they suffered the most from COVID-19.

Style and sector performance on vaccine optimism

Source: Goldman Sachs Global Investment Research, FactSet, Good Judgment Project.

Note: Correlation of factor and sector relative returns (vs. ASX200) with weekly changes in vaccine optimism, defined as the probability of having a vaccine before 1Q2021 minus the probability of a vaccine after 3Q2021 according to the Good Judgment Project.

A strict valuation discipline

So how are the Ophir portfolios positioned for a vaccine and possible revival of value stocks?

Some investors try to pigeonhole us a ‘growth’ style investor. Based on some of our early investments into A2 Milk, Afterpay and Xero, they assume all or most of the companies we invest in trade on high price-to-earnings (P/E) valuations, which many define as the ‘growth’ style.

But that is far from the truth. Whilst we look for companies that can structurally grow earnings over the long term at rates faster than the market, we have a strict discipline about not overpaying for that growth. Ideally, we’d like to pay ‘below market’ earnings multiples (P/E ratio or our preferred metric EV-to- EBITA) for ‘above market’ earnings growth.

Where we have a high confidence of outstanding long-term growth, yes we will pay above market earnings multiples, and sometime significantly above market. But the portion of our funds in companies trading on valuation ratios materially above market will always be limited. Importantly, where one of those companies comes into an Ophir fund, one must come out.

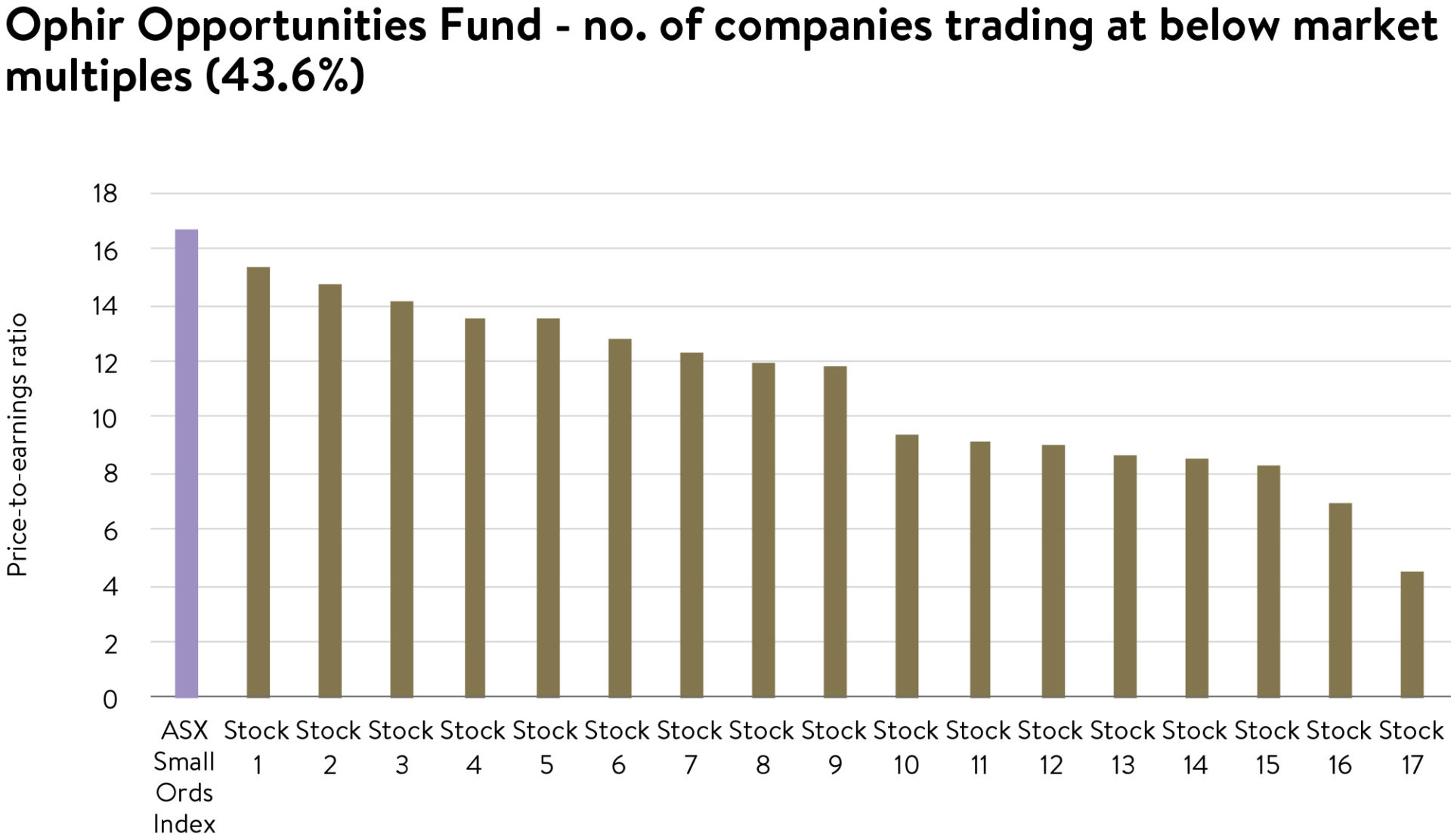

A significant proportion below market multiples

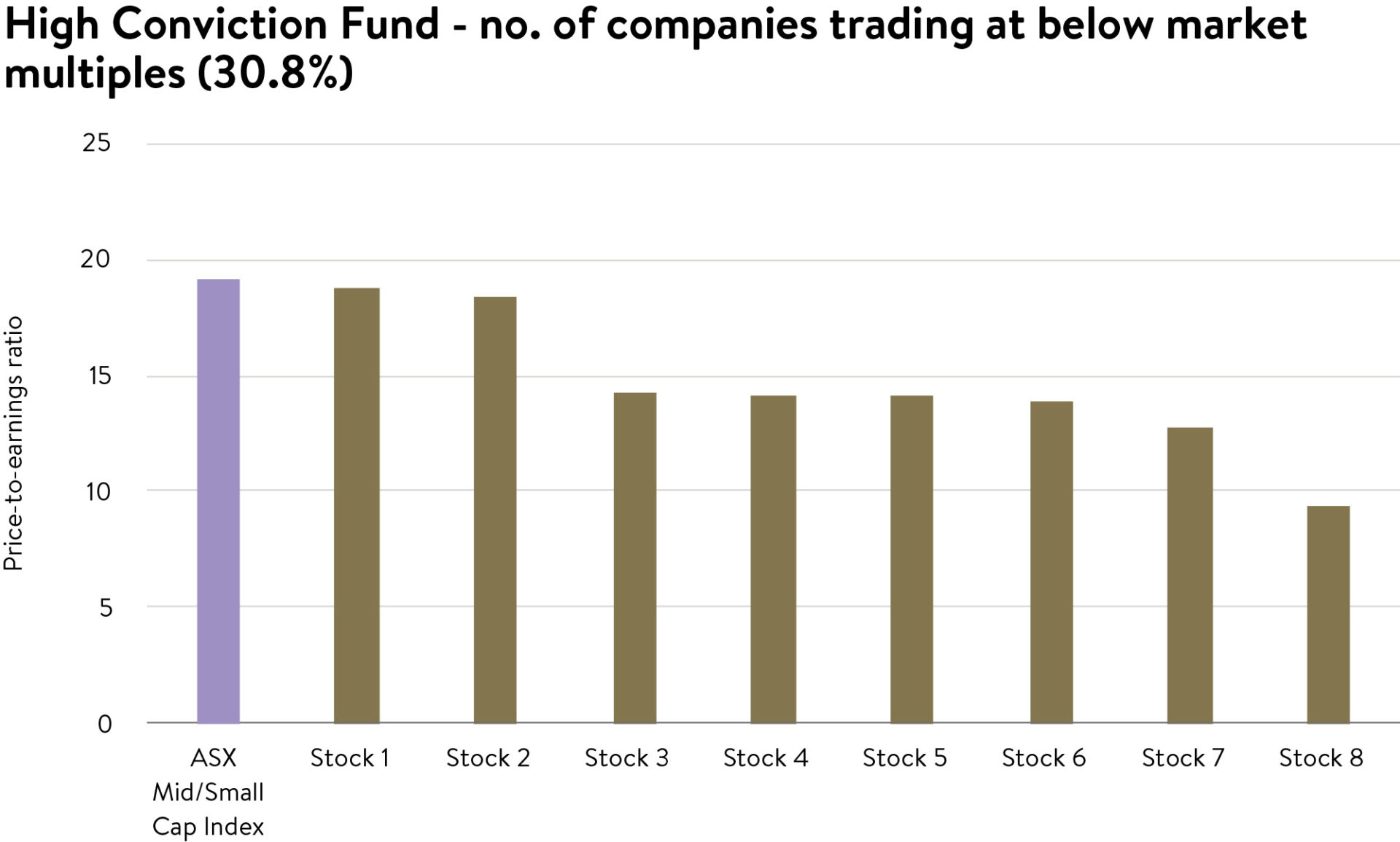

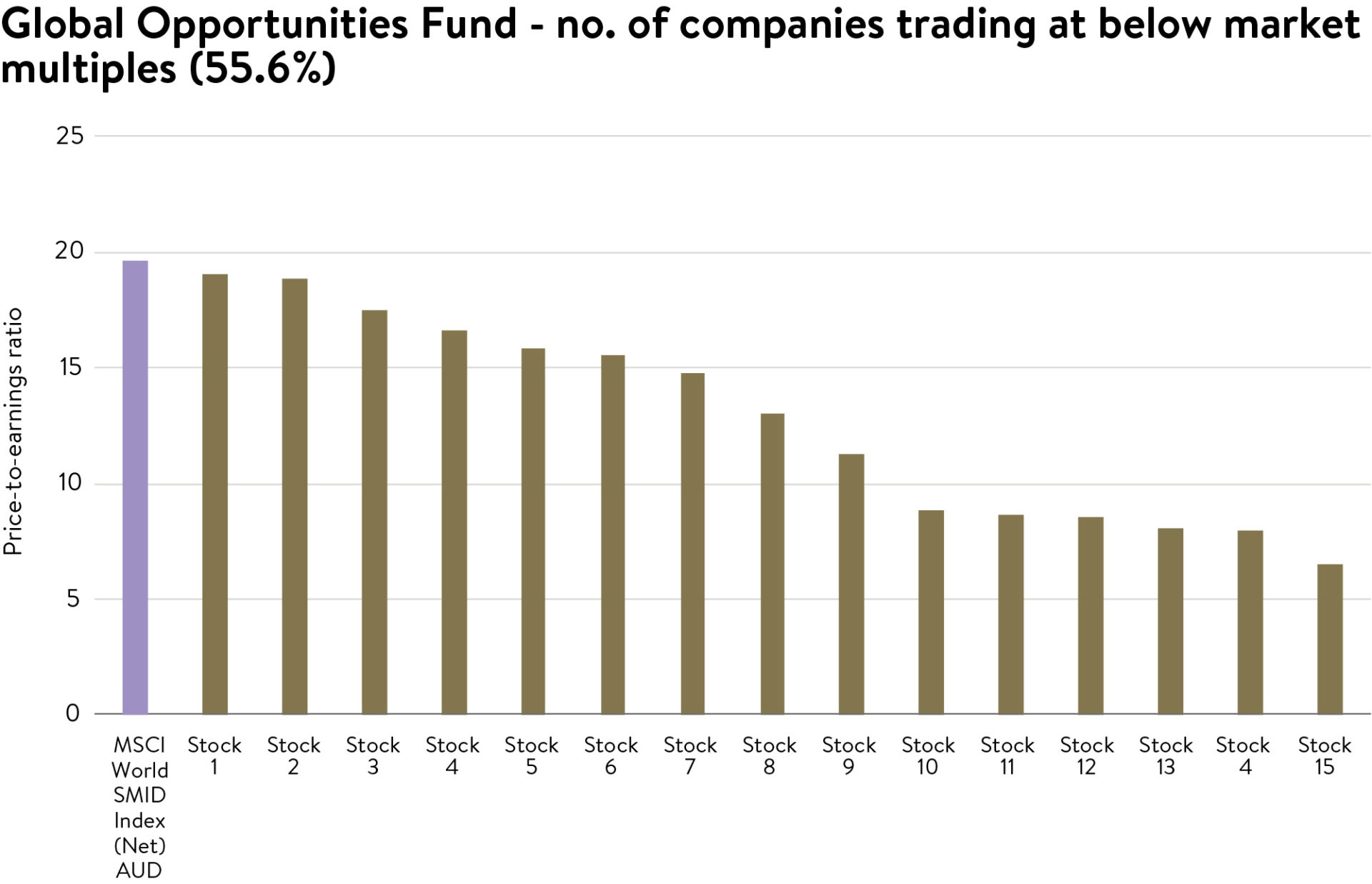

To provide some transparency on this approach, below we detail the number and proportion of companies trading on below market (benchmark) price-to-earnings ratios in each of our three Funds.

Ophir Fund’s holdings trading at below market valuations

Source: Ophir Asset Management, Bloomberg. Note: benchmark P/E ratios are for FY21 based on Bloomberg consensus earnings estimates. Stock P/E ratios are based on an average of FY21-FY23 Bloomberg consensus earnings estimates to take account of normalisation of earnings post COVID-19. Proportion of companies trading a below market P/E ratios in brackets in title of each chart. Proportion is based on the companies available in Bloomberg with consensus estimate available for any of FY21-FY23. Data as at 30 September 2020.

As can be seen, a significant number, between 30-55%, of holdings in each Fund currently trade at below market price-to-earnings valuation multiples.

This range of around a third to a half of our stocks is typical of our experience throughout time. On average at a portfolio level we believe we are obtaining multiples of the market’s rate of earnings growth whilst not paying significantly more than the market’s valuation.

Relaxed about a value revival

As a result, we are not particularly concerned if the value style does well for a period of time on the release of a vaccine.

We have significant exposure to companies trading at value prices, but most importantly, companies that grow and take market share irrespective of the macro environment or vaccine status. Crucially, staying small and nimble lets us flex the proportion of our Funds we have in more value-orientated companies through time.

Ultimately in a low-interest-rate, low-growth world that we were in pre-COVID-19, and will likely return to, we believe investors will be willing to pay up for earnings growth where it can be found. Our challenge, which gets us out of bed every day, is hopefully to be one of the first, if not the first, to find these structurally growing companies, before the market does and their true value is realised.

The small-cap valuation advantage

As a final note on growth and value, we note much of the heightened valuations we see in markets, at least compared to history, tends to be in US large caps and technology-dominated indices like the NASDAQ. Whether these prices will ultimately be justified will only be known with certainty in the rear-view mirror.

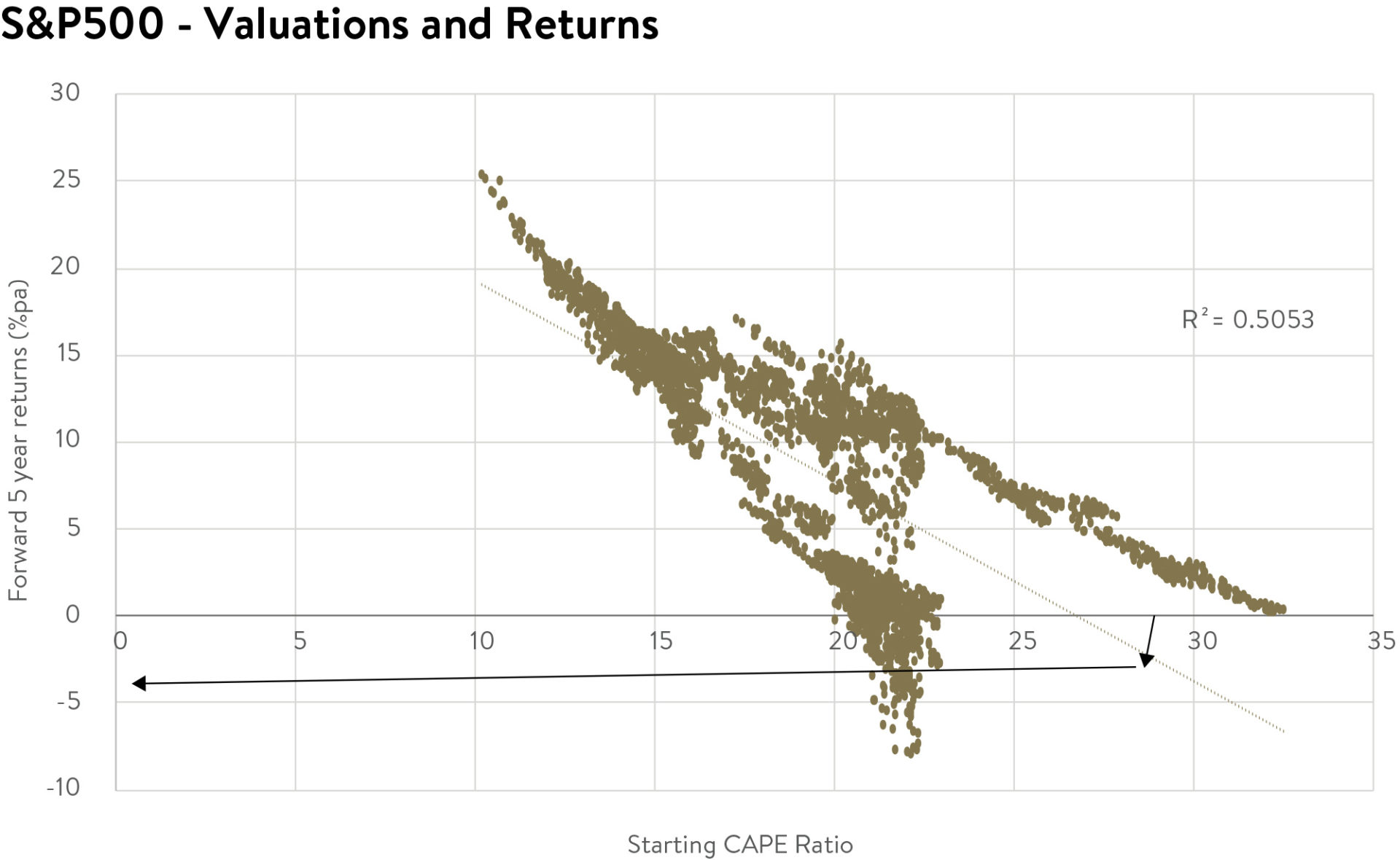

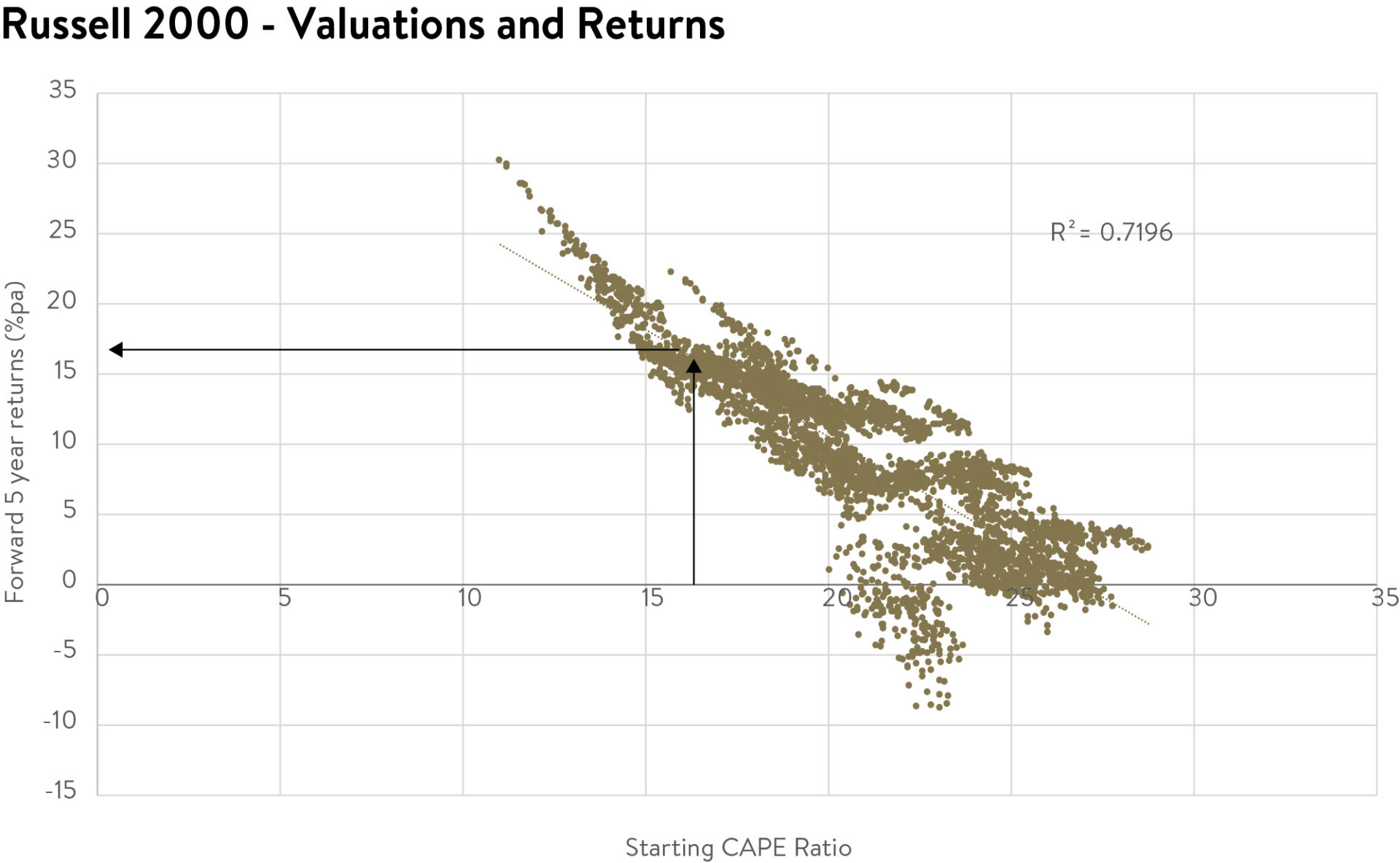

But as a guide, one of the best predictors of market returns for the next 5 years though has been starting cyclically adjusted price-to-earnings (CAPE) ratios. CAPE ratios are simply ‘through-the-cycle’ ratios that compare current market prices to 10-year average real (inflation-adjusted) historical earnings.

Based on history, US large caps (S&P500), trading at a 28.2x CAPE ratio, may deliver low single-digit or even negative returns in the next five years.

US large caps (S&P500) expensive versus history

Current US large cap (S&P500) valuation correlates to low returns next 5 years

US small caps (Russell 2000) cheap versus history

Current US small cap (Russell 2000) valuation correlates to high returns next 5 years

Source: Ophir Asset Management, Bloomberg. Daily price used from 1 Jan 2001 to 30 Sept 2020.

The best of both worlds

Whether this lower starting valuation for US small caps and the Australian sharemarket bears out in higher returns is yet to be seen. One thing is sure, though: we prefer to be looking in the pools of stocks – i.e. small caps — where valuations are not as demanding.

For us, despite the market rebound since March, and taking account of the modest pull back in September, we still see value in our favoured markets where we are not having to overpay for growth.

Finding tomorrow’s leading companies within this group, while not overpaying, to us makes the most sense. We never have both feet firmly in either the growth or the value camp. Rather, we look to borrow from the best both have to offer.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.