By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

We discuss corporate earnings growth and whether falling earnings growth forecasts could lead to another leg lower for the market.

Welcome to the October Ophir Letter to Investors – thank you for investing alongside us for the long term.

Darkest before dawn

We get it. It’s hard to focus on the ‘long term’ when markets have been falling and whipsawing.

Take one of the old-school market indices, the Dow Jones Industrials Index. It was down -7.3% in May, down another -15.9% in June, up +9.5% in July, down -3.1% (only!) in August, down -9.6% in September, and up a whopping +13.9% in October last month. For good measure, the October rise was the biggest monthly gain since January 1976!

This is not normal.

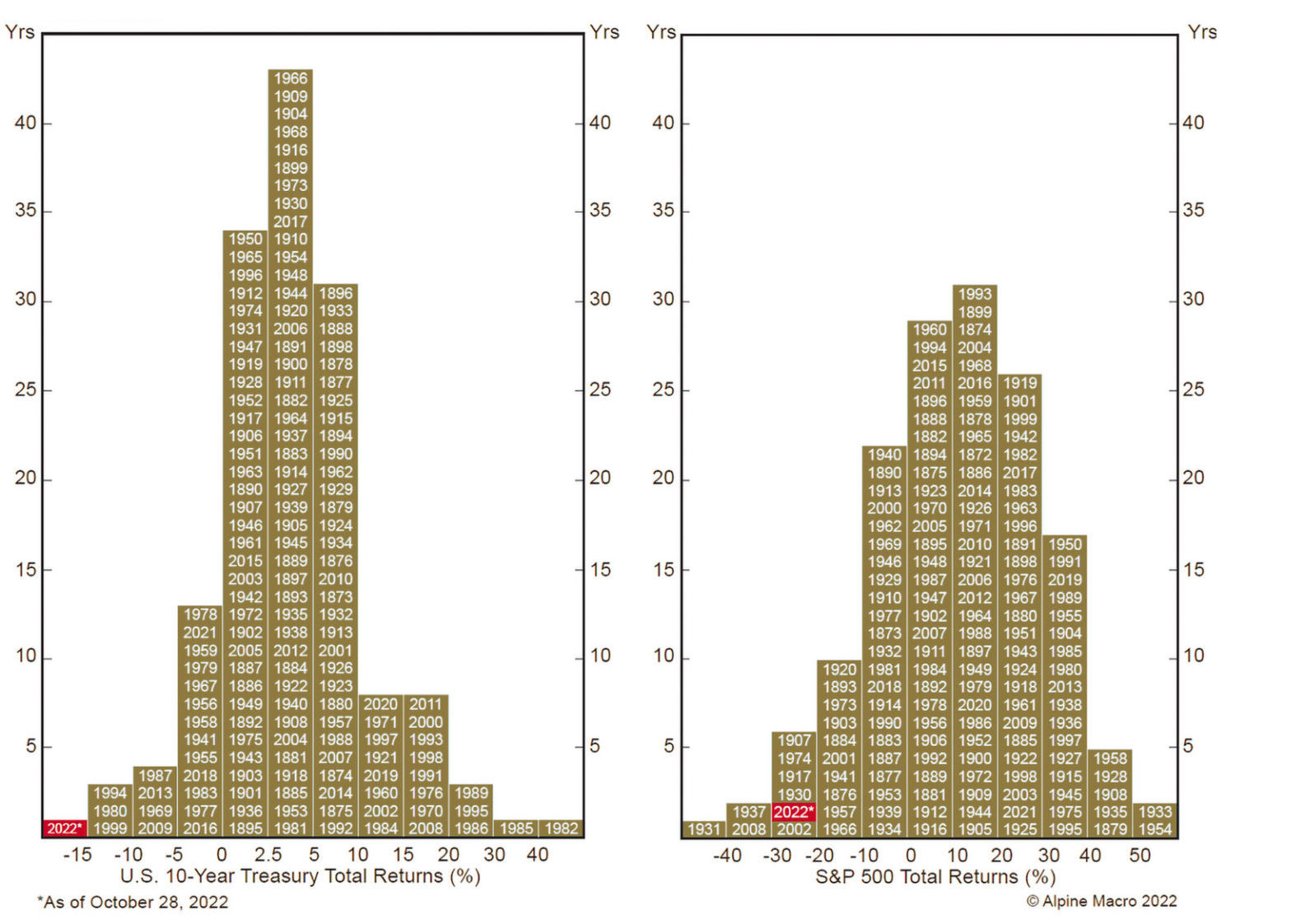

Speaking of abnormal. To see how abnormally bad this year has been, just look at how ‘left-tailed’ the returns of US stocks and bonds have been. As we’ve written before, basically no one alive has seen US stocks and bonds stink as much in tandem.

Distribution of historical stock and bond returns

Source: RealApline Marco

Stock and bond returns have risen and fallen (most fallen!) on every ebb and flow of rhetoric from central banks.

And so it was again in October.

This time though, there was no US Fed meeting in October (they only meet in eight months of the year) to spoil the party. Instead, share markets got excited because fellow central banks – an acronym soup of the RBA, BOE, BOC, ECB – were dovish (not raising rates or not raising rates as much as expected).

The market also reversed oversold conditions. And it was also helped by some reasonably resilient September quarter earnings results (with some key exceptions).

Many share markets were up more than 6% in local currency terms with the Russell 2000 (+11.0%), S&P500 (+8.1%), Nikkei (+6.4%), MSCI Europe (+6.2%) and ASX200 (+6.1%) all beating that margin.

The only real dark spot was over in China. The Hang Seng and MSCI China indices were down -14.7% and -16.8% each. Investors voted with their portfolios on the outcome of the recent Chinese Communist Party Congress and President Xi’s further commitment to China’s zero-covid policy.

This month in our Letter we’ll check in on:

- The latest interest rates and inflation chatter

- Third-quarter reporting season and some beaten-up FAANGs

- How the market’s earnings expectations are starting to get real

- Two top Aussie stocks suited to tough times

And importantly, we also look at why it’s important for investors to remember that the stock market usually bottoms before the economy. A crucial point to remember for investors as the economic headlines get bleaker.

October 2022 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during October. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +7.8% net of fees in October, outperforming its benchmark which returned +6.5%, and has delivered investors +21.9% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +6.3% net of fees in October, underperforming its benchmark which returned +6.8%, and has delivered investors +13.0% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +12.9% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +6.8% net of fees in October, underperforming its benchmark which returned +8.0%, and has delivered investors +16.3% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

A hawk amongst the doves

The Fed might not have had its monthly pow-wow in October but it more than made up for that at its early November meeting. Central banks have always been important (at least in the short term) for markets. But it seems like this year every time Chair Powell speaks it is must watch TV. (CNBC is being unmuted on the big screen in the Ophir office more this year than any time we can remember.)

Powell had one main message from the Fed’s meeting this month: The Fed’s a hawk (determined to raise rates to fight inflation) and it’s not about to change its wings (just yet).

Underneath that there were three key takeaways for us:

- Yes, interest rate hikes might slow soon, but they may go on for longer than previously thought if inflation remains high. The Fed asked investors to reject what their life coach may have told them: it’s about the destination (for interest rates), rather than the journey of getting there.

- It’s still way too early to be thinking about an interest rate pause or cut.

- Beating inflation is more important than avoiding a recession.

The Fed would rather overtighten and risk recession – and come to the rescue with rate cuts if needed – than under-tighten, lose control of inflation, and have to ratchet up the speed of hikes again.

We think this means the probability of recession in the US in the next year is very high.

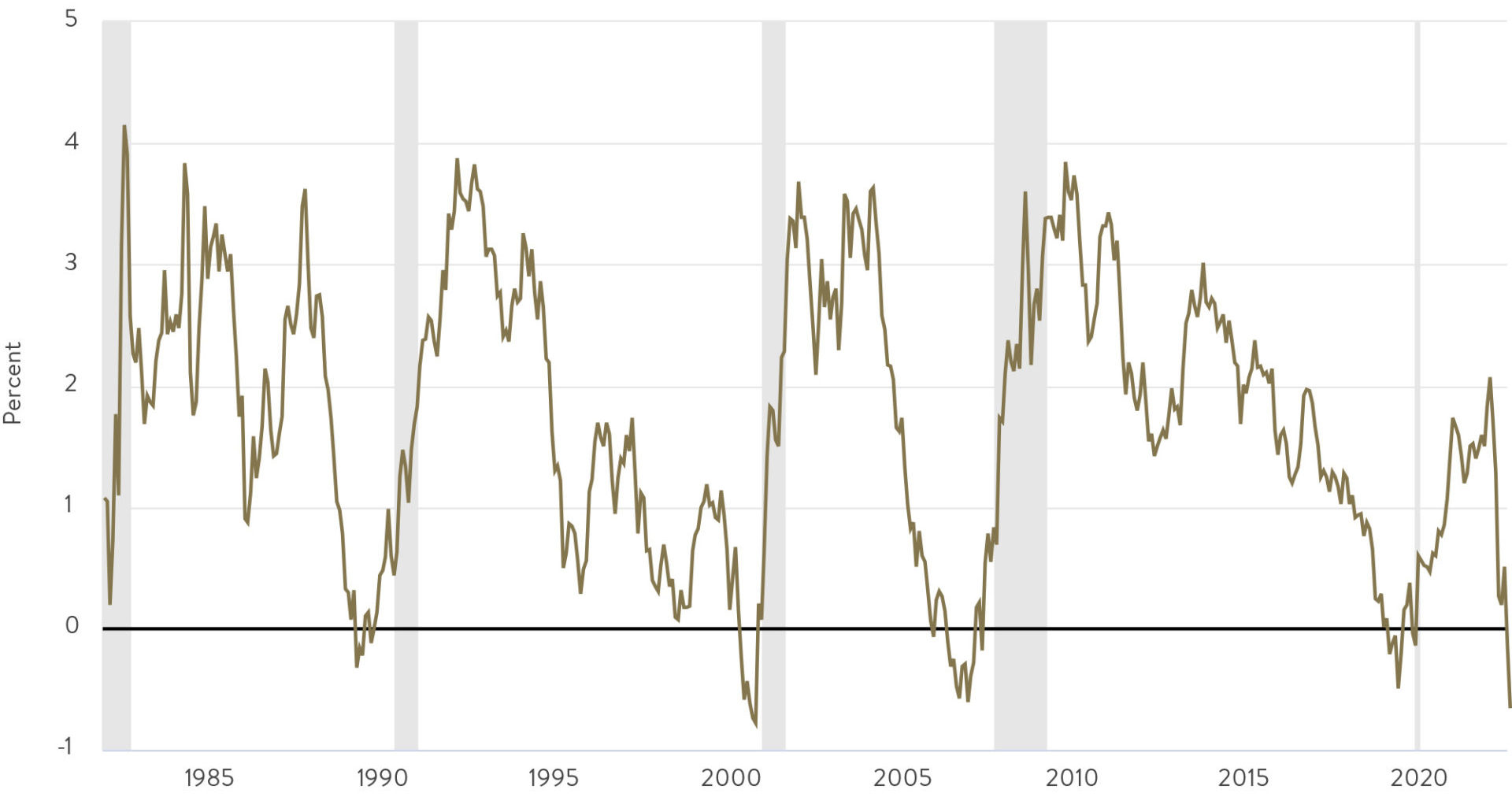

10-Year Treasury constant maturity minus 3-Month Treasury constant maturity

Backing this up is that one of the best recession indicators, the spread between the US 10-year and 3-month treasury yields, actually turned negative last month.

It ‘bats 1000’ in US baseball parlance (i.e. it is right every time) at predicting recessions. It shows that raising short-term interest rates above long-term ones to cool an economy generally throws it into contraction (recessions are indicated by shaded grey bars).

It may likely be too late to save the US from a looming recession, but it may not be too late to save it from a severe one.

But this all hinges on inflation coming down post haste.

One of the biggest sources of inflation in the US has been shelter inflation (basically rents and imputed rents for property owners). That has driven more than 40% of the rise in core US inflation over the last year.

The good news is that more real-time indicators of new leases is rolling over and this should play a big role in driving down overall inflation next year. Also at the time of writing the Oct monthly U.S. CPI report was just released and showed some promising signs of an inflation slowdown. We’ll need to see some more signs of this ASAP if the US economy is to walk the VERY narrow path to achieving a soft landing.

September quarter reporting

Despite this macro action, most of our time recently has focused on September quarter reporting for companies in our global funds.

You might recall that the US June-quarter reporting season for the market was better than feared. It helped drive what proved to be a bear market rally through to mid-August.

Many were wondering if September quarter reporting might spur another rally.

Talking points between CEOs and fund managers centred around high labour and input costs, slowing consumer demand, a strong US dollar impacting foreign revenues, volatile commodity prices and rapidly rising interest rates.

Payments provider Mastercard summed up the switch in consumer spending from goods to services, and back to more normal levels:

“…overall consumer spending has remained resilient, although we are seeing some shifts in what consumers are buying… We saw notable strength in airline, lodging and restaurants spend with the shift away from categories like home furnishings and appliances. The current mix between retail, Travel & Entertainment and other categories of spend is now broadly similar to pre-pandemic levels.”

Whilst small caps are still reporting at the time of writing, most of the large caps that drive the overall market have finished their reporting.

The US large caps were pretty resilient overall. Some 46% of companies beat consensus earnings estimates by more than one standard deviation. That’s around the long-term average of 47%.

S&P500 earnings also grew by a soft, but respectable 3%, over the year. The Energy sector, the standout for the share market this year, was up 140%. If you stripped out energy, however, overall earnings fell -4%.

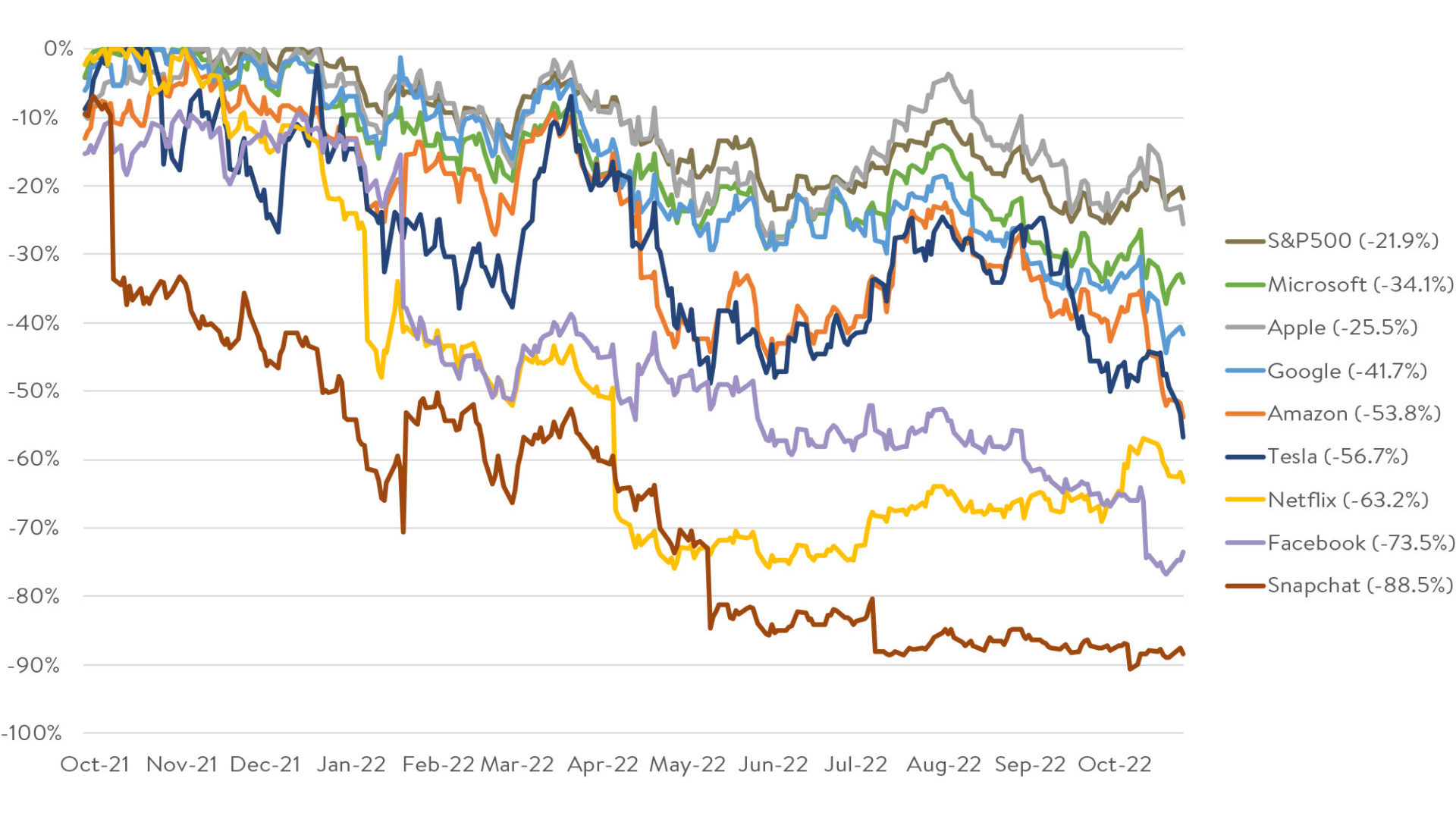

The Generals get shot

The other main chink in the armour for this reporting season was the once-impenetrable ‘Generals’ of the US share market, the FAANGs (or pick your derivation).

The FAANGs came under heavy fire.

In the last week of October, Microsoft and Google had their worst days of the year. Facebook (Meta) had its second worst (crashing -24% on the Thursday alone). While Amazon fell over -13% during that week.

Downbeat sales outlooks were the common denominator as they deal with slowing growth and rising costs and interest rates. Meta recently laid off 13% of its staff, reminding investors again that even the once mighty can fall.

Big Tech drawdowns

Source: Factset. Data as at 9 November 2022

Apple was the only FAANG spared. Demand for its premium devices and services remains relatively strong.

Out of the other well-known tech companies, Snapchat and Meta (Facebook) have well and truly been taken to the woodshed and investors are asking who is next as all are coming under margin pressure.

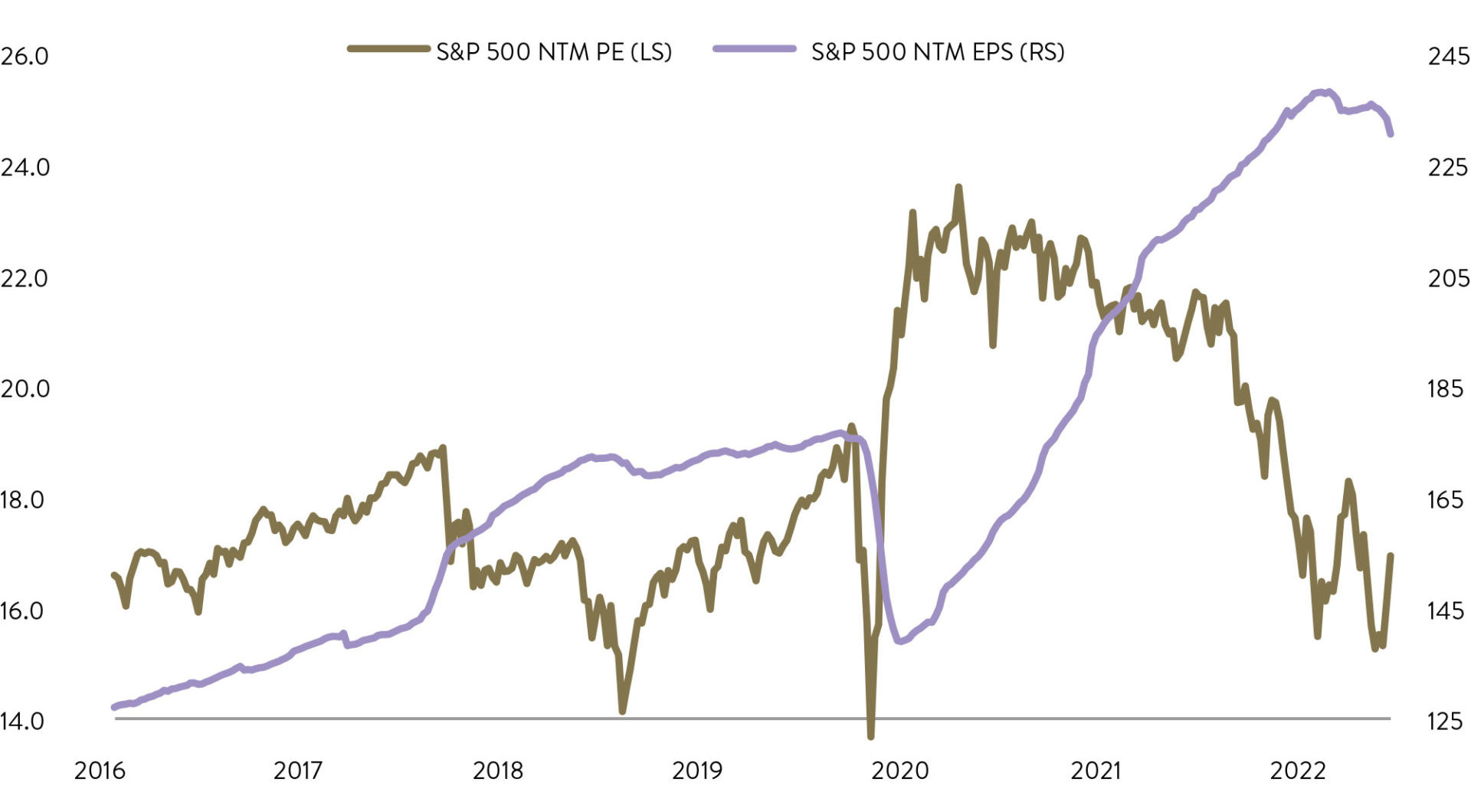

Markets starting to get real on earnings

As we’ve been talking about recently, markets will bottom in a sustainable way when earnings expectations over the next year start to match reality.

Market consensus has been too ‘Pollyanna-ish’ about earnings in 2023. That optimism is at odds with the orchestrated slowing of economies by central banks.

But that seems to be changing.

For example, the US large caps earnings growth forecast (EPS) for the next twelve months (NTMs) has recently been cut from 10% to around 4%. (The recent fall in the purple line below).

This follows the fall in the market price-to-earnings ratio (PE) over the last year, which has been the primary driver of the market falls so far (gold line).

Valuation Trends Lower as EPS cuts begin

Source: Factset, Morgan Stanley Research as of Oct 31 2022

The question on almost every investor’s lips is: have earnings expectations been cut enough, or is there more to go? Valuations have largely normalised, but is there another leg lower for the market driven by falling earnings?

Historically, in economic recessions since World War II, US earnings have fallen by a median of -13%. If a US recession is on the cards, this suggests there might be more to go for earnings cuts.

It’s always darkest before dawn

That’s the bad news.

There may be further cuts to corporate earnings growth and, in fact, outright falls in the weeks and months ahead.

But the good news is the share market is forward looking. As earnings, employment and the economy worsen, the share market at some stage will bottom and recover.

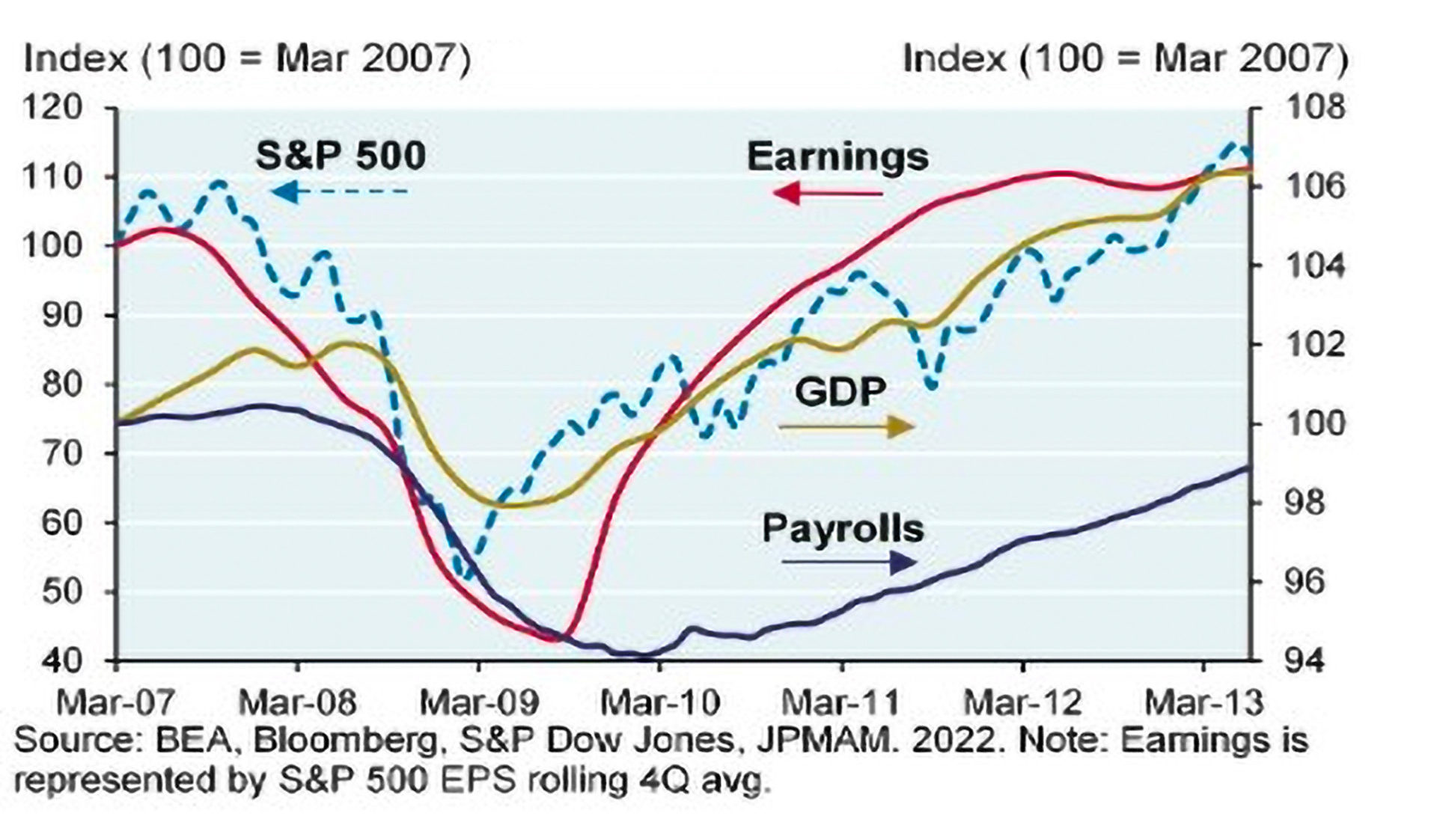

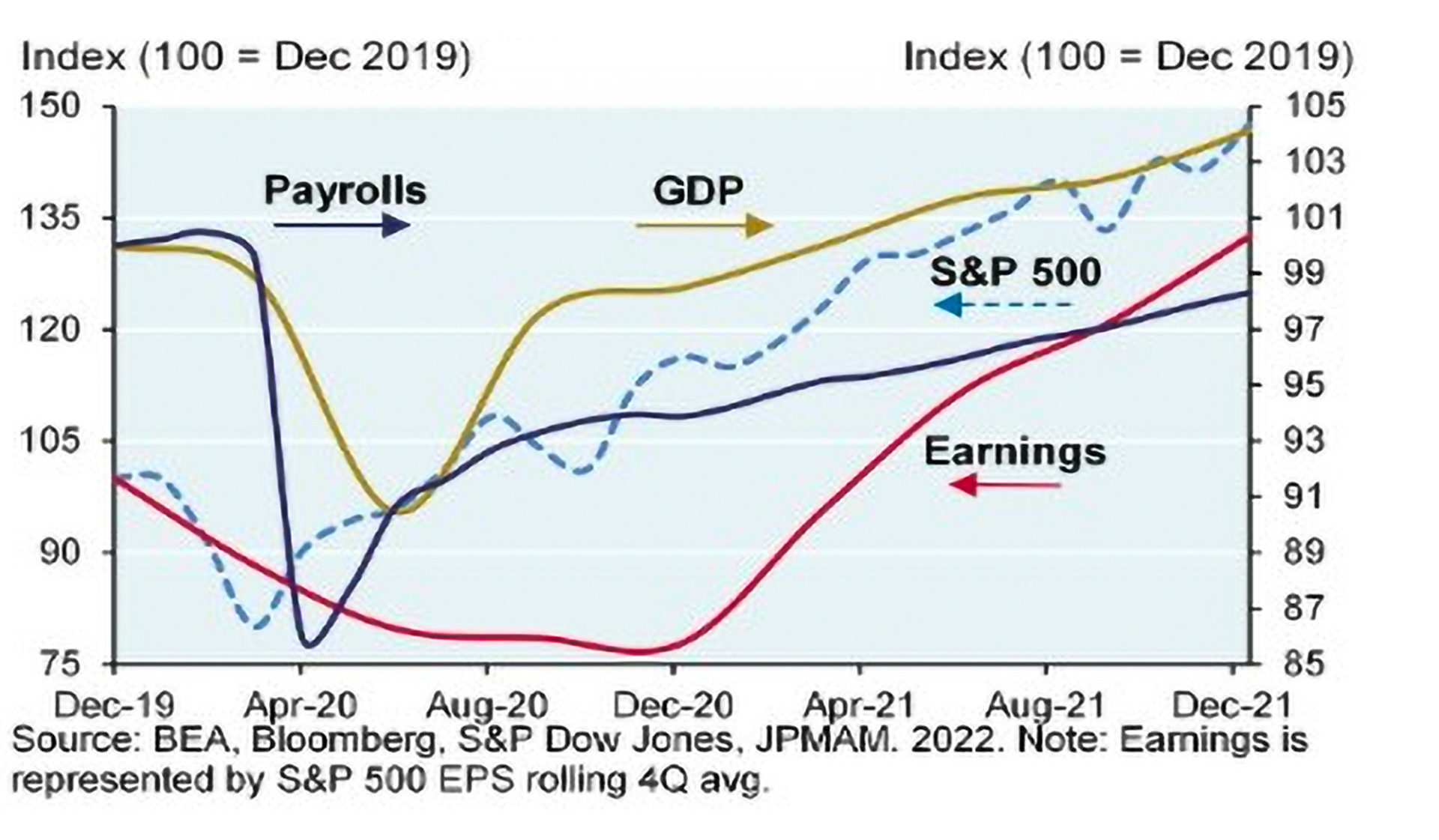

Global financial crisis

Global COVID pandemic

In the charts above you can see that during the last two US recessions, the S&P 500 bottomed before earnings, employment and the economy. If you look at history, you’ll find the same outcome across the vast majority of recessions.

After falling 18% from its January 3 highs at the time for writing, the S&P 500 is already pricing in some of the damage. Credible estimates we have seen suggest that those price declines factor in a 0-5% earnings fall.

As the economic picture gets worse, and so do daily newspaper headlines, investors must fight against the temptation of cashing in their chips.

It is darkest before dawn.

The market rebounds before the worst of the economic pain is over.

And, if history and our experience are any guide, the rebound can be swift on the other side.

At Ophir, we are well positioned for a slowing economy; but we’re also well positioned with a game plan for the inevitable rebound.

The latter includes a shopping list of businesses we believe will be some of the biggest beneficiaries in the recovery to come.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.