By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

We look at 6 key questions investors have about the impact of the banking crisis, the outlook for interest rates, and how our Funds are positioned for this complex investing environment.

Welcome to the March Ophir Letter to Investors – thank you for investing alongside us for the long term.

GFC Redux or isolated incident?

If you work in financial markets, or you have some solid investing experience, you could be forgiven for waking up at night in mid-March in a cold sweat with GFC nightmares and flashbacks.

Silicon Valley Bank (SVB), Signature Bank (SB), Credit Suisse … all collapsed during the month. Was a ‘Lehman Brothers’ moment just around the corner? A collapse that triggers a GFC-like event?

It was an understandable question.

In this letter, we will look at 6 key questions that investors have about the impact of the banking crisis, the outlook for interest rates, and how our Fund portfolios are positioned for this complex investing environment.

While we are being somewhat defensive and cautious, particularly with a strong focus on owning companies with strong balance sheets, we are also remain resolutely focused on our proven, earnings-focused investment strategy that has delivered superior long-term returns.

March 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during March. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +1.0% net of fees in March, outperforming its benchmark which returned -0.7%, and has delivered investors +21.1% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned -1.7% net of fees in March, underperforming its benchmark which returned -1.6%, and has delivered investors +12.9% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -3.8% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +1.2% net of fees in March, outperforming its benchmark which returned -1.1%, and has delivered investors +13.6% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

1. How serious is March’s global banking crisis?

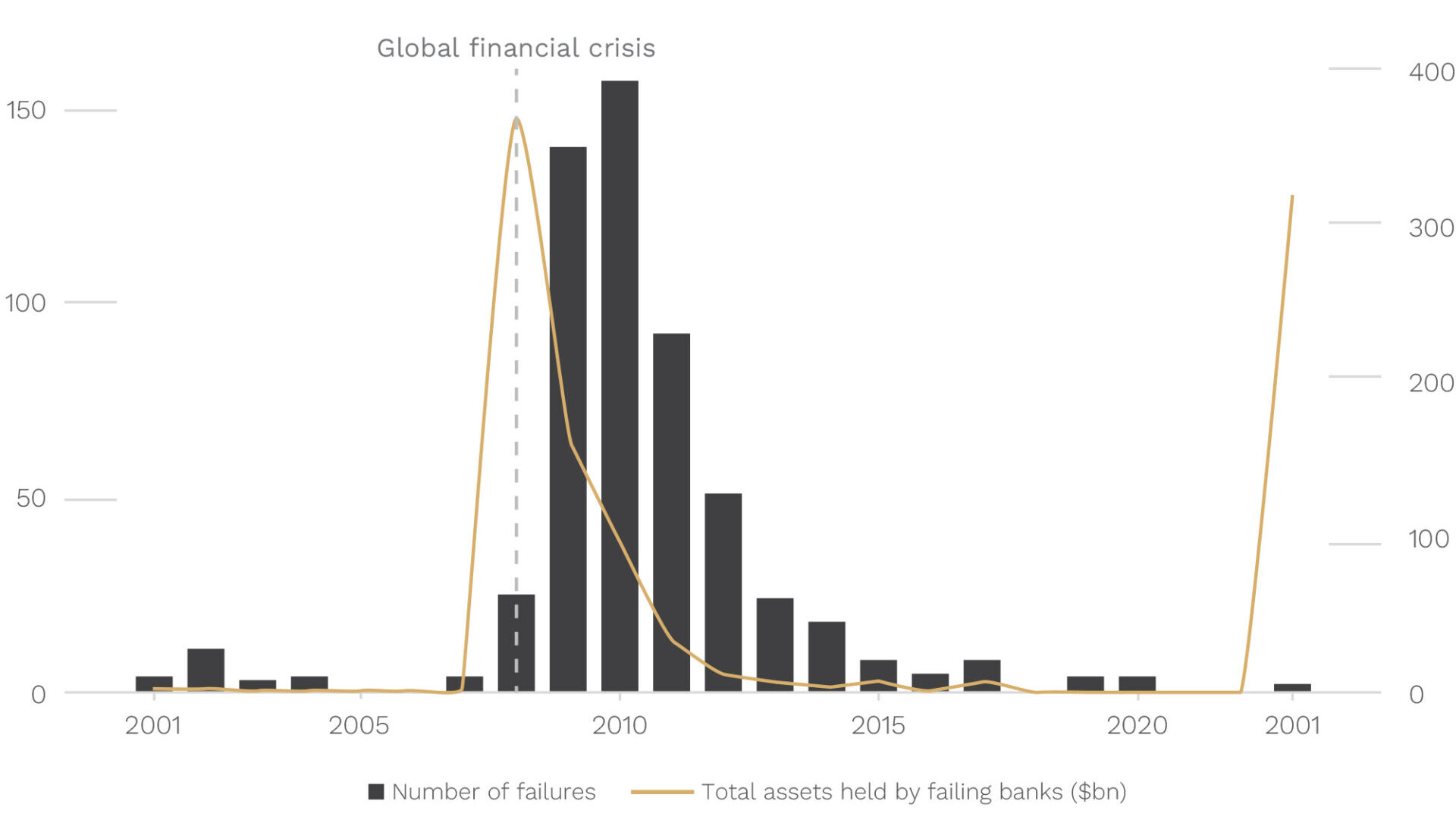

While few, the US bank failures were substantial. SVB had US$213bn in assets and SB had US$110bn in assets. So both sat firmly in the top 30 banks in the US (see chart). Their collapses represented the second and third-largest bank failures in US history, smaller only than Washington Mutual during the GFC.

US Bank Failures this Century

Source: FDIC

US authorities were quick to respond, though. They guaranteed SVB and SB deposits and put liquidity programs in place to help stem contagion to the broader banking sector.

The US regional banking failures in March also mostly stemmed from idiosyncratic causes (focussed exposure to start-up tech and crypto sector customers), so a broader systemic banking issue à la the GFC looks less likely. There are already signs things have stabilised with deposit outflows from the US banking sector, particularly in small regional banks, slowing.

That said, the situation could still deteriorate because of flow-on effects to credit and economic growth. It is hard to forecast, however, because the severity of the crisis will be determined by ephemeral things like ‘confidence’ in the banking sector and by the willingness of depositors in 0% interest-paying accounts to chase higher returns outside the banking sector in the likes of money market funds and short-term treasuries.

Suffice to say we are watching the situation closely.

2. How did share markets respond to the banking crisis?

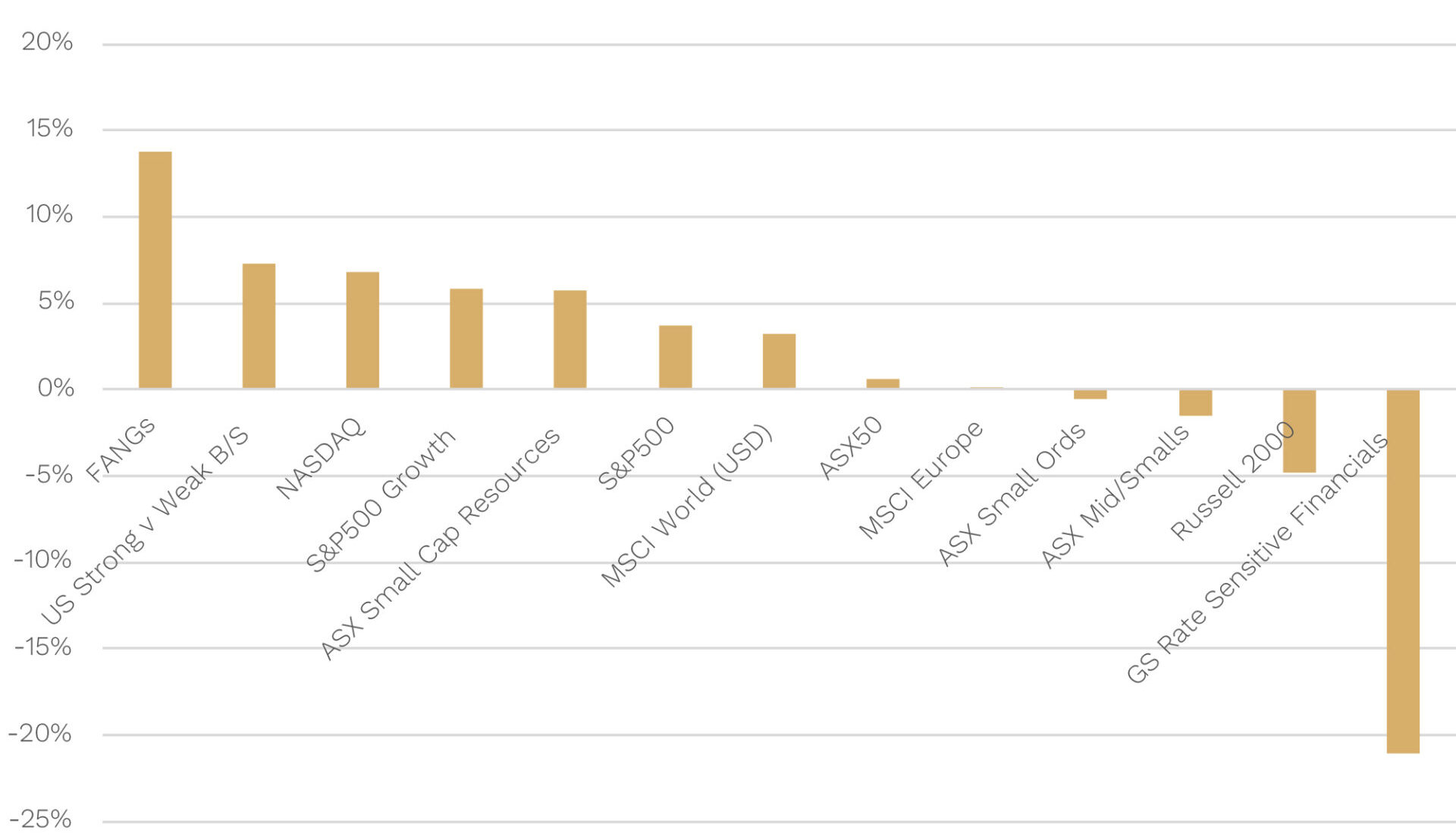

Share markets responded with a mixed performance in March, but the banking sector ructions did have its fingerprints on the month’s winner and losers.

March 2023 Performance (Total Return)

Source: Factset. Returns in local currency terms unless specified.

Financials got hit hard. Investors are fretting about the impact of recent higher interest rates on the banking sectors’ marked-to-market loan losses, as well as slower loan growth.

But businesses with strong balance sheets outperformed. Investors are worried a bank credit tightening cycle could hurt companies with excessive borrowings, so they shifted to the safety of conservatively geared stocks. Given our focus on companies with strong balance sheets, this contributed to the in-general outperformance in our Funds during March.

The other big winner was mega-cap tech, as shown by the FANGs, which benefited from ‘safe-haven’ flows and a fall in longer-term interest rates that supported their valuations.

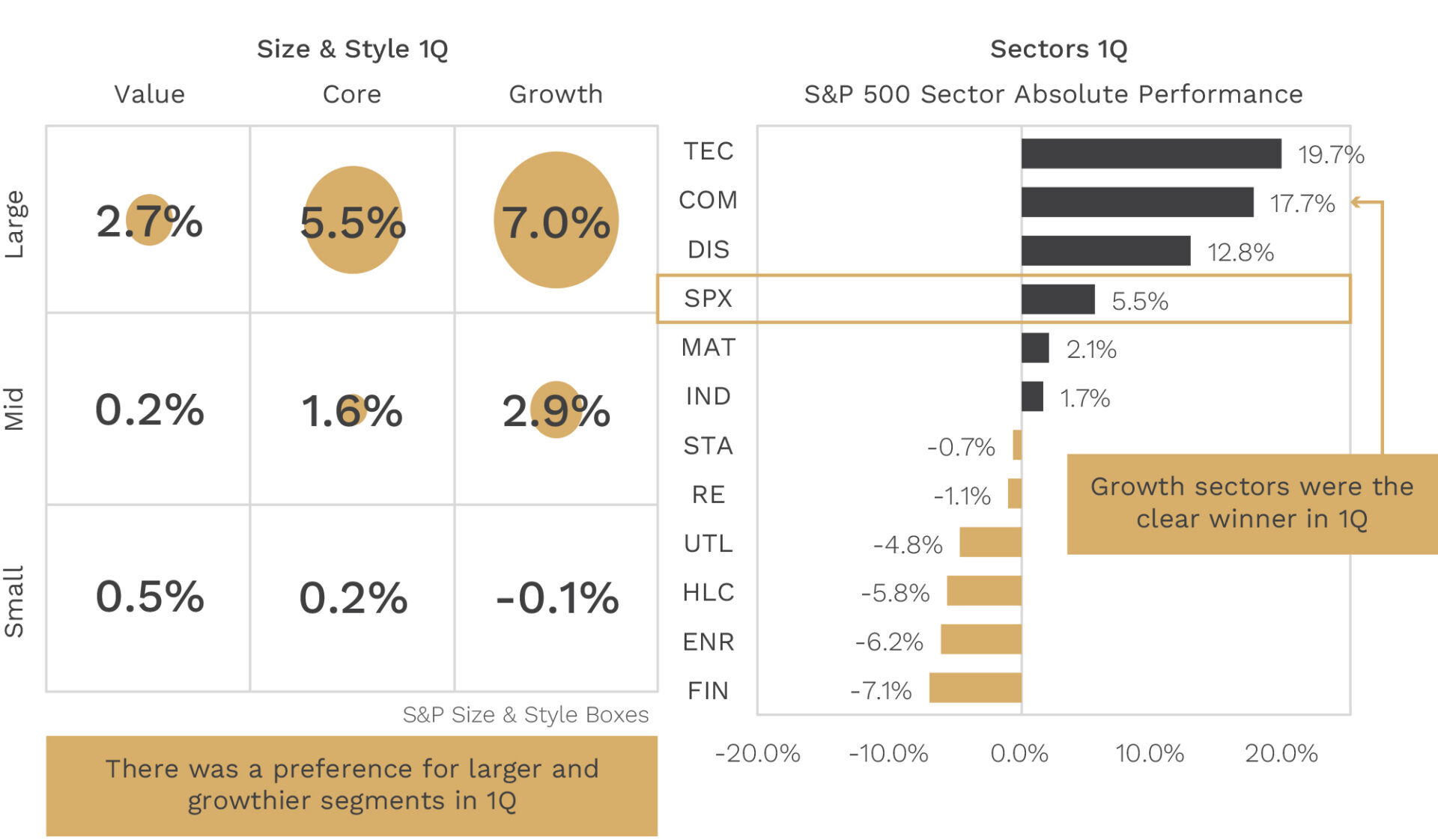

This mega-cap tech outperformance was probably the standout theme year-to-date for the March quarter. You can see below that large-cap growth companies were far and away the winner.

What Did Investors Favour in Q1 and Will it Continue?

Source: @MichaelKantro

Interestingly, and relevant for us given our exposure, the growth segment in US small caps didn’t benefit from falling long term interest rates. It was actually the worst performing US style sector.

3. Is this now the last Fed hike we’ll see?

Source: Roger Federer

In response to the banking issues of March, financial markets have dramatically repriced where they think interest rates are going. Exhibit A is the US Federal Reserve. At the time of writing, markets were pricing that it was a line ball decision whether the Fed is done hiking rates this cycle, with rate cuts starting from July. This is in stark contrast to pricing at the start of March, before the banking issues, where further hikes were priced for May and June, with rates then kept on hold for the rest of 2023.

This repricing has been echoed in Australia where the Reserve Bank paused in April after 10 consecutive monthly hikes. Market pricing here also suggests the RBA has hung up the hiking boots this cycle.

Increasingly, investors think the Fed’s ‘move fast and break things’ monetary policy is starting to cause more carnage, with credit tightening by banks set to replace interest-rate increases in restraining demand and bringing inflation under control.

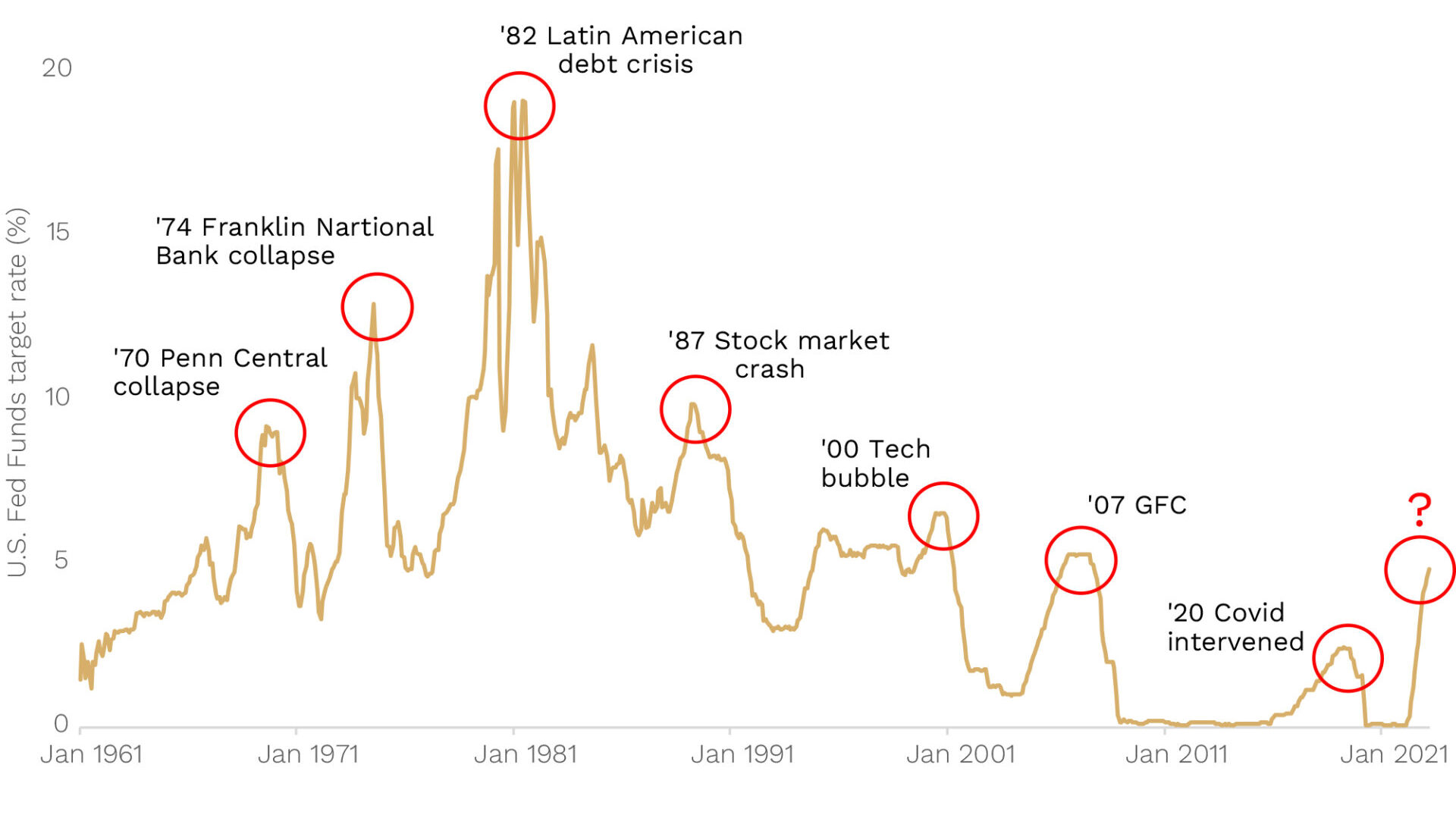

There is good historical precedent to think we may be getting to the ‘break things’ part of this hiking cycle.

As we show below, this is the fastest rate-tightening cycle in the US since the late 70s/early 80s. Such rapid rate rises are usually stopped by cracks appearing in some part of financial markets or the real economy.

Will Something Big Break?

Source: Ophir, Factset

The SVB collapse could be the canary in the coalmine this time. Recent US data in late March/April (inflation, ISM New Orders, job openings) suggests the economy is slowing.

4. How is Ophir positioning its portfolio?

From July last year corporate earnings growth for the U.S. has been consistently revised down. Back in July, it peaked at about +10% growth for the next 12 months but forecast growth is now basically flat. Given the lagged impact of rate hikes on earnings and economic growth, and the margin squeeze that still seems ahead for corporates, we think this is still overly optimistic.

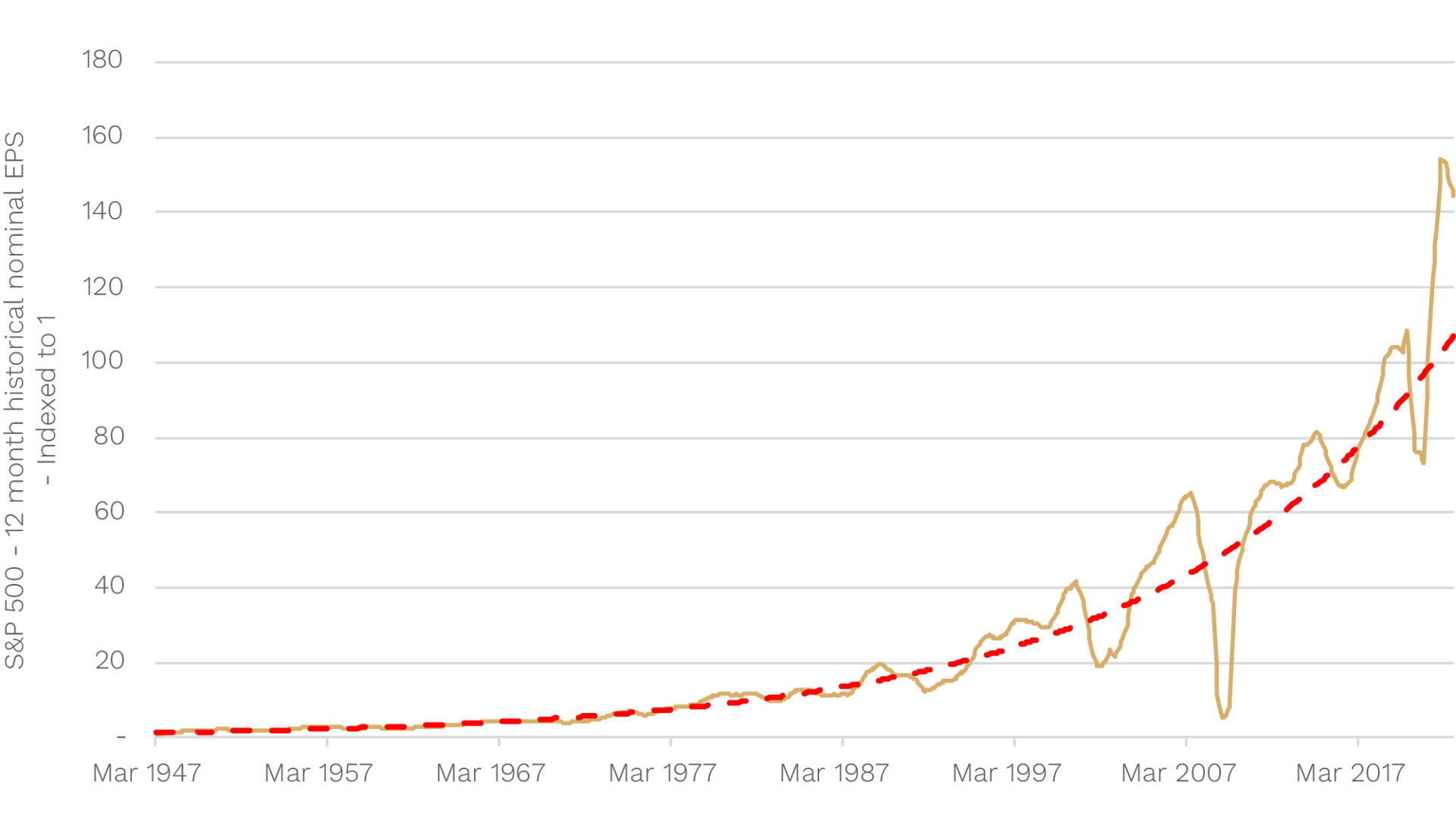

Historically, U.S. earnings are still well above their long-term trend line (by about -24%, see chart below). They have been boosted by excessive fiscal and monetary policy during Covid, as well as expanding margins as companies put through big price increases for customers. If, indeed, recession is ahead for the U.S, which looks more likely than not, history shows S&P 500 earnings fall by a median of -13%.

How Far Could Earnings Fall?

Source: Ophir, Factset

Together, this sees us maintaining a cautious portfolio positioning. We are not making any outsized macro bets given challenges around macro timing, but our Funds are:

- Modestly overweight cash at around 10-13% levels, versus the 5% historic average.

- Marginally further up the market-cap spectrum (though still in small and mid caps) than usual. Given heightened downside risks, this provides us with extra liquidity advantages so we can more easily pivot portfolio positioning.

- Overweight businesses with more resilient, less macro-sensitive earnings. In our High Conviction Fund (ASX:OPH), for example, we hold insurers AUB Group (ASX:ASB) and NIB Holdings (ASX:NHF) which are seeing an upswing in premiums; and Resmed (ASX:RMD) in the Health Care industry, which is benefiting from structural growth in its key product for its core customer base (those with sleep apnea). Similarly, in our Global Opportunities Fund, we hold businesses like Transmedics (NDQ:TMDX), which specialises in organ transplant technology that has very little sensitivity to the macroeconomic cycle (the procedures are a necessity!).

5. Given the uncertainty, how strong are the balance sheets of your holdings?

Perhaps, as expected in light of the banking and credit issues highlighted by SVB and SB, we have been fielding some questions on the balance sheet positioning of our portfolio companies.

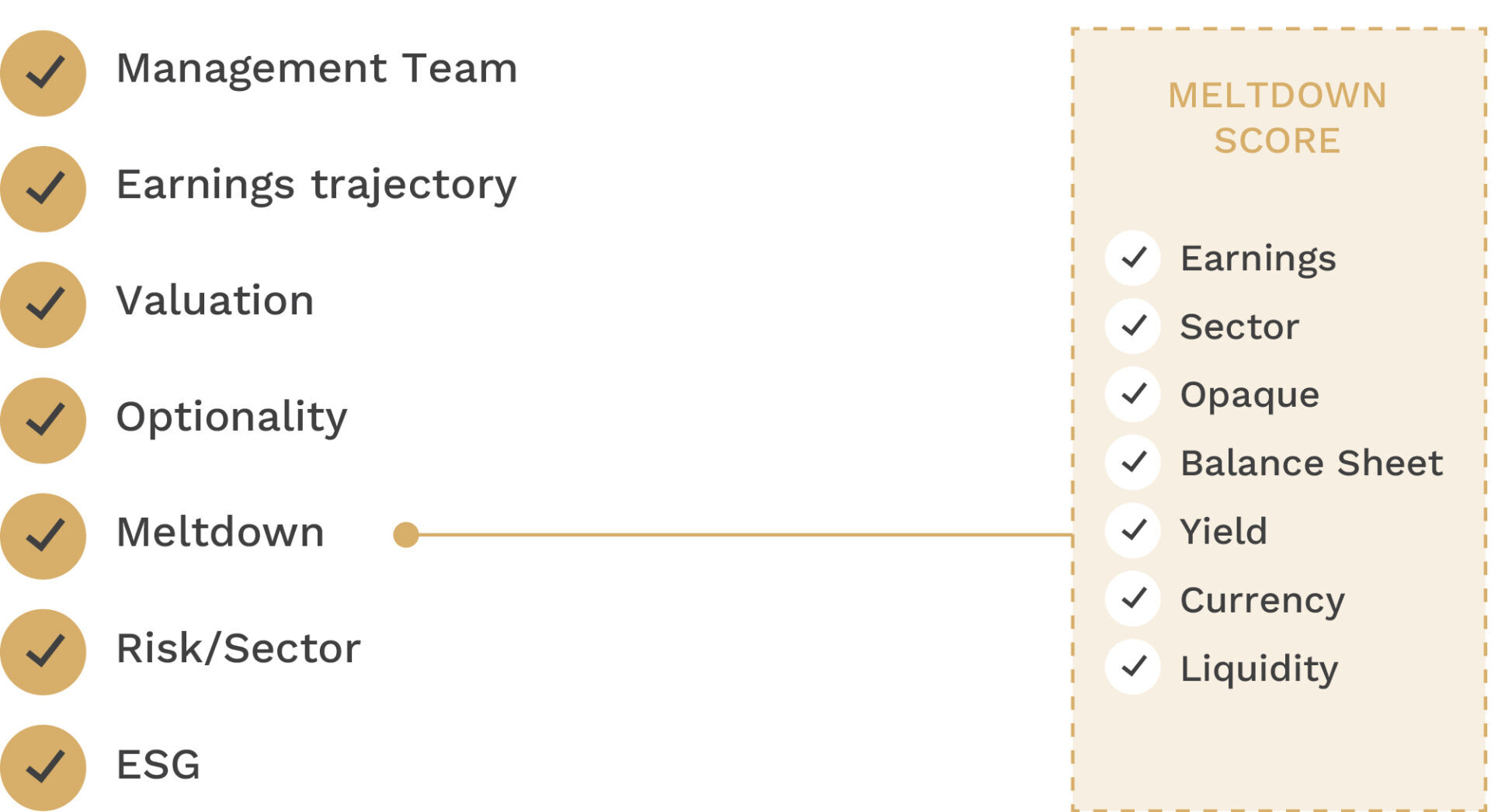

We analyse the balance sheet of every portfolio company. This is factored into the ‘Balanced Score’ we calculate which has seven core elements you can see on the left-hand side below.

Ophir Balanced Score and Meltdown Score

In particular, under the ‘Meltdown’ element we assess how a company is likely to perform in an economic meltdown. This element breaks out to a further seven areas, including how a company’s balance-sheet strength is likely to impact its performance when economic growth slows or contracts.

As we learned when managing money during the GFC, a strong balance sheet provides three major benefits in times of stress:

- Lower interest costs, or a net cash position, can help protect earnings when revenue falls.

- Credit spreads widen during economic downturns and refinancing debt, if it can be done at all, can be very costly and is best avoided/minimised.

- It provides optionality to acquire distressed competitors at fire sale prices to consolidate your industry and come out stronger on the other side.

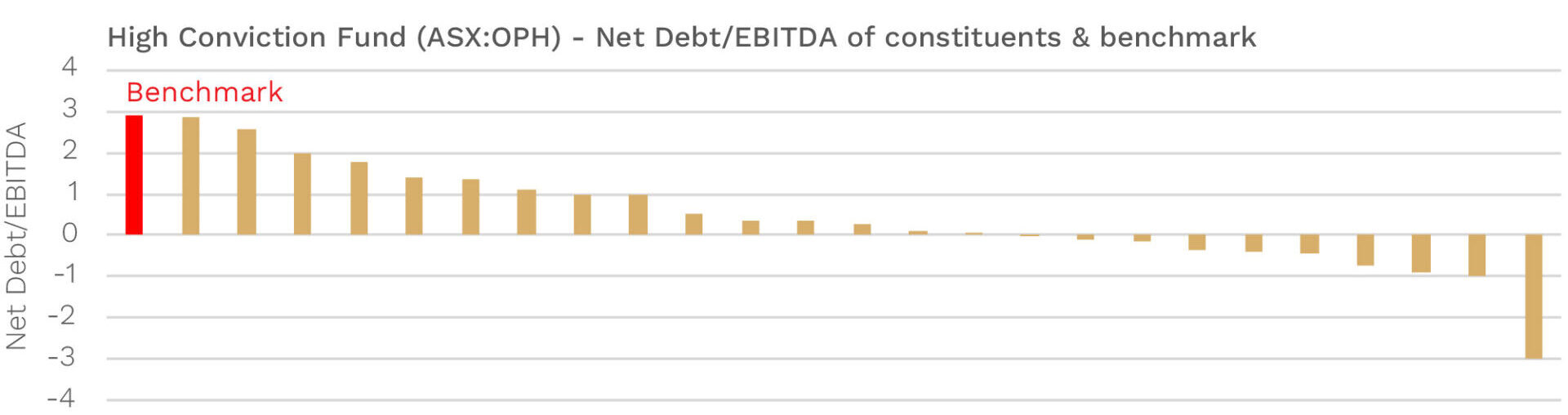

A common way to measure the level of gearing on a company’s balance sheet is the level of Net Debt (Short + Long Term Debt – Cash) divided by EBITDA (Earnings Before Interest Tax Depreciation and Amortisation: a proxy for cash flow available to service debt costs).

As an example below we provide the debt profiles for this metric across portfolio companies in our (Australian) High Conviction Fund (ASX:OPH).

Debt Profile of OPH

Source: Ophir & Factset. Data as of 31 March 2023 and benchmark highlighted in red. Benchmark: Ophir High Conviction Fund – 50% S&P / ASX Small Ordinaries Accumulation Index (XSOAI) 50% S&P / ASX Midcap 50 Accumulation Index (XMDAI). Net Debt amounts exclude leases for portfolio companies.

As you can see, the debt levels are relatively modest. The vast majority of companies have lower gearing than the market benchmark. We also note that a significant portion have either very low/no debt or are in fact in net cash positions (negative Net Debt/EBITDA). These debt characteristics are similar across all our Ophir Funds.

We believe our Funds are well positioned if credit conditions continue to tighten and put more pressure on highly geared companies and their share prices, like we saw in March.

6. Why aren’t you more defensive given the bleaker economic outlook?

We have also been asked why, if it’s obvious there may be more difficult times ahead for economic growth and corporate earnings, our Funds aren’t even more defensively positioned.

It’s a great question and the simple answer is that:

- A slowing in fundamentals (revenue, earnings etc) is often largely already reflected in market prices; and/or

- Timing when it will be fully reflected in market prices is incredibly difficult, if not impossible.

Michael Burry of Scion Capital, as documented in the great movie ‘The Big Short’, correctly bet against subprime mortgages. But he very nearly went out of businesses because he was too early. Prices continued to rise (moving against his ‘short’ position) and investors demanded their money back as losses mounted. A moratorium on investor redemptions, and the eventual collapse of subprime values, saved Burry and his firm. The lesson is that, often, there is little difference between being right but too early … and being wrong.

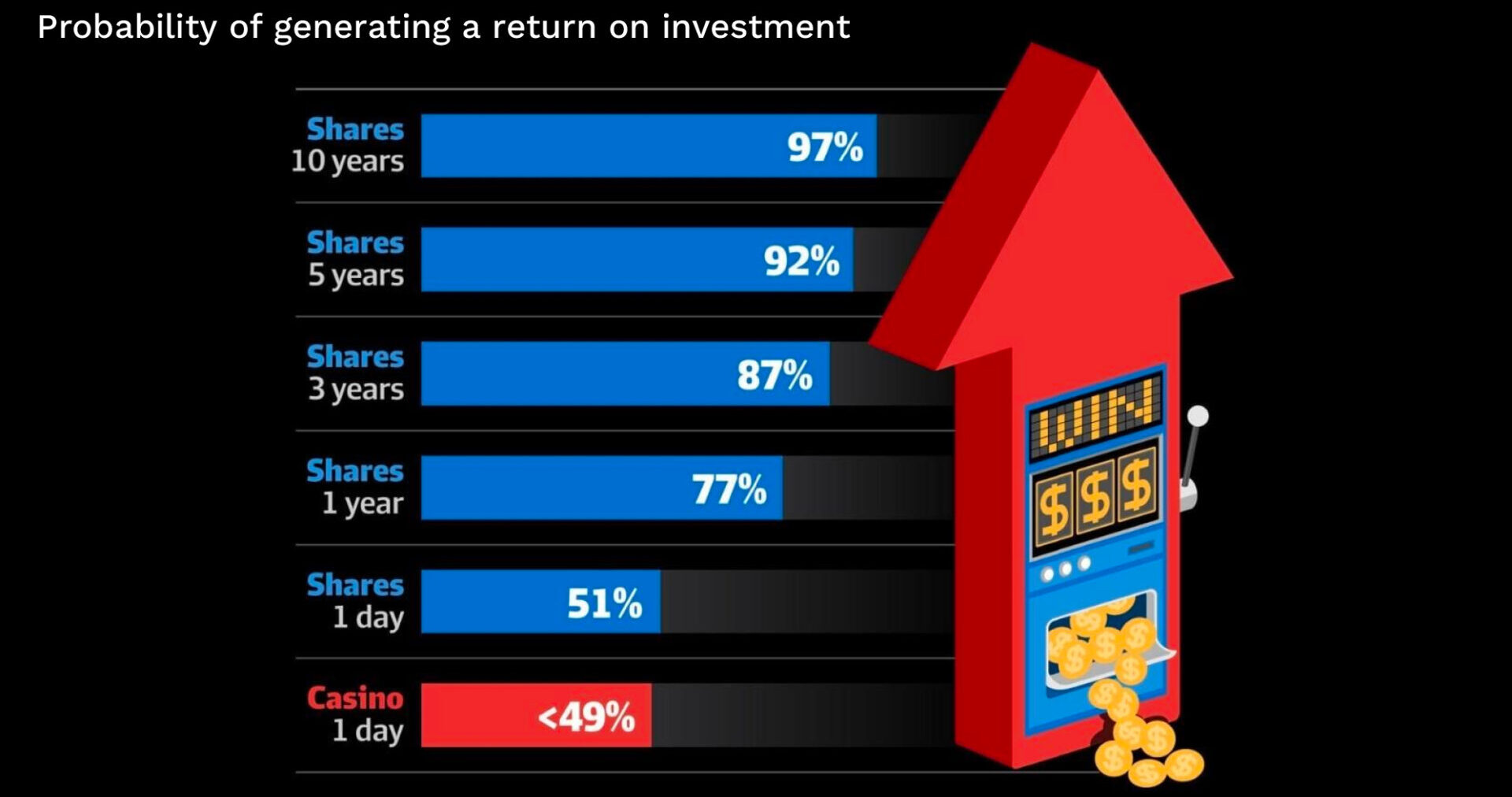

As long-time readers will know, being ‘long’ the share market is not like gambling at a casino. At a casino the odds favour the house. The longer you play the more likely you are to lose.

The share market is skewed in your favour. You are exposed to the ingenuity of entrepreneurs and business leaders striving to make more and better ‘things’ with less. You share in the rewards of the capitalist system (the worst system of them all, except for all the others!).

Blackjack vs Buffet

Source: Ophir Asset Management, Australian Financial Review

With a minimum investment time horizon of 5 years for all our Funds, why wouldn’t we want to maintain a relatively fully invested position when the probability of generating a return over that period is so favourable?

In this uncertain environment it’s important to remember the opportunity cost of not being invested in the share market can be very high, given it is an endeavour where long-term returns are overwhelmingly skewed in your favour.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.