Welcome to the June Ophir Letter to Investors – thank you for investing alongside us for the long term.

Immaculate disinflation to the small cap rescue?

Investors have had to contend with inflation, the start of rate cutting cycles, a bifurcated US economy, and wars in Europe and the Middle East. If that wasn’t enough, another force has been thrown into the blender: politics.

Snap French and UK elections started things off. Joe Biden’s woeful first presidential debate performance saw the US get involved. Then, spectacularly and tragically for the innocent victim in the crowd, former President Donald Trump narrowly survived an assassination attempt at a rally in Pennsylvania. And just now President Biden has withdrawn from the race.

Most relevant for June’s performance in our Funds was the risk aversion the French elections injected into the Paris stock market, a market where Ophir has a number of portfolio holdings. French stocks dropped just shy of -14% during the month!

Sacre Bleu!

Source: Bloomberg. Data from 31 May 2024 to 30 June 2024.

In this month’s Letter to Investors, we’ll look at how we manage exposure to individual countries, like France. Then we’ll touch briefly on three key important topics:

- The US presidential election and what it might mean for the outlook for inflation, bonds and stocks.

- Whether ‘immaculate disinflation’ is alive and well again in the US. Is this the rocket small caps need?

- And, finally, we’ll play a quick game of ‘Who am I?’ We ask you to guess this ‘family friendly’ high conviction stock we hold in our Australian Funds. We think this stock is a potential 10-bagger! (Read or scroll to the end of this Letter to play!)

June 2024 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during June. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +2.8% net of fees in June, outperforming its benchmark which returned -1.4%, and has delivered investors +21.9% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned -0.8% net of fees in June, outperforming its benchmark which returned -1.4%, and has delivered investors +12.9% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +1.2% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -2.2% net of fees in June, unperforming its benchmark which returned -2.1%, and has delivered investors +14.4% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

Quelle horreur! This is why we don’t bet the farm on one country

By far the main contributor to underperformance in our Global Funds during the month was our overweight exposure to France. Without this, we would have outperformed.

Why are we overweight French listed companies?

It is certainly not from any particular view on the French economy or political risks. Rather, from a bottom-up perspective we have found some great ideas in France.

The political uncertainty around a hung Parliament, however, triggered indiscriminate selling in June, and the four French companies we hold fell around -10% to -13% during the month in Euro currency terms.

Ultimately, this volatility doesn’t change our investment thesis on any of these businesses and they have, in general, recouped some of June’s falls in July at the time of writing.

From a portfolio management perspective, though, it does raise an important point: We will never bet the farm on a certain geography versus our Global Funds’ benchmark – the MSCI World SMID Cap Index.

We are bottom-up stock pickers, not macro allocators. We don’t make large, active (over- or under-weight to benchmark) geographic allocations based on a belief that a certain country’s share market will deliver superior risk-adjusted returns.

Typically, we do not go more that plus or minus 20% overweight or underweight a certain country in our benchmark. Most often it is 10% or less.

We don’t want an event like what happened in France in June to be the major determinant of whether we out or underperform over the medium to long term. We want performance to be based on getting the fundamentals of individual companies we own right – that is, identifying businesses with superior growth prospects that are underappreciated by the market.

Historic US market calm before the political storm?

Making money in your large-cap share portfolio has been easy of late with lots of return, yet very little volatility.

The S&P 500 just put on another 3.6% in June, and the Nasdaq added a further 6.0%. The VIX – the so-called ‘fear index’ in the US – has been plumbing lows at the 12-13 times range. This signals the market has very little concerns about a bumpy road ahead.

Another, far simpler, method of looking at recent market calm is the number of days the S&P 500 has gone without a 2% fall.

We have just eclipsed 350 days – the longest streak without a 2% pull back since 2007, just before the GFC. That’s quite an auspicious record to now hold.

In fact, a stretch of calmness by this measure has only occurred 11 times in the last 100 years!

Source: Bloomberg. Data to 22 July 2024

3 things investors can expect from a second-term Trump

However, we know from history that the months right before a US election tend to be more volatile times for share markets.

Will this time be different?

After Biden’s poor showing in the first presidential debate, and the attempted assassination attempt on his debating partner and challenger, Trump, it has become much more likely ‘The Donald’ will add to his title as the 45th President of the United States by becoming its 47th.

There is still time between now and November for things to change, but the market has been starting to price in the greater odds of a Trump victory. (At writing, President Biden has stepped aside from challenging the 2024 election with Kamala Harris the likely Democratic candidate as highlighted in betting markets – see chart)

Source: Bloomberg: PredictIt odds for who will win 2024 U.S. Presidential Election

From what we know so far, a Trump presidency will likely focus on four main policy initiates, including:

- Limiting imports and reshoring economic activity

- Curbing migration

- Extending the Trump era tax cuts, and

- Repealing the Inflation Reduction Act (IRA).

Given this, what should investors expect from a Trump Presidency? Here’s what we think is likely:

- Higher-for-longer inflation

Import and migration restrictions, as well as extending tax cuts, are all inflationary. All else being equal, this could mean inflation remains above the Fed’s target of 2% for some time, at least the next two years.

- Higher bond yields

The combination of higher inflation, rising government debt and stronger economic activity will likely put upwards pressure on bond yields. We could see US 10-year bond yields in the range of 5-6%.

- Higher equity prices

Extending corporate tax cuts will provide a shot in the arm for US profits and margins. Trump, as he was during his first Presidency, is a market-friendly leader and we expect he will want to continue that in his second term. A key caveat is whether rising bond yields become a headwind to equity market performance. The speed of any rise will be the key here. We know that, initially, rising bond yields weren’t a headwind to share market gains during Trump’s first term in office.

Overall, we expect the market to like anything that increases the odds of a Trump presidency.

But history suggests we should still expect the share market to get more volatile as we approach election day, and that, if Trump wins, higher inflation, bond yields and equity markets become incrementally more likely.

Will ‘immaculate disinflation’ rate cuts rocket smalls caps?

As regular readers and many investors would be aware, since the latest equities bull market started in late 2022, there has been little market breadth. Small caps have dramatically underperformed, and a small handful of mega-cap tech companies have driven the market.

One of the few times market breadth has widened during this bull market was in December last year. That’s when the US Federal Reserve first indicated they were likely done raising interest rates this cycle, and that rate cuts were likely in 2024.

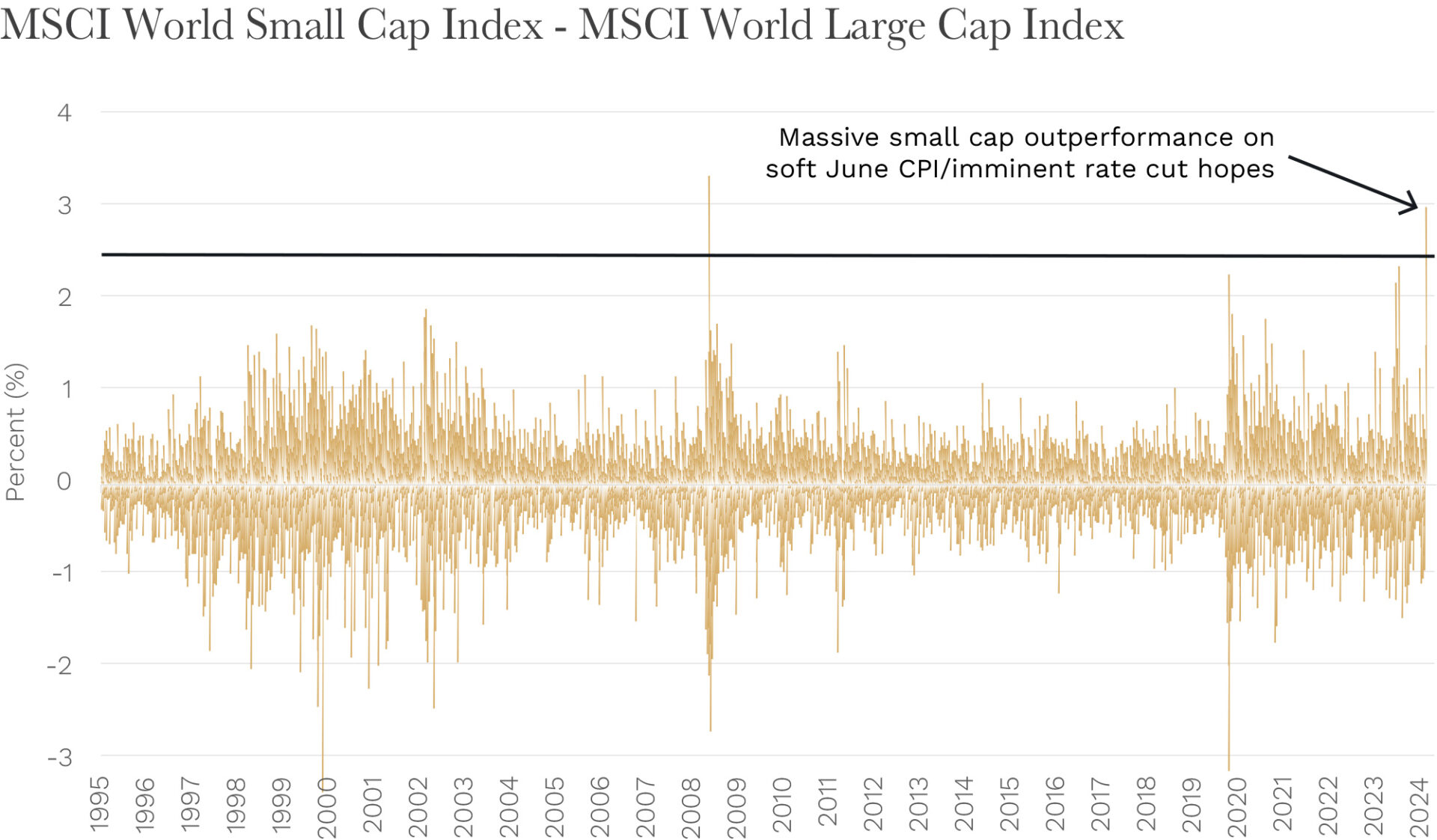

As of writing in July, we have just seen another big signal that indicates that small caps are poised to outperform on the back of so called ‘soft landing’ rate cuts by the Fed.

US inflation data for June, released on the July 11, was notably softer than expected. US annual Core CPI is still 3.3%, but on a three-month basis is annualising at 2.1% – virtually bang on the Fed’s 2% target.

Fed Chair Powell appears to be getting the “further evidence” that inflation is softening that he needs in order to cut rates this year. At the same time, unemployment remains relatively low.

Global Small Caps reacted by posting their second-largest outperformance over Global Large Caps in history! (see chart for outperformance of 3.03% on the 11th July 2024).

And for good measure the Russell 2000 – the small-cap index – had its largest outperformance versus the Nasdaq ever!

Source: Bloomberg. Data to 11 July 2024

This was a MAJOR market rotation day.

It gives investors some idea of where market positioning and demand is likely to move if a soft-landing rate-cuts scenario continues to play out. This rotation of small cap outperformance, at the time of writing, has continued in the days after the 11th July.

For those wondering what might the catalyst be for small caps to catch up their monumental underperformance versus large caps and mega cap tech, it’s clear: soft CPI and impending Fed rate cuts.

The market has now fully priced in (i.e. a 100% chance) a Fed rates cut of at least 0.25% in September.

Is this the starter’s gun small caps have been waiting for?

If the economy holds, and the rate-cutting cycle starts on the 18th September as predicted by markets, it is looking increasingly likely based on recent market behaviour.

Who am I? – The Ophir Company guessing game

Now, let’s play a game.

I am US tech company listed on the ASX. Earlier this month I listed on the NASDAQ.

My product is a smartphone app that families use to share their locations.

That app lets me know if my teenager, who has just gotten their drivers licence, is speeding or, God forbid, has crashed the car.

I have 25 million daily users. They use my app at least 5 times per day (that’s a lot of worried parents!!).

In February, on the day I announced I would introduce advertising to my free users, my share price soared nearly 40%.

We think Duolingo is a good ‘comp’ (comparative company) to assess the potential upside to revenues and valuation for this company from introducing an advertising income stream.

I am a top holding and top performer in the Ophir Opportunities Fund and Ophir High Conviction Fund (ASX:OPH).

My share price is up over 125% in the last 12 months.

Who am I?

I am Life360 (ASX:360) and if you want to know why Andrew Mitchell thinks I could be a 10 bagger in Ophir’s portfolios … click on the link here to listen to Andrew’s interview with Murdoch Gatti on The Rate of Change podcast.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.