What we think could be the next 10 bagger on the ASX

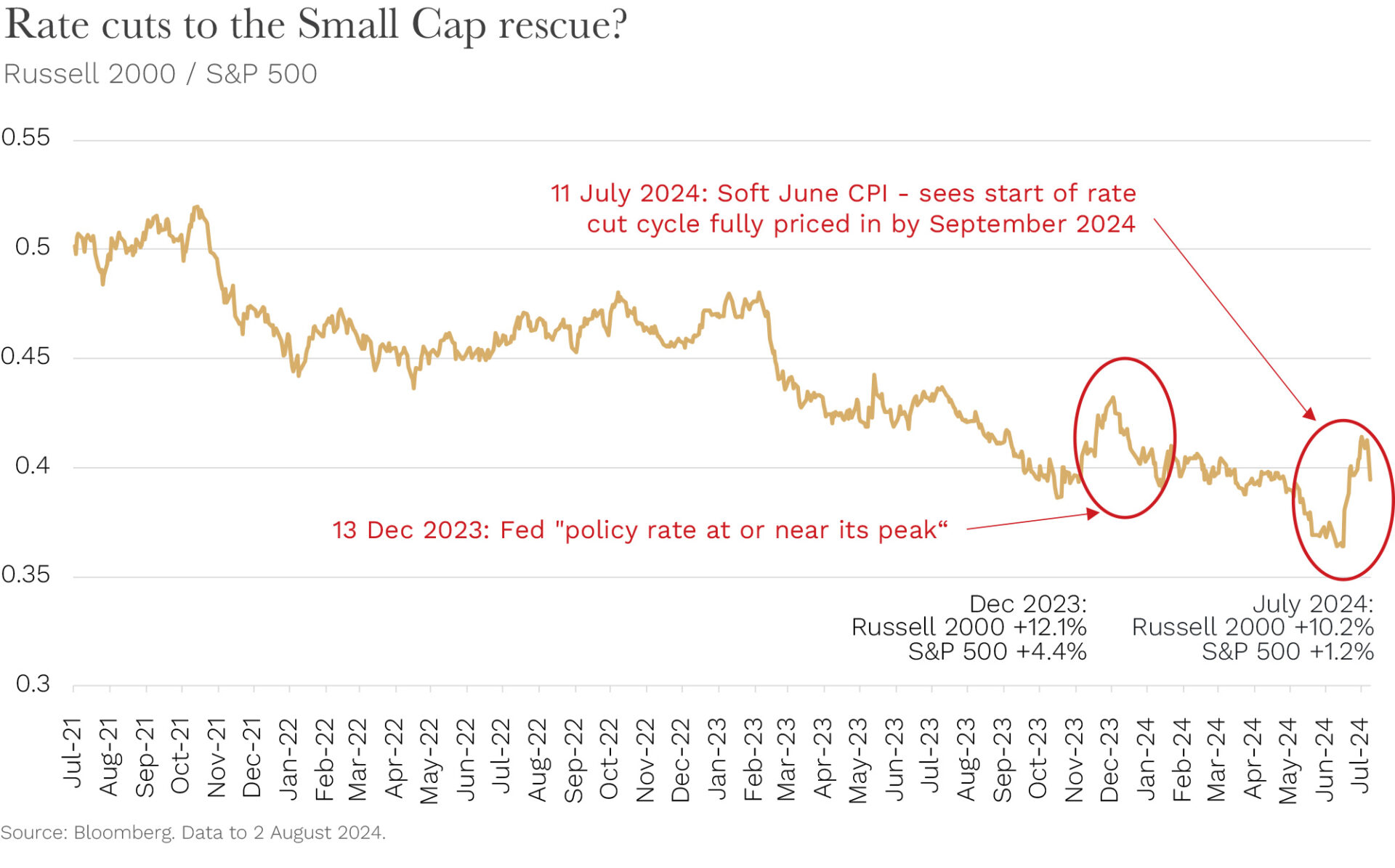

The share market party kept rolling in July, with little to indicate August’s looming ‘flash crash’. The story of July was the massive rotation from the Magnificent 7 (Apple, Microsoft, Nvidia, etc) into US small caps.

The Russell 2000 US small-cap index was up a whopping +10.2% (in USD) for the month. The S&P 500 eked out just +1.2%, with the Mag7 actually falling -0.6%.

The small-cap surge provided a big tailwind to our Global Funds’ performance during the month.

Small caps globally have had to play second fiddle to large caps since late 2021. As far as the US share market is concerned, there have only been two periods since then where small caps have had some time in the sun. One was back in December last year; the other July just gone.

What do they have in common?

Essentially, during those two periods the market started to price in a higher chance the US Federal Reserve would cut rates (see chart).

Source: Bloomberg. Ophir.

Higher interest rates, starting in late 2021/early 2022, caused small caps to underperform. Lower rates may be their saviour.

The one complicating factor? Whether the long-discussed US recession will eventuate or not.

Like a manic depressive, the share market in recent times has been lurching from ‘soft landing’ rate-cut hopes (good for markets and small-cap outperformance) … to recession and emergency rate cut fears (bad for markets and potentially small-cap underperformance).

While the economic consensus, if there is one, remains in the soft-landing camp, views are wide and outcomes uncertain.

July 2024 Ophir Fund Performance

Before we jump into the Letter in more detail, we have included below a summary of the performance of the Ophir Funds during July. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +5.2% net of fees in July, outperforming its benchmark which returned +3.5%, and has delivered investors +22.2% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +2.8% net of fees in July, underperforming its benchmark which returned +3.8%, and has delivered investors +13.1% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -1.1% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +9.3% net of fees in July, outperforming its benchmark which returned +8.0%, and has delivered investors +15.9% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

Great risk/reward in small caps

We like the asymmetry for small caps; that is, they have big upside performance potential but limited relative downside to large caps if things get rough.

We think cheap valuations versus large caps (especially in the US) are likely to be the kindling for small-cap outperformance in the US, with soft-landing rate cuts likely to be the spark. (Based on market pricing, those rate cuts will almost certainly start from next month at the Fed’s September 17-18th meeting.)

But if a US recession happens, along with supersized emergency rate cuts by the Fed, small caps will almost undoubtedly fall. However, given the chasm in valuations, those falls will likely be less – or at least not much more – than large caps.

The US small cap price-to-earnings (PE) ratio is currently at 16.5x versus 24.3x for large caps. US small caps have not been as cheap versus large caps since the Dot.com bubble 25 years ago. When the bubble burst and recession followed, large caps fell more than small caps because their valuations had to drop from nose-bleed levels.

When US recessions have ended, across all the major share markets in the world, small caps have then significantly outperformed in the first year of the market rebound.

In our view, the relative case for global small versus large caps over the next 5-10 years has not been as compelling as it is today for at least a quarter century. We don’t know the exact catalyst, but as Warren Buffett says, “price is what you pay, value is what you get”.

For the rest of this month’s Letter to Investors we wanted to give you a deep dive on the ‘Who Am I’ company that we flagged in last month’s Letter to Investors – ASX listed company Life360. We think Life360 has the best chance of any ASX-listed company of being a ‘10 Bagger’ (increases in value 10 times over) over the next 5-10 years.

Facebook for friends … LinkedIn for business … and Life360 for family?

When travelling in the US for work there is a lot of down time in the back of an Uber travelling between meetings.

You inevitably start talking to the driver about their families and, of course, America’s favourite topics: crime, homelessness and gun laws.

From the hundreds of these uber rides we can tell you three things:

- No one feels safe in America;

- Many of these drivers work incredible hours (often in multiple jobs) to give their family a better life; and

- The number of drivers that use Life360 with their families has grown exponentially over the last five years.

Life360 is a ‘freemium’ app. The app provides real-time location services for families. You can set up notifications to get an alert when your child arrives at school, leaves school and then arrives home.

If you want to pay for a subscription, you get driver reports, which show how your child is driving (are they speeding? using their mobile phone? etc), roadside assistance, towing, and crash detection with emergency response.

Today, there over 70 million users worldwide, 40 million of those in the US, and two million paying a subscription for the app (think US$15/ month).

Incredibly, on Apple’s ubiquitous mobile operating system (iOS), Life360 now has the fourth-highest daily active users of any social networking app in the US … and the 13th highest of any app! (You’ve obviously heard the names of all the other big-use apps, like YouTube, Facebook, TikTok, Instagram, Snapchat and Spotify.)

Why we own Life360

We have owned Life360 since mid-2020 when it traded at around $3.50 per share (Ophir owns the stock in all our Australian equity funds including the Ophir Opportunities Fund and the Ophir High Conviction Fund (ASX:OPH).

We were attracted to the growing subscriber base, the ability to move to a tiered subscription model and the free optionality inherent in their user base.

The stock has certainly taken us on a rollercoaster ride. At one stage, it fell close to $2.50. At writing, it was trading at just over $18 per share.

Essentially, there are three key reasons we own Life360:

1. Life360 is going viral in the US and has an ultra-low cost of acquiring customers

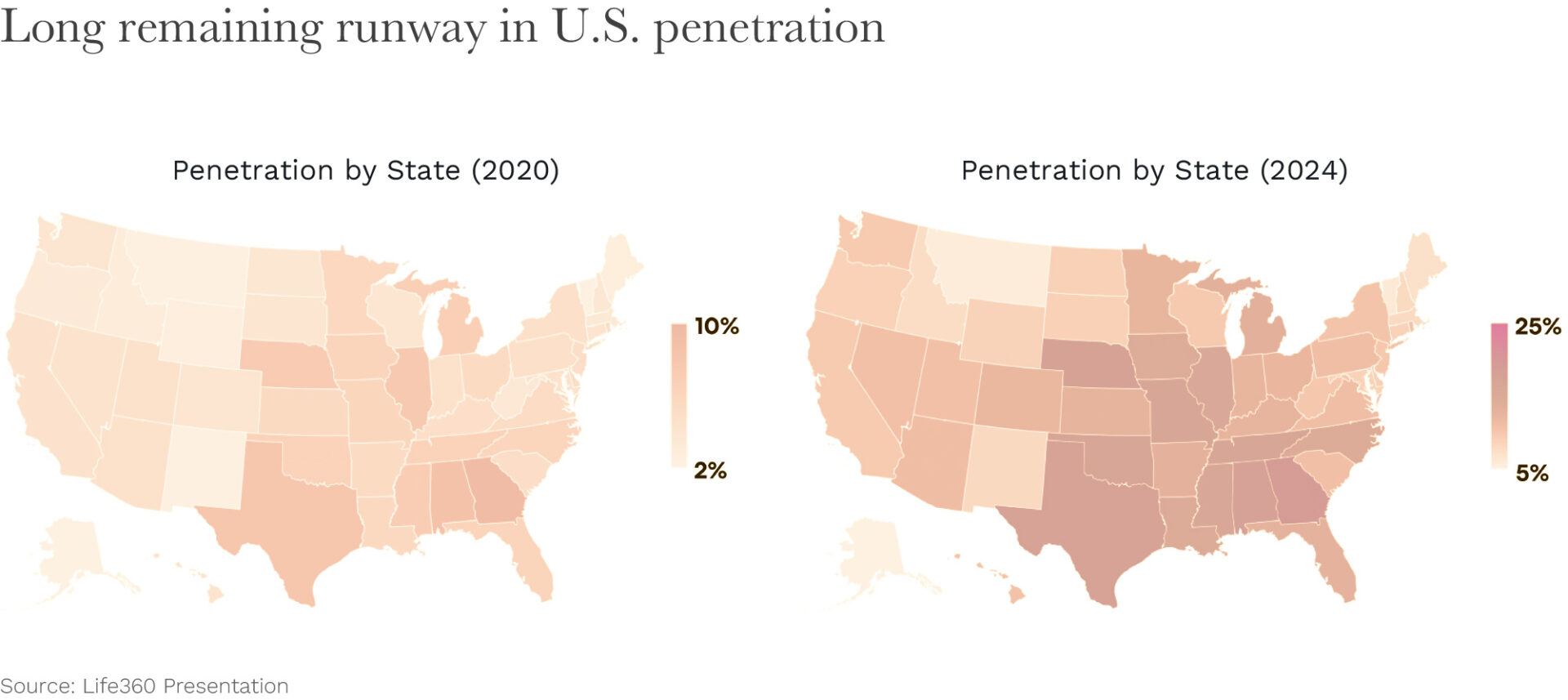

Life360 has been spreading like wildfire through the US, especially in the South. Some 13% of Americans are now using Life360 regularly, up from 6% just four years ago. In the Southern States, like Texas, up to a quarter of people are using the app.

Source: Life360 Presentation

The Southern States are still the fastest-growing States in the US. Could Life360 go from 40 million to 100 million users in the US? There is no evidence growth is slowing.

Now it is starting to spread globally.

Importantly, Life360 reported that between 70% and 80% of users sign up because of word of mouth. Recently, the number of users downloading the app has accelerated, despite the company spending less on marketing and advertising.

To help make its app even more viral in the next couple of years, Life360 is set to release its ‘Pet’ product, which will allow pets to be tracked with GPS live in the app. Life360 will also release elderly care, where an elderly parent can have a wearable device integrated with the app. The wearable could feasibly detect a fall and automatically send an emergency dispatch, as well as notifying family members. Life360 is becoming a ‘cradle to grave’ business targeting a huge global end market.

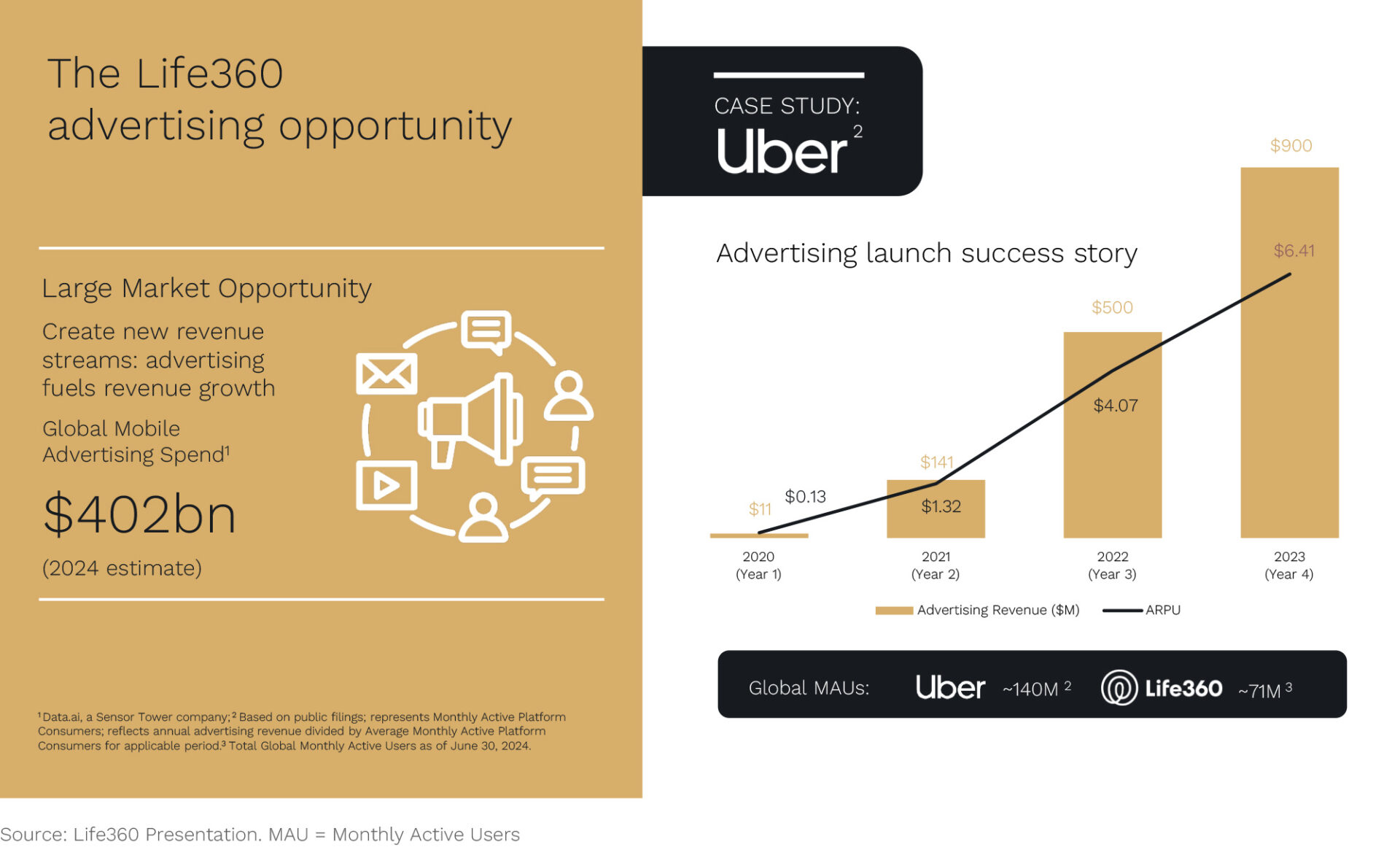

2. The potential to be a powerful ‘Facebook-like’ ad business

Life360 has the potential to become like Facebook and become a marketing business. Like a newspaper, Facebook uses content to attract a crowd and sell adverts. But with Facebook, the user creates content for friends for free. Facebook then targets the best ads to users consuming the content. This creates a very valuable loop: low cost to acquire customers through free content; ultra-low cost to create content; and the ability to target ads algorithmically .

We view Life360’s location services as the ‘content’ created by the family unit. Family members are always creating content for other family members to consume. Moreover, Life360 uses that content to target ads using algorithms and achieve high conversion on those ads. Why might they have the best algorithms to target advertising? For the app to work, they always need to know your location. What other app can claim this? That data is a goldmine for advertisers.

In February this year Life360 announced that it will launch advertising on its platform. From the first second of that day Ophir were buying more stock, even when the stock was up over 20%.

We estimate there will be over 100 billion views on their app over the next 12 months. We have spoken to many people in the digital advertising industry. Their insights suggests that Life360 should be able to charge advertisers somewhere between $3 and $6 per 1,000 views in three to five years’ time on the app in the US.

Interestingly, Life360 included the Uber example (below) in their latest chart pack to illustrate the potential of advertising for the company. This suggests they are thinking along the same lines.

In five years, we believe advertising will likely generate more revenue than Life360’s subscription business. However, the true excitement comes from their margins. In our view the subscription business has the potential to get to 30% profit margins in 2029. But given the content is free and acquiring the customers is free, we think digital advertising can deliver 80% plus profit margins for Life360.

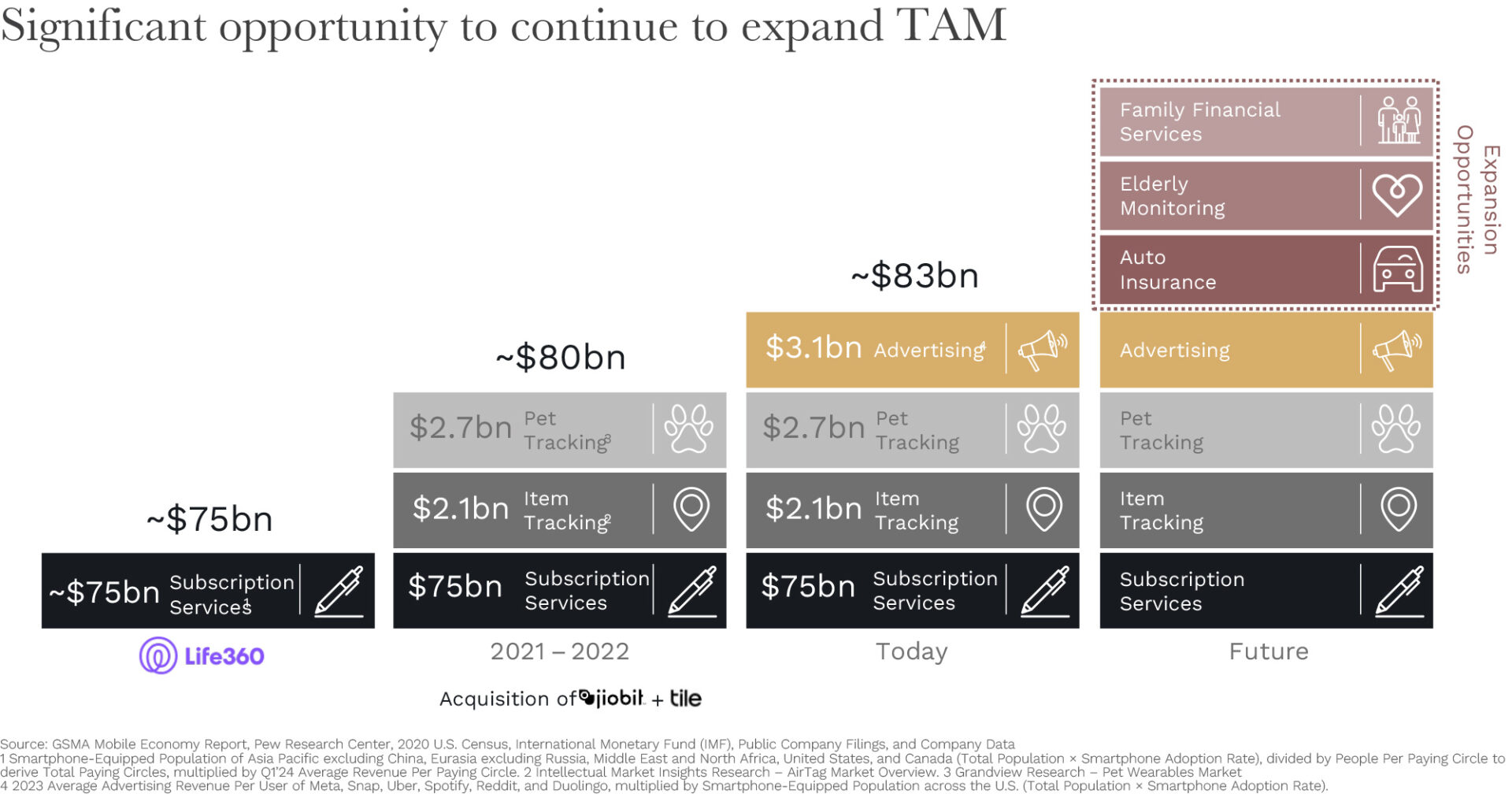

3. Even more opportunities from add-on products like auto insurance

But we don’t see the business stopping there. Life360 has other ‘free options’ – products with massive upside potential that aren’t being valued by the market – embedded. Like auto insurance. Given Life360 knows who is speeding, and the generally good versus bad drivers, they have the ability to price risk better than the standard insurer. Could they offer discounted car insurance to the best drivers who drive infrequently through safe areas at low-risk times? Again, they will have no cost to acquire customers given they are existing users of the app.

Teenage debit cards are another latent opportunity. Parents can pay pocket money through the app and watch how their children spend it in real time. From the days of the Dollarmite account through Commonwealth Bank, signing up kids has been a great way to win long-term customers for a bank. Greenlight is a private US operator in this space, and we estimate it makes well over $100 million of ongoing revenue at high incremental margins on revenue growth.

Importantly, you are not paying for any of these potential businesses where Life360 will have a huge comparative advantage in the cost of acquiring customers and data collected from location services.

Source: Life360 Presentation

The key risk

The key risk for us, of course, will be Apple’s ‘Find My’ app.

It allows Apple users to do many (but not all) of the same things the free Life360 app does. It is conceivable, especially in an AI world, that Find My becomes a lot better and Life360 is not able to stay meaningfully in front of Apple.

While we don’t know what Apple will do here, it’s important to note that Android and Google have been moving away from location services.

Importantly, over 50% of families using Life360 have at least one family member on an Android phone. Given the inoperability between Android and Apple’s iOS, the Find My location services will not be effective for those entire family units.

A rare Aussie 10-bagger opportunity

It is not every day you come across a business listed in Australia that is growing globally above 20% per annum and has 70 million active customers. In the next few years, we will watch and see if Life360 can flex its free product offering to grow to become a truly global platform business.

The hard work has already been done in building the crowd. While Apple will always remain a risk, the potential to make 10x your money in Life 360 means that, to us, there is bigger risk not owning Life360 than worrying about what Apple will do next.

There are no certainties in investing, but Life360 is a company that has us pretty excited. A small cap company growing fast, into a big global end market, with lots of free options for business expansion. Now that’s the type of company we love at Ophir.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.