By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we cover how Wall Street strategists are more divided than ever on the outlook for the U.S. share market in the second half of 2023 and how it factors into our portfolio positioning.

Welcome to the July Ophir Letter to Investors – thank you for investing alongside us for the long term.

Soft landing ahead?

It was one of the greatest ‘soft landings’ of all time.

It was back in 2009, while financial markets were still gripped by the GFC.

But it wasn’t the U.S. economy. That was still mired in the worst economic downturn since the Great Depression.

It was actually Chesley ‘Sully’ Sullenberger’s soft landing.

On 15th January 2009, after a bird strike caused total engine failure, Sullenberger landed U.S. Airways Flight 1549 ever so gently on the Hudson River, saving all 155 passengers and crew on board.

You know you’ve got a story on your hands when six-time academy award winner Tom Hanks played the hero in the movie ‘Sully’.

Fast forward to today, and U.S. Fed Chair Jerome Powell is trying to be the new Sully and land the U.S. economy softly and avoid a hard-landing recession.

The stakes are high. The U.S. is the world’s largest economy at the forefront of the fight against inflation, with the fastest interest rate hiking cycle in decades.

The fate of households, business and investors, not just in the U.S. – but in a number of other advanced economies – hangs in the balance.

In the last couple of months, ‘goldilocks’ economic data in the U.S. has helped propel share markets forward.

U.S. economic growth has been ‘not too hot or too cold’, whilst inflation has continued to fall without any meaningful deterioration in labour markets.

Powell must be wondering if Tom Hanks is available again for another movie.

This helped create a sea of green for equity markets in July, building on June’s gains, with U.S. small caps (Russell 2000) leading the way, up 6.1%, US tech (Nasdaq Composite) up 4.1%, Australian Small caps (ASX Small Ords) up 3.5%, US large caps (S&P500) up 3.2%, Australian Large caps (ASX50) up 2.6%, and European Stocks (MSCI Europe) rising 2.0%.

July 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during July. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +2.7% net of fees in July, underperforming its benchmark which returned +3.5%, and has delivered investors +21.5% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +4.2% net of fees in July, outperforming its benchmark which returned +4.0%, and has delivered investors +13.6% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +8.3% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +2.6% net of fees in July, underperforming its benchmark which returned +3.3%, and has delivered investors +14.2% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

In this month’s Letter to Investors, we look at what a Sully-like ‘soft landing’ might mean for two areas of importance to our investors:

- The performance of U.S. share markets when inflation peaks, and

- The performance of our Global Opportunities Fund, which is fast approaching its 5-year anniversary.

While all things macroeconomic appears to be the market master at the moment, and our focus for this month, our investment team of course remains fully focused on what has delivered us sustained long-term success and outperformance: getting the earnings right.

Inflation peak = share market bottom?

As you would no doubt be aware, the prospect of a soft landing has seen share markets in a number of key economies ‘bottom’ in 2022.

Many investors are naturally asking whether these really were the lows of this cycle, or whether markets could fall again.

We are reminded of Winston Churchill’s dictum that, “The farther back you look, the further ahead you can see”.

In that vein we look to the past to see what has happened to the U.S. share market (the largest and the one with the longest history) when inflation has peaked previously.

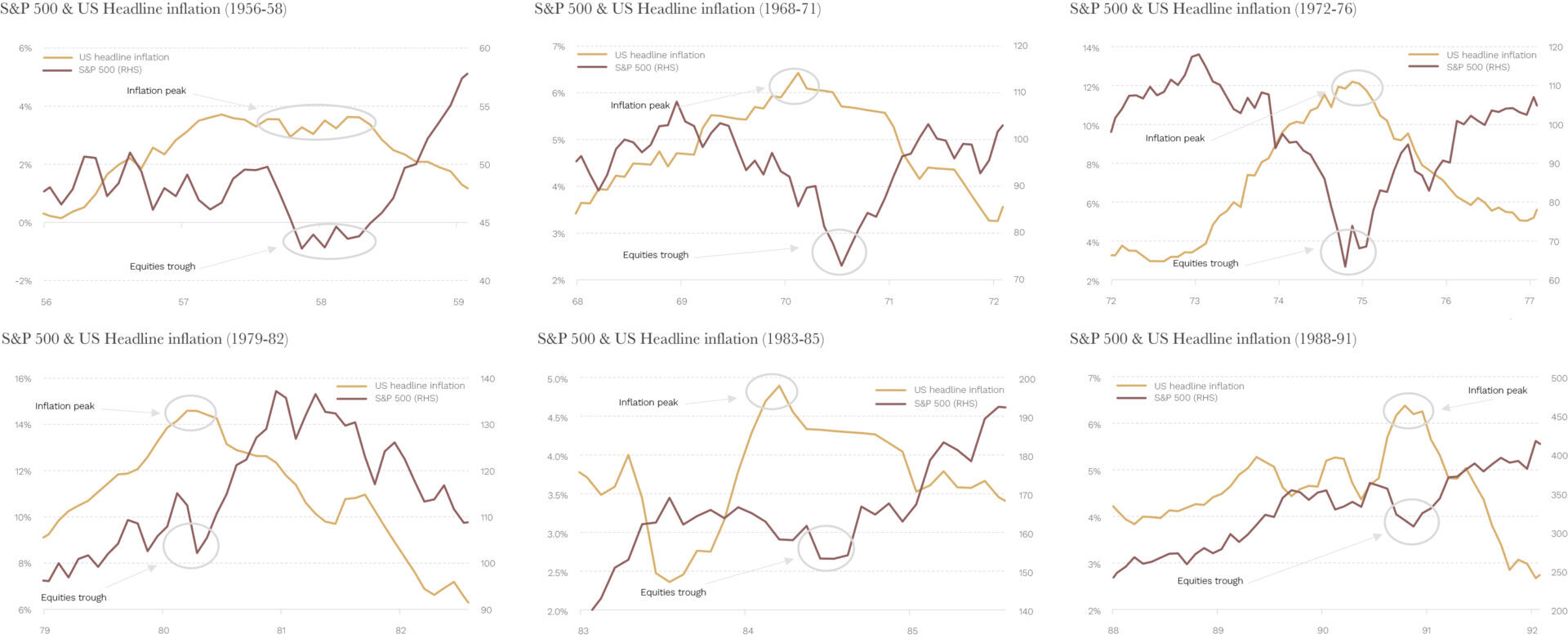

The results from the 1950s onwards are shown in the examples below. In each, we show the inflation peak (orange line with grey circle) and share market bottom (red line with grey circle).

Source: MST Marquee, MacroPolicy Perspectives & Refinitiv.

What you can see is that when inflation has peaked, it has roughly coincided with the share market bottom. On average, across the eight instances in the U.S, the share market has bottomed three months after the inflation peak. There is one exception, 1974, when the share market bottomed two months before the inflation peak.

Today’s episode of inflation in the U.S. has seen headline inflation peak at 9.1% in June 2022, and the share market bottom in October 2022 … almost exactly in line with the historical average.

This certainly adds weight to the ‘share market has bottomed already’ argument.

Two caveats

We’d caveat this, though, with two cautionary points:

- Firstly, the Fed has been slow to hike rates this cycle. For most of this hiking cycle, it has been hiking whilst annual Consumer Price Inflation (CPI) has been falling. This is unusual historically and does raise the prospect that the most significant impact on economic and corporate earnings growth is still ahead.

- Secondly, given this is the most significant inflation episode since the 1970/80s, the Fed may be more cautious about cutting rates too early. History has shown it is better reputationally for a central bank to keep rates higher and risk a recession, than cut too early and risk reigniting inflation.

Nonetheless, if inflation can keep falling at its current trajectory, the Fed may be able to ease rates sooner rather than later, and markets can look to the economic rebound on the other side.

This is a big ‘if’ though. Just as the Fed and most economists got the initial ‘transitory inflation’ call wrong back in 2021, they may again miscalculate the speed of this disinflation.

Macro headwinds over for the Ophir Global Opportunities Fund?

Does a potential ‘soft landing’ bode well for our Funds?

As mentioned, the Ophir Global Opportunities Fund is fast approaching its 5-year anniversary in October. We thought it’d be a good opportunity, therefore, to look back at the Fund’s performance, particularly in light of the impact of macroeconomic tailwinds and headwinds, and to outline a likely return to ‘normal’ where earnings dominate once again.

Overall, since inception in September 2018, the Fund has provided a net (after fees) return of 14.2% per annum, a most pleasing result. This places it near our long-term internal return target of 15%-per-annum for each of our Funds. It also puts the Fund at the top of the performance table for global small cap funds available in Australia (according to FE fundinfo).

An investor’s experience in the Fund, however, will no doubt be coloured by when they entered the Fund because performance has had three distinct periods:

1. A strong start

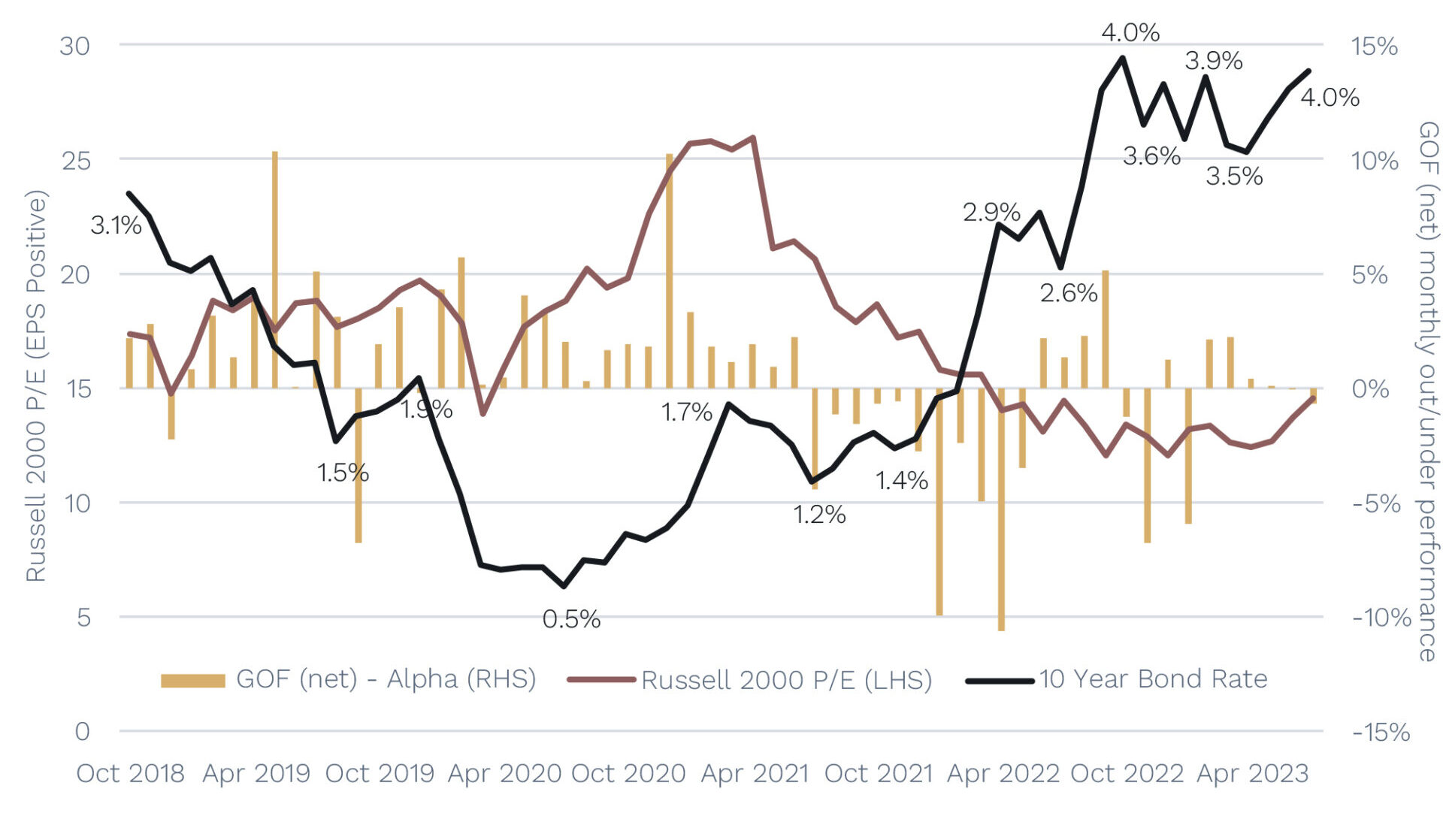

After launching in October 2018, the Fund had a dream start. It outperformed in 30 of its first 33 months. You can see this in the chart below where the orange bars describe monthly outperformance (above the line) or underperformance (below the line) versus the Fund’s benchmark, the MSCI World SMID Cap Index Net Returns (AUD).

Global Opportunities Fund – Performance Review

Source: FactSet & Ophir. Data as of 31 July 2023.

2. A very tough middle

Starting around mid-2021, though – and particularly through late 2021 and early 2022 – the Fund had an extended run of underperformance.

As we’ve discussed previously, this period was when interest rates – particularly the all-important long-term interest rates used for valuing shares – started moving dramatically higher as markets anticipated the Fed raising short-term rates to combat inflation.

You can see this in the chart above, with the U.S. 10-year bond rate (black line) moving up from around 1% in mid-2021 to around 3% in mid-2022, and ultimately 4% in late 2022.

In the scheme of bond market moves, this was a dramatic increase, particularly from low starting levels. In 2022, it triggered the worst bond market returns ever in the U.S.

For shares, this was also a massive headwind for valuations and nowhere more so than in smaller, faster-growing companies in the U.S. – a market segment that comprises about 60-70% of the Global Opportunities Fund.

We show this in the chart above, with valuations for U.S. small caps (as proxied by the Russell 2000 index in red) basically halving from around 25x in mid-2021 to around 12-13x by mid to late 2022. This was accentuated for the smaller and more growth-orientated companies found in our Fund compared to the broad Russell 2000 index.

3. More recent stabilisation

With long-term interest rates and market valuations (black and red lines) stabilising, the Fund’s performance has stabilised, and over the last year the Fund has performed broadly in line with its benchmark.

A return to normal

The most important point here is that the large increase in long-term interest rates, and resulting big fall in valuations in small-cap companies in the U.S, which created a big macroeconomic based headwind for the performance of the Global Opportunities Fund, looks largely done. That is if you believe, as we do, that we are nearing the end of the tightening in short-term U.S. interest rates, and that US inflation has passed its peak.

It is our belief that that U.S. small caps will go back to being led by their earnings outcomes more so than macroeconomic forces, and that suits us just fine.

The normal state of affairs for share markets is for earnings growth to reign supreme as the driving force behind share prices. Indeed, earnings are almost all that matters in the long term.

Our investment process is geared towards ‘getting the earnings’ right over the next 3 to 12 months, rather than forecasting market expectations. ‘Getting the earnings right’ is what has driven our long-term outperformance in all the Ophir funds and we don’t expect this to change in the future.

Ultimately, when liquidity flows back down to small caps, which we expect to occur when the ‘recession/no-recession’ debate is settled, we should see small caps outperform, as they historically do when we come out of bear markets. It is our expectation that valuations should then revert from ‘cheap’ back to more normal ‘fair value’ levels, or even above.

Getting the earnings right

Despite the prospect of a ‘soft landing’, we are deliberately positioning our portfolios so that we are not making a big macroeconomic call that should dominate portfolio outcomes versus the market. We are finishing up the quarterly reporting season for companies in our Global Opportunities Fund and into full-year reporting for our Australian funds at present.

Our eyes remain firmly fixed on ‘getting the earnings right’ and avoiding any earnings landmines. This is what we can control, and it will put the Funds on solid ground no matter the economic machinations to come this year, and whether we see a soft landing or not.

We look forward to giving you a more detailed summary next month on how we have fared this earnings season across our Funds.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.