By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we discuss whether the current rebound in markets is a classic ‘bear market rally’ that will subsequently be reversed or the start of a new bull market.

Welcome to the July Ophir Letter to Investors – thank you for investing alongside us for the long term.

Sea of green in July as risk-taking returns

Share markets caught a massive bounce in July and early August, continuing the gains since many bottomed in mid-June. While share markets of almost all varieties were up in July (except the Chinese and Hong Kong markets), it was small caps and growth sectors that led the way.

Large caps delivered good returns, with the S&P 500 (+9.2%), Nikkei (+5.3%), ASX 200 (+5.8%) and MSCI Europe (+7.6%) returning more than 5%. Small caps delivered even better returns, with the Russell 2000 (+10.4%) and ASX Small Ordinaries index (+11.4%) returning over 10% in July. The Nasdaq was the best performer, returning +12.4% over the month.

Growth stocks outperformed value stocks for the second month in a row. The S&P 500 Growth Index beat the S&P 500 Value Index by 6.9% and the MSCI Australia Growth Index outperformed the MSCI Australia Value Index by 6.1%. In the US, growth’s outperformance in the small-cap space was smaller, though. It only outperformed value by 1.5%.

There is a chance, of course, that the recent market rebound could just be a relief rally given some leading economic indicators continue to deteriorate and more interest rate hikes by key central banks are undoubtedly on the way.

What has driven this recent rebound in share markets since the June lows?

Markets were probably getting a little oversold in June and some respite was due. Then a ‘bad news is good news for share markets’ narrative started to take hold.

In the wake of softer economic data and a coming peak in inflation, the US Federal Reserve came across as a little more dovish than expected at its July meeting press conference. Chair Jerome Powell noted “at some point it will be appropriate to slow down” rate hikes. Although other Fed Governors have tried to walk back that dovishness in speeches since, the share market has continued to rally on the back of support from a fall in longer-term bond rates.

July 2022 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during July. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +9.5% net of fees in July, underperforming its benchmark which returned +11.4%, and has delivered investors +21.9% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +7.6% net of fees in July, underperforming its benchmark which returned +10.3%, and has delivered investors +13.3% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +18.8% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +8.3% net of fees in July, outperforming its benchmark which returned +7.0%, and has delivered investors +15.0% p.a. post fees since inception. (October 2018).

Download Ophir Global Opportunities Fund Factsheet

A question we are getting asked regularly is whether the current rebound in markets is a classic ‘bear market rally’ that will subsequently be reversed or the start of a new bull market.

The reality is no one knows. What we can say is that bear market rallies are almost par for the course. Below we show the current four rallies that have occurred during this bear market with the last being the biggest.

S&P 500

Source: FactSet. Data from 9 August 2021 to 9 August 2022.

If we look back though at the tech bubble in 2000, you can see in the chart below that there were six major rallies over the two-year bear market, with some of them greater than 20%.

S&P 500

Source: FactSet. Data from 1 July 1999 to 31 December 2002

We are certainly not saying that this market will fall as much as the tech crash (we think that’s very unlikely), but the point is that large rallies can occur during a bear market and don’t necessarily signify the start of a new bull market.

Given the heightened level of uncertainty in markets, we are maintaining more flexibility in our funds (through higher cash and market cap weightings) and we are not ready to declare for sure that this bear market is dead.

Importantly, we are not trying to time any continuing bear market or new bull market, but rather respond to the level of uncertainties we see. As the saying goes, “there are old pilots and there are bold pilots, but there are no old bold pilots”. When it comes to market timers, we could say the same thing: the bold pilots (timers) just don’t last and often spectacularly crash in a ball of flames. It’s also why you don’t see any economists or market timers on the Forbes Rich List!

Two factors driving performance

Another regular question we are being asked relates to our recent performance. There is no doubt the last 6-9 months has been the most challenging period of performance that Ophir has faced in its 10-year history.

We see two main reasons for the recent falls in the performance of our funds and the differences in performance between our Australian and global funds.

Factor 1: Smalls and growth underperformed – with the US hardest hit

While the small-cap growth segments of share markets were some of the best performing in July, this has certainly not been the case for most of the last six to nine months.

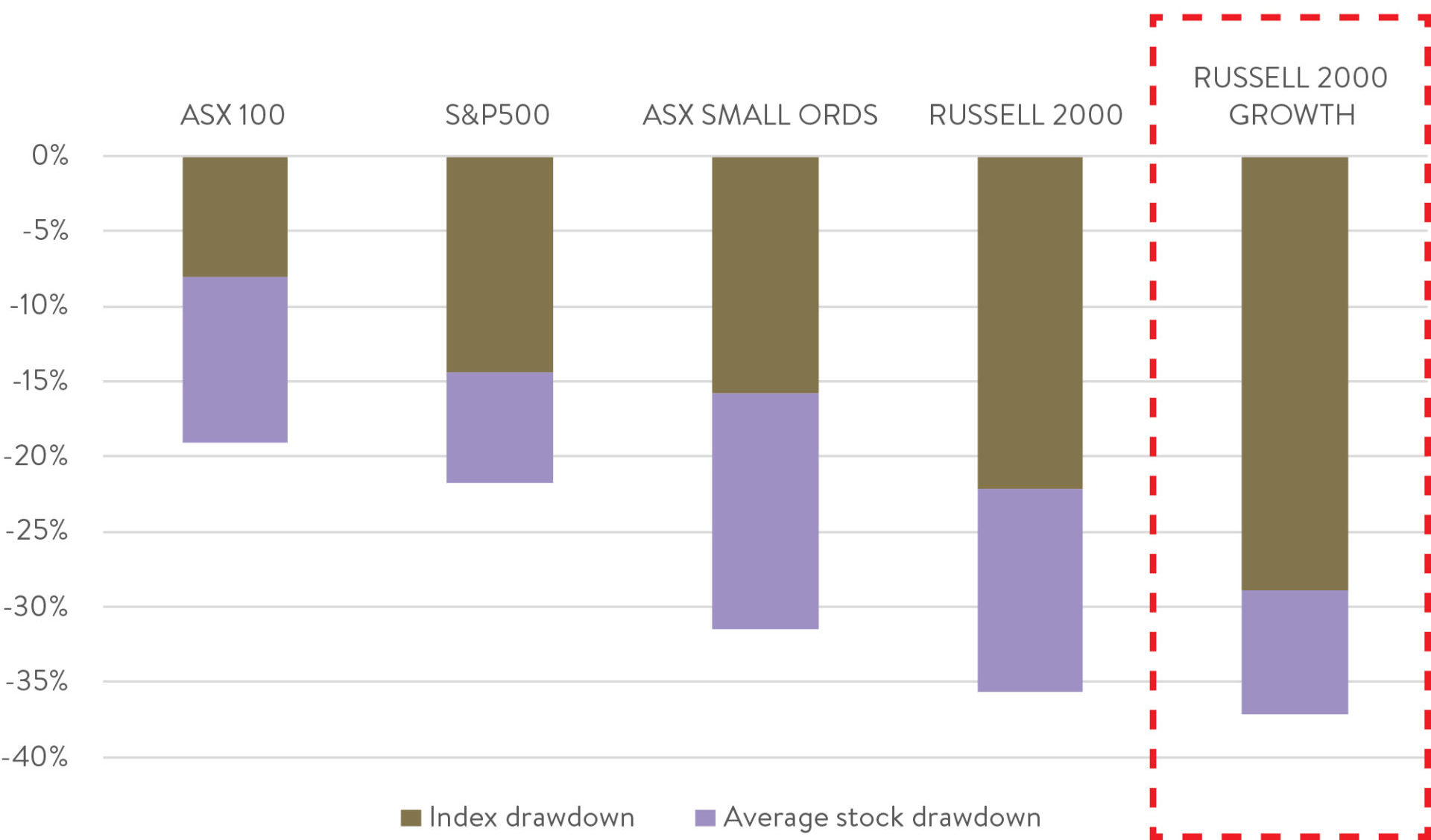

US Small cap growth ‘ GFC’

Source: FactSet. Drawdown equals % off 52 week high. Data as at 9 August 2022.

When looking at the 52-week drawdown (falls from their high over the last year) across a number of key indices, a few things stand out:

- The Aussie share market has fallen much less than many others (e.g. ASX100 is down much less than the S&P500).

- Small-cap stocks have fallen much more than large-cap stocks. (e.g. you can see this both with headline indices for small caps are down more than large and the average stock drawdowns are also much larger than index drawdowns that are market cap/size weighted.

- Growth-style companies (those with higher growth in revenues/profits) have fallen much faster than broad market or value indices (e.g. the Russell 2000 Growth index has fallen a lot more than the Russell 2000 index).

Taken together this explains a large part of why

- Our global funds have underperformed our Australian funds.

- Our funds have generally underperformed their broad market benchmarks recently because the Ophir Funds have a skew towards smaller more growth orientated businesses (in line with our investing style) and this segment of the market has seen the biggest falls.

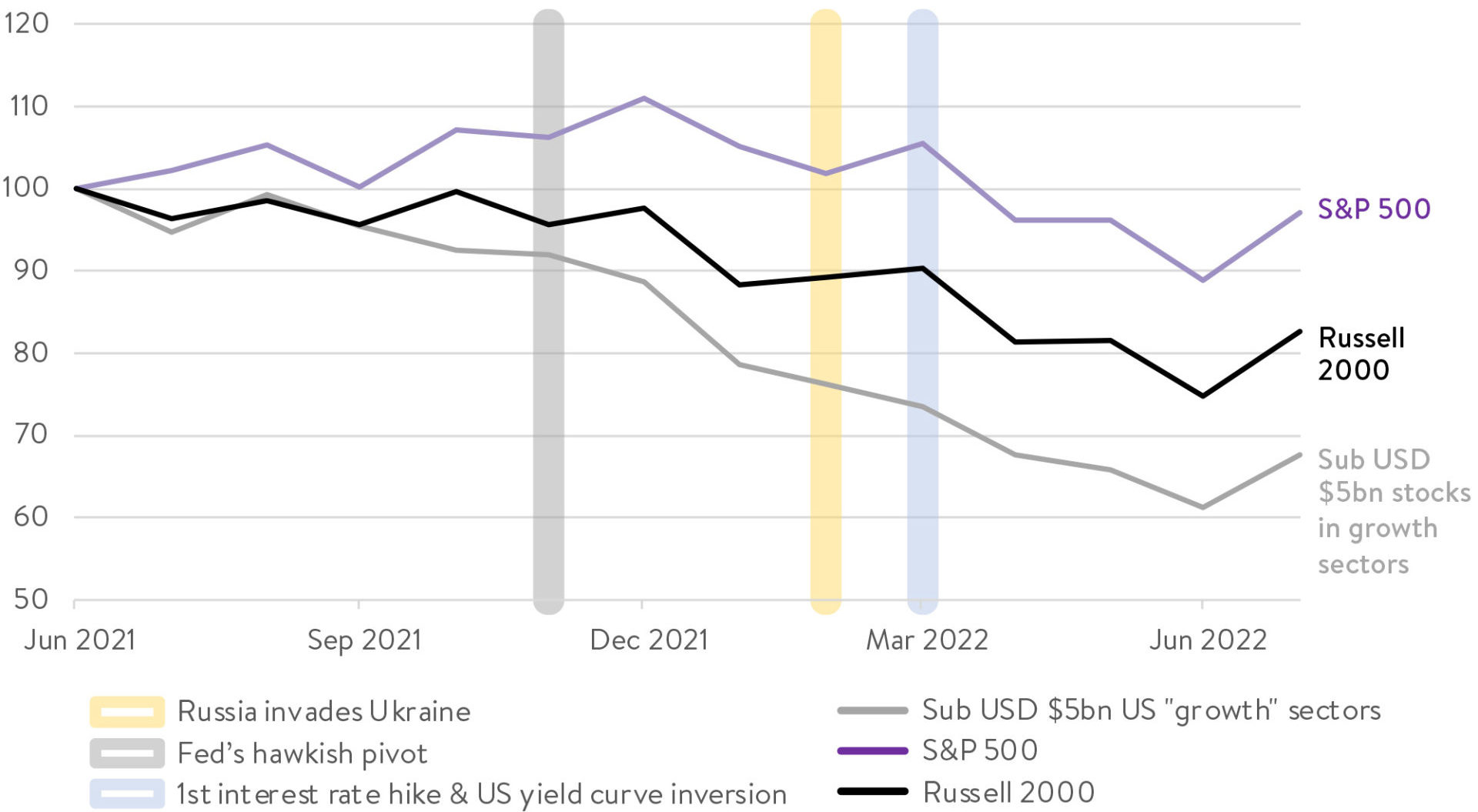

As mentioned in previous letters, these falls in the small-cap growth-orientated segment of the market started back in November 2021, much earlier than other market segments, such as US large caps (S&P500 – see chart below).

This happened when the Fed pivoted late last year and embarked on a rate-hiking cycle to combat sticky inflation. That hiking created the biggest valuation headwinds for the fastest-growing businesses. The hiking cycle was then supercharged in late February this year after the onset of the Ukraine war which exacerbated inflation problems. Expected Fed rate hikes this year have risen from just 1% at the start year to nearly 4% today.

As a result, valuations (price to earnings ratios) for small-cap growth companies have fallen the most in decades. As you can see above, the average small-cap growth company in the US is down around -37% over the last year. And because this is an average there are some that are down far more, as much as -60% to -70%!

Global Fund have fallen in line with market segment Ophir invests in over the short term

Source: FactSet. Data as of 31 July 2022. “Growth” sectors include information technology, consumer discretionary, consumer staples, health care and industrials.

Our style of investing in small-cap growth-orientated businesses will sometimes have headwinds, as it has recently; and sometimes it will have tailwinds, such as 2018-2020. But in the long term (5+ year periods), our success depends on the earnings growth of the businesses we hold and whether they are growing faster than the market expects. This has not deteriorated over the last 6-9 months, which is why we remain confident of hitting our longer-term (5+ year) internal return target of 15% p.a. across our funds.

Factor 2: We stayed with the consumer too long

If Factor 1 above was the only reason for our underperformance, then perhaps we could just point to our investing style and say, “hey, we were always going to be down materially, particularly in our global funds over the last few months given our segment of the market has been sold off the most aggressively”.

That is unacceptable to us though for two reasons. Firstly, we always want to outperform our market segment. Though the last 6-9 months is a short period, we are disappointed we have not outperformed our market segment of small cap growth businesses for our global funds.

And secondly, we do feel that there was an ‘own-goal’ that exacerbated the underperformance of our global funds: Essentially, we stayed overweight in businesses exposed to consumer discretionary spending for too long.

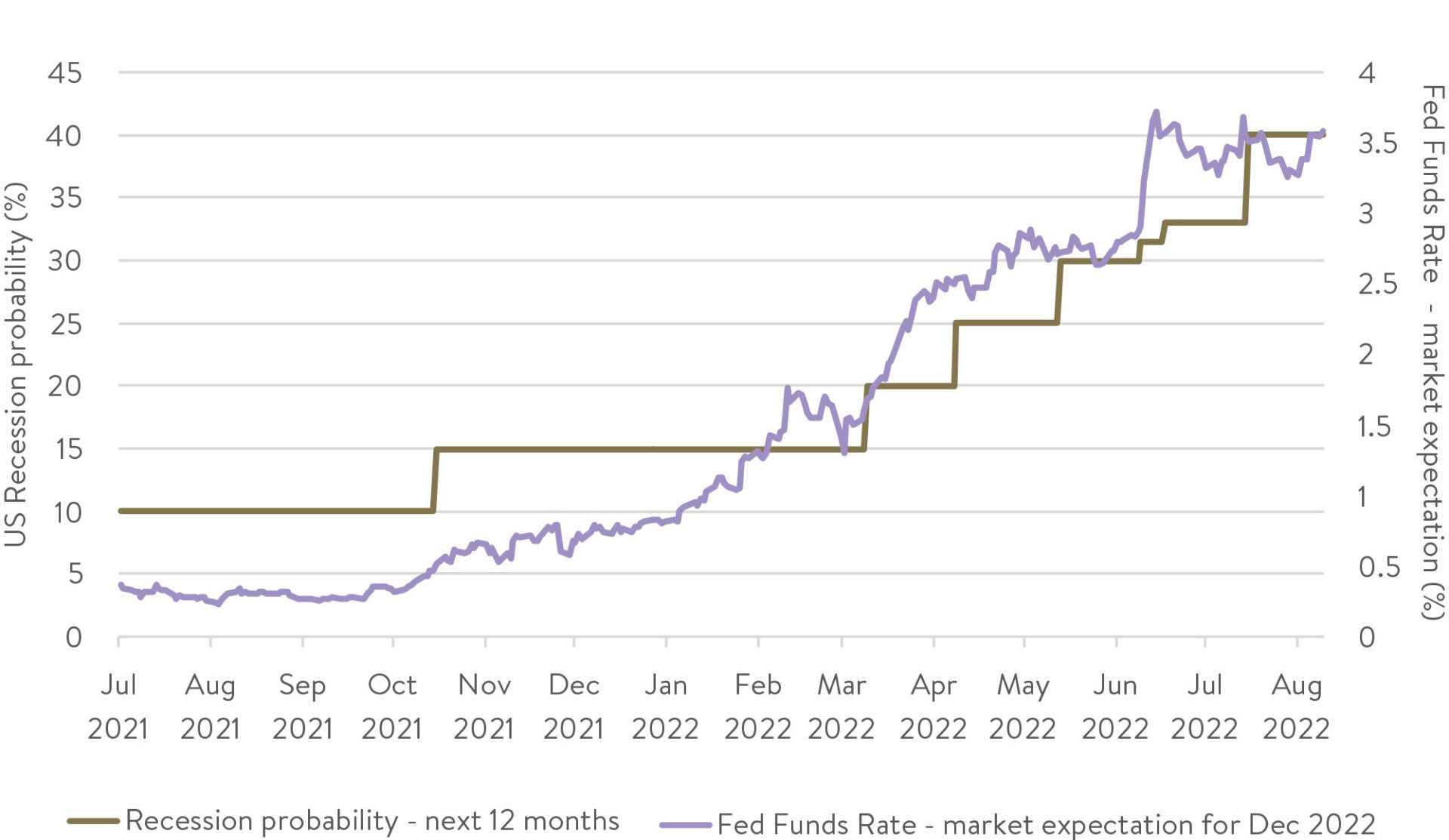

Back in January and February this year we saw the probability of recession in the US as quite low. Markets were ascribing a 10-15% probability of recession. That’s actually the default recession probability for any given year because recessions tend to occur around every 7-10 years or so. The economists we trust most were even a little more optimistic. They thought the probability of a recession was below 10%. Markets were also saying the Fed would only hike rates by 1% during 2022.

So, we were happy to stay overweight consumer discretionary stocks, which would otherwise be one of the hardest hit sectors in a recession, in our global funds.

This turned out to be wrong.

US Rates and recession probability march higher hand in hand

Source: FactSet. From 1 July 2021 to 9 August 2022.

Due to a combination of stickier inflation, the Ukraine war and further COVID lockdowns, particularly in China, central banks including the Fed have had to hike rates much faster than expected to contain multi-decade-high inflation. The probability of recession in the US and the number of delivered and expected rate hikes by the Fed sky-rocketed (see chart above).

We paid a heavy performance price in our global funds for this overweight exposure to consumer discretionary, which has subsequently sold off heavily.

We make no excuses for this and have to cop it on the chin. We think this mistake added around -10% to underperformance in our global funds this year.

What can we learn from this period?

We think that the key lesson is that when the macro environment is so uncertain and central banks are likely to start on a rate-hiking cycle we should not have maintained such an overweight position in one potentially exposed sector. Given the wide range of possible outcomes, we should have limited this exposure so that portfolio performance was more reliant on bottom-up stock picking (our strong suit) rather than what amounted to a more meaningful macro bet.

This is not our first mistake, and it will certainly not be our last. It’s crucial that we learn from it though, and we have beefed up our daily and weekly portfolio management meetings to highlight these types of risks sooner.

From Macro to Micro

As mentioned, macro has been in the driver’s seat for markets over the last year. There is some hope though that may start to wane over the next few months. The big increase in interest rate expectations and long-term bond yields, which has been driving markets, is likely largely over.

We still think there can be some more outsized moves given inflation uncertainty still casts a shadow over markets, but they are likely to be smaller than the ones seen over the last year. That to us says the micro, or bottom-up fundamentals of companies will become more important, a change we would welcome because it is where we believe we have an edge on the market and competitors.

For now, though, as we move through reporting season for our Australian and global funds, our focus is on being in companies whose earnings can’t miss. If earnings do miss, their stock will be punished harshly. As we always say internally “it’s never in the price”: That is, if a company reports bad news, even if the market sensed it was coming, the share price nine times out of ten still falls.

We are being ultra-sure that our portfolio companies’ results will beat expectations and its own guidance. That provides some margin of error. If we are wrong and earnings are only in line with expectations the share price won’t likely be punished. However, if we think the result will only come in line with expectations/guidance, but the result misses because of something from left field we didn’t expect, then you can be sure the market will dole out significant pain to the share price during this point of the cycle.

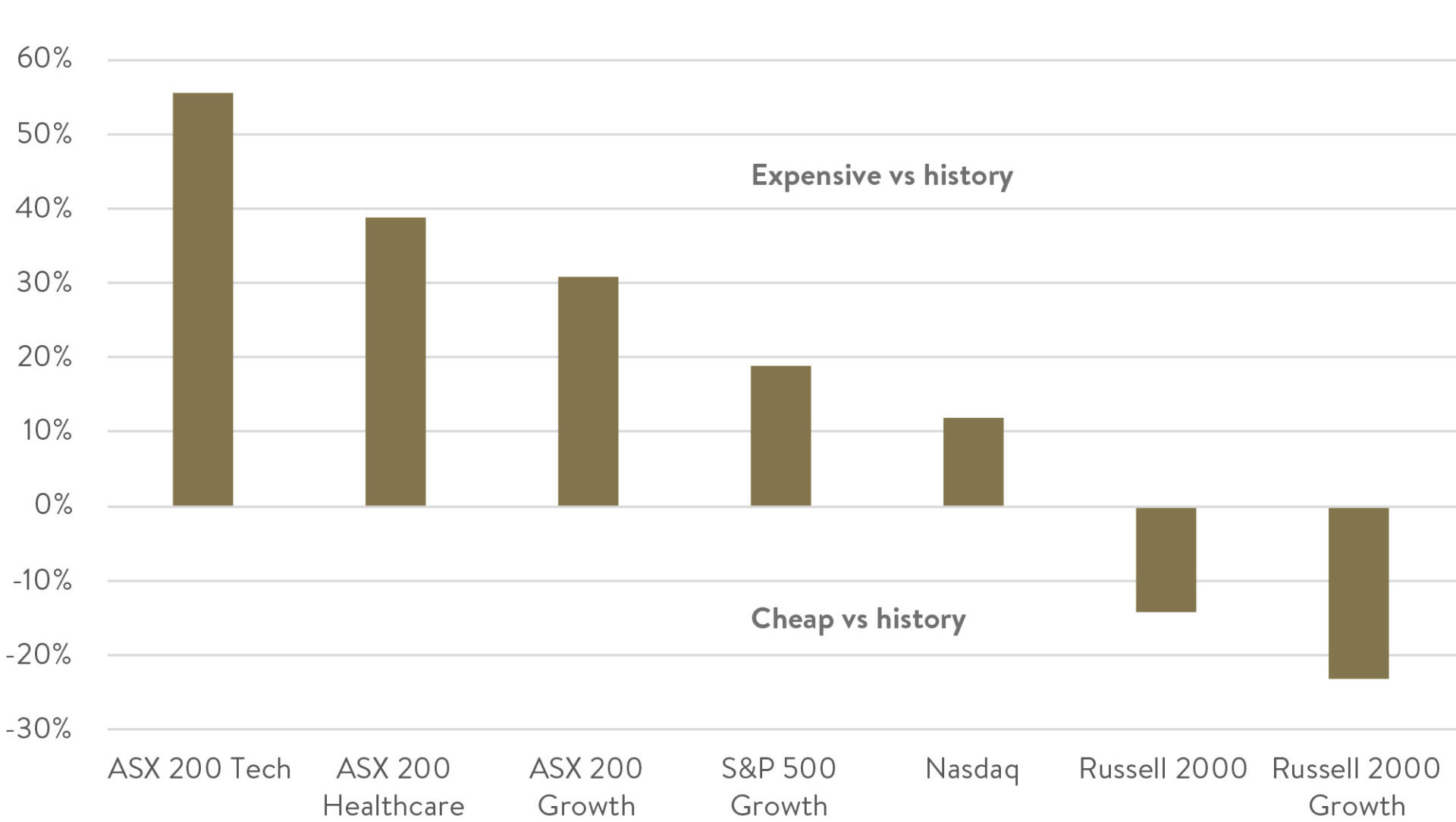

A shopping list of opportunities

To end on a positive note, one area that continues to excite us is valuations, particularly in the area hardest hit this year – US small-cap growth companies. They are now one of the growth parts of the market that look quite inexpensive (see chart below). They represent around 60% of our global funds, which bodes incredibly well for future returns from this market.

PE of growth vs long-term average

Source: MST Marquee as at 5 August 2022.

As previous letters have highlighted, because we are heading into a slowing earnings environment, we are positioned in businesses with more resilient earnings. These companies continue to have strong growth prospects over the next year or two.

But we have a growing shopping list of businesses that we will buy when it is the right time to add some even faster-growing businesses, more leveraged to macroeconomic growth, back into our funds. Many of these companies are trading at valuations we haven’t seen for quite some time. This excites us as we believe they can help set up the Ophir funds for strong returns over the next few years.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.

[1] Or in other words a “shocker” in rhyming slang for those outside the Land Downunder.