By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our July 2021 Letter to Investors we share with you some of the most frequently asked questions (and our answers) from conversations we have had with our fellow investors recently.

Dear Fellow Investors,

Welcome to the July Ophir Letter to Investors – thank you for investing alongside us for the long term.

Your 10 most-frequently asked questions

July is typically one of the quietest times of the year for fund managers. Companies go into ‘black out’ as they prepare their annual, six-monthly or quarterly results both in Australia and overseas.

Company news tends to vanish into a vacuum. Share prices don’t have much to trade off from a stock-specific perspective, and prices are more at the whim of the broader macroeconomic environment.

So, with this in mind in this month’s Letter to Investors we thought we would share some of the most frequently asked questions (and our answers) from conversations we have had with our fellow investors recently.

We answer your questions on topics ranging from the risks of inflation, trading premiums, our biggest lessons from the past year, and Afterpay.

July 2021 Ophir Fund Performance

Before we jump into the letter, we have included below a summary of the performance of the Ophir Funds during July. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +1.6% net of fees in July outperforming its benchmark which returned +0.7% and has delivered investors +25.6% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -0.1% net of fees in July, underperforming its benchmark which returned +0.7% and has delivered investors +19.8% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -6.2% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned -2.1% net of fees in July, underperforming its benchmark which returned +2.4% and has delivered investors +42.4% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Questions & Answers

1. Question: Markets are at or close to all-time highs. Should I be worried? Can the gains continue?

Newspapers love to exclaim when share markets have made new highs. They often add that the gains surely can’t last, and that a crash is around the corner. Sensationalism and fear sells.

But no one can tell you where the share market is going to go in the short term. To paraphrase the great economist John Kenneth Galbraith, when it comes to short-term forecasting, there are only two groups of people – those who don’t know, and those who don’t know they don’t know!

Peter Lynch, the famous manager of the Magellan Fund at Fidelity, perhaps summed it up best when he said: “Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves.”

The share market is a game skewed in your favour. As a whole, you are exposed to the collective ingenuity of individuals and businesses constantly coming up with new ideas and better and smarter ways of producing goods and services. This is why markets go up over time.

There will always be things to worry about in the share market, but we are firmly in the camp of ‘it’s time in the share market, not timing the share market’.

And so too is arguably the world’s greatest investor of the last 100 years, Warren Buffett. “In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497,” Buffett said back in 2008.

If you get constantly worried out of the share market, or think you can consistently and accurately time your entry and exit, you risk sacrificing all those potential gains the share market has to offer. (Footnote to Buffett’s comment: the Dow has since tripled despite the GFC and COVID-19 and is now above 35,000!).

We don’t try and shift our ‘cash versus shares’ split around in our funds in any major way. Like Peter Lynch, we think that activity is more likely to subtract value than add.

The reality is share markets spend most of their time at or quite close to all-time highs. We are as happy as ever to remain close to fully invested, and to personally keep reinvesting any excess cash from our business into our open funds.

2. Question: We’d love to be able to access some of your funds that are now closed. Why don’t you open them again when some money inevitably comes out?

We are fortunate that little money has flowed out of our closed funds over the years. Investors who have taken some of their money out have typically used it to fund their lifestyle expenses, although no doubt some redeemed when short-term performance wasn’t what they expected.

We are more than happy with both. In the latter case, it likely suggests the fund’s investment horizon didn’t match the investor’s time horizon in the first place.

Ultimately, where any money has come out of our closed funds, we view that freed-up capacity as an asset of all our existing investors, including ourselves as significant investors. That freed-up capacity is an asset because staying small is a huge advantage in small cap investing.

At the risk of over-quoting Buffett, he has noted that “anyone who says that size does not hurt investment performance is selling. It’s a huge structural advantage not to have a lot of money.” Buffett is spot on there.

At Ophir, we have all our own money in the Ophir funds, and we have a big incentive to not let them get too big and hurt performance. We will continue to back ourselves to grow into any freed-up capacity through performance generation.

3. Question: We are hearing a lot at the moment of the risk of inflation. Do you think the risk is real, and if so, what are you doing about it in the portfolios?

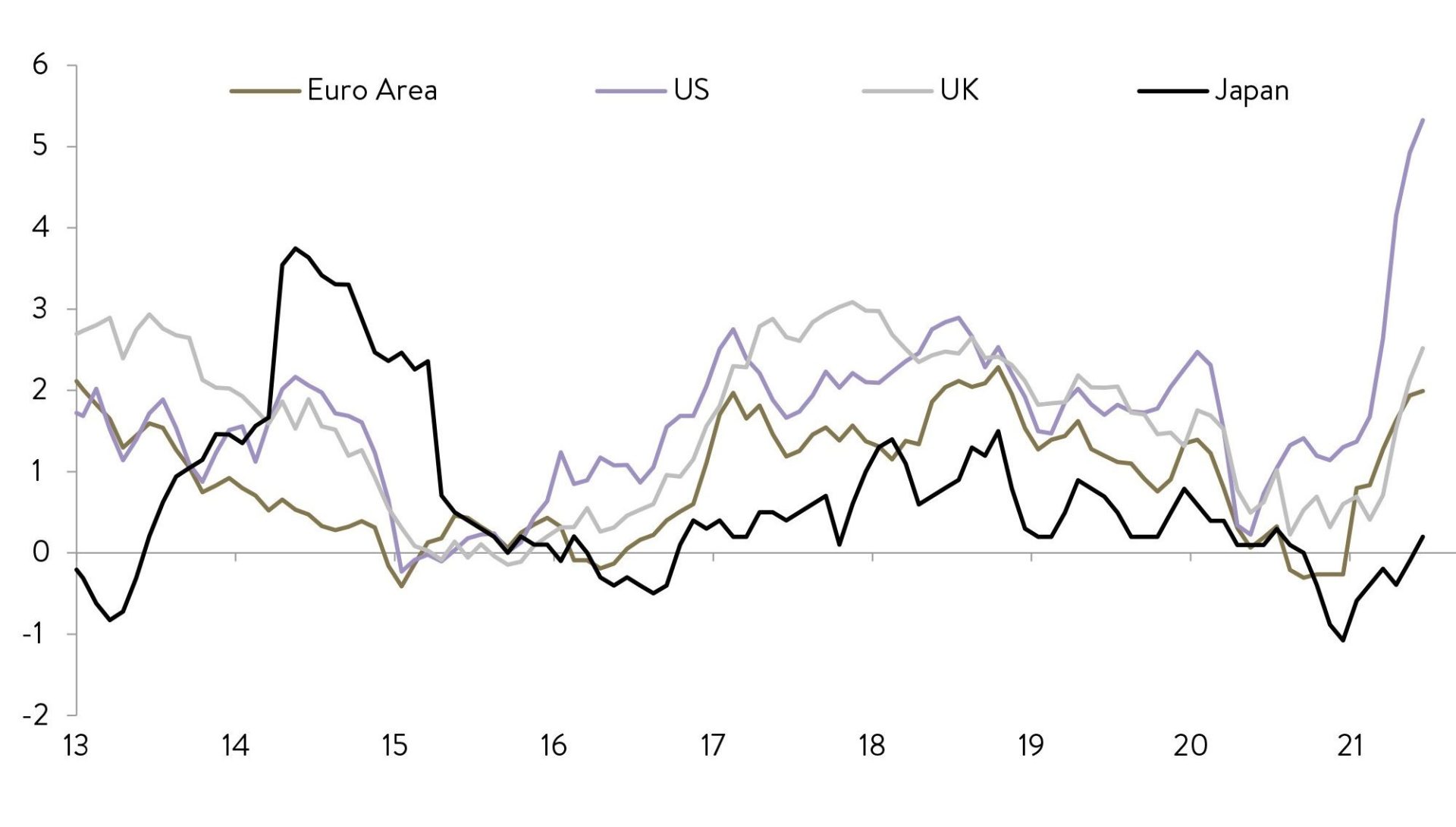

Companies are talking more about rising prices in some of their inputs. This mostly boils down to Covid-19 stopping the global economic engine, then it starting again as economies reopen and social distancing measures are relaxed. As can be seen below, inflation has been rising globally, especially in the US.

Inflation (CPI, yoy)

Source: Goldman Sachs Global Investment Research

Prices for things like lumber, semiconductor chips and used cars have spiked. But, like most central banks, we suspect that these spikes will be largely temporary. Lumber prices, for example, are down more than 60% from highs just three months ago.

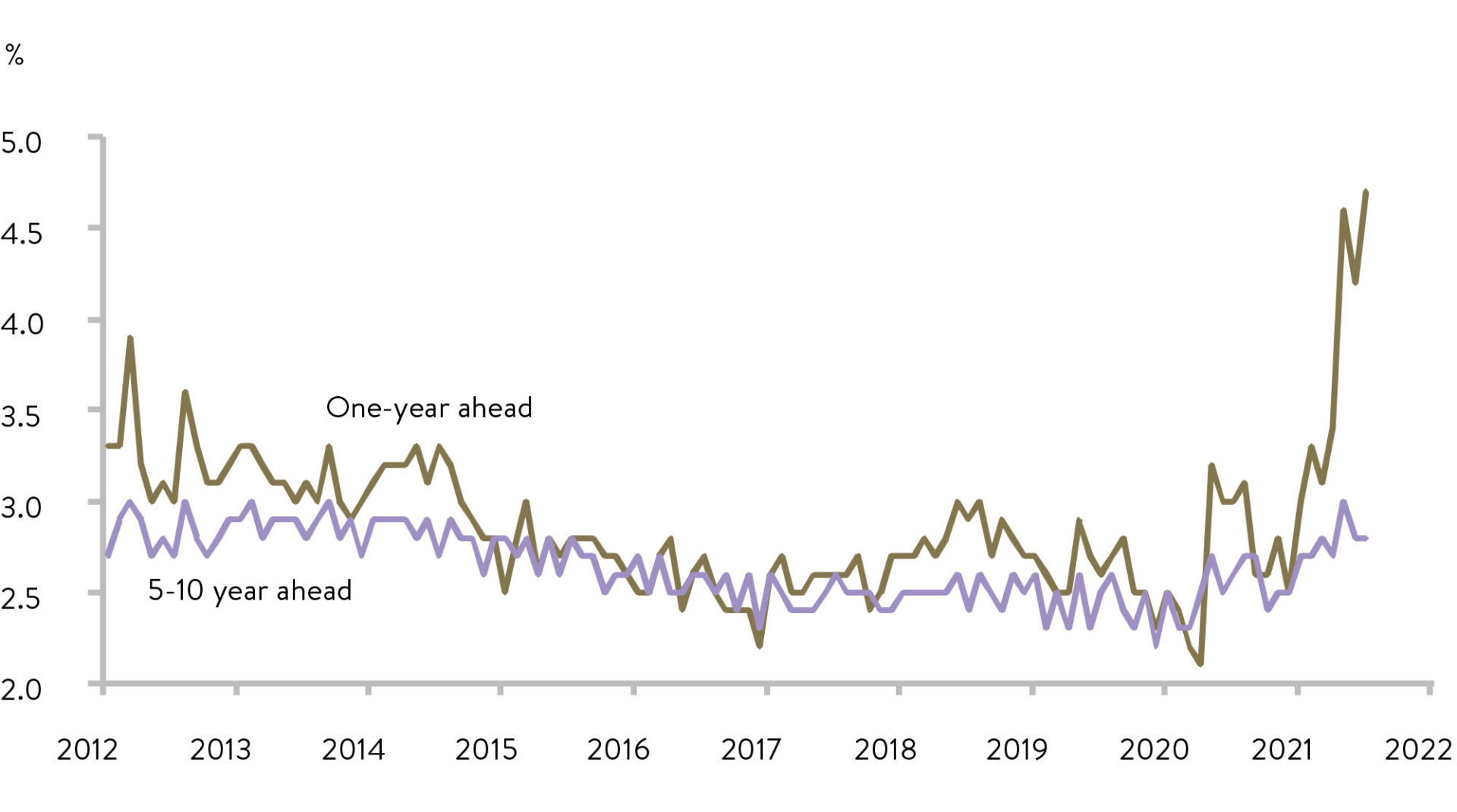

The Michigan survey of consumers in the US also shows that individuals believe the uptick in inflation will be temporary.

Michigan survey inflation expectations

Source: University of Michigan, J.P Morgan

However, some forecasters do believe inflation may be more persistent. Given there is a risk they are right, we have reviewed our portfolio and made small adjustments where necessary to ensure the companies we are invested in have greater power to lift prices should cost input pressures turn out to be more persistent.

4. Question: Your Listed Investment Trust – the High Conviction Fund (ASX:OPH) is trading at a significant premium to NTA, why do you think that is?

The OPH premium has traded at a range of 5% to 15% for much of the last 6-9 months. A number of factors have likely contributed to this, including:

- The equity market’s recovery from March 2020 COVID-19 lows has shrunk discounts/increased premiums in the listed equity fund market.

- Larger and more liquid vehicles, such as OPH tend to trade at smaller discounts/larger premiums over the long term.

- We activated and used OPH’s buyback mechanism during 2020, which likely made investors more confident that Ophir is willing to buy OPH at material discounts.

- OPH has performed strongly versus the benchmark and peers since its inception, which has helped increase demand for the vehicle.

- We have actively broadened out the base of investors in OPH. This has increased awareness of the fund and created more willing buyers at various discount and premium levels.

We are aware from inquiries that some investors would like to invest in the fund, but are waiting for a smaller premium to exist. Investors have asked if we would be willing to issue more units in the fund at NAV to help reduce the premium.

We don’t believe that would be in the best interests of existing investors. Like all our funds, we want to strictly manage capacity and we do not wish to increase capacity in OPH, which has been closed ended since 2018.

5. Question: A number of your funds paid out significant distributions for the 2020/2021 financial year. Is that typical and what do you expect distributions to be going forward?

The Ophir Global Opportunities Fund, Ophir High Conviction Fund (ASX:OPH) and Ophir Opportunities Fund paid out circa 16%, 10%, and 19% of their pre-distribution net asset value, respectively, for the 2020/21 financial year.

We made these significant distributions because of the high investment returns generated over the financial year, some of which we realised as distributable capital gains when we adjusted portfolios during the Covid-19 market swings.

The small and mid-cap companies we invest in typically are growing rapidly and re-invest cash flow for future growth rather than pay out high dividend yields. As such the annual distributions we pay out will primarily be realised capital gains, as opposed to dividends.

That makes it virtually impossible to forecast the level of distributions from year to year in advance. Distributions will largely depend on future market moves, and when the market realises the value we have seen in our portfolio companies.

Based on history, distributions from our longest-running funds have averaged around 3-4% over the long term, but that is an average and can be quite lumpy from year to year. For those not wanting to receive distributions in cash, we suggest updating your elections to selection the Distribution Reinvestment Plan with our unit registries (Automic for our unlisted funds) and (Boardroom for OPH).

6. Question: We sometimes hear that the turnover in your funds is high. Is this true and if so, why?

Ultimately, our investment process determines turnover in our funds. We don’t target a specific turnover figure, though we are more active than many fund managers.

We invest in companies we believe can grow, expand their share of large markets and compound earnings over the long term for investors. But we also want to hold positions at the right size in our funds reflecting our conviction over time. So, we can be quite active topping up or trimming positions.

Our Ophir Opportunities Fund provides the best insight into our portfolio turnover as it leverages the same investment process that is used across all our funds, and with a track record of 9 years, is the longest-running of the Ophir funds. It has averaged around 100% turnover per annum over the long term. Around 40% of this is due to new stocks entering or leaving the fund and around 60% is due to top-ups of or trimming existing positions.

The 40% due to new stocks entering, or old stocks leaving, averages out at about a 2.5-year holding period. But holding periods can diverge. Sometimes we hold companies for as little as six months and other times we hold for 5+ years.

We don’t hold for some preconceived period. Rather, it depends on how quickly and fully the market prices in the future trajectory of the business that we believe exists.

As a final word on turnover, it is quite correlated with performance. When performance is higher, turnover tends to be higher. Importantly, causation runs both ways here. When we have a higher level of investment ideas, that hopefully leads to higher performance, and turnover will tend to increase.

Also, when performance is higher, we are more likely to have share prices reach our targets and we’re therefore recycling capital into new ideas or simply just reducing positions that have run higher for risk management reasons.

7. Question: Afterpay has just had a takeover offer from Square which the Board has recommended. What do you think this means for Afterpay and the Buy Now, Pay Later (BNPL) sector?

We thought consolidation in the sector was always on the cards but we’re a little surprised at how soon it may be happening. The Afterpay takeover offer just goes to show that the big payments players know they need to be exposed to the BNPL sector as it’s not going away and will likely be an enduring part of the payments landscape. Increasingly investors should be viewing BNPL as just one part of a suite of products in the payments offering from a provider, rather than just a standalone.

Investors in Afterpay now have an interesting call to make as they won’t get the pure BNPL exposure and growth – though many may have a similar attraction to Square which is also a fast growing and passionately run fintech that is disrupting the traditional banking model.

We think it’s just the end of the beginning for Afterpay. Square seems a good match with lots of synergies. Since the acquisition announcement you can see that 1+1 = 3 with Square’s share price rising significantly. We also think if it’s not happening already, we expect a lot of speed dating between the other BNPL players and potential suitors. You can see this with the moves in a number of their share prices.

We still own Afterpay in case a bidding war breaks out with potential suitors such as Apple or PayPal. Further consolidation in the BNPL industry will likely follow with perhaps 2-3 key players left at maturity. We can see BNPL being just one, albeit very important, offering in a suite of products for the dominant payment’s providers.

There is no doubt though this is a big acquisition for Square to bed down – much bigger than anything that’s come before. Investors should be watching closely how the technology and culture integration goes.

8. Question: What’s the biggest lesson you have learned over the last 12 months?

In the past 12 months, our biggest lesson is to remain disciplined and not make significant macro calls and adjust our portfolio because of the whims of the market. Covid winners, cyclicals, reopening, value, etc, are all market trends that have emerged in the last 12 months.

We only have to look at the US bond market, which began to fear inflation early this year. US 10-year Treasuries spiked to 1.7%. Then they were recently sub 1.2% just five months later, a massive move.

The bond market often more efficiently and accurately predicts long-term economic activity than the equity market. If the bond market can’t make up its mind, what chance have we got?

Our lesson is to keep sticking to our knitting, invest in what we know, and know it’s time in the market, not timing the market

9. Question: Will you have any further new funds in the future to invest in?

Almost certainly yes, although none are imminent. We are in the fortunate position that we own 100% of Ophir.

The primary reason we would open a fund, or funds, in the future would be to provide growth opportunities for the excellent members we have working in the investment team. We certainly can’t take credit for all the results at Ophir. We operate as a team, and we can attribute much of our success to others in our team. With such high-performing colleagues, naturally many will want to have funds of their own, or funds where they play a larger role. We’d love to be able to provide them with those opportunities at Ophir.

And don’t forget. A core part of our business is that we, including the staff, invest all our investable wealth into the Ophir funds. So, rest assured we would never launch a new fund that we wouldn’t be willing to put a large chunk of our own money in.

10. Question: Ophir has had some great successes from a performance and business perspective over the last nine years since you started. What motivates you Andrew and Steven to keep going?

First and foremost being a fund manager is a lot of fun (for us at least) and we’re not very good at anything else so it does limit our choices of what to do next! As Buffett said, if you were stuck on a deserted island, fund managers aren’t high on the list of people you’d want there – it’ll be a doctor, carpenter – somebody useful!

We are also truly grateful to have some of the most interesting, loyal and supportive investors. And some of the most thoughtful. We learn from you, receive valuable feedback that helps makes our business better, and you rightly continue to hold us to account.

We understand many of you, however, may have only recently joined the Ophir family. It is not lost on us the trust you have placed in us and that our long-term historical returns are just numbers on a page for you at present.

We love our jobs and hope to repay the faith our fellow investors have shown, whether you are new or longstanding. We hope to be managing our own capital, along with those who wish to invest alongside us, for the next thirty-plus years here at Ophir.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.