By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

We outline our key insights from the December reporting season and the specific outcomes from our portfolios. We also present the bull and bear cases for share markets in 2023.

Welcome to the February Ophir Letter to Investors – thank you for investing alongside us for the long term.

The cycle is dead. Long live the cycle.

After equity markets launched in January like a rocket ship, the engine started to splutter a little in February.

The US (S&P500 down -2.4%), Australia (ASX200 down -2.3%) and emerging market equities (MSCI EM down -6.5%), including China (MSCI China down -10.2%), all posted falls. But European equities (MSCI Europe up +1.8%) continued their good form, backed by a milder winter, and Japanese equities eked out a small gain (Nikkei up +0.5%).

It is often said that business cycles don’t die of old age, but they get killed by central banks. That is, interest rate hikes designed to squash inflation end up delivering a ‘coup de gras’ to the economy and send it into recession.

A US recession this year is one of the most forecast recessions ever. But stronger-than-expected February economic data served as a stay of execution for the world’s largest economy. The data included non-farm payrolls rising a massive 517,000 in January; unemployment dropping to 3.4% (it’s lowest in 54 years!); stronger-than-expected inflation – specifically in wages-driven services inflation; and hawkish speeches from Federal Reserve Bank members.

The good economic news, however, was bad share market news.

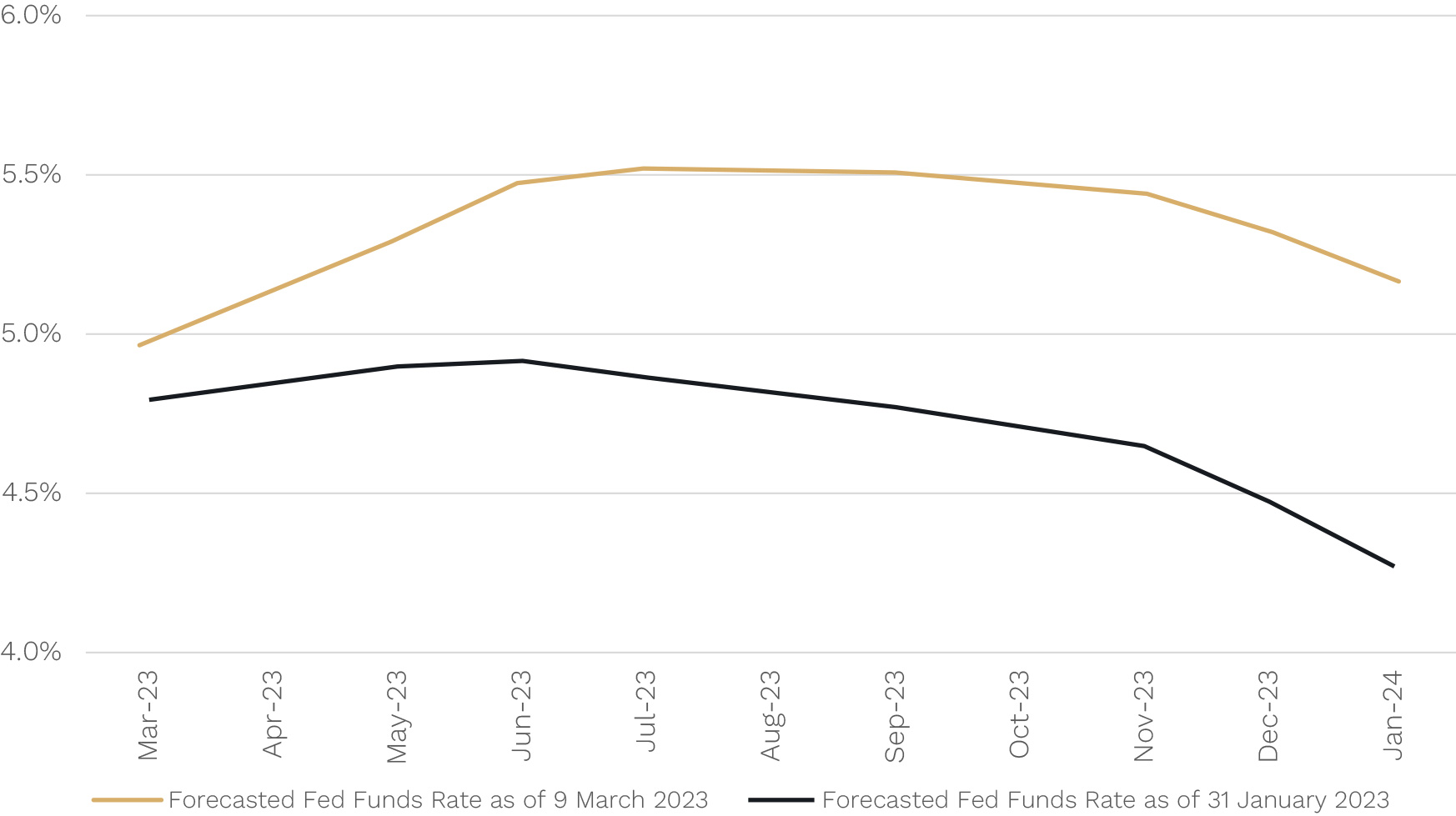

Markets now expect more Fed rate hikes

The peak forecasted Fed Funds Rate (FFR) this cycle moved from 4.9% at the start of February to 5.5% as at the time of writing (see chart below). Even more importantly, nearly all the rate cuts expected for the second half of 2023 have been priced out. About a full 1% move higher in year end expected policy rates by both the Fed and European Central Bank have now been priced in compared to their early February lows.

Forecasted Fed Funds Rate

While the better-than-expected economic data means a U.S. recession in the very near term is unlikely (“long live the cycle”), it perhaps just kicks the can down the road further for when one may occur as more rate hikes are needed to subdue consumer demand.

N.B. since writing on Thursday last week (9th March), as well covered in media reports, a U.S. regional bank, Silicon Valley Bank (SVB) has collapsed and been put into receivership by the Federal Deposit Insurance Corporation. U.S. government authorities have subsequently guaranteed the deposits of SVB and put in place additional liquidity measures for the banking sector to stem contagion fears. Market pricing of the forecast Fed Funds Rate has moved significantly since (with rate hike expectations pared back) as a result. We expect this pricing to remain fluid until the flow on impacts from the resolution of SVB becomes clearer.

In this month’s Letter to Investors, we review the all-important February reporting season across both our domestic and global funds. Overall, it was a pleasing reporting season that saw all our Funds outperform.

We also measure the merits of both the bull and bear arguments for share market returns over the rest of 2023 and ask which of these camps has the stronger case?

February 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during February. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -3.3% net of fees in February, outperforming its benchmark which returned -3.7%, and has delivered investors +21.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -0.9% net of fees in February, outperforming its benchmark which returned -3.5%, and has delivered investors +13.4% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -5.1% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +4.2% net of fees in February, outperforming its benchmark which returned +2.0%, and has delivered investors +13.6% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Reporting season: solid revenues, but margin squeeze signals tougher times

Reporting season is without doubt the most important and busiest time here at Ophir. A deluge of data sees us and the team pulling our longest days of the year. But they are also the most exciting time. They are like game day for an athlete where you see if all the preparation has paid off.

In the long term, almost all that matters for share prices is earnings growth that is stronger than the market expects. Good results help set up companies for strong operating momentum that means continued good results in the near term are more likely.

So how could we summarise the recent US and Australian reporting season? Basically as:

Still-solid revenue growth. But higher raw materials, wages and now interest rate costs are squeezing margins.

(Companies last year had often been able to pass on these higher costs through higher prices, preserving margins, but that looks to be more challenging going forward.)

At a slightly more granular level, a few points of note emerged during reporting season:

- There is evidence that consumers, who are getting crunched by depleted COVID savings, higher cost of living and higher interest rates, are increasingly less willing to accept higher prices.

- Some companies have disguised strong revenue growth from just strong price increases, but have actually had low sales volume growth. As 2023 progresses they will increasingly be exposed on their margins. Their input costs will stay high, but they will find it difficult to raise prices.

- In Australia, we saw some signs of this consumer weakness in bellweather names, such as Harvey Norman and Breville. Viva Energy showed that consumers were trading down from premium to regular fuel. This trade down was also seen with Domino Pizzas having one of the worst results though supermarkets were still solid, and Super Retail Group (the owner of BCP and MacPac brands) benefitted from the trade down from expensive international travel.

- We also saw a de-stocking trend emerging. Some time ago, as a result of COVID-induced supply chain issues, many companies moved from ‘just in time’ inventory management to ‘just in case’. That trend is waning a little as supply chains normalise and demand subdues, which means companies don’t want to be caught holding excess stock, especially if it ages poorly e.g. fast fashion.

Making strides: Our Funds’ positive report card for earning seasons

So how did our Funds themselves perform during the recent Australian half-yearly reporting season (six months to December) and US quarterly reporting season (3 months to December)?

Below, we provide a snapshot of results for our portfolio companies.

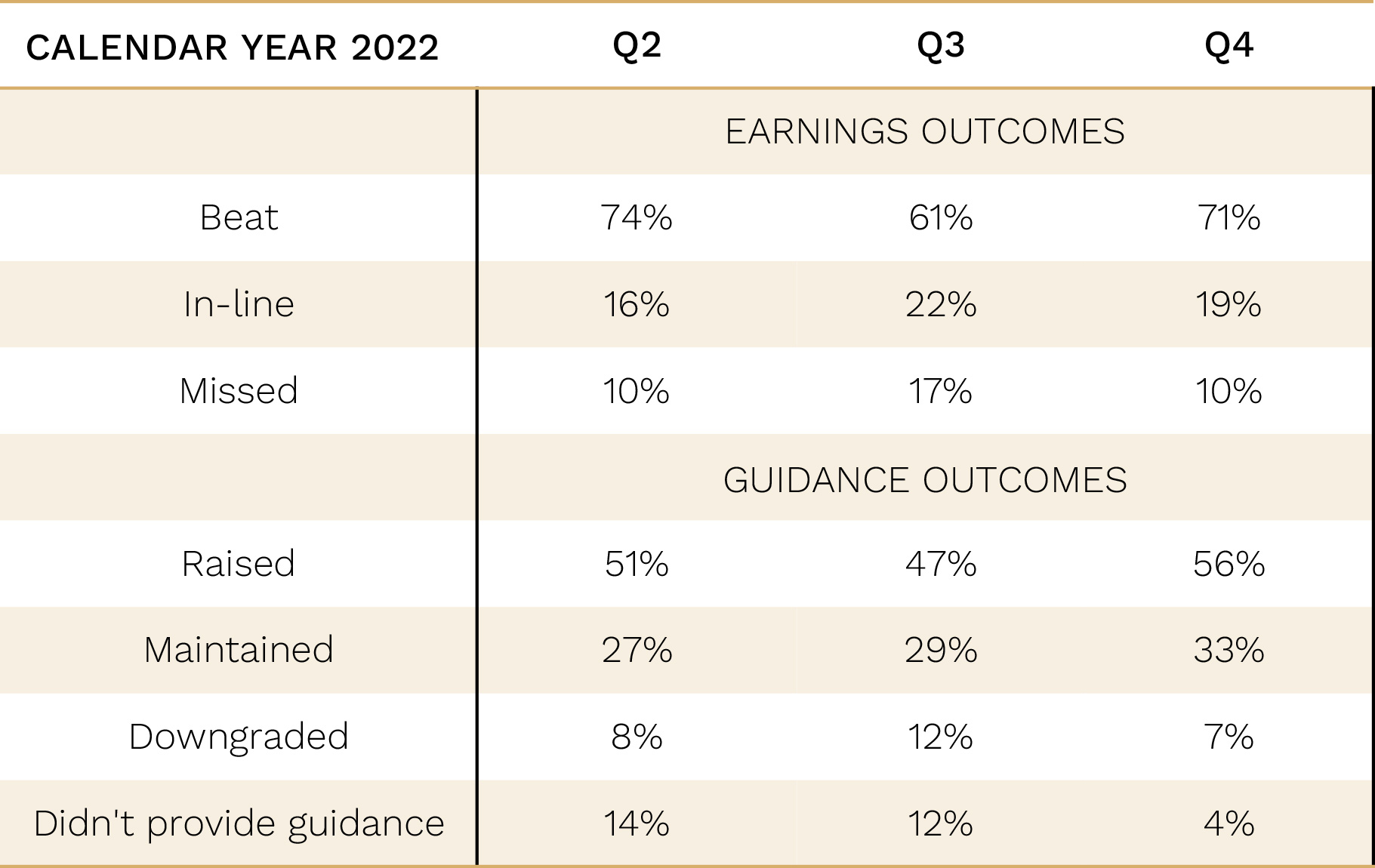

Global Opportunities Fund Reporting Season Outcomes

Source: Ophir. Factset.

First up, the table above shows how we went in Q4 for our Global Opportunities Fund. There are two main areas on which we judge ourselves and the team:

- Has the company’s earnings result for the historical period (Q4) beat or missed the market’s expectations?

- Did the company raise or lower its guidance for future earnings?

(If it’s a ‘beat and raise’ (beat on earnings and raised guidance) you can have high confidence the share price will react positively and outperform the market on the day, assisting the Fund to outperform.)

Earnings outcomes were, in general, a little better than Q3, though there was still a higher ‘missed’ level than we are comfortable with.

What was really pleasing, though, was the proportion of companies who raised earnings guidance (58%), which was the best of the last three reporting seasons. This is particularly important at this point in the cycle because, given the heightened macroeconomic uncertainty at present, a company’s view through the front windscreen is much more important than what they can see through the rear-view mirror (of historical results).

Source: Company presentations.

One of the best results was in a US company we hold called Stride Inc (LRN US) which provides online education services to primary and high schools in the US.

The market had been questioning whether the business was simply a big beneficiary of COVID ‘learn from home’. But a strong result eased those fears and validated our investment thesis. The stock is up 37% year-to-date. The business trades on about a 16x forward P/E and is growing earnings at about 15% per annum, but with defensive characteristics. We maintain Stride as a core position in the Fund.

Our Aussie report card

Turning to the Australian reporting season, and our Ophir High Conviction Fund (ASX:OPH) also posted a good result.

As we have written before, the Aussie market structurally has a lower level of ‘beats’ than the US because market expectations for results are more conservative in the US.

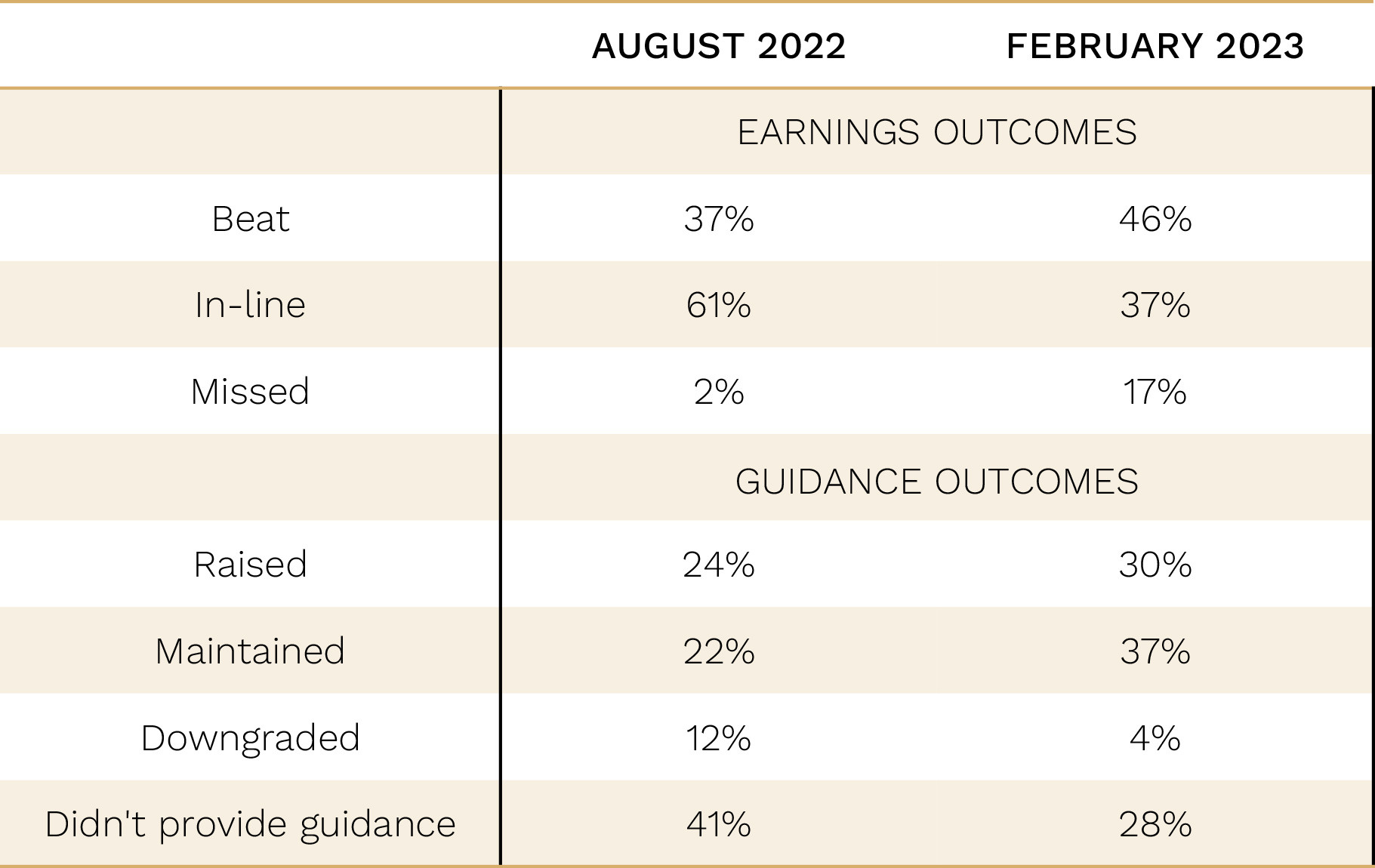

Ophir High Conviction Fund Reporting Season Outcomes

Source: Ophir. Factset.

We had a high beat/inline result on earnings, but misses increased from the low base of the previous half (which we didn’t expect to be maintained). The misses (of 17%), however, were only three positions out of the 20 companies that reported.

One of our best results was AUB Group, Australia’s largest insurance broker. It beat its half-year result and upgraded full-year earnings guidance. Even more importantly, the insurer upgraded its medium-term margin expectations for most business lines. The CEO Mike Emmett has been doing a great job turning around underperforming brokers and integrating their large acquisition last year of the UK-based Tysers business.

On the other side of the ledger, staying in the insurance space, NIB Holdings, the private health insurer, clocked a small miss on its earnings result. Its core private health insurance business was a little behind as claims continue to normalise post-COVID. However, uptake of their travel insurance business is performing well on the back of continued economic reopening. Long term, we continue to like management’s ability to deploy capital into new areas such as its recent acquisition of plan managers who administer the National Disability Insurance Scheme (NDIS).

Balancing the bull and bear cases for 2023

There is a heightened level of uncertainty at present about where share markets will head for the rest of the year so we thought we’d review the evidence.

As regular readers will know, we don’t tend to make big macro bets on the direction of economies or markets because that’s not where our edge lies. But that said we don’t completely ignore it either because it does impact markets, particularly in the short term. We spend time each week going over the key economic news flow, interest rate and market moves and reviewing our Funds to make sure they remain appropriately positioned. And most importantly, to ensure we are not taking excessive or unintended risks.

We are currently somewhat, though not overly, cautiously positioned in our Funds. But, so we don’t fall foul of confirmation bias (only taking views that are consistent with our existing beliefs), we are always stress-testing our views by looking at alternative opinions.

There are two main reasons we have seen for a bullish view on sharemarkets this year:

- Firstly, during January, there was a high degree of buying support across a very wide portion of listed companies in the U.S.. This resulted in certain technical market ‘breadth’ triggers being met. These triggers are rarely breached and historically, when these triggers have been met, the percentage of times the market has been higher over the subsequent 6-12 months has been very high.

- Secondly, while corporate earnings growth for the U.S. share market (which leads global shares) may be sluggish this year, inflation will fall, the Fed will ultimately cut rates, and earnings will rebound at some point in 2024. The share market is forward looking, and it is already looking forward to that earnings rebound to drive the market higher.

Both reasons have some plausibility, particularly the second, and provide a reason for investors not to be overly cautious when they position their portfolios.

That said, we don’t find them entirely satisfactory either.

The first, the ‘breadth’ trigger, likely only occurred because January’s soft inflation data and lower rates expectations reversed some of 2022’s broad-based macro-driven sell off. We are not sure that market momentum in January will continue throughout the rest of the year. The disinflationary journey is likely to be bumpy, as we saw in February.

We have more sympathy for the second reason: that earnings will rebound in 2024. This may be more likely if major economies have an ‘immaculate disinflation’ in 2023. Interest rates would not need to stay high for long which would will limit economic and earnings damage this year. Rates could then be cut sooner, with economies and earnings rebounding. It’s hard, however, to look across the earnings ditch this year, to a rebound next year … if you don’t know how big the ditch is. Much will depend on high how interest rates need to go in the US, and how long they will need to stay high, to get inflation under control. And that is by no means certain.

The bear camp, on the other hand, says the probability of recession in major economies is still high. They argue that inflation will say higher for longer than expected and as a result rates will stay higher for longer too. They also cite a number of weak leading economic indicators. In sum, the bears argue earnings forecasts still need to come down to reflect the likely weak economic picture ahead.

Where do we land?

We believe caution is still warranted.

We have slightly elevated levels of cash in our Funds. We are underweight businesses most exposed to consumer discretionary spending. And we prefer companies with more resilient earnings streams. Clean balance sheets are important too because they underpin this resilience and provide ‘optionality’ for growth.

In this environment, the market shoots first and asks questions later, so we need to make sure earnings misses are low. We are always looking to sell our weakest positions to make way for stronger ideas with higher earnings conviction.

But we don’t want to become too bearish because history shows us that much of the gain in the ultimate share market recovery comes in the early stages, and missing out can really hurt longer-term returns.

Hitting the road

Ultimately, we are first and foremost ‘bottom-up’ focused investors because those are the calls we are most likely to get right.

In March, we get out on the road to meet our companies that have just reported. We look management in the eye to either build conviction or decide to find other opportunities.

As we say to the team regularly in this market, if it’s not a ‘beat’ it can easily be treated like a ‘miss’. We remain laser-like focused on getting out from behind our desks to ensure we are invested in those businesses that are likely to keep beating now, and in the future.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.