By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our February 2022 Letter to Investors we check in on the ‘big picture’ factors of inflation, interest rates, and now the Russia-Ukraine war, and how they are driving share markets at present. We also take a look at February reporting season here in Australia and what our outlook is across our Funds.

Dear Fellow Investors,

Welcome to the February Ophir Letter to Investors – thank you for investing alongside us for the long term.

Russia-Ukraine war added to the worry list

Share markets continued their shaky start to the year in February after the world was rocked by the outbreak of war between Russia and Ukraine.

The humanitarian crisis is truly shocking and we and the team at Ophir can only hope that a non-violent resolution is found as quickly as possible.

Global share markets, as measured by the MSCI World index, have now had their third-worst start to a year since 1991. The S&P 500 (-3.0%), Nasdaq (-3.3%), and MSCI Europe Index (-3.0%) all ended in the red for February.

However, Australia was one bright spot with the ASX 200 (+2.6%) and ASX Small Ords (0.0%) relative outperformers following a better-than-expected February company reporting season.

About 80-90% of what we do every day is meeting with existing and prospective portfolio companies, generating ideas, building valuation models of businesses, and talking to customers, suppliers, competitors and brokers of the companies we are analysing.

What we don’t do is spend 80-90% of our time looking at the big-picture macro forces at play. Not because they can’t have large impacts on share markets, (they can!) but because out-guessing the hundreds of thousands of professionals who try to price these forces is very tough and we simply don’t have an edge in it.

Most of the top-down forces at play are macroeconomic in nature and one of us (Andrew) has actually been an Economist at Federal Treasury in Canberra and with the CBA in Sydney. Over the medium to long-term, it is easier to consistently get an edge on the market through bottom-up analysis of companies than it is through top-down macroeconomic forecasting. Plus, it’s a lot more enjoyable … you’ll have to trust Andrew on that!

We feel, however, we are again in one of those periods where ‘big picture’ factors are driving markets and have been for a few months now, rather than ‘bottom-up’ factors, or underlying company fundamentals.

This is creating challenges for the shorter-term performance of our Funds. But we have been here before, and we understand what the root cause is – as we’ll detail below. We personally share the pain with you and remain fully invested in our Funds as always. The good news is there are some very attractive opportunities now on offer in the market that we haven’t seen at these prices for several years.

In this letter, we will touch on the big forces at play, notably the flow-on impacts to the global economy from the truly historic war raging in Eastern Europe and particularly what that means for inflation and interest rates. We then turn our attention to the recent reporting season here in Australia. And we look at how these topics impact portfolio performance and how we are positioning the Ophir Funds.

February 2022 Ophir Fund Performance

Firstly we have included below a summary of the performance of the Ophir Funds during February. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -3.6% net of fees in February, underperforming its benchmark which returned 0.0%, and has delivered investors +23.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -7.1% net of fees in February, underperforming its benchmark which returned -0.2%, and has delivered investors +14.8% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -3.3% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned -5.6% net of fees in February, underperforming its benchmark which returned -3.2%, and has delivered investors +24.8% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Ukraine-Russia war boosts biggest commodities rally in more than a century

As you know from the graphic images, we are now witnessing a deeply troubling war between Russia and Ukraine. Beyond the human tragedy, it has the potential to throw more fuel on the inflation fire by turbocharging commodity prices.

In our Investment Strategy note this month we cover in detail the impact the current war may have on share markets, primarily by looking at geopolitical and military events through a historical lens. Please click here should you wish to read.

A brief summary is that history suggests regional conflicts tend to only inflict minor damage on global share markets, with selloffs followed by speedy recoveries.

It’s important to state that our Ophir Funds have zero exposure to Russian equities, and we certainly plan to keep it that way.

Both Russia and Ukraine are small economies on the global stage, but they can still influence the global economy via commodity exports where they are major players, particularly Russia.

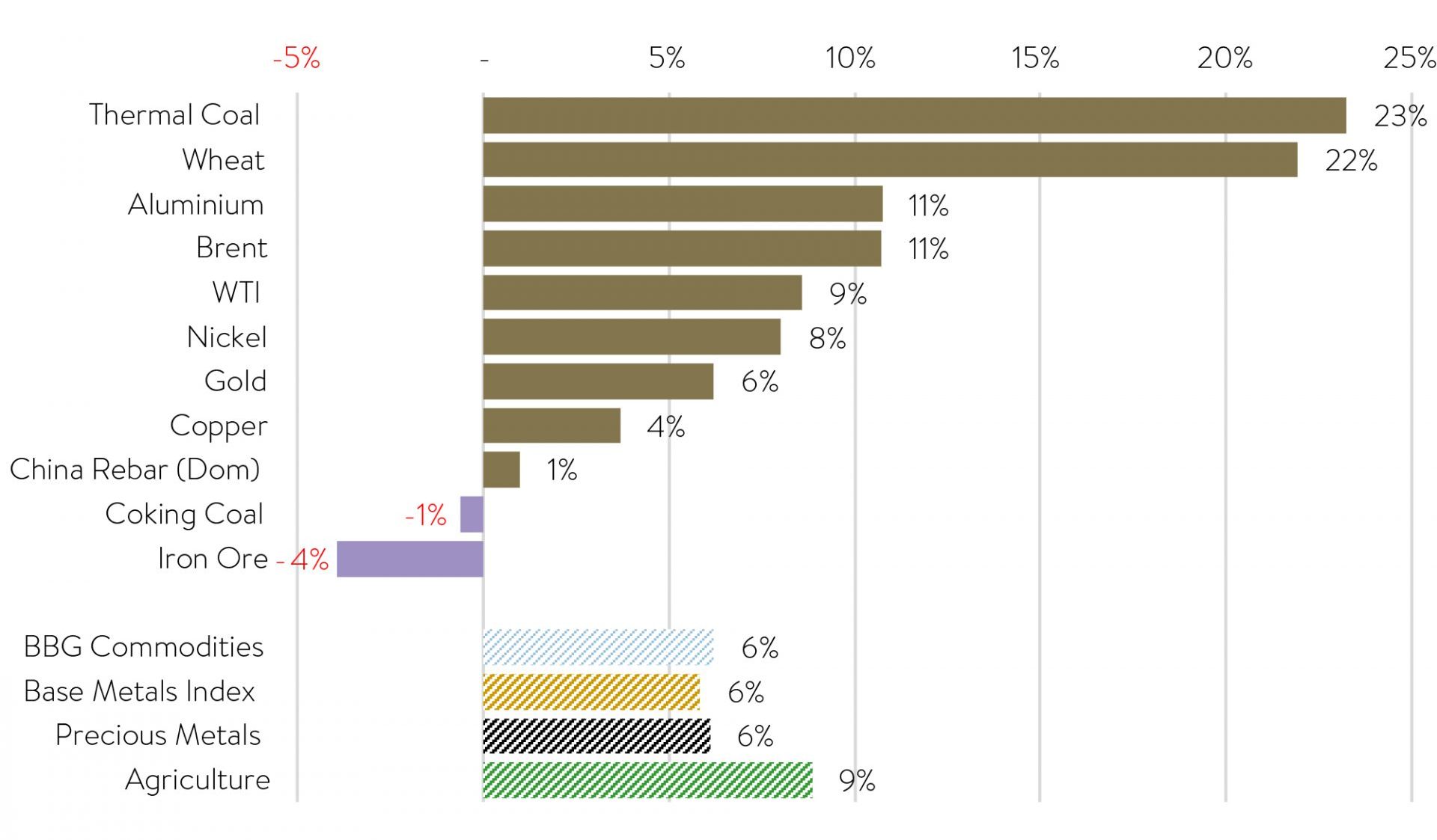

A whole host of commodity prices went berserk in February after war broke out. The Bloomberg Spot Commodity Index which tracks 23 futures contracts on commodities, rose by 13% last week – the most in a week since 1960!

Commodities | Feb-22 %age change

Source: J.P. Morgan Global Economics

Commodity prices were already recovering from COVID lows in 2020, and this has now been the strongest cycle since we have good data going back to 1914. It is quite incredible and clearly the result of enormous fiscal and monetary stimulus providing an extra boost to the COVID recovery.

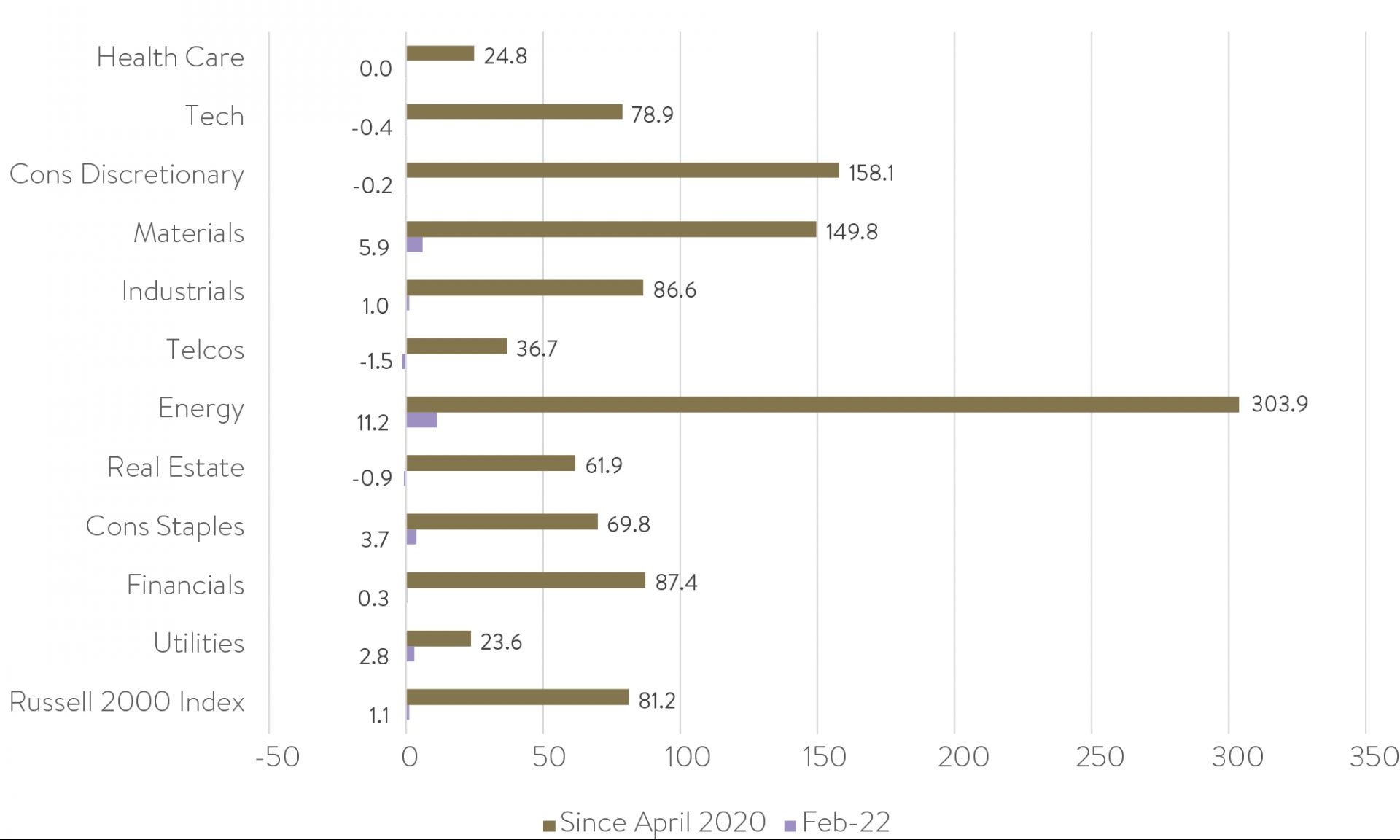

This has been creating a big winner on a sector basis both in February, but also since markets started climbing back from the initial COVID-19 hit in 2020. And that sector is … Energy.

When we look at US small-cap sector returns from the market bottom in 2020, Energy is way out in front and you would see a similar picture in any major share market index.

US small cap sector returns

Source: Factset

Along with Energy, the Materials sector has also benefited from higher commodity prices. That has certainly not helped relative performance in the Ophir Funds of late given we are structurally underweight these two commodity-exposed sectors, as detailed in previous letters.

But the war is unlikely to stop Fed’s aggressive rate rises

Late last year, major central banks, most notably the US Fed, provided a version of mea culpa ‘lite’ when it indicated that inflation – like that second cousin who eats all the food at the Christmas party despite not being invited – is going to stick around a little longer than expected.

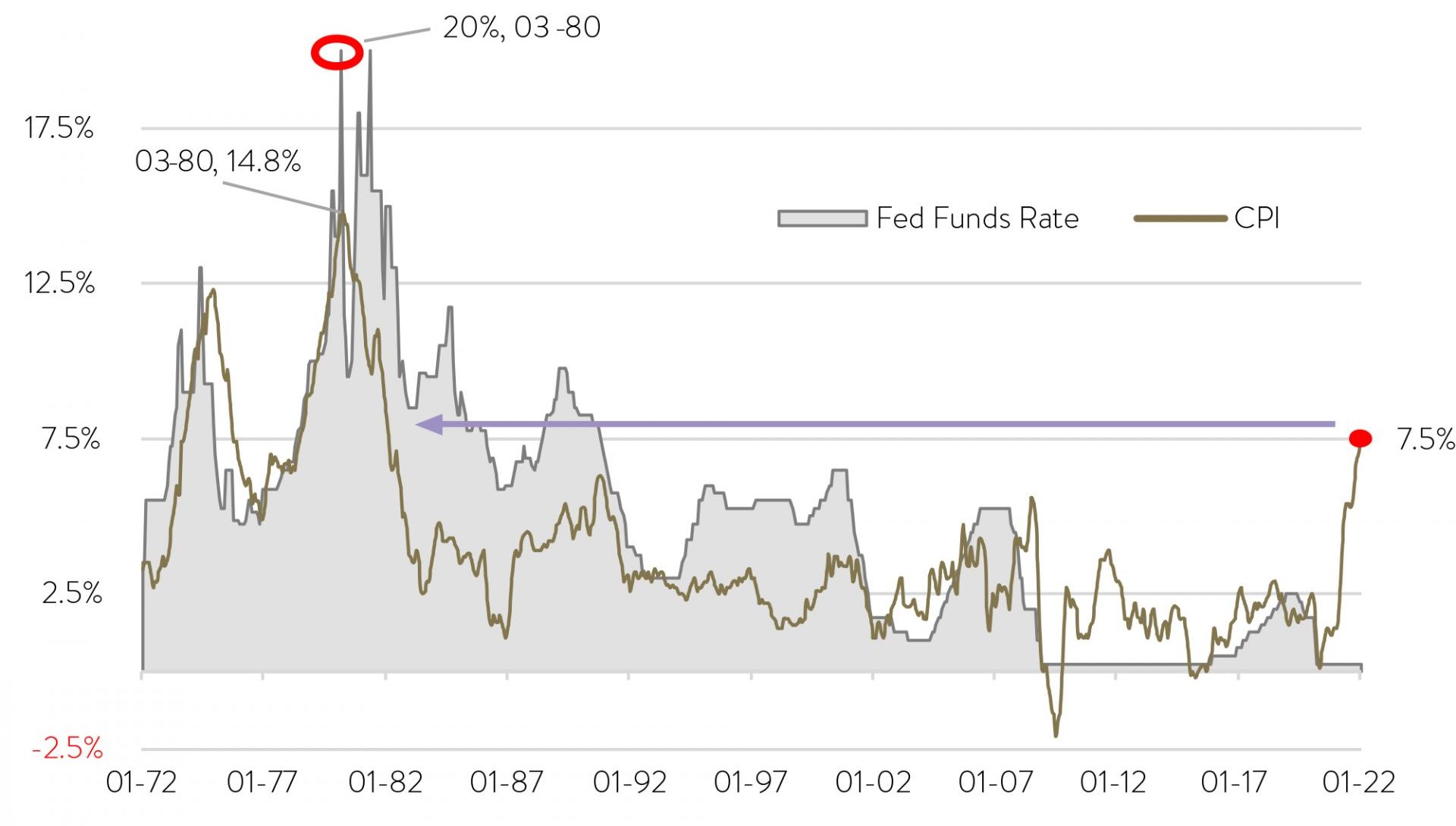

Inflation is at a 40-year high (and with perhaps higher to go now!) but the key policy rate, the Fed Funds Rate is WAAAAY lower than where it was last time CPI had a 7 in front of it.

US | FED Funds Rate vs. CPI (1972 – current)

Source: J.P. Morgan calculations, Bloomberg Finance L.P.

Some economists argue the Fed needs a shock-and-awe approach to regain its inflation-fighting credibility. They want successive 0.5% hikes each meeting this year until it gets to 2.5-3%.

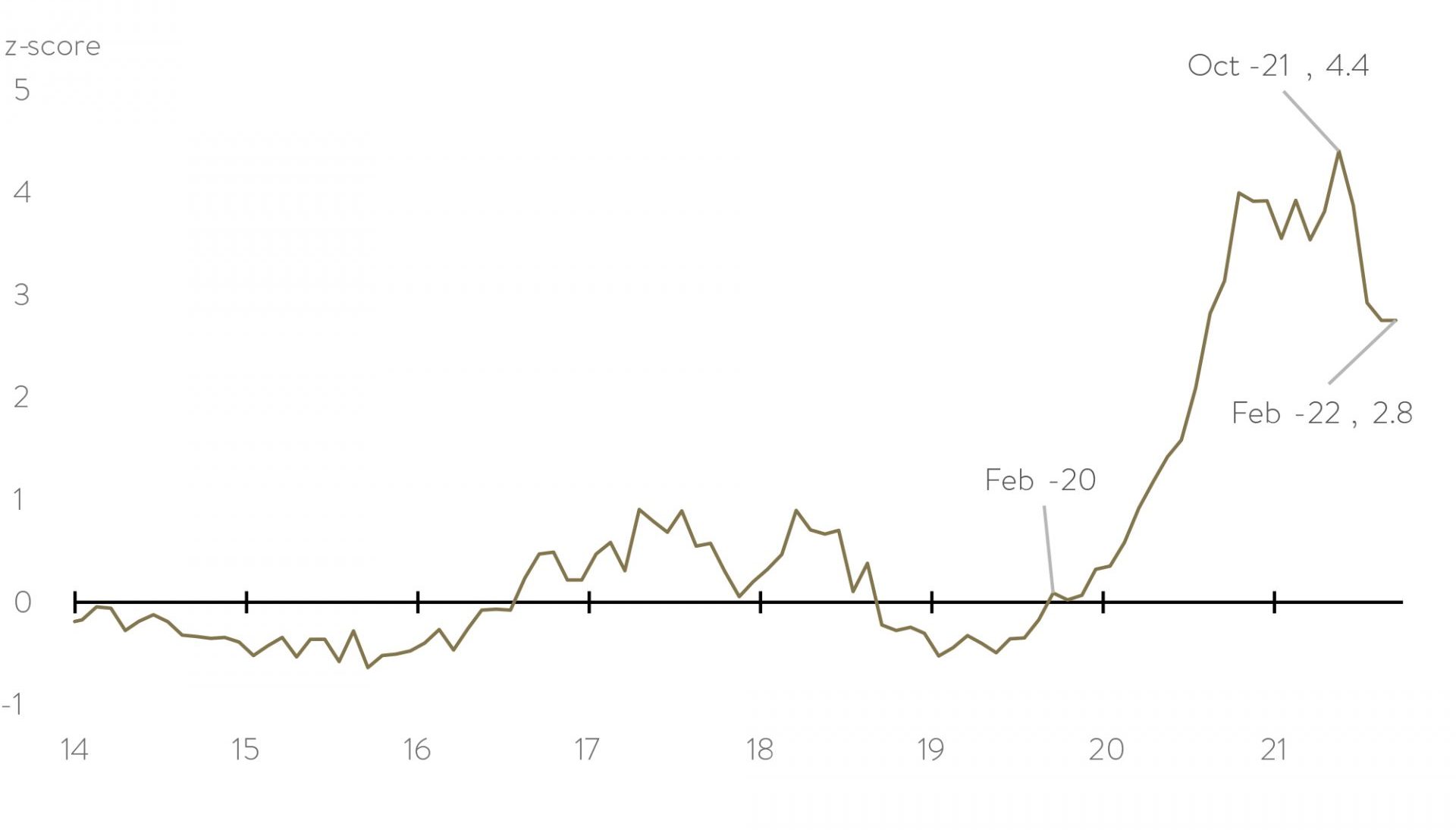

But other economists promote a go-slow approach because they argue inflation is likely to start heading down very soon, regardless of what the Fed does. They say that bottlenecks, which have been choking goods supply chains and causing much of today’s high prices, are easing – a leading indicator of tomorrow’s lower inflation. Indeed, below you can see investment bank UBS’s supply chain stress indicator appears to have peaked, partly due to Asian supply chains coming back online as they abandon COVID-zero policies.

Global bottleneck pressure is easing

Source: UBS, Haver

*Note: chart shows a median z-score of 20 different indicators, including delivery time and backlog indices, shipping and air freight cost, global demand imbalance, empty/full container ratios, shipping queue, orders/inventory data, and cargo load factors.

The Russia-Ukraine war has just added another source of supply chain and inflation pressures though.

Indicators highlight though that the Fed will likely get on with its job of raising rates fairly aggressively this year from March, with any escalation in the Russia-Ukraine war to make it a little more cautious.

Australian reporting season – Financials and commodities shine

With all the gripping macro dramas, it’s easy to forget we have just been through one of the busiest times of the year – February reporting season for both our Australian and global funds.

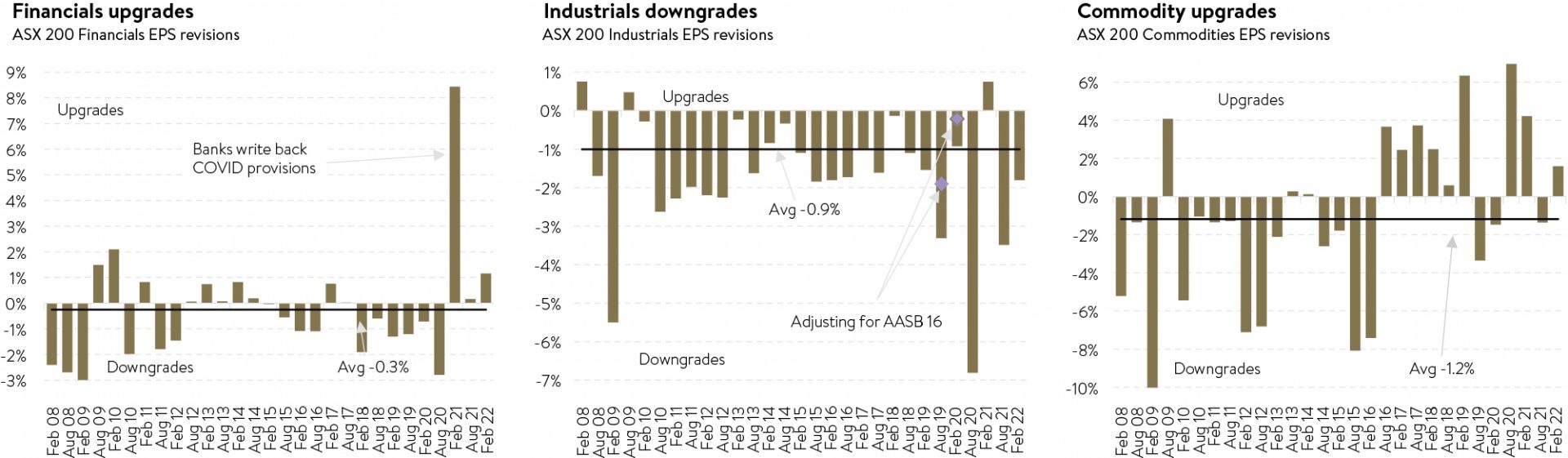

For listed corporate Australia it was a good reporting season. We saw a high level of earnings ‘beats’ and the second-largest upgrade to overall expected full-year earnings since the GFC. (Let’s not get too excited, the upgrade to FY22 profits overall was only 0.9%.)

The strength, however, was in two sectors we don’t participate in much: financials and commodities. Financials (& more specifically the big banks) are benefiting from funding costs remaining low, while banks are benefitting from a lot of businesses looking to borrow to expand amid strong economic activity.

For commodities, we probably need not say more than we have above. While some of the main commodity players are facing cost issues, particularly around labour, they have not had any trouble passing this on given the rude health of most commodity prices.

Upgrades/Downgrades to next June earnings per share (EPS)

Source: Company data, FactSet, MST Marquee

Industrials was the standout laggard, with bigger-than-average downgrades due to a host of reasons. Many were company-specific, but if there was one common theme it was cost issues that have progressively moved from higher raw materials to higher labour costs. We suspect the Ukraine war’s impact on commodity prices will keep the pressure on materials costs, given many of them are commodity linked.

Overall, the Australian share market can be expected to be more shielded from the negative impacts of the war given our virtually non-existent trade linkages with Russia and Ukraine, and because the large commodity exporters that dominate our market are now getting paid more for their goods.

Without the tailwinds of significant exposure to financials and commodity exporters, it was a reasonably tough reporting season for our Australian equity funds in terms of share price performance. Any result in our industrials-centric portfolio that was not perfect (i.e. a large beat on actual earnings and raising of future earnings guidance) was dealt with harshly.

Two examples were City Chic (ASX:CCX) and Uniti Wireless (ASX:UWL) which were down -20.4% and -21.3% respectively during February.

The former’s result came in at the top end of their earnings guidance and the latter met earnings expectations. Not results that would normally warrant such harsh share price treatment. But investors focussed on issues (high inventory for CCX and a housing construction slowdown for UWL) that we don’t believe will prevent them from overdelivering on earnings in the next few years. As such we have continued to use the price weakness to add to the positions.

Pleasingly, though, earnings season showed that we continue to select a disproportionate number of companies in our Australian and global funds that are upgrading their earnings versus downgrading. As we and the team work hard to maintain this, ultimately we believe we’ll be rewarded by the market over time – as we always have been.

Overall, the market currently has expectations of around 12% earnings growth for the ASX200 for the June 2022 financial year, down significantly from the initial reopening-boosted 31% year-on-year growth to December 2021. This is still above average and suggests that the Aussie share market can still generate reasonable returns this year providing it’s not derailed by an escalation in the war or by central banks taking away the punchbowl too quickly.

There is now great valuation in our space (that the market will recognise sooner or later)

As covered in our last letter there has been a very aggressive sell-off in more growth-orientated small caps globally, including in Australia, but particularly in the United States.

Given this is the space in which we invest, fund performance has been significantly negatively impacted of late, despite no deterioration in the overall underlying earnings-generating ability of the companies in our funds.

Last month we provided a version of the below chart for the last 3-4 years. We thought we would extend it back further to 2005 for which there is available data across all the relevant stats.

US Small Cap Valuations

Source: Factset

The story it tells is that valuations in US small caps (brown line) and US small-cap growth-orientated businesses (purple line) are now back in line with their longer-term averages (dotted line versions). This gives us some comfort that most of the valuation compression in this part of the market we invest in for our global funds may be behind us.

Now of course markets can over-correct in the short term. Just see the low valuations during the GFC years 2007-09 in the chart, though higher interest rates (grey line) then arguably justified lower valuations.

With valuations now around average levels compared to history, we think good value remains on offer. This is also true now for our Australian funds and as a result, our cash levels in the funds have been set at reasonably low levels. For the market to reward those fast-growing businesses though we may need investors to ‘move on’ from focussing on the big picture items we looked at earlier.

This could be soon, or it could be later this year, but ultimately the market will move on. The market will go back to being mostly being driven off company fundamentals, like it always has. And the wonderful companies in our funds will surprise the market with their ability to grow rapidly and sustainably into the future.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.