By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we take a close look at what happened in the U.S. and Australian reporting seasons. Specifically, we outline how the Australian corporate earnings cycle is lagging the U.S. and what that means for the outlook for Aussie shares.

Welcome to the August Ophir Letter to Investors – thank you for investing alongside us for the long term.

Australia Inc … to the naughty corner

August is the busiest month of the year for our investment team. With financial reports streaming through day after day, drinking from a firehose is the best analogy for this period. The month started, of course, with June quarterly reporting for stocks in our global funds. It finished with full financial year 2023 reporting for companies in our Australian funds.

Like the proverbial iceberg, there was plenty going on under the surface, including meaningful downgrades to next year’s earnings for corporate Australia. (We’ll cover this in more detail later in the letter.)

But at a headline level, in the first three weeks of August, we saw falls in major equity markets. Most indices fell -3% to -6%. Then a partial recovery in the last week pared some of those losses and markets ended the month with falls of between -1% to -3%. The Russell 2000 index, the whipping boy of equity markets over the last one to two years, however, was hit a little harder, falling just over -5%.

While you might think reporting season would have had the greatest sway over August share market performance, it was actually mostly about interest rates and the macro, again.

August 2023 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during August. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -0.3% net of fees in August, outperforming its benchmark which returned -1.3%, and has delivered investors +21.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned -1.2% net of fees in August, outperforming its benchmark which returned -1.3%, and has delivered investors +13.2% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -3.1% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -0.1% net of fees in August, underperforming its benchmark which returned +0.2%, and has delivered investors +13.9% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

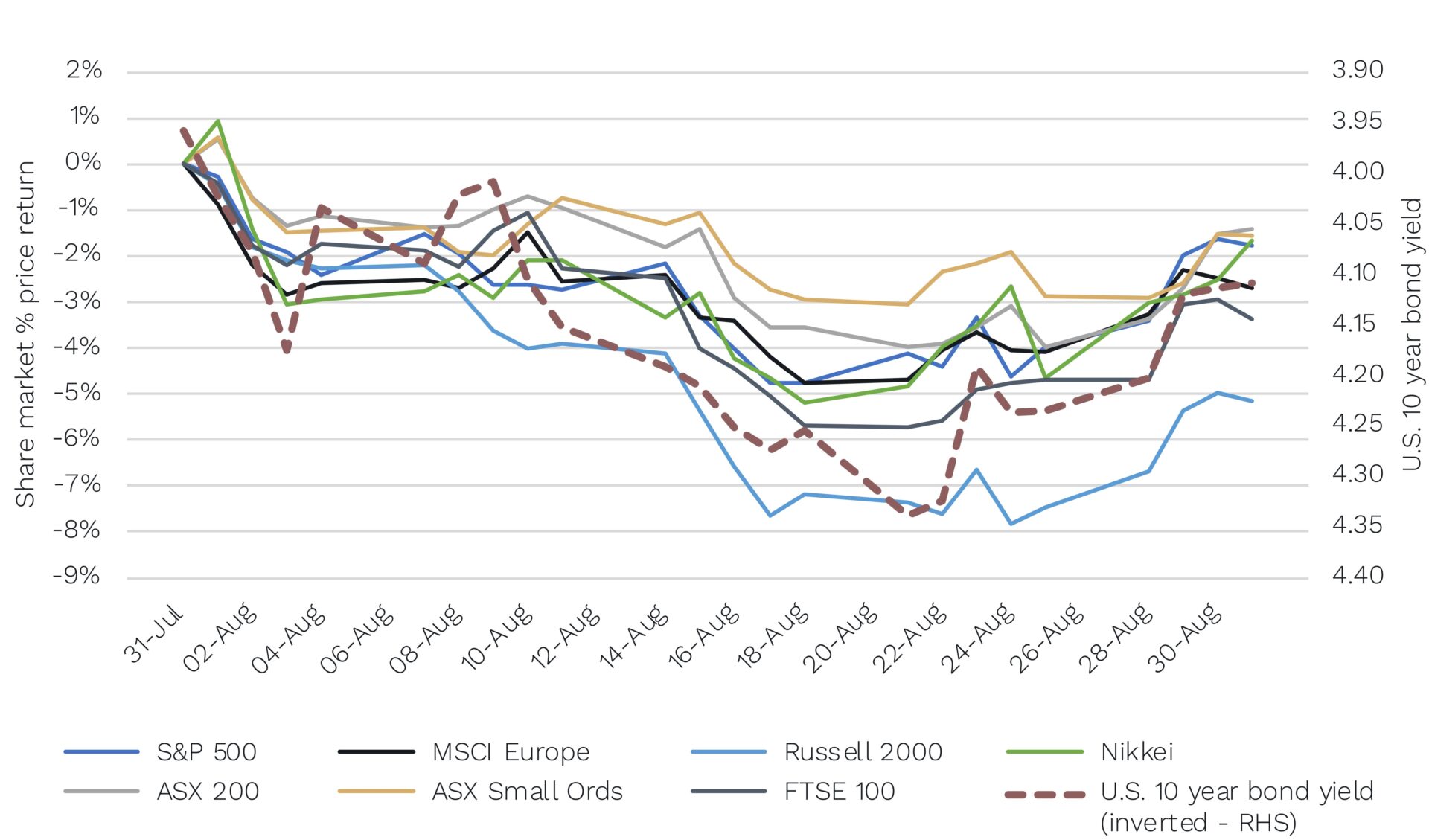

Equity markets move with US bond yield in August

Source: FactSet.

Above, you can see equity market returns during August compared to the (inverted) U.S. 10-year government bond yield.

There was an 85-90% correlation between this key bond rate and the major share markets for the month. When long-term interest rates rose share markets fell during most of the month. Then when interest rates started falling again in late August, equity markets reversed course and rose.

As a key discount rate for valuing assets, the U.S. 10-year bond rate during the month was responding to higher expectations for long-term inflation and economic growth.

Incredibly, in mid-August the 10-year bond rate reached its highest level since 2007! Higher-for-longer interest rates feels like it’s here to stay – at least until (or if) it breaks something. In the meantime it likely does create a headwind for the inexorable rise in valuations of share markets that has characterised most of 2023.

But despite the macro influence in August, earnings season is still obviously vital – hence the time chained to our desks. In this Letter, we look closely at what happened in the U.S. and Australian reporting seasons. But we particularly take a close look at what happened to an important holding of our global funds. The company’s shares were punished, despite beating earnings forecasts and raising outlook guidance. Was that fair? And we also look closely at how the Australian corporate earnings cycle is lagging the U.S. and what that means for the outlook for Aussie shares.

Global funds reporting season – Low misses/downgrades … but little reward

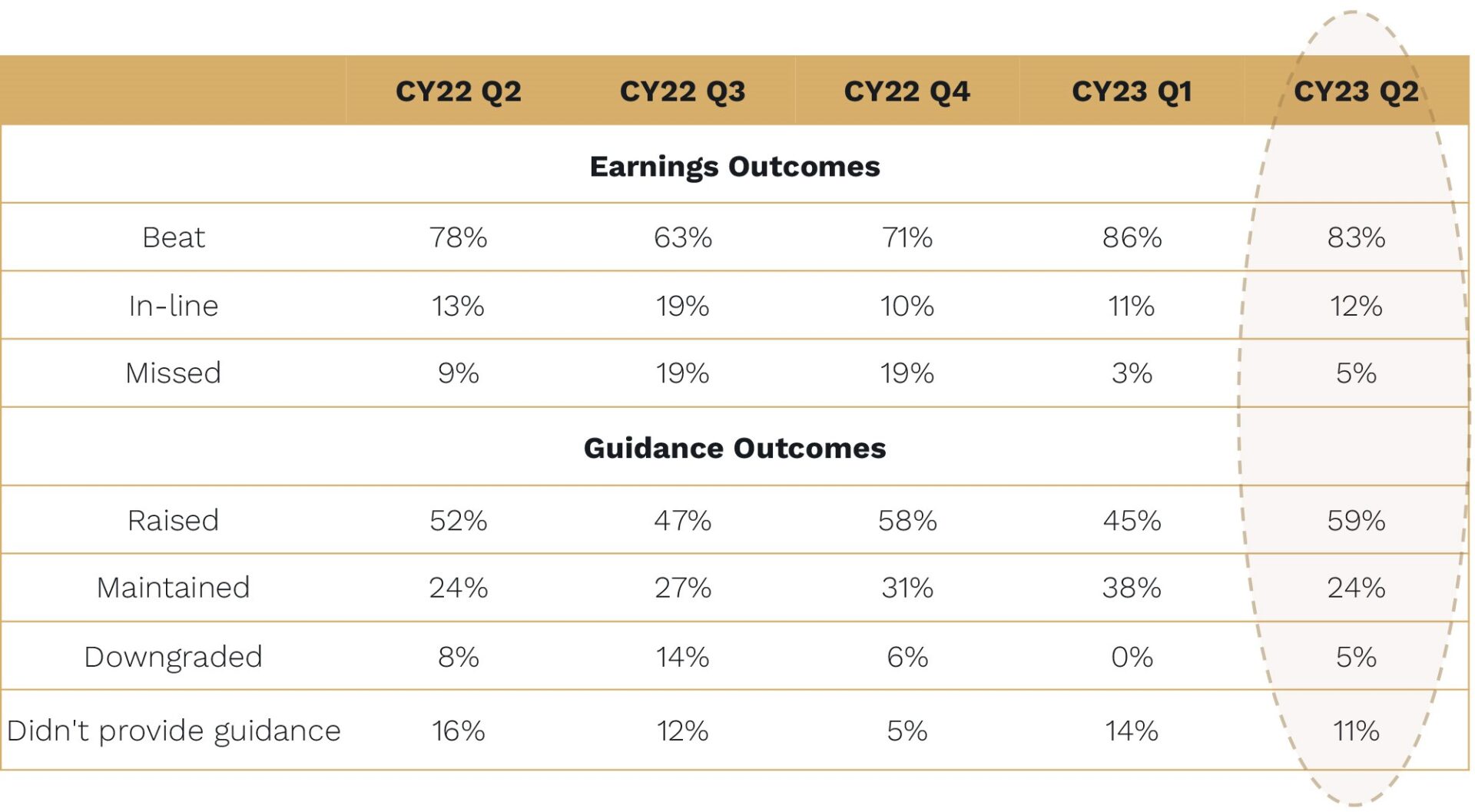

As mentioned, our global funds completed their June quarter reporting seasons during August. From a fundamentals perspective (revenues/margins/profits) it was a pleasing outcome. Only one company (of the 28 that reported) fell short of the market’s earnings expectations and downgraded its earnings guidance.

Below, we show the earnings and guidance outcomes for companies reporting June quarter results in our global funds, reweighted to equal 100% for those that reported. For earnings outcomes a “beat” means a company’s earnings result for the quarter was at least 2% above the market’s consensus expectation whilst a miss is at least 2% below those expectations. The same holds for guidance outcomes where “raised” guidance reflect earnings guidance for the next quarter or year by the company is raised by 2% or more whilst “downgraded” guidance means earnings expectations are lowered by 2% or more. The earnings and guidance outcomes are each reweighted to equal 100% for those that reported and are weighted by portfolio weight, with an average taken across our two global funds.

Global Funds – Strong Q2 Reporting Season

Source: Ophir. The simple average of the Ophir Global Opportunities Fund and Ophir Global High Conviction Fund outcomes have been stated. The results are weighted by the portfolio weights of the constituents that reported.

Increasingly, however, the post-results performance of share prices depends more on a company’s guidance than earnings outcome. That’s because the market is looking into an opaque macroeconomic picture ahead and where future earnings certainty is more highly prized by the market.

Why the unhealthy reaction to TransMedics’ result?

But for many companies, even a clean sheet of ‘beat and raise’ (beat on earnings result and raise earnings guidance) has not guaranteed good share price performance this reporting season. It’s been a case of the market ‘shooting first and asking questions’ later.

This downgrading of importance of earnings results and guidance from companies and upgrading of the importance of macro influences has largely been in place this cycle since the U.S. Federal Reserve in November 2021 first suggested it needed to embark on its current inflation fight.

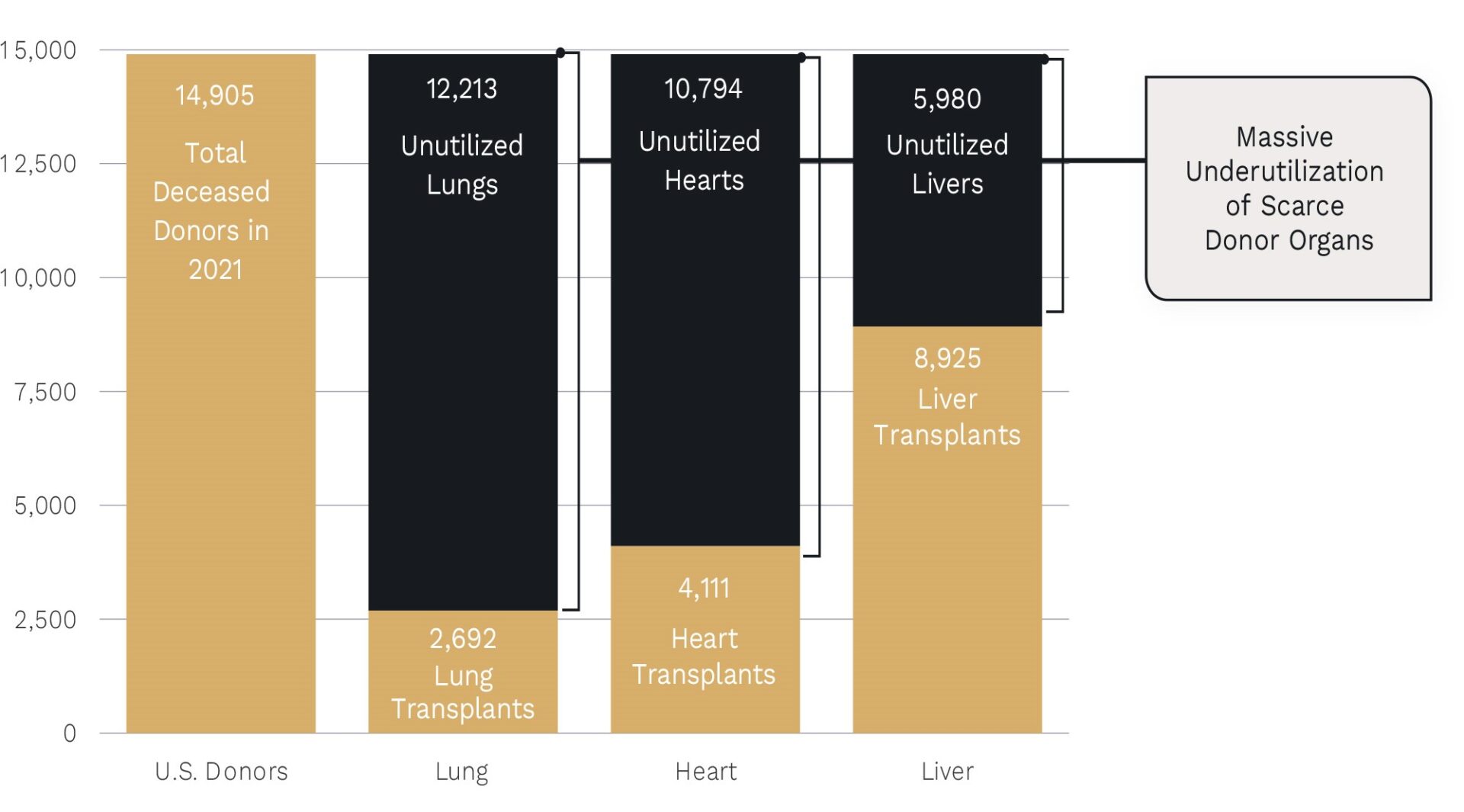

Exhibit A is TransMedics, a company we hold in our global funds. The company removes, stores and transports liver, heart and lung organs for transplants, primarily in the U.S.

The company offers a portable warm blood profusion technology, which allows organs to be kept alive longer and travel further distances to recipients, drastically reducing wastage. Its technology is solving the problem of unutilised organs. Incredibly, about 70% of hearts available for transplant go to waste.

Significant problem in organ transplantation

Source: 2022 Organ Procurement and Transplant Network (OPTN) Data.

As an early-stage business, which is ploughing all operating cash flow back into growing the business, TransMedics primarily trades on its revenue result rather than earnings. It earned USD$52.5 million in June quarter revenue, a 24% beat to the market consensus forecast of $42.5 million, and 156% growth on the June quarter revenue from the previous year.

It also raised calendar year 2023 revenue guidance from $160-170 million to $180-190 million at the result. So a very solid ‘beat and raise’.

But what did the stock price do post result? It sold off -23% over the following two days and was down -30% in August in total (making it our largest performance detractor during the month by some margin).

Why such a harsh reaction?

TransMedics share price had surged +52% this year (pre the result and a whopping +197% since we first purchased in July last year). Going into the result, the stock traded on heavy volume. Some investors were clearly expecting a flawless result.

TransMedics (Nasdaq:TMDX) – Share price

Source: Company presentations and Ophir. Data as of 1 September 2023.

Yet, despite the ‘beat and raise’, the result raised two questions for investors. Firstly, the growth in heart transplants was 4% quarter-on-quarter. That likely wasn’t as high as the market was expecting. Is market-share growth faltering for this segment? Secondly, TransMedics recently raised debt to buy an aviation business to aid its transportation of organs. Will that ultimately pay off?

So what is our view on the two issues above?

- The company had a much higher proportion than usual of “dry runs” for heart transplants during the quarter meaning they were called for the case, but the potential donor didn’t progress to the heart stopping. The call outs for heart transplants were much higher in Q2 than in Q1 but as the company asserts this is just part of the quarter to quarter “ebbs and flows of organ transplants” though it’s something we are watching closely. If the proportion of dry runs was the same as in Q1, they would have had about 20% growth in heart transplants, and it would have been a non-issue.

- TransMedics is building out a fleet of about 15 planes across eight regional hubs in the U.S. in the next year, which will likely cover almost 100% of their U.S. transport needs. Using third-party transportation is a key bottleneck in the organ transplant industry, a problem that is only likely to get worse as TransMedics scales (they lost about 40 organs in Q2, or about $4 million in lost revenue because they couldn’t find a plane). We are comfortable with the projected return on invested capital in the planes, which should help simplify their operation and help create a bigger moat around the business. Again, we will be monitoring their execution closely.

The overall attraction of TransMedics for us is it helps provide exposure to a company that is not only rapidly growing and taking market share in its industry, but is actually helping grow the industry through its leading technology.

Importantly, Transmedics revenues have very little sensitivity to the economic cycle, so its success does not depend on whether the U.S. economy has a soft or a hard landing over the next year. The company has ambitious plans to scale to 10,000 transplants per year over the next five years and we remain excited by its prospects.

Australia reporting season: Revenues up, profits down as companies battle rising wages and interest bills

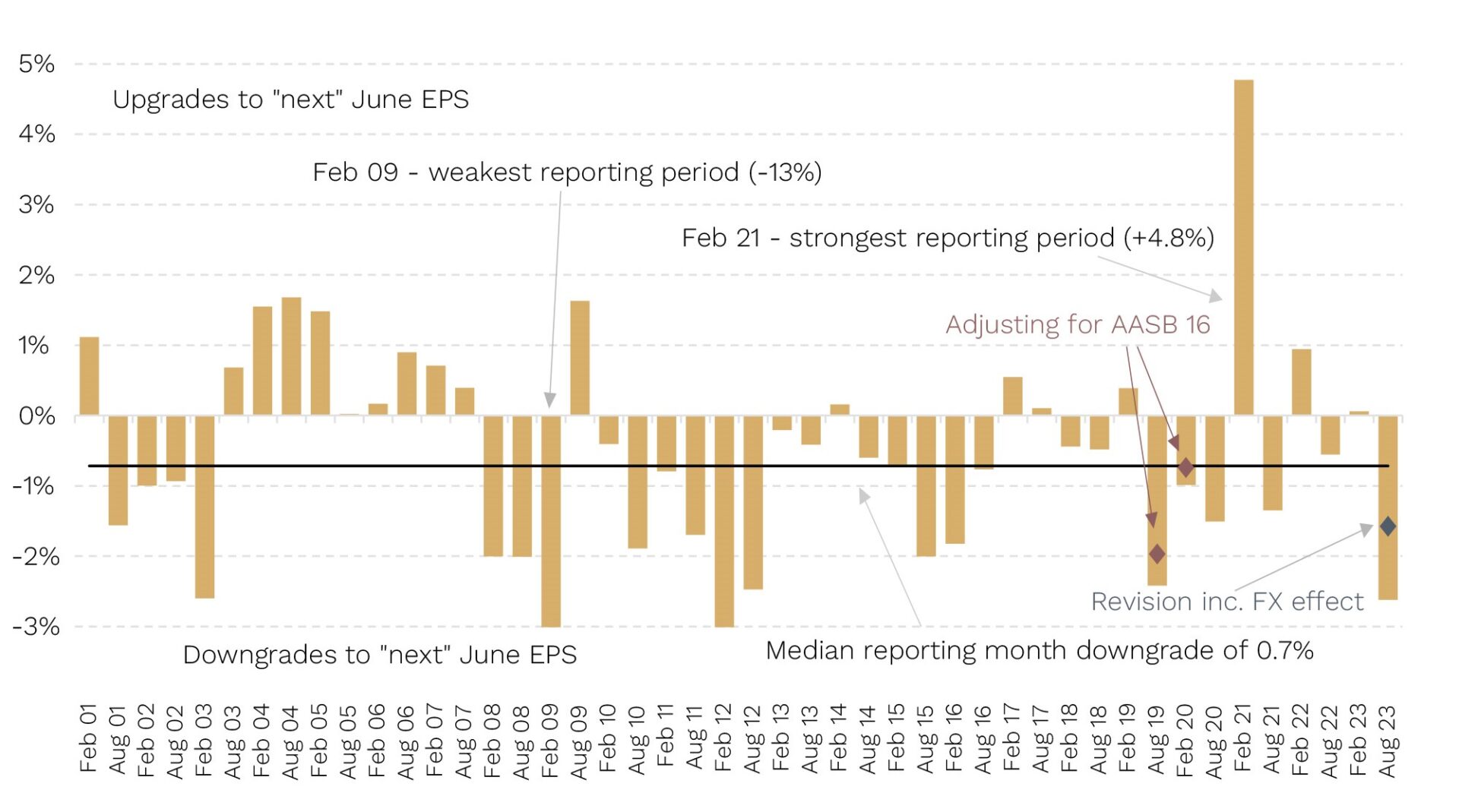

No matter how you slice it, it was a tough reporting season for listed corporate Australia in aggregate. Our favourite scoreboard is revisions to full financial year earnings that come off the back of a company’s results. The market is forward looking, so what it thinks about the future prospects of a company is usually more meaningful than the historical results it just posted.

As you can see below, on this score the August 2023 reporting season (for June 2023 full financial year results) was the third worst this century, with a -2.6% downgrade. In dollar terms, $4 billion was slashed from expected FY24 profits.

One of the weakest

ASX 200 reporting season EPS upgrades/downgrades for the 12-months to June

Source: Company data, Factset, MST Marquee

Why was it so bad?

Well, it wasn’t revenues. They were upgraded for FY24 off the back of resilient nominal GDP growth and a consumer with excess savings still stuffed in their wallets. Wesfarmers, Coles and Woolies collectively chalked up about $2 billion of revenue upgrades.

It’s costs that’s the issue. Higher wages and interest costs are crunching margins. Minimum wage hikes and super increases were called out by many, including JB HiFi and drinks-and-pokies retailer Endeavour Group. Supermarket giant Coles was a microcosm of Aussie reporting season. It upgraded revenue by 2% but had profits downgraded by -10% as costs bite.

Consensus ASX 200 corporate earnings growth is now a paltry -4% in FY24. If rate cuts don’t come to the revenue rescue, ‘cost management’ is likely to become the catchcry of corporate Australia this financial year.

Earnings growth revisions – Australia and the US diverge

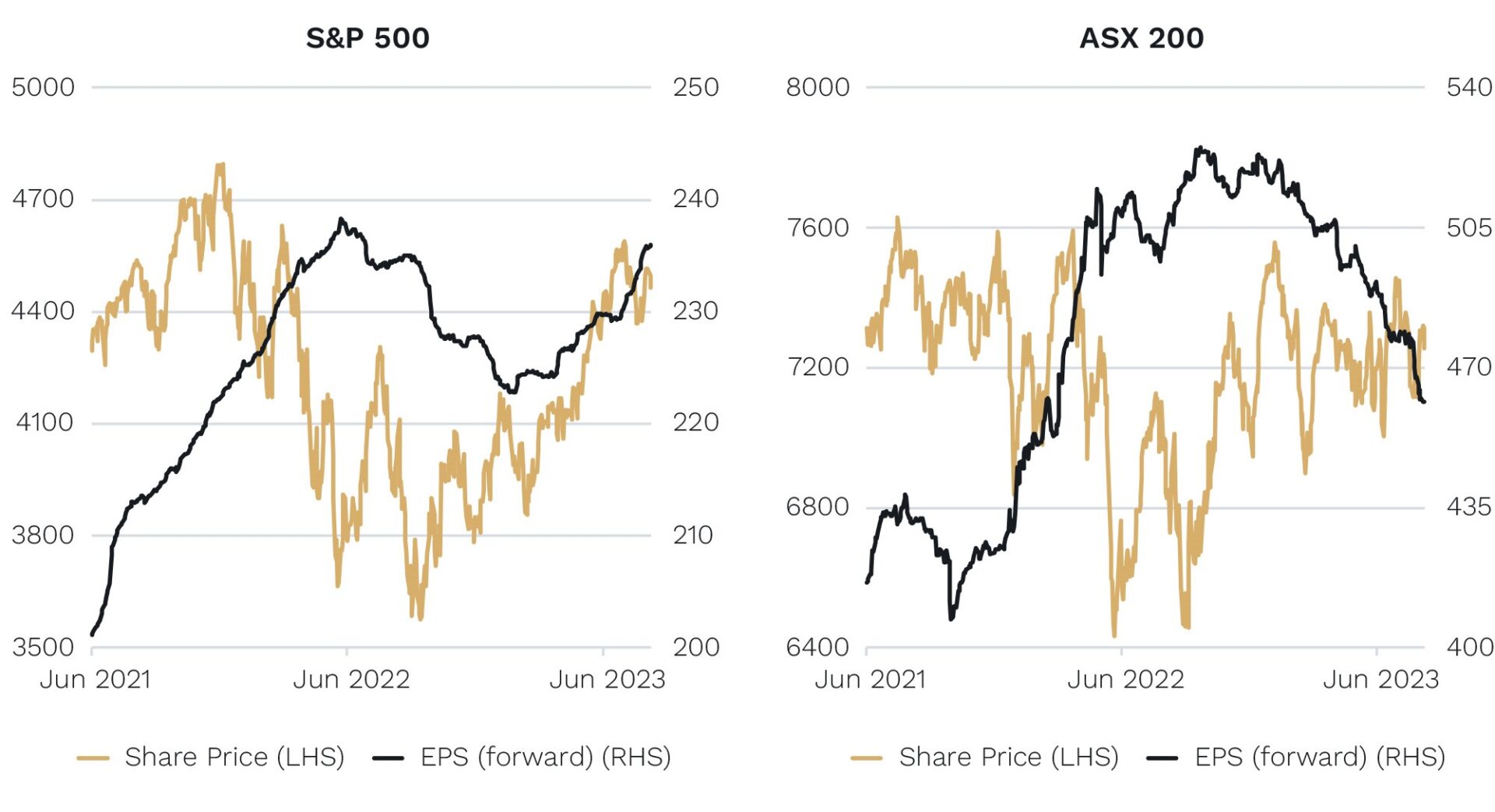

Source: Factset. Data from September 2020 to September 2023.

On the right chart above, you can see consensus earnings forecasts for the year ahead for the Australian share market. They have continued to be downgraded (black line, right chart). That stands in stark contrast to the U.S. share market where forecast earnings have been upgraded from lows in February this year (black line, left chart).

The Australian corporate earnings cycle looks at least about 6 to 9 months behind that of the U.S., which also helps explain the underperformance of the Australian share market versus the U.S. more recently (yellow lines above). This may continue to create a short term head wind for the relative performance for the Australian versus U.S. share markets.

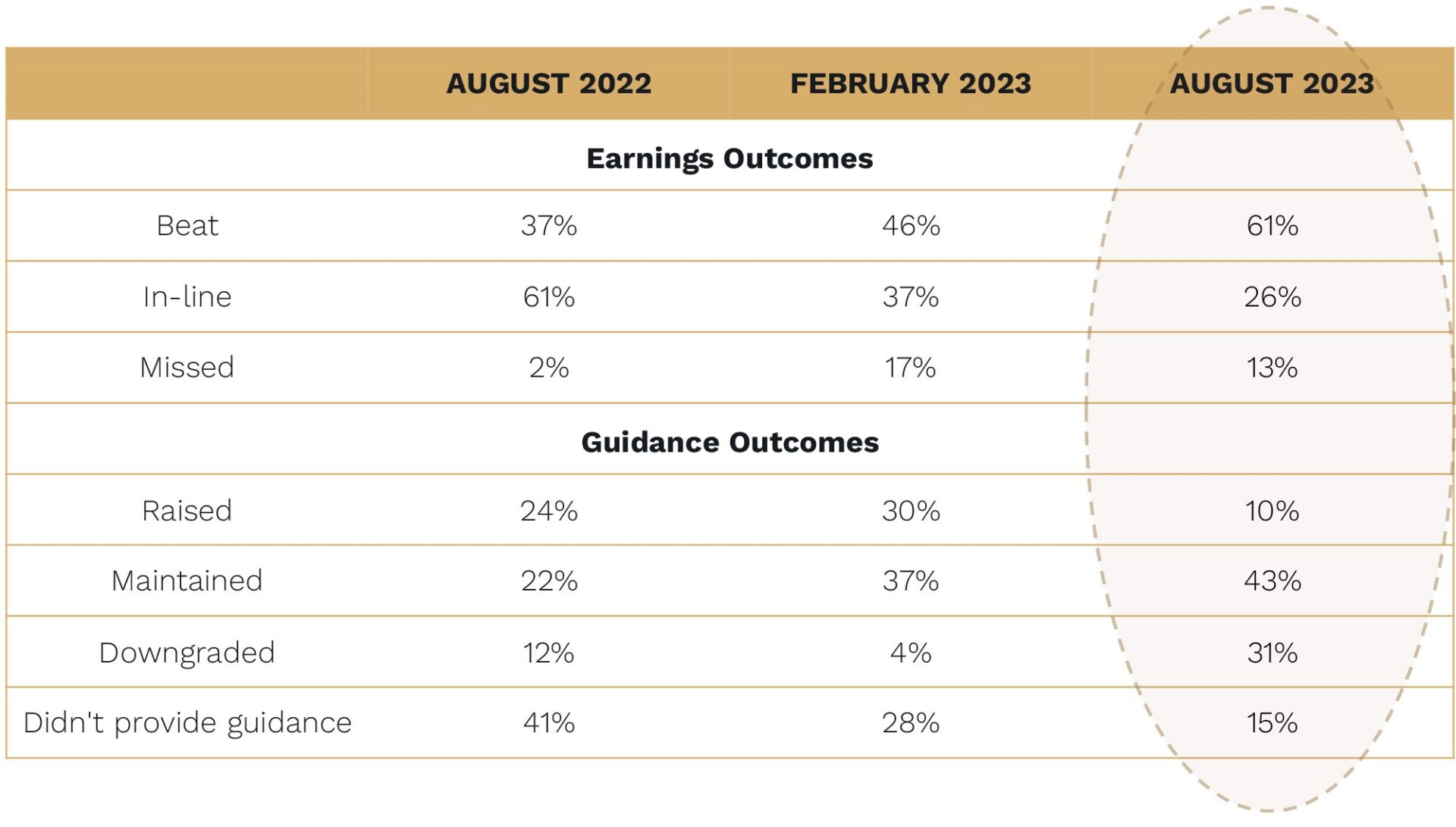

Our Australian funds, of course, were not immune to the profit outlook downgrades this reporting season. We show this below in our Australian reporting season scorecard for August 2023. While we had a high level of earnings ‘beats’ on companies’ actual results, downgrades for earnings guidance was also much more elevated than recent reporting seasons.

Ophir High Conviction Fund – Reporting season outcomes

Source: Ophir.

Avoiding guidance downgrades is a challenge at this part of the earnings cycle for all fund managers in Australia, where downgrades can be as much a function of conservatism from the board of directors and management as it is about actual deteriorating business conditions.

Eyeballing management

For now, though, it’s time to unshackle the ankles, leave the desks behind, and get out on the road to see company management of existing portfolio companies. We also have a shopping list in mind for new ideas. The better performers in this environment are likely to have unique products or services that can drive resilient revenue growth, strong cost management to help maintain or grow margins, and low debt levels to help mitigate the impact of interest rate rises.

Looking management in the eye and asking the tough questions is a core part of our investment process. It always will be. It’s also some of the best protection we have to help ensure the earnings trajectories of our companies remain on track to meet – or beat – our expectations.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.