By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In this month’s Letter to Investors we discuss the major themes from both the Australian and US reporting seasons, share our reporting season scorecard and discuss some of the winners and losers in our portfolios.

Welcome to the August Ophir Letter to Investors – thank you for investing alongside us for the long term.

Earnings season wrap: Better than feared … but fear remains

Powell makes clear inflation enemy # 1

That didn’t last long.

In early August, major global equity markets continued their rally from June and July’s annual lows.

Market watchers cited several reasons for the rally:

- Equity markets had been oversold in June/July

- Hedge funds were ‘short covering’

- The Fed’s hoped-for ‘dovish’ pivot

- A better-than-feared June global corporate reporting season

But by mid-month the rally began petering out.

Bear market rally and fall continues

S&P500 – Current

Source: FactSet. Data from 9 August 2021 to 2 September 2022.

ASX Small Ords – Current

Source: FactSet. Data from 9 August 2021 to 2 September 2022.

Russell 2000 – Current

Source: FactSet. Data from 9 August 2021 to 2 September 2022.

It became clear the sharp bear-market rally of the previous 6-8 weeks was just that, a bear-market rally, and not a sustained recovery.

Powell puts pivoters in place

Then, at the end of the month, U.S. Fed Chair Jerome Powell gave his Jackson Hole speech. He put the ‘pro-pivot’ interest rate camp, which had been expecting the Fed to stop raising rates because of slowing growth, to the sword.

Powell assured markets that inflation was public – and the Fed’s, — enemy number one, and that there was likely no interest rate relief coming in 2023. He stated:

“While higher interest rates, slower growth and softer labour market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain”.

Powell was channelling his best inner Paul Volker: the Fed Chair who quashed the 70s and 80s inflation, and threw the US into recession, through aggressive rate hikes; rather than his inner Alan Greenspan: the Fed Chair known for riding in on his white horse and saving markets with interest rate cuts, dubbed the ‘Greenspan put’.

Higher equity markets and lower long-term bond yields would have no doubt been playing on Powell’s mind heading into Jackson Hole. They were contributing to easing financial conditions – the polar opposite of what he needs to tame inflation.

Aussie strength

Powell got what he wanted. The S&P500 and Nasdaq fell -2.5% and -3% respectively on the day of his speech, and at the time of writing they have fallen further in the days since. Bond yields have also marched higher across the interest rate curve.

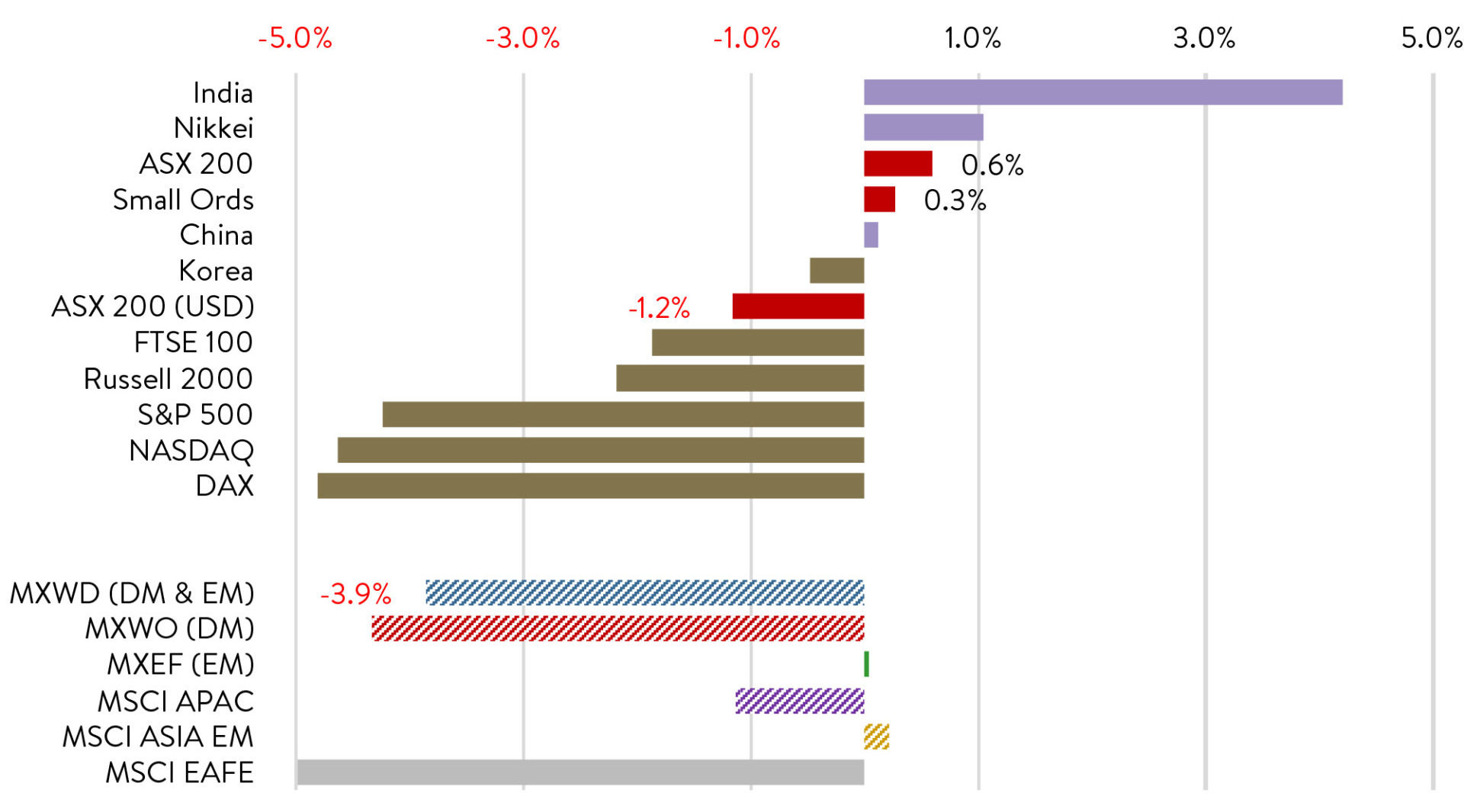

All up in August, equity markets were mixed, with the Aussie market one of the best-performing developed markets during the month (ASX200 +0.6%).

But U.S. (S&P500, -4.2%) and Europe (Stoxx 50, -6.5%) markets were down substantially, with further falls at the time of writing in early September (see chart).

Global Equities MoM Performance | Aug-22

Source: JP Morgan

August 2022 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during August. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +3.6% net of fees in August, outperforming its benchmark which returned +0.6%, and has delivered investors +22.1% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +1.7% net of fees in August, underperforming its benchmark which returned +2.4%, and has delivered investors +13.4% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -7.7% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +0.6% net of fees in August, outperforming its benchmark which returned -1.6%, and has delivered investors +14.8% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

Outside of the Fed taking away the central bank punchbowl, late July and August were all about quarterly results in the US and full-year results to 30 June 2022 in Australia.

Below we take you through some highlights of the Australian reporting season, including our ‘scoreboard’ for earnings ‘beats and misses’ across all our funds.

Lastly, we discuss our portfolio positioning and how we are balancing earnings growth with earnings resilience.

A positive lead

Entering the US and Australian reporting seasons, investors feared earnings and guidance might be poor because of a triple whammy of higher interest rates, a slowdown post the initial covid recovery, and high input costs such as raw materials and wages.

But then the Australian reporting season in August received a positive lead-in from the US where consumers were more resilient than investors expected.

Amazon saw an improvement in key operational metrics and a “subsequent step-up on consumer demand”; Visa hadn’t seen any evidence of consumers pulling back spending in its markets; and Bank of America reported that its customers spent the highest quarterly period on record in quarter two, at $1.1 trillion in total spending. That’s up 12% year-over-year.

The positive US lead also proved to be the case domestically, and the Australian reporting season could be summed up as “not as bad as feared” with slightly better-than-expected earnings.

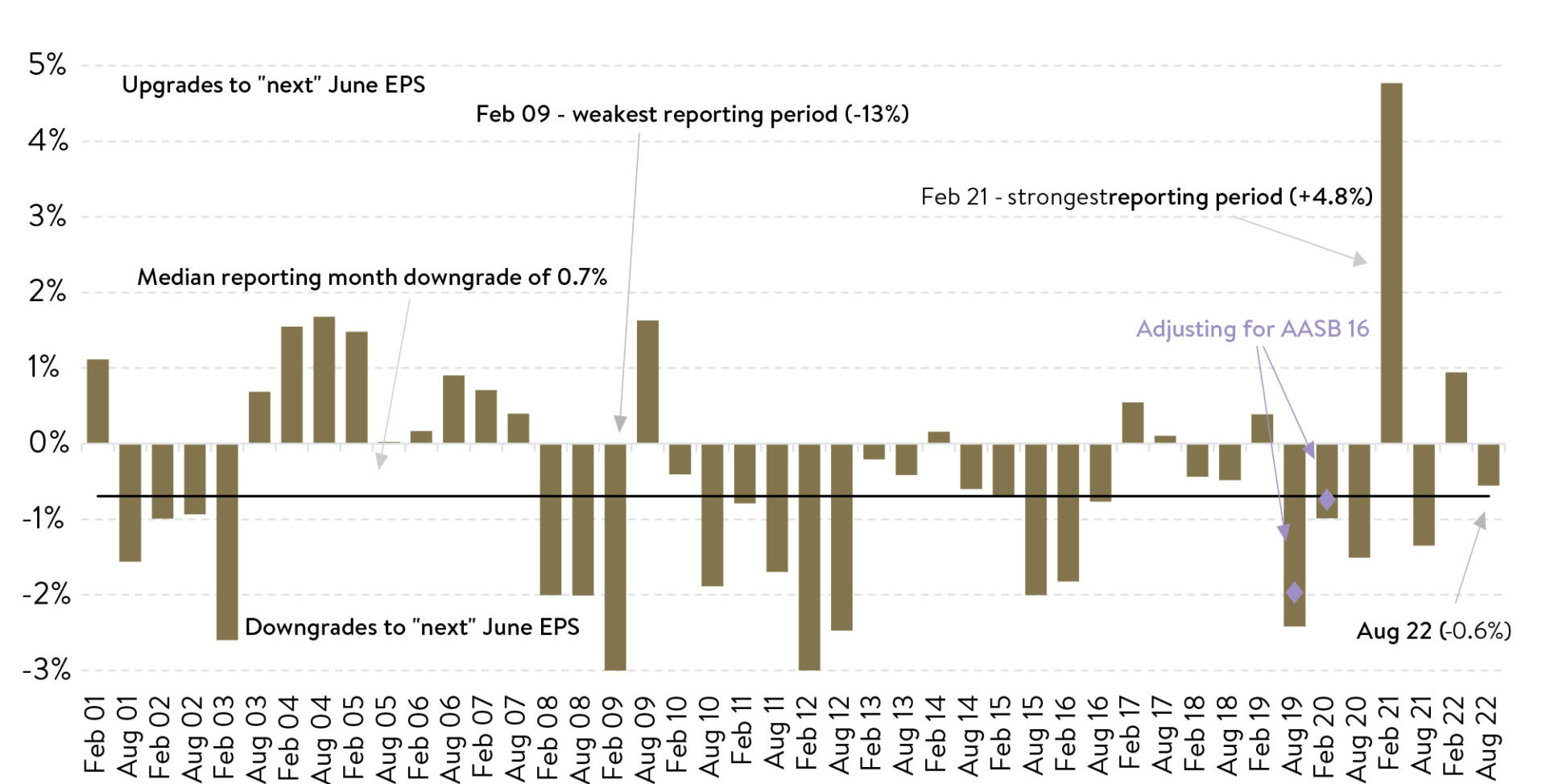

ASX200 Industrials earnings grew 7% over FY22, 0.4% higher than expectations.

ASX 200 companies saw negative revisions to earnings for FY23 of -0.6%, which is pretty much in line with the -0.7% long-term average.

ASX 200 reporting season EPS revisions for the 12 months to next June during a reporting season month (Feb & Aug)

Source: MST Marquee

Consumer wallets still flush

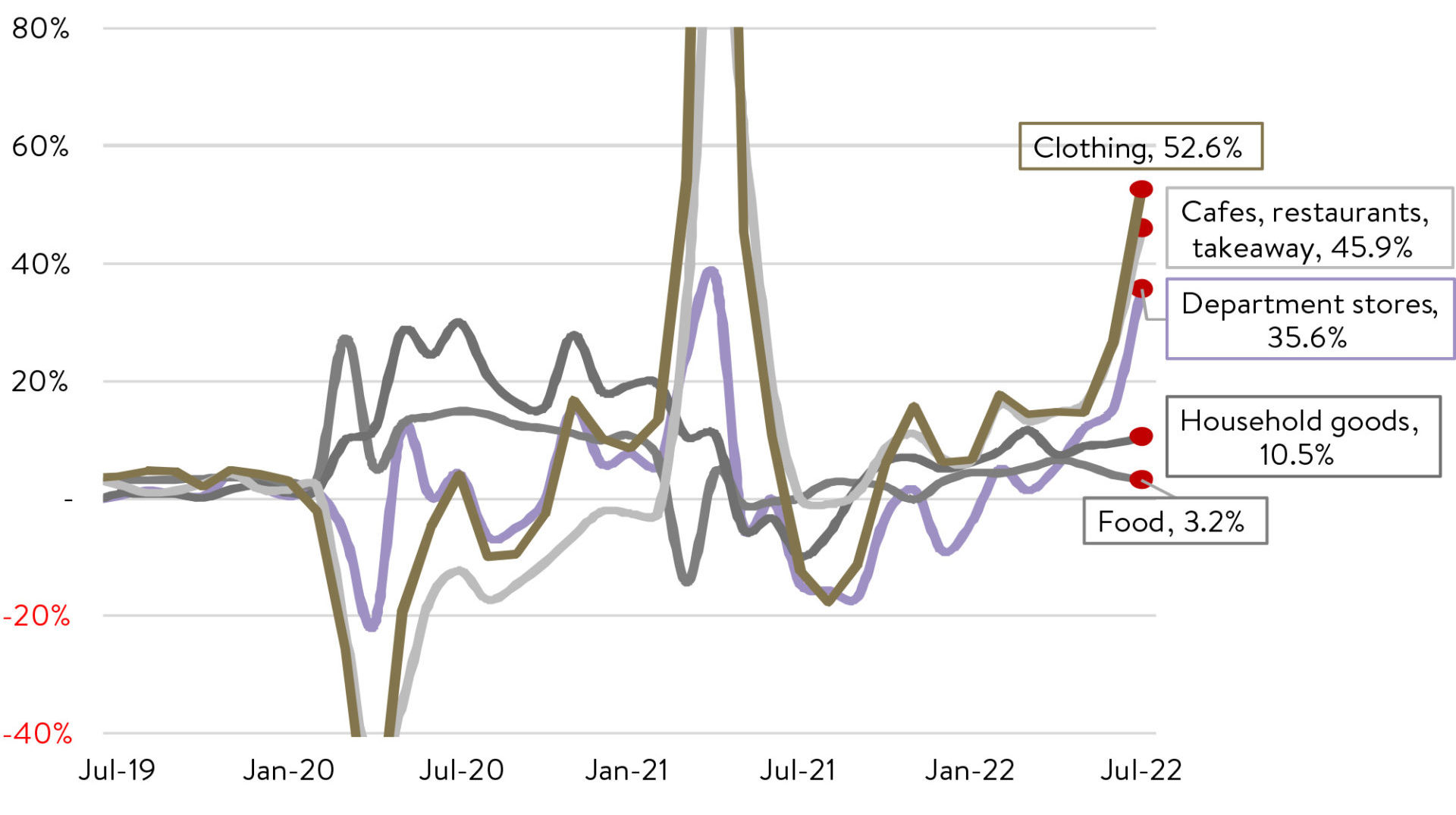

Like the US, the surprising strength of the consumer was one of the standouts of Australian reporting season.

With low unemployment, higher wages growth and savings built up, Aussie households haven’t been shy in putting their debit and credit cards to work. This was confirmed by July’s strong retail sales data with discretionary spending displaying strength (see chart).

Australia retail sales (YoY%) by category

Source: J.P. Morgan, Bloomberg Finance L.P.

Consumer-focussed companies like Lovisa, Wesfarmers, Nick Scali, Super Retail Group and Accent Group all provided strong results. We also saw further revenue upgrades for FY23 from companies like JB Hi-Fi, Nine Entertainment and Star Group.

Bigger tests lie ahead, though, for consumer-facing businesses and corporate Australia in general over the rest of this year. High inflation and rising interest rates are putting pressure on household budgets. Rate increases notoriously have a lagged impact. We can already see early warning signals of more pain to come with consumer confidence in the doldrums and house prices declining.

So, despite the solid earnings season, we may not have seen the worst of the earnings downgrades yet in Australia or the other major overseas share markets we invest into.

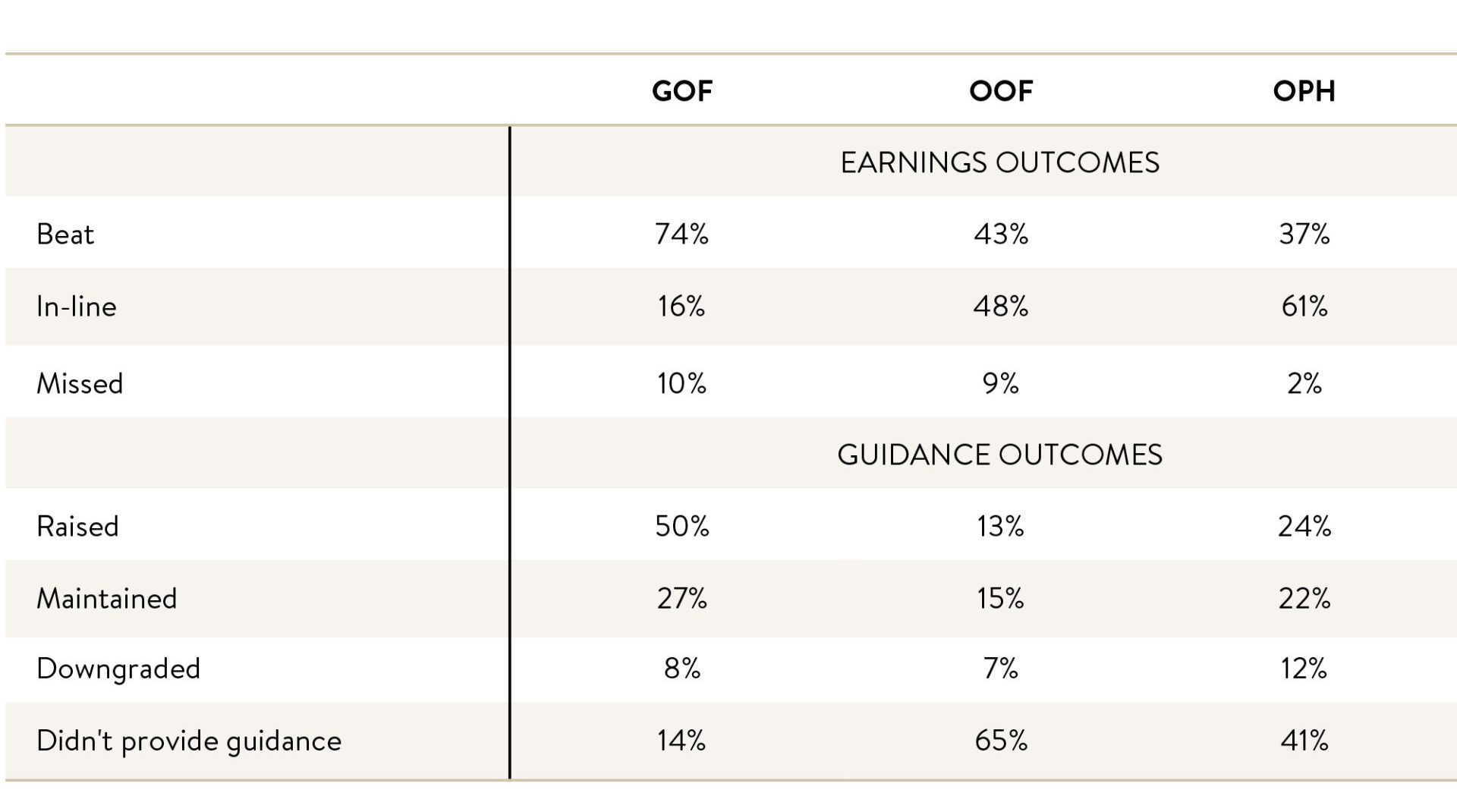

Minimising misses: Our reporting season scorecard

To also help sum up our reporting season we thought we’d take you ‘behind the curtain’ of our internal scorecard.

For each of our Funds, we separate the percentage of those that reported during this reporting season into a Beat, In-Line or a Missed. Beats are >2% above market consensus and Missed are >-2% below market consensus.

Ophir June reporting season scorecard

Source: Ophir

What you can see is a very low percentage of Missed results, which is what we want. Misses, particularly in this environment, are generally sold off on the day of their result and often also over subsequent days and weeks.

What also stands out is the higher percentage of Beats in our global fund. This is nothing to be concerned about from the perspective of our Australian funds. Market consensus for earnings tends to be ‘low balled’ in the US so there are generally more companies beating on their earnings results.

The other stat we provide is the percentage of the reporters that either Raised, Maintained, Downgraded or simply didn’t provide guidance for future earnings.

Given its forward-looking nature, the market often cares more about future guidance than actual results. So, it is important to minimise companies in our portfolio that downgrade guidance because they are usually sold heavily during reporting season.

These results in the table above are important. If we continually get the earnings and guidance results right more than the market, then history suggests ultimately portfolio performance will follow.

Winners and losers

Below we show some of the top common contributors and detractors to performance in August across both of our Australian equity funds, the Ophir Opportunities Fund and Ophir High Conviction Fund.

Australian Funds – August Top Contributors & Detractors

Source: Company Data

One of the largest contributors to performance for the month was AUB Group (ASX:AUB). AUB provides insurance broking, underwriting and risk services in Australasia. The company’s share price rose +14.7% in August on the back of a strong FY22 result and positive guidance.

It, along with Omni Bridgeway (“OBL”), are two of the top holdings in our Ophir High Conviction Fund. Both provide more resilient, less macro-sensitive earnings-growth profiles. They demonstrated this during the GFC where they were two of the top performers.

On the other side of the ledger, one of the largest detractors to performance in August was NextDC (ASX:NXT). NXT provides data centre outsourcing solutions, connectivity services and infrastructure management software. It reported at the top end of guidance but its silence on major contract wins disappointed the market. The company’s share price fell -11.0% over the month.

While we were pleased from a fundamentals perspective on the earnings and guidance outcomes overall from portfolio companies in our Australian funds, they saw mixed returns versus their benchmarks.

The Ophir Opportunities Fund strongly outperformed its benchmark for the month, while the Ophir High Conviction Fund (“HCF”) modestly underperformed. Part of this can be explained by the very strong performance of the mid-cap benchmark during August that the HCF is measured against. The mid-cap benchmark was up 4.3% during August, more than 6x the +0.7% that the small-cap index gained. (The mid-cap index received a big boost from the Materials sector outperformance which is a part of the market we remain structurally underweight.)

4 earnings themes

So, if we step back, what were some of the major themes to come out of reporting season? Here are 4 that we believe are most important:

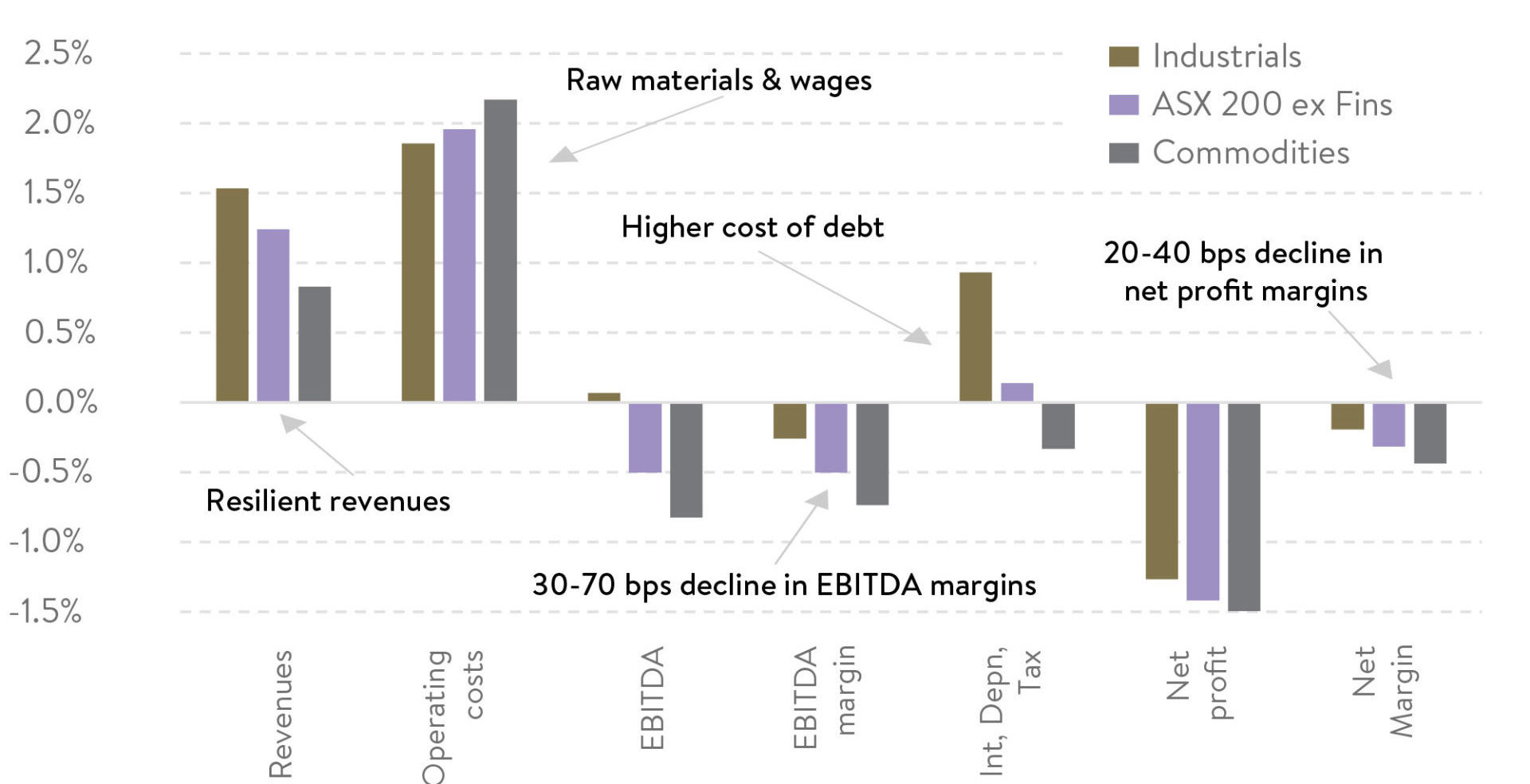

- Revenues held up better than expected and were revised up for FY23. Perhaps this is not too surprising in a high inflationary environment. It does speak to the degree companies were able to pass on some price pressures.

- Operating cost pressures are coming through, the most cited being raw materials and freight costs. There is some evidence, however, that some pressures may be starting to abate with commodity prices falling and supply chain congestion from COVID lockdowns starting to ease. Wages pressure was also a common call out. While it is a bigger issue in the US, Australian wage inflation has picked up and some companies made note of the 5% increase in award wages to start this year.

Revisions to June 2023 P&L line items during reporting period

Source: MST Marquee

- Interest costs are becoming a headwind for industrials that haven’t fixed debt costs. This will intensify as the RBA continues to hike rates and we see the flow-on effect to the economy, albeit with a lag. We saw this play out with some Real Estate Investment Trust (REIT) results, a sector that typically has high gearing levels. The REIT sector had the worst share price performance of any in August, down -3.9%.

- Taken together many companies suffered margin squeezes. One bright side is that companies able to raise prices will likely get some margin and profits payback when cost growth slows/falls, but selling prices remain stickier and are kept high.

Within our wheelhouse: Portfolio Positioning

Given all this, what have we done with our portfolio?

We haven’t made major changes to our portfolio positions across the Ophir funds over the last month.

They remain biased toward businesses with more resilient earnings, which is appropriate during an economic slowdown. We maintain higher-than-usual levels of liquidity with higher cash levels and businesses a little higher up the market cap spectrum (though still clearly in small and mid-cap land). We also think clean balance sheets are a must at present in a sharp interest rate hiking environment.

More recently we have reduced exposure to the very highest growth (and often more expensive) end of the market given the outlook for higher interest rates and a more uncertain macro backdrop.

All companies owned, though, remain well within our wheelhouse.

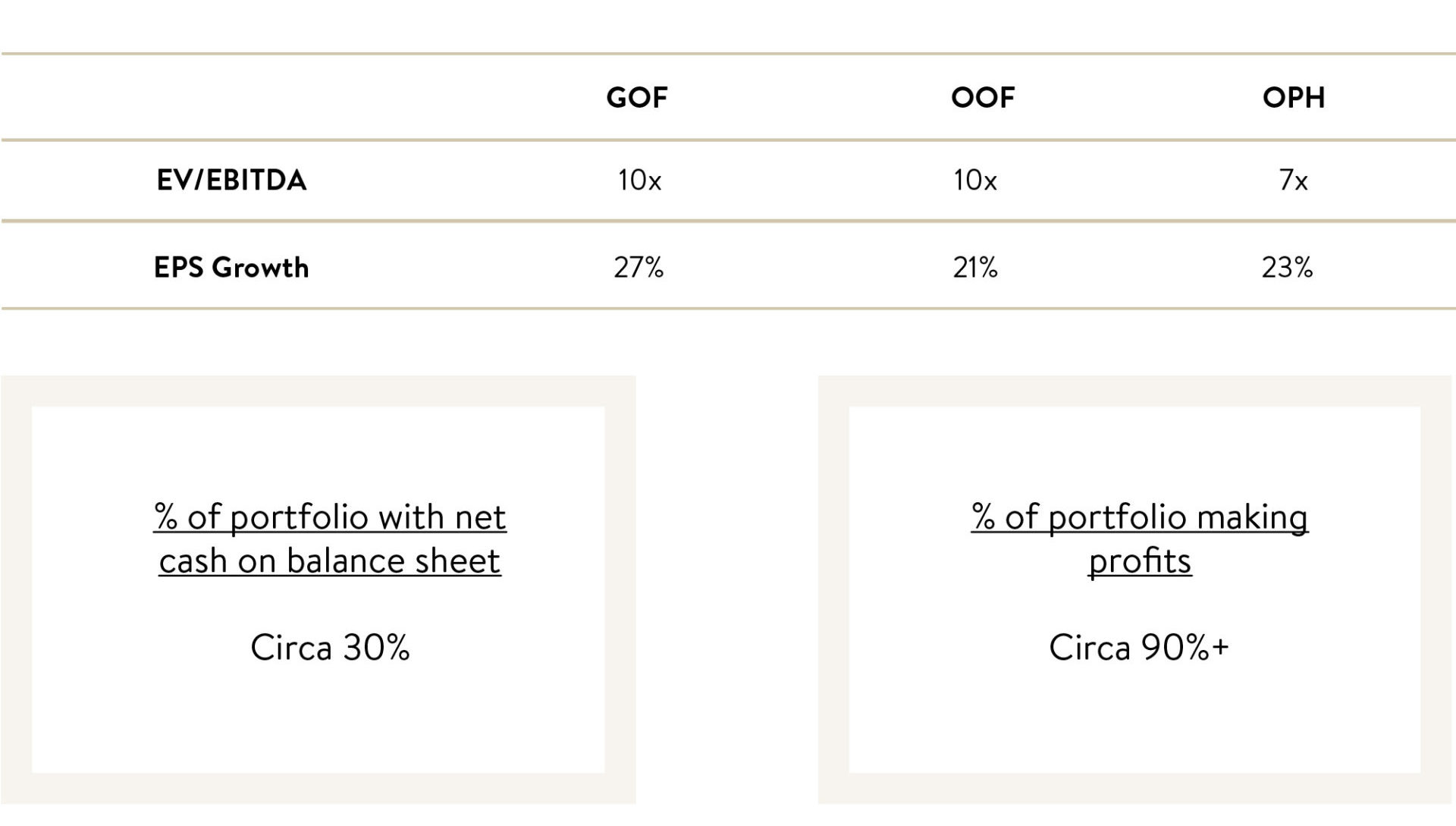

They typically display stronger-than-market earnings growth, attractive valuations, both against peers, the market and their own history, and optionality to grow through strong balance sheets (see table below).

Key Ophir fund metrics

Source: Ophir. Data as of 31 August 2022. EV/EBITDA is the weighted harmonic mean and EPS Growth is the weighted average with a collar of 0 to 50.

And as usual, we are underweight in the more cyclical and value-orientated sectors such as REITs, utilities, financials, energy and materials sectors.

But we are very excited about valuations in small caps, which remain very attractive, particularly in the US.

We believe this will help underpin our ability to generate attractive returns when the market eventually recovers, and more generally over the long term.

History suggests that market downturns, like now, provide some of the best opportunities to buy quality growth businesses at prices you wouldn’t otherwise be able to.

This is an opportunity we are doing everything we can to make sure we don’t miss.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.