By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our August Letter to Investors we take a look at the recent Australian reporting season and examine the four key themes that emerged, as well as asking is this “As Good as It Gets?” this market cycle.

Dear Fellow Investors,

Welcome to the August Ophir Letter to Investors – thank you for investing alongside us for the long term.

As Good as It Gets?

You may remember the 1997 blockbuster hit ‘As Good as It Gets’ starring Jack Nicholson and Helen Hunt (the last movie to take out both Best Actor and Actress awards at the Oscars).

The lead character, Melvin (Nicholson), is a bestselling romance novelist. But because of his acid tongue and OCD, he struggles to form relationships. The plot centres on a key question: Can Melvin overcome his struggles and find everlasting love. Or is Melvin’s old life ‘as good as it gets’?

We were reminded of this movie during August’s reporting season when, after seeing companies post bumper results for last financial year, we began asking: Is this as good as it gets?

In this Letter, we look at some reasons Australian companies won’t find everlasting bumper performances this year, with earnings and share price gains likely to moderate.

We also examine 4 key themes that emerged in August’s reporting season, including ‘reopening’ stocks such as Flight Centre and Star defying Delta; ramped-up rhetoric from CEOs around inflation (should investors worry?); and whether Aussies really are primed to go on a spending spree – particularly given the Government’s ‘pea-shooter’ stimulus – when lockdown ends.

August 2021 Ophir Fund Performance

Before we jump into the letter, we have included below a summary of the performance of the Ophir Funds during August. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +8.1% net of fees in August outperforming its benchmark which returned +5.0% and has delivered investors +26.4% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +11.1% net of fees in August, outperforming its benchmark which returned +4.4% and has delivered investors +21.6% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +0.3% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +1.9% net of fees in August, underperforming its benchmark which returned +3.1% and has delivered investors +41.9% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

One of our best months

It was just a year ago that Australian listed corporates were in serious trouble. Earnings had slumped 20% in the year to June 30, 2020, courtesy of Australia’s first round of lockdowns.

But from that almighty hole, corporate profits have roared back to life. They have surged +30% to June 30, 2021, driven by record-low interest rates, war-time fiscal stimulus, and economic reopening, though in fits and starts.

This August was one the best months for our Australian strategies. Our High Conviction Fund and Ophir Opportunities Fund outperformed their respective benchmarks by 7.4% and 3.9% (gross) each.

It’s natural, therefore, that investors like us were asking: is this ‘as good as it gets’?

The answer is: probably. There are several reasons and signals that both profits and market gains are likely to moderate in FY22.

Miners and banks boost unlikely to repeat

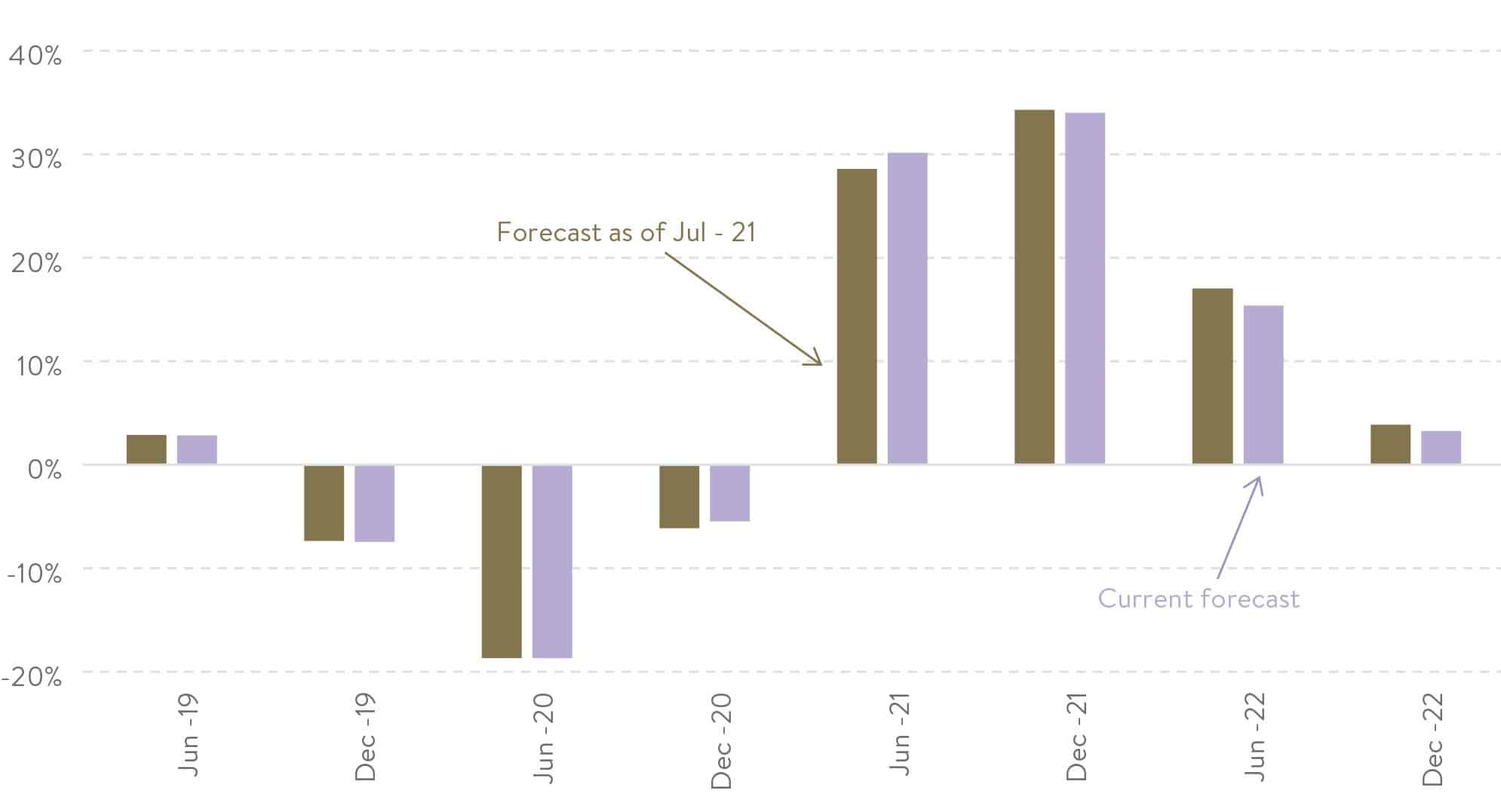

Firstly, as you can see in the chart below profit growth is forecast to slow to around 15% over the next year.

ASX 200 EPS growth and bottom-up consensus forecast

Source: MST Marquee

Iron ore miners probably won’t get a big boost from record iron-ore prices again. And banks won’t benefit from the write-back of loan loss provisions like they did this year, which were originally put in place but largely not needed when the virus first broke out. Indeed, the contribution of the banks and iron ore to earnings growth in FY22 for Aussie equities is likely to slump from three quarters in FY21, to just one third.

15% earnings growth is nothing to be sneezed at, but the cupboard is increasingly bare.

Earnings upgrades ho-hum

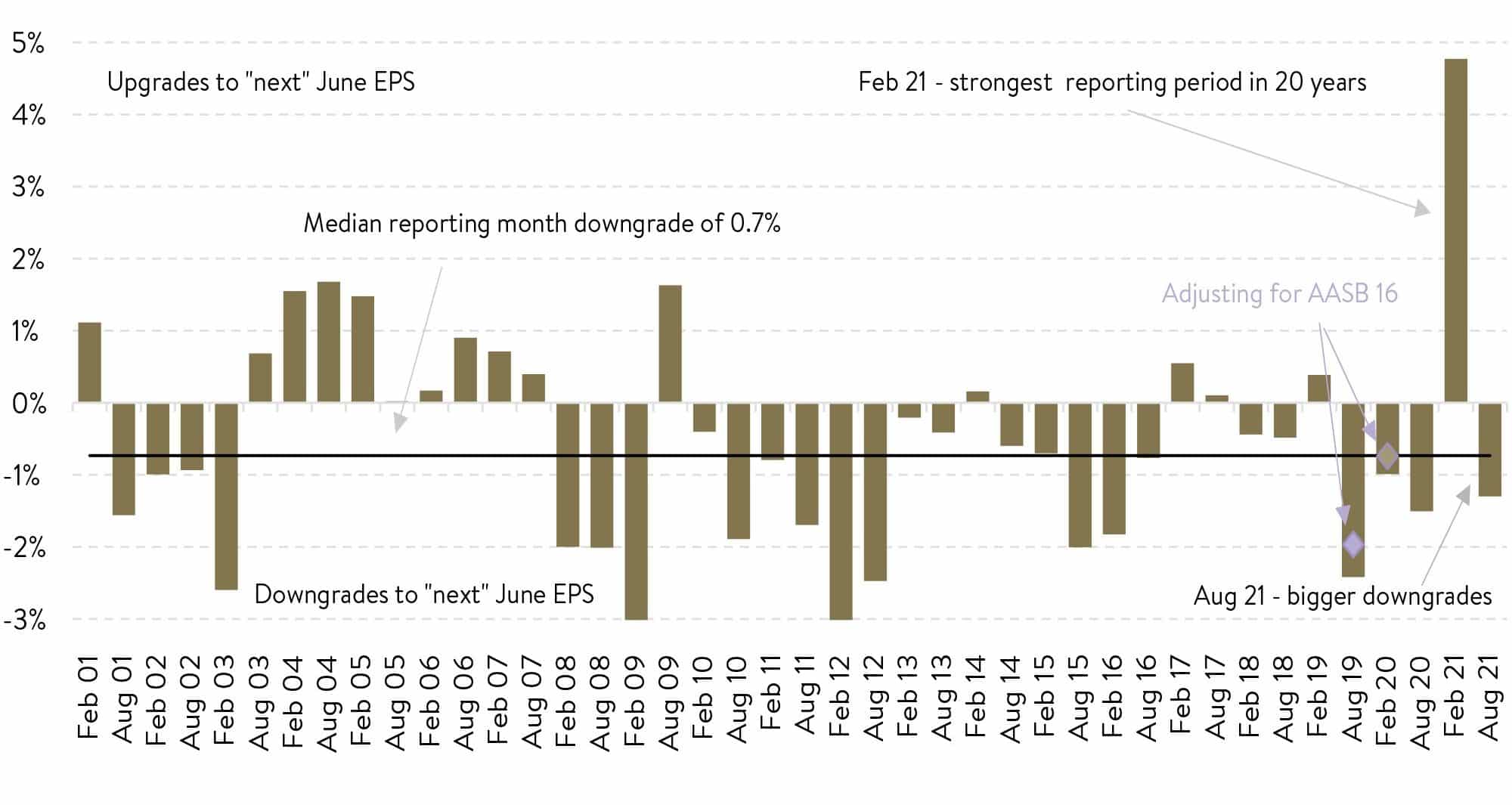

Secondly, despite the strong results in August, analyst earnings downgrades for FY22 were bigger than average.

Reporting season is as much about company’s outlook statements for the year ahead, as it is for their profit results. The strength of these outlooks can be gauged by how much broker analysts revise their earnings forecasts.

The February reporting period earlier this year knocked it out of the park. We saw the strongest analyst upgrades in 20 years. But August was ho-hum. FY22 earnings were downgraded by -1.4%. That’s more than the average -0.7% downgrade seen during these periods (see chart) and another signpost that profits are moderating.

ASX 200 reporting season EPS upgrades/downgrades for the 12 months to June

Source: MST Marquee

Earnings and price recovery normalising

And thirdly, the V-shaped price recovery for the Aussie share market (ASX200) over 2020/21 has led the earnings recovery. We are now a good nine months into a period of earnings expansion (see chart). Investors can still make good gains in this part of the cycle, but those gains are generally moderate, and markets are prone to sentiment-driven pullbacks.

ASX 200 Price & EPS during current cycle

Source: MST Marquee

The 4 key themes from August’s reporting season

Looking back, it’s always helpful to group together key themes that have come out of reporting season as we sit down with the investment team to look at what might be in store for the next year in markets.

Some key ones that caught our eye were:

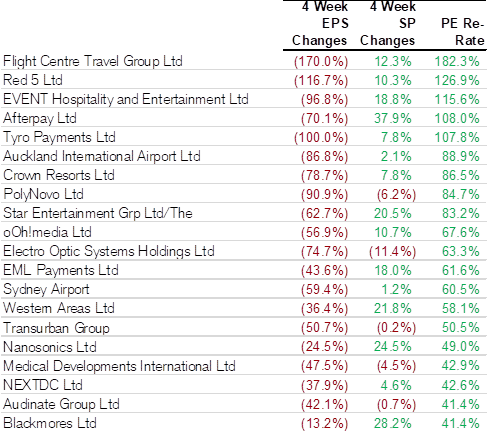

1. Continued support for re-opening theme despite Delta delay

Firstly, companies most exposed to a reopening economy continue to see some of the biggest expansions in their PE ratios (also known as PE “re-rates”).

This includes travel-related companies like Flight Centre, Auckland Airport, Sydney Airport and Transurban; and hospitality and entertainment-related businesses like Event Hospitality, Tyro Payments, Crown Resorts and Star Entertainment.

Investors clearly believe the Delta variant of COVID-19 will delay, not destroy, ‘reopening’ businesses’ profit recovery. Investors are willing to look across the earnings chasm created by current lockdowns in NSW and Victoria.

Source: Credit Suisse

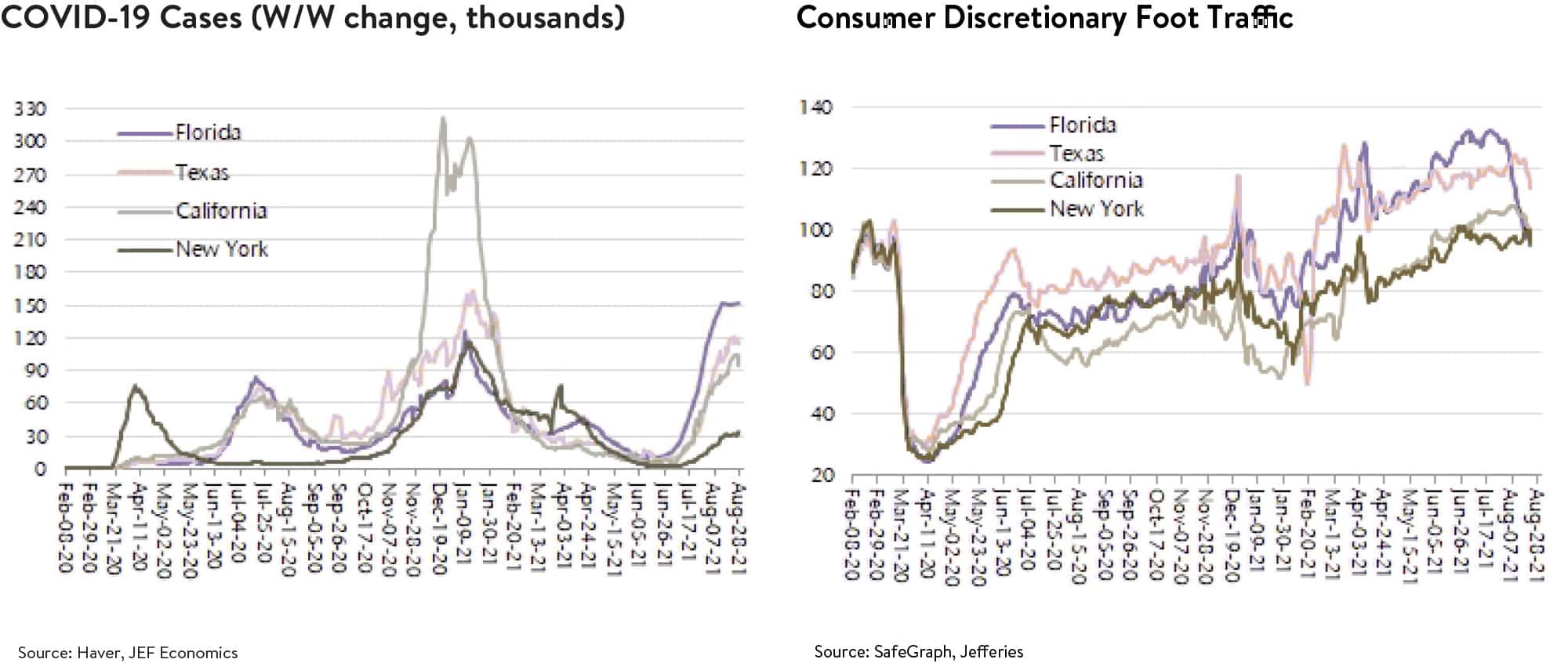

A good ‘canary in the coalmine’ for Australia when we attempt to ‘live with COVID-19’ later this year is the United States. In southern US states, COVID-19 cases worsened with the Delta variant and activity, such as foot traffic in consumer discretionary areas, dropped off. We don’t think, therefore, that a return to normal activity domestically in late 2021 and early 2022 is assured, especially in areas where vaccinations rates are low or slower to ramp up.

Source: Jefferies

2. Covid winners start to lose

On the flip side, some companies that benefitted most from COVID-19 have had the biggest falls in PE ratios (or PE de-rates). This includes companies like Sonic Healthcare and Healius (formerly Primary Healthcare) that process COVID-19 tests. They have had big profit upgrades but muted share price reactions. Another is Reece, the plumbing and bathroom supplier, which benefitted from a surge in at-home spend and home renos during lockdown, but saw a substantial price fall in August despite a profit upgrade.

We think the market will continue to rewards companies more exposed to a reopening domestic economy in the months ahead, despite it likely to be a bumpy and uneven journey. This is very much front of mind for us and is factored into our portfolio construction decisions at present.

3. Yes, it’s time to complain about costs.

Many people often think macroeconomists are detached from reality. And sometimes they are right! But we are seeing economists’ concern about inflation get real support from CEOs during earnings calls this reporting season. A big reason broker analysts have revised profits down for the next year in Australia is rising costs.

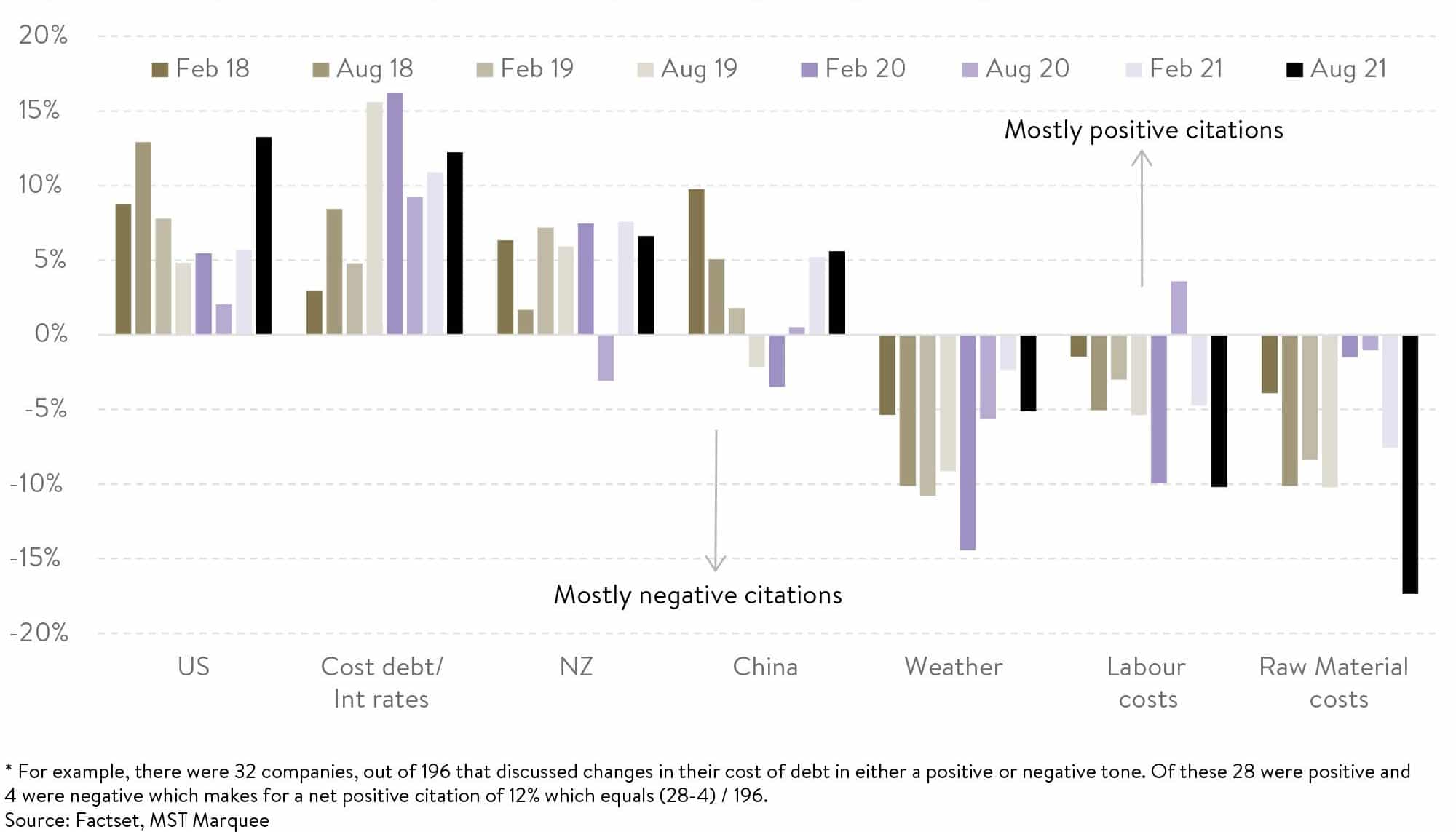

Raw materials (we include freight here) and labour cost problems

Proportion of net positive citations by ASX 300 companies during the Aug-21 earnings calls on revenues and cost items*

Source: Factset, MST Marquee

In August, management teams really ramped up rhetoric around rising labour and raw material (including freight) costs.

Most labour shortages and higher labour costs were companies impacted by border closures in the mining, mining services and construction sectors. That includes Downer, Worley Parsons, Champion Iron and Monadelphous.

Higher freight costs were also a common bugbear from diverse companies such as Nick Scali, Resmed, Baby Bunting and Wesfarmers. They all complained about rising freight costs increasing their cost of goods sold.

Interestingly, companies tend to be managing these cost increases so far. On the freight and raw materials side, they are ensuring they have enough inventory built up in case supply chains become bogged down again. And on the labour side, many companies are looking ahead to reopening in NSW and Victoria. They want to hold onto staff so they have the capacity to meet demand when pent up ‘revenge spending’ takes place when we reopen.

We continue to scan our portfolios to ensure the companyies we invest in have some pricing power in reserve should these higher costs become more pervasive. Still, we think most of these higher costs will prove temporary.

4. Government and households to the rescue?

One of the key reasons corporates have rebounded so quickly in FY21 is the Australian Government’s mammoth support. It was on a scale not seen since World War 2. It mostly covered April to September last year and was designed to help get the economy back on its feet given the nationwide lockdown in the June quarter.

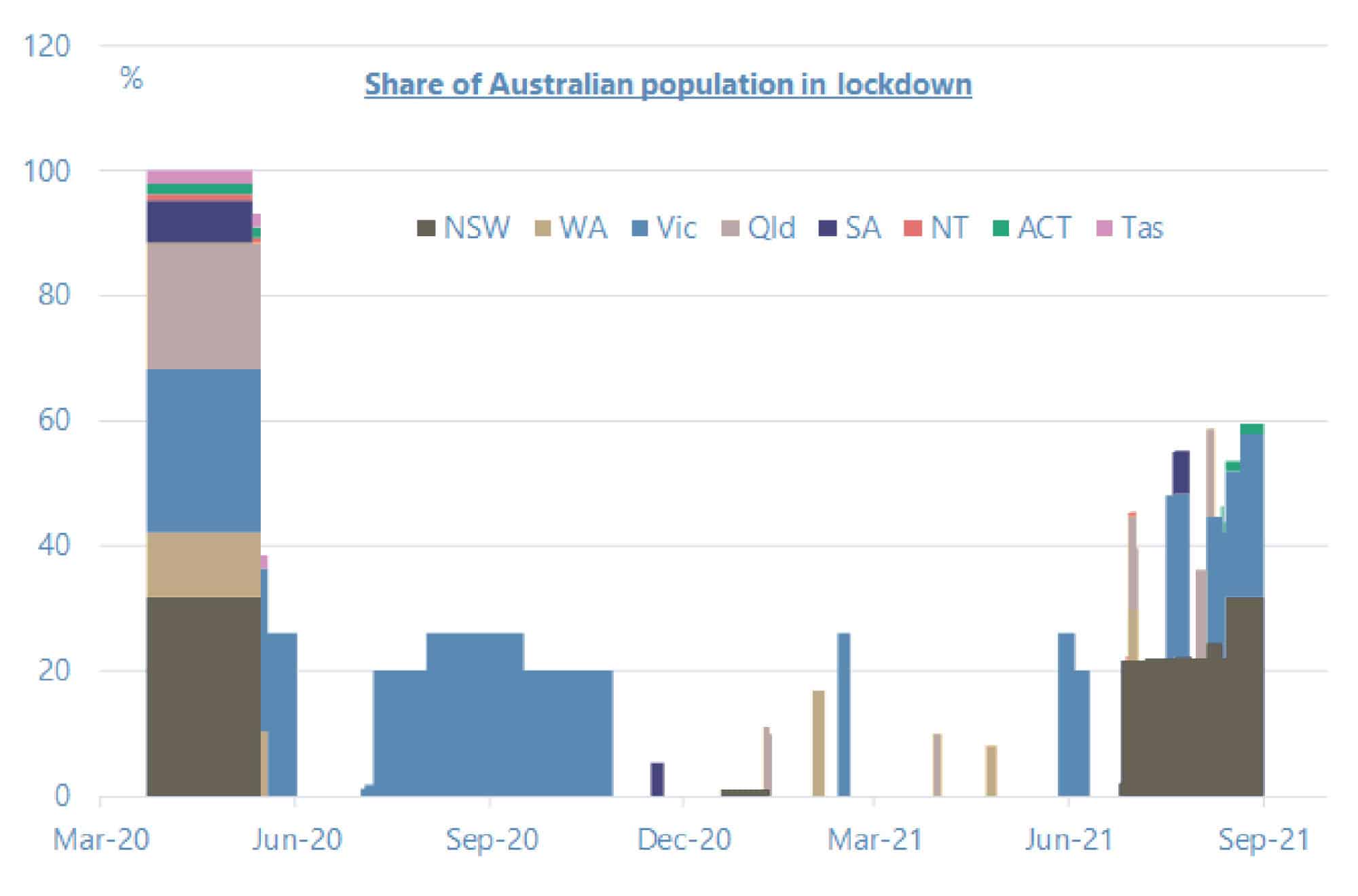

Now in the current NSW and Victorian lockdowns, 60% of the population is back under some of the tightest restrictions in the world (see chart).

60% of the Australia population is now in lockdown

Source: ABS, RBA, State and Territory Governments, Jarden estimates

While there is light at the end of the tunnel, many companies have been reluctant to provide concrete guidance for FY22.

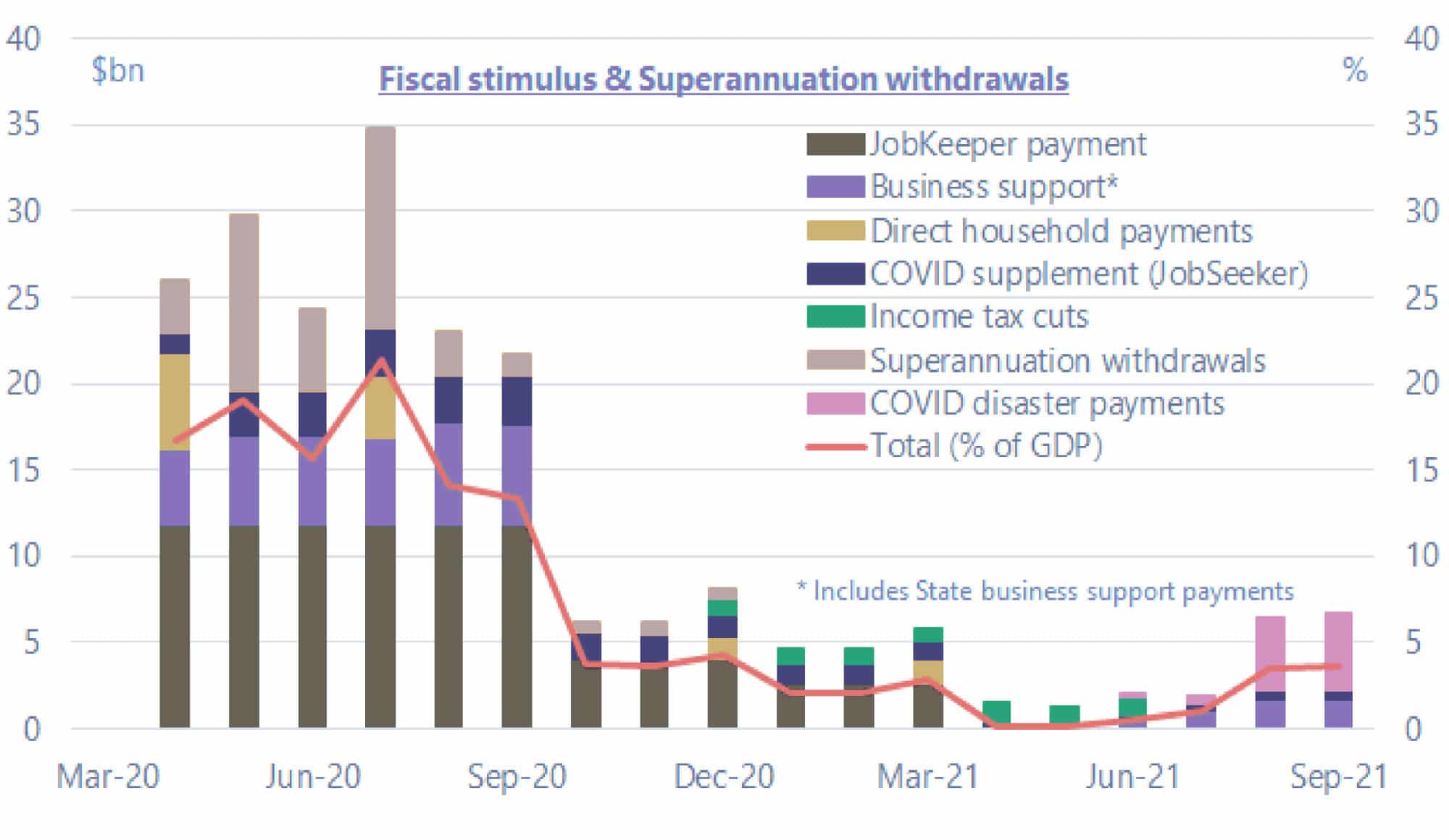

One thing is for certain. The government is there to help, but it will not be providing anything like the kind of support directly to businesses, and indirectly through households, that it provided last year (see chart).

Source: ABS, Australian Governments, Jarden estimates

Business support payments are much more targeted at the non-listed SME segment and are a fraction of those provided in 2020. Individual COVID disaster payments, on a per-employee basis, are closer but still trail what was provided last year.

So, all in all, whilst Australian governments brought the big bazooka in 2020. But so far this year it’s been more like the peashooter!

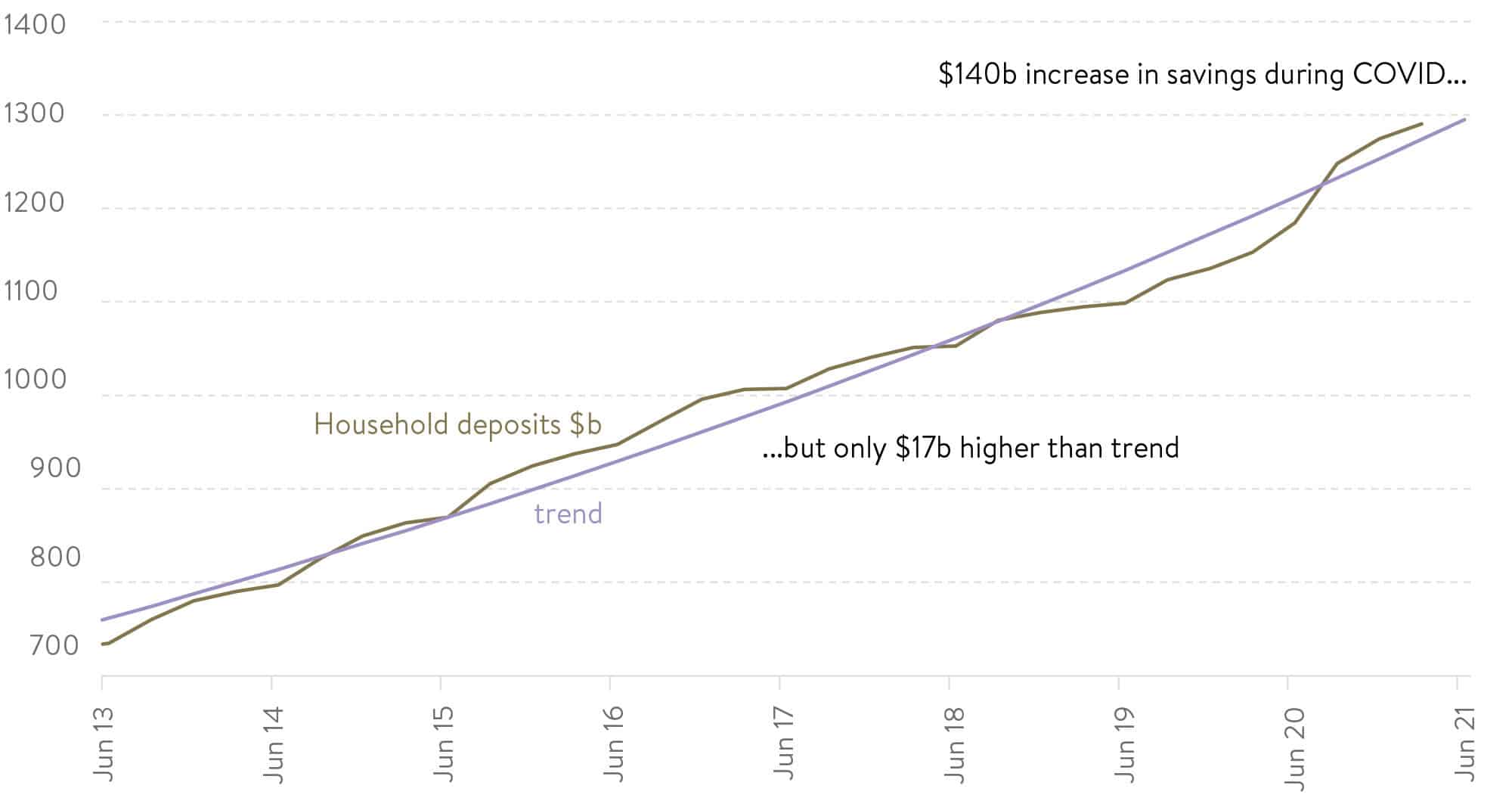

Many have been touting a booming reopening later this year. They cite the war chests households have built up during COVID-19 from over-generous government support. And they argue consumers are dying to give their wallet a workout once they can get out of the house.

There are elements of truth in this. But a good chunk of the 2020 transfers from the government were just replenishing the household piggy bank which got depleted because of the decade low household savings rate seen just prior to COVID-19. In fact, whilst household savings have increased $140bn during COVID-19, MST Marquee estimates this is only $17bn higher than trend.

Savings up but barely above trend

Household deposits (A$b)

Source: MST Marquee

All of this says to us, that the boost to more cyclically orientated companies that are most exposed to domestic demand, such as the shopping centre REITs, might be a little more modest than some are expecting.

So again, we peer forward into the new financial year and, whilst the horizon is a little clearer than this time last year, there is plenty of navigating still to be done as Australia shortly transitions to living with COVID-19.

How we are playing this

Given the outperformance of reopening themed stocks in other countries that are now living with COVID-19, we are at the margin skewing our Australian funds to companies that are exposed to this reopening thematic domestically. Though we’ve been conscious not to be in positions that are overly reliant on government supported demand.

We also believe cyclically orientated businesses are unlikely to get the same boost they did last year on the initial vaccine news given earnings and economic growth momentum appears to be peaking, which sees us with a greater balance between these and more defensive type companies.

Also, with the Fed likely about to start tapering its QE this year, and the RBA about to commence the same, longer term bond yields may start to inch higher again which sees us more cautious on very highly priced, high-growth companies as this often creates a headwind for their share prices.

We must say though we’re excited that this is hopefully the last reporting season we’ll ever do in lockdown! And we’re chomping at the bit to get out and see companies again face to face and discover some new hidden gems.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.