By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our April 2020 Letter to Investors we review what caused markets to rebound, what we’ve been doing about it, and identify some trends emerging in consumer behaviour.

Dear Fellow Investors,

Welcome to the April 2020 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Month in review

“I don’t believe anyone knows what the market is going to do tomorrow, next week, next month, next year.” Warren Buffett at 2nd May 2020 Berkshire Hathaway annual shareholder meeting

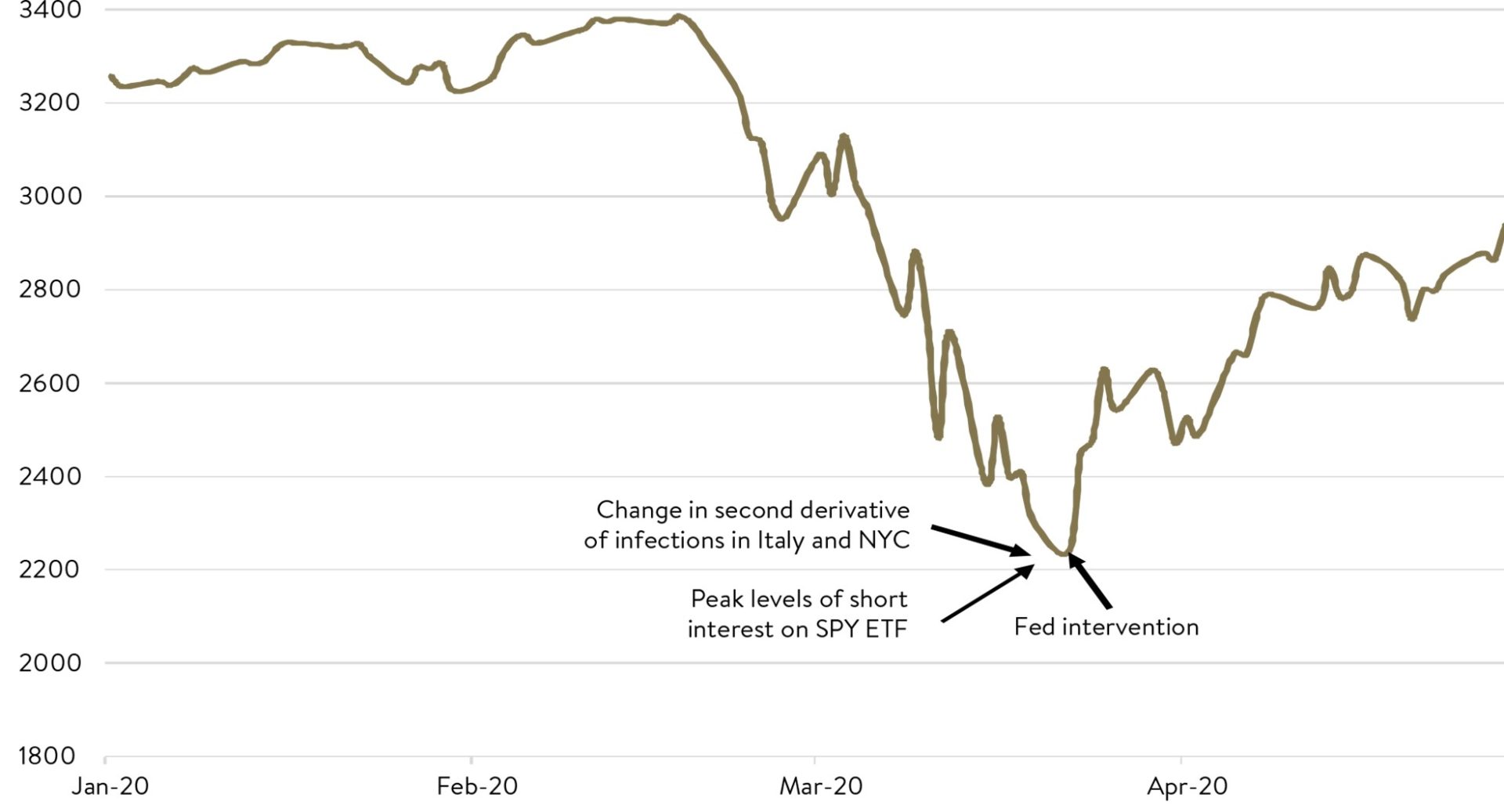

It is easier to believe this from Warren Buffett after one of the fastest bear markets in history in March was followed up by one of its fastest bull markets into April. Who would have known? Though of course Warren has been saying a version of this quote for years, and for good reason. There is scant evidence that anyone has a clear crystal ball over these types of short time horizons.

With the benefit of hindsight we now know that major global sharemarkets came roaring back to life in April on the back of three main events during the month:

- Historic monetary and fiscal support from central banks and governments that has generally, especially on the monetary side, far eclipsed that seen during the GFC.

- Success in “flattening the curve” in COVID-19 cases in countries that have implemented social distancing measures.

- Steps towards re-opening economies that have had the most success in containing the virus.

S&P500 Performance

Source: JP Morgan

This has raised investor questions though. Have sharemarkets gone too far in April, in reversing losses from February and March? Over the next few months there is no doubt that we are going to see some of the worst economic data the world has seen since the Great Depression (1930s). This includes the sharpest falls in GDP, the highest unemployment and the largest contraction in corporate earnings in many countries. Unlike the Great Depression, this crisis is likely to be much shorter, though there will likely be some lasting impacts on consumer behaviour. At the time of writing it appears the market is looking through much of the horrible short-term wave of economic data that we are only just now arriving at. This may be fine and entirely reasonable for those with a long-term view, but we know the market isn’t always the most rational place when uncertainty is high and can overreact on both the downside and the upside.

We admit we don’t know how the market will react in the short term to the poor data we will see over the next few months, but neither does anyone else. As long-term investors though, for us this crisis is as much about ascertaining what long term changes we might see in consumer buying behaviour as it is about avoiding the immediate losers. Remember, the value of a company is the present value of ALL its future earnings stream, not just those in the next year or two. We remain positioned relatively defensively across our strategies, not yet ready to allocate too meaningfully to quality companies that have been in the eye of the COVID-19 storm, though there will come a point for this. We have continued to put capital to work in businesses where we see reasonable earnings clarity at present, minimal or even positive exposure to COVID-19, and at prices that whilst subject to higher than normal levels of short term uncertainty, represent very good value to us on a medium to longer term view. We admit that in the short term, for some investors, volatility can be painful. For us it continues to provide some of the best buying opportunities that we expect will help underpin returns in our portfolios over the next 3-5 years.

Ophir Fund Performance

The Ophir Opportunities Fund returned +16.2% for the month after fees, outperforming its benchmark by +2.0%. Since inception, the Fund has returned +22.9% per annum after fees, outperforming its benchmark by +17.9% per annum.

Growth of A$100,000 (after all fees) since Inception

| Since Inception (p.a.) | 5 Year (p.a.) | 3 Year (p.a.) | 1 Year | FYTD | 3 Month | 1 Month | |

| Ophir Opportunities Fund* | 29.6% | 20.0% | 20.4% | 7.4% | 1.9% | -14.6% | 16.7% |

| Benchmark* | 4.9% | 4.9% | 3.2% | -13.3% | -13.0% | -19.0% | 14.3% |

| Value Add (Gross) | 24.6% | 15.1% | 17.1% | 20.7% | 14.9% | 4.4% | 2.5% |

| Fund Return (Net) | 22.9% | 15.6% | 16.9% | 1.8% | -2.2% | -15.8% | 16.2% |

* S&P/ASX Small Ordinaries Accumulation Index (XSOAI). Past performance is not a reliable indicator of future performance

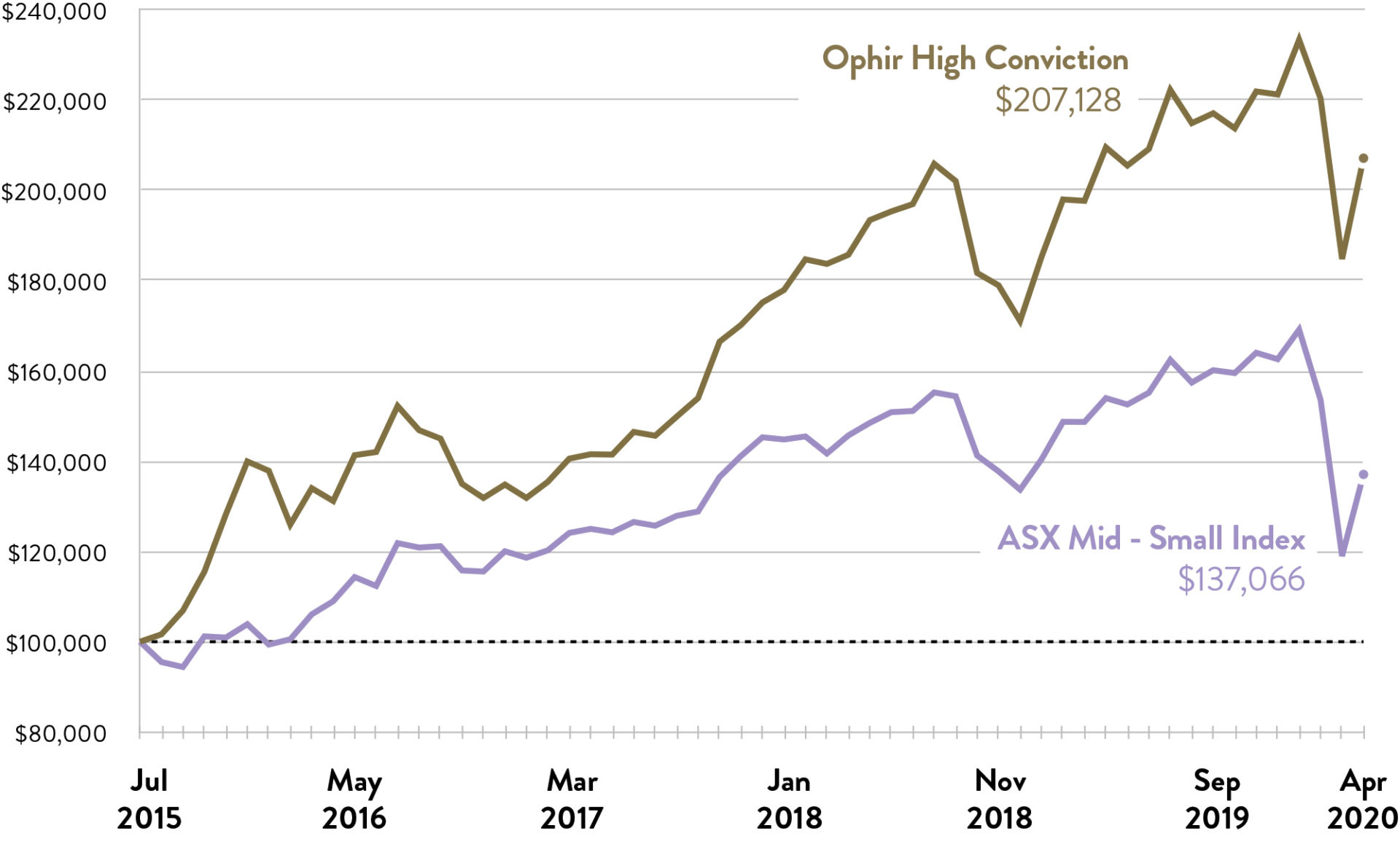

The Ophir High Conviction Fund investment portfolio returned +12.1% for the month after fees, underperforming its benchmark by +3.1%. Since inception, the Fund’s investment portfolio has returned +16.6% per annum after fees, outperforming its benchmark by +9.7% per annum. The Ophir High Conviction Fund’s ASX listing provided a total return of +18.6% for the month.

Growth of A$100,000 (after all fees) since Inception

| Since Inception (p.a) | 3 Year (p.a.) | 1 Year | FYTD | 3 Month | 1 Month | |

| Ophir High Conviction Fund (Gross) | 21.6% | 17.3% | 3.8% | 3.9% | -8.1% | 11.4% |

| Benchmark* | 6.9% | 3.1% | -11.0% | -11.7% | -19.0% | 15.2% |

| Gross Value Add | 14.8% | 14.2% | 14.7% | 15.6% | 10.9% | -3.8% |

| Ophir High Conviction Fund (Net) | 16.6% | 13.5% | -1.1% | -1.0% | -11.2% | 12.1% |

| ASX:OPH Listing Total Return | n/a | n/a | -8.5% | -4.8% | -13.2% | 18.6% |

* 50% S&P/ASX Small Ordinaries Accumulation Index (XSOAI), 50% S&P/ASX Midcap 50 Accumulation Index (XMDAI). Past performance is not a reliable indicator of future performance

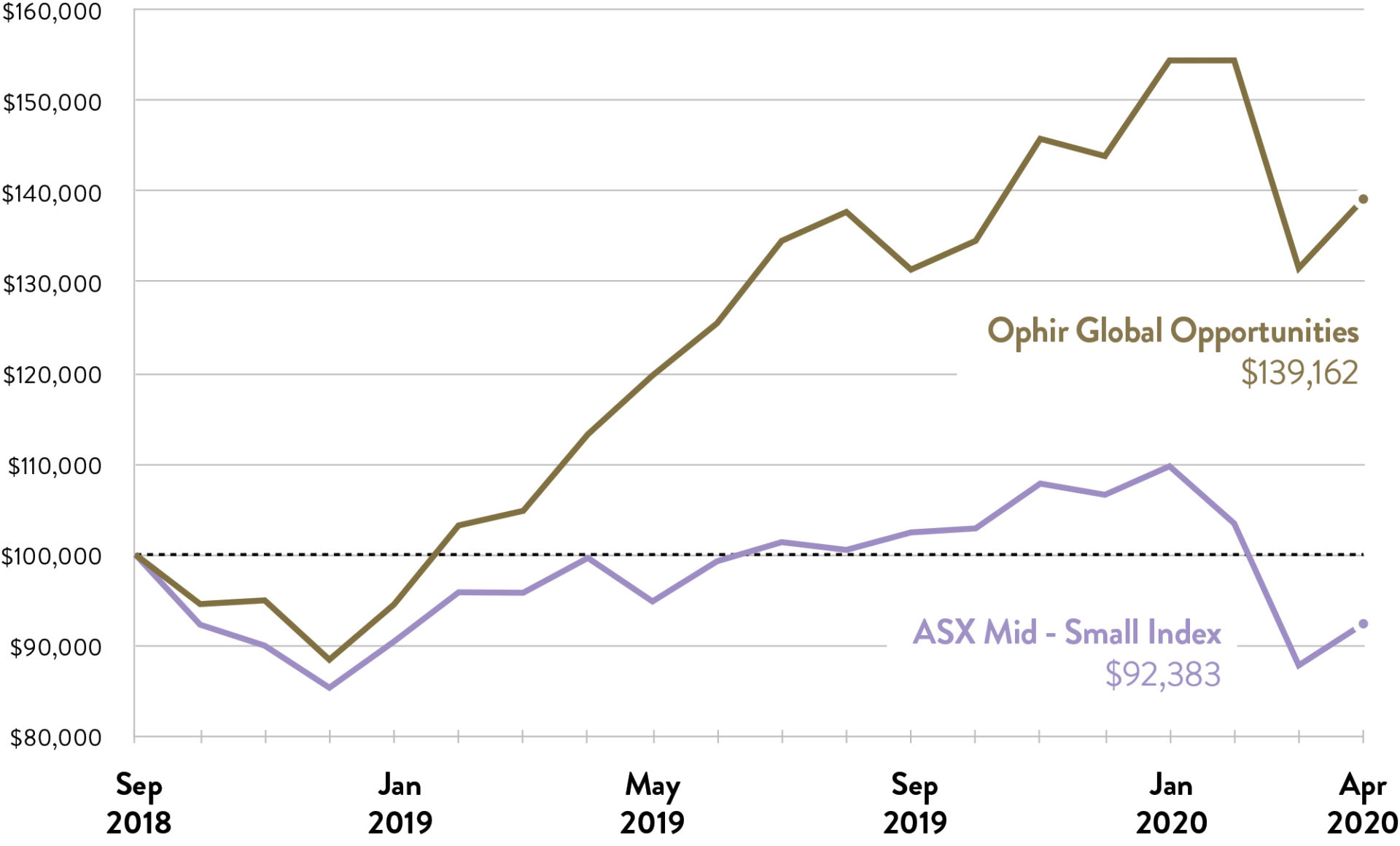

The Ophir Global Opportunities Fund investment portfolio returned +5.8% for the month after fees, outperforming its benchmark by +0.6%. Since inception, the Fund’s investment portfolio has returned +23.3% per annum after fees, outperforming its benchmark by +28.1% per annum.

Growth of A$100,000 (after all fees) since Inception

| Since Inception (p.a) | 1 Year | FYTD | 3 Month | 1 Month | |

| Ophir Global Opportunities Fund (Gross) | 33.1% | 33.1% | 17.0% | -7.9% | 5.9% |

| Benchmark* | -4.9% | -7.3% | -6.9% | -15.8% | 5.2% |

| Gross Value Add | 38.0% | 40.4% | 23.9% | 7.9% | 0.7% |

| Ophir Global Opportunities Fund (Net) | 23.3% | 22.9% | 10.9% | -9.9% | 5.8% |

* MSCI World SMID Index (Net) (AUD). Past performance is not a reliable indicator of future performance

Macroeconomic and market highlights

Both experts in investing and epidemiology are used to exponential growth. Anything that grows at a constant rate has its level grow exponentially, whether that be the dollar value of your investment portfolio or the number of COVID-19 cases. Starting investing or social distancing measures earlier can have profound impacts on your ending wealth at retirement or the peak in the number of virus cases. In the case of the latter, we are seeing the very real impact on a country by country basis of being a week or a month too late in responding to the virus on the number of cases, deaths, excess demand for ICU capacity and extent and duration containment measures need to be in place.

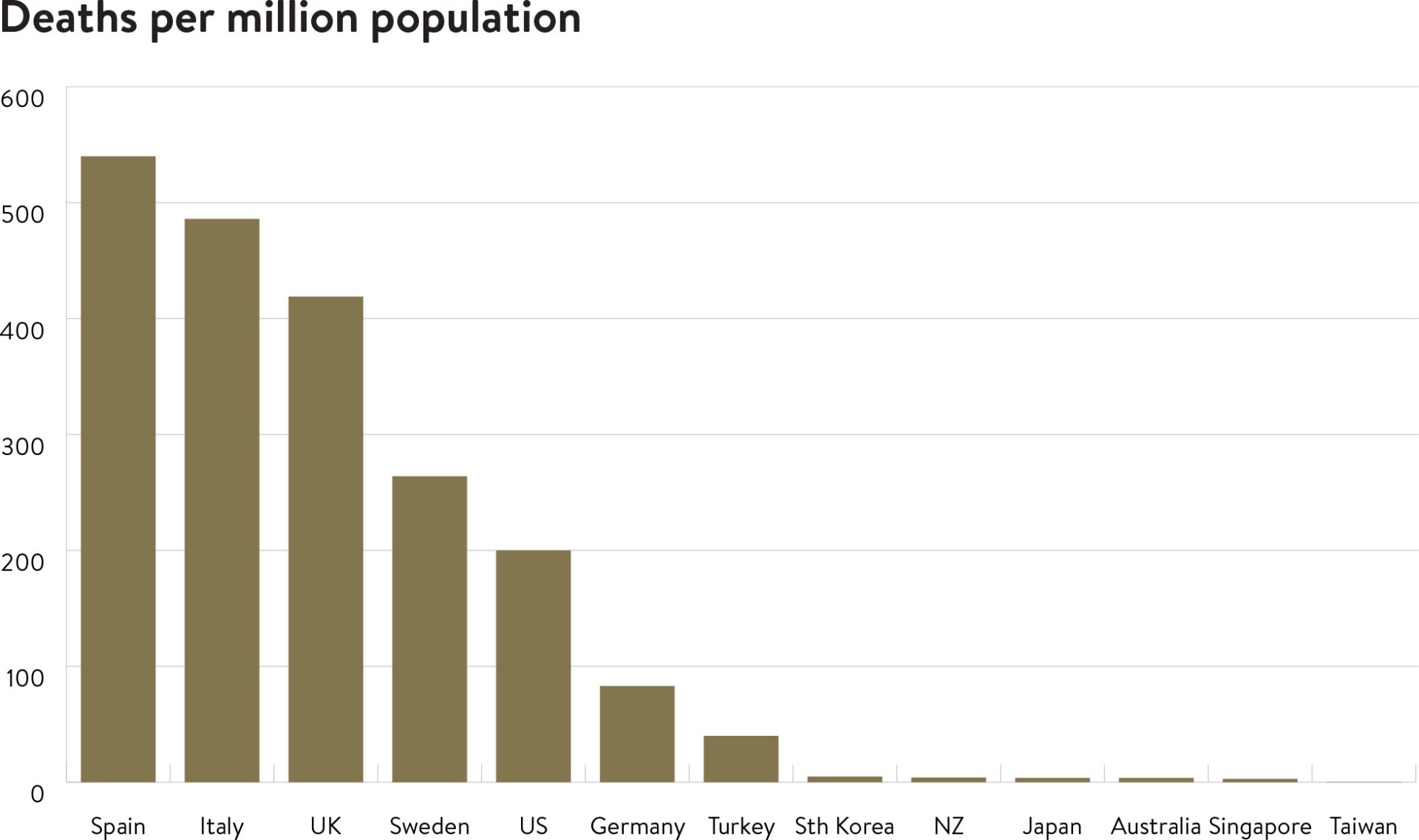

Australia has again lived up to our “lucky country” reputation (although significant credit should be given to good planning) in our ability to avoid the worst health outcomes from the virus (see chart below).

Deaths per Million Population

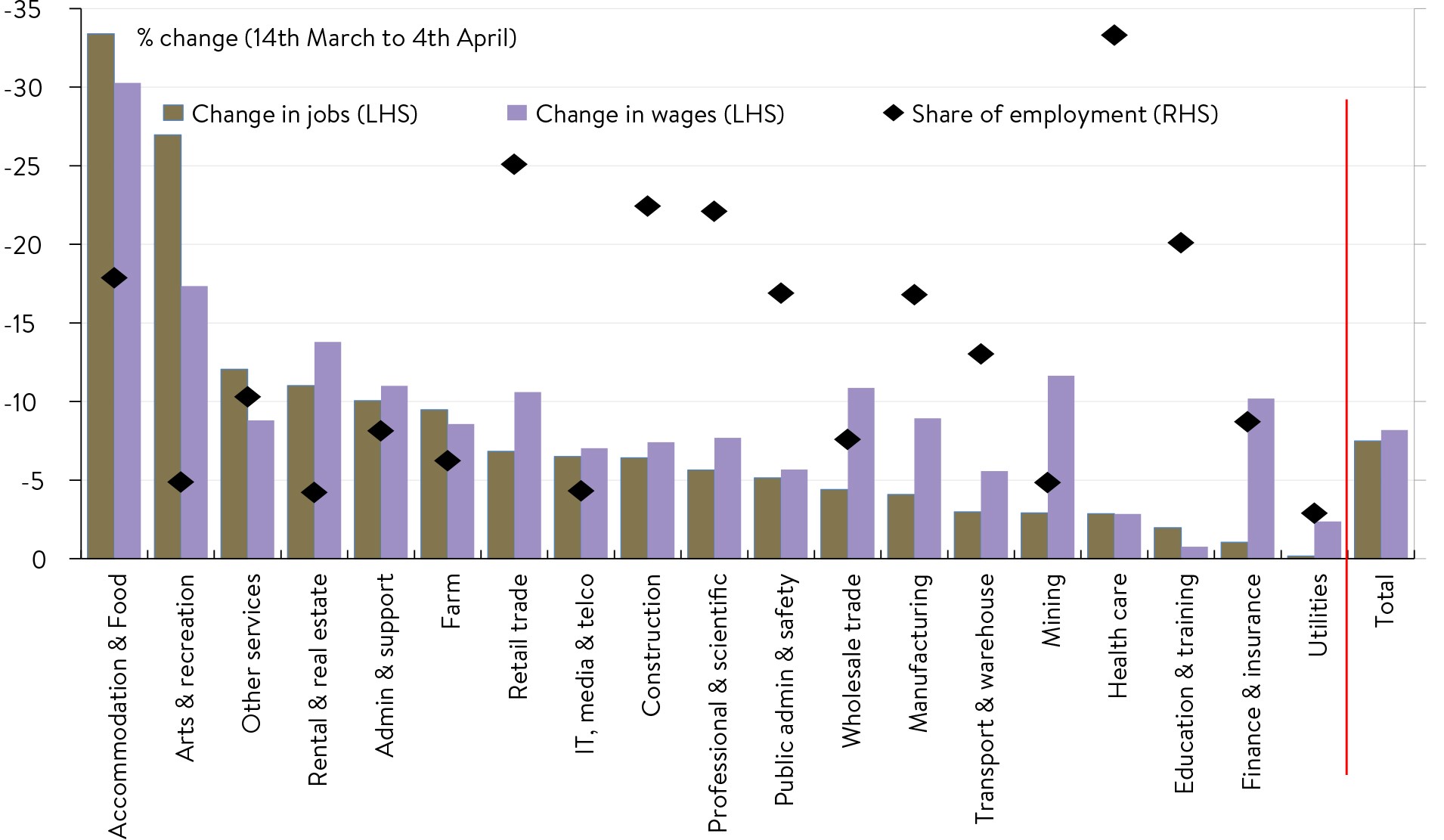

The economic impacts though as a result of lockdown measures are significant. There is a myriad of ways to show this in the data, but below we show the job and wage outcomes from weekly payrolls in Australia. As expected, the outcomes are worst in accommodation and food as well as arts and recreation industries, though all are seeing a hit.

Source: ABS, UBS

Lockdowns are beginning to ease in those FIFO (first in, first out) countries and those with the earliest responses, though we see a return to normal some way off given the threat of reinfection in the absence of a vaccine or herd immunity. Economic and corporate earnings data may begin to improve in some countries in the September quarter of this year though we see a snap right back as highly unlikely. We remain watchful of the less spoken about impact in emerging and developing economies (ex-China). Many have a reduced ability to implement social distancing measures and are more susceptible to sovereign debt defaults, but are often intricately interwoven into global supply chains and provide a disproportionate share of global growth at present.

Early emerging trends from the virus crisis we are seeing are some companies and industries having their tailwinds intensified. Examples include almost anything e-commerce related, health care products and services, in-home entertainment (including video streaming and gaming) and home delivery (particularly food and grocery related). On the flip side landlords will likely continue to see pressure in the retail and office space as people resort to buying more online, reducing the need for shop footprints, and employers re-evaluating how much workspace they need as the work-from-home trend accelerates.

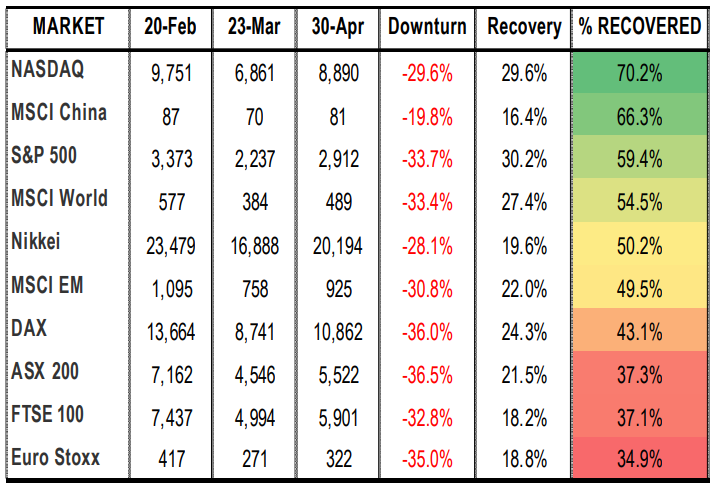

Turning to markets one interesting trend that we saw play out over April was the differentiation in recovery across markets. As seen in the table below, the Chinese (MSCI China) and US sharemarkets (S&P500), and in particular the US tech segment (NASDAQ), has seen the strongest recovery. Australia (ASX200) however has been a standout laggard.

Source: JP Morgan

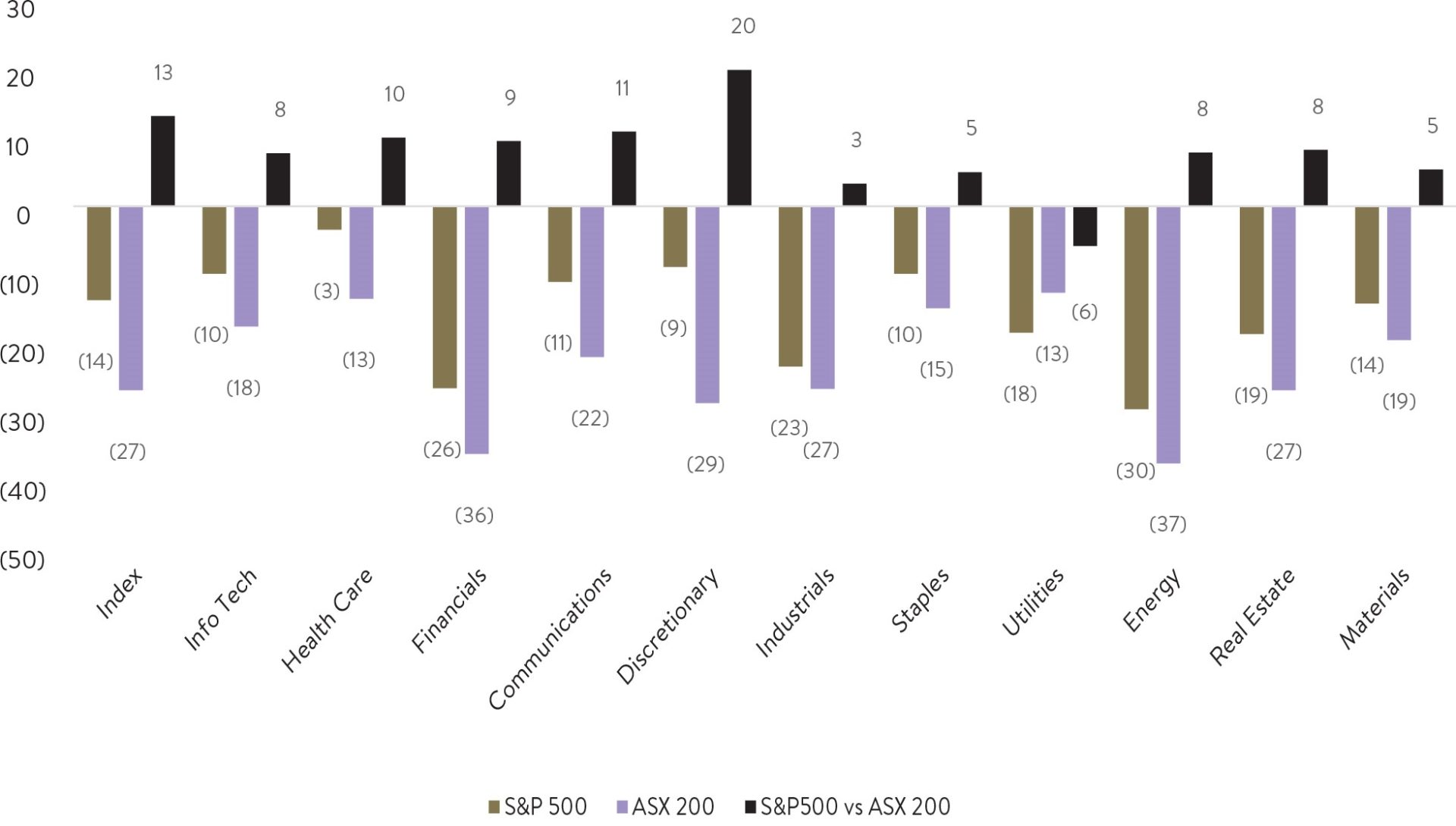

This stems from firstly that every sector (ex-Utilities) in the US has outperformed Australia (see chart below). Secondly, from index sector composition with Financials, a relative underperformer during COVID-19, is a much larger portion of the Australian market, whilst IT has done comparatively better and dominates the US sharemarket. Equity raisings have also created a small relative headwind with 28 ASX listed firms raising circa $17bn at an average price discount of 16%.

From February’s peak, the ASX200 is down 27% vs S&P500 down 14%.

Source: Bloomberg, Goldman Sachs

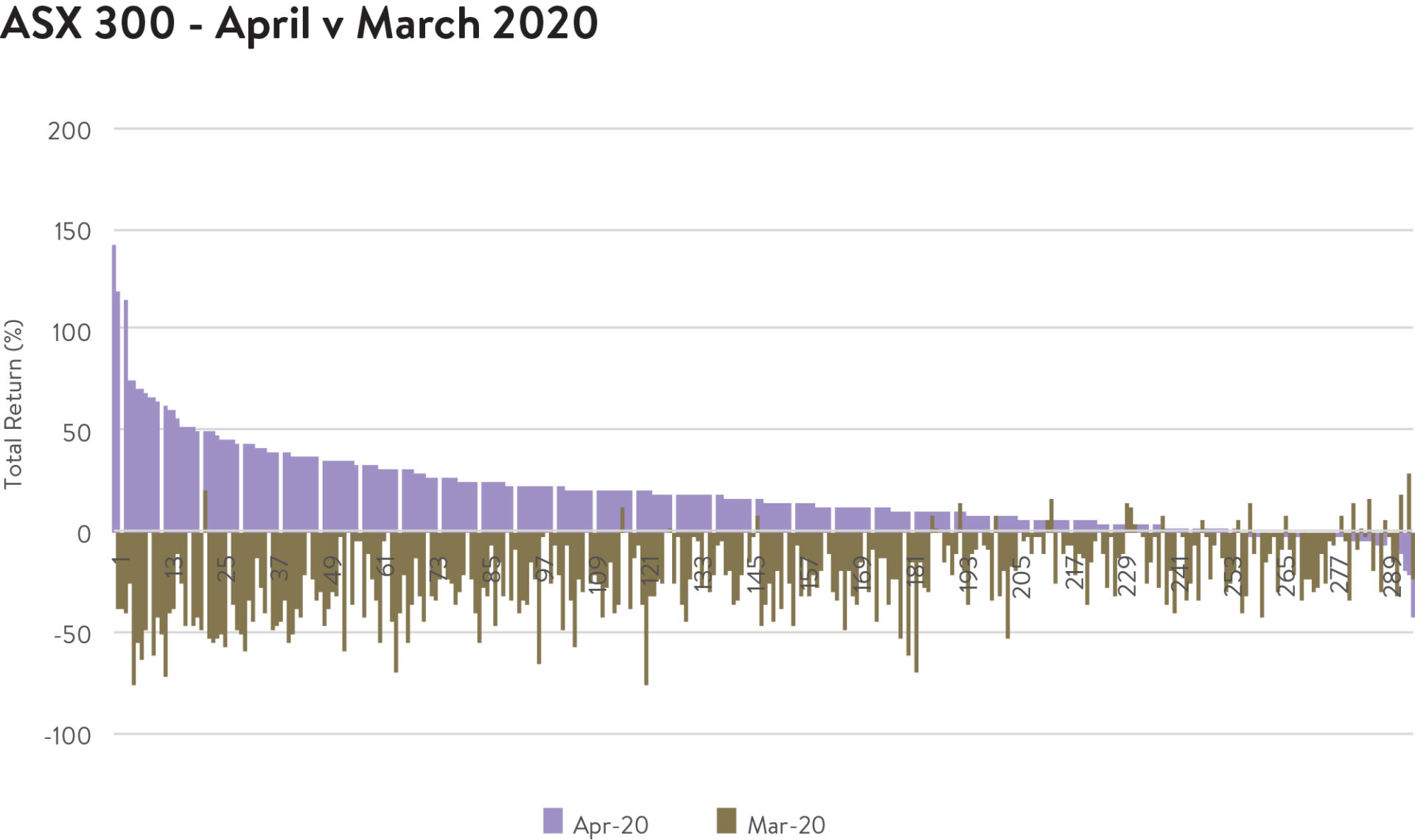

It wasn’t just across the board gains for sharemarkets in April, it was also the case for underlying stocks. Below we show the top 300 stocks on the ASX sorted by their highest to lowest total returns for April in blue. In orange we show their equivalent gains or loss for March. Your Australian equity fund manager could be forgiven for posting a negative return in March, almost everything went down (92% of companies did). Likewise, it would be highly concerning if they logged a negative return in April as almost everything went up (86% of companies did). This goes to show the more pronounced impact of COVID-19 on markets as opposed to stock specific news, with those falling the most in March tending to rise by an above average amount in April. This often saw more low quality, highly geared companies or those most impacted by COVID-19 rally strongly over the month. This is one trend we are happy to miss out on in the short term, as we pursue higher quality, long term structural growers.

ASX 300 – April v March 2020

Source: Ophir, Bloomberg.

We haven’t been making major moves in our cash exposures in our Australian or global equity strategies to try and time these market inflection points. As we alluded to in our opening Warren Buffett quote, we believe trying to derive the major portion of your returns from this activity is a fool’s errand. Those that did go to cash in mid-March at peak fear would have missed the 20-30% subsequent rebound. Could the market still create new lows this year and this significant move to cash turn out to be a good one…..perhaps. Though it is not one we’d want to bet the house on.

We’d rather stick to our knitting where our advantage lies. This is in conducting fundamental bottom up research to get an “edge” on understanding a company better than the market and our competitors. Then putting capital to work in those we believe are mispriced either via better than expected prospects or trading at cheaper than fair prices for those prospects. Volatility creates the opportunity to identify these mispricing. History and experience indicate this heightened volatility will not be here indefinitely, so we remain as hard working as ever to make sure this opportunity is not lost, and we can take full advantage.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.