Roses are Red, Violets are… Also Red

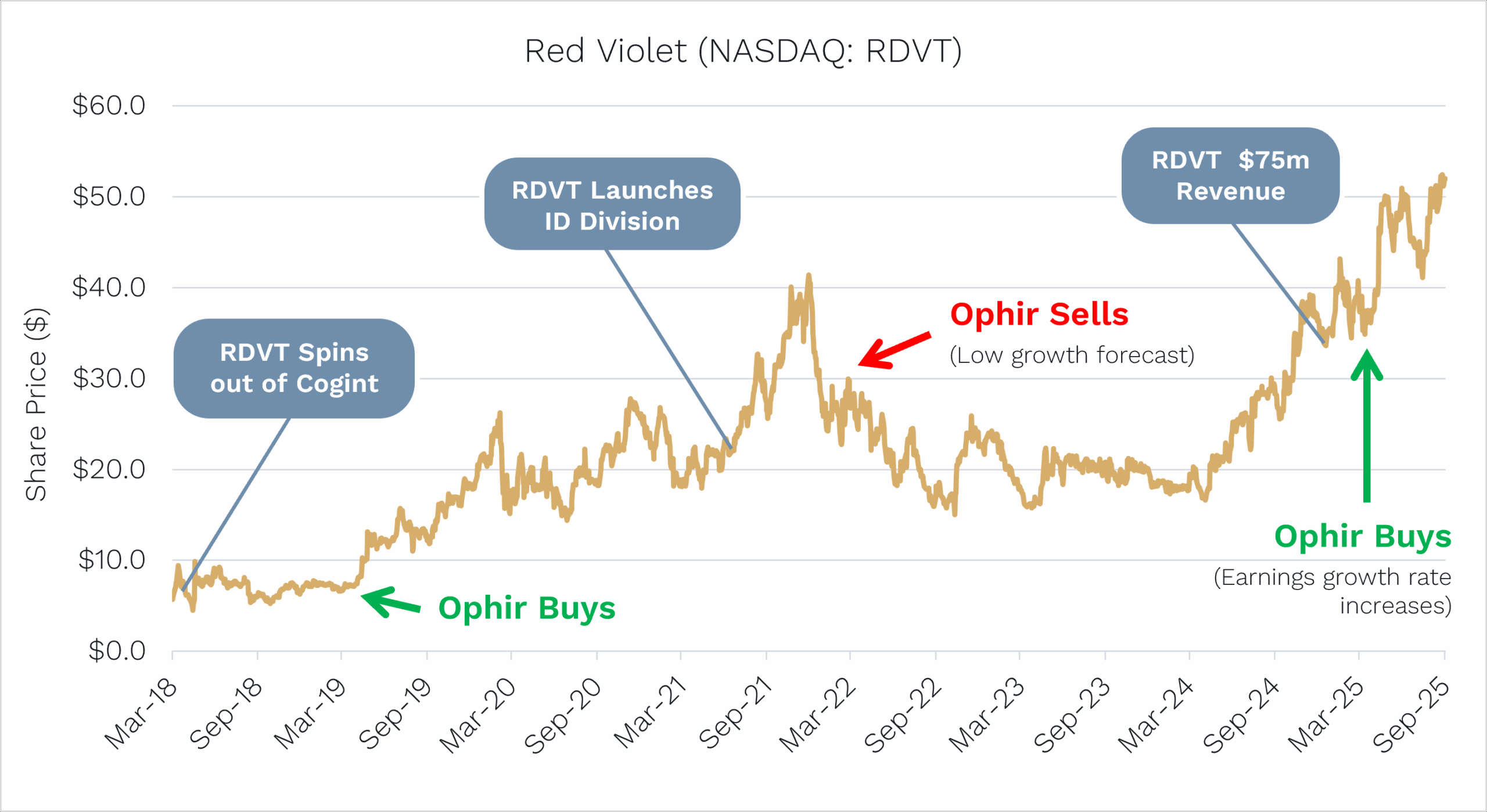

At Ophir, we leave no stone unturned. During our extensive travel and company visitation programs, we hate leaving any meeting slot unfilled. And that’s exactly what led us to Red Violet all the way back in 2018.

While on a fact-finding mission to Florida to see larger listed and core portfolio companies, this obscure, $100m data analytics company accepted our meeting request.

Within a year, after a full deep dive into the industry, we made our first investment and reinvested in the company earlier this year as we gained confidence growth rates could reaccelerate to above 20%.

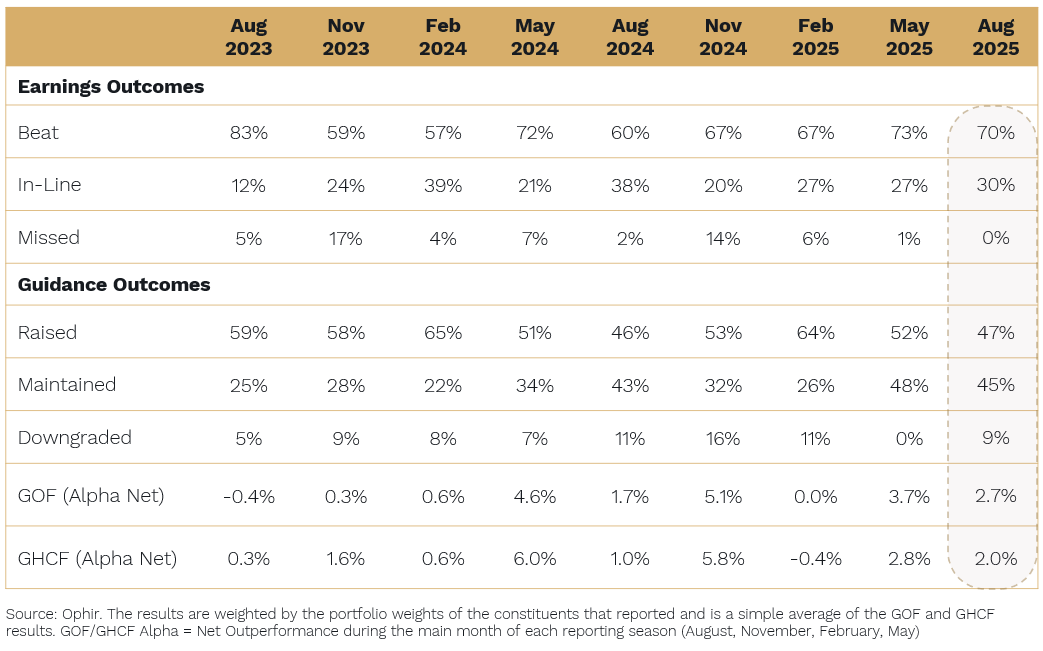

Source: Ophir, Bloomberg. Data as of 30 September 2025.

Red Violet is a leading provider of identity verification and fraud prevention analytics. It applies proprietary models to massive, multi-source datasets to help clients across financial services, insurance, real estate, legal, and government uncover who they’re really dealing with in real time, with high accuracy.

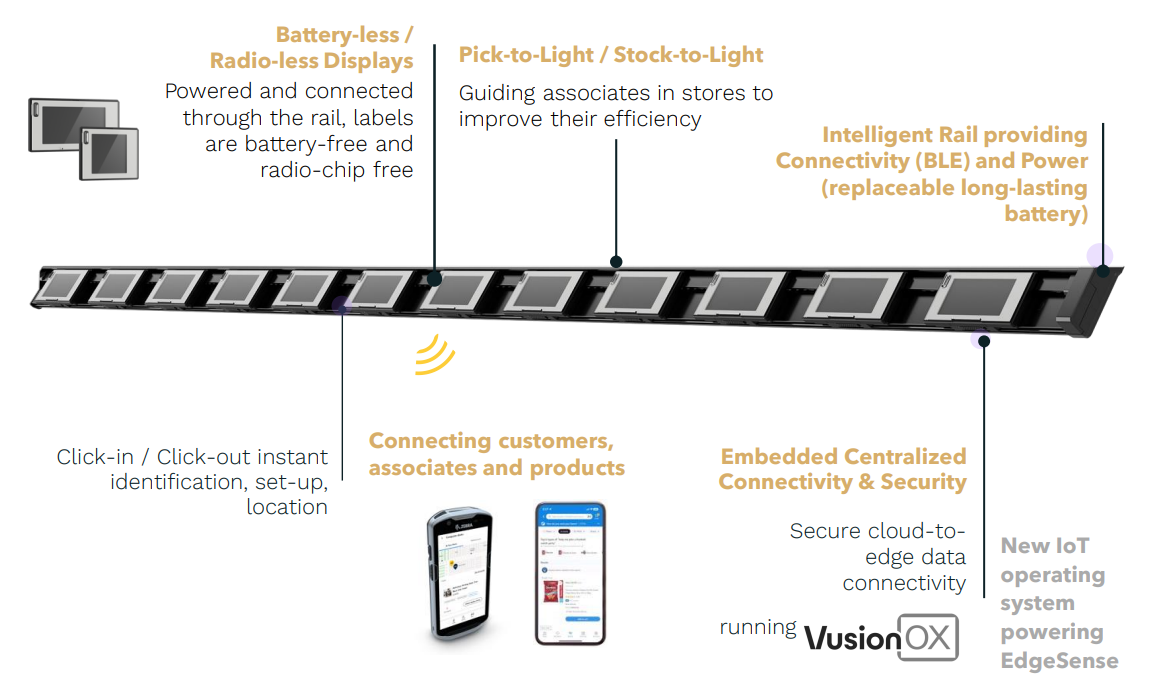

Its cloud-native, multi-tenant architecture enables clients to integrate easily, ingest data quickly, and access deep insights across use cases such as:

- Fraud prevention and detection (e.g. digital payments, e-commerce)

- Regulatory compliance (e.g. KYC/AML for banks)

- Risk scoring and mitigation (e.g. insurance underwriting, claims history)

- Public records and background checks (e.g. for real estate, legal, and law enforcement)

Data Done Differently

Red Violet is one of only a handful of U.S.-listed, micro-cap (<$1bn market cap) Software & IT Services companies with positive net income and a 3‑year revenue CAGR above 10%.

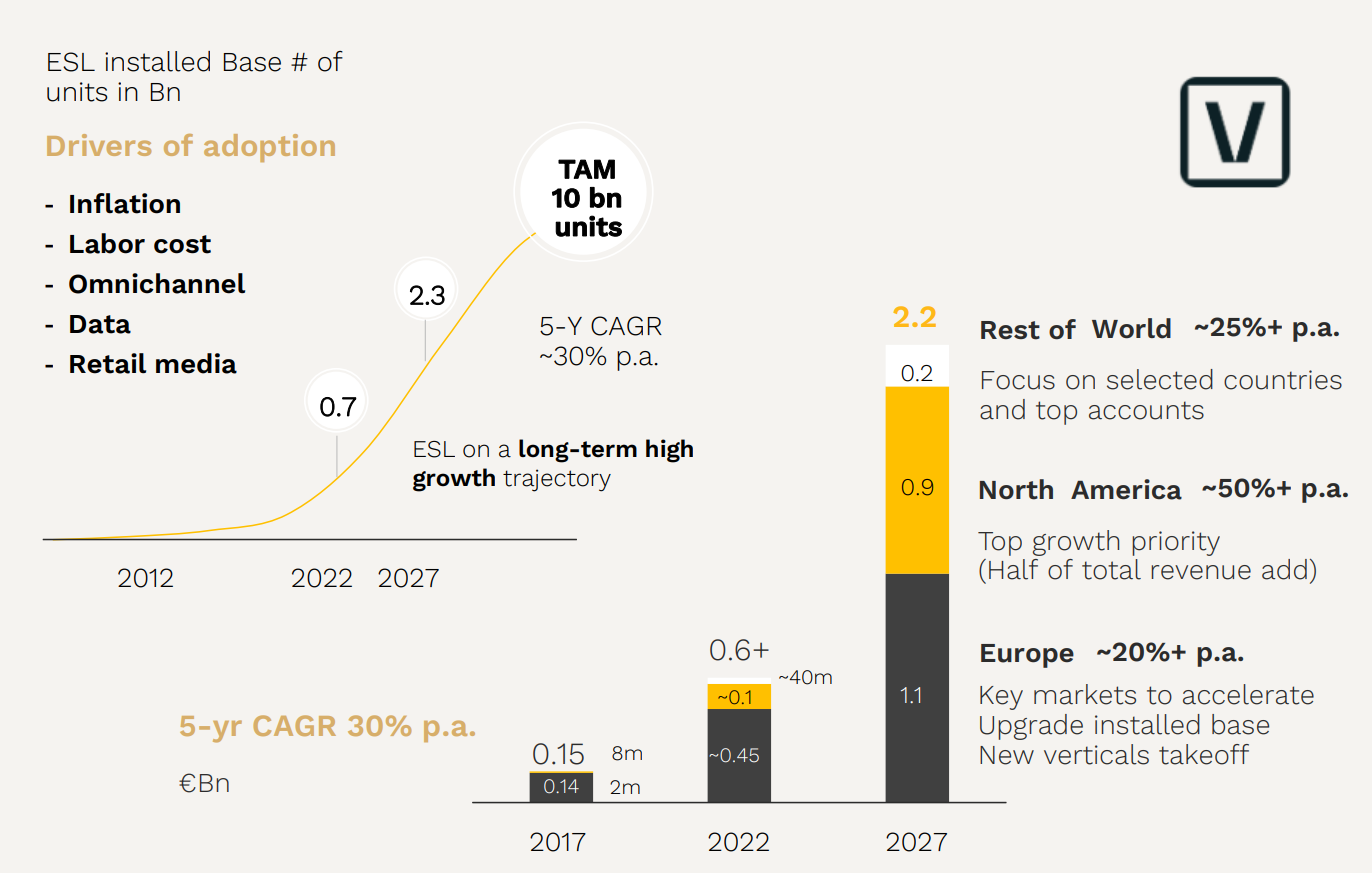

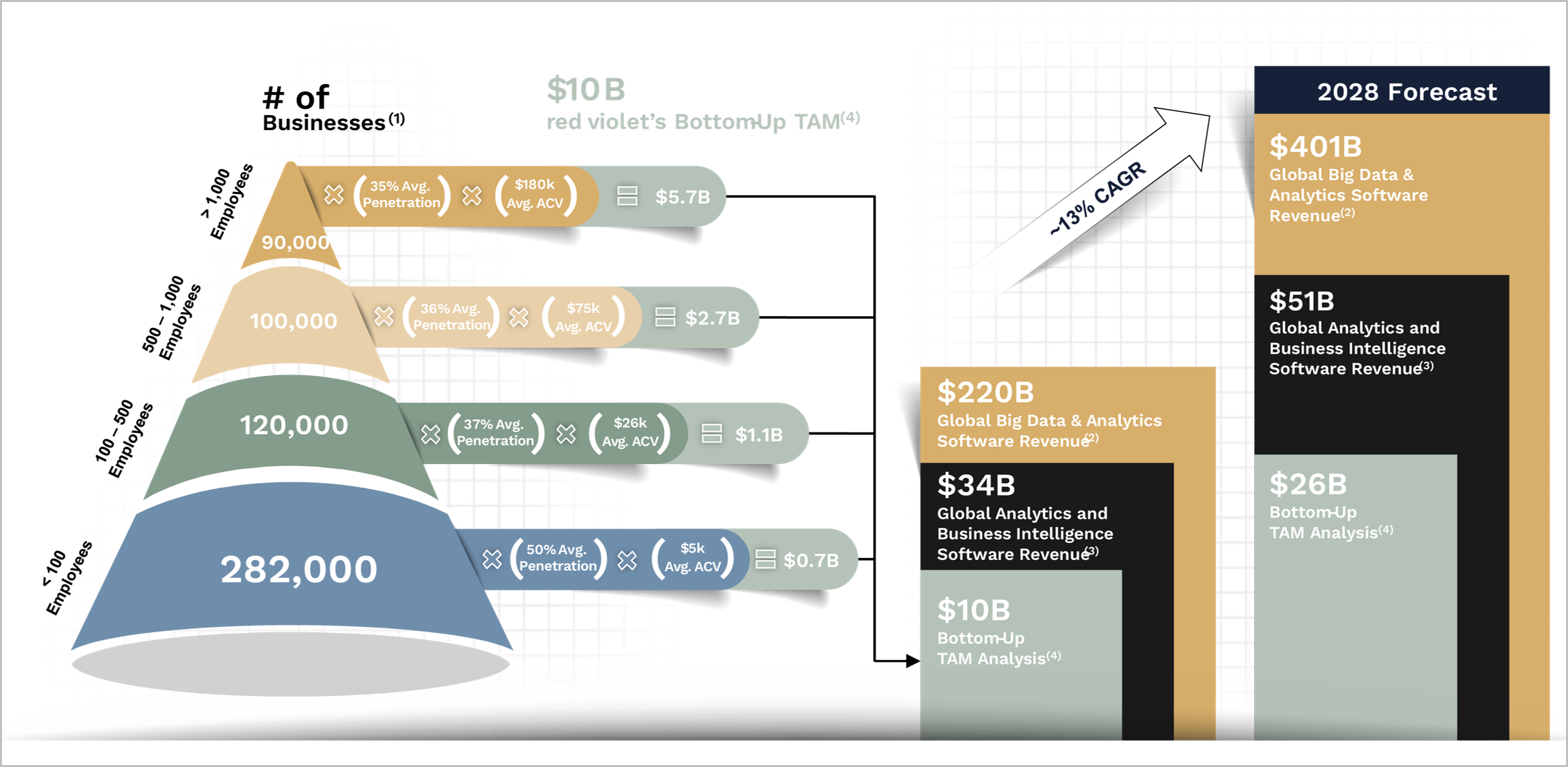

With a Total Addressable Market exceeding $10bn globally, and current market penetration below 1%, we believe Red Violet is in the early stages of a multi-year growth story.

Source: Red Violet Company Presentation – August 2025. Ophir.

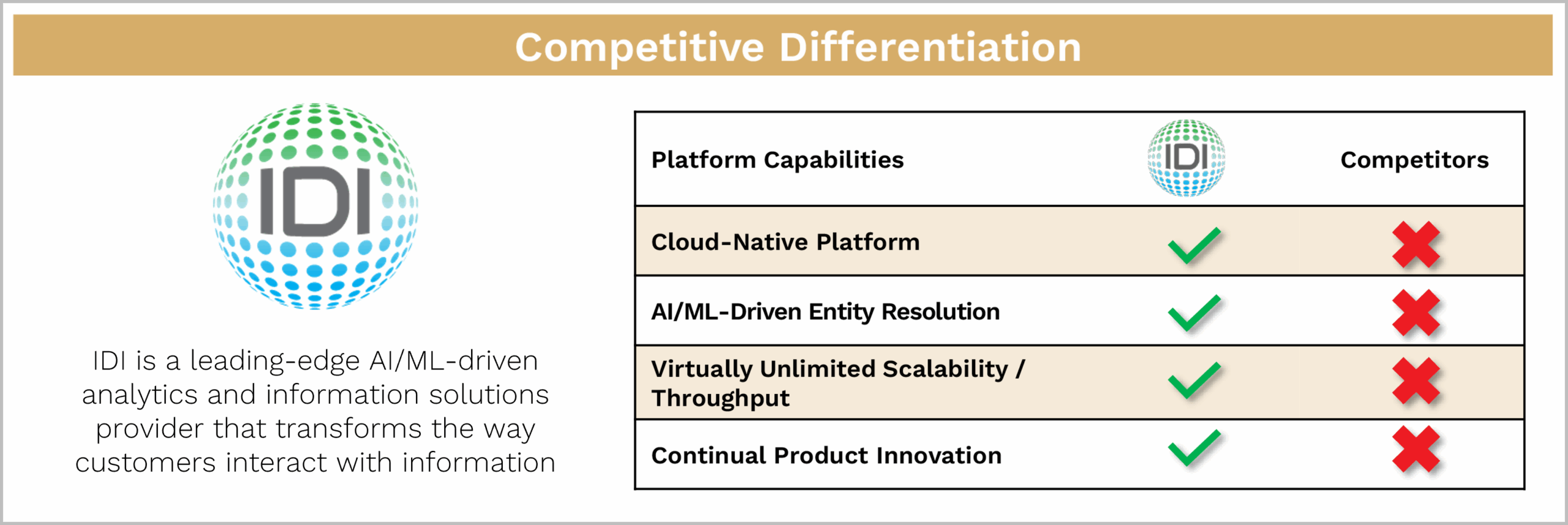

Legacy incumbents such as Equifax, Experian, LexisNexis and TransUnion dominate the traditional credit bureau model, but Red Violet is capitalising on key advantages to gain share.

Red Violet’s proprietary data platform, IDI, was built by the same tech team behind LexisNexis and TransUnion’s platforms. This is effectively their third and most refined iteration, incorporating everything that worked well in prior versions and improving on what didn’t. With the lead developer now retired, it’s likely to remain their final iteration, giving Red Violet a uniquely battle-tested and future-proof platform.

Source: Red Violet Company Presentation – August 2025. Ophir.

Red Violet’s architecture allows for:

- Faster ingestion and integration of new datasets

- More accurate and dynamic modelling

- Customisation across customer-specific verticals

Their technological edge, paired with strong customer validation, is allowing Red Violet to take share from legacy players.

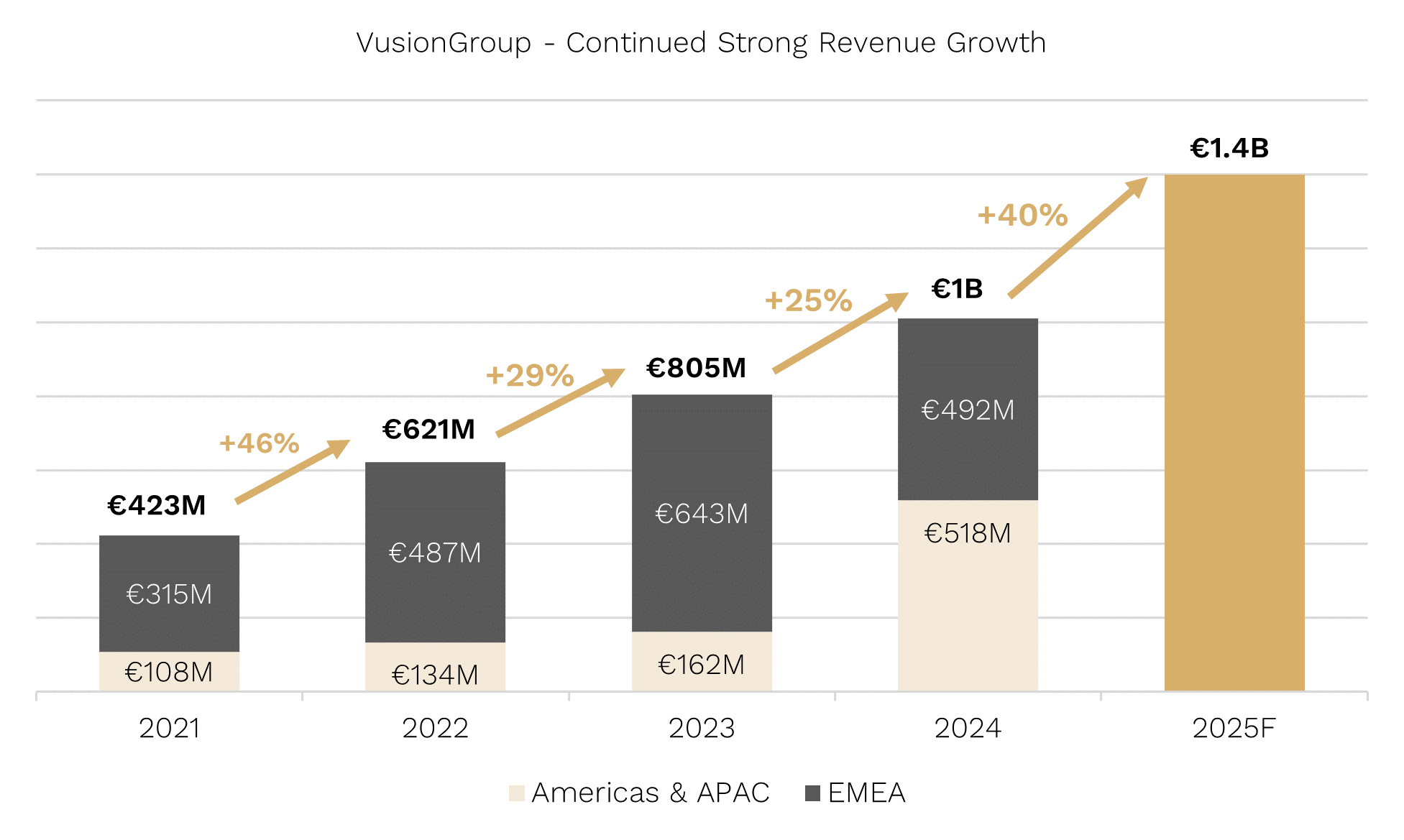

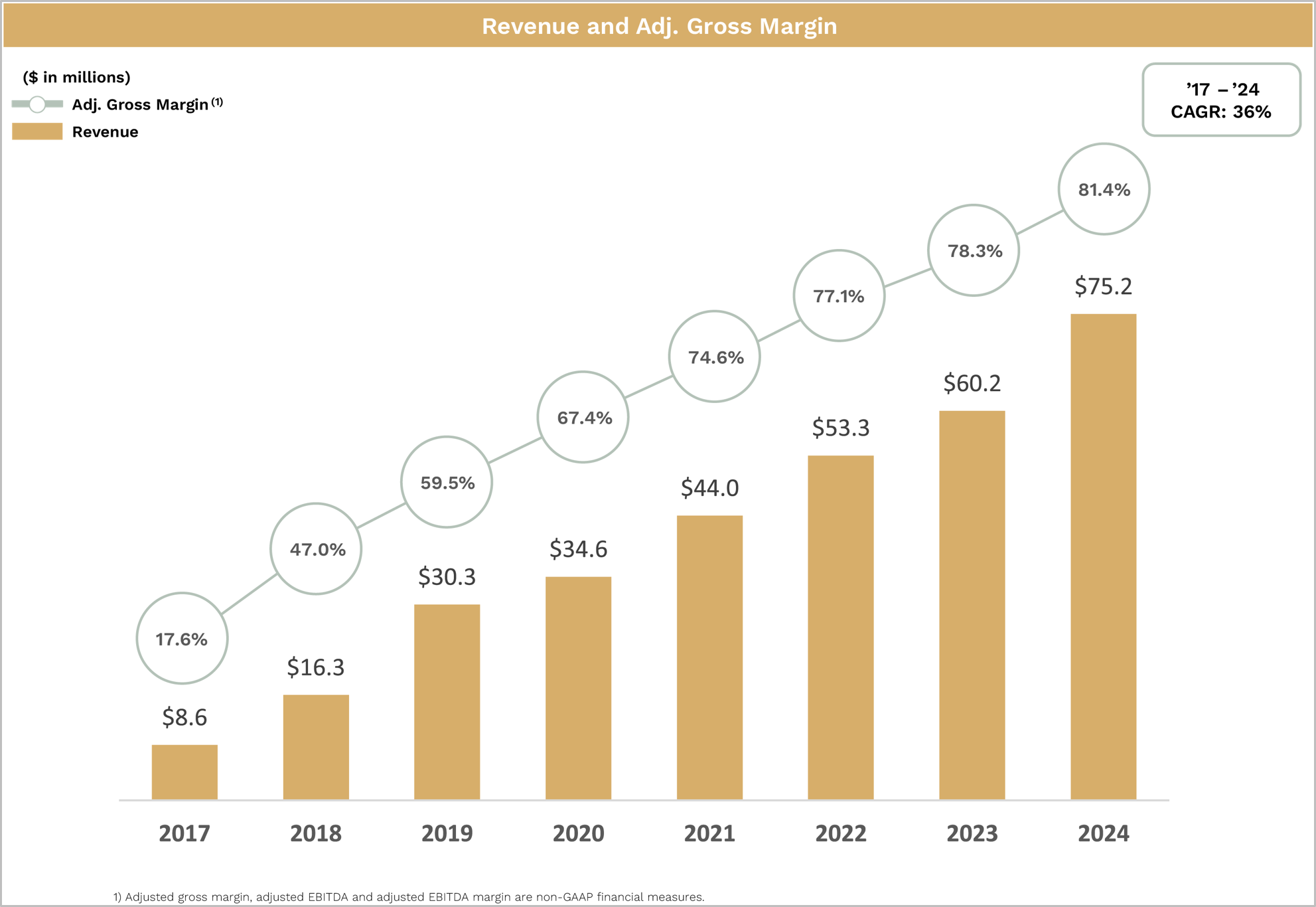

- Revenue is growing at more than +20–25% annually

- It has 95%+ incremental gross margins, enabling significant operating leverage

- Long-term EBITDA margins could exceed 60%, with EBITDA compounding at 30%+

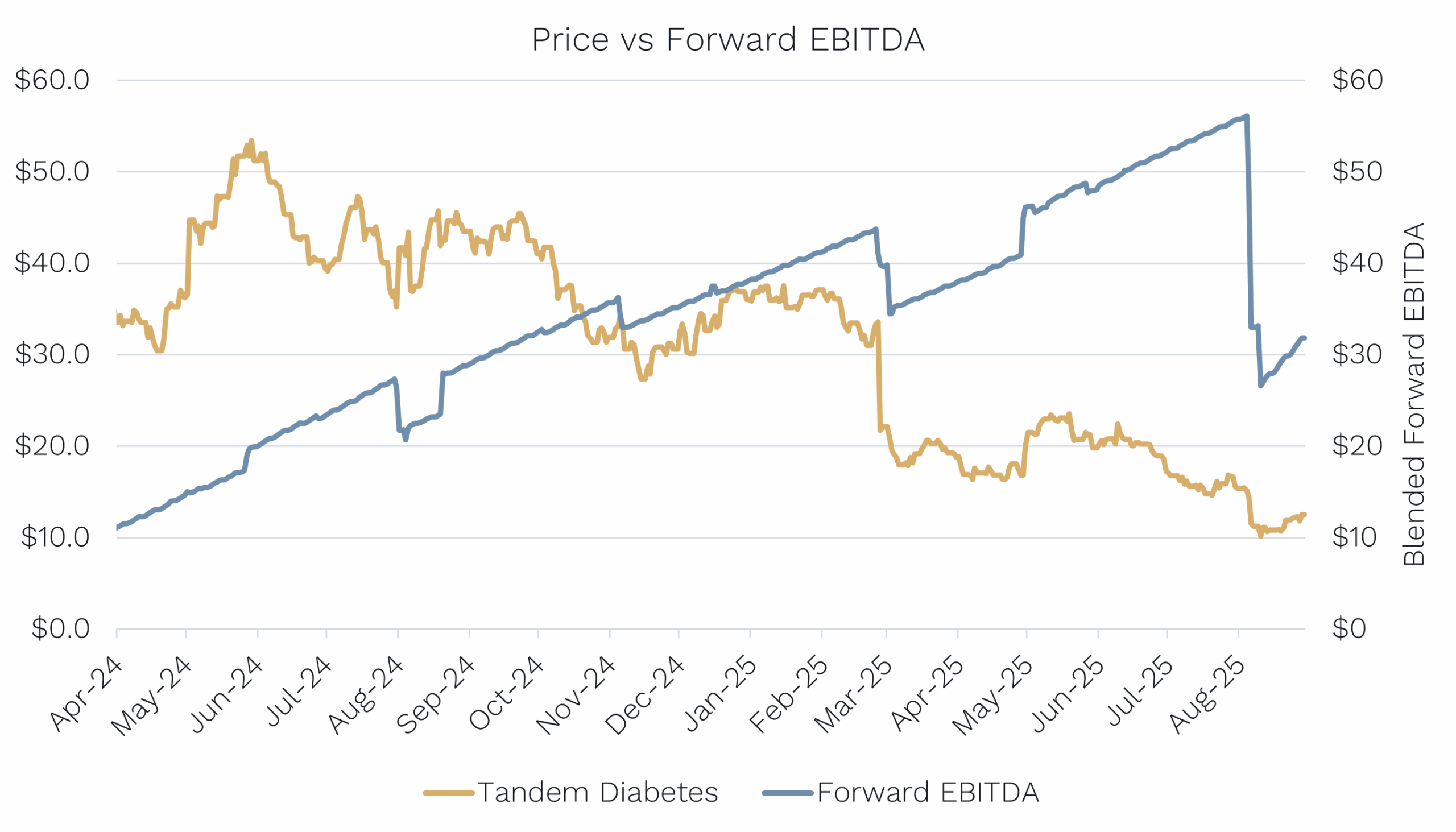

- Red Violet trades on a high-teens multiple of EBITDA, but we see the potential for rerating given its growth, margin profile, and balance sheet strength

Source: Red Violet Company Presentation – August 2025. Ophir.

Interesting Use Cases

Red Violet’s platform is used in ways that go far beyond traditional identity checks:

- Banks stop fraud in real time on new account openings

- Retailers flag “multi-drop” transactions to prevent high-value fraud

- Insurance firms detect repeat claim filers or link disparate records

- Real estate firms uncover bankruptcies or aliases during screening

- Law enforcement uses the platform for investigations

This diversity of applications shows how embedded the platform is becoming — and how non-cyclical much of its revenue base really is.

Building Our Edge

We’ve been tracking Red Violet for over seven years. Since our initial meeting in 2018, we’ve:

- Met with all major competitors, including the big credit bureaus

- Held calls with dozens of customers across financial services, insurance, real estate, and government

- Validated the long runway of growth through first-hand feedback on performance, accuracy, and pricing

This early access and sustained diligence has helped us build a high-conviction position before the market caught on.

Best Is Yet to Come

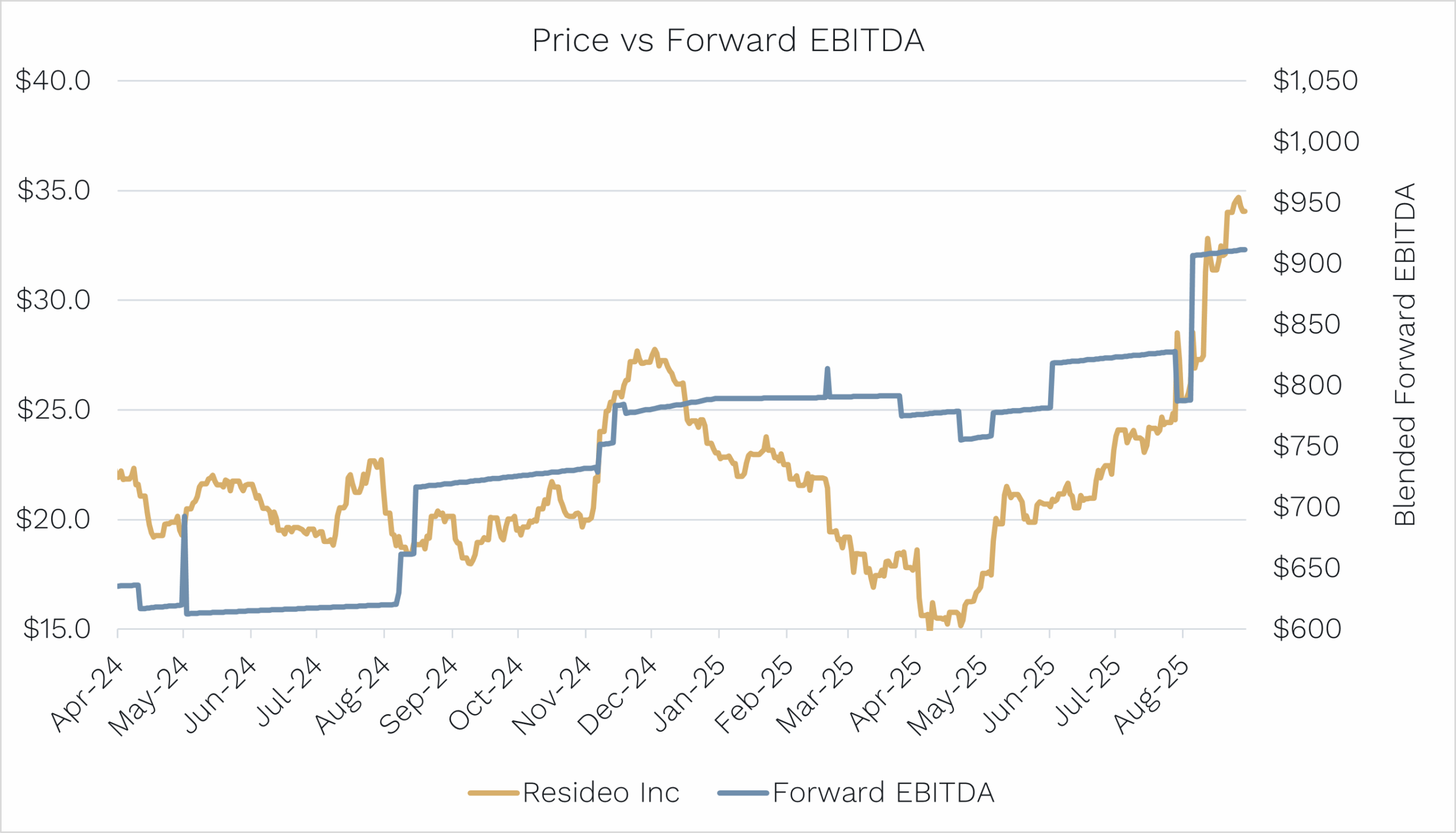

The stock has been a strong performer since our entry, but we think the best is yet to come:

- Revenue was up 25% in 2024, hitting $75m

- The business is profitable, with no debt and $36m in cash

- With continued share gains and vertical expansion, we expect years of compounding ahead

- And if margins continue to expand, we see 30–40% total shareholder return (TSR) potential annually for 3–4 years

- With limited analyst coverage it remains a relative unknown today, but as growth continues it will attract more attention

In a world where high-growth, high-margin companies often trade at 30–40x EBITDA, Red Violet’s current high-teens valuation offers meaningful upside from multiple expansion alone.

With its clean balance sheet, niche leadership, and embedded optionality, we see Red Violet as one of the most compelling compounders in small-cap tech today.