By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

Ensuring that our portfolios have exposure to the right balance of defensive and growth companies is something we are currently focusing on heavily.

Dear Fellow Investors,

Welcome to the May 2019 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Month in review

The resurgence in animal spirits that have seen global equity markets post a remarkable rally during the first four months of 2019 were dampened during May by escalating trade tensions between the US and China. In a continuation of the ‘tit for tat’ approach by both countries to the trade talks, the US increased tariffs on USD 200 billion worth of Chinese goods from 10% to 25% with China retaliating by announcing tariffs on USD 60 billion worth of US goods. This led to deep declines throughout the course of May in the majority of global equity markets with the MSCI World Index declining -6.2%, the S&P 500 declining -6.6% and the deepest pain felt in China where the MSCI China fell -13.6%.

With President Trump’s fixation on tariffs to achieve his trade goals and President Xi’s determination not to bow to US pressure, a protracted battle could be on the cards. On its face the US economy is in good shape with unemployment at a 50-year low, soaring consumer confidence and wages starting to tick up. However the uncertainty caused by the trade war is having an effect with bond markets now estimating three rate cuts by the end of 2020. Only 6 months ago bond markets were predicting three rate rises. Whilst predicting how the trade war plays out is anyone’s guess, we have been holding slightly higher levels of cash in our portfolios so that we can take advantage of the more pronounced gyrations in valuations caused by heightened levels of uncertainty.

Local markets significantly outperformed their global equity counterparts during May with the larger cap S&P/ASX 100 leading the charge by posting a positive return of +1.1% and the smaller cap S&P/ASX Small Ordinaries Index registering a modest decline of -1.3%. Australian equity markets were able to buck the global trend due to a trifecta of domestic measures. These measures are designed to stimulate domestic demand by increasing household disposable income, improving credit availability and reducing interest costs. Firstly, the Coalition’s surprise election victory which is likely to deliver income tax cuts, subject to Senate crossbench support. Secondly, the banking regulator APRA’s easing of interest-servicing buffers. Thirdly, the Governor of the RBA indicated that interest rates would need to fall to lift inflation towards target. Communication services (+7.3%), bank (+3.1%) and retail (2.6%) sectors were all beneficiaries of these measures during May.

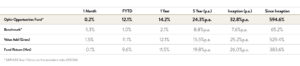

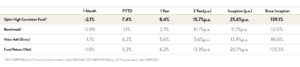

The Ophir Opportunities Fund returned -0.15% after fees, outperforming the ASX Small Ordinaries Index by 1.10%. The Ophir High Conviction Fund returned -1.92% after fees, underperforming its benchmark by -1.14%.

Balancing the defensive and growth mix

The recent domestic stimulus measures will provide some short term relief to cyclical companies that are heavily reliant on the strength of the Australian consumer. However, it is unlikely that it will act as a cure in the longer term to the structural headwinds impacting both the Australian and global economy. For this reason, we continue to recycle out of companies that are more exposed to the Australian consumer and add companies that are more defensive in nature whilst still having the ability to meaningfully grow.

We are also cognisant that while the current bull market is the longest on record, its trajectory has been much flatter than previous rallies and the backdrop for equities remains favourable. As a result, we still retain exposure to some higher beta stocks in our portfolios that can participate in the upside.

Ensuring that our portfolios have exposure to the right balance of defensive and growth companies is something we are currently focusing on heavily. An example of a more defensive company we have recently added to the Ophir High Conviction Fund (ASX:OPH) is sleep-related breathing disorder medical equipment company ResMed (ASX:RMD). We have been closely monitoring RMD for the last few years and had previously missed an opportunity to buy in at what was in hindsight a favourable price.

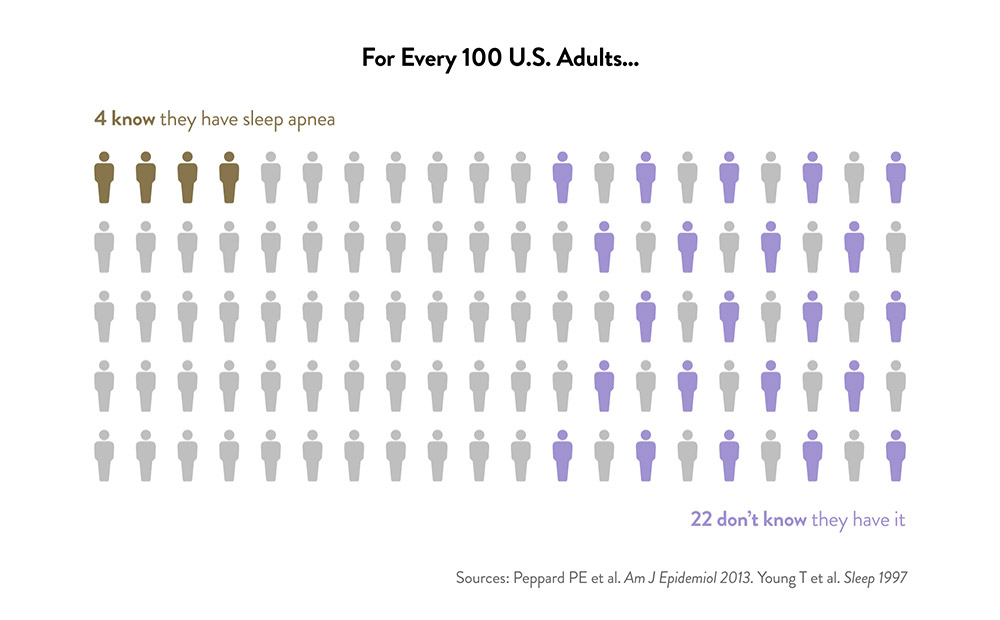

RMD is a serial compounder having grown normalised EPS from 3.9cps in 1995 to $3.35 in June 2018, a compound growth rate in excess of 20%. Despite this impressive historic growth, we still remain excited about RMD’s future growth prospects as it still operates in an undiagnosed industry whereby over 80% of potential patients still don’t know that they have sleep apnoea.

In addition, the industry is evolving at a faster rate with an increasing focus on data and IT.“Connected care” and the communication, and more importantly analysis, of patient data is now imperative to ensure compliance and ultimately reimbursement by insurers. It’s increasingly becoming an industry where only the larger players can sufficiently invest in the R&D to fund these developments that are being demanded by customers.

In a related area, RMD has started to invest in the Chronic Obstructive Pulmonary Disease market, which is the third leading cause of death worldwide. The company has invested capital in new offerings as well buying businesses. It’s still too early to see the payback but we believe the end prize is significant and will continue to monitor the company’s progress and development.

Finally, we also like RMD’s market position where it is one of only 3 major participants operating in its industry. Moreover, the industry itself is defensive in nature which helps balance cyclicality of the portfolio.

As mentioned previously we do continue to hold some higher growth companies within our portfolios including Afterpay (ASX:APT). While valuations for many of these higher beta stocks can appear stretched, in our view when a company’s operating metrics are accelerating like APT’s and they are dominating their industry vertical, then the equity market at some point is willing to shift from a valuation based on this year’s earnings to discounting its future potential earnings in a couple of years. Recent examples of such a valuation shift include a funds under management goal for Magellan (ASX:AFG) and a funds under administration target for Netwealth (ASX:NWL).

The “Hermes” of infant milk formula

Doing the extra work on a company is something we pride ourselves on at Ophir and during May we spent a week in China as we have done for a number of years now, exploring the vast opportunities for Australians companies. It is also always useful to check on the development of A2 Milk (ASX:A2M) which has been a very successful investment for us.

We met a large number of infant formula competitors, store managers, regulatory experts, Australian embassy officials, Austrade, as well as visiting numerous stores. We again came back excited and confident of A2’s continuing success in the market. While A2’s market share has grown rapidly in recent years, and its availability definitely increased, we see further expansion in the Mother and Baby Stores as a key area of opportunity. The store managers we spoke with all highlighted A2 as the best performing brand they stocked. In a number of smaller stores we visited where A2 was not currently stocked, the brand was well known to management and one of the most requested brands by mothers. As one Chinese infant formula expert put it to us A2 enjoys a very strong reputation in online baby forums with Chinese mothers referring to it as the “Hermes” of infant milk formula.

We look forward to meeting with many of you at our upcoming Meet the Manager event series where we will talk through a number of our portfolio holdings.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

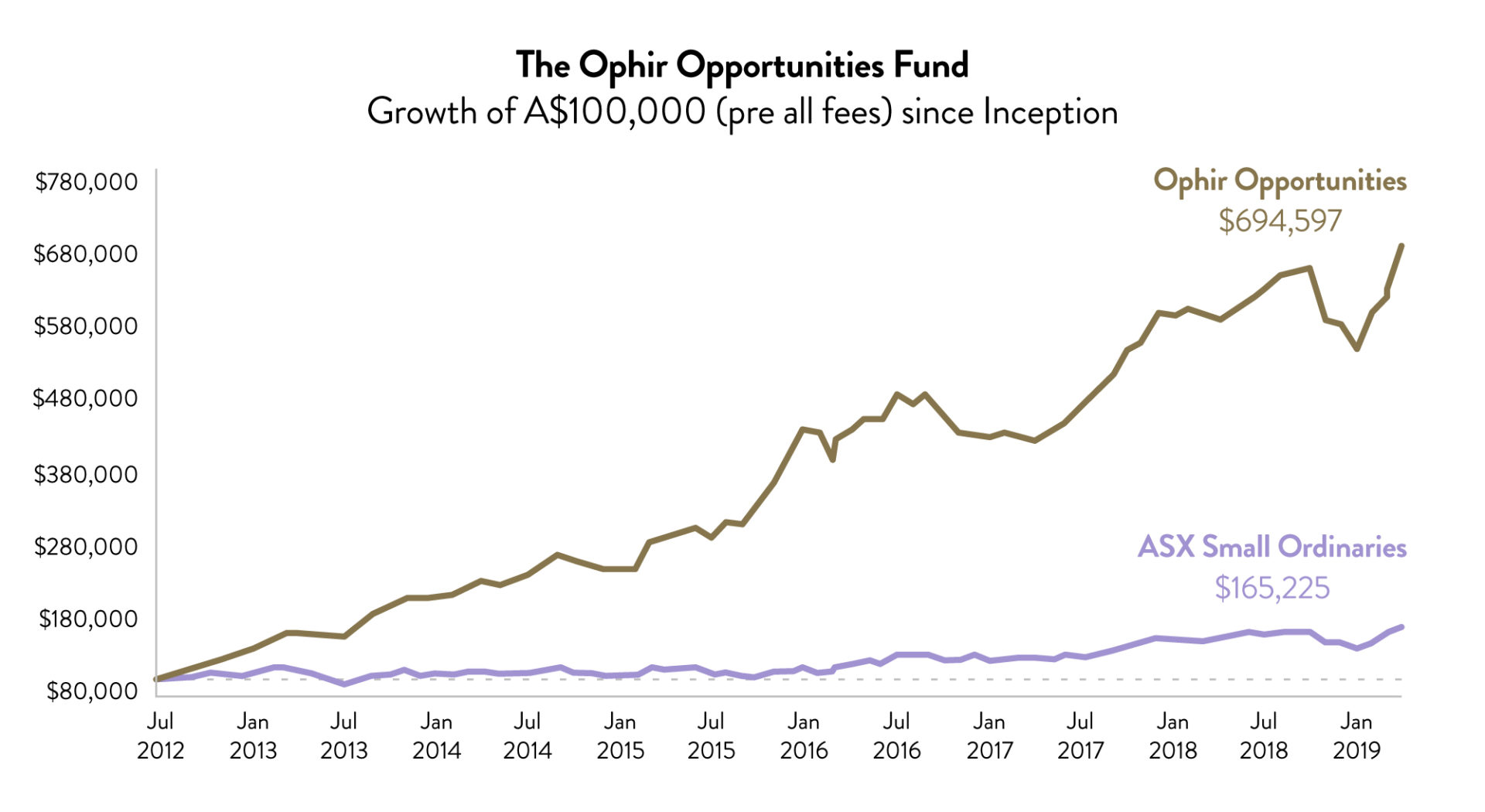

The Ophir Opportunities Fund returned +0.3% for the month outperforming the benchmark by 1.5% before fees. Since inception, the Fund has returned +32.8% per annum, outperforming the benchmark by 25.2% per annum before fees.

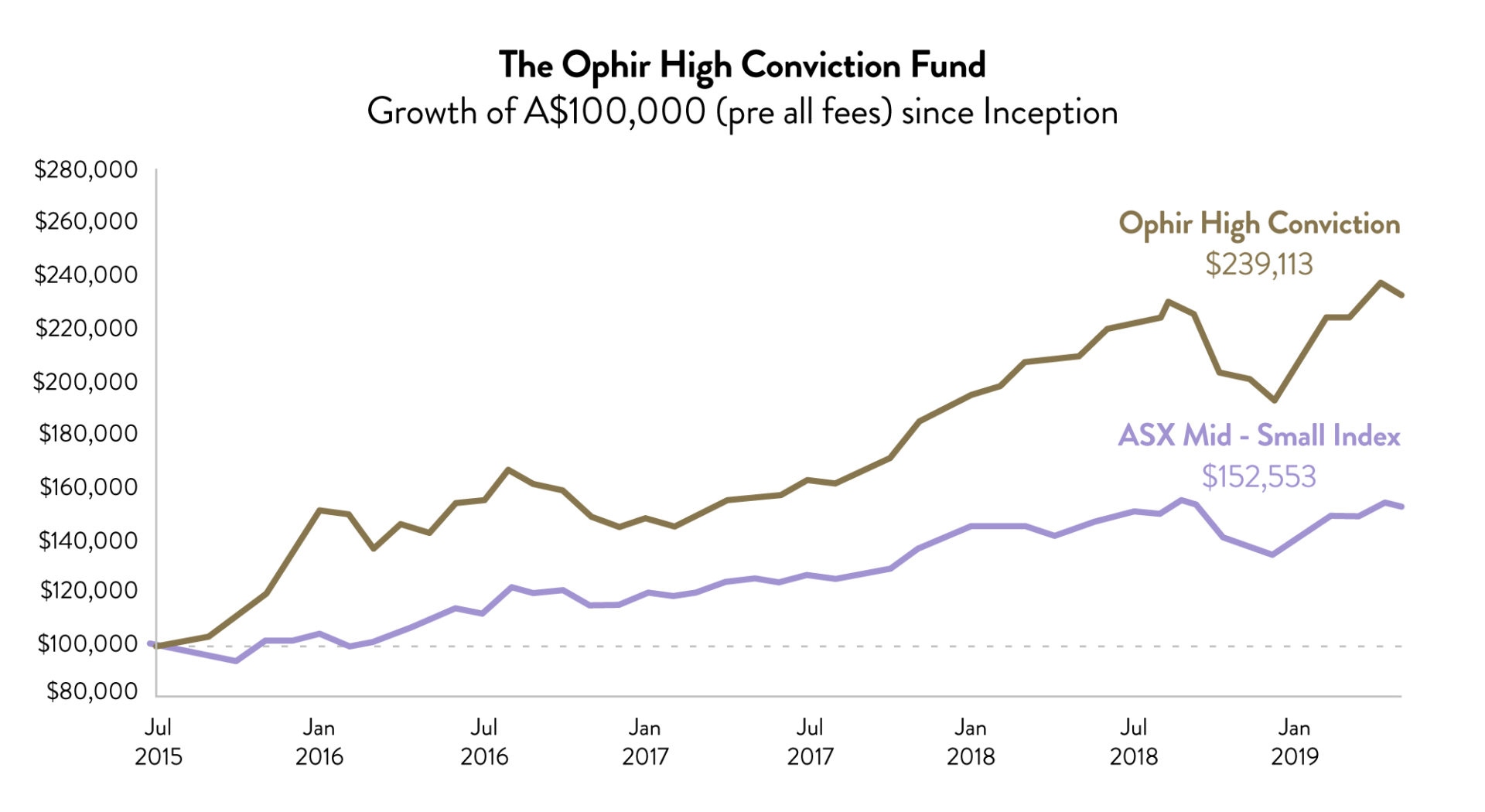

The Ophir High Conviction Fund returned -2.1% for the month, underperforming the benchmark by 1.1% before fees. Since inception, the Fund has returned +25.6% per annum, outperforming the benchmark by 13.9% per annum before fees.

Key contributors to the Opportunities Fund performance this month included Afterpay Touch (APT), Jumbo Interactive (JIN) and Kogan.com (KGN). Key detractors included Pilbara Minerals (PLS), Macmahon Holdings (MAH) and Aurelia Metals (AMI).

Key contributors to the High Conviction Fund performance this month included Afterpay Touch (APT), A2 Milk Company (A2M) and Reliance Worldwide (RWC). Key detractors included Mercury NZ (MCY), Evolution Mining (EVN) and Northern Star Resources (NST).

This document is issued by Ophir Asset Management (AFSL 420 082) in relation to the Ophir Opportunities Fund & the Ophir High Conviction Fund (the Funds) and is intended for wholesale investors only. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir Asset Management accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. Any investment decision in connection with the Funds should only be made based on the information contained in the Information Memorandum and/or Product Disclosure Statements.