PDF

The Great Currency Hedging Debate

In this Letter to Investors, we look at:

- The record small cap outperformance run in January, and why we think the small cap renaissance will be sustained.

- What is causing the big changes in market leadership, including the ongoing surge in gold and silver.

- Why traditional software companies remain on our radar despite the recent fear-driven indiscriminate selling across the sector.

- Whether, in light of the Aussie dollar ripping in January, investors should hedge their currency exposure to our global funds?

After ho-hum headline index returns of 1.4% for the S&P 500 and 1.8% for the ASX 200 in January, you might be thinking that not much happened to start 2026.

You’d be dead wrong!

Under the surface, there was a lot going on, and we want to touch on four key developments in this month’s Letter:

-

Record small cap run

The first is that investors had small caps front of mind.

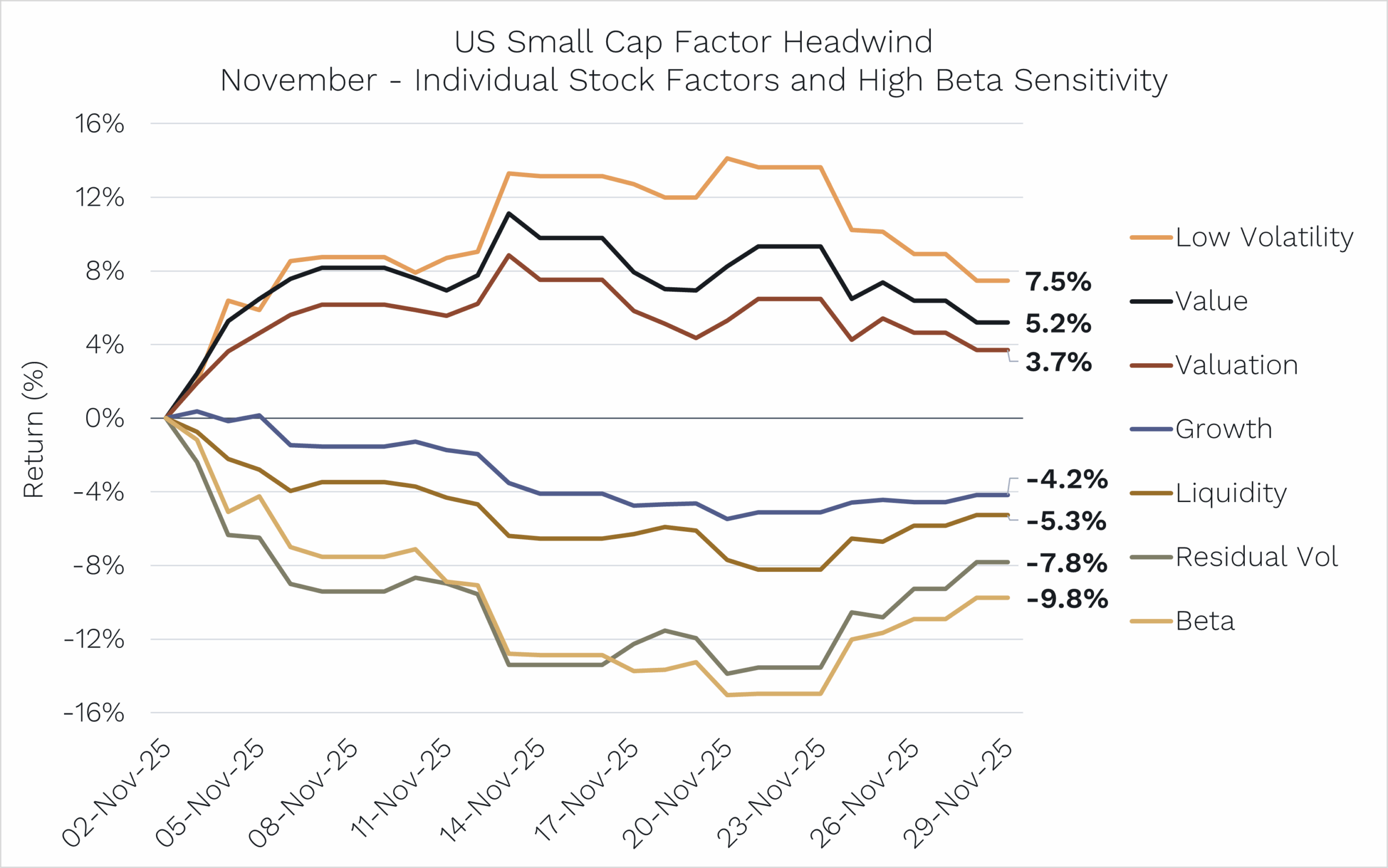

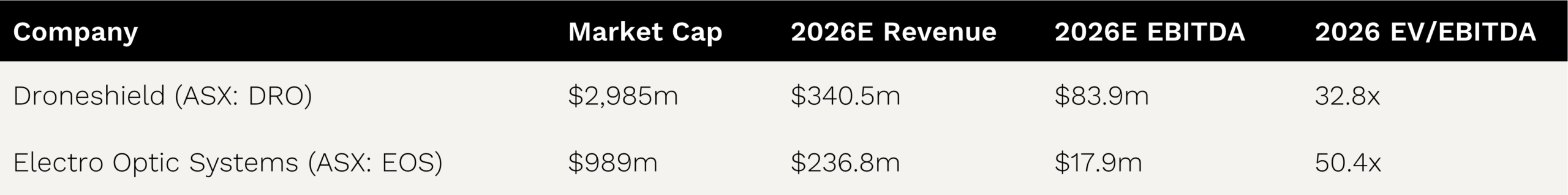

While the S&P 500 was +1.4% in January, over in small cap land, the Russell 2000 was up 5.4%.

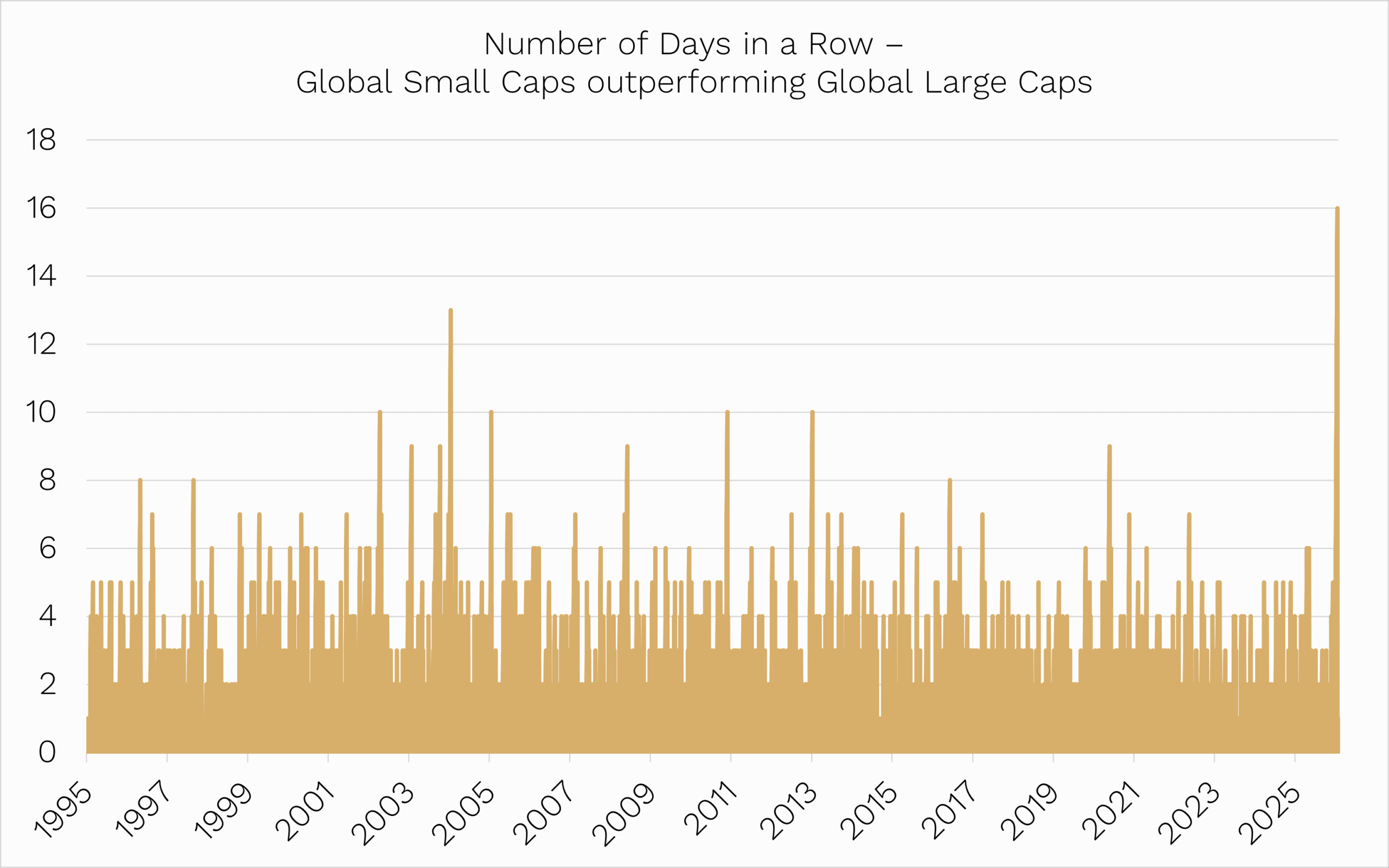

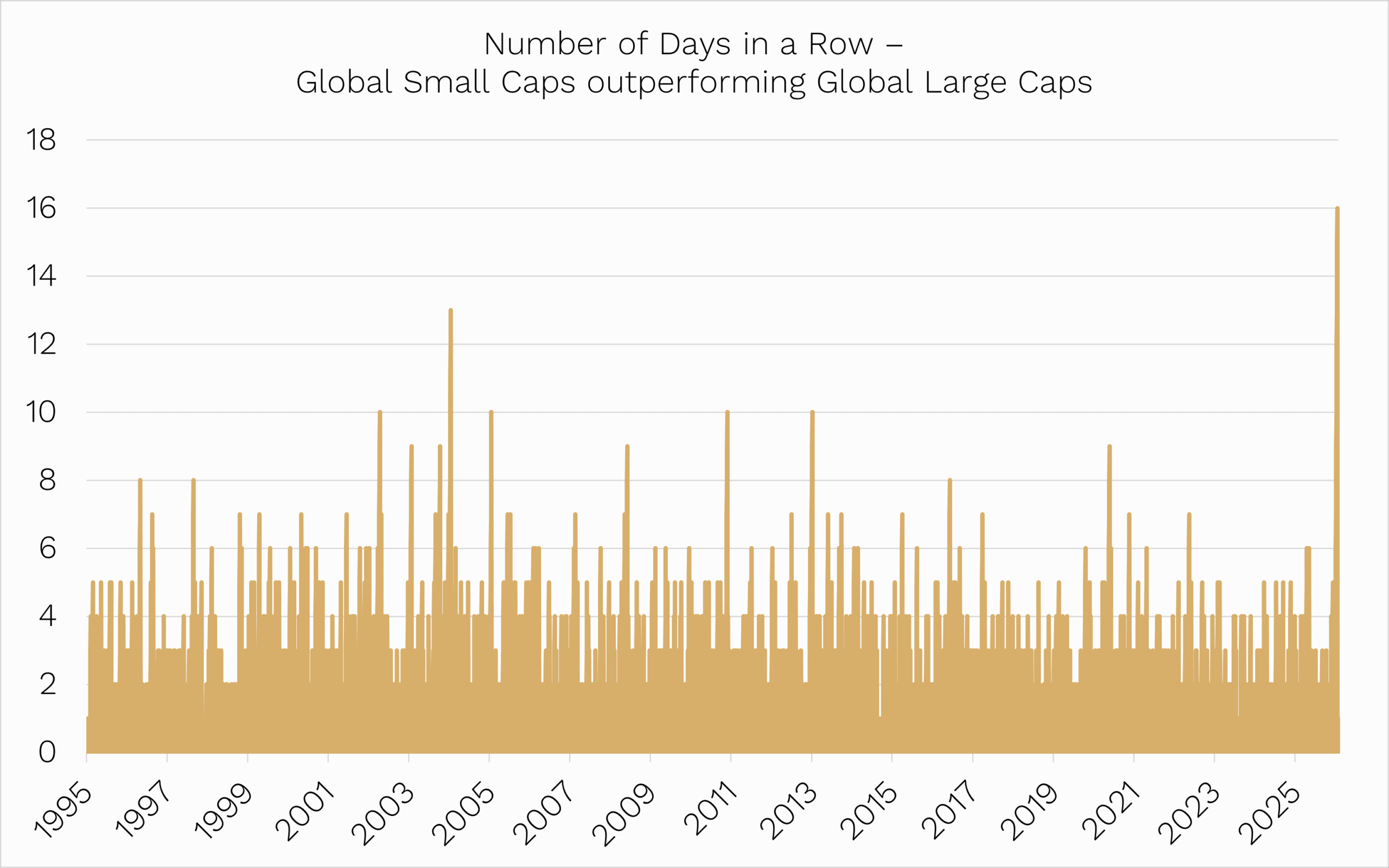

Global small caps (MSCI World Small Cap Index) outperformed global large caps (MSCI World Large Cap Index) for 16 consecutive trading days – the longest streak in the 30-year history of the data!

Source: Bloomberg. Global Small Caps is represented by the MSCI World Small Cap Index and Global Large Caps is represented by the MSCI World Large Cap Index.

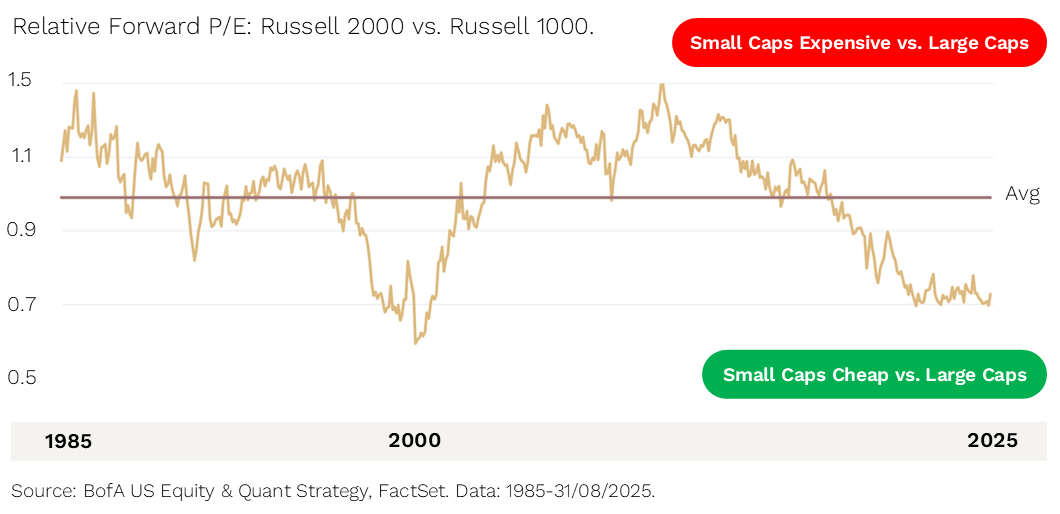

As we’ve been saying for some time now, valuations, including relative valuations, are like an elastic band, and they can snap back fast.

Global small caps have been trading at the cheapest valuation to global large caps in 25 years.

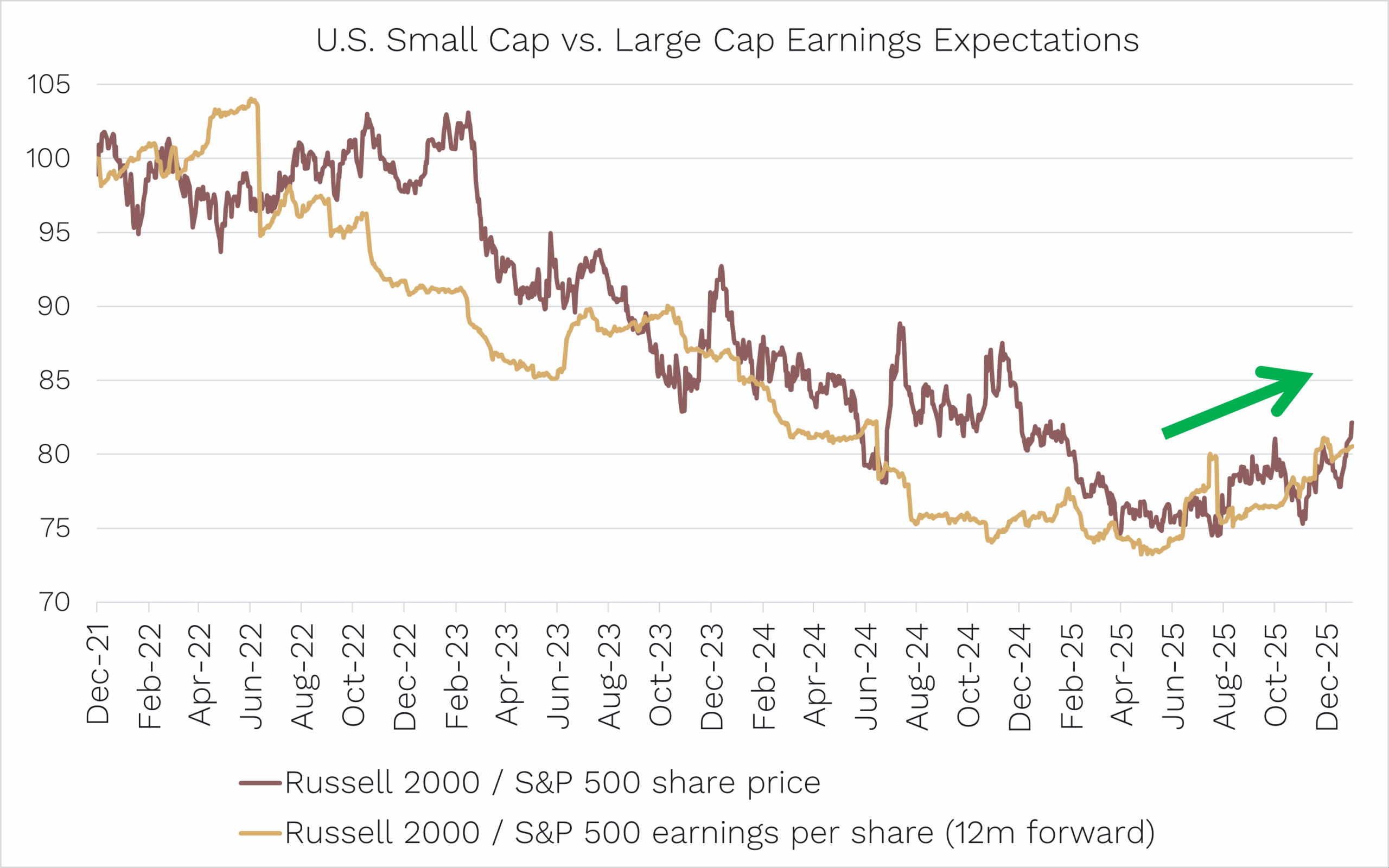

Last month, we covered how we think the catalyst for this snap back for outperformance to start was Small Caps earnings expectations outperforming like they have been in recent months (link).

This broadening in earnings growth, particularly outside of the Magnificent 7 in the U.S., is happening as the U.S. economy looks to be in the early days of a mid-cycle acceleration.

At the time of writing in early February, another key leading economic indicator helps to confirm this with the Manufacturing Purchasing Managers Index (a key cyclical real-time barometer of the U.S. economy) seeing the biggest monthly gain since we were all released from COVID lockdowns in 2020.

This is important because it gives us confidence the small cap snap-back is not another short-term ‘head fake’; but rather a more durable broadening in economic and earnings growth that includes small cap land.

-

Gold glitters

You must have been hiding under a non-shiny rock to not hear about what’s been happening recently to the price of shiny metals – gold and silver.

In January, gold was up 13.3% and silver rose 18.9%. This was after they rose 64.6% and 148.0% respectively in 2025.

Move over share investing!

It could have been even better. Gold and Silver were up over 25% and 60% each at one point during January (!) before President Trump announced the new Federal Reserve Chair would be Kevin Warsh.

Markets view Warsh as a more hawkish choice for interest rates than his main competitors. In response, the U.S. dollar and bond yields rose in late January, which reduced the appeal of precious metals as a hedge against worries that too low interest rates would stoke inflation fears and dollar debasement.

All in all, still a great month for gold, and a bad one for any boyfriend planning on buying their partner jewellery.

This fed into a cracking month for the materials sector, which rose 9.5% in Australia (ASX 200) and 8.6% in the U.S. (S&P 500).

Materials was only pipped by the Energy sector, which rose 10.6% in Australia and 14.4% in the US after the oil price (WTI) surged 14% in January off the back of Iran conflict supply concerns and Winter Storm Fern in the U.S. disrupting production.

-

Software sinks

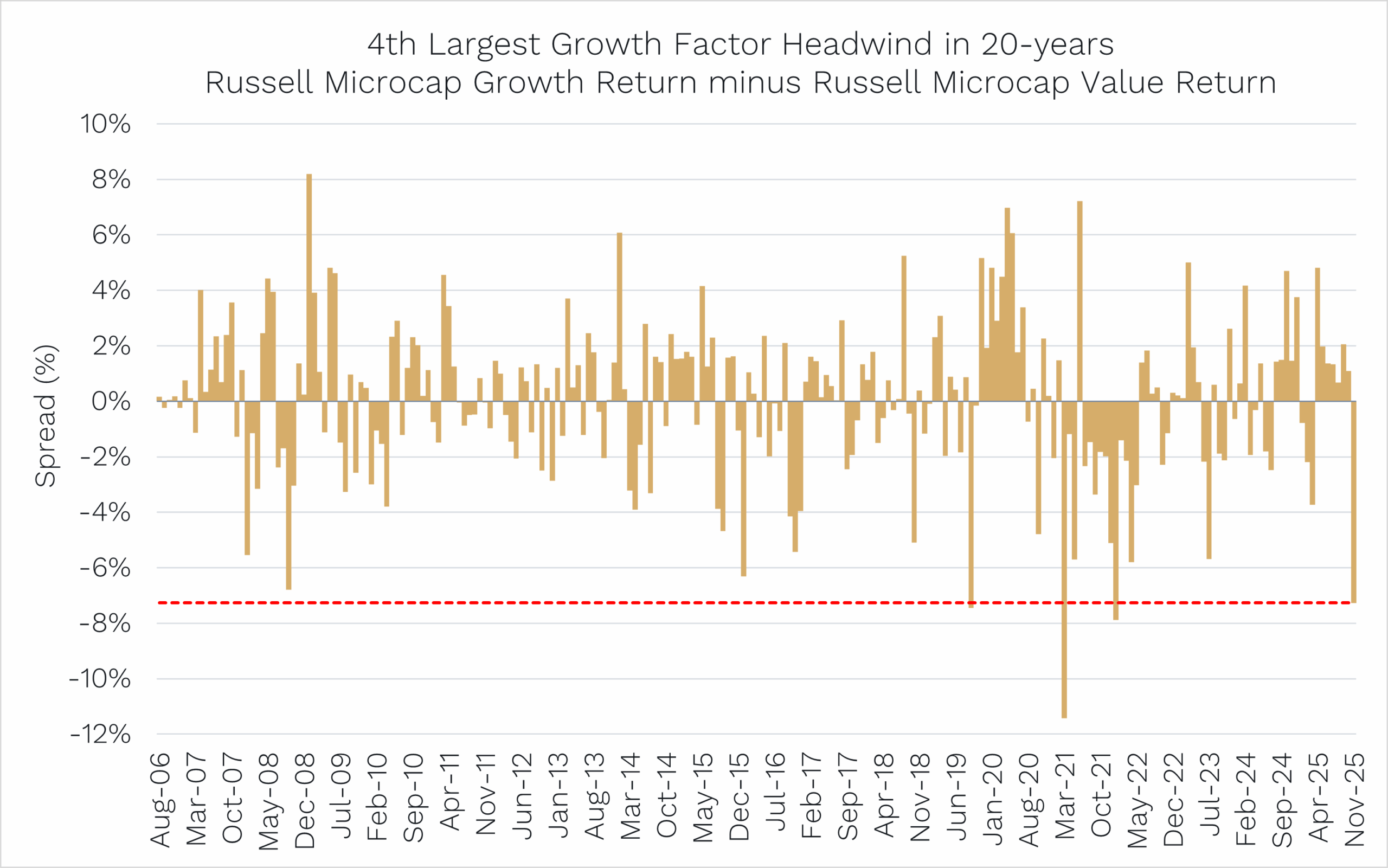

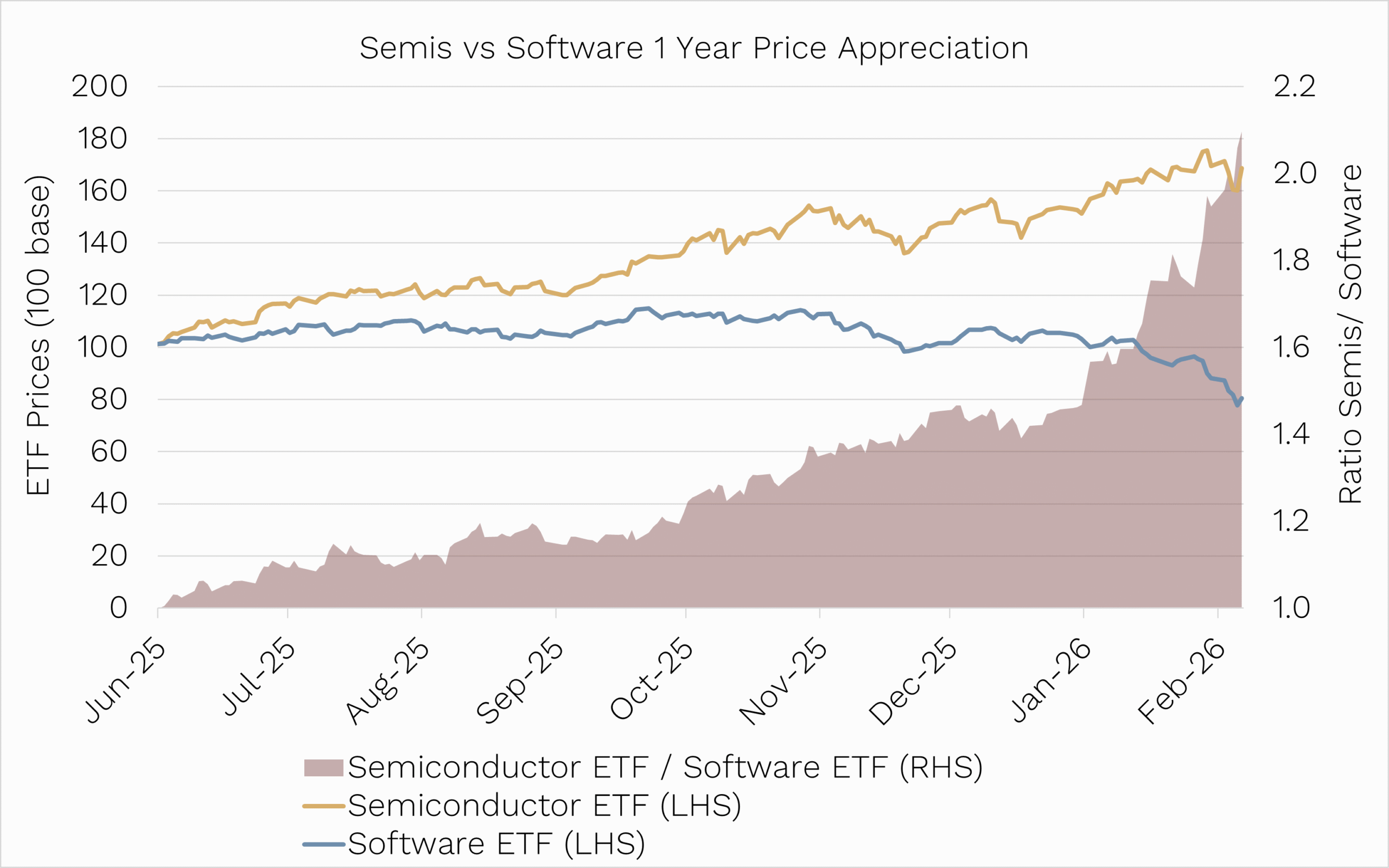

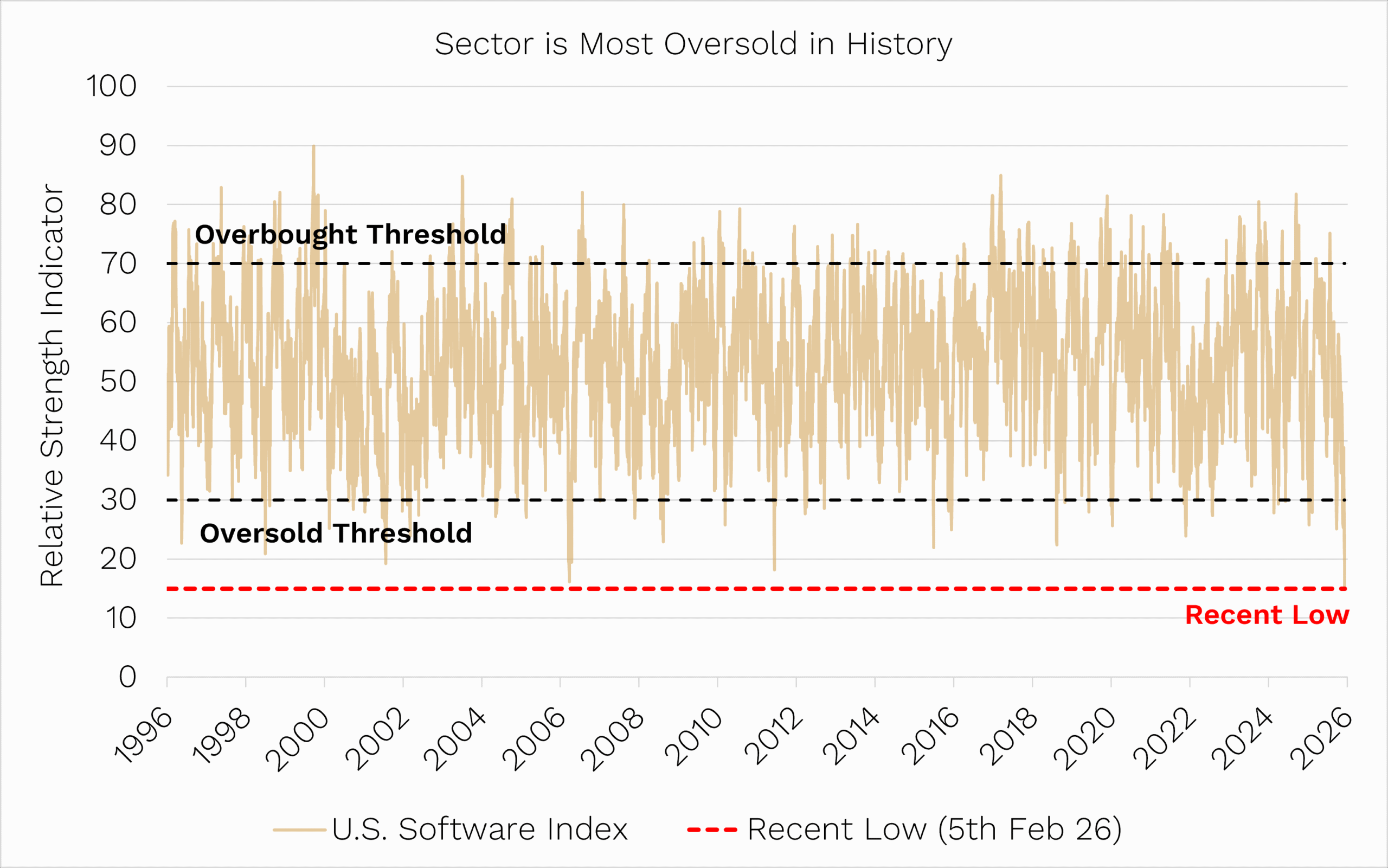

On the flip side, the IT sector globally and software businesses in particular have faced a bloodbath.

It started at the back end of 2025 and has picked up steam this year.

Domestically in Australia, the IT sector was down -9.4% in January, while it fell a much more modest -1.7% in the U.S.

This understates the carnage in the U.S., though, where the S&P 500 Software Index was down -13.1% on the month, nearly twice the fall of the next worst industry group.

What caused it?

Well, it’s a murderer’s row of suspects, including:

- Claude’s new AI release

- ChatGPT

- Agentic coding

- Fear of what’s to come from Elon Musk’s ‘Macrohard’ – which started as a joke on Microsoft’s name.

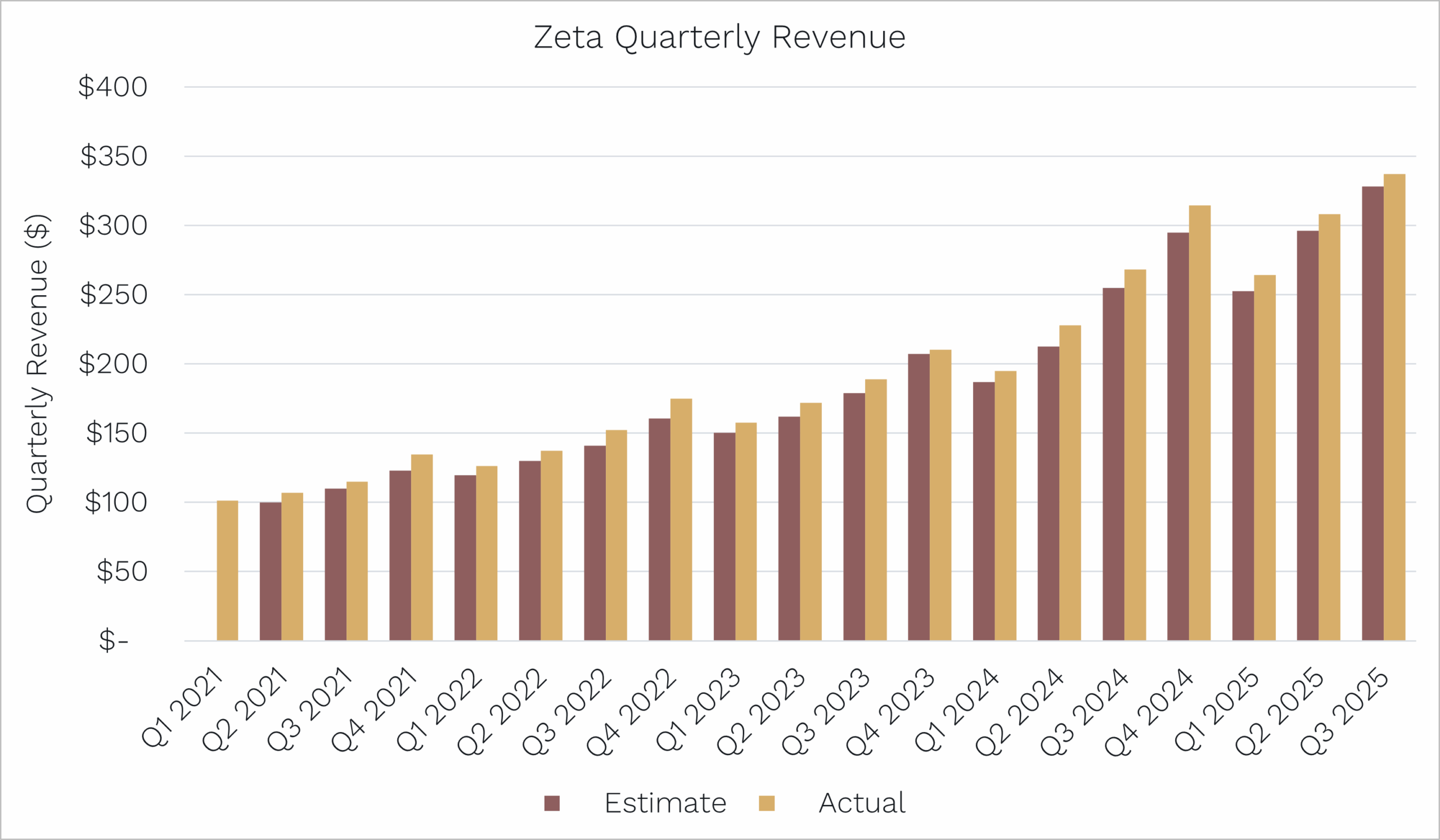

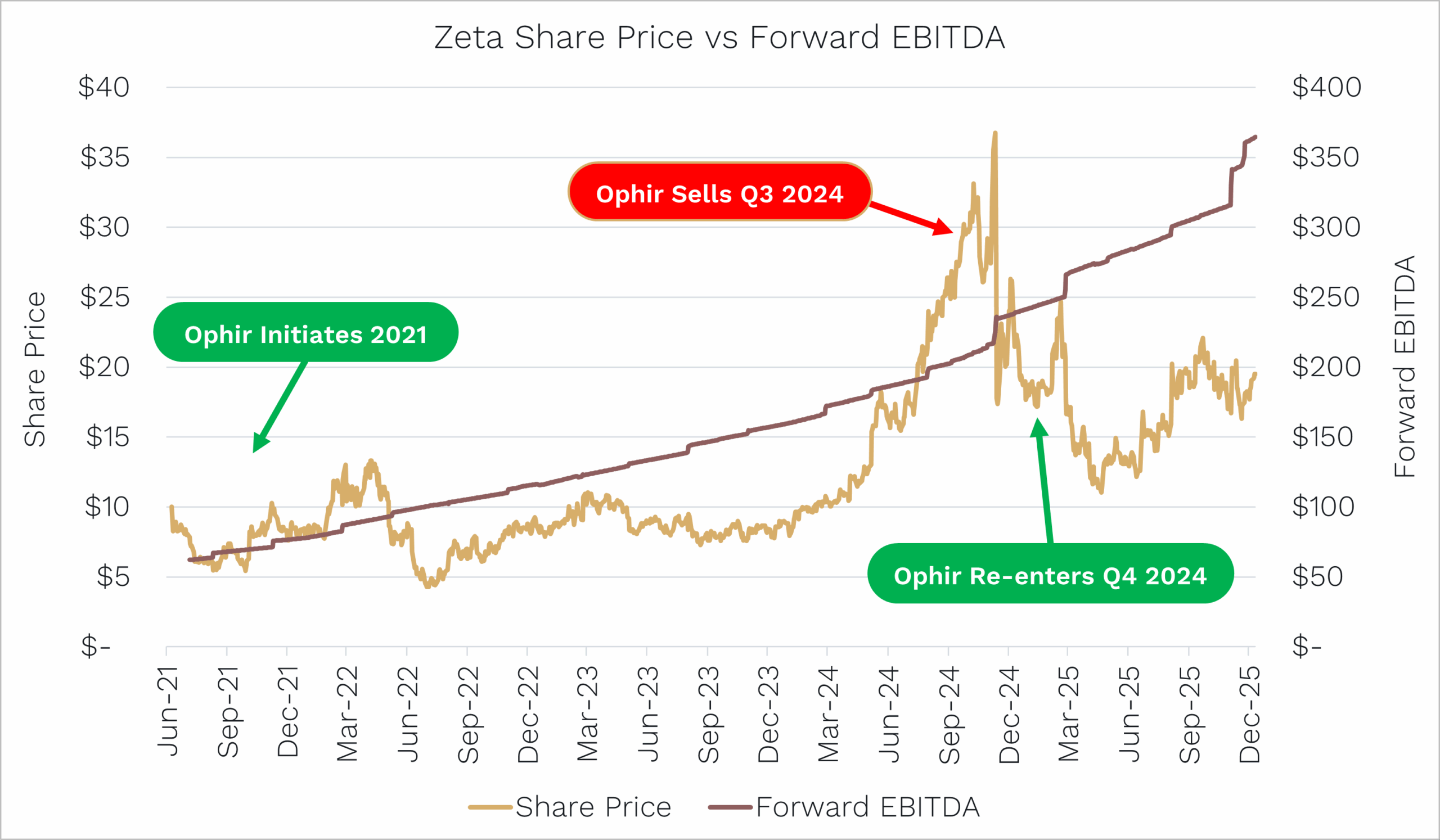

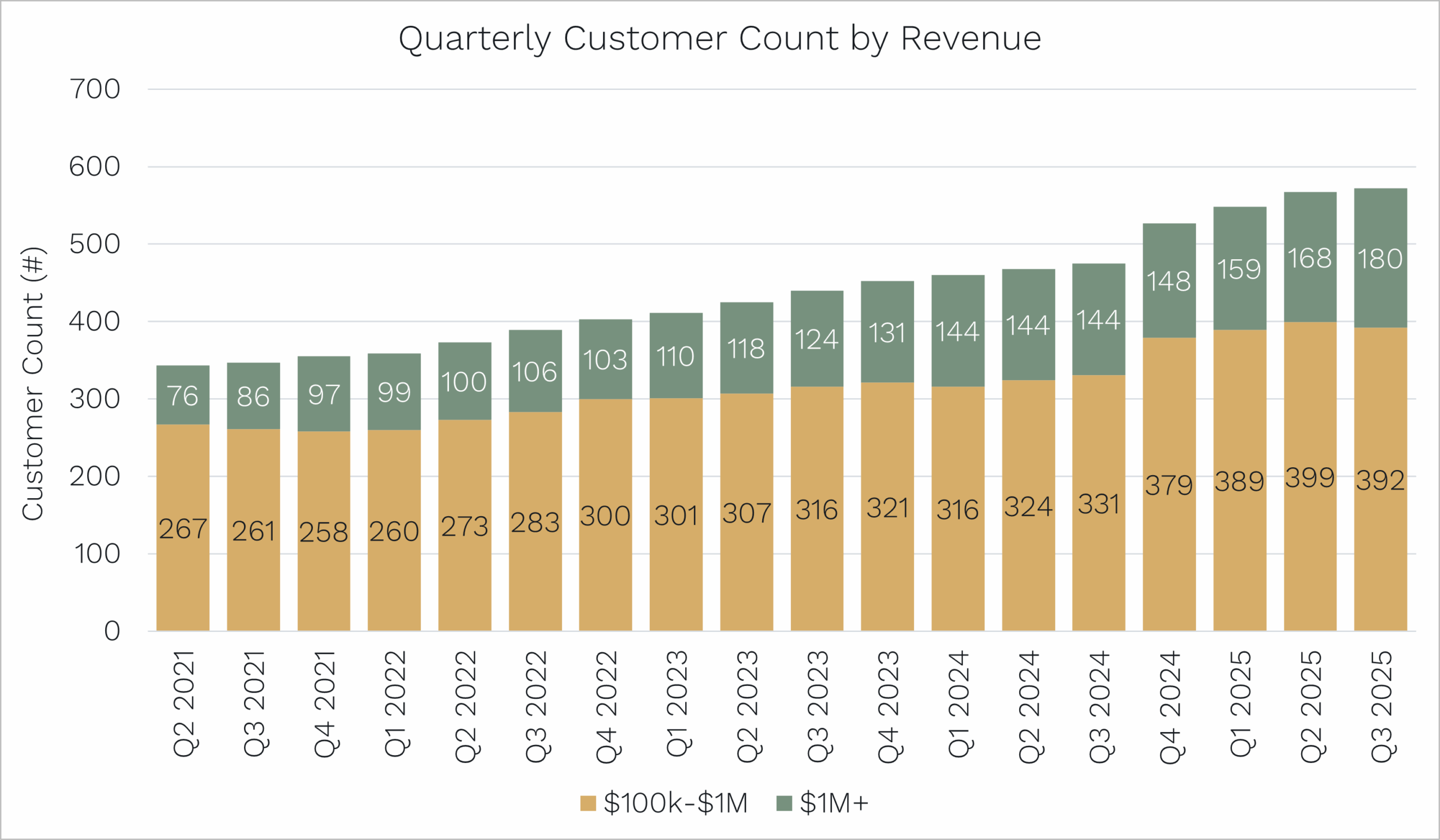

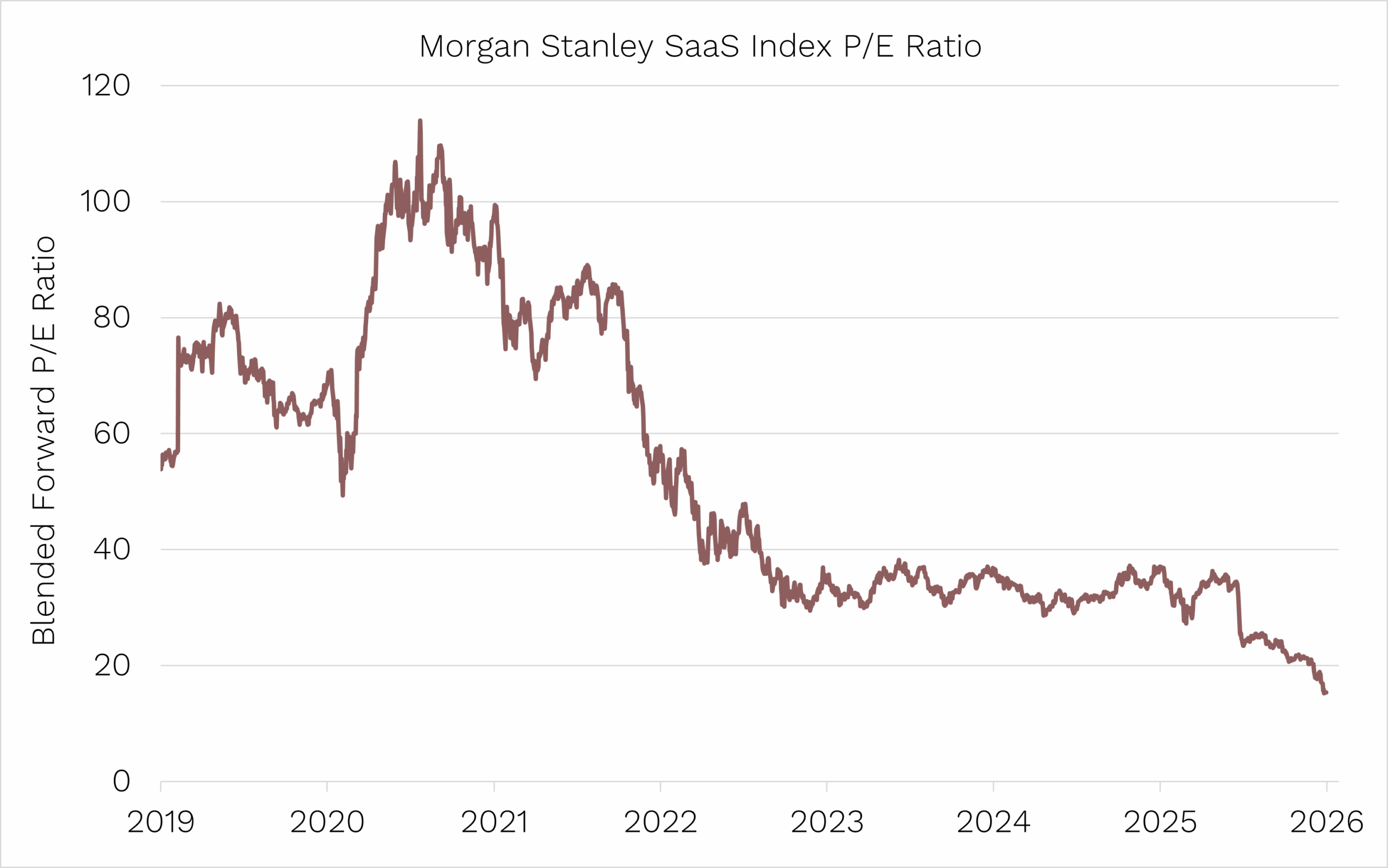

But broadly, investors have become petrified at how easy it might be for AI to replicate and improve on traditional software businesses, particularly those operating what was previously thought of as stable Software-as-a-Service models (delivering applications on the internet usually via subscriptions).

The victim list so far is a roll call of some of Australia’s best-known tech names, like Xero, TechnologyOne, WiseTech, Catapult Sports, Pro Medicus and Life360.

In the U.S., it includes names like Atlassian, Docusign, ServiceNow, Salesforce, Palantir and Adobe – all those names are down -20% or more so far this year, at time of writing.

The sell-off has been indiscriminate, with high-quality stocks tossed out with the low quality, and those with likely big moats against AI disruption getting carted with the rest.

It’s interesting, because if history tells us anything with the internet, it’s that the software application layer of the internet made all the money – think Google, Meta, Amazon, WhatsApp, etc.

But with AI, there are essentially five layers:

- Energy needs: Including companies like Constellation Energy that power data centres.

- Chips needs: NVIDIA is the clear standout here in the semiconductor design and manufacturing space.

- Memory/storage needs: Mostly in the cloud, in data centres with winners like Microsoft Azure, Amazon Web Services, Coreweave and NextDC.

- Large Language Models: Like Claude, ChatGPT, Gemini and Grok, which are the most visible winners so far.

- Application software layer: This is also where some hardware like robotics sits as investors debate what form factor the software will be delivered in – e.g. desktop/mobile/glasses/robot, etc.

There will no doubt be new AI-enabled application software companies that we don’t know yet, or haven’t been established, that will likely be big winners and household names in 5-10 years.

But to assume all of today’s traditional software companies are going to be losers and not be able to successfully integrate and leverage AI seems very shortsighted.

It really is an environment of ‘shoot first, ask questions later’ at the moment. So important is this topic that we’ve written this month’s entire Strategy Note about it, which we encourage you to read (link).

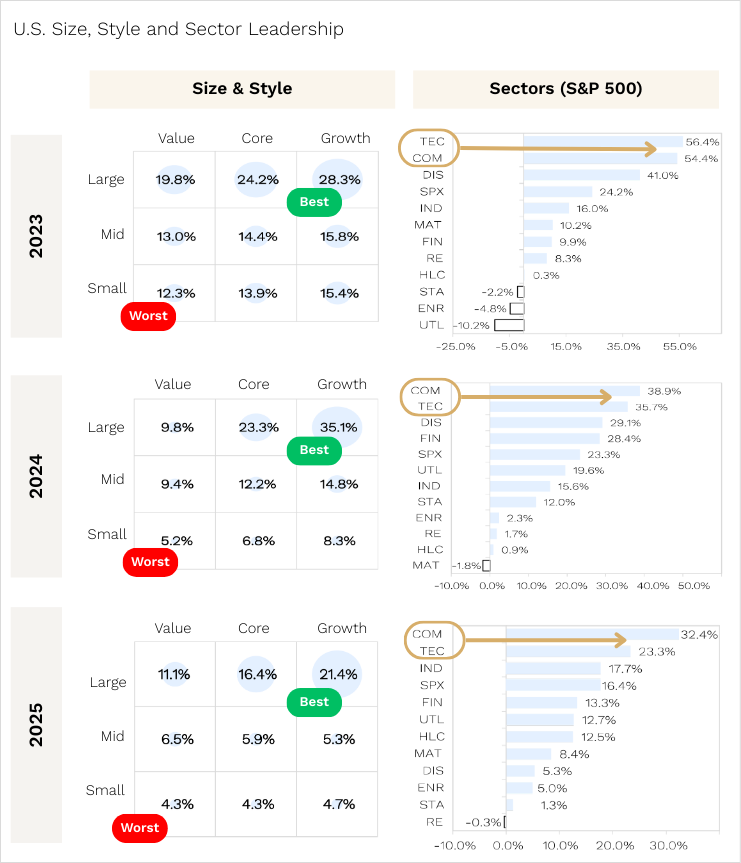

For now, the Materials, and particularly commodities outperformance, as well as software underperformance, have created headwinds for our style of investing and performance.

At the margin, we are typically structurally underweight Materials (which is a more cyclical/value sector) and overweight IT (which has more high-quality growth style companies). Andrew covers this in this month’s video update (link).

Importantly, though, it’s clear some of these traditional software businesses today that are able to harness the benefits of AI to increase their moats, along, of course, with new AI-related start-ups, will be some of the best performing in the years ahead, and they remain firmly in our investment ‘hitting zone’, which keeps us incredibly excited.

-

Big currency movements

Finally, anyone in Australia who has been booking their U.S. holiday trip at the moment will likely have been licking their lips.

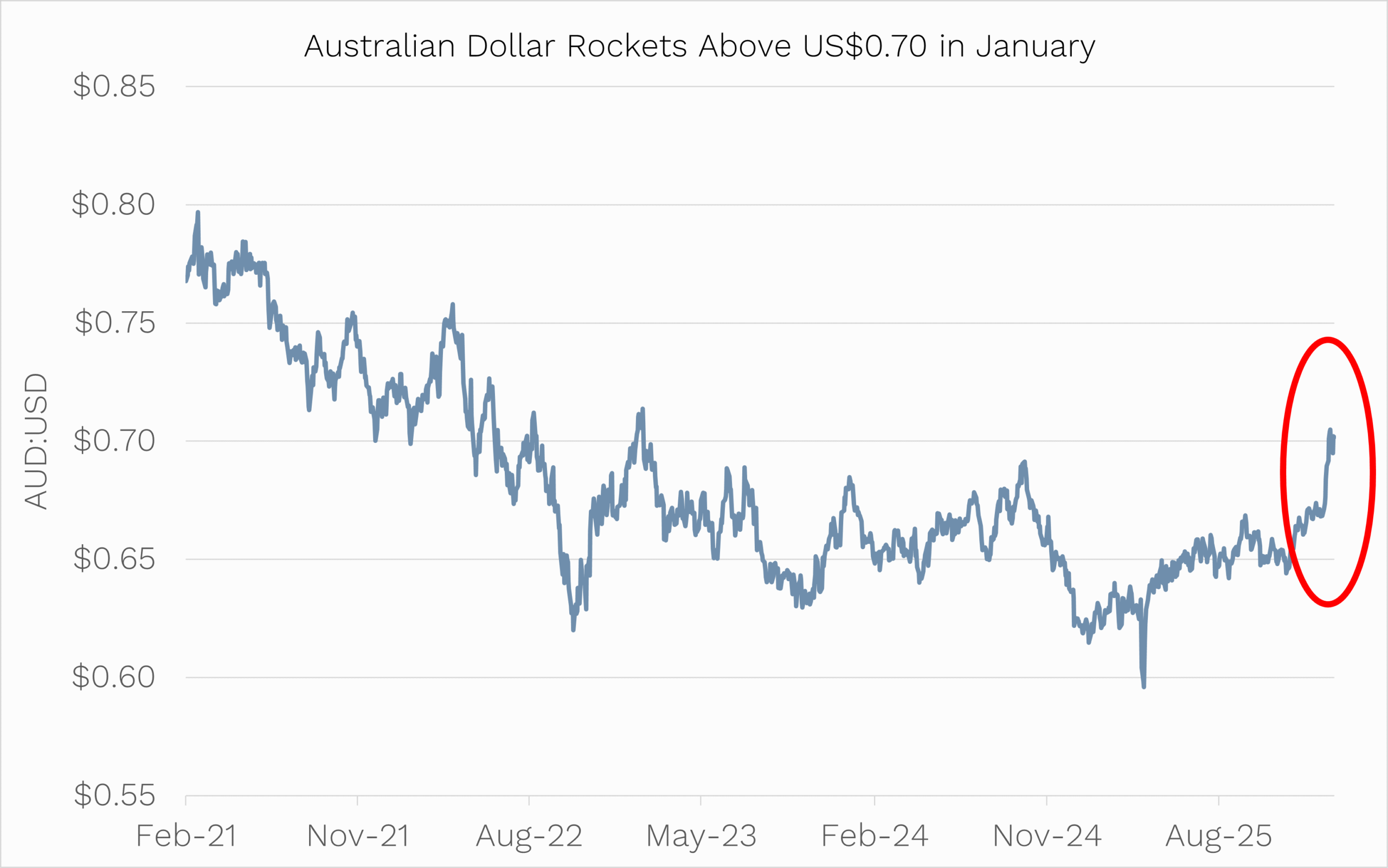

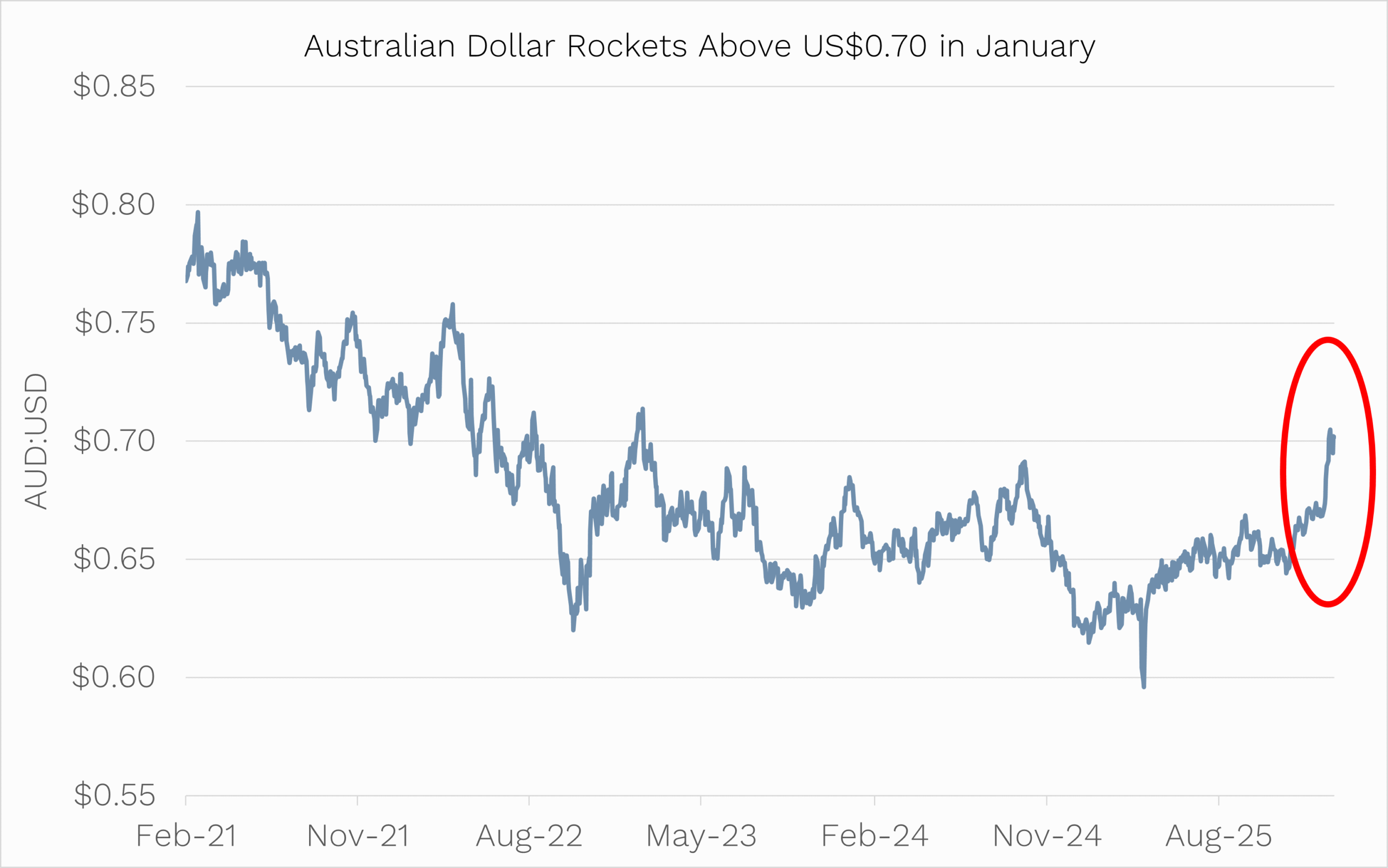

In January, the Australian dollar rocketed above US$0.70 for the first time in a few years and is well above the sub-US$0.60 level it reached at one point last year.

Source: Bloomberg. Ophir.

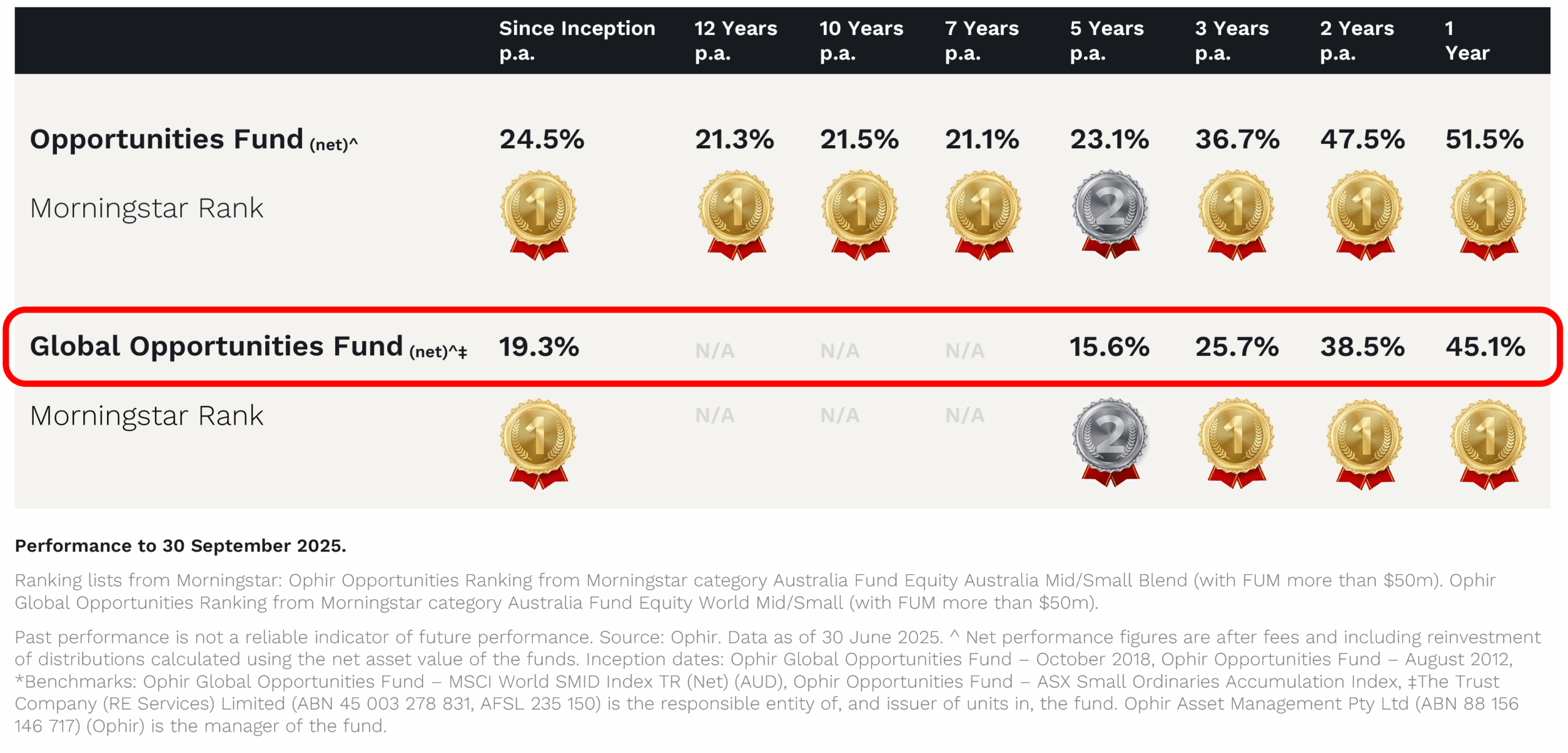

While this is great for holiday makers to the U.S., it is a headwind to the performance for the Australian-dollar returns of the unhedged classes of our global small/mid-cap Funds, the Global Opportunities Fund and Global High Conviction Fund.

We do have a 100% currency hedged class of the Global Opportunities Fund available though (Class H), and it protected against the appreciation in the Australian dollar in January relative to all the major currencies in which we invest, including the U.S. dollar, Euro, British Pound and Japanese Yen.

Why did the Australian dollar increase against so many foreign currencies? Will it keep happening? And should you hedge it?

Given the U.S. dollar represents 60-70% of our currency exposure in the Global Funds, we’ll keep our focus here.

There have been two key factors pushing down on the U.S. dollar lately:

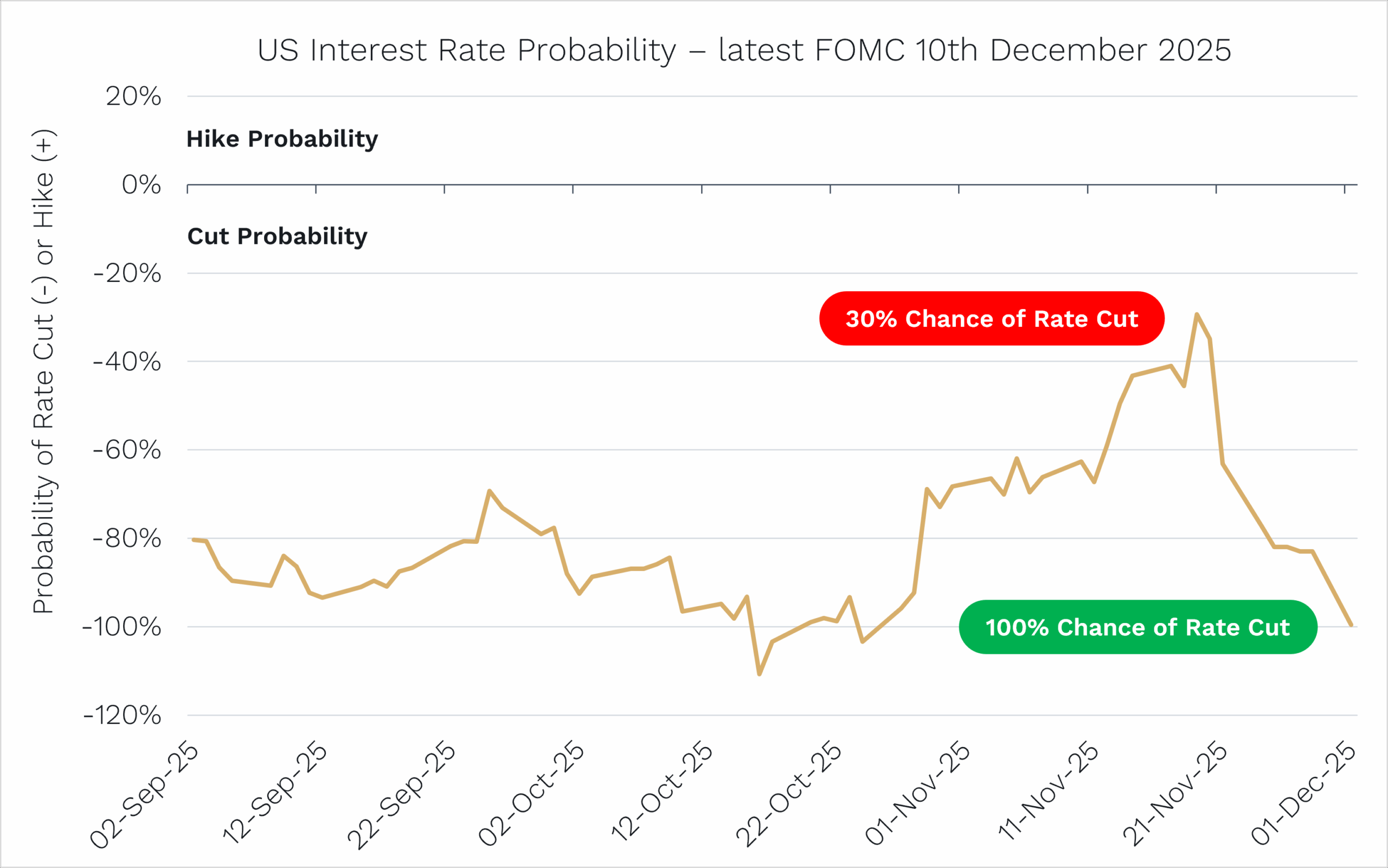

- The Fed is expected to cut rates by more than any other major central bank (some central banks including in Australia and Japan are actually hiking.) That makes U.S. interest rate yields less attractive to foreign investors and therefore reduces demand for U.S. dollars.

- With U.S. exceptionalism fading and risk sentiment improving as global growth improves, capital flows are shifting to more ‘risk on’ countries, including Australia.

Will this trend of an appreciating Australian dollar continue in the near term?

Sadly, the answer, if we are being honest, is that no one really knows with any high degree of confidence. (The RBA itself simply forecasts no change in its projections.)

Since 1983, when the AUD began freely floating against USD, it has averaged almost bang on US$0.75. Where we are today is pretty close to that average.

With official rates likely still pointing higher in Australia and lower in the US this year, as well as evidence of acceleration in growth helping to support commodity prices, there may be a little upside still to the Australian dollar.

That said we are pretty close to that long-term average and short-term forecasting of the currency is perhaps the most difficult of all asset prices.

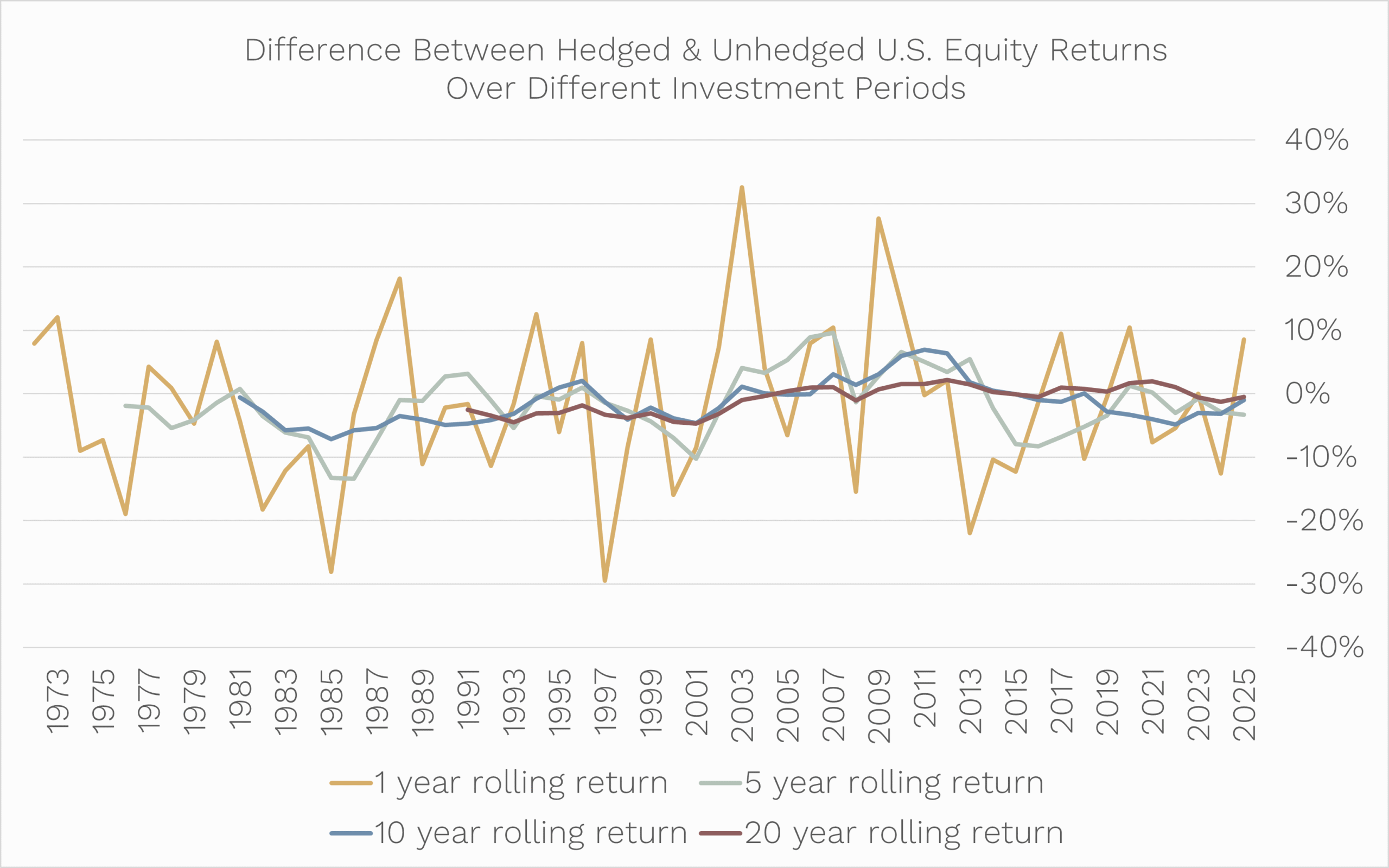

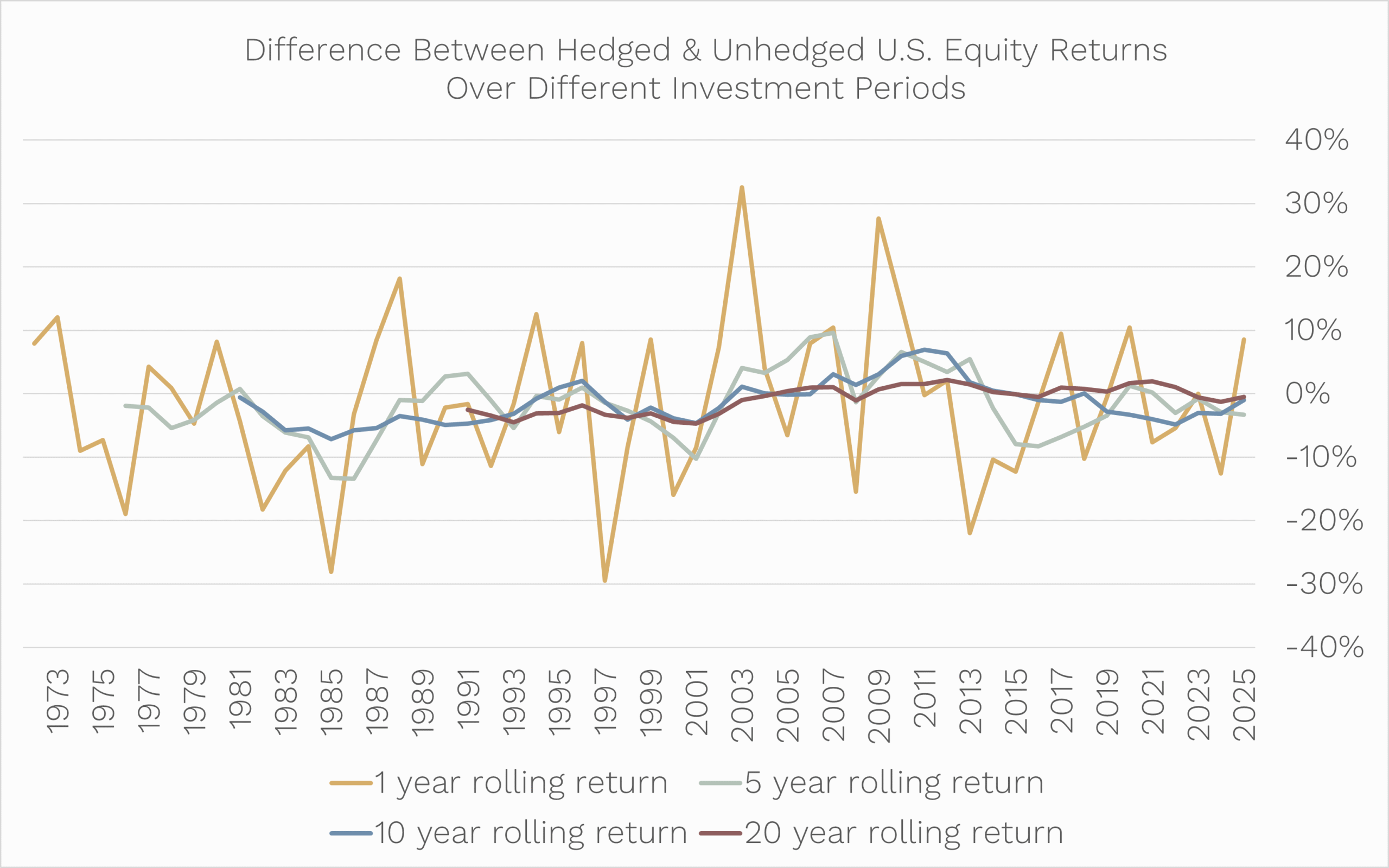

Fortunately, in the longer term, it tends not to matter that much whether you are hedged or unhedged for currency movement in your exposure to overseas equities.

You can see this below, where the difference in annual returns between hedged and unhedged U.S. equity returns, from the perspective of an Australian investor, can be big – often in the 10%-30% range.

But when you get out to 10- and 20-year rolling periods, the difference is quite small (often 0-3% p.a.).

Source: Bloomberg. S&P 500 Index used for U.S. Equity returns and AUD/USD exchange rate used to compute unhedged returns.

There is one key benefit, though, of the unhedged Global Opportunities Fund classes: foreign currencies, and most notably the U.S. dollar, are negatively correlated with global share markets.

When share markets sell off, like in March 2020 after COVID first broke out, the U.S. dollar tends to rise, and the Australian dollar fell, offsetting the decline in an Australian investor’s exposure to the U.S. equity market.

For example, the currency-hedged maximum drawdown of the S&P 500 in March 2020 was -33.9% while the unhedged number was -24.3% as the Australian dollar fell from US$0.67 to around US$0.57.

That is why, long-term, most Australian investors have larger allocations in unhedged global equities than funds that provide currency hedging.

At the end of the day, the choice is yours! We’ll just be working our butts off, aiming for the underlying companies we invest in to provide great returns for you.

As always, if you’d like to chat to us about any of the Funds, please feel free to call us on (02) 8188 0397 or email us at ophir@ophiram.com.

Thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date this was prepared and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.

![]()