Optimism Dies Hard

In this Letter to Investors, we look at:

- How share market breadth is back, with small caps posting a stellar August

- The extreme valuation differential between small and large caps that suggests smalls are strongly placed to outperform in the next 5-10 years

- The outlook for small caps for the next 12-18 months based on four scenarios (which scenario is most likely, and which is best for small caps)

- How small caps are one of the most attractively valued asset classes anywhere in the world today, and

- Why all this makes us confident that our Funds are poised to deliver 15%+ average returns in the coming years

Ophir Fund Performance – August 2025

Before we dive into the Letter, you’ll find a detailed monthly update on each of the Ophir Funds below.

The Ophir Opportunities Fund returned +10.3% net of fees in August, outperforming its benchmark which returned +8.4%, and has delivered investors +24.0% p.a. after fees since inception (August 2012).

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +6.3% after fees in August, underperforming its benchmark which returned +7.0%, and has delivered investors +14.8% p.a. after fees since inception (August 2015). The ASX listing returned -1.9% for the month.

The Ophir Global Opportunities Fund* returned +4.9% net of fees in August, outperforming its benchmark which returned +2.1%, and has delivered investors +18.8% p.a. after fees since inception (October 2018).

The Ophir Global High Conviction Fund* returned +4.1% net of fees in August, outperforming its benchmark which returned +2.1%, and has delivered investors +14.7% p.a. after fees since inception (September 2020).

*Refers to Class A units.

Welcome to the party, pal!” – John McClane

It’s Christmas Eve 1988 in Los Angeles.

Terrorist Hans Gruber and his band of German thugs have just crashed Nakatomi Plaza’s Christmas party and are looking to rob the joint.

What Hans didn’t count on, though, is that NYPD cop John McClane is making a surprise visit to the Plaza to reconcile with his estranged wife Holly who is attending the party.

After tossing a terrorist out of a window onto an unsuspecting LAPD cop car below, McClane yells his classic line to the startled driver: “Welcome to the party, pal”.

Source: Die Hard (1988).

It was, of course, action hero Bruce Willis as McClane who delivered the line in the cult classic and holiday favourite, Die Hard. Suddenly, Arnie’s Terminator quip of “I’ll be back” had some competition for best 80s action movie one-liner

August reminded us that, despite the laundry list of macro risks, investors’ optimism too “dies hard”.

During the month, investors couldn’t be held back, and even small-cap investors got a “welcome to the party” this month.

August saw the market add more gains to the rally from April’s post Liberation Day share market low.

The S&P 500 in August was up +2.0%. U.S. small caps put on a whopping +7.0%, boosted by Fed Chair Powell opening the door to a September rate cut.

Following in the footsteps of its U.S. big brother, ASX large and small caps put on a very similar +2.7% and +8.5% respectively (ASX100 and ASX Small Ords).

Small caps to trounce large?

Share market “breadth is back baby” I can hear John McClane say.

Regular readers will know we’ve been highlighting how the epic small-cap-market underperformance over the last 4-5 years has made small-cap valuations globally versus large the cheapest in a generation (25+ years).

The mega-cap tech companies have body slammed the rest of the market for much of the last decade.

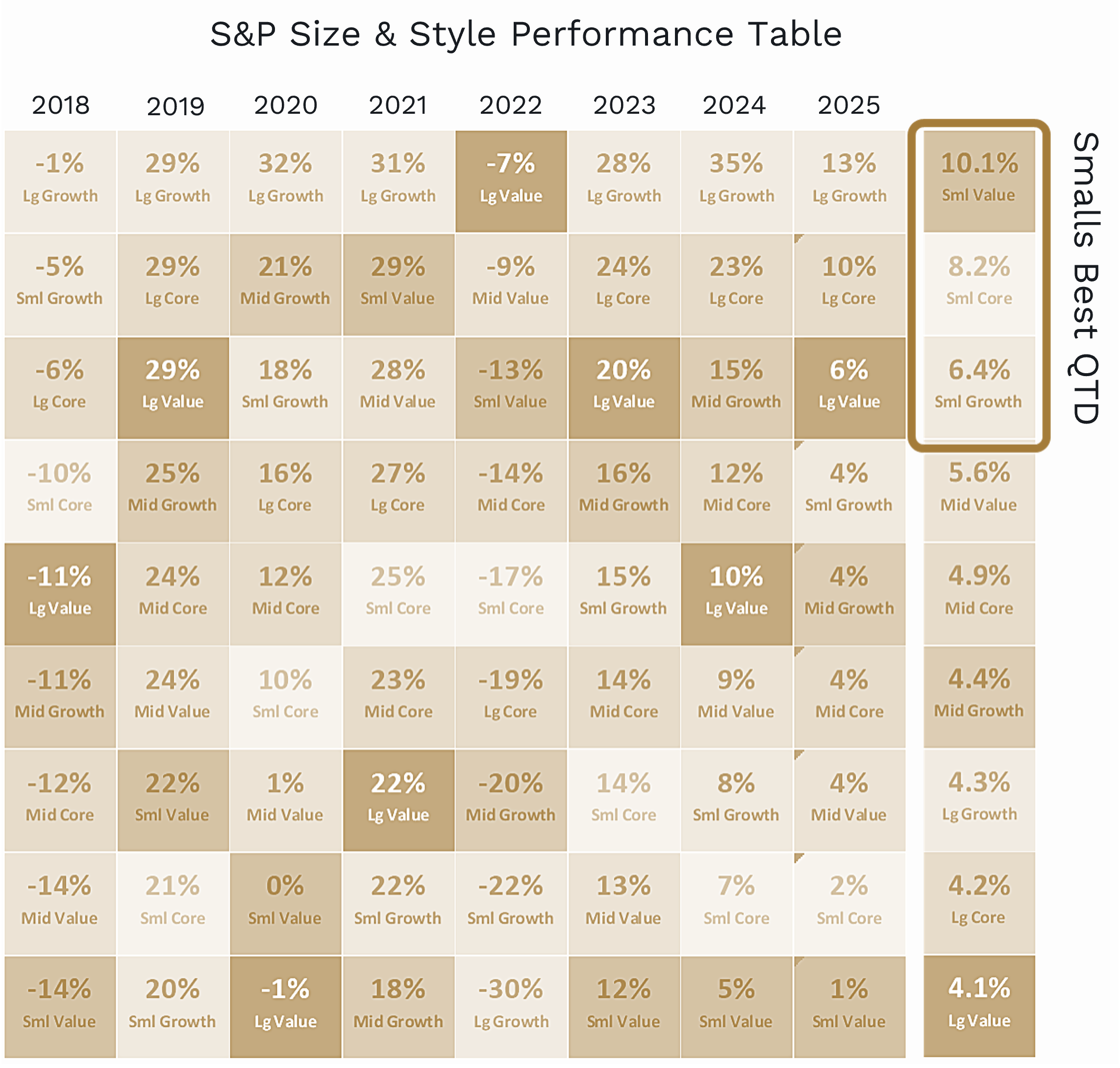

The chart below shows the different size (large/mid/small) and style (value/core/growth) segments of the U.S. share market since 2017.

The mega-cap tech poster childs, the Magnificent 7, are all large-cap growth businesses.

(Source: Piper Sandler & Co.)

But based on history, the extreme valuation differential we see now means that it’s highly likely small caps will trounce large caps over the next 5-10 years.

So what will the next 12-18 months look like?

Four Scenarios

You thought breaking Holly out of Nakatomi Plaza was tough, well short-term forecasting is the investment equivalent!

So, for this month’s Letter to Investors, we thought we’d lay out the four most likely near-term economic scenarios for U.S. small caps, which given their 65% odd share, is also likely to drive small caps globally.

The four scenarios we see immediately ahead are outlined below from most to least likely, with our best estimate for their likelihood in brackets:

1. Fed normalises rates, low growth continues (40%)

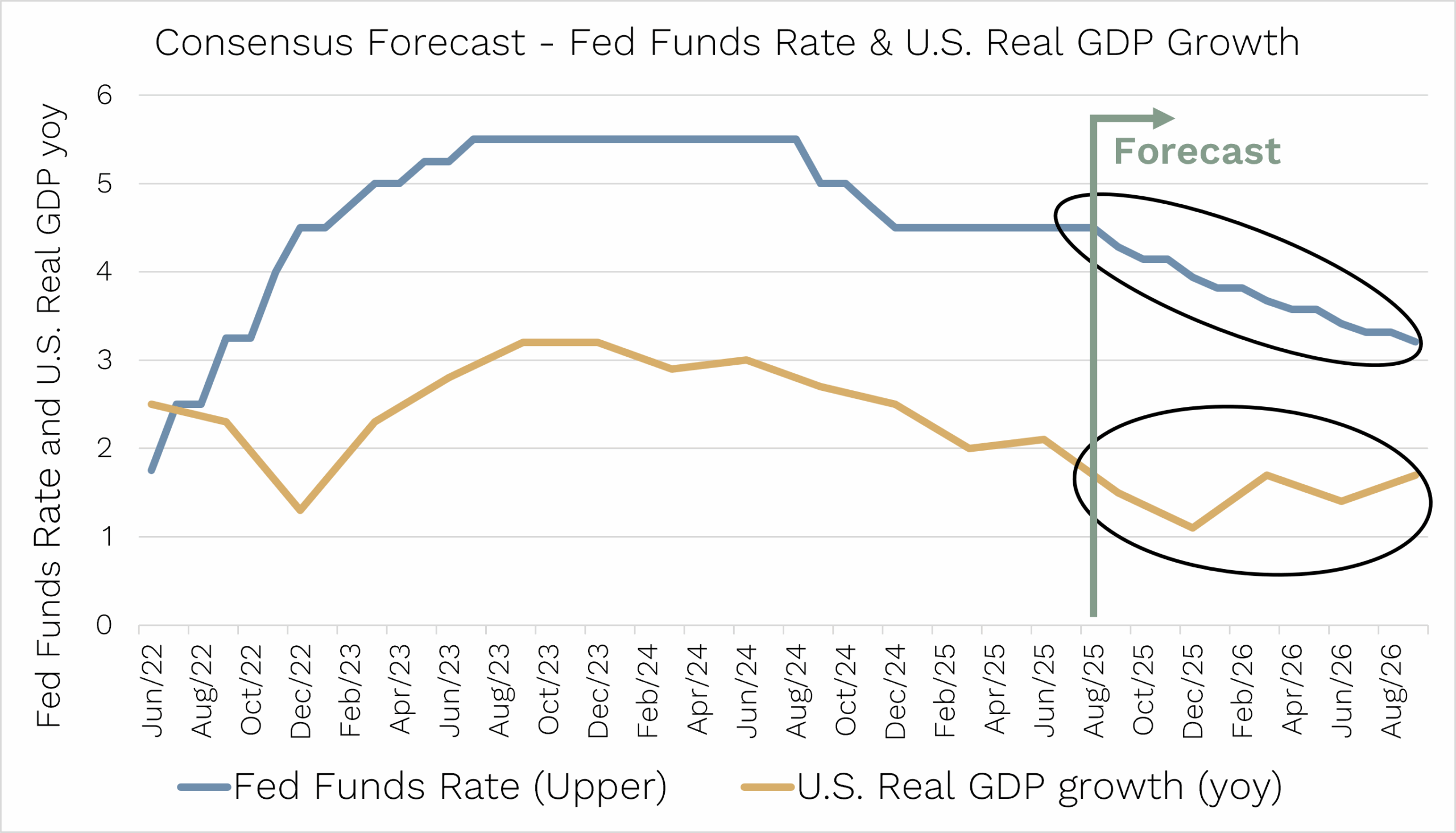

This is the most likely scenario. We’re in good company because it’s the consensus of market participants and economists.

As you can see below, the market is pricing that after being on hold so far this year, the Fed will get off the fence and recommence its rate-cutting cycle at its next meeting on 17th September (blue line).

Source: Ophir. Bloomberg.

For us as stock pickers, this is typically a good environment.

Market returns might be more modest. But when economic (1-2% forecast above) and corporate earnings growth are low, higher-growth companies that we focus on (and are experienced in finding before the market) suddenly become rare diamonds and get bid up by the market.

Scenario 1 bottom line: Moderate market returns (including small caps); best outperformance opportunity

2. Fed normalises rates, growth booms (30%)

The next most likely outcome is rates normalising lower and helping kick off an economic boom later this year and next.

For most businesses in the U.S., rates have been uncomfortably high for many years. It shows as sluggish aggregate earnings growth outside the Magnificent 7.

Combine that with Trump’s One Big Beautiful Bill – including its immediate expensing of Capex and R&D and deregulatory agenda – and some economists see U.S. real GDP boosted to near 3% next year.

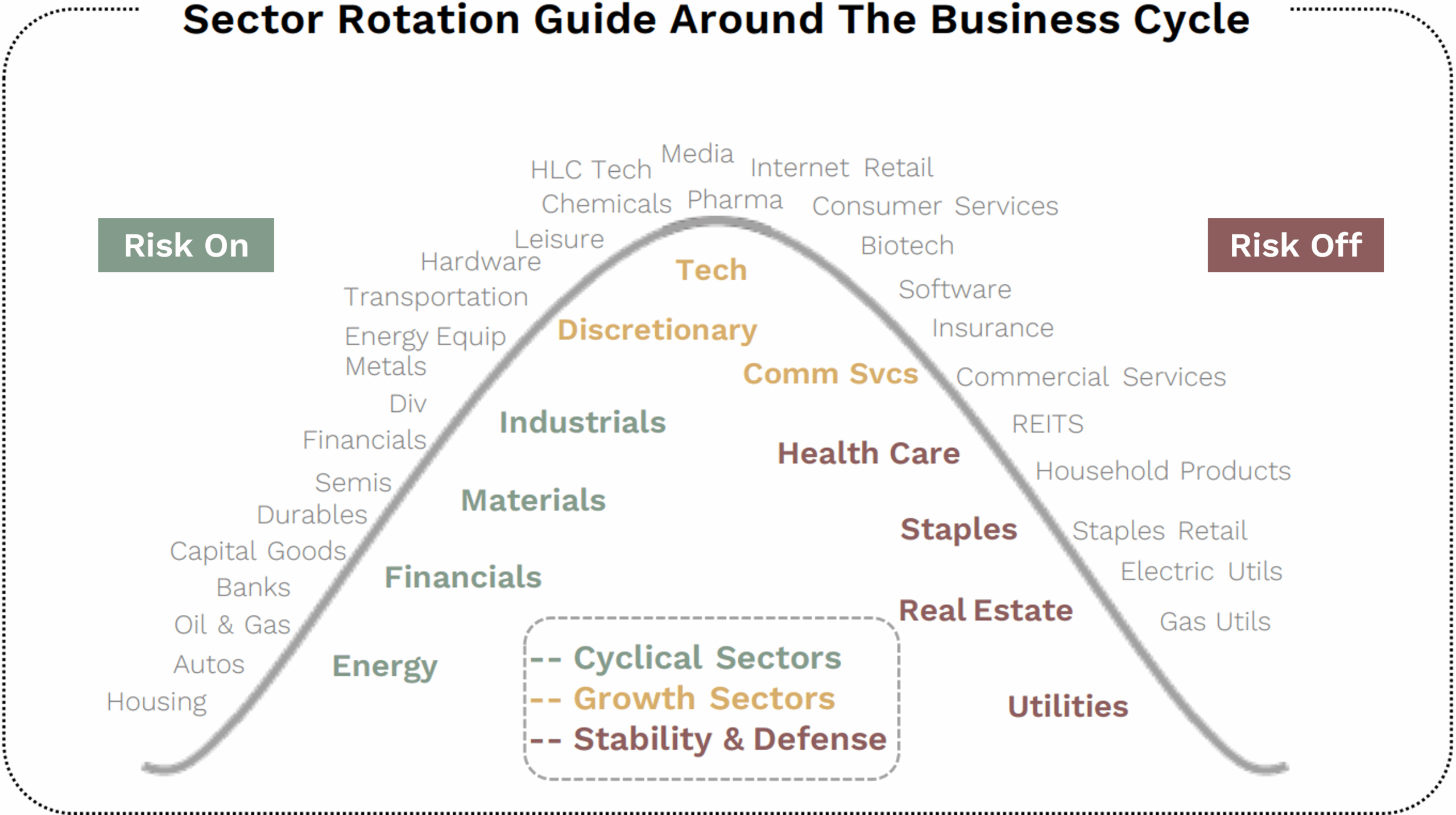

This would ignite rocket fuel under the risk-on and cyclical parts of the share market, including the housing, energy, financial, materials sectors … and small caps.

For investors, these are the exciting types of environments where you make 20-50% in a year from the small-cap market.

But while great market returns in small caps could be expected, it would be a more challenging environment for us to outperform.

Why?

Because we tend to be underweight the most cyclical sectors of the share market, particularly energy, financials and materials.

Cyclicals tend to have fewer of the structural-growth businesses that we like to focus on (low-growth regional banks dominate the financial sector in the U.S.).

We also don’t have expertise in forecasting the underlying commodity prices that dominate short-term moves in energy or materials businesses.

Source: Piper Sandler

Still, in this scenario, our investors are likely to be happy because small caps will probably have ripped big time; and we’ll be happy to just keep up with that boom.

Scenario 2 bottom line: Best small-cap market returns, will be tougher for us to outperform

3. Fed cuts quickly as recession arrives (25%)

The consensus of economic forecasters puts the probability of a U.S. recession in the next 12 months in the 25-30% range (Bloomberg).

That may sound high until you realise the forecasts never get below 15%, because recessions occur, on average, about one in every seven years.

So, while recession risk is a little elevated – mostly due to risks from U.S. tariffs and a still-restrictive Fed policy rate – a recession is not the most likely outcome expected from most in the “dismal science”.

But if one did occur, then undoubtedly share markets would fall as they always have in U.S. recessions. This is the worst-case outcome for market returns in both large and small caps.

Just because the recession probability is elevated, though, there is no point getting too defensive by doing things like going to cash for two main reasons:

- It’s not the most likely scenario and the cost of foregone returns could be huge if the likelier scenarios above play out; and

- Even if a recession is on the cards, it’s virtually impossible to predict the exact timing of the market downturn (and subsequent recovery) that historically has always accompanied it, like you’d need to in order to be better off than just staying invested.

Nine out of 10 times in a recession small caps fall more than large caps. But there is a good case to be made that may not happen if a recession occurred today.

The last recession where large caps fell more than small caps was the Dot.com-related recession in the early 2000s.

Large caps fell more because they were so much more expensive than small caps.

Ring a bell, anyone?

Today, small caps are the cheapest versus large since just before that Dot.com recession. So it’s a real possibility that, if a recession were to rear its head today, large caps would fall more than smalls in a sell-off.

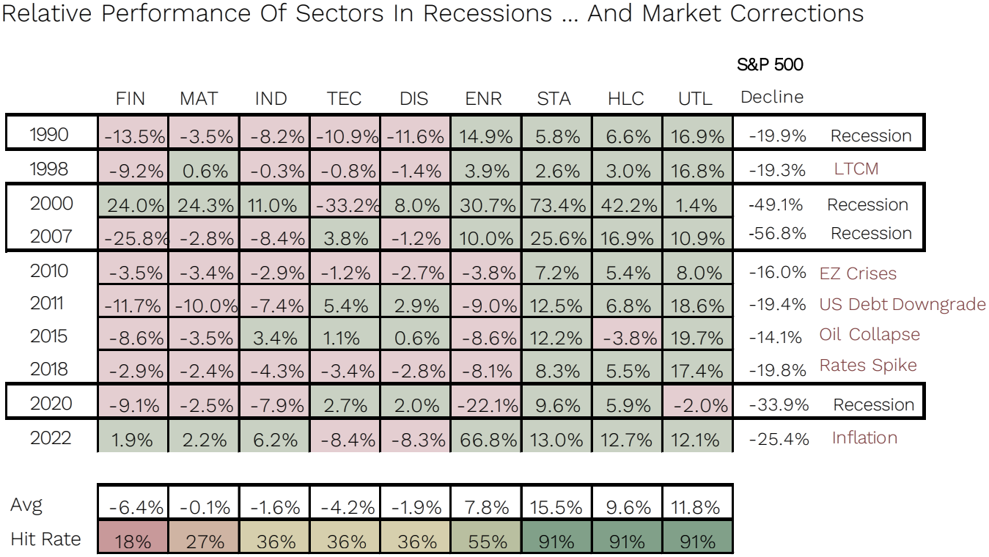

The sectors that do well in a recession are “stability” sectors like health care, consumer staples, utilities and real estate (see table below).

Source: Piper Sandler

The other group of companies that outperform in a recession are businesses whose earnings are beating market expectations. These are our forte.

And while we tend to invest less in utilities and real estate, the health care and consumer staples sectors are firmly in our wheelhouse and provide us with plenty of opportunity to outperform.

Scenario 3 bottom line: Worst market returns (though small caps may outperform); moderate outperformance opportunity

4. Inflation ramps and Fed raises rates (5%)

What happened to all that inflation we were promised by the market pundits from Trump’s tariffs?

If it turns out that material inflation is still on the way – even though the Fed playbook is to look through tariff-induced inflation – we could see higher interest rates if it feeds into higher inflation expectations.

We think this is the least likely scenario, though it’s not completely off the table.

But the Fed will have a high bar for it to decide to reverse its forecasts for rate cuts, even putting aside Trump’s pressure to stack the Federal Open Market Committee (FOMC) with sycophants to get them lower.

Investors could see this as a mini replay of what happened in 2021/2022 when rates rose, markets sold off, and small-cap growth-oriented businesses felt the worst of the valuation squeeze.

This time, though, instead of rates lifting from zero, they are already at 4.5% today in the U.S.

We are not sure the U.S. economy could handle much higher rates without causing a more serious slowing in demand and inflation.

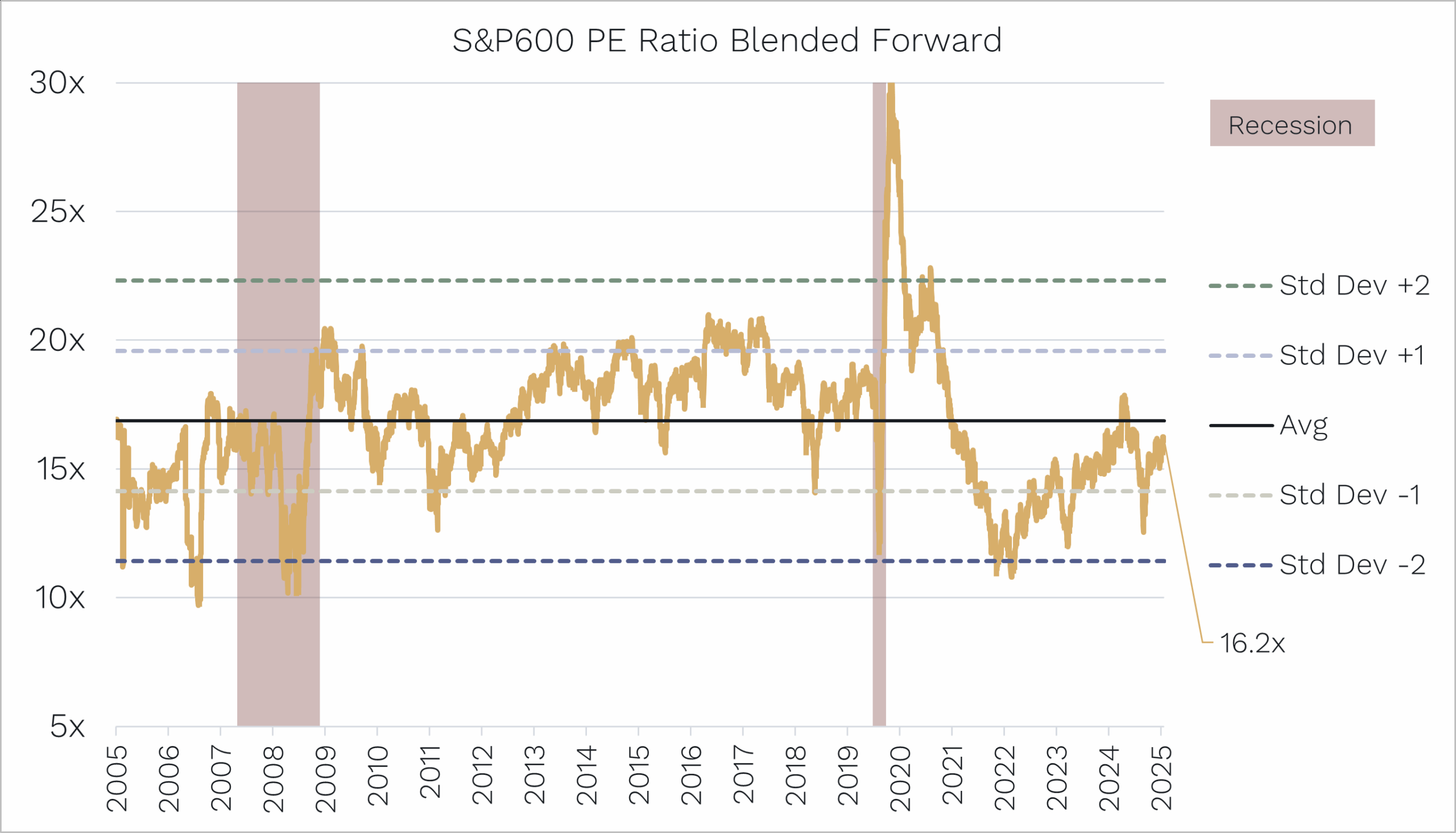

Also, today, U.S. small caps trade on a below-average 16x price-to-earnings ratio (PE). That’s a far cry from the two standard deviations expensive 22x they traded on prior to the 2021/2022 sell-off, so they likely have less downside risk.

Source: Ophir. Bloomberg

Regardless, this scenario would likely see markets fall, though not likely as much as in the recession scenario.

It would be hard for us to outperform, though, as the faster-growing small caps we invest in would have their valuations impacted more.

Lucky it’s the least likely scenario, with probably a 5% or lower likelihood.

Scenario 4 bottom line: markets likely fall, worst outperformance opportunity

An exciting time to be a small-cap investor

Now that’s a lot of different scenarios and only one, or perhaps even a variant of one, will play out. But it’s good to understand the risks, though not be frozen by them. That’s investing.

The first two scenarios are the most likely in our view and great for Ophir investors.

The third is bad for investors, but we think there are quite good prospects that we will perform better than large caps.

The fourth is the worst but least likely.

But this is the short term: the next 12-18 months.

Investors in our Funds should have a minimum time horizon of at least five years.

And on that score global small caps are cheap. They are one of the very few asset classes you can say that about today and that’s great news.

So, as we look out over the next five years we remain confident we can achieve our internal target of 15% per annum on average – a level we have met or exceeded in all our Funds.

Valuations in our part of the market are attractive.

The team is experienced, stable and locked in.

And we remain as hungry as ever to deliver great returns for ourselves and our investors.

As John McClane might say “Yippee-ki-yay”!

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document has been prepared by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420082) (“Ophir”) and contains information about one or more managed investment schemes managed by Ophir (the “Funds”) as at the date of this document. The Trust Company (RE Services) Limited ABN 45 003 278 831, the responsible entity of, and issuer of units in, the Ophir High Conviction Fund (ASX: OPH), the Ophir Global Opportunities Fund and the Ophir Global High Conviction Fund. Ophir is the trustee and issuer of the Ophir Opportunities Fund.

This is general information only and is not intended to provide you with financial advice and does not consider your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon any information provided and consider seeking advice from a financial advisor if necessary. Before making an investment decision, you should read the relevant Product Disclosure Statement (“PDS”) and Target Market Determination (“TMD”) available at www.ophiram.com or by emailing Ophir at ophir@ophiram.com. The PDS does not constitute a direct or indirect offer of securities in the US to any US person as defined in Regulation S under the Securities Act of 1993 as amended (US Securities Act).

All Ophir Funds are deemed high risk within their respective Target Market Determination documentation. Ophir does not guarantee the performance of the Funds or return of capital. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Any opinions, forecasts, estimates or projections reflect our judgment at the date of this was prepared, and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct.

Actual returns could differ significantly from any forecasts, estimates or projections provided.

The Trust Company (RE Services) Limited is a part of the Perpetual group of companies. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital.