We discuss why COVID-19 has created an investing environment ideal for high quality active equity managers.

After the recent COVID-19 volatility, investors are no doubt asking themselves whether an active or passive strategy is the best way of navigating these challenging market conditions.

We think that when it comes to investing in small cap companies, the decision is generally clear – investors will gain superior results from an active strategy that aims to outperform the markets and that concentrates a portfolio in unappreciated companies.

But an active strategy is particularly well placed to outperform a passive strategy now because we have a ‘stock picker’s market’.

Two types of markets

Through business cycles, markets typically oscillate between two distinct periods:

1. When share prices are driven by top-down forces: forces which are driven by macroeconomic, political, or global factors;

2. And when share prices are driven by bottom-up factors: information will relate to the financials, or specifics, of an individual company.

For equity managers, the distinction between these two phases are profound and require different allocation of risk.

Defining the market

So how can we tell which type of market we are in?

Portfolio managers use two common statistical measures – correlation and dispersion — to measure the magnitude of variations between individual stock returns. Correlation measures to what extent stocks are moving in the same direction; while dispersion quantifies the magnitude of return variation amongst stocks.

When equity markets are heavily influenced by macroeconomic forces, correlations tend to move higher. Portfolio managers are left with fewer opportunities to generate a return which is meaningfully different from the rest of the market. When bottom-up factors dominate, correlations tend to fall.

Correlations measure if asset classes move in synch; it does not measure the magnitude of those movements. Even when correlations are high, the opportunities for active managers to make money have not necessarily vanished.

There have been numerous periods in history where correlations amongst equities were high (i.e. all stocks were moving in similar directions simultaneously); but where investors could still find diversification benefits if the dispersion of those returns were high.

COVID-19 creates an ideal environment

From 2011 to 2018 stock correlations remained continually high, while return dispersions stayed low. This persistence appears to have been driven by two of the most defining market thematics we have witnessed over the last decade: the use of quantitative easing (QE) as a policy tool by central banks; and the rising weight of money held in passive investments products.

Not surprisingly, these conditions have made the last decade incredibly tough for many active equity managers and forced many to leave the industry.

Opportunities available for stock pickers

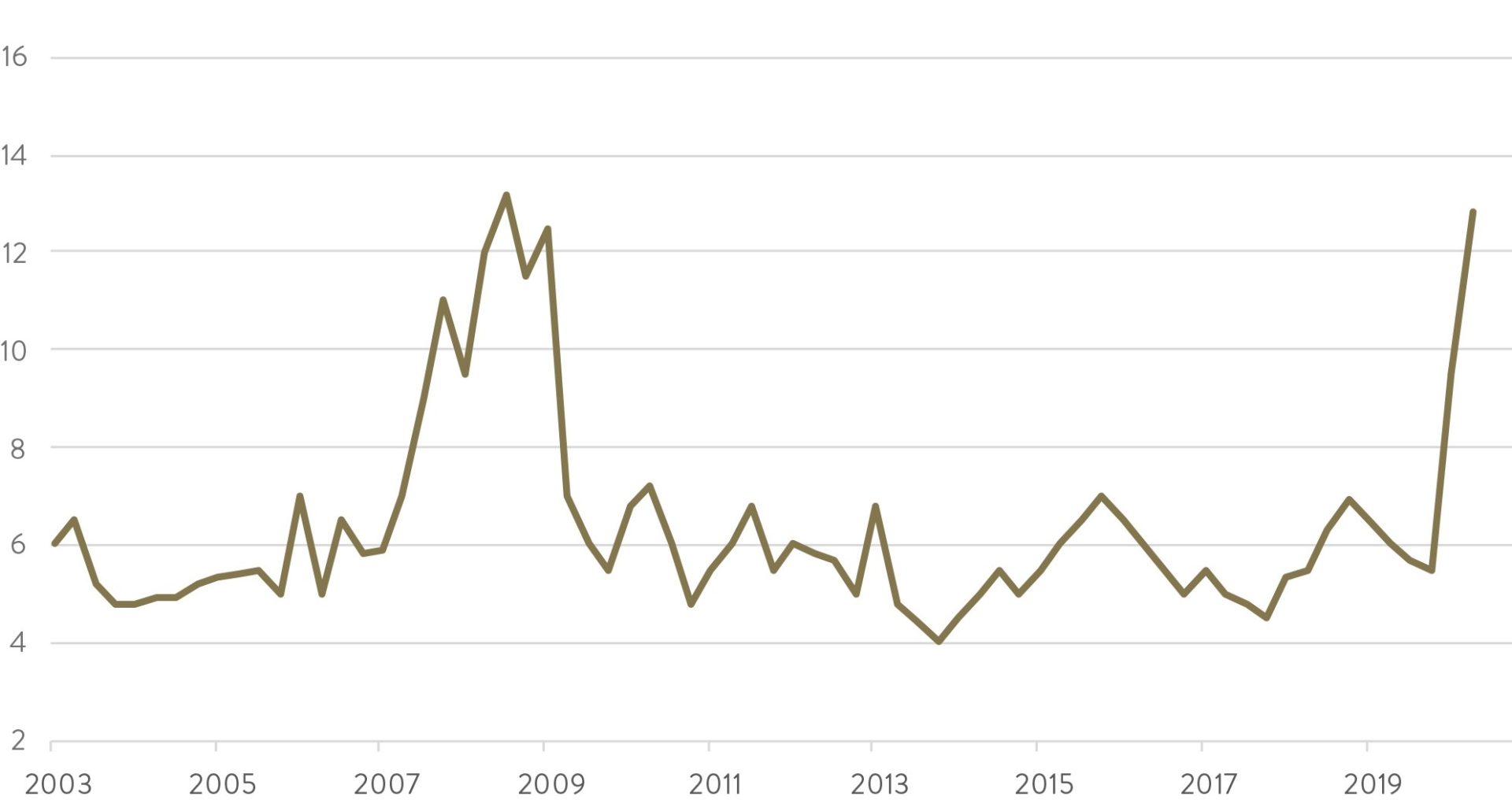

(cross-sectional dispersion of stock returns on the ASX*)

Source: Goldman Sachs, *3 month average

But that has now changed because of COVID-19.

COVID-19 has been the catalyst that has broken equities out of the narrow dispersion patterns they have traded in over the last decade. This can be most clearly seen in the chart above, which shows a sharp spike upwards in the dispersion of stock return on the ASX.

As equity investors, we view these widely dispersed stock returns as providing an ideal environment for us to implement our active strategies. Whilst correlations remain high as most stocks have moved down in February and March, then up in April and May, during this uncertainty markets have tended to price stocks imperfectly, leading to great opportunities.

We have now entered a stock picker’s market that suits an active strategy more than it has in over a decade.

Once markets gain confidence that the coronavirus crisis has passed, the volatility and dispersion which stocks are currently showing will tend to moderate.

Until this happens however, we will be assertive in using our stock picking skills to build positions in companies which we believe are mispriced. These months have been stressful for investors, but they have also provided the opportunity to rotate into the stocks which will be the winners over the next cycle.