Small cap companies are more volatile, suffer bigger drawdowns and are less liquid than large-cap stocks however there are many wonderful ‘pros’ of investing in small caps. In this month’s Investment Strategy Note we outline 4 reasons small caps remain our favourite place to invest.

There is no doubt that in this tough market investors are seeing the downsides of small caps – greater volatility, less liquidity and bigger falls. They may be questioning why they should bother allocating to this market segment. In this Investment Strategy Note we look at 4 reasons why investors should stick with small caps.

Volatility is back in shares and bear markets (>20%+ falls) can be found all over the place including in US tech (NASDAQ), US small caps (Russell 2000), IPO stocks, most growth companies and some Asian markets (China, Hong Kong and Singapore). Many other markets, notably the S&P500, have flirted with bear-market-sized falls.

As is usually the case during declines, markets are treating small caps like the runt of the litter, falling first, faster and harder than their large-cap counterparts.

As of writing (early June), domestically, the Australian small-cap industrials index is down -22.3%, versus just -5.1% for the large-cap ASX50 Index. Similar trends can be found overseas with the Russell 2000 small-cap index down -24.6% compared to -14.9% for the S&P500 large-cap index.

There is no doubt that small-cap stocks are more volatile, have bigger drawdowns and are less liquid than large-cap stocks. Times like these can test an investor’s nerve and patience. They can also reveal what an investor’s true risk tolerance is, compared to what may be stated during much calmer investment waters. By this stage it is often too late if an investor hasn’t “right-sized” their allocation to small caps.

But if you can get comfortable with the volatility of small caps, there are some truly wonderful ‘pros’ that make small caps our favourite and chosen place to invest.

1. It’s easier for small caps to disrupt the large caps than ever before

Back in the late 19th century in the US, the largest companies were often controlled by the so-called ‘Robber Barons’ who created powerful monopolies in their industries from real estate, railroads and finance to steel and oil. Over time, policy makers and regulators increasingly recognised that competition benefited consumers and the playing field started to change.

But today, technology and globalisation have made it easier for small firms to compete with, and disrupt, their larger counterparts. Many businesses are software-based and they can be scaled to a global audience. Video conferencing technology and real-time supply-chain management solutions mean a CEO can run a manufacturing business scattered throughout the world.

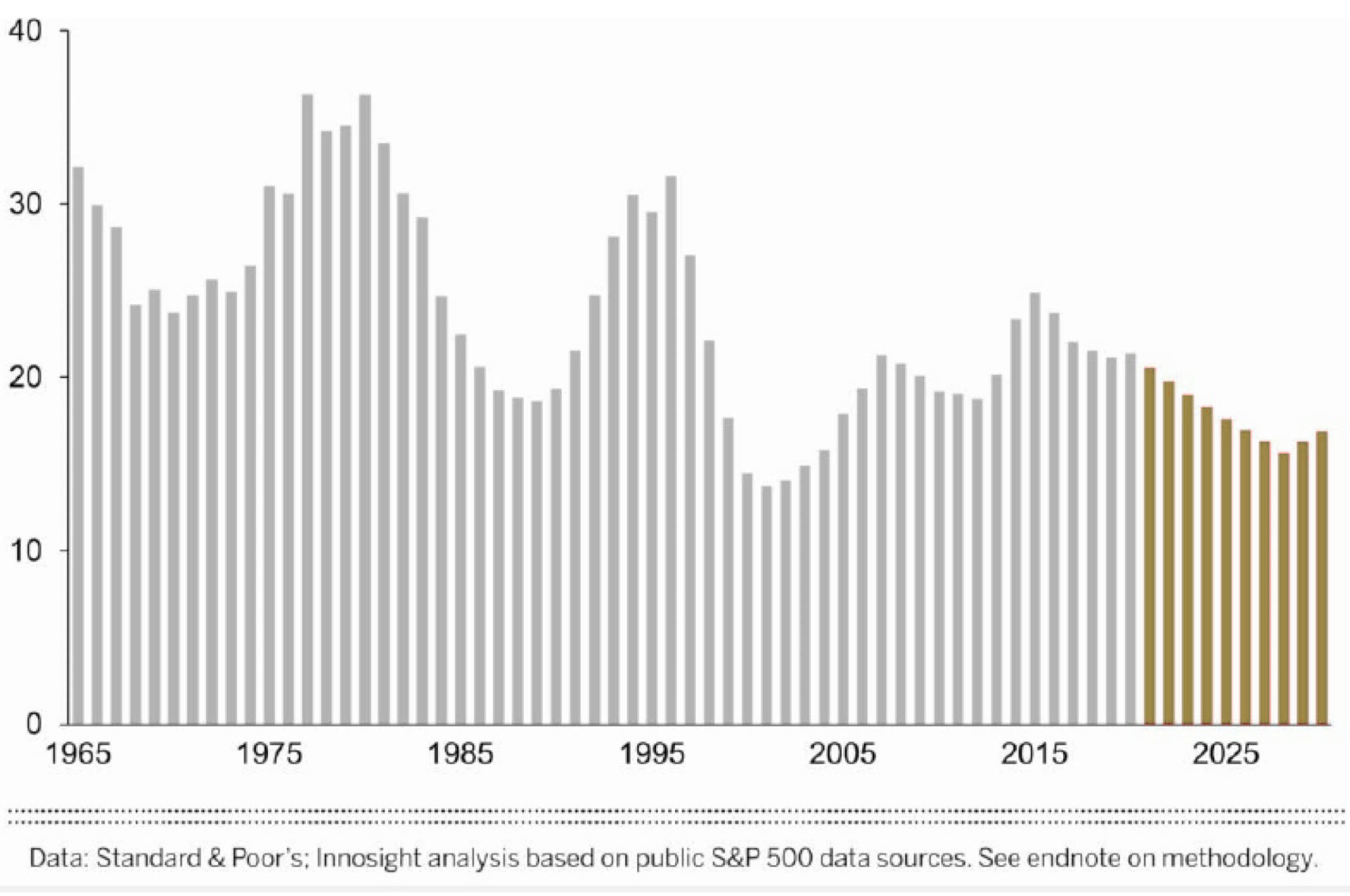

Average company lifespan on S&P 500 Index in years (rolling 7-year average)

Source: Innosight

Disruption from smaller competitors has seen the average time a company has spent as a large cap in the S&P500 steadily decreasing over the decades, from over 30 years in the 1960s to forecast to be around 14 years later this decade (see chart above).

Tomorrow’s leaders come from the small-cap space. Investors who find these companies early can earn big returns before the company becomes a mature industry leader and known to the masses.

2. Small caps historically earn higher returns

One of the most common reasons many investors allocate to small caps is the potentially high investment returns on offer. Very long-term evidence suggests that investors earn a ‘small-cap’ premium.

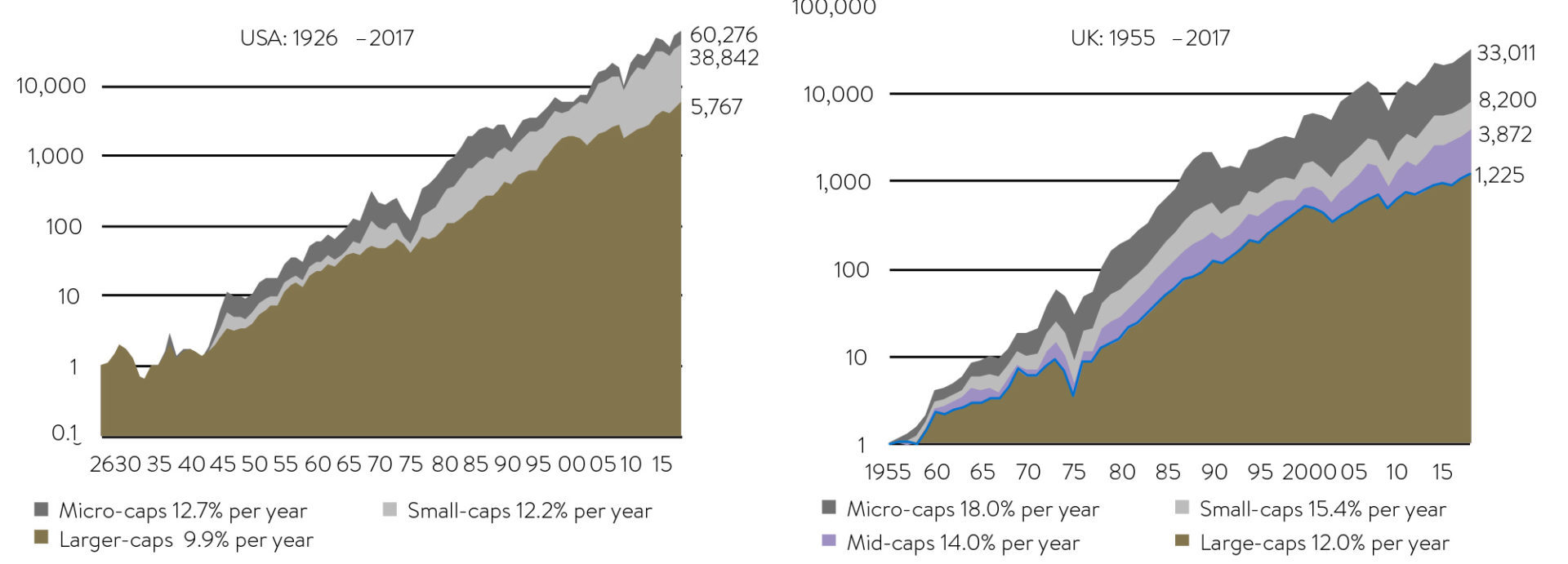

Two markets where researchers have gone back the furthest analysing if this premium exists are the US and UK share markets.

Amazingly since 1926 in the US, $1 invested in large caps grew to US$5,767 dollars by the end of 2017. But if it was invested in small caps it grew to a staggering $38,842. Similarly, but over a shorter period, since 1955 in the UK $1 invested in large caps grew to GDP1,225, but GBP8,200 in small caps.

Long-run cumulative performance of stocks in different size bands in the USA and UK

Source: Credit Suisse Global Investment Returns Yearbook 2018.

While these are amazing statistics of the higher, very long-term returns earned by small caps, investors would do well to temper their expectations. Though it is reasonable to assume that small-cap investors will continue to earn a premium because of small caps’ riskier nature, this may not occur over all periods. There have been periods of 10-20 years where small caps have underperformed large caps, including in Australia.

3. It is easier to find an ‘edge’ in small caps

One of our favourite reasons for investing in small caps is that the market is less efficient. There are fewer people looking at, and analysing, small caps and fewer investors to compete with. That means the share prices of small caps are less likely to reflect all the available information about them.

Long-time Ophir investors know we often talk about what ‘edge’ or insight we have that the market hasn’t reflected in a company’s share price. This is much easier to do when there are fewer eyeballs on the stock.

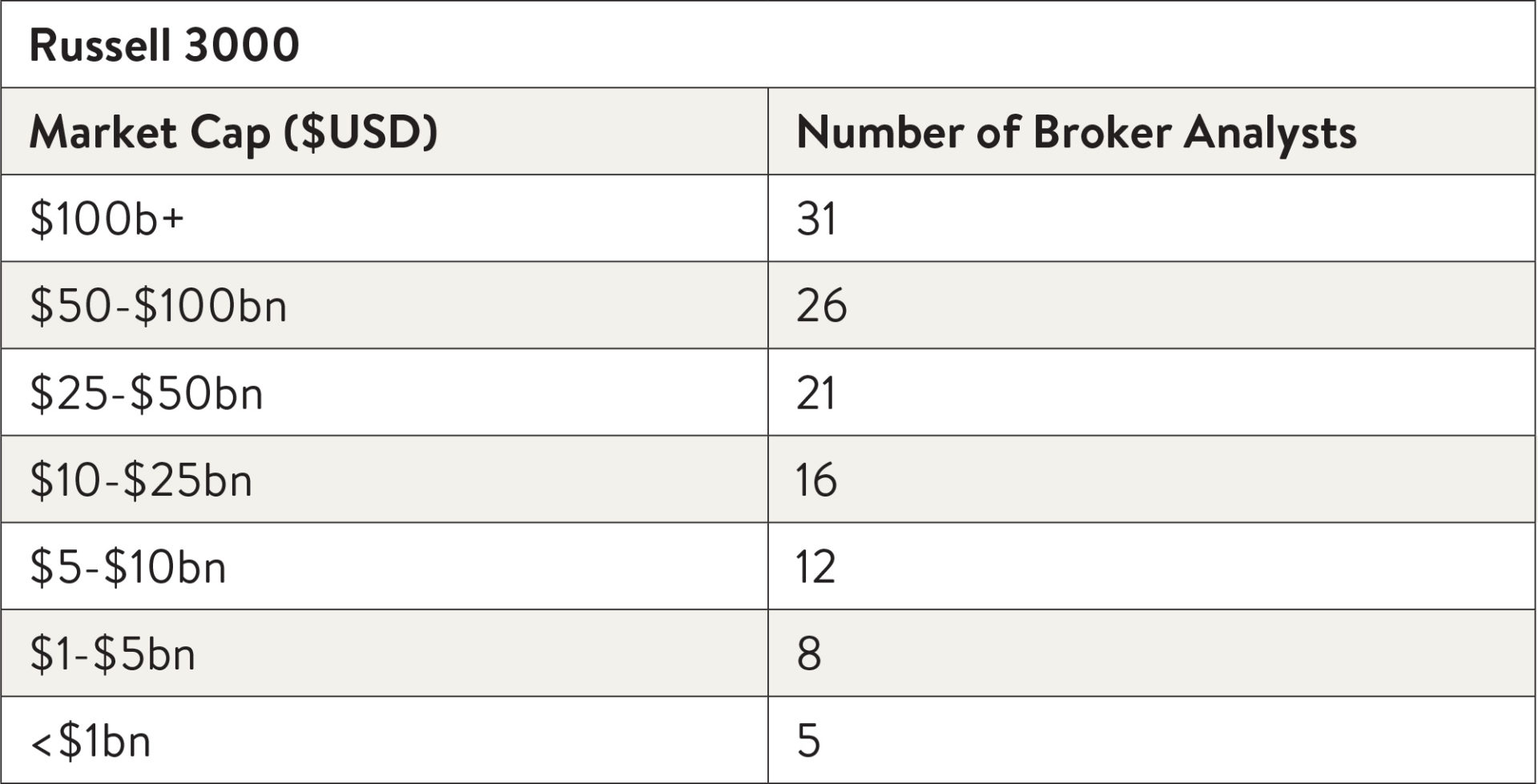

Source: Factset. Data as of 31 May 2022

In the table above, we have broken down the largest 3000 companies in the US by size (market cap) into different buckets. On the right-hand side of the table, we show the average number of broker analysts that cover companies in each of those size buckets. As company size shrinks, so too does the number of professional analysts at brokerages conducting analyses on the businesses.

We typically focus on companies smaller than USD$5bn in market cap and so generally they will have somewhere between 0-10 analysts covering them. This contrasts with the mega-cap household names as Apple, Microsoft, Amazon, Google and Facebook that typically have around 50-60+ broker analysts.

As Warren Buffett has said, “I don’t look to jump over 7-foot bars, I look around for 1-foot bars than I can step over”. We feel the same about getting an edge in small caps. That doesn’t mean it’s always easy. Competition is always increasing in markets and many other things can influence share prices in the short term other than fundamentals. But we feel much more confident getting an edge on a sub-USD$5bn company than a Microsoft or Amazon.

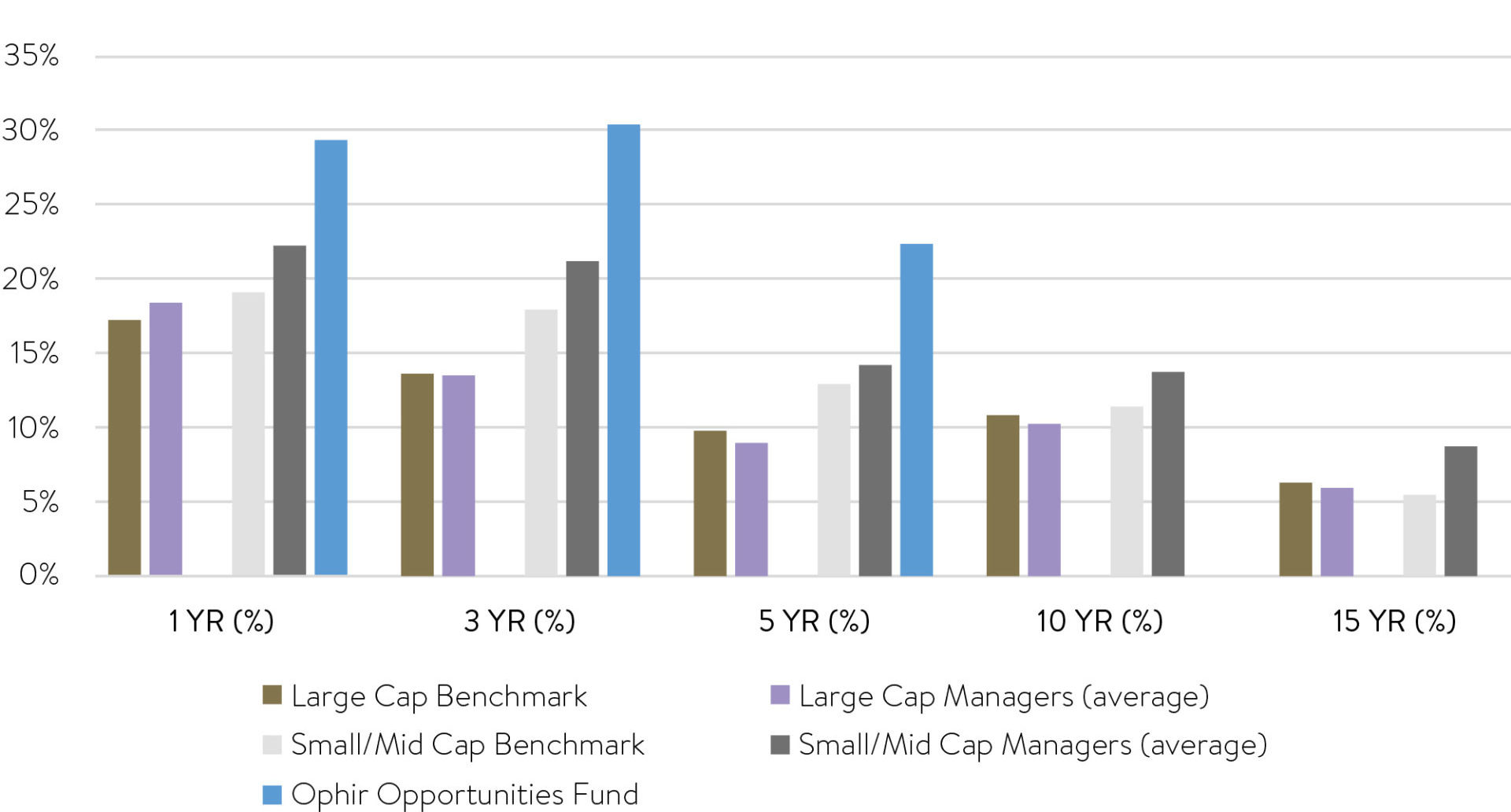

This is also borne out when looking at the results of Australian small cap managers compared to their benchmarks over the longer term versus large cap managers.

Australian Small & Large Cap Managers compared to Benchmark

Source: S&P, SPIVA Scorecard Australia December 2021, Ophir

The results (above) from the latest Standard & Poor’s SPIVA Scorecard for active managers to December 2021 show that large- cap active managers, on average, have underperformed their benchmark over the longer term after fees. But small-cap managers have outperformed. Our Australian small-cap Ophir Opportunities Fund, which has the longest track record of any of our funds, has also outperformed.

We believe less efficient small-cap markets have helped the pros beat their benchmarks over the long term.

4. Small caps are now great value

Finally, one of the reasons we are most excited about the outlook for returns in small caps from here over the medium to long term is the attractive value that has emerged.

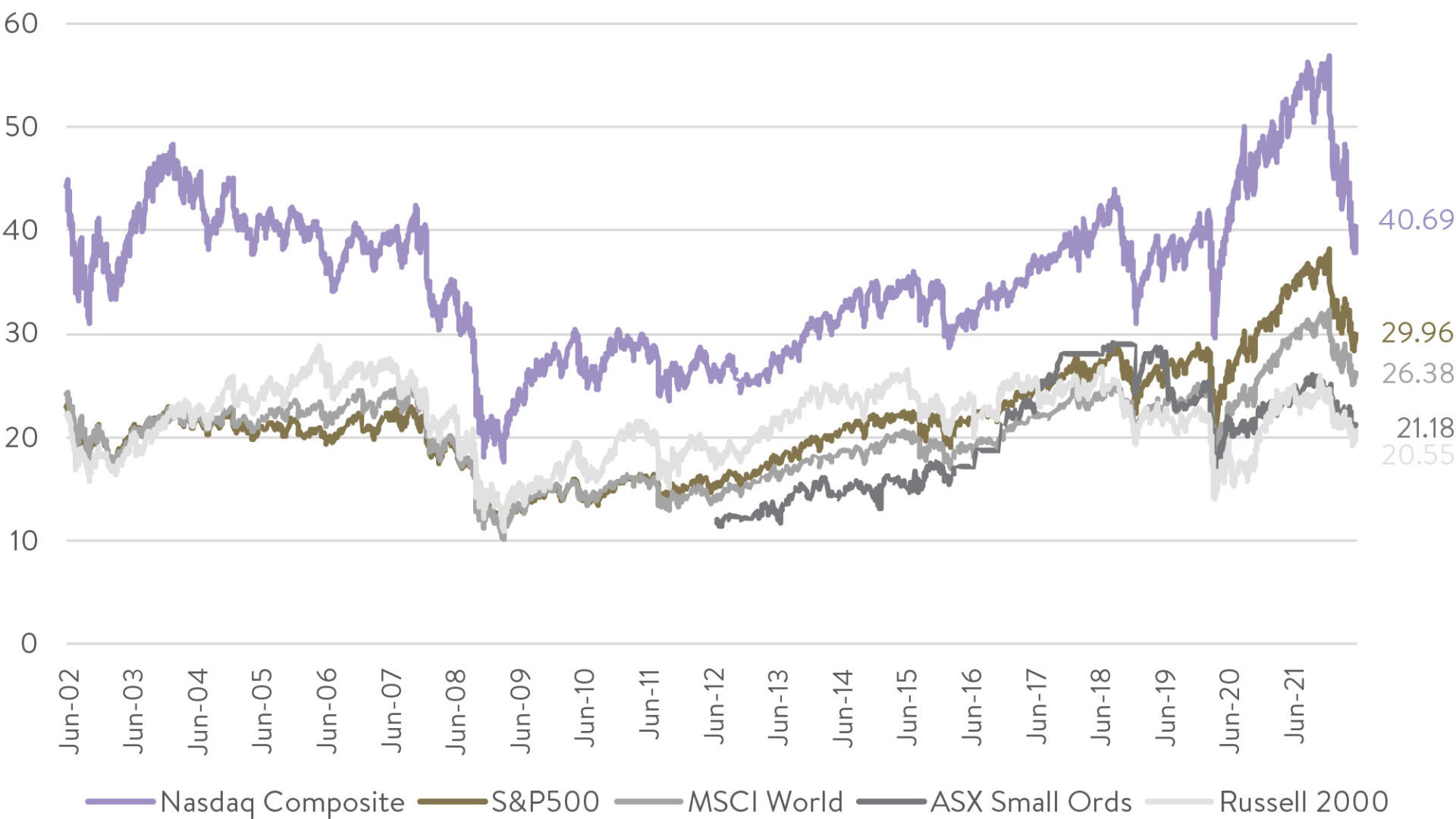

Of course, a key part of this value has been the painful compression in valuations across most equity markets, generally most pronounced in small caps. Our favoured market valuation metric, the cyclically adjusted price-to-earnings ratio shows Australian and US small caps (ASX Small Ords and Russell 2000) are now much cheaper than overseas large-cap markets (NASDAQ, S&P500 & MSCI World).

Share market valuations – Cyclically Adjusted P/E Ratios

In fact, US small caps have not been as cheap when compared with US or global large caps in more than 20+ years.

This suggests that small-cap market returns look favourable over the next 5+ years and hopefully we can improve on those market returns through significant outperformance.

In all, we feel that our 15%-plus p.a. annual return target across all our funds over the long term is quite achievable from this starting point. A large part of that confidence stems from investing in an attractively valued and less efficient small-cap market with an investment process that we believe gives us an edge in identifying mispriced companies over the long term.