In our Investment Strategy Note we answer your most common questions on distributions from Ophir’s funds. We also provide some insight into what they have been historically to provide a guide for what they might be in the future.

Key Points

- Distributions from the Ophir funds are volatile and hard to predict

- Investors have different views on distributions based on their income and tax requirements

- Most of the distributions from the Ophir funds are capital and will continue to be so going forward

- We do not target a distribution rate so please assume (or budget) for zero: anything extra is a bonus

- The Distribution Reinvestment Plan is the only way to maintain investments in our closed funds

Who could forget Cuba Gooding Jr in his star-making and Oscar-winning turn as sports star Rod Tidwell in the movie Jerry Maguire? He is perhaps most remembered for the scene where he asks his sports agent, portrayed by Tom Cruise, to scream down the phone at him “Show me the money!”

In a similar, though generally less dramatic fashion, many investors want their fund managers to pay them an income – or ‘show them the money!’ – from their fund’s returns.

Fund management land refers to these payments as ‘distributions’. The manager can pay distributions at any frequency they like, but generally either monthly, quarterly, six-monthly or annually. (Annually is generally the least frequent option given managed funds generally must pay out taxable income at least annually.) They can even pay ad doc ‘special’ distributions.

Below we look at your top 9 questions about distributions; what they are, how they are calculated, and most importantly what investors in the Ophir funds should expect when it comes to distributions.

1. What is a distribution?

A managed fund generates income from dividends on shares, or interest on cash and fixed income, and capital gains when they sell investments such as shares. Managed funds, by law, must ‘attribute’ income (dividends, interest, etc) and any realised capital gains to investors each financial year for tax purposes. At Ophir, we pay out the cash components of this ‘attributable’ income (dividends, interest, realised capital gains) once per year in July, just after the end of the financial year.

2. How often do funds … ‘show me the money?’

Managed funds can distribute returns more than once a year, particularly fixed income funds where investors are relying on steady and frequent income. Managed equities funds typically distribute less frequently, often six-monthly or annually, because the companies they invest in pay dividends only once or twice a year, and because investors often (though not always) invest in shares primarily for capital growth.

3. How are distributions calculated?

Taxable income, which is attributable to investors, is income plus realised capital gains minus expenses (like management fees). This number is divided by the number of units on issue in the fund to arrive at a distribution per unit.

Distribution per unit = income (dividends, interest etc) + realised capital gains – fund expenses

/ units on issue

For example, if you held 100 units at $1 distribution per unit, you would receive a $100 distribution.

The unit price of the managed fund typically falls after the distribution by the amount of the distribution. If the unit price, for example, was $10 before distribution and the fund paid investors a $1 distribution per unit, the post-distribution unit price would be $9. The investor still has $10 in value, but it is now comprised of $9 in the managed fund and $1 in cash from the distribution.

4. What is a DRP?

Managed funds typically offer Distribution Reinvestment Plans (DRPs) where, if you don’t want to receive the distribution in cash, you can instead re-invest the distribution back into the fund. You still have a tax obligation relating to the distribution, but you keep your money invested.

At Ophir, we provide investors with a DRP option in all our funds. This is popular because we strictly manage capacity (i.e. we close our funds at a level so that size does not impact performance) and DRPs are the only way investors can buy units in the funds we have closed.

5. How can a managed fund have a zero distribution in a year?

In some years managed funds, including the Ophir funds, pay no distribution. This is often when attributed income is negative for the year. This usually occurs when income and realised capital gains are less than expenses. That often happens when there are realised capital losses, or when realised capital gains are more than offset by prior year’s carried forward capital losses.

6. What is the link between distributions, performance and turnover?

What drives the level of distributions in equities funds, and in particular the Ophir funds?

When we have paid large distributions from the Ophir funds, they have primarily comprised significant realised capital gains – as you will shortly see below.

Large realised capital gains are typically a function of

- Strong historical performance, at least of certain companies in the portfolio, if not at a total fund level, and

- Higher portfolio turnover – that is selling companies to purchase new ones.

We are more likely to have large realised capital gains, and therefore large distributions for the financial year, when total fund performance and portfolio turnover are higher.

7. What have Ophir’s distributions been historically?

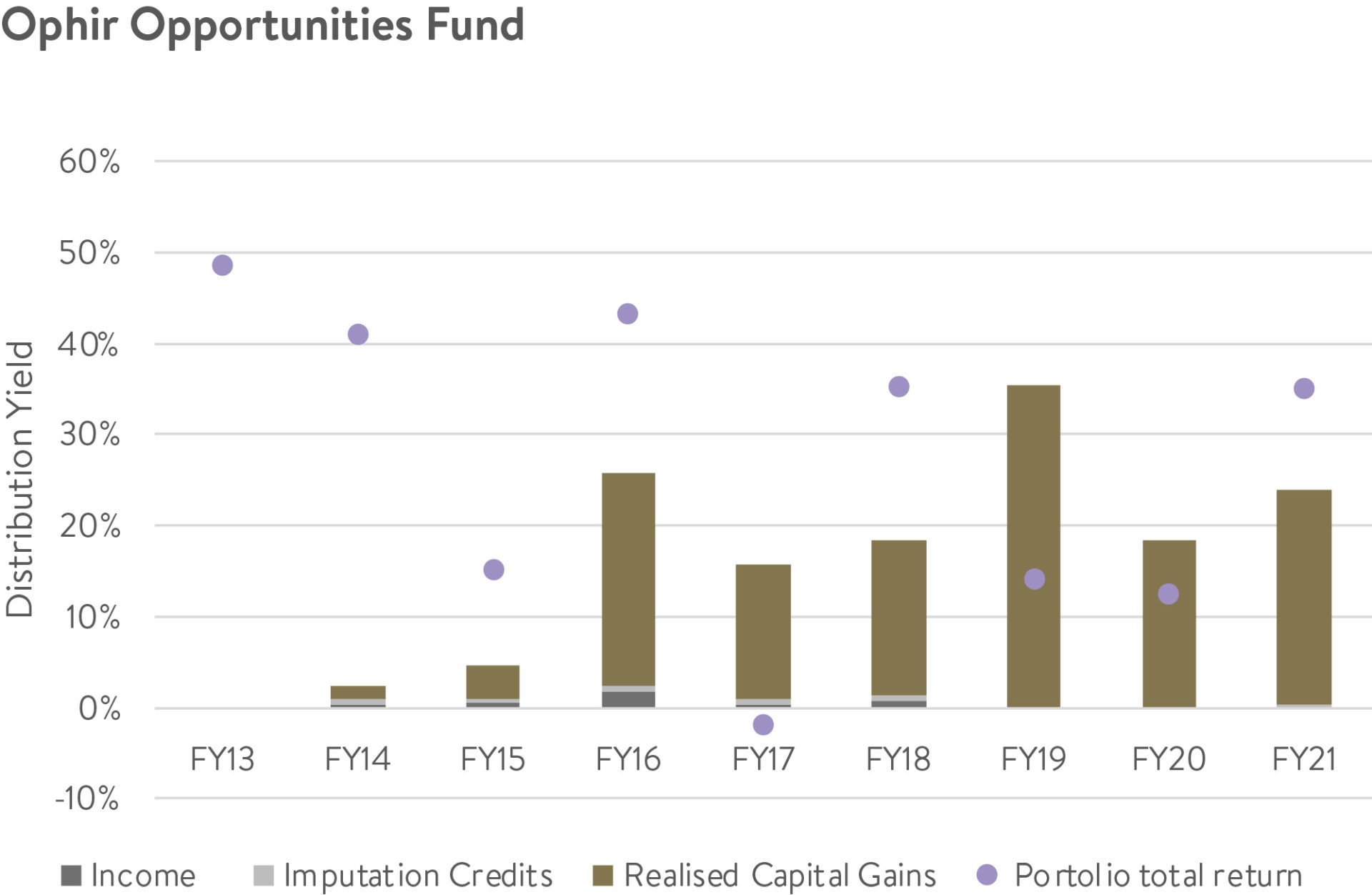

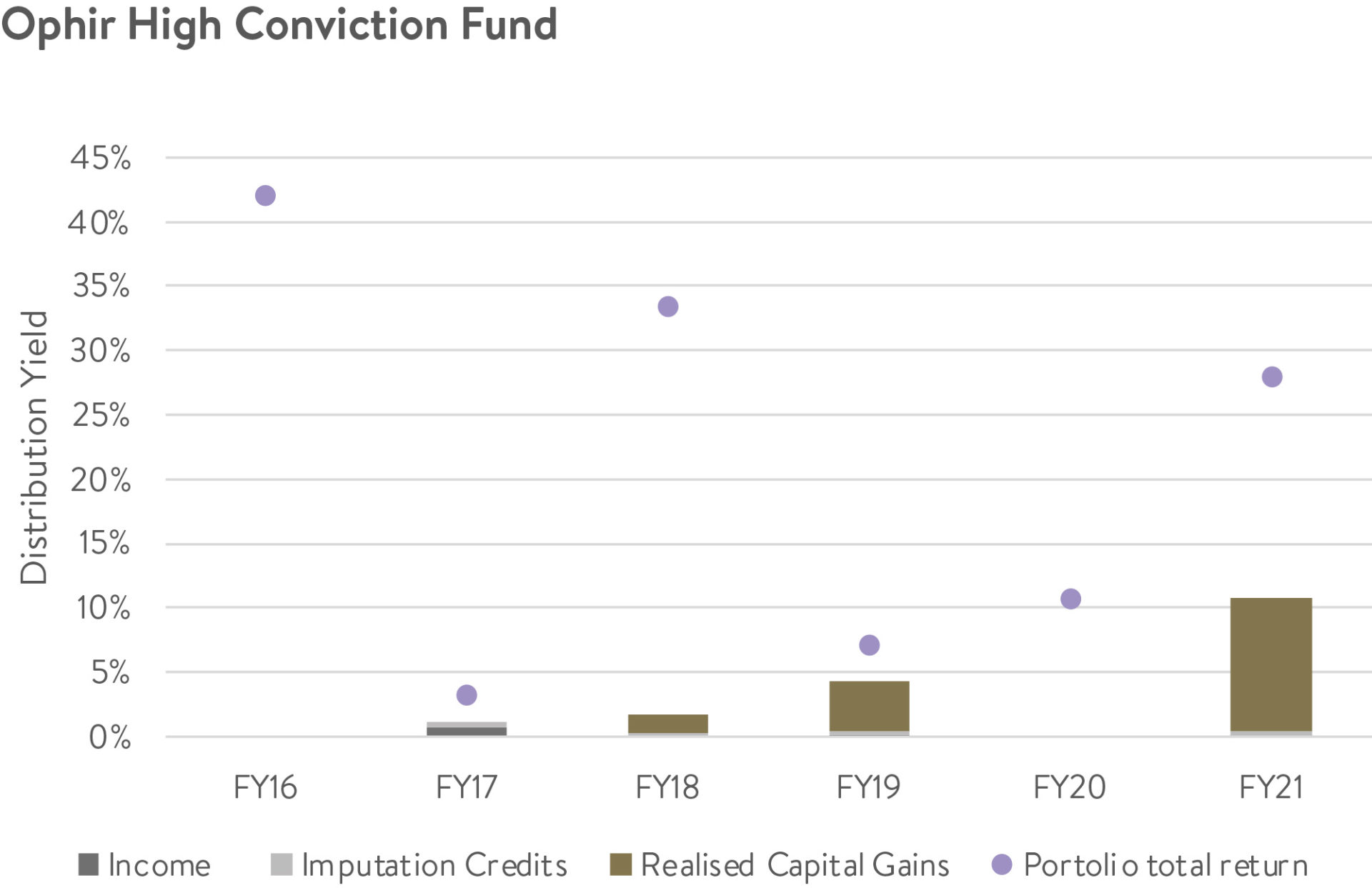

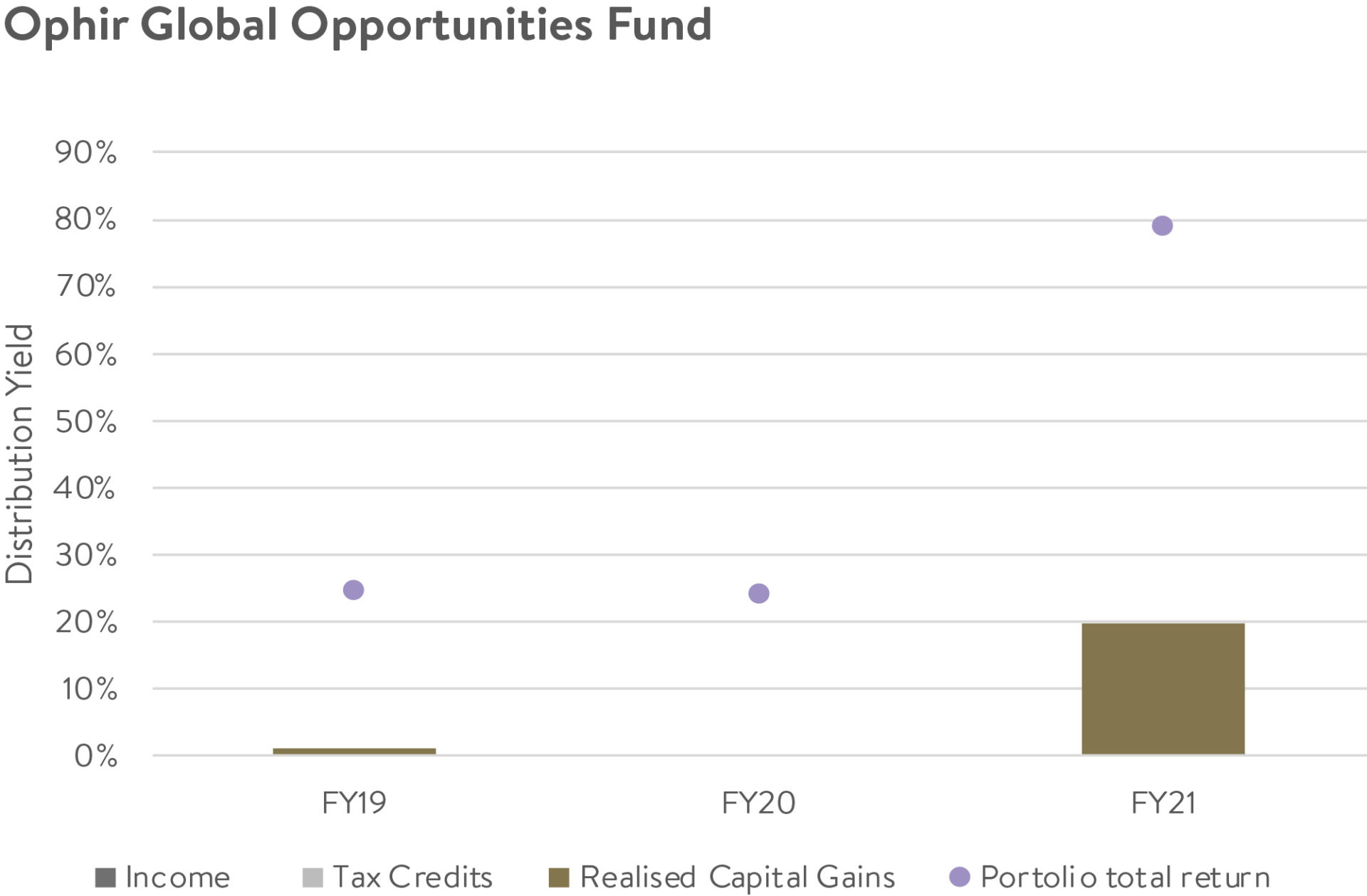

In the below charts we show the historical distributions from the Ophir funds for each financial year.

We show this as a ‘distribution yield’. Just like a dividend yield of an individual share, this is the distribution, including any non-cash tax credits like imputation/franking credits in Australia, divided by the unit price of the fund.

Source: Ophir Asset Management, Link Fund Solutions. Note: distribution yield is distribution per unit divided by the ex-price at the end of the financial year detailed.

A few quick points come to mind from reviewing the charts of the distributions above:

- They are overwhelmingly comprised of realised capital gains.

- Income, such as from dividends (and its attached imputation credits for our first two Australian equity funds) is quite low. This is fully expected given we are investing in small and mid-cap businesses that are growing fast and therefore primarily reinvesting profits for future growth, rather than paying them out as dividends.

- In the early years of a fund’s life, distributions tend to be lower. This is primarily due to the fact that the funds are in net inflow from new applications, meaning there is less need for selling and therefore realising gains as we are investing new applications into the market.

- By contrast, when our funds reach capacity and inflows cease, distributions tend to be higher and have a closer link to the portfolio/fund’s total return during the financial year.

- A portfolio/fund’s total return in a financial year and its distributions are not perfectly correlated. There could, for example, be no/low distribution despite high portfolio returns because we sold positions with significant historical capital losses or where meaningful capital losses were carried forward from previous financial years. Conversely, we can have high distributions when portfolio returns are low because some positions were sold with significant historical capital gains.

8. What level of distributions should I expect from the Ophir funds?

This is, without doubt, one of the most frequent questions we get.

You should generally expect the income component of distributions to be very low to non-existent because of the style of companies we invest in and because dividends are netted off against fund expenses.

As the charts above show, distributions will be almost wholly realised capital gains and lumpy from year to year. If the fund has had a very strong performance year, then there is a very good chance (though not assured) that the distribution that year will also be high. Given fund total return performance cannot be forecast with accuracy from year to year, we also cannot accurately forecast the size of any realised capital gains and hence distributions.

We are relatively active and portfolio turnover in our funds is on the high end for an equity manager. We discussed this here in a recent Investment Strategy Note. Given this, a significant portion of our capital gains in a financial year can be expected to be realised, although this will differ by fund as turnover differs.

As a recap, if we rank our Ophir funds from the highest turnover to lowest, it would be something like this:

Global Opportunities Fund > Ophir Opportunities Fund > Ophir High Conviction Fund.

Therefore, we would expect the Global Opportunities Fund to realise a greater proportion of capital gains in a given year than the Ophir High Conviction Fund. And we’d therefore expect the Global Opportunities Fund to pay out more of its total return as distributions.

One of the key takeaways is that because of a large portion of capital gains being realised and then distributed, investors who wish to maintain their exposure in our closed funds should consider the DRP. Investors can adjust their DRP elections for each of our funds via the Automic Investor Portal under ‘Reinvestment Plans’.

9. What does Ophir’s focus on total return mean for distributions?

We have spent considerable time explaining the ‘distribution” component of our total returns, what they are, how they are derived and what you should expect. Of course, distributions are just one of two components of ‘total returns’ from managed funds – the other being ‘capital growth’.

Capital growth is the increase in the unit price of the fund over time and is driven by unrealised capital gains – or positions in companies we have not sold (yet).

Ultimately, total returns are what matters most for investors because they measure the total benefit the fund manager has provided. You are likely to do a disservice to yourself if you disproportionately focus on just one of the two components.

Some investors are overly focused on the distribution return from managed funds because they use it to fund lifestyle expenses. But it’s not just the cash you are ‘shown’ through distributions that matters.

If you prioritise a fund with a certain distribution return, but it provides an overall poor total return, you are probably cutting off your nose to spite your face.

We’d prefer, every day of the week, a fund with a 20% p.a. total return over the long term with no distribution return, to one providing a steady 5% p.a. distribution return and 5% p.a. capital growth (10% p.a. total return).

As Buffett has always said of Berkshire Hathaway stock which doesn’t pay income, you can create some yourself anytime you like by selling some of it.

We feel similar about the Ophir funds.

Our genuine hope though is that if we provide great total returns – you won’t want to!