In our Investment Strategy Note we discuss the pros and cons of single or staged entry into share markets.

Equity market volatility has tested even the most experienced investor over the last six months. But these whipsawing markets have presented a particularly big challenge if you are making new investments. Should you invest all at once via a single market entry; or dribble your money in via staged portions over time?

Making a new investment is hard because you not only need to take a view on the market, but you also expose yourself to a significant degree of regret risk. What happens when you make a well-justified move and invest on a particular date, but then – with the benefit of hindsight — it turns out to be less profitable than later dates? Major regrets. (Why didn’t I hold off and wait for better prices?)

Not surprisingly, many investors are tempted to stage their share market entry over multiple buys or entry points, also referred to as dollar cost averaging (DCA). They reason that by spreading over several tranches, they avoid the hindsight risk of having chosen one particularly unfavourable date to make the investment.

There is also a strong argument in favour of immediate entry (i.e. one large buy transaction, also known as ‘lump sum’ investing), however. Any delay involves unnecessary risk taking. There are always reasons why now may not be the best time to act, but investment decisions are often neither comfortable nor easy and market calls must be made!

Both arguments have merits.

Superior returns

But, on average, investors earn superior returns in equities through a single market entry, or lump sum.

The logic for this is pretty intuitive – share markets tend to go up over time and anything that delays full entry is likely to see you miss out on some gains. And single-entry, lump-sum investing has delivered superior returns on average over the last twenty years.

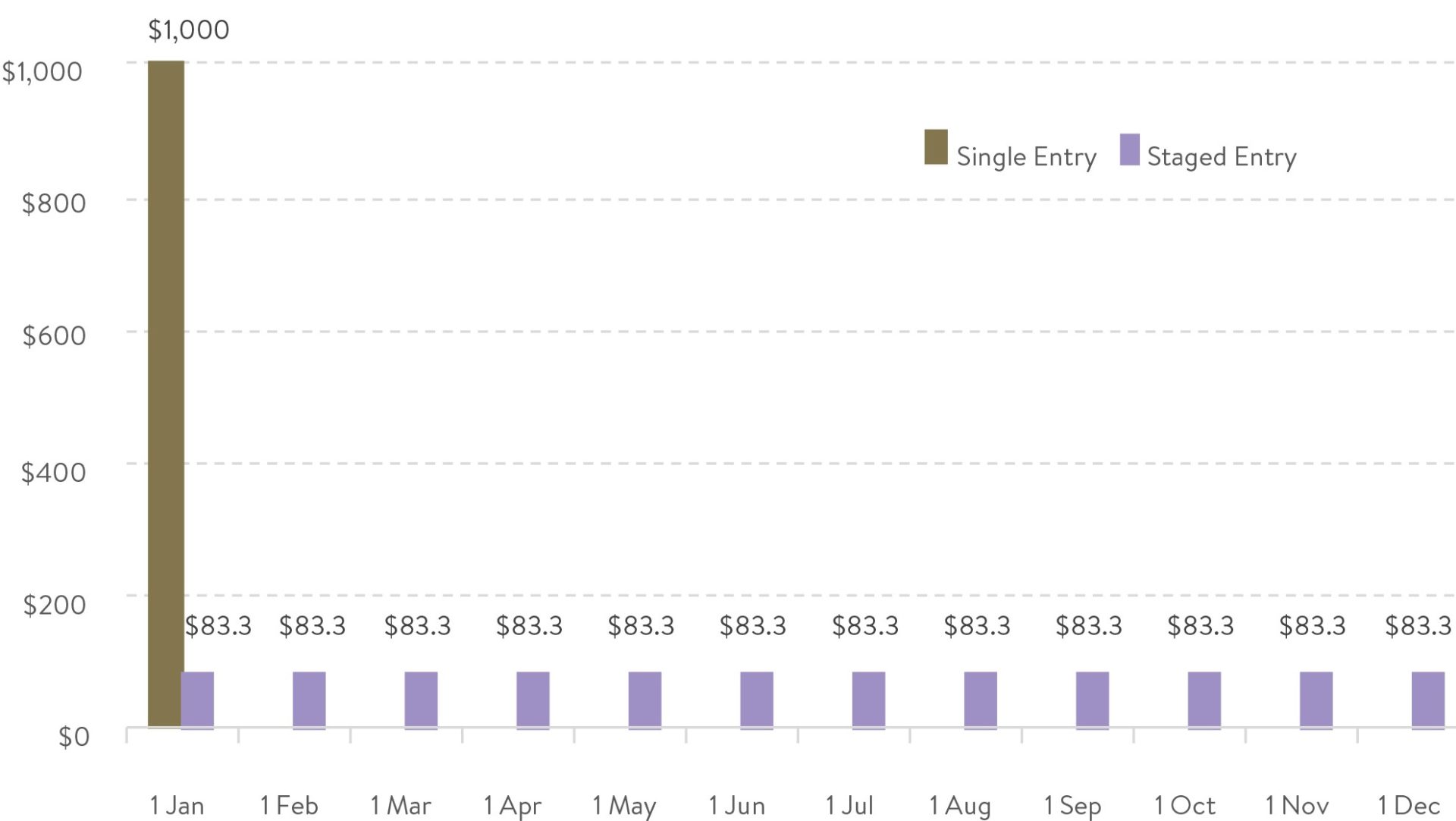

Let’s assume that each year you had $1000 to invest in the Aussie small caps index. For the single-entry option, the full amount (in this example $1000) is all invested on the 1st of January. But under the staged scenario, 1/12 of that amount (i.e. $83.33), is invested on the first day of each month.

In each case the same total dollar amount ($1000), is invested into the index each year, however the timing differs.

Timetable of Investments – Single Entry vs Staged Entry

A losing proposition

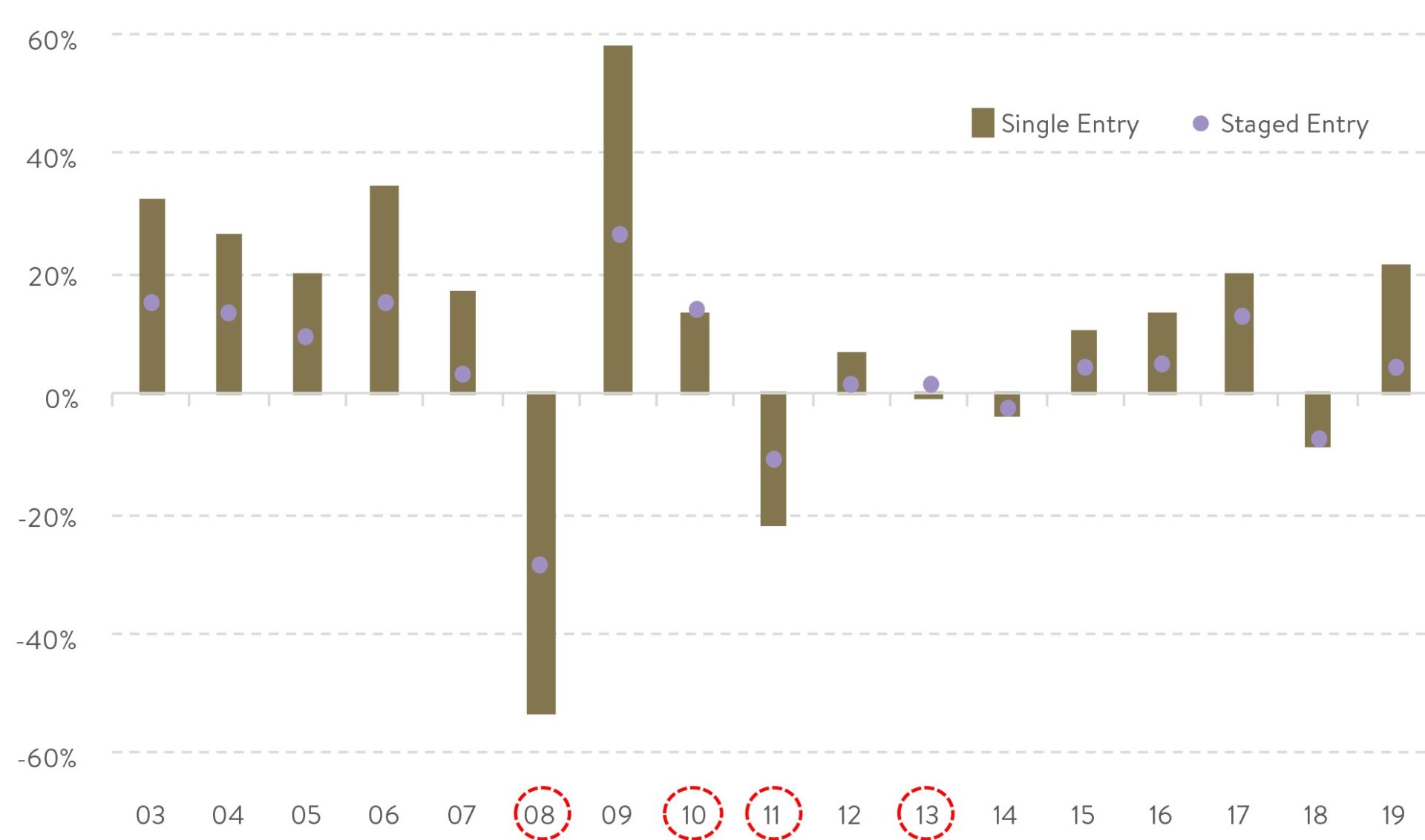

As the table below shows, because markets rise far more often than they fall, most of the time dollar cost averaging doesn’t help, and is just an outright losing proposition. Investing evenly throughout the year means on average you just buy in at higher and higher prices. You end up poorer than simply investing in a lump sum at the beginning of the year.

In fact, over the past 17 years, using dollar cost averaging only ‘won’ four times for Aussie small caps as a whole – in 2008, 2010, 2011, 2013. In retrospect, this is not surprising. Three of these four years were outright bear markets where the Australian small ordinaries index finished down, so by slowing the investment of monies, you were able to find cheaper entry points!

DCA proved superior in just one year, 2010, when markets finished up. That’s only because the market declined significantly in the first half of the year, then made up virtually all of its returns for the year in just the last three months.

Annual Investment Returns – Australian Small Ordinaries

Staging a market entry only adds value when a falling market provides the opportunity to buy in at lower prices. The problem is that in practice this generally does not happen, markets go up far more often than they go down.

Psychological barriers

The evidence shows it’s clear that a single market entry/lump sum investing is the best strategy on average for investors when they deploy money into equity markets.

But some strong psychological barriers need to be overcome to implement a single market entry.

One barrier is the false sense of security of staying in cash. Investors get comfortable with a nest egg that doesn’t fluctuate, even if it isn’t working for them. They then try and time their re-entry to the market by waiting for the ‘right’ conditions. But behavioural investing data shows that the longer you are in cash, the longer you are likely to stay in cash. Unfortunately, conditions usually only appear ‘right’ after equities have rebounded.

The cold reality is that, as much as some of us might think we know which times we should stage entry, the resounding evidence from studies is we don’t.

Missing out

The message we emphasise to our investors is that staging a market entry/DCA can smooth out portfolio volatility and provide psychological comfort. But the trade-off is that you will tend to earn a lower return on investment on average.

Staging market entry/DCA can be thought of like insurance. Most of the time you won’t need it and it will just end up costing you money, as it did in 13 of the last 17 years in the example above.

Of course, just as there is no one right answer for everyone whether they should take out insurance on different personal assets or income, there is no one right answer for everyone on whether to stage entry/DCA or to invest in a single entry/lump sum. It comes down to your risk tolerance.

But what we do know is, the longer you take to get into the market, the more on average you are likely to miss out on. Single-entry, lump-sum investing will enhance your wealth most of the time. You should not overlook this potential benefit when deciding what approach is right for you.