By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

There is not much that is normal about the current market and many of our investors have asked us recently whether we have seen such a big market dislocation before. In this month’s Letter to Investors we discuss what we learnt from the savage GFC market and why fundamentals win in the end.

Welcome to the May Ophir Letter to Investors – thank you for investing alongside us for the long term.

This too shall pass: What we learnt from the savage GFC market (and why fundamentals win in the end)

For the first half of May, you could forgive investors for thinking, ‘here we go again – more equity market falls across the board’. There was a lot for investors to digest and worry about, including rate hikes, sky-high inflation, Chinese COVID lockdowns, ongoing supply chain bottlenecks, an Australian election, the ongoing Russia/Ukraine war … and let’s not forget about increasing US recession fears.

Phew! Drinking from a fire hose is the analogy that comes to mind.

After seven weekly falls on the trot for the S&P500, a record-equalling eighth week of falls was in sight. But then share markets rebounded in the second half of May from oversold conditions after some evidence indicated that inflation may have peaked in the US. In all for the month, global equity markets ended mixed, with many indices closing at breakeven, including the S&P500 finishing the month dead flat (+0.0%).

The outliers were China, up +4.6% (Shanghai Comp) on recent news of lockdowns easing; whilst the Aussie share market was at the other end of the ledger. Domestically, large caps (ASX100) were down -2.6%. Small caps fell a much heavier -7.1%, giving back some of their recent relative outperformance.

One consistent theme during the month was the continued sell off in ‘growth’ companies, especially at the pointy end. Non-profitable tech stocks were down -12.6% and Goldman Sach’s basket of ‘Long Duration’ (read high growth) US equities was down -11.8%. ‘Value’-style companies, by contrast, continued to outperform, as did the Energy sector with oil prices keeping their upward march with Brent oil rising +12.3%.

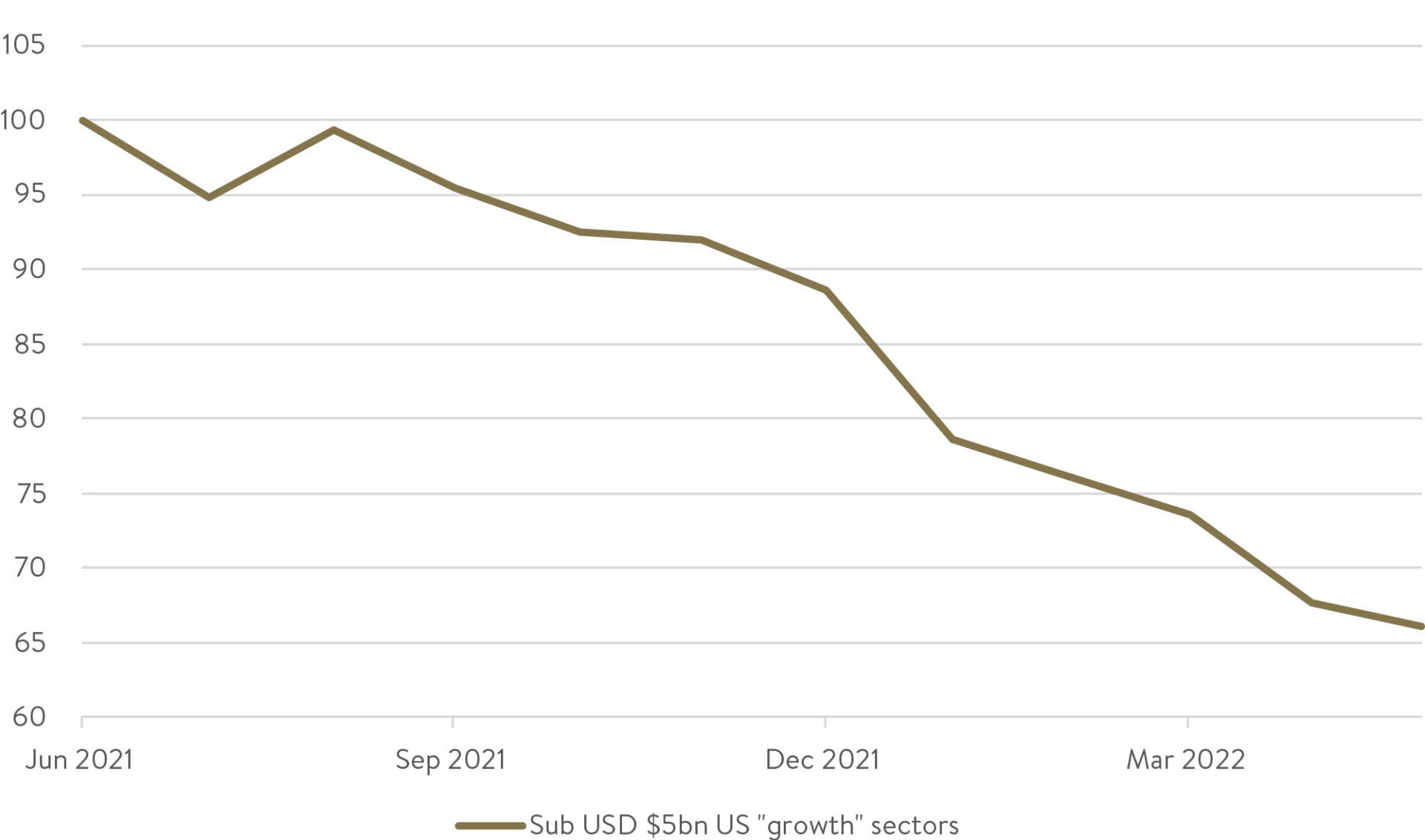

Market segment Ophir Global Funds invest in has fallen significantly

Source: FactSet. Data as of 31 May 2022. “Growth” sectors include information technology, consumer discretionary, consumer staples, health care and industrials.

But as you can see in the chart above, the segment of the market we invest in globally, small-cap growth-orientated businesses below USD$5bn in market cap, continued their falls, though at a reduced pace from April (see chart below).

So in this month’s Letter to Investors, instead of reviewing the minutiae of market moves, we thought we’d step back and highlight some of the lessons we learnt from the last time we experienced steep falls in our part of the market during the GFC.

We also present some interesting analysis that shows the fundamentals of our Funds remain very strong, despite the steep sell offs in stock prices.

It is fundamentals, and particularly company earnings growth, that ultimately drive share prices over the long term.

These GFC lessons and our funds’ rock-solid fundamentals are why – despite the tough times recently – we remain very confident that we can deliver investors strong outperformance in the next 3-5 years when markets return to normal.

May 2022 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during May. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned -5.7% net of fees in May, outperforming its benchmark which returned -7.0%, and has delivered investors +22.0% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -5.6% net of fees in May, underperforming its benchmark which returned -5.2%, and has delivered investors +13.8% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -0.0% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -4.6% net of fees in May, underperforming its benchmark which returned -1.1%, and has delivered investors +14.5% p.a. post fees since inception. (October 2018).

Download Ophir Global Opportunities Fund Factsheet

We have seen this scary sell-off movie before

One question we have been asked more recently given the brutal sell off in equities, particularly in small-cap growth businesses, is whether we have seen this kind of market fall and dislocation before.

The answer is yes: during the GFC when we managed an Aussie small cap focussed fund at our former employer before we founded Ophir.

As it’s often been attributed to Mark Twain, “History doesn’t repeat itself, but it often rhymes”. The causes, scale and speed of the current equity market sell off are quite different from the GFC, but there are some ‘rhymes’ given human psychology plays such a big part and tends not to change.

It was a baptism of fire at our former employer. We started the fund right before the GFC and our fund took a heavy circa -50% fall early on as markets crashed. Though it was painful at the time, crucially for long-term investors due to the amazing benefits of compounding of returns over the long term, the fall only looks like a small hiccup on a steadily upwards trending journey.

This is one of the most important lessons for investors: the compounding of returns over the long term from the share market is your friend and it is BECAUSE of the occasional severe falls that the market tends to reward you handsomely for staying invested.

Stock picking helped us bounce back strongly

After the circa -50% fall during the GFC, when the market recovered, we also recovered but much faster.

How?

Well, we focused intently on stock picking.

The greatest mispricing of companies tends to occur during periods where macroeconomic factors, fund flows and fear guide markets. Some businesses are completely ignored by investors and what’s happening with their operations and fundamentals goes out the back window. There is no point thinking your companies are the most harshly dealt with by the market. There are plenty of companies down -70% or more whose operations will sail through the period and produce outstanding share-price rebounds on the other side.

That is what happened during the GFC when, after bottoming in March 2009, the fund we were involved with eclipsed its previous highs within 12 months and then went on to post further material gains.

We don’t know when a subsequent rebound in performance will happen after the current sell off – nor its size – but we know there will be one. In the meantime, we are scouring Australia and the globe, hungry to find those gems that will be re-rated when the market invariably gets back to focussing on fundamentals.

Fundamentals always matter … in the long run

For those of you familiar with professional basketball you may have heard of Tim Duncan, the NBA player who is widely regarded as the best power forward to have ever played the game. He retired in 2016 from the San Antionio Spurs and was inducted into the Hall of Fame in 2020. He was also nicknamed ‘the Big Fundamental’ due to his no-nonsense style of play, mastery of the fundamental concepts (footwork, shooting, rebounding) and distaste for the flashier aspects of the game. In basketball, fundamentals ultimately matter most.

And so it is in investing.

Regular readers will be familiar with us explaining how markets have recently been driven by macro factors, such as inflation and interest rates, and that it has not been a stock pickers’ market. What we mean is that returns in this market haven’t really been driven by fundamentals like revenue and earnings growth.

But in the long term, it’s all about company earnings growth. Fundamentals matter. In fact, in the long term, it’s almost all that matters.

Share prices are driven primarily by two things, earnings per share (EPS) growth and any change in valuation e.g. movements up or down in the price-to-earnings (PE) ratio. Longer term though one of these tends to dominate – it’s earnings growth.

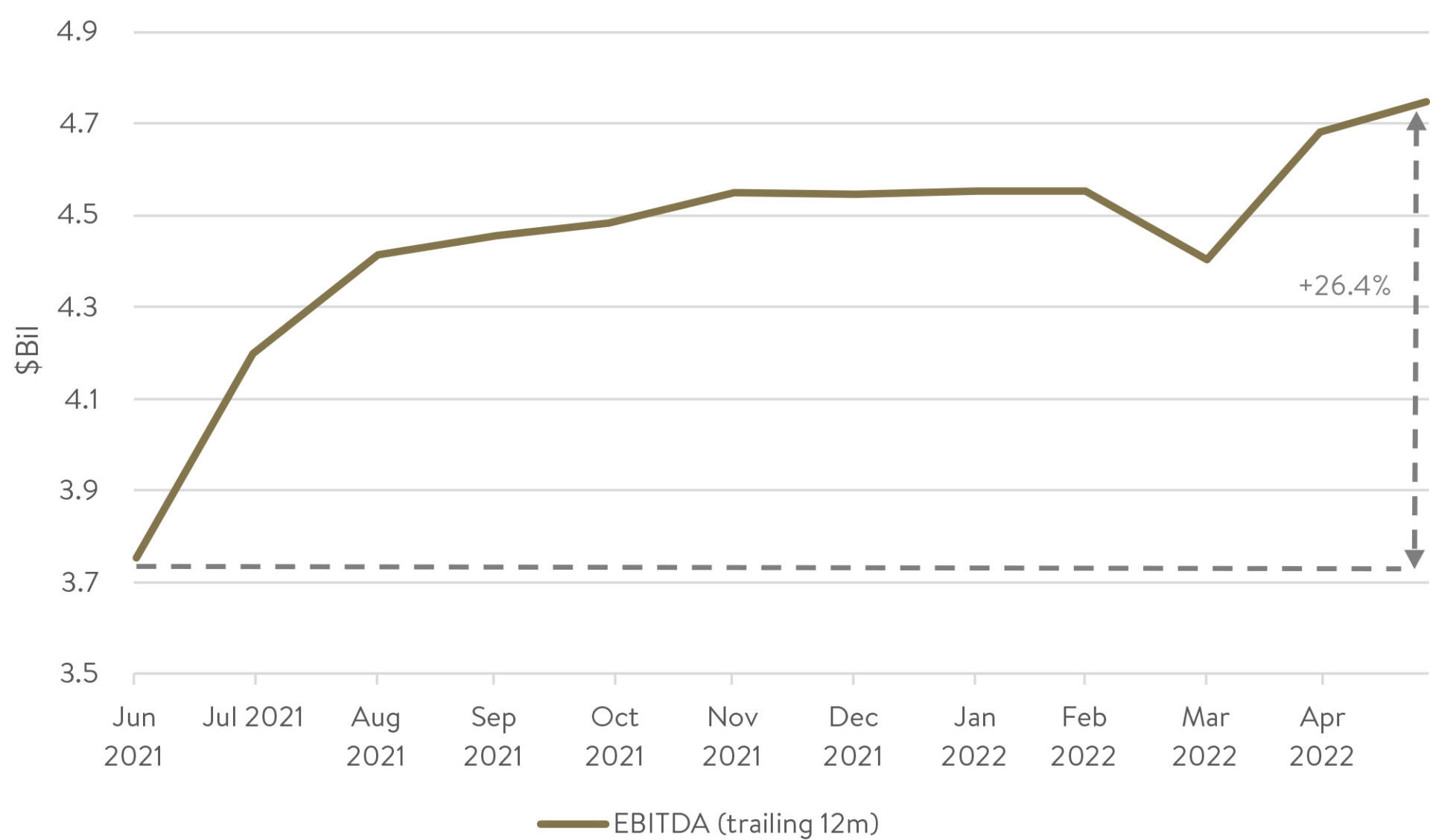

Earnings continue to grow strongly e.g. Global Opportunities Fund

Source: Ophir & FactSet. Global Opportunities Fund portfolio as at 31 May 2022 detailing trailing 12m EBITDA over time.

As an example, in the chart above we show how for our Global Opportunities Fund, the current portfolio’s earnings (as proxied by EBITDA) have grown by a little over +26% during the last 11 months. Yet the Fund is significantly down because the compression in valuations (such as PE ratio) has overwhelmed the growth in earnings.

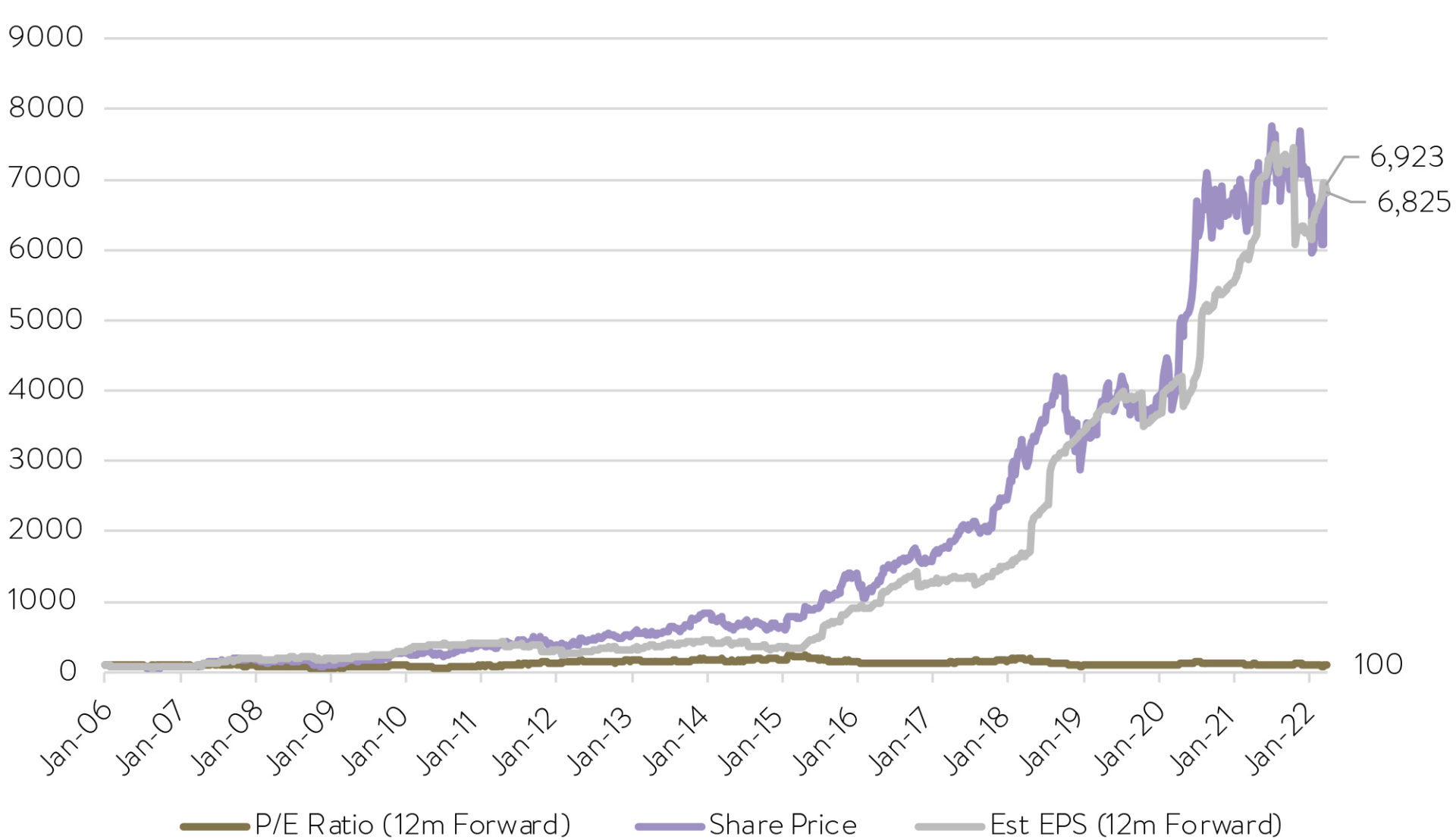

In the long term, though, what matters most is earnings growth. We have shown this below for one of the world’s largest companies, Amazon, but we could almost choose any company over the long term.

We have simply indexed to 100 at the start their share price, EPS growth and PE ratio over the long term. What you can clearly see is that the share price (purple line) is driven in the long term by EPS growth (grey line). If it were changes in the PE ratio then you’d see the gold line mirroring the purple line – it doesn’t.

Amazon (Price, EPS, PE Ratio – indexed to 100)

Source: FactSet

The macro (inflation, interest rates etc) can heavily influence PE ratios in the short term and hence share prices. But ultimately, it’s earnings growth that is the main driver in the longer term.

As Buffett’s teacher Ben Graham once said “In the short run, the market is a voting machine but in the long run, it is a weighing machine”.

And what it is weighing is earnings growth.

Our stocks continue to beat consensus

With that in mind, we continue to focus on underlying fundamentals and the earnings of companies we own and those for which we are conducting due diligence.

One key way we assess how we – and the rest of the investment team here at Ophir – are performing is whether our companies’ earnings are beating market consensus.

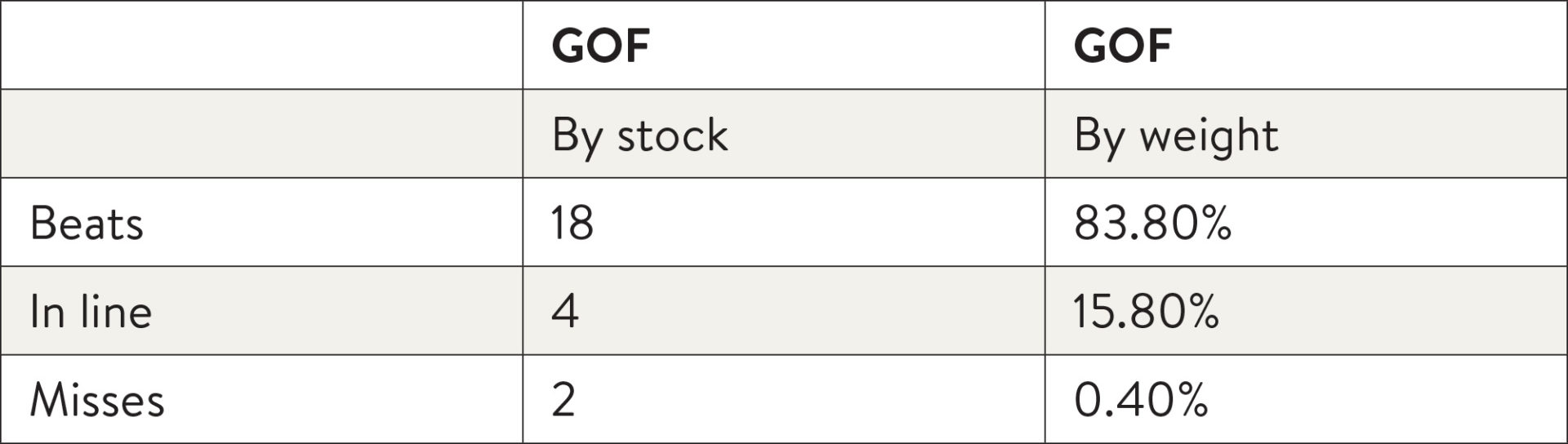

The March quarter financial reporting for the US companies we own in our Global Opportunities Fund has just been completed. The table below shows, of the companies that reported, how many beat consensus (2%+ above), how many were in line (+/- 2%), and how many missed (2%+ below).

The overwhelming majority did better than the market expected, both by the number of stocks and by their weight. This was up there with our better reporting seasons and we strongly believe that by continuing to get the earnings right, that fund performance will follow over time.

That has clearly not been happening over the last six months, but eventually it will when the macro headwinds subside.

If our funds were a single ‘stock’, we’d be excited

Another way to look at our funds and their attractiveness at different points in time is to see what they look like in aggregate. Each fund is a collection of different companies. But when you add up all their characteristics, you gain a view of what the fund would look like if you thought of it as a single stock.

Let’s look at the Global Opportunities Fund as an example.

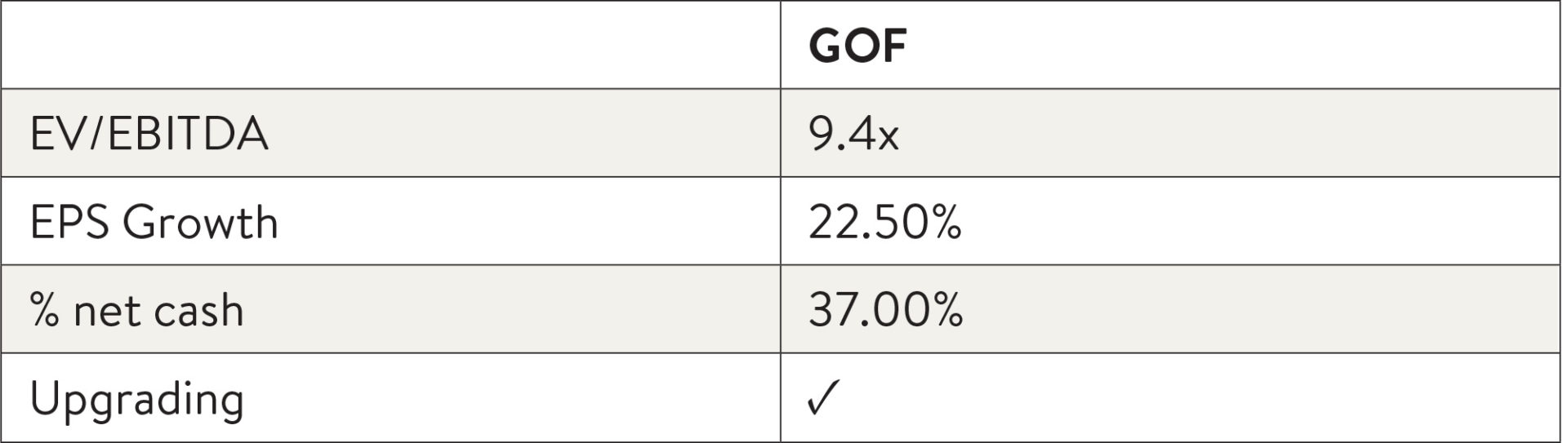

The overall valuation of the Fund is an Enterprise Value-to-EBITDA ratio of 9.4x (and a PE ratio of 16.6x), with over 20% earnings growth, a high proportion of companies with net cash (no net debt) on their balance sheet and the vast majority beating and upgrading earnings (as highlighted above).

Source: Ophir. Data as of 31 May 2022. (EV/EBITDA is blended forward weighted harmonic mean. EPS growth is weighted average with collar of 0 to 50.)

If this were just one company, we’d be incredibly excited to buy it with these metrics.

Therefore, despite the recent significant falls in performance, we remain very optimistic about returns over the next 3-5 years, particularly given the opportunities we are finding in the market at present.

Getting the fundamentals right

No doubt there are some further headwinds ahead for corporate earnings globally as they slow from the super-charged levels caused by re-opening. More interest rate hikes are likely to slow consumer spending in advanced economies. As discussed last month, we have already positioned our Funds for this scenario. We have trimmed the most consumer-exposed businesses, positioned in more defensive growth businesses, and increased liquidity to ensure we have the flexibility to shift the portfolios as the economic environment evolves.

To sum up, we continue to feel we are getting the fundamentals of businesses right. The current sell off is painful for many investors. But history shows that this happens once every 10 or 20 years. As our time at Paradice also shows, these periods create great opportunities.

We and the team want to ensure it is not a wasted one. We are travelling as much as we ever have to ensure we are invested in the businesses that will rebound most when the market recovers, and when the market returns to focussing on what matters most: company fundamentals.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.