By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our January 2021 Letter to Investors we review some bubbly pockets of investment markets and what we do to protect against market pull backs.

Dear Fellow Investors,

Welcome to the January 2021 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Markets falter at month end on retail traders’ revenge

Investors would have noticed that equity markets were heading for a relatively strong January until the last week. That’s when an historic David-versus-Goliath battle erupted between retail traders and hedge funds in the US, which triggered a freakish trading frenzy in a dying old company, GameStop.

This spooked markets and caused hedge funds to reduce risk, seeing share markets generally pull back over the last few trading days of the month.

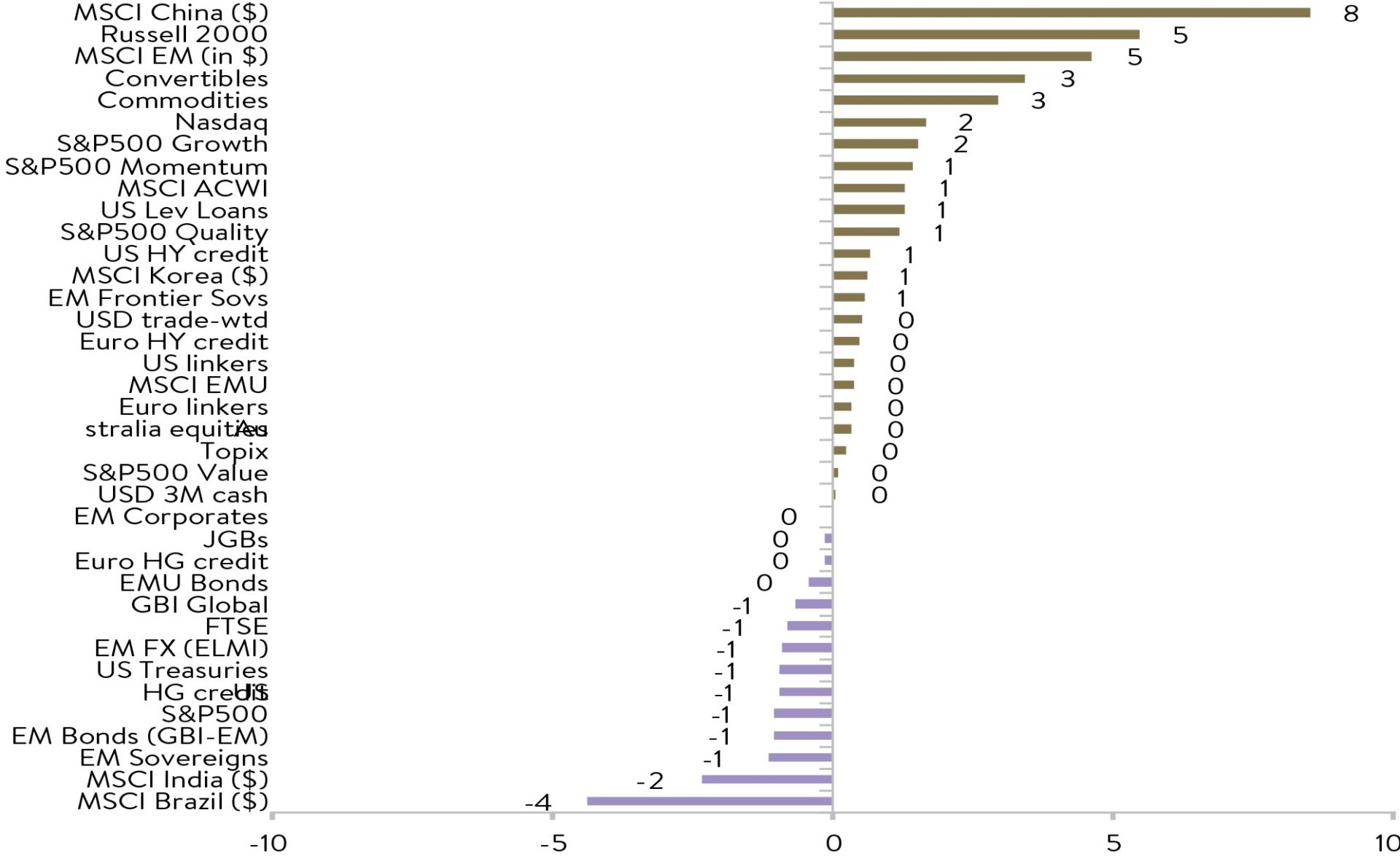

In all, most share markets, except for emerging markets which outperformed, posted either small gains or losses with not much divergence (see chart). In the wake of GameStop, which pushed many smaller companies higher, US small caps were the exception in developed markets, with the Russell 2000 up a strong 5% in the month.

In this letter we look at what the roaring retail speculation highlighted by GameStop means for valuations and our investment process (hint: not much).

But we also look at four pockets of exuberance in the market (Bitcoin, US IPOs, call options and growth-stock trading volumes) that — while not being the ‘four horsemen of the apocalypse’ portending a major bear market — are indicators that clearly suggest investors do need to be managing risk in this environment, and also remain focused on investing in quality companies at reasonable valuations, as we are doing at Ophir.

Source: JP Morgan

January 2021 Ophir Fund Performance

Before we jump into the letter, we have included below a summary of the performance of the Ophir Funds during January. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +0.8% net of fees in January, outperforming its benchmark which returned -0.3% and has delivered investors +25.1% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned -1.3% net of fees in January, underperforming its benchmark which returned -0.7% and has delivered investors +19.0% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of -1.1% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +4.6% net of fees in January, outperforming its benchmark which returned 1.3% and has delivered investors +41.0% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

The great short squeeze

The GameStop saga has now entered folklore. We cover the drama in detail in our Investment Strategy note this month. But basically retailer traders hanging out on a Reddit forum, WallStreetBets, ganged up on some Wall Street hedge funds.

Using ‘fee-free’ trading platforms such a Robinhood, they aggressively bought some of their most shorted US small caps stocks, including GameStop, an old-school video game retailer. They pushed GameStop’s price from around USD$19 at the end of last year to $347 at its peak in the last week of January this year.

In a classic short squeeze, hedge funds scrambled to cover their short positions and stem losses by buying back these stocks. To fund that buying, they often sold positions in other stocks. So they simultaneously reduced their overall exposure to the share market and racked up big losses.

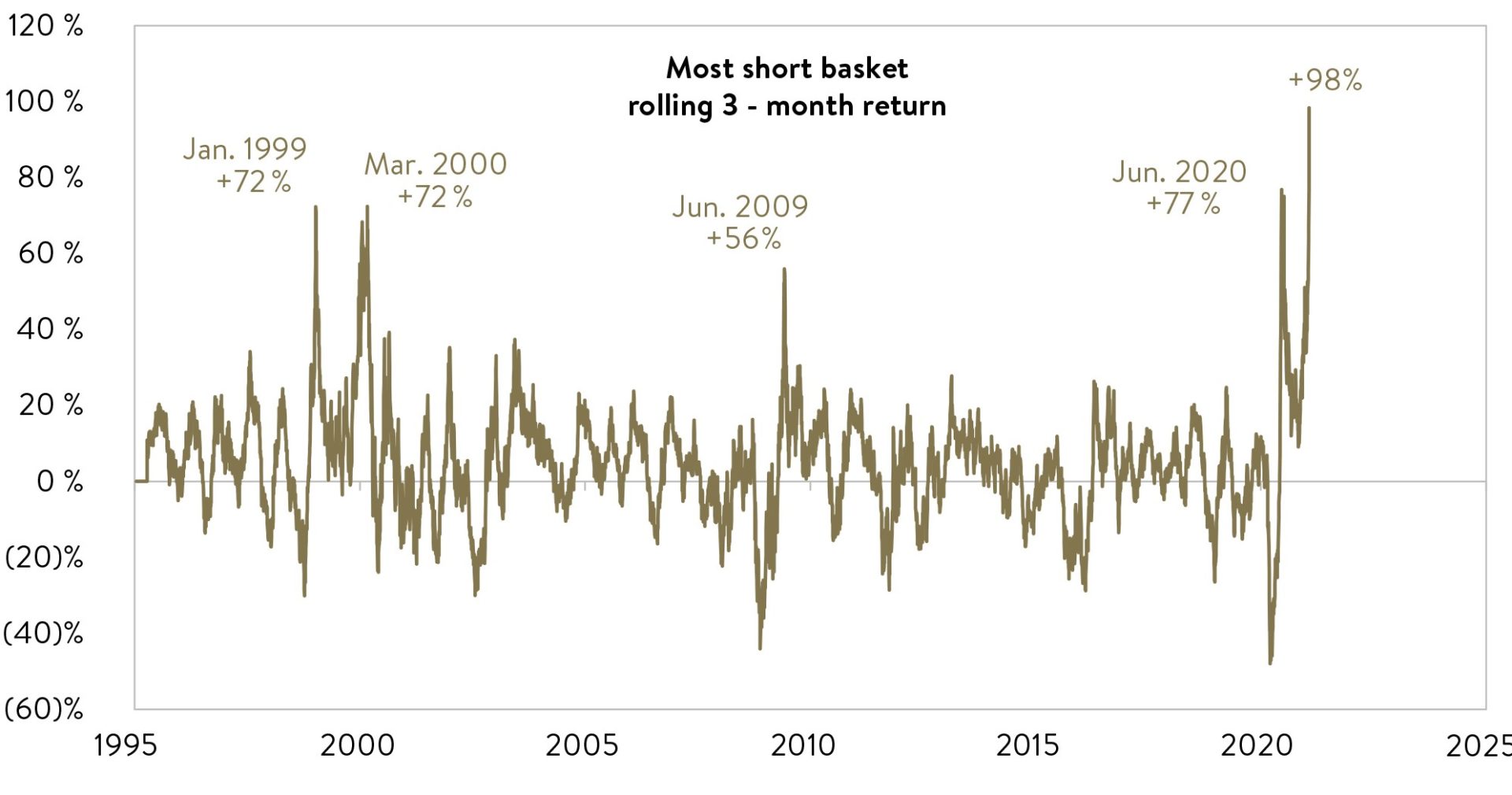

The retail traders’ revenge saw some of the most shorted stocks in the US skyrocket (see chart).

The most shorted stocks have rallied sharpley (ticker: GSCBMSAL)

as of 28 January, 2021

Source: Goldman Sachs Global Investment Research

The crowd unleashed

What was interesting about this episode, other than hedge funds being (likely very temporarily) beaten at their own game, was that it occurred at a time when ‘short interest’, or the amount of a company’s shares sold short, is the lowest it has been in the US in over 20 years.

Aggregate short interest is exceptionally low relative to history

as of 15 January, 2021 (most recent short interest data available)

Source: FactSet, Goldman Sachs Global Investment Research

We think this is further evidence that investors are generally positioned bullishly heading into 2021 on the back of positive vaccine and corporate earnings news.

The GameStop saga also shows the power unleashed by the democratisation of investing that has given retail traders access to cheaper investment platforms and better information, combined with the power of social media and forums such as Reddit. (One thing you can bet is that Goliath (hedge funds) will have learnt a valuable lesson and will be better prepared next time individual investors want to gang up on them.)

But we do worry when this retail trading is based on pure speculation and prices move well away from any reasonable relationship with fundamentals. Many fingers will get burned when, ultimately, everyone heads for the exit on these stocks, but not all get out in time. Gamestop is now a case in point. At the time of writing, the price was back down to USD$90 with its short interest more than halving.

Ultimately, valuations based on future prospects matter. The speculator enters this game at their peril.

Remaining anchored to valuation

We have often been asked over the last week if the Reddit/GameStop/short squeeze phenomenon will alter the way we value companies or implement our investment process. The answer is: “not really”.

We have always tracked the level of short interest in the companies we hold and how this changes through time. We avoid fundamentally or structurally flawed businesses which tends to see us not holding those with significant short positions. If we do hold a company with any material short interest we must be very confident we have an edge on the business unappreciated by shorts, and why their thesis is unlikely to be borne out.

If we do own a company with meaningful short interest, that short interest tends to be at much, much lower levels than the companies caught up in the Gamestop saga. We would also hold very few of them, so risk is managed.

We will always anchor our investment process around valuations. We won’t be chasing companies with strong price momentum, when that momentum is not being driven by fundamentals.

The rise of retail traders, as illustrated by GameStop, may mean that price can move away from fundamentals, and intrinsic value, for longer periods of time. And we may have to reweight positions more frequently as a result.

But we will wait and see how pervasive this impact is, though. Our hunch is ‘not very’ as retail traders realise this strategy is no endless avenue to a ‘free lunch’ for all.

Exuberance Exhibit 1: Bitcoin

You might remember, but last month, we looked at some bear market indicators for share markets (insert hyperlink to last LTI).

It has become increasingly clear over the last few weeks that, whilst we don’t believe the markets we invest in, Australian and global small and mid-caps, are in a bubble, there are indicators that some parts of investment markets are frothy with stretched investor sentiment.

We can’t, for example, help but notice the amount of noise about Bitcoin. We are constantly asked about its valuation. Even Uber drivers ask for our thoughts. And ads for Bitcoin trading courses and transacting platforms are becoming ubiquitous.

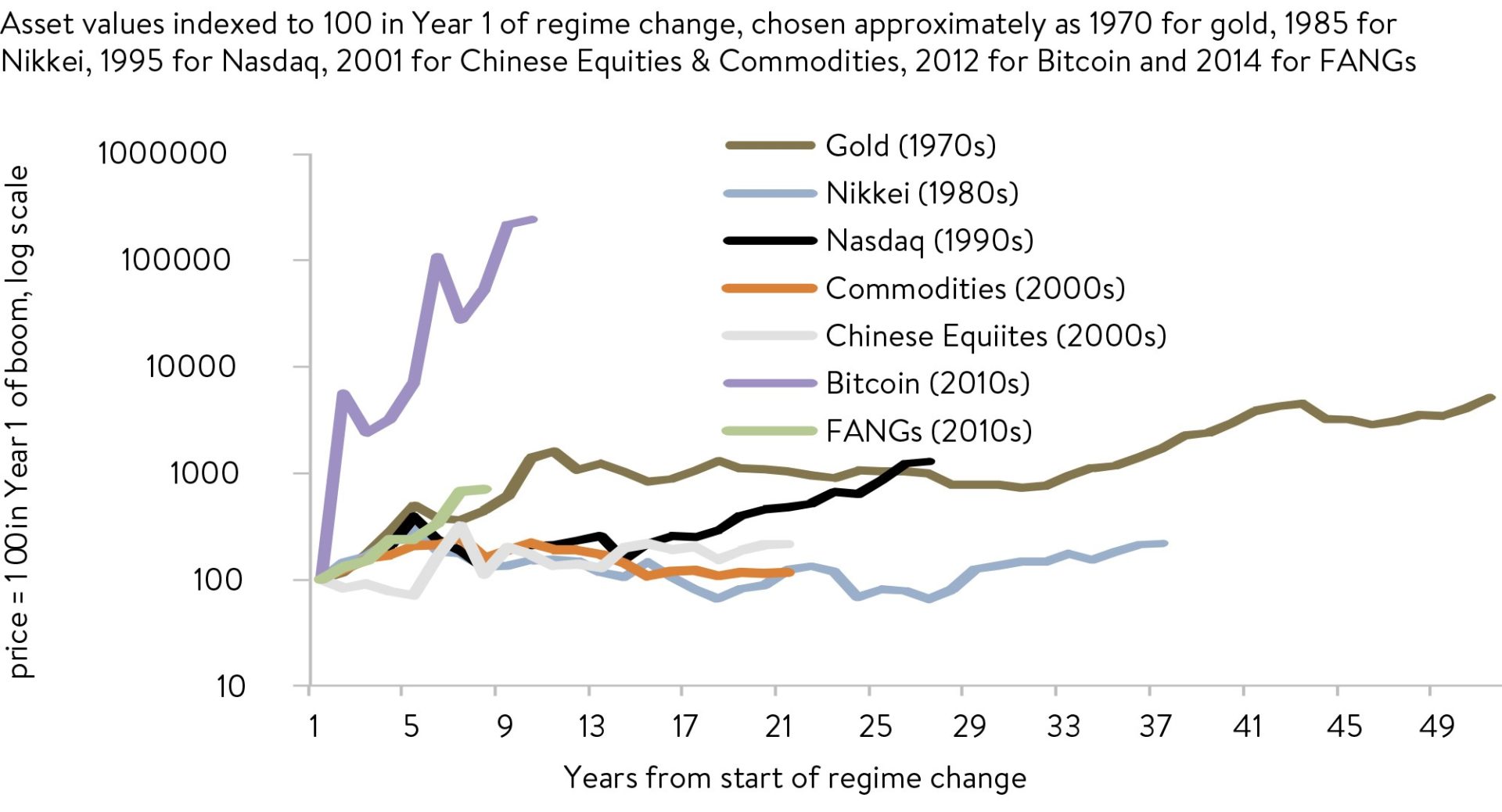

This is not unexpected given the rise in price of Bitcoin over the last few years, putting other financial market bubbles in the shade (see chart).

The Bitcoin ascent

Source: J.P. Morgan

Importantly, though, Bitcoin is somewhere between a collectible and a currency (and not a particularly good one yet). So in our view, it doesn’t qualify as an asset because it doesn’t generate cash flows from which to value it. This makes it ripe for speculation and a good barometer for when financial market sentiment is high.

Exuberance Exhibit 2: SPAC IPOs

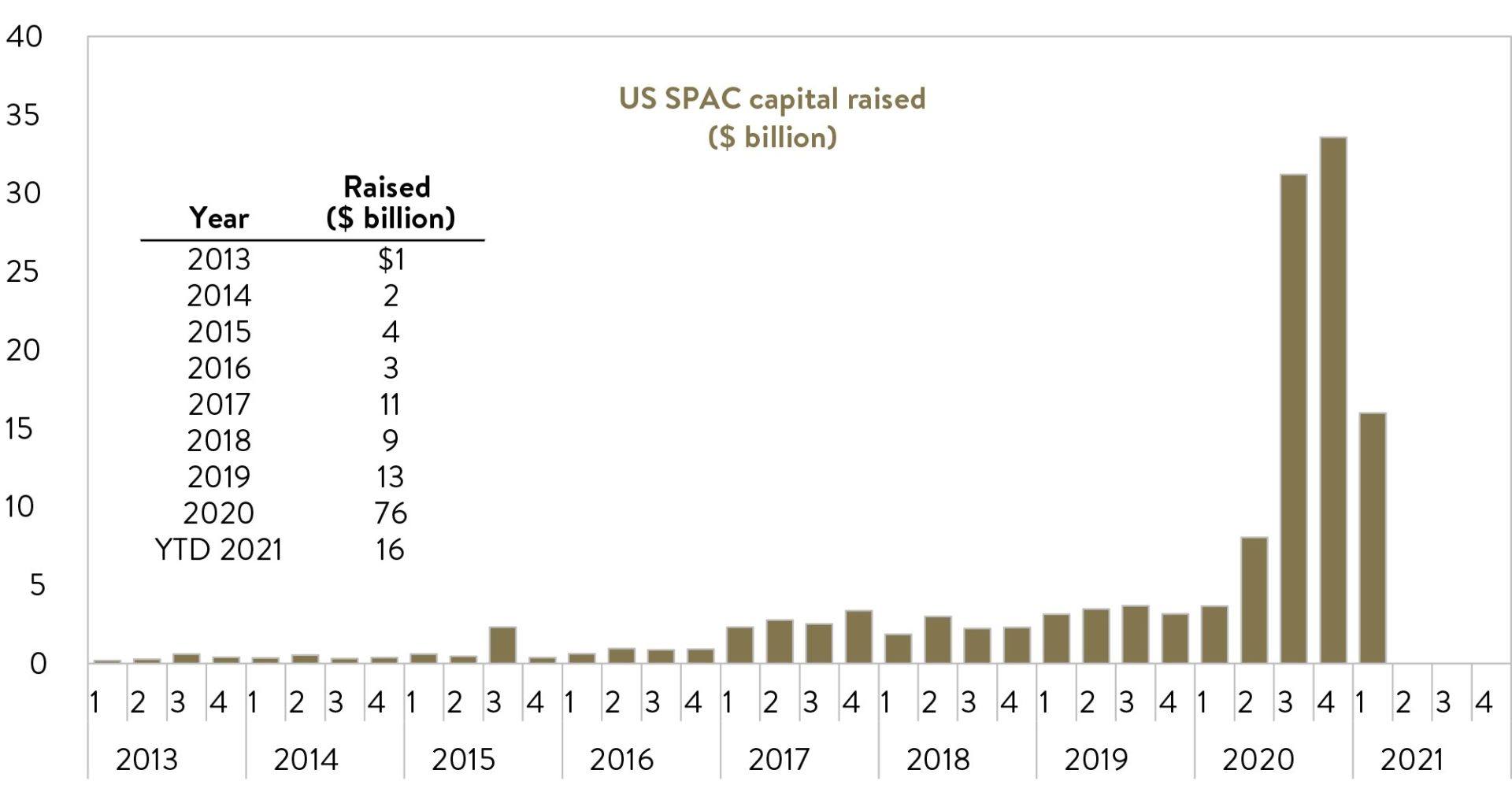

Another measure of market exuberance is IPO issuance, which has ramped up in the US, particularly through what are called Special Purpose Acquisition Companies, or SPACs for short. These vehicles, often called ‘blank cheque’ companies have a two-year window to find a private company target which they merge with to effectively list it, or else hand back the capital to investors.

IPO issuance tends to increase when company owners think they can raise capital, or sell out, at heightened valuations in the market, and generally not when it represents good value for buyers. SPACs have been around for a number of years, but they raised six times the amount of money in 2020 than they did in 2019.

SPACs have emerged from a relative backwater to become the dominant form of listing for US companies, now currently comprising over 50% of IPO activity in the US.

Their boom has come with SPACs bringing early-stage higher-growth businesses, particularly technology businesses, to market. There is huge demand for these stocks from retail traders with more time on their hands and less aversion to volatility.

The demand has been fuelled by interest rates near 0%, which means the opportunity cost for investors of having their cash tied up in a SPAC waiting for an acquisition is low. Private office leasing company WeWork is the latest in a long line said to be in talks with a SPAC to go public.

The 2020 SPAC IPO boom has continued into early 2021

as of 21 January 2021

Source: Dealogic, Goldman Sachs Global Investment Research

Exuberance Exhibit 3: retail call options

This next measure of exuberance is tied to the democratisation of investing we spoke about earlier that has given retail investors cheap access to trading platforms and financial information. When combined with government stimulus cheques and extra time on their hands, small retail traders have been investing heavily in call options on individual listed companies.

These options essentially give the buyer the right to buy a share in a company at a certain price (strike price) and the trader executes the option if the share price rises above the strike price. They are generally bought if the investor is bullish on the company and its price is rising higher, but they are popular with retail traders because options are a cheaper way to get exposure to that potential price rise.

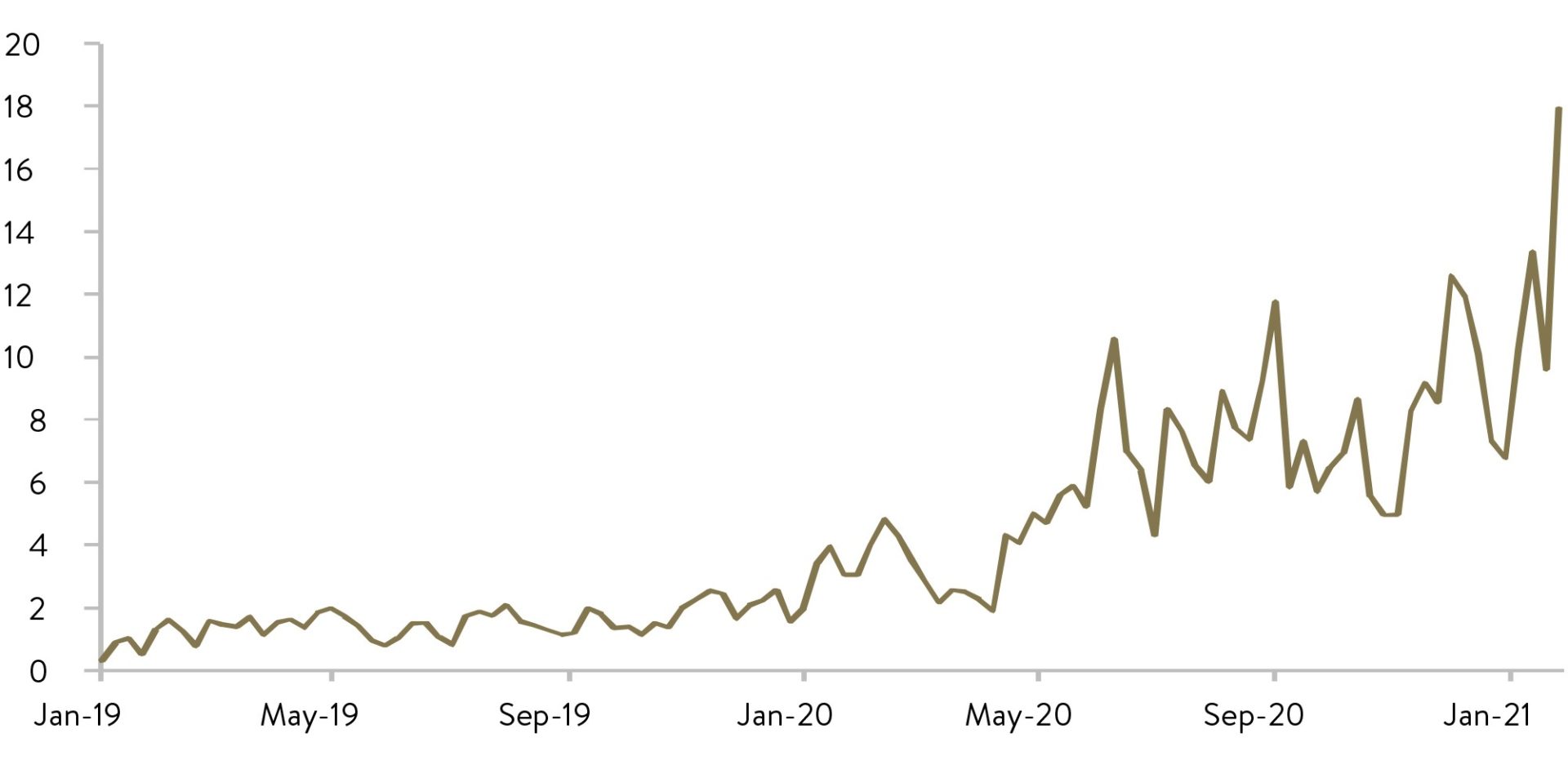

As can be seen in the chart below, call option volumes for small parcels (less than 10 contracts) that retail traders tend to buy, have gone through the roof over the last year, and particularly the last few weeks.

Call Option Buy Minus Sell at Open for investors with less than 10 contracts for options on individual US equities

In mn contracts. Last obs is for the week ending 29th Jan 2021

Source: OCC, Bloomberg Finance L.P., J.P. Morgan

Such betting by often value agnostic retail traders should give long term investors pause as this may not be a particularly sustainable source of demand behind price rises of companies.

Exuberance Exhibit 4: growth stock volume

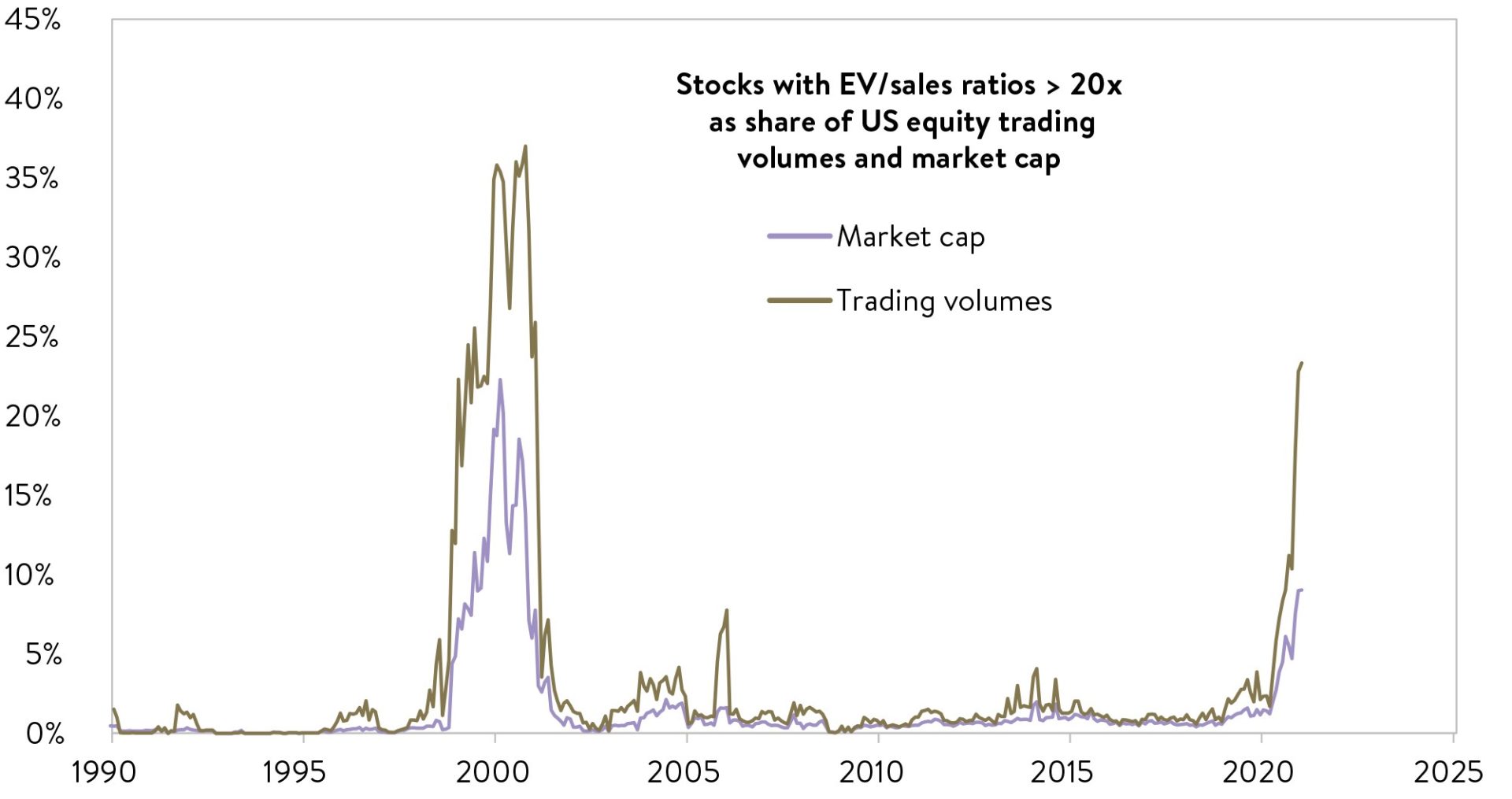

And, finally, trading volumes in the most expensive growth orientated companies has exploded recently (see chart).

Whilst not at the dot.com levels from 2000 at present, those companies trading at great than 20 times Enterprise Value-to-Sales ratios (an historically expensive level) are making up a much bigger part of the market and account for around a quarter of all trading activity.

There are some rational reasons for this, including some large high growth (and high valuation) technology companies further entrenching their dominate positions during COVID, but it does suggest caution is warranted.

Trading in stocks with extremely high EV/sales ratios has surged

as of 21 January 2021: LTM EV/sales ratios of stocks with LTM revenues > $50 million

Source: Compustat, Goldman Sachs Global Investment Research

A buying opportunity

In the short term, we would not be surprised to see a 5-10% pull back in the major sharemarkets given the extended level of investor optimism we see in some corners at present. Timing, though, for any pullbacks is always difficult to judge when it is sentiment based.

We would see such a pull back as a buying opportunity in our funds and a healthy occurrence for markets. We think it less likely that a major bear market is around the bend given the supporting backdrop to corporate earnings as the vaccines bring the virus under control, and central banks’ willingness to keep short-term and long-term interest rates lower for even longer in the absence of signs of inflation.

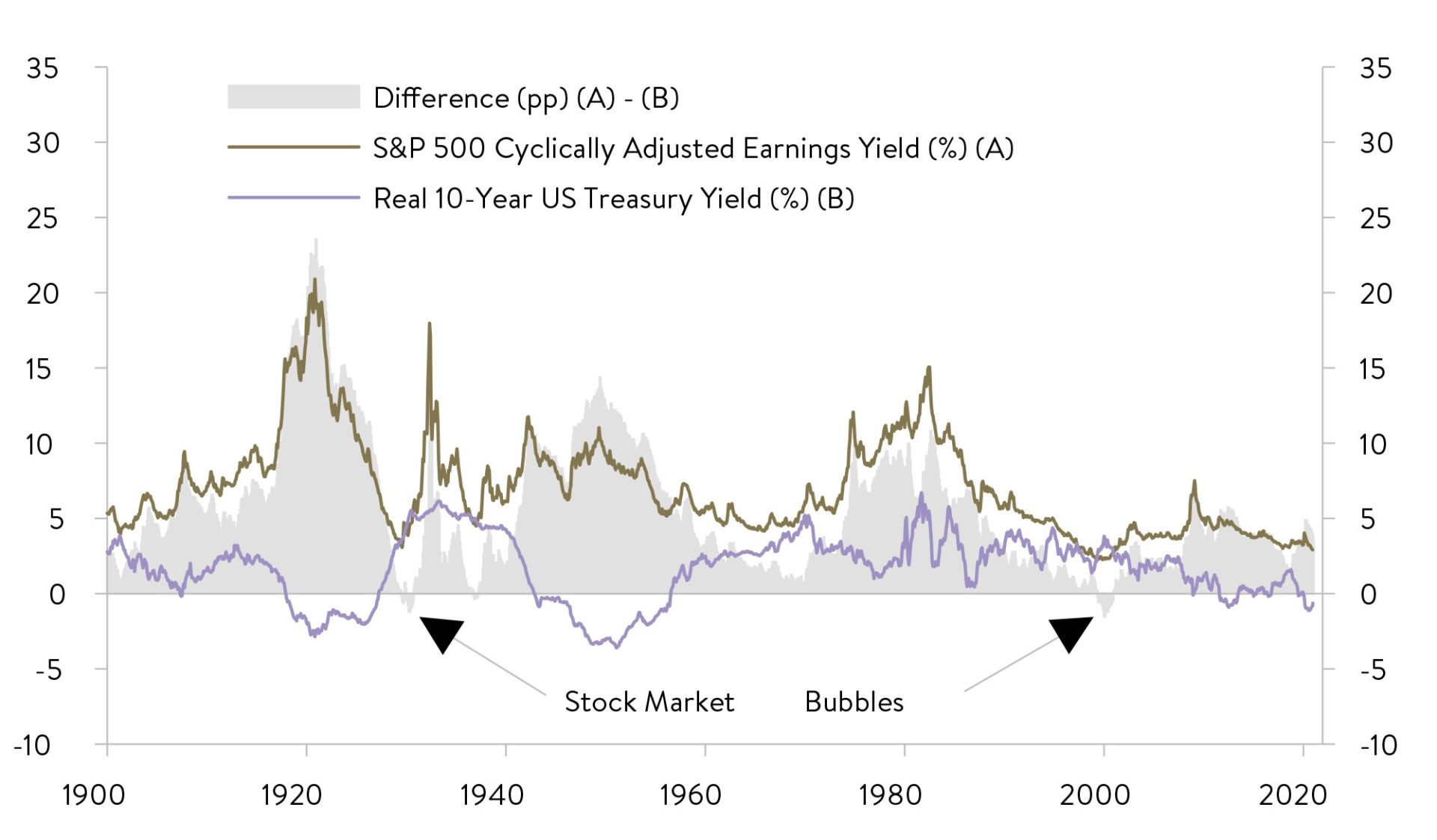

This should support the attractiveness of equities relative to bonds for some time yet. As seen below, the world’s largest sharemarket in the US, which makes up around 50% of global equities and leads the direction of global sharemarkets, is still providing a healthy earnings yield buffer compared to bonds (grey bars).

Relative valuations: US equities & treasuries

Source: Capital Economics

Our risk management plan to deal with bubbly markets

So whilst we don’t see the markets we invest in at ‘bubble’ valuation territory, some measures of investor sentiment described above do argue for caution in company selection. In this environment, investors need to manage risk.

At Ophir, our risk management plan, which is imbedded in our investment process, was borne out of the searing experience of the global financial crisis (GFC).

Beyond being well diversified by company, sector and geography and not overexposed to any particular investing style, our risk-management plan ensures the companies we hold in our funds have a high probability of upgrading earnings at their next results announcement and are trading on reasonable valuations compared to fundamentals (cash flow and earnings) and peers.

Moreover, we track how the company is likely to fair in an economic and market ‘meltdown’. This includes tracking measures related to liquidity, dividend yield, gearing and how opaque the company’s business model is. We aggregate these measures at a portfolio level to understand how we are faring across each metric, ensuring the exposures are calibrated appropriately for where we are at in the market cycle.

In conjunction these measures help provide downside protection in the event of any market sell off. At present whilst largely being fully invested within our funds, we are paying particular attention to not overpaying for growth and have become more conservatively positioned across our meltdown risk metrics at a fund level.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.