By Andrew Mitchell & Steven Ng

Co-founders and Senior Portfolio Managers

In our August 2020 letter to investors we review how narrow the recent market rally has been as well as delve into a better than expected Australian reporting season, though note much uncertainty remains.

Dear Fellow Investors,

Welcome to the August 2020 Ophir Letter to Investors – thank you for investing alongside us for the long term.

Month in review: The four reasons we avoided an awful August

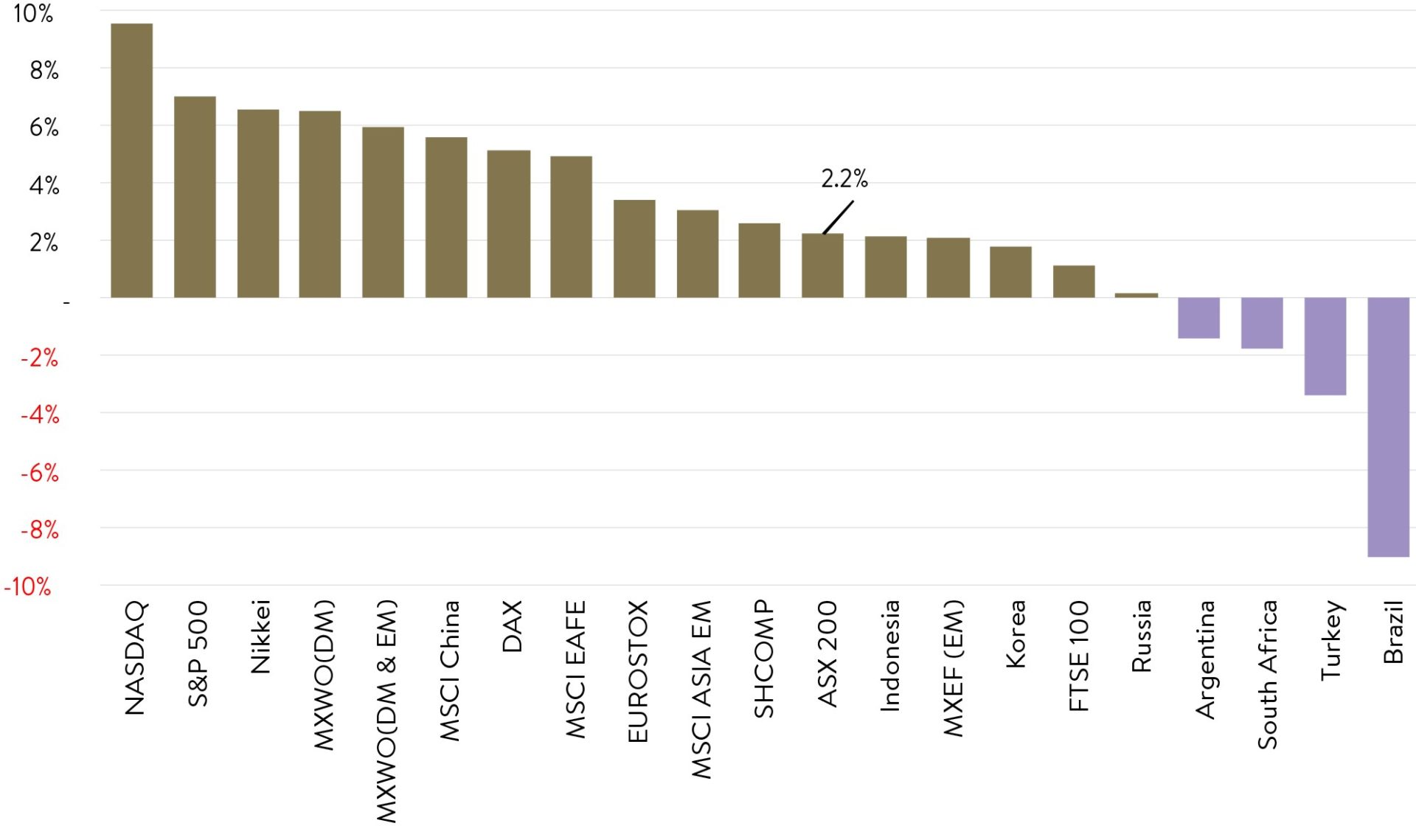

History tell us August typically delivers poor equity market performance, but they shrugged off the past and almost every equity market around the world posted positive returns. The US (S&P500), and in particular the large US tech stocks (heavily represented in the NASDAQ), led the way (see chart below).

Global markets performance – August 2020

Source: Bloomberg, JP Morgan

Ophir Fund Performance

The Ophir Opportunities Fund returned +7.9% net of fees in August, outperforming its benchmark by 0.7% and has delivered investors +26.2% p.a. post fees since inception (August 2012).

Download Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund investment portfolio returned +4.9% net of fees in August, underperforming its benchmark by 1.9% and has delivered investors +19.7% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +11.7% for the month.

Download Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +2.2% net of fees in August, outperforming its benchmark by 0.2% and has delivered investors +28.6% p.a. post fees since inception (October 2018).

Download Ophir Global Opportunities Fund Factsheet

The Aussie share market (ASX200 +2.2%) logged its best August returns in a decade (just goes to show you how poor August typically has been), and its fifth consecutive monthly gain. But August also represented its worst underperformance against developed equity markets this century (-4% underperformance).

This relative underperformance has been a consistent theme this year because of Australia’s poorer fundamentals (earnings and dividends have fallen more in Australia) and less favourable market sector composition (smaller IT and healthcare sectors in Australia).

For those of us who fish in the small cap part of the Aussie equity market, however, August was a lot kinder with the ASX Small Ords Index up 7.3% on a total return basis.

In this letter we’ll take a look at the four reasons why August bucked the history books.

The world’s best-performing IT market

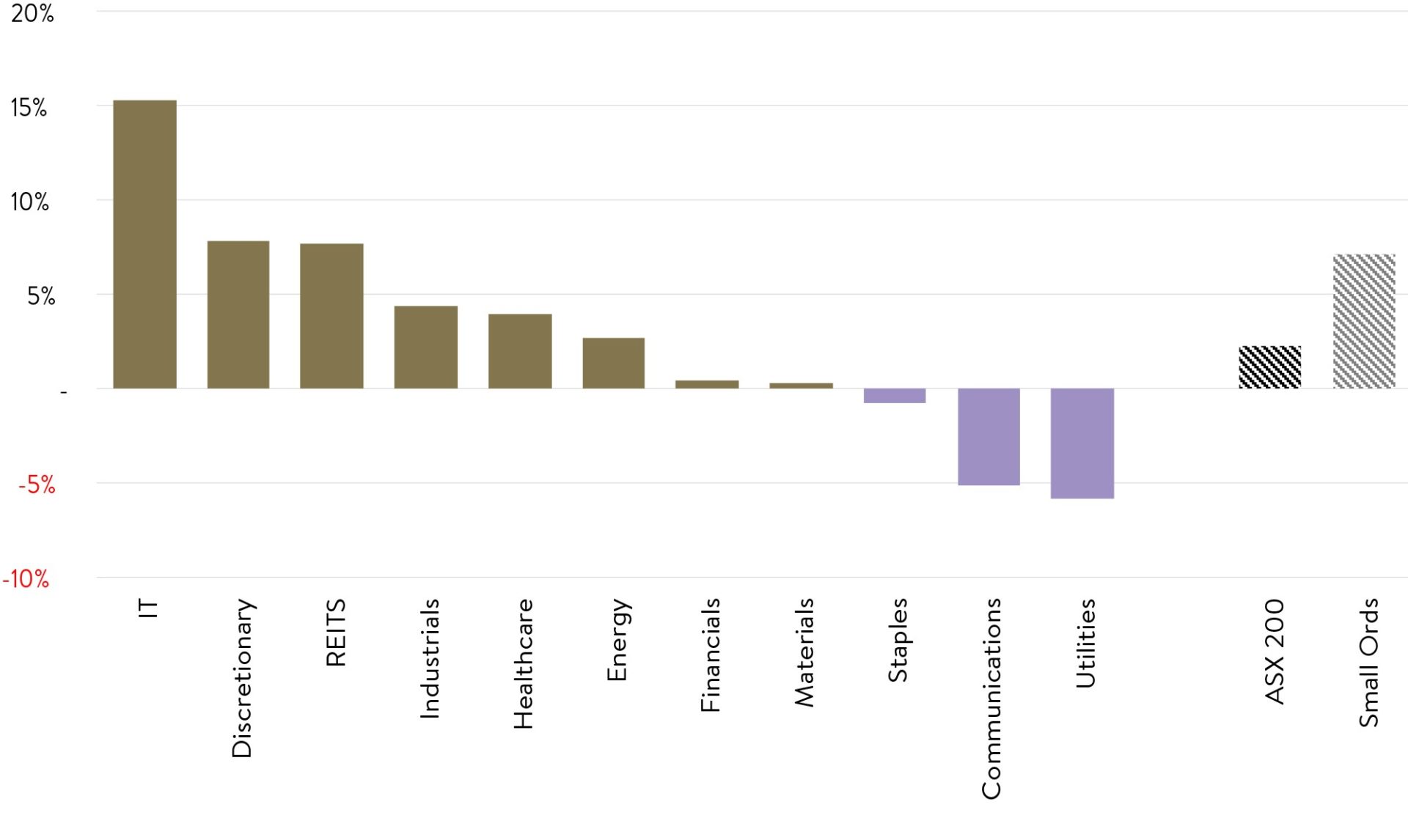

The first reason August wasn’t too awful is the IT market continued to surge.

If you thought only the US was throwing a tech party, our Aussie IT market, whilst dwarfed in size by the US, showed it knows how to mix it with the big boys, providing twice the return of the next best sector in the local market during the month.

Australian ASX200 sector performance – August 2020

Source: Bloomberg, JP Morgan

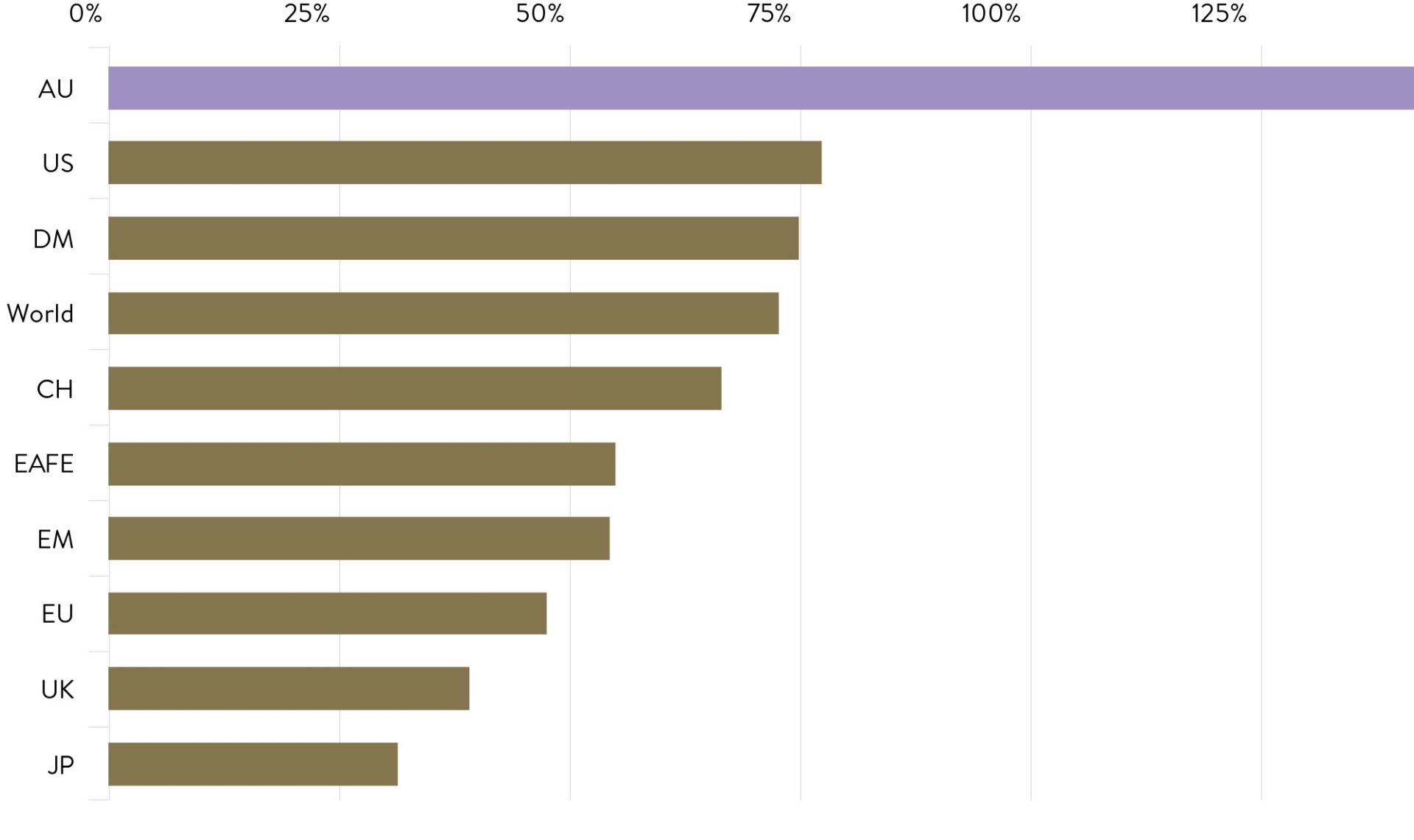

Even more impressively, from the recent COVID-19 induced market bottom on March 23rd the Australian sharemarket has actually had by far and away the best performing IT sector in the world.

MSCI country IT sector performance since Covid-19 market bottom 23/03

Source: Bloomberg, J.P. Morgan estimates

Much of this can be attributed to Afterpay rising a staggering +927% over this period; though Nearmap (+250%), Codan (+176%), EML Payments (155%), Megaport (+151%), Data#3 (+137%) and Wisetech (+135%), Appen (+99%) and NextDC (+75%) have shown the Australian IT market is not a one trick pony during the market recovery.

In the US, though, tech’s dominance has made for a narrow market rally with the S&P500 up 8.3% for 2020, but on an equally weighted basis for the index it is still down -3.7% for the year.

This is exemplified by Apple recently passing the USD $2trillion valuation, with this one stock now being worth more than the entire FTSE 100: the largest 100 companies on the UK sharemarket.)

Apple worth more than largest 100 stocks on UK sharemarket

Source: Bloomberg

The Fed’s punchbowl set to continue … for years

The August rally was helped by a rebound in leading economic data and rising hopes around fast-tracked vaccines and therapeutics for COVID-19.

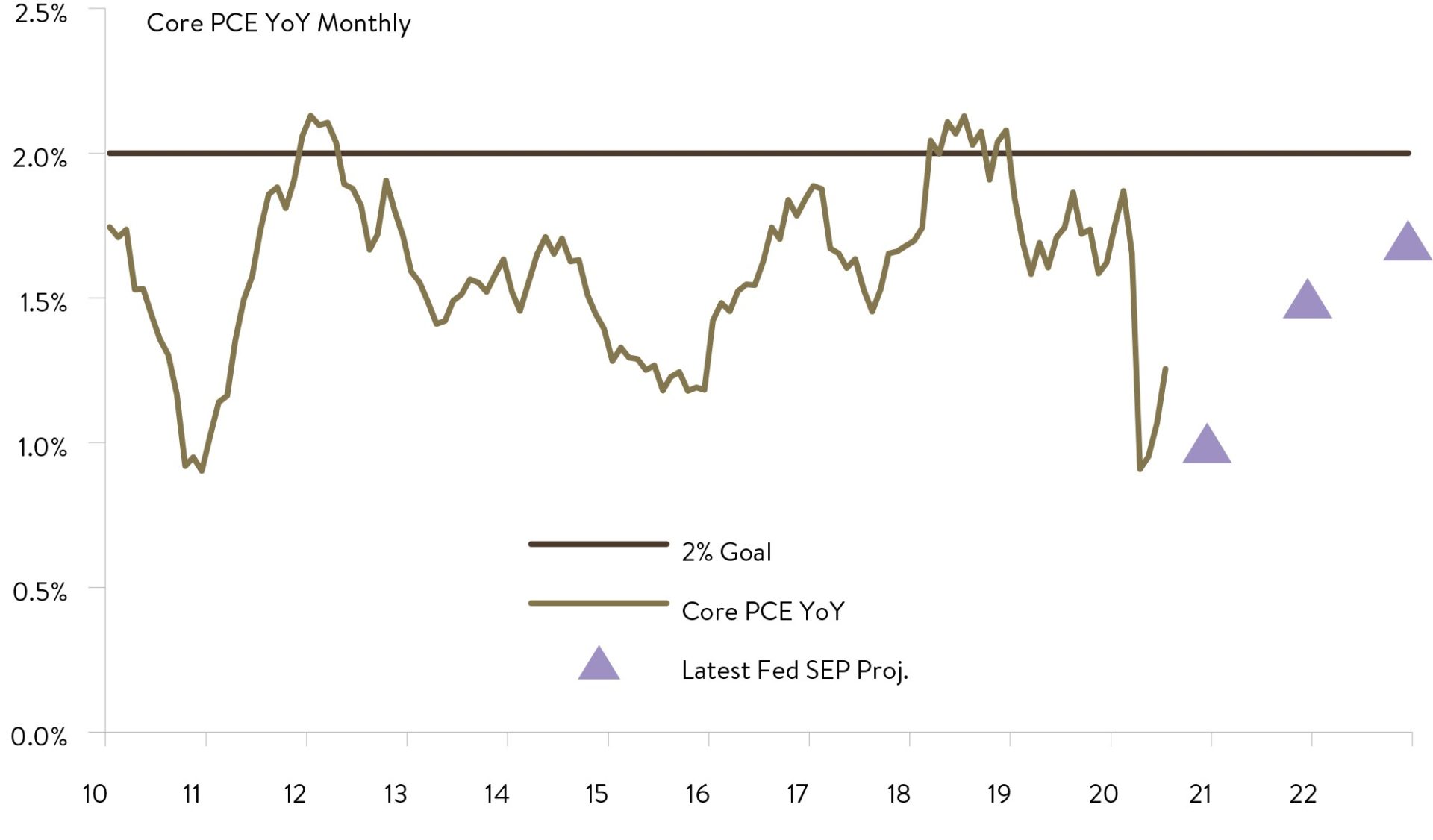

But markets were also fuelled after the Fed indicated it would be keeping rates lower for longer even when/if inflation starts to recover.

On this last point Fed Chair Powell made the important announcement that the US Fed would be targeting average inflation of 2% over time and that instead of trying to head inflation off at a 2% limit, it would let inflation run “moderately” above the 2% target “for some time”. This pivot in strategy will now seek to “make up” for previous inflation undershoots such as we have seen over the last decade (see chart below).

That’s positive for equities. It means the Fed’s punchbowl is here to stay, likely for years, and that more monetary stimulus may in fact be on its way at its September meeting.

Core PCE (inflation) not close to the 2% goal in the Fed’s latest forecast (Statement of Economic Projections – SEP).

Source: BEA, Federal Reserve, UBS

The re-opening theme

The third reason things didn’t go amiss in August is that economies are staying open around the world.

Victoria’s lockdown is an exception. Globally, governments are reluctant to re-impose mobility restrictions when faced with rising COVID-19 cases. According to UBS, the average level of mobility restrictiveness globally has remained the same since mid-July with a weighted average rating of 3.4 out of 10 on the UBS restrictiveness index. That compares to 6.7 at the peak in April. Generally, in places where restrictions have been tightened, they have been much more targeted and growth friendly. That’s helping the economic recovery to hold – at least to date.

We saw the re-opening theme play out in the August rally with well-known global names across the Hotel (MGM Resorts +39.8%, Marriott +22.8%, Wynn Resorts +20.7%, Hilton +20.4%) and Travel (Delta Air +23.6%, Southweat +21.7%, American Airlines +17.4%, United Airlines +14.7%, Norwegian Cruise Line Hldgs +25.4%) sectors all providing outsized returns, though of course all are still down, and some very significantly, over the year.

This theme was replicated in the Australian market with travel exposed stocks partially healing some of the wounds inflicted on their share prices by COVID-19. Notable beneficiaries here during August were Corporate Travel Management +83.2%, Webjet +31.5%, Flightcentre +24.9% and Qantas +22.0%.

Reporting season: better than feared

The final reason we avoided an awful August is that reporting season was better than expected.

The end of August of course marks the end of the 2020 financial year reporting period for the majority of Australian listed companies. This reporting period will very likely mark the nadir of the earnings recession both in Australia and other developed economies. The catch up for lost growth though will likely take some time (see chart below).

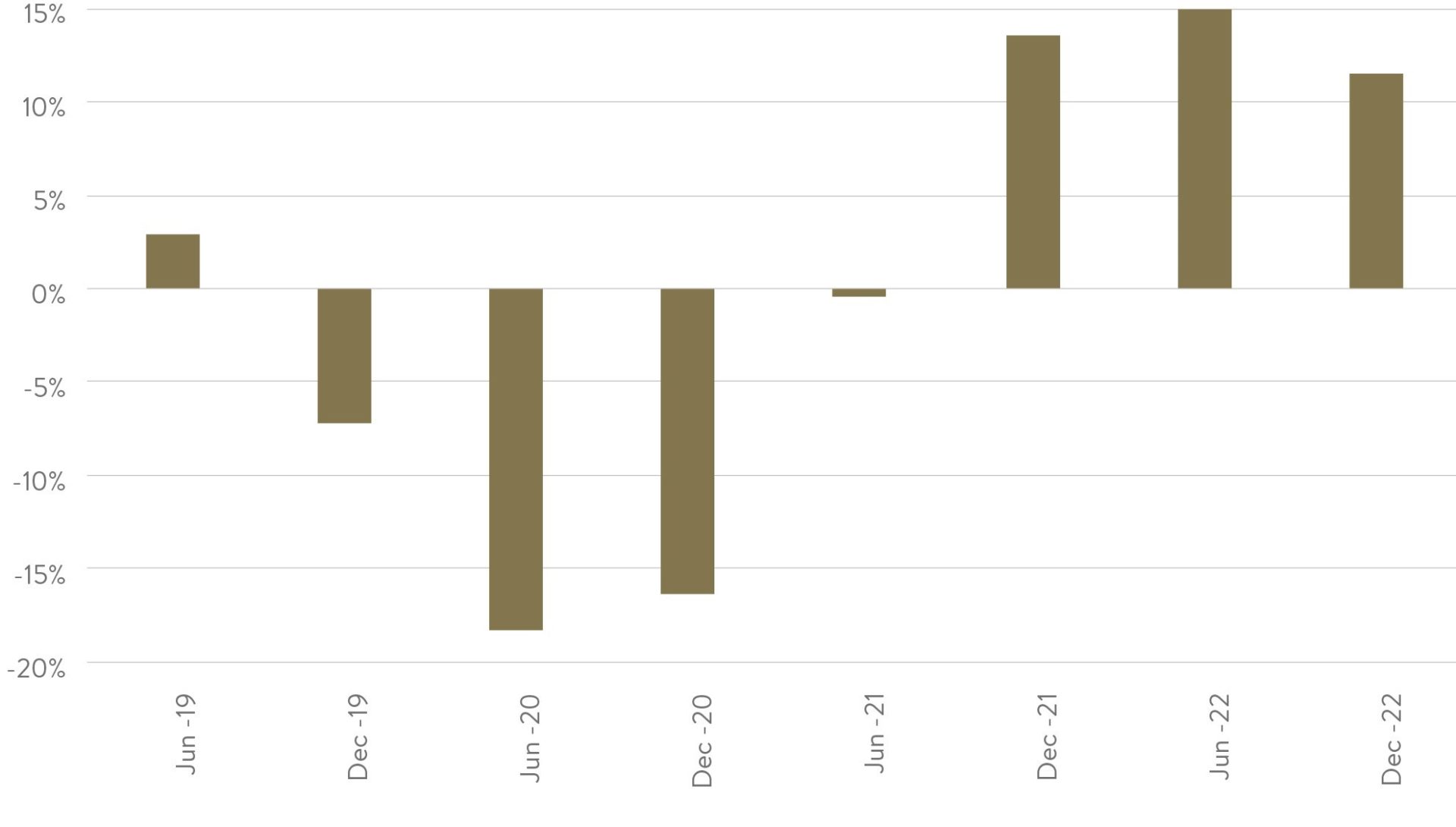

ASX200 Year-on-Year Earnings Per Share Growth

Source: MST Marquee

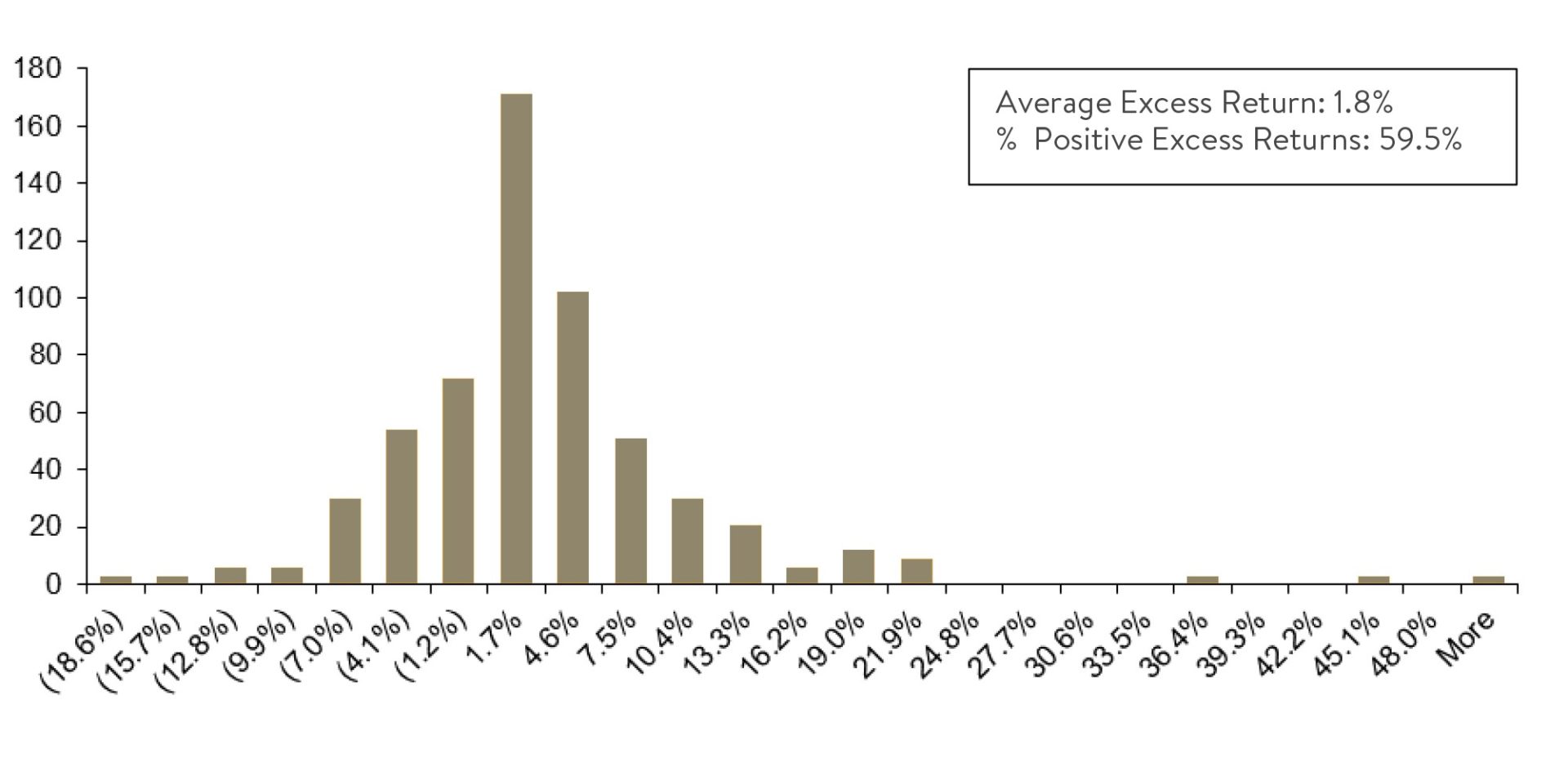

Heading into reporting season, investors were fretting about uncertainty and reduced company guidance. But in a sure sign investors were too pessimistic, about 60% of companies logged positive excess returns (market outperformance) in the three days after they announced their results. This saw an average positive excess return of 1.8%, highlighting results were generally better than feared.

Announcement returns for ASX200 stocks during August reporting season

Source: Refinitiv, Macquarie Research, August 2020. Announcement returns are defined as the excess returns relative to the ASX200 for the 3 days post releasing results.

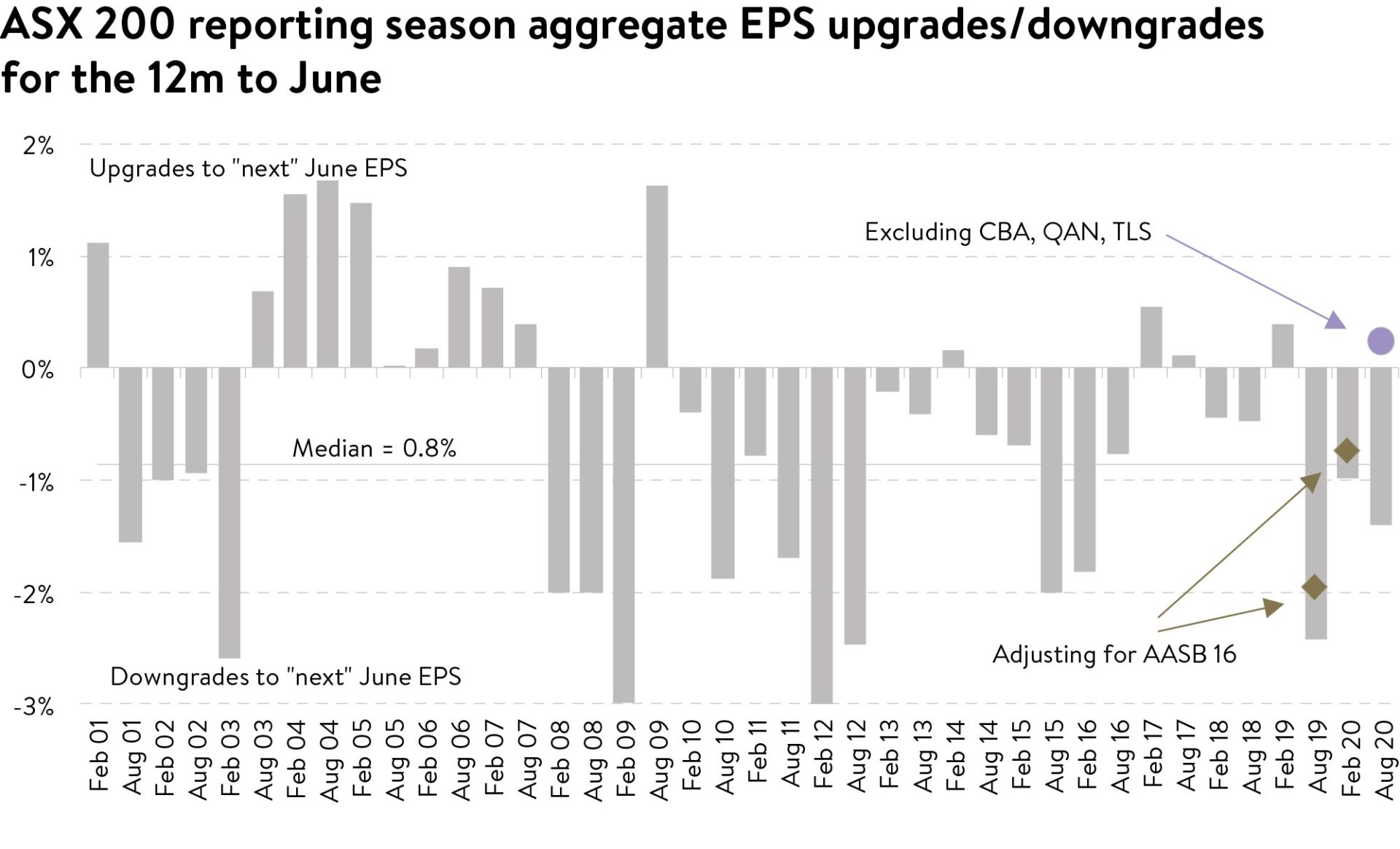

Looking ahead, corporate earnings for the 2021 financial year were downgraded by -1.4% during reporting season, a slight negative surprise compared to the typical -0.8% downgrade we have seen historically. This result deserves an asterisk, though, because stripping out the large Commonwealth Bank, Qantas and Telstra downgrades would actually have seen earnings upgraded for FY21 during this report season. Still, we acknowledge this is cheating though, a bit like the cricketer saying we would have won the test “but for” getting run out on the last ball.

Worse than normal downgrades but deserves an (*)

Source: Company Data, Factset, MST Marquee

A mixed bag

For Ophir the Australian reporting season was a bit of a mixed bag, but this was not entirely unexpected.

We posted strong positive returns in August in both our Ophir Opportunities Fund (+7.9% net of fees) and High Conviction Fund (+4.9% net of fees, investment portfolio). We slightly outperformed the benchmark in the former (by 0.7%) and moderately underperforming (by 1.9%) in the latter. Our headline performance was held back a little bit because we held less in re-opening thematic names but that does not cause us concern longer term.

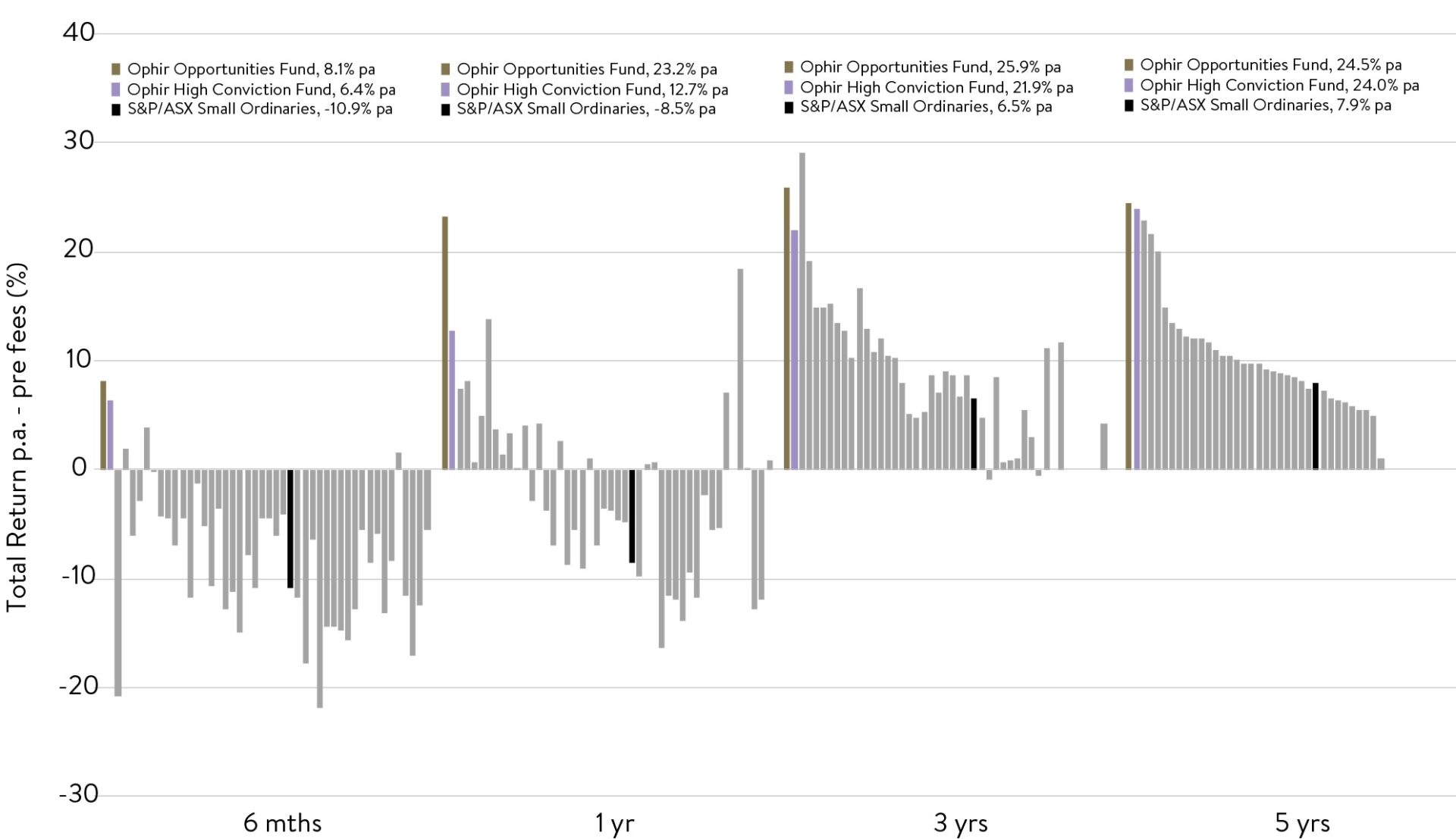

August’s result was not “unexpected” because we had significantly outperformed the market and peers over the previous 6 months to the end of July. In fact, our two Australian equity funds were the 1st and 2nd ranked in the Mercer survey of Australian Small Cap managers over that period. And we were two of only five managers to generate a positive return. (As foreshadowed last month, they are the two best performing compared to this peer group over the last 5 years).

Mercer Survey – Australian Small Caps to 31 July 2020

Source: Mercer

This undoubtably led to much “good news” and high expectations to already be priced into core longer-term positions in these funds. That includes A2 Milk and Resmed in our High Conviction Fund which were down -11.8% and -13.7% respectively in August but are up +25.5% and +19.4% on the year (in a period when the Australian market was down -4.1%).

A2 Milk is somewhat a victim of its own success after upgrading earnings guidance in March. The market had been expecting it to beat that guidance, but instead came in line with the midpoint of this upgraded guidance. But second-half profits grew 32% indicating there is still plenty of momentum in the business, and we see A2 Milk continuing to take market share with growth in its China label product a key highlight.

Looking at Resmed, opposing forces are impacting the company. Higher ventilator sales for COVID-19 treatment are a key positive. That has offset declines in its core CPAP/sleep related sales caused by mobility restrictions and high unemployment reducing potential patients’ access to assessments and health care coverage for Resmed’s products. On net we still like the business longer term given its leading position servicing the underdiagnosed sleep apnea market, but we expect it might be a rockier path near term as it navigates to growth ahead.

The opportunity in uncertainty

On a final positive note, we continue to be excited by the opportunity that uncertainty provides and the rewards on offer for finding the companies the market has overlooked or misunderstood.

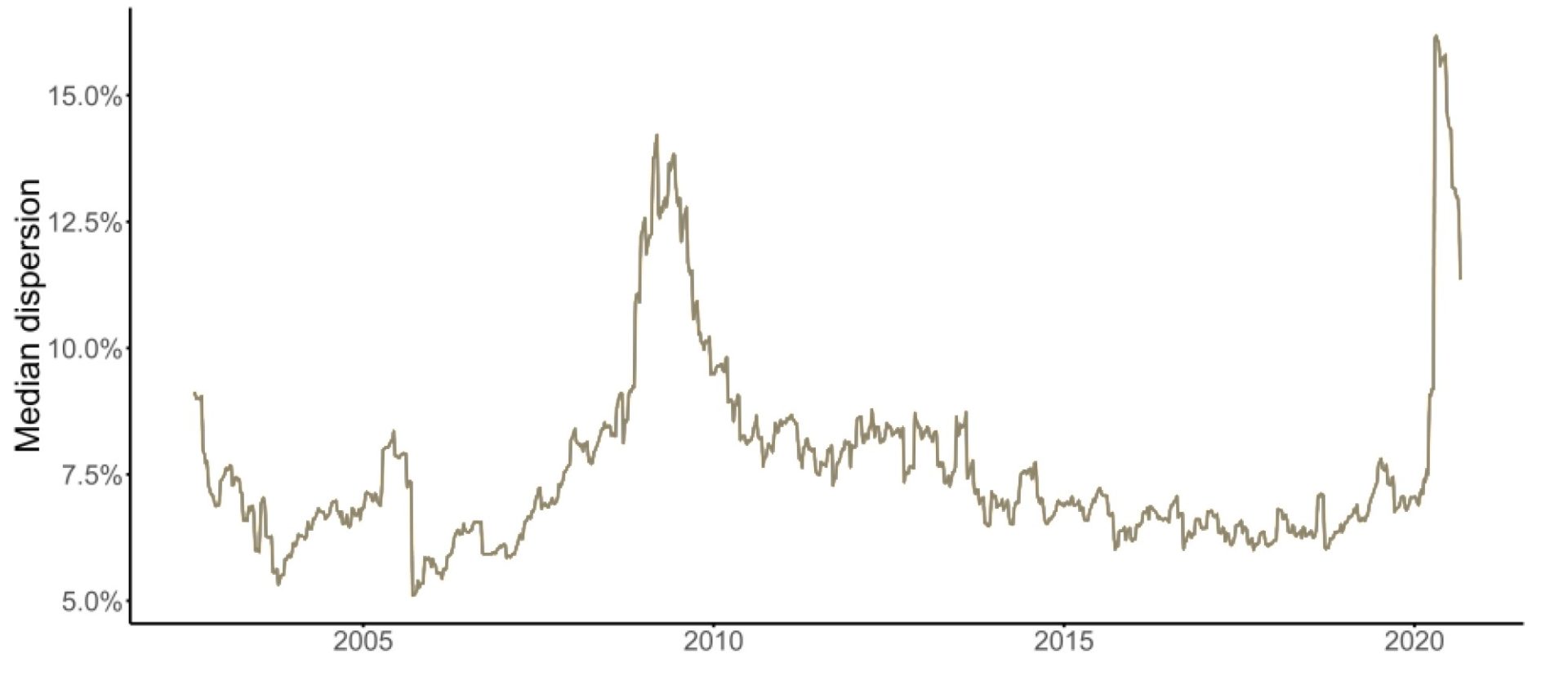

Interestingly, while dispersion in analysts’ earnings forecasts for companies in the Australian market have reduced as management of companies have provided some greater clarity on the outlook ahead, dispersion, and its accompanying uncertainty, still remains at very elevated levels.

Dispersion in analyst EPS forecasts

Source: Refinitiv, Macquarie Research, August 2020. Dispersion is calculated as the standard deviation of consensus earnings forecasts for FY1.

This is great news for us. The lack of consensus means the market is desperately looking for capital allocators – like Ophir — who can correctly determine companies’ earnings trajectories amid this uncertainty. We remain hard at work doing just that.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.